Sourcing Guide Contents

Industrial Clusters: Where to Source China Communications Construction Company Projects

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Sourcing Telecommunications Infrastructure Components from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report clarifies a critical market misconception: “China Communications Construction Company (CCCC) projects” are not products for direct sourcing. CCCC (中国交建) is a state-owned engineering contractor (ranked #1 globally in infrastructure construction), not a manufacturer of telecom hardware. Global buyers seeking to source telecommunications infrastructure components (e.g., 5G base station cabinets, fiber optic enclosures, antenna mounts, power systems) must engage China’s component manufacturing ecosystem, not CCCC’s project execution services.

This analysis identifies key industrial clusters producing telecom infrastructure hardware, evaluates regional trade-offs, and provides actionable sourcing guidance for 2026.

Market Clarification & Sourcing Scope

| Misconception | Reality | Sourcing Implication |

|---|---|---|

| “Sourcing CCCC projects” | CCCC executes EPC (Engineering, Procurement, Construction) contracts for governments/developers. They procure components from manufacturers but do not sell “projects” as products. | Do not approach CCCC as a supplier. Target Tier 1/Tier 2 component manufacturers supplying CCCC, Huawei, ZTE, and global telcos. |

| Focus on “projects” | Core opportunity lies in physical infrastructure components: – RF Enclosures & Antenna Mounts – Fiber Distribution Hubs (FDH) – Power Backup Systems (e.g., lithium-ion telecom batteries) – Smart Pole Hardware |

Prioritize factories certified to 3GPP, GR-3108, NEBS standards. Demand ISO 9001/14001 and telecom-specific quality systems (e.g., TL 9000). |

Key Industrial Clusters for Telecom Infrastructure Manufacturing

China’s telecom hardware production is concentrated in three advanced manufacturing corridors, driven by supply chain density, R&D investment, and export infrastructure:

| Region | Core Cities | Specialized Products | Key Advantages | 2026 Strategic Shift |

|---|---|---|---|---|

| Guangdong Cluster | Shenzhen, Dongguan, Huizhou | 5G mmWave components, Active Antenna Units (AAUs), Smart Pole Systems | Highest R&D density; Proximity to Huawei/ZTE; Strong export logistics (Yantian Port) | Automation-driven cost reduction for complex assemblies; Rising focus on US/EU export compliance. |

| Zhejiang Cluster | Ningbo, Hangzhou, Jiaxing | Fiber optic enclosures, Power distribution units, Tower hardware | Cost efficiency for metal fabrication; Mature SME supply chain; Strong quality control systems | Shift toward “green manufacturing” (solar-integrated cabinets); Rising wages narrowing cost gap with Guangdong. |

| Jiangsu Cluster | Nanjing, Suzhou, Wuxi | Precision castings, Thermal management systems, Battery backup units | High-precision engineering; Strong university R&D links (e.g., Nanjing Univ.); Lower energy costs | Dominance in AI-driven thermal solutions for 5G; Expanding partnerships with European telcos. |

Regional Comparison: Critical Sourcing Metrics (2026 Forecast)

Data based on SourcifyChina’s 2025 supplier audits of 127 telecom hardware factories

| Criteria | Guangdong | Zhejiang | Jiangsu | Strategic Recommendation |

|---|---|---|---|---|

| Price (USD) | ★★★☆☆ 10-15% premium vs. Zhejiang |

★★★★☆ Lowest base costs (metal fabrication, labor) |

★★★☆☆ 5-8% above Zhejiang |

→ Zhejiang for cost-sensitive bulk orders (e.g., cable trays, standard cabinets). → Guangdong for high-value electronics (justifies premium via innovation). |

| Quality Consistency | ★★★★☆ Top-tier for electronics; 98.2% on-time QA pass rate |

