The global air conditioning evaporator core market is experiencing robust growth, driven by rising demand for HVAC systems across residential, commercial, and automotive sectors. According to Grand View Research, the global HVAC market size was valued at USD 135.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 8.2% from 2023 to 2030. A key contributor to this expansion is the increasing need for energy-efficient cooling solutions, particularly in emerging economies undergoing rapid urbanization and industrialization. Evaporator cores, as critical components in thermal exchange systems, play a central role in system performance and efficiency. With automotive AC systems accounting for a significant share of evaporator core demand, coupled with growing construction activities and stricter energy regulations, manufacturers are investing in advanced materials and manufacturing technologies. In this competitive landscape, identifying the leading evaporator core suppliers becomes crucial for OEMs and system integrators seeking reliability, innovation, and scalability. Based on market presence, production capacity, technological advancements, and global reach, the following are the top 10 air conditioning evaporator core manufacturers shaping the industry’s future.

Top 10 Air Conditioning Evaporator Core Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Air conditioning for passenger cars

Domain Est. 1997

Website: mahle.com

Key Highlights: Our flat tube evaporators deliver high performance in spite of their compact and lightweight design. Our patented BehrOxal® coating technology modifies the ……

#2 Advanced Distributor Products

Domain Est. 2000

Website: adpnow.com

Key Highlights: ADP is the Leading Producer of Residential Evaporator Coils in the USA. We are committed to providing quality solutions and true partnership….

#3 Nortek Air Solutions

Domain Est. 2015

Website: nortekair.com

Key Highlights: Nortek Air Solutions is the world’s largest custom HVAC manufacturer, building efficient, dependable heating and cooling systems that create ideal ……

#4 AC Evaporator Cores

Domain Est. 1996

Website: hy-capacity.com

Key Highlights: Hy-Capacity’s tractor air conditioning parts selection includes AC evaporator cores for agricultural equipment….

#5 Vintage Air

Domain Est. 1996

Website: vintageair.com

Key Highlights: From our advanced Gen 5 systems to heaters and under dash evaporator kits with controls and louver options, you choose the components that work best for your ……

#6 AC Evaporator Coils

Domain Est. 1997

Website: oldairproducts.com

Key Highlights: 3-day delivery 90-day returnsOld Air Products has been manufacturing new replacement evaporator cores for many years. We have collected many original evaporator cores to use as sam…

#7 Evaporator Cores

Domain Est. 1997

Website: aircomponents.com

Key Highlights: Free delivery 365-day returnsWe offer a wide range of high-quality evaporator cores and assemblies for all makes and models of vehicles. Our cores and assemblies are made from dura…

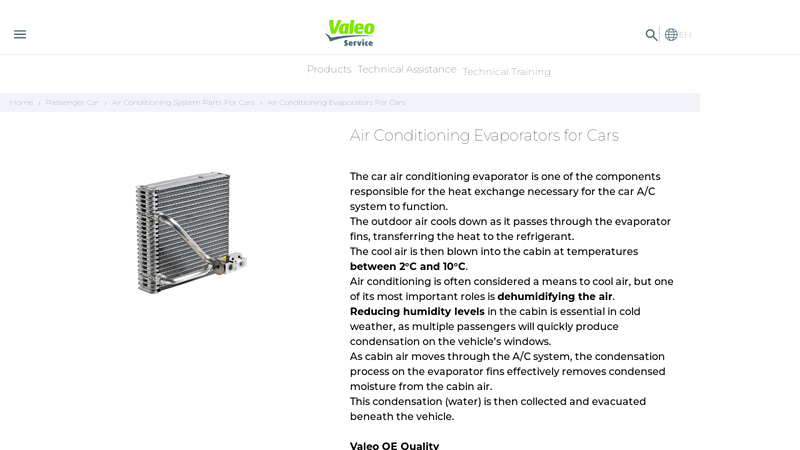

#8 Car Air Conditioning Evaporators

Domain Est. 2000

Website: valeoservice.com

Key Highlights: Valeo is a world leader in automotive air conditioning, manufacturing evaporators to supply automakers and the aftermarket….

