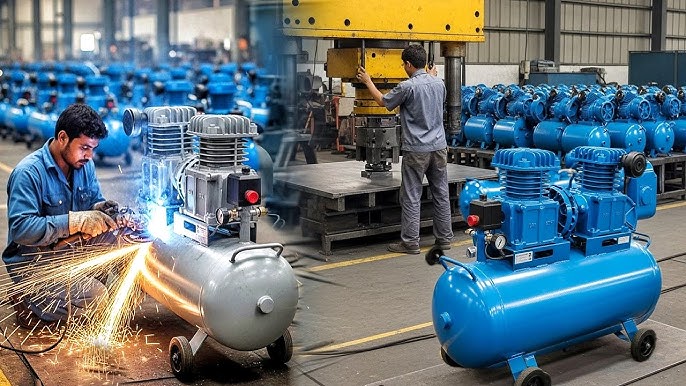

The global air compressor market is experiencing robust growth, driven by rising industrial automation, increasing demand in manufacturing, and expanding applications in industries such as automotive, construction, and oil & gas. According to a report by Mordor Intelligence, the market was valued at USD 34.8 billion in 2023 and is projected to reach USD 48.1 billion by 2029, growing at a CAGR of 5.6% during the forecast period. Similarly, Grand View Research estimates a CAGR of 5.4% from 2023 to 2030, underlining sustained momentum across regions, particularly in Asia-Pacific due to rapid industrialization and infrastructure development. As energy efficiency and smart manufacturing become key priorities, leading manufacturers are innovating with variable speed drive (VSD) technology, oil-free compressors, and IoT-enabled monitoring systems. In this evolving landscape, the top 10 air compressor manufacturers stand out for their technological leadership, global footprint, and strong R&D investments, shaping the future of compressed air solutions.

Top 10 Air Compressor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

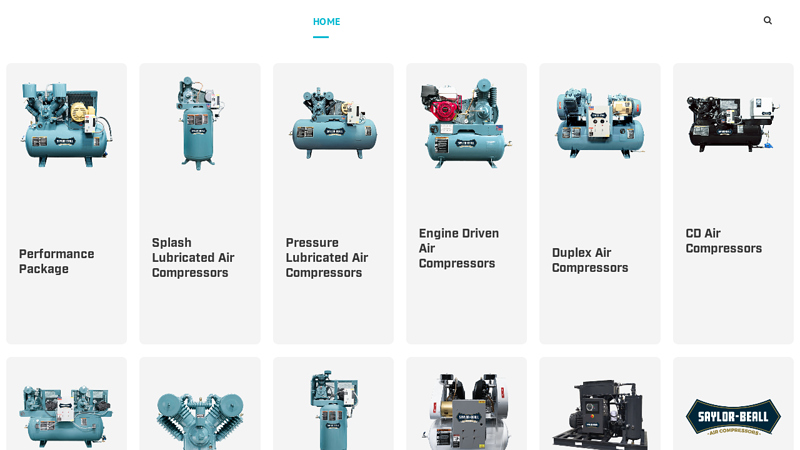

#1 Saylor

Domain Est. 1997

Website: saylor-beall.com

Key Highlights: Specialized manufacturers of two stage air compressors for commercial and industrial application….

#2 ELGi Industrial Air Compressors

Domain Est. 1997

Website: elgi.com

Key Highlights: ELGi Compressor in USA offers a wide range of portable air compressors that are environmentally friendly and adhere to most of the international standards….

#3 Bauer Compressors: High

Domain Est. 1997

Website: bauercomp.com

Key Highlights: Bauer Compressors manufactures a broad range of compressor systems for various breathing-air and industrial applications….

#4 Air Compressors for Industrial Use

Domain Est. 1997

Website: aircompressors.com

Key Highlights: Shop industrial and commercial air compressors, air dryers, and parts at AirCompressors.com. Trusted brands, expert support, and fast shipping….

#5 Ingersoll Rand Air Compressors, Power Tools, Lifting and Fluid …

Domain Est. 2001

Website: ingersollrand.com

Key Highlights: Air Compressors & Systems Ingersoll Rand is a worldwide manufacturer and distributor of unrivalled compressed air solutions, parts and accessories and services ……

#6 Campbell Hausfeld

Domain Est. 1997

Website: campbellhausfeld.com

Key Highlights: Campbell Hausfeld, The Air Power Expert™, creates reliable, easy-to-use air compressors and air tools for users from beginner to professional….