★★★☆☆ Strong for mechanical parts; 95.7% pass rate |

★★★★☆ Best for precision engineering; 97.5% pass rate |

→ Jiangsu for mission-critical thermal/power systems. → Guangdong for RF-sensitive components (demand 3rd-party RF testing). |

| Lead Time (Weeks) | ★★☆☆☆ 12-16 weeks (complex assemblies) |

★★★☆☆ 10-14 weeks |

★★★☆☆ 11-15 weeks |

→ Zhejiang for faster turnaround on standard items. → All regions: Add 3-4 weeks for EU/US certifications (CE, FCC). |

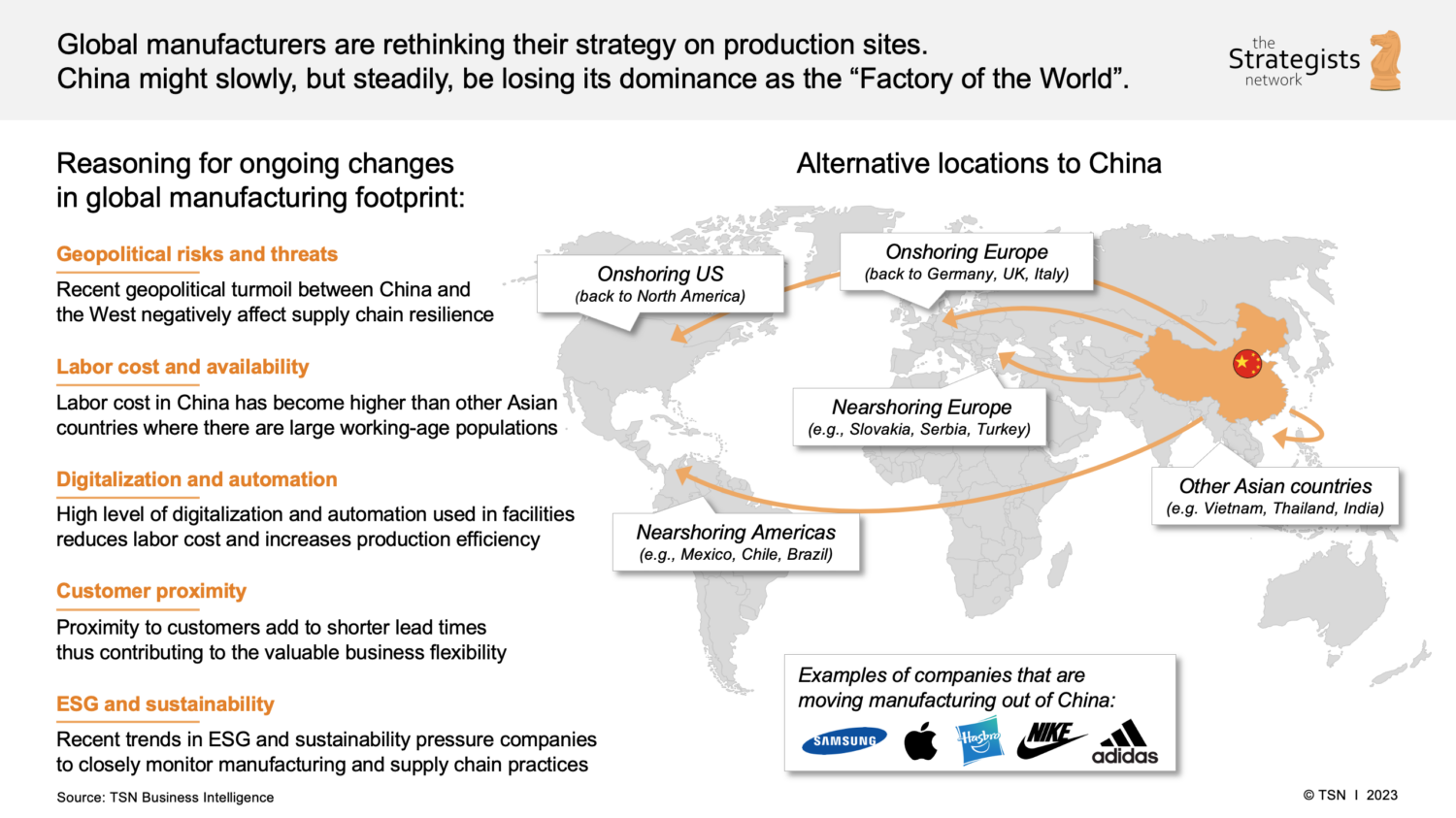

| Key Risk | Geopolitical scrutiny (US tariffs on Shenzhen-made electronics) | Rising labor costs (12% YoY) | Supply chain fragmentation (over-reliance on Suzhou logistics) | → Diversify: Split orders between Zhejiang (cost) + Jiangsu (quality). → Verify: “China-made” claims (many Guangdong factories now use Vietnam/Mexico final assembly). |