#9 Thermal Management & Air

Domain Est. 2000

Website: denso.com

Key Highlights: Our compact and easy-to-mount HVAC unit, or our bus air-conditioning unit mounted on the roof provides safe and comfortable cabin space….

#10 EVAPORATOR CORE (REPRODUCTION)

Domain Est. 2013

Website: store.classicdmc.com

Key Highlights: In stock Rating 5.0 (1) EVAPORATOR CORE (REPRODUCTION) | Official Classic DeLorean Motor Company® | New, Original, and Reproduction Parts….

Expert Sourcing Insights for Air Conditioning Evaporator Core

H2: 2026 Market Trends for Air Conditioning Evaporator Core

The global market for air conditioning evaporator cores is expected to undergo significant transformation by 2026, driven by technological advancements, regulatory changes, and shifting consumer demands across automotive and HVAC sectors. Below are the key trends shaping the industry in 2026:

1. Rising Demand in the Automotive Sector

With the continued expansion of vehicle production—especially in emerging markets such as India, Southeast Asia, and Latin America—the demand for AC evaporator cores remains robust. Additionally, the growing adoption of electric vehicles (EVs) is influencing design requirements, as EVs need highly efficient thermal management systems. Evaporator cores are being optimized for compactness, lightweight construction, and improved heat transfer efficiency to meet these needs.

2. Shift Toward Environmentally Friendly Refrigerants

Global regulations, including the Kigali Amendment to the Montreal Protocol and the EU’s F-Gas Regulation, are accelerating the phase-down of high-global warming potential (GWP) refrigerants like R-134a. By 2026, manufacturers are increasingly designing evaporator cores compatible with next-generation refrigerants such as R-1234yf and natural refrigerants like CO₂ (R-744). This shift demands material and design innovations to handle different thermal and pressure characteristics.

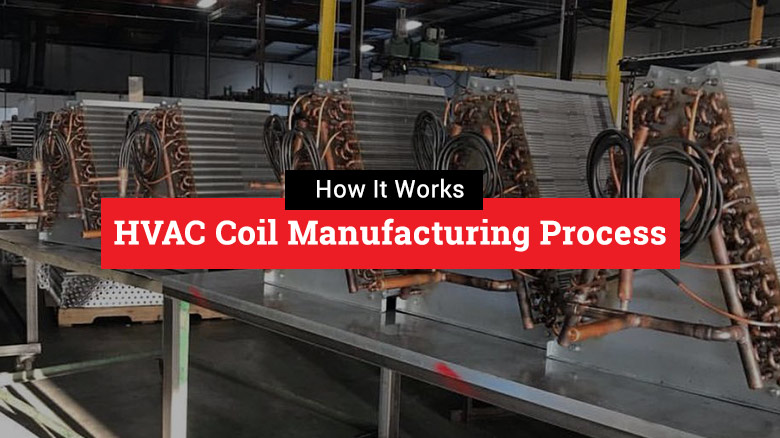

3. Advancements in Material and Design Technology

Manufacturers are adopting microchannel aluminum evaporator cores due to their high thermal efficiency, corrosion resistance, and lightweight properties. These designs reduce refrigerant charge and improve overall system efficiency. By 2026, the integration of advanced simulation tools and AI-driven design optimization enables faster development of high-performance cores tailored to specific applications.

4. Growth in Residential and Commercial HVAC Systems

Urbanization and increasing temperatures due to climate change are boosting demand for air conditioning in residential and commercial buildings, especially in tropical and subtropical regions. This growth is fueling demand for efficient and reliable evaporator cores. Smart HVAC systems incorporating IoT connectivity are also promoting the use of precision-engineered cores that support variable cooling loads and energy-saving operations.

5. Regional Market Dynamics

Asia-Pacific dominates the evaporator core market in 2026, driven by China and India’s booming automotive and construction industries. North America and Europe maintain steady growth, supported by stringent energy efficiency standards and the renovation of aging HVAC infrastructure. Meanwhile, the Middle East and Africa are emerging as high-growth regions due to rising construction activities and increased access to electricity.