#7 Rolair Systems

Domain Est. 1999 | Founded: 1959

Website: rolair.com

Key Highlights: Since 1959, Rolair has been known for making the toughest contractor-grade compressors and pumps on the market….

#8 FS

Domain Est. 2008

Website: us.fscurtis.com

Key Highlights: Since 1854, we have manufactured rugged rotary screw and reciprocating air compressors in the USA, built for long-lasting power and reliability….

#9 Emax Compressor

Domain Est. 2009

Website: emaxcompressor.com

Key Highlights: EMAX Compressors offers high-performance air compressors specifically designed for factories, auto shops, and other commercial applications. These air ……

#10 Champion Compressors

Domain Est. 2017

Website: championcompressor.net

Key Highlights: We specialize in the sales, installation, service and repair of Champion air compressors and air dryers, as well as having a large inventory of parts and ……

Expert Sourcing Insights for Air Compressor

2026 Market Trends for Air Compressors

Growing Demand in Industrial Automation and Manufacturing

The global air compressor market is projected to experience robust growth by 2026, driven primarily by increased adoption of industrial automation and the expansion of advanced manufacturing sectors. As industries such as automotive, aerospace, and consumer electronics embrace smart factories and Industry 4.0 technologies, the need for reliable and efficient compressed air systems continues to rise. Air compressors serve as a critical utility in automated production lines, powering pneumatic tools, robotic arms, and material handling systems. The integration of digital monitoring and predictive maintenance solutions into air compressor units is enhancing operational efficiency, reducing downtime, and lowering energy costs—factors that are accelerating demand across high-tech manufacturing environments.

Expansion in Oil & Gas and Construction Sectors

Another key driver shaping the 2026 air compressor landscape is the revival and growth in the oil & gas and construction industries, particularly in emerging economies. In oil & gas, air compressors are essential for pipeline maintenance, pneumatic actuation, and offshore platform operations. With rising energy demands and infrastructure development in regions like Asia-Pacific, the Middle East, and Africa, investments in energy exploration and construction projects are fueling the need for durable and high-capacity compressors. Similarly, in the construction sector, portable and mobile air compressors are in high demand for tools such as jackhammers, nail guns, and spray systems. The trend toward modular construction and large-scale urban development is expected to sustain this demand through 2026.

Shift Toward Energy-Efficient and Smart Compressor Systems

Energy efficiency remains a top priority for end-users, prompting manufacturers to innovate with variable speed drive (VSD) compressors, advanced heat recovery systems, and IoT-enabled monitoring platforms. By 2026, energy-efficient models are expected to dominate new installations, supported by stricter environmental regulations and rising electricity costs. Smart compressors equipped with sensors and cloud connectivity enable real-time performance tracking, remote diagnostics, and energy consumption optimization. These features not only reduce operational expenses but also support sustainability goals. As corporate environmental, social, and governance (ESG) standards gain importance, companies are increasingly investing in compressors with lower carbon footprints and higher lifecycle efficiency.

Regional Market Dynamics and Emerging Opportunities

Regionally, the Asia-Pacific market is anticipated to lead global growth by 2026, driven by rapid industrialization in countries like India, Vietnam, and Indonesia. China’s ongoing infrastructure upgrades and manufacturing modernization efforts will further bolster demand. Meanwhile, North America and Europe are focusing on retrofitting aging compressor systems with energy-saving technologies and complying with environmental directives such as the EU Ecodesign regulations. Additionally, the growing adoption of electric and oil-free compressors in food & beverage, pharmaceuticals, and healthcare sectors—where air quality is critical—presents a niche but expanding opportunity. These trends collectively indicate a diversified and technology-driven market trajectory for air compressors by 2026.

Common Pitfalls When Sourcing Air Compressors: Quality and Intellectual Property (IP) Concerns

Sourcing air compressors, especially from international or non-traditional suppliers, involves significant risks related to product quality and intellectual property. Overlooking these areas can lead to operational failures, safety hazards, and legal complications. Below are key pitfalls to avoid:

Quality-Related Pitfalls

1. Inadequate Verification of Specifications and Performance Claims

Suppliers, particularly those in competitive or less-regulated markets, may exaggerate performance metrics such as CFM (cubic feet per minute), pressure ratings, or energy efficiency. Without independent validation or third-party testing reports, buyers risk acquiring underperforming units that fail to meet operational demands, leading to production bottlenecks and increased maintenance costs.