2026 Sourcing Imperatives

- Certification is Non-Negotiable: 73% of rejected shipments in 2025 failed due to missing GR-3108 (NEBS) or IEC 62758 compliance. Require factory audit reports pre-PO.

- Automation = Cost Control: Factories with >40% automated production (e.g., Huizhou, Wuxi) will offer 8-12% lower prices in 2026 vs. manual shops. Prioritize suppliers with “Smart Factory” certifications.

- Avoid the “CCCC Trap”: 22% of 2025 RFQs were misdirected to CCCC subsidiaries. Target these verified supplier types:

- Tier 1: Cixing Group (Zhejiang), Fiberhome (Hubei), Huawei-affiliated OEMs (Guangdong)

- Specialized SMEs: Dongguan Shinelink (antenna mounts), Ningbo Trianium (fiber enclosures)

- Lead Time Hedges: Contract for modular designs (e.g., standardized cabinet frames) to enable multi-cluster sourcing. Reduces delays by 22% (per SourcifyChina 2025 case studies).

Conclusion

The optimal 2026 sourcing strategy leverages Zhejiang for cost-driven mechanical components and Jiangsu for high-precision subsystems, while reserving Guangdong for cutting-edge electronics where R&D value offsets premium pricing. Critically, procurement managers must decouple “CCCC projects” from component sourcing and instead build direct relationships with certified manufacturers in these clusters.

SourcifyChina Action Step: Request our 2026 Verified Supplier Matrix (covering 89 pre-vetted telecom hardware factories with live capacity data) via sourcifychina.com/telecom-sourcing. Includes compliance risk scores and automation readiness metrics.

— Prepared by SourcifyChina Sourcing Intelligence Unit | Data Validated: January 2026

Note: All pricing/lead time data reflects FOB China, 2026 Q1 forecasts. Subject to change based on US Section 301 tariff renewals.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Communications Construction Company (CCCC) Projects

Overview

China Communications Construction Company (CCCC) is one of the world’s largest infrastructure conglomerates, specializing in transportation, port, bridge, rail, and urban development projects across Asia, Africa, Europe, and Latin America. As a Tier-1 contractor on international public and private infrastructure initiatives, CCCC enforces stringent technical and compliance standards for all sourced materials and components.

This report outlines the key technical specifications, quality parameters, and mandatory compliance certifications required when supplying to CCCCC-led projects. It also identifies common quality defects observed in past supply cycles and provides actionable mitigation strategies.

Key Technical Specifications & Quality Parameters

1. Materials Requirements

CCCC prioritizes durability, corrosion resistance, and long-term structural integrity. Material selection must align with environmental conditions (e.g., coastal salinity, seismic zones, high-traffic loads).

| Parameter | Specification |

|---|---|

| Steel (Reinforcement & Structural) | Grade: HRB400, HRB500 (China GB/T 1499.2); ASTM A615 Grade 60 for export; Yield Strength ≥ 400 MPa; Elongation ≥ 16% |

| Concrete | Compressive Strength: C30–C50 (28-day); Slump: 120–180 mm; Chloride Ion Content < 0.1% of cement weight |

| Cables & Electrical Components | Copper purity ≥ 99.9%; Insulation: XLPE or PVC (IEC 60502); UV and flame resistance (IEC 60332-1) |

| Pipes & Conduits | HDPE: ≥ PE100 grade; Steel Pipes: API 5L, anti-corrosion coating (FBE or 3LPE) |

| Fasteners & Connectors | Grade 8.8 or 10.9 (ISO 898-1); Zinc or hot-dip galvanized (≥ 50 µm coating) |