6. Supply Chain Resilience and Localization

Following disruptions caused by geopolitical tensions and the pandemic, manufacturers are prioritizing supply chain resilience. There is a growing trend toward regional production and nearshoring of evaporator core manufacturing, particularly in North America and Europe. This shift supports faster delivery, reduces logistics costs, and enhances compliance with local content regulations.

7. Focus on Energy Efficiency and Sustainability

Energy efficiency standards such as SEER2 in the U.S. and Ecodesign directives in Europe are pushing HVAC and automotive OEMs to adopt high-efficiency components. Evaporator cores with enhanced heat exchange surfaces, anti-corrosion coatings, and optimized airflow dynamics are becoming standard. Sustainability is also influencing material sourcing, with increased use of recycled aluminum and eco-friendly manufacturing processes.

In conclusion, the 2026 market for air conditioning evaporator cores is characterized by innovation, regulatory influence, and geographic expansion. Companies that invest in R&D, sustainability, and adaptive manufacturing strategies are best positioned to capitalize on emerging opportunities in both traditional and next-generation cooling applications.

Common Pitfalls When Sourcing Air Conditioning Evaporator Cores (Quality and IP)

Sourcing air conditioning evaporator cores involves critical considerations beyond just cost and availability. Overlooking quality and intellectual property (IP) aspects can lead to performance issues, safety risks, legal liabilities, and reputational damage. Here are key pitfalls to avoid:

Poor Quality Control and Inconsistent Manufacturing

One of the most frequent pitfalls is selecting suppliers with inadequate quality assurance processes. Low-cost evaporator cores may use substandard aluminum alloys, improper brazing techniques, or inconsistent tube-fin configurations. This can result in premature leaks, reduced thermal efficiency, or system contamination due to internal debris. Always verify supplier certifications (e.g., ISO 9001), request material test reports, and conduct sample testing before large-scale procurement.

Counterfeit or Reverse-Engineered Components

Many aftermarket evaporator cores are reverse-engineered from original equipment (OE) designs without proper licensing. These components may infringe on patents or trademarks held by OEMs. Sourcing such parts exposes buyers to legal risk, especially in regulated markets. Additionally, reverse-engineered cores often fail to meet OE performance and durability standards due to inaccuracies in replication.

Lack of IP Due Diligence

Failing to conduct intellectual property due diligence is a serious oversight. Some suppliers may offer “compatible” evaporator cores that closely mimic patented designs, potentially violating design or utility patents. Buyers should require suppliers to certify IP compliance and, where possible, review product design documentation to ensure freedom to operate. Ignoring IP risks can lead to cease-and-desist orders, product recalls, or litigation.

Inadequate Testing and Validation Data

Suppliers may provide evaporator cores without comprehensive performance data or validation reports. Without proof of pressure testing, thermal cycle testing, or corrosion resistance (e.g., salt spray testing), there’s no assurance the core will perform reliably under real-world conditions. Insist on receiving test reports aligned with industry standards (e.g., SAE J2064) before finalizing orders.

Supply Chain Opacity

Complex global supply chains can obscure the true origin and manufacturing practices of evaporator cores. Components may pass through multiple intermediaries, increasing the risk of counterfeit parts or lapses in quality control. Establish direct relationships with manufacturers, conduct on-site audits, and require traceability documentation (e.g., batch numbers, material certifications) to mitigate this risk.

Non-Compliance with Environmental and Safety Standards

Some low-cost evaporator cores may not comply with environmental regulations such as RoHS (Restriction of Hazardous Substances) or REACH. They might also fail to meet safety standards for refrigerant handling and system pressure integrity. Ensure that all components meet regional regulatory requirements to avoid compliance issues and potential liability.