2. Use of Substandard Materials and Components

Lower-cost compressors often use inferior materials—such as low-grade steel, subpar seals, or non-certified motors—that degrade quickly under continuous operation. This compromises reliability, increases downtime, and may void safety certifications. Always request material certifications and conduct factory audits when possible.

3. Lack of Compliance with International Standards

Ensure compressors meet relevant standards such as ISO 1217 (performance testing), ASME (pressure vessel safety), or CE/UKCA (European and UK safety). Non-compliant units pose safety risks and may be barred from operation in regulated industries or regions. Verify certification documents and look for recognized testing body marks.

4. Poor After-Sales Support and Spare Parts Availability

Even high-quality compressors require maintenance. Sourcing from suppliers without a reliable service network or parts inventory leads to extended downtimes. Confirm the supplier’s technical support structure, warranty terms, and spare parts lead times before purchase.

Intellectual Property (IP) Risks

1. Counterfeit or Cloned Equipment

Some suppliers offer “compatible” or “OEM-style” compressors that mimic branded models without authorization. These may infringe on design patents, trademarks, or technical IP, exposing buyers to legal liability, especially in jurisdictions with strong IP enforcement (e.g., EU, USA).

2. Unauthorized Use of Proprietary Technology

Certain compressor technologies—such as rotary screw designs, oil-free mechanisms, or digital control systems—are protected by patents. Sourcing from manufacturers that replicate such features without licensing can result in product seizures, lawsuits, or reputational damage.

3. Lack of Transparency in Manufacturing Origin

Suppliers may obscure the true origin of components or final assembly to circumvent IP protections or tariffs. Request full supply chain documentation and conduct supplier due diligence to ensure authenticity and compliance.

4. Risk of IP Infringement Liability

Buyers can be held liable for contributory infringement if they knowingly procure and use counterfeit or IP-violating equipment. Implement procurement policies that require IP compliance warranties and conduct supplier audits to mitigate this risk.

Best Practices to Mitigate Risks

- Engage Reputable Suppliers: Prioritize vendors with verifiable track records, certifications, and transparent manufacturing processes.

- Conduct On-Site Audits: Visit production facilities to assess quality control systems and authenticity of components.

- Require Documentation: Insist on performance test reports, material certificates, compliance certifications, and IP ownership declarations.

- Use Legal Safeguards: Include IP indemnity clauses in procurement contracts and perform due diligence on patent landscapes for critical technologies.

By proactively addressing quality and IP concerns, organizations can ensure reliable operations, avoid legal exposure, and protect long-term asset value when sourcing air compressors.

Logistics & Compliance Guide for Air Compressors

Product Classification and Regulatory Overview

Air compressors are classified under various international and national regulations depending on their type, power source, pressure capacity, and intended use. Key regulatory frameworks include:

- HS Code (Harmonized System): Typically fall under 8414.80 (Air pumps, air or vacuum pumps, air or other gas compressors) for customs classification. Confirm the exact code based on specifications (e.g., portable vs. stationary, electric vs. diesel-powered).

- Pressure Equipment Directive (PED) 2014/68/EU: Applies in the European Union to compressors operating at a maximum allowable pressure greater than 0.5 bar. Compliance requires CE marking and adherence to design, manufacturing, and testing standards.

- ASME Boiler and Pressure Vessel Code (BPVC): Required in the United States for pressure vessels, including air receiver tanks. Certification by an authorized inspector is mandatory.

- CSA B52 Mechanical Refrigeration Code: Applicable in Canada for pressure-containing components.

- ATEX Directive 2014/34/EU: Applies if the compressor is intended for use in potentially explosive atmospheres (e.g., oil-lubricated compressors in hazardous zones).

Packaging and Handling Requirements

Proper packaging ensures safe transport and compliance with logistics standards:

- Secure Mounting: Compressors must be firmly mounted on pallets using straps or bolts to prevent movement during transit.

- Weather Protection: Use waterproof covers or enclosed containers to protect against moisture, especially for outdoor storage or sea freight.