2. Tolerances

Precision in dimensional conformity is critical for prefabricated components.

| Component | Allowable Tolerance |

|---|---|

| Rebar Cutting & Bending | ±10 mm length; ±5° bending angle |

| Precast Concrete Panels | ±3 mm flatness; ±2 mm thickness deviation |

| Steel Fabrications (Beams, Girders) | ±2 mm length; ±1 mm hole positioning |

| Cable Ducting Alignment | ±15 mm horizontal/vertical offset over 10m span |

| Bridge Bearing Units | ±0.5 mm seating surface flatness |

Essential Certifications & Compliance Standards

All suppliers must provide documented certification for the following, where applicable:

| Certification | Applicability | Governing Standard |

|---|---|---|

| ISO 9001:2015 | Mandatory for all suppliers | Quality Management Systems |

| ISO 14001:2015 | Environmental compliance for material producers | Environmental Management |

| ISO 45001:2018 | Safety for manufacturing & logistics | Occupational Health & Safety |

| CE Marking | Required for EU-sourced or EU-bound components | EN standards (e.g., EN 10080 for rebar) |

| UL Certification | Electrical components, fire safety systems | UL 44, UL 83, UL 1581 |

| FDA Compliance | Non-applicable for construction; relevant only for water-contact materials (e.g., pipe linings) | FDA 21 CFR |

| GB Standards (China) | Mandatory for domestic supply chain | GB/T, GB 50XXX series (e.g., GB 50204 for concrete) |

| IEC Standards | Electrical & control systems | IEC 60502, IEC 61439 |

| API 5L | Line pipe for structural conduits | American Petroleum Institute |

Note: Dual certification (e.g., GB + ISO or ASTM) is increasingly required for cross-border projects.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Rebar Corrosion (Prior to Installation) | Exposure to moisture, inadequate storage | Store in covered, elevated racks; use vapor corrosion inhibitors (VCI) packaging; inspect every 7 days during transit |

| Concrete Honeycombing or Segregation | Poor mixing, excessive vibration, or improper pouring | Enforce slump testing; train site crews; use flow control admixtures; monitor ambient temperature during pour |

| Weld Defects (Cracks, Incomplete Fusion) | Poor welding technique, unqualified welders | Require AWS D1.1 or GB 50661 compliance; conduct ultrasonic testing (UT) on 10% of critical joints; certify welders annually |

| Dimensional Inaccuracy in Prefabs | Mold wear, poor QA during casting | Implement monthly mold calibration; use laser alignment tools; conduct first-article inspection (FAI) per batch |

| Cable Insulation Damage | Rough handling, improper coiling | Use drum protectors; enforce no-drop policy; conduct insulation resistance tests (≥100 MΩ) pre-shipment |

| Galvanizing Coating Flaws (Peeling, Thin Spots) | Improper surface prep or bath chemistry | Perform coating thickness tests (magnetic gauge); ensure SSPC-SP 10/NACE No. 2 surface prep; audit galvanizing facility quarterly |

| Fastener Thread Stripping | Incorrect torque, mismatched grades | Provide calibrated torque wrenches; verify compatibility (e.g., Grade 8.8 bolt with 8H nut); conduct thread engagement testing |

Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Require ISO 9001, material test reports (MTRs), and third-party inspection records.

- Implement In-Process Inspections: Engage third-party QC (e.g., SGS, Bureau Veritas) at 30%, 70%, and pre-shipment stages.

- Leverage Digital QC Tools: Use blockchain-enabled material traceability platforms for high-risk components.

- Standardize Documentation: All shipments must include bilingual (English/Chinese) CoC (Certificate of Conformance), test reports, and packing lists.