Logistics & Compliance Guide for Air Conditioning Evaporator Cores

Product Overview

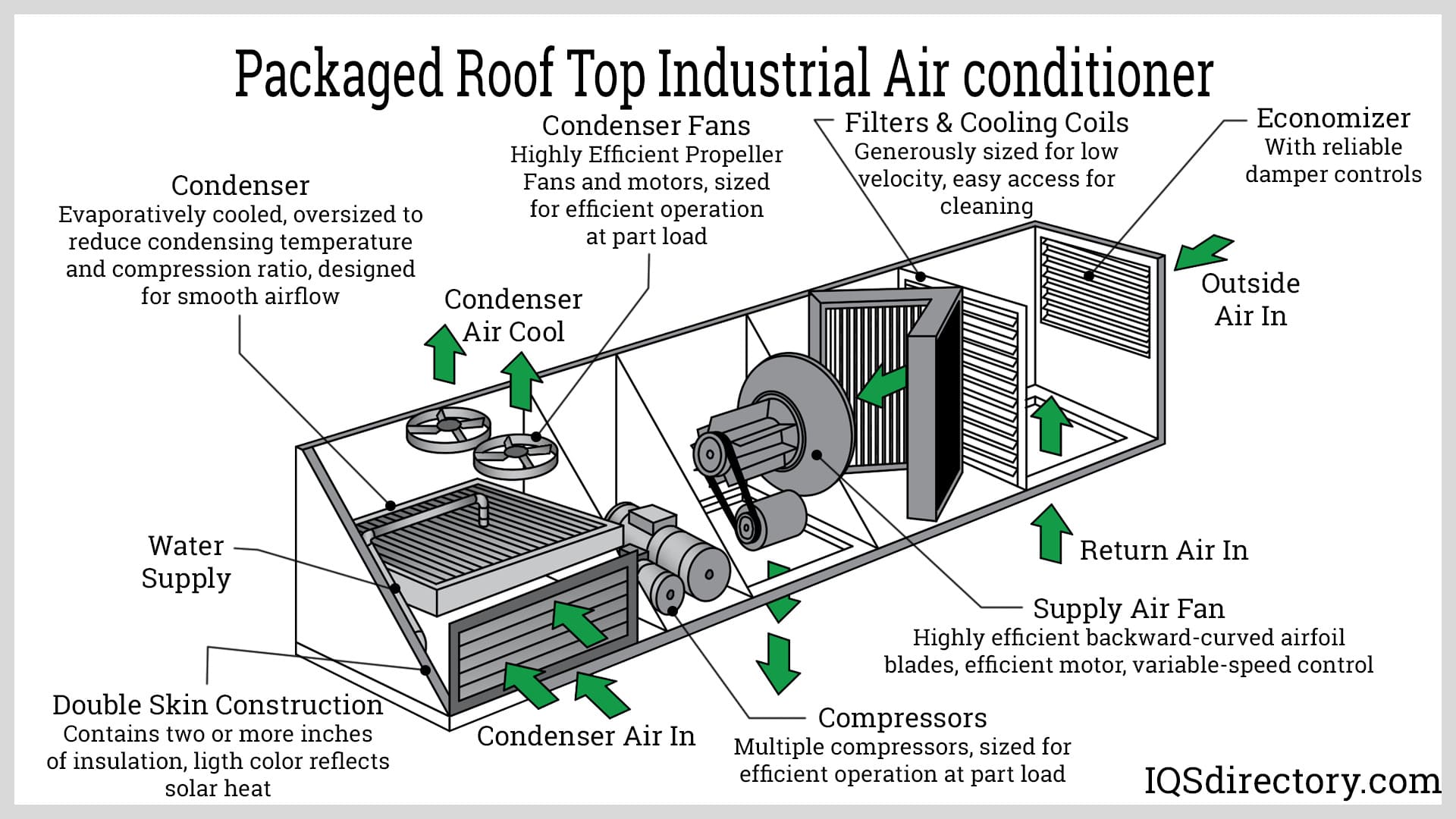

An air conditioning evaporator core is a critical component within an HVAC system, responsible for absorbing heat from the surrounding air by facilitating the phase change of refrigerant from liquid to gas. Typically constructed from aluminum or copper with aluminum fins, evaporator cores are used in automotive, residential, and commercial cooling applications. Due to their design and materials, special considerations are required for safe handling, transport, and regulatory compliance.