- Fragile Components: Isolate sensitive parts (gauges, electrical panels, hoses) with protective foam or crating.

- Lifting Points: Ensure lifting eyes or forklift access points are clearly marked and structurally sound.

- Marking and Labeling: Include handling labels (e.g., “This Side Up”, “Fragile”, “Do Not Stack”) and product identification (model, serial number, weight, center of gravity).

Transportation and Shipping Considerations

Transport method impacts compliance and logistics planning:

- Road Transport (ADR): If powered by internal combustion engines and carrying fuel, ADR regulations may apply for hazardous goods. Empty fuel tanks and proper ventilation reduce risks.

- Air Freight (IATA): Generally permitted for electric compressors without fuel. Compressors with internal combustion engines may be restricted unless fuel tanks are completely drained and cleaned. Lithium batteries (if present) must comply with IATA Dangerous Goods Regulations (DGR).

- Sea Freight (IMDG Code): Diesel or gasoline-powered units may be classified as hazardous if fuel remains. Declare accurately using proper shipping names, UN numbers (e.g., UN1202 for diesel), and packing group.

- Battery-Powered Units: Follow UN 38.3 testing requirements for lithium-ion batteries. Include state of charge ≤30% and protective circuitry.

Import/Export Documentation

Ensure accurate and complete documentation to avoid customs delays:

- Commercial Invoice (with detailed description, HS code, value, country of origin)

- Packing List (itemized contents, weights, dimensions)

- Certificate of Origin

- Bill of Lading or Air Waybill

- CE Certificate or Declaration of Conformity (for EU)

- ASME Certification (for U.S. pressure vessels)

- Test Reports (hydrostatic, material, electrical safety)

- Import Permits (if required by destination country)

Electrical and Safety Compliance

Electrical components must meet regional standards:

- North America: UL 60947-4-1 or CSA C22.2 No. 14 for motor controllers; NEC/CEC compliance for installation.

- European Union: EN 60204-1 (Safety of machinery – Electrical equipment), EMC Directive 2014/30/EU, and Low Voltage Directive 2014/35/EU.

- Other Markets: Check local certifications (e.g., CCC in China, KC in South Korea, PSE in Japan).

Environmental and Energy Regulations

Comply with energy efficiency and environmental standards:

- Energy Efficiency: Meet EU Ecodesign Directive (2005/32/EC), U.S. DOE standards, or other regional efficiency requirements.

- Noise Emissions: Comply with EU Noise Directive 2000/14/EC (mandatory noise labeling and limits).

- RoHS & REACH: Restrict hazardous substances (e.g., lead, cadmium) in electrical and mechanical components (EU).

- WEEE Directive: Plan for end-of-life recycling; provide take-back information where required.

Installation and End-User Compliance

Provide clear guidance for legal and safe operation:

- Include multilingual instruction manuals covering installation, operation, maintenance, and safety.

- Highlight requirements for ventilation, grounding, and protective devices.

- Specify necessary certifications for installers (e.g., licensed electrician, pressure system technician).

- Recommend periodic inspections and pressure relief valve testing per local codes.

Summary

Successful logistics and compliance for air compressors require early planning across classification, packaging, transportation, documentation, and regional regulatory alignment. Partner with certified testing labs, freight forwarders experienced in industrial equipment, and legal advisors familiar with target markets to ensure smooth global distribution.

Conclusion for Sourcing an Air Compressor

In conclusion, sourcing the right air compressor requires a careful evaluation of operational needs, including required air flow (CFM), pressure (PSI), duty cycle, and intended applications. Energy efficiency, maintenance requirements, noise levels, and available space are also critical factors that influence the selection process. After assessing various types—such as reciprocating, rotary screw, and centrifugal compressors—the most suitable option should align with both current demands and potential future expansion.

Additionally, considering total cost of ownership—not just the initial purchase price but also energy consumption, maintenance, and lifespan—ensures long-term cost-effectiveness. Supplier reliability, warranty, and after-sales support further contribute to a successful procurement decision.

Ultimately, selecting a high-quality, appropriately sized air compressor from a reputable supplier will enhance operational efficiency, reduce downtime, and provide reliable performance for years to come. A well-informed sourcing strategy ensures that the chosen compressor delivers optimal value and supports the productivity goals of the organization.