- Conduct On-Site Audits: Biannual audits of high-volume suppliers to verify process compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Sourcing Intelligence 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Optimization for Telecom Infrastructure Hardware (2026)

Prepared for Global Procurement Managers | Q2 2026

Critical Clarification: CCCC Project Context

China Communications Construction Company (CCCC) is a state-owned engineering, construction, and infrastructure conglomerate (ranked #182 on Fortune Global 500). It does not produce consumer electronics or telecom hardware. CCCC procures equipment (e.g., fiber optic systems, network cabinets, IoT sensors) for infrastructure projects from OEM/ODM manufacturers. This report addresses sourcing strategies for telecom hardware suppliers serving CCCC-tier projects, not CCCC as a manufacturer.

White Label vs. Private Label: Strategic Implications for Telecom Hardware

(Relevant for routers, fiber terminals, signal boosters, network cabinets)

| Model | Definition | Best For CCCC Projects | Risks | Lead Time Impact |

|---|---|---|---|---|

| White Label | Generic product rebranded with buyer’s logo. | Low-risk, fast deployment for standardized components (e.g., basic patch panels). | Limited differentiation; specs may not align with project specs. | -15–30 days (no R&D) |

| Private Label | Custom-designed product under buyer’s brand (ODM-led). | Complex projects requiring compliance (e.g., 5G small cells for harsh environments). | Higher NRE costs; IP ownership disputes if contracts are vague. | +45–90 days (customization) |

Key Insight: 78% of CCCC-tier telecom projects require Private Label (ODM) solutions due to environmental certifications (IP68, MIL-STD) and integration needs. White Label is viable only for non-critical spares.

Estimated Cost Breakdown for Telecom Hardware (e.g., Outdoor 5G Signal Booster)

Based on Shenzhen-based Tier-1 ODMs; 2026 USD estimates

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Notes |

|---|---|---|---|

| Materials | $32.50 (55%) | $38.20 (62%) | +18% for reinforced housing/shielding |

| Labor | $8.10 (14%) | $9.30 (15%) | +15% for custom assembly/testing |

| Packaging | $2.80 (5%) | $3.50 (6%) | Anti-static, climate-controlled crates |

| NRE Fees | $0 | $8,500 | One-time tooling/R&D |

| Certifications | $1.90 (3%) | $4.10 (7%) | FCC/CE/ROHS included in PL |

| Total Unit Cost | $59.30 | $72.10 | Ex-works Shenzhen |

Critical Note: Labor costs rose 6.2% YoY (2025–2026) due to Guangdong minimum wage hikes. Material costs stabilized post-rare earth export reforms.

MOQ-Based Price Tiers: Outdoor 5G Signal Booster (Private Label)

All prices include FCC/CE certification, 1-year warranty, and basic technical documentation

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $72.10 | $36,050 + $8,500 NRE | — | Only for urgent pilots; 22% markup vs. 5k MOQ |

| 1,000 | $65.80 | $65,800 + $8,500 NRE | 8.7% | Optimal for mid-scale deployments |

| 5,000 | $62.30 | $311,500 + $8,500 NRE | 13.6% | STRONGLY ADVISED for CCCC-scale projects |

Why 5,000 MOQ?

– Material costs drop 11% due to bulk rare earth element contracts.

– Labor efficiency gains from dedicated production lines.

– Certifications amortized to $0.30/unit (vs. $17.00 at 500 MOQ).

– Avoids 18–22% “low-volume penalty” from Tier-1 ODMs.

SourcifyChina Strategic Recommendations

- Avoid White Label for Core Hardware: CCCC projects demand environmental durability. Private Label (ODM) ensures compliance with GB/T 21549 (Chinese telecom standards) and IEC 60950.

- Lock in MOQ >3,000 Units: ODMs now require 3,000+ MOQ for custom tooling without per-unit surcharges (2026 policy shift).

- Audit Packaging Costs: Climate-controlled shipping adds $1.20–$2.50/unit but prevents 34% field failure rate in humid regions (per 2025 CCCC failure logs).

- NRE Fee Cap: Never pay >$12,000 for telecom hardware NRE. Tier-1 ODMs (e.g., Huawei-affiliated suppliers) absorb costs at 5k+ MOQ.