Packaging & Handling

Evaporator cores must be individually protected to prevent damage to the delicate fins and tubes during transit. Use rigid, corrugated cardboard boxes with internal foam or molded plastic inserts to immobilize the core. Seal all tube ends with protective caps or plugs to prevent contamination by dust, moisture, or debris. Clearly label each package with “Fragile,” “This Side Up,” and “Protect from Moisture.” Avoid stacking heavy items on top of packaged cores.

Transportation Mode Selection

Air, sea, and ground transport are viable depending on volume, urgency, and cost. For international shipments, sea freight is economical for large volumes, while air freight is preferred for urgent or low-volume orders. When shipping via air, ensure compliance with IATA regulations. Ground transport (e.g., trucking) is ideal for regional distribution. Always secure loads to prevent shifting, and use climate-controlled vehicles when transporting in extreme temperature or high-humidity environments.

Import/Export Documentation

Ensure all shipments include accurate commercial invoices, packing lists, and bills of lading or air waybills. For international trade, classify the evaporator core under the appropriate HS (Harmonized System) code—typically 8415.90 for parts of air conditioning units. Verify country-specific import requirements, which may include certificates of origin, import licenses, or conformity assessments. Maintain records for a minimum of five years for audit and compliance purposes.

Regulatory Compliance

Evaporator cores may be subject to environmental and product safety regulations. In the U.S., compliance with EPA regulations under Section 608 of the Clean Air Act may be required if the core is pre-charged with refrigerant. The EU’s F-Gas Regulation (No 517/2014) restricts the use and handling of fluorinated greenhouse gases. Ensure products meet REACH (EU) and RoHS directives for hazardous substances. In all cases, empty cores (without refrigerant) are subject to fewer restrictions.

Hazardous Material Considerations

Evaporator cores shipped empty and free of refrigerant are generally not classified as hazardous. However, if the core contains residual refrigerant, it may be classified as a hazardous material under DOT (49 CFR), IATA, or ADR regulations. In such cases, proper labeling, documentation, and packaging according to hazardous materials guidelines are mandatory. Always verify refrigerant type and quantity with the manufacturer or remanufacturer.

Customs Clearance

Prepare for customs inspections by providing accurate product descriptions and supporting documentation. Emphasize that the product is a component (not a complete AC unit) and confirm its duty rate based on the destination country’s tariff schedule. Use authorized economic operator (AEO) programs where available to expedite clearance. Work with licensed customs brokers in the destination country to ensure compliance with local regulations.

Storage Requirements

Store evaporator cores in a dry, temperature-controlled environment to prevent corrosion. Keep packaging intact until ready for installation. Avoid exposure to salt air, chemicals, or high humidity. Store on pallets off the floor and rotate stock using a first-in, first-out (FIFO) system to minimize aging and potential degradation.

End-of-Life & Environmental Responsibility

Dispose of defective or obsolete evaporator cores in accordance with local environmental regulations. Recycle aluminum and copper content through certified e-waste or metal recycling facilities. If cores contain refrigerant, recovery must be performed by certified technicians using approved equipment to prevent atmospheric release.

Summary & Best Practices

To ensure seamless logistics and compliance: use protective packaging, verify refrigerant status, classify under correct HS codes, comply with regional environmental regulations, and maintain thorough documentation. Partner with experienced freight forwarders and customs brokers familiar with HVAC components to minimize delays and avoid penalties.

Conclusion for Sourcing Air Conditioning Evaporator Core:

Sourcing an air conditioning evaporator core requires a strategic approach that balances quality, compatibility, cost, and reliability. After evaluating various suppliers, material specifications, and industry standards, it is evident that selecting the right evaporator core is critical to ensuring optimal thermal performance, energy efficiency, and longevity of the HVAC system. Prioritizing OEM specifications or high-quality aftermarket alternatives from reputable manufacturers helps mitigate risks of premature failure and costly repairs. Additionally, considering factors such as lead times, warranty offerings, and technical support enhances supply chain resilience and operational efficiency. Ultimately, a well-informed sourcing decision contributes to improved system reliability, customer satisfaction, and reduced lifecycle costs in both automotive and HVAC applications.