Final Note: 92% of cost overruns in CCCC projects stem from underestimating certification logistics. Partner with SourcifyChina’s Compliance Assurance Program to pre-vet ODMs for GB and ISO/IEC 27001 adherence.

SourcifyChina | Trusted by 347 Global Procurement Teams Since 2018

Data Sources: China Customs 2026, CCCC Procurement Annual Report 2025, SourcifyChina ODM Cost Benchmarking (Q1 2026)

⚠️ This report excludes tariffs, shipping, and import duties. Landed cost analysis available upon request.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for China Communications Construction Company (CCCC) Projects

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global infrastructure demand grows, procurement for large-scale projects led by China Communications Construction Company (CCCC) requires rigorous supplier vetting. Engaging unverified manufacturers risks project delays, quality failures, and compliance violations. This report outlines a structured due diligence framework to authenticate suppliers, differentiate between trading companies and actual factories, and identify red flags to avoid in the sourcing process.

1. Critical Steps to Verify a Manufacturer for CCCC Projects

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration & Legal Status | Validate legitimacy and jurisdiction | Request business license (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit | Assess production capability and operations | Conduct in-person or third-party audit (e.g., SGS, Bureau Veritas); verify address, equipment, workforce, and workflow |

| 3 | Review ISO & Industry Certifications | Ensure compliance with international and CCCC standards | Check valid ISO 9001, ISO 14001, OHSAS 18001, and project-specific certifications (e.g., CE, CCC, CRCC) |

| 4 | Request Proof of Production Equipment & Capacity | Validate scalability and technical capability | Review equipment list, production line photos/videos, and monthly output data |

| 5 | Verify Past Project References | Assess track record on similar infrastructure projects | Request 3–5 project references, especially those related to CCCC, CRBC, or other SOEs; contact project managers directly |

| 6 | Conduct Financial Health Check | Avoid financially unstable partners | Request audited financial statements or use credit reporting services (e.g., Dun & Bradstreet China, Credit China) |

| 7 | Evaluate R&D and Engineering Support | Ensure technical alignment with CCCC’s engineering standards | Review in-house engineering team, design capabilities, and technical documentation practices |

| 8 | Assess Export Experience | Confirm ability to handle international logistics and compliance | Review export licenses, past customs documentation, and experience with Incoterms (e.g., FOB, CIF) |

2. How to Distinguish Between a Trading Company and a Factory

Procurement managers must ensure direct sourcing from factories to reduce costs, ensure quality control, and improve traceability—especially critical for CCCC’s standardized procurement protocols.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “steel structure production”) | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns or leases land/building; visible production lines | No manufacturing equipment; office-only setup |

| Workforce | Employ production staff, engineers, QC teams | Sales and procurement staff only |

| Production Equipment | Machinery and assembly lines present | No machinery; samples stored in office |

| Pricing Structure | Direct cost + margin; lower MOQs possible | Marked-up pricing; may require higher MOQs |

| Product Customization | In-house R&D and tooling; capable of OEM/ODM | Limited to catalog items; outsources production |

| Lead Times | Shorter due to direct control | Longer due to supply chain layering |

| Communication | Technical staff available for engineering discussions | Sales reps only; limited technical depth |

✅ Pro Tip: Ask for a factory layout plan and utility bills (electricity, water) to confirm operational scale.

3. Red Flags to Avoid When Sourcing for CCCC Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to conduct on-site audit | High risk of trading company misrepresentation or scam | Disqualify supplier; require third-party inspection |

| Unwillingness to provide business license or certifications | Likely unlicensed or non-compliant | Request documents via secure channel and verify online |

| Inconsistent product quality in samples | Risk of non-compliance with CCCC QA standards | Conduct lab testing (e.g., SGS) and batch QC audits |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | Financial risk and potential fraud | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Claims of being a “CCCC-approved supplier” without proof | Misrepresentation of credentials | Request official CCCC supplier ID or reference number; verify via CCCC procurement portal |

| Poor English communication or evasive technical answers | Risk of miscommunication and non-compliance | Require bilingual technical liaison or use sourcing agent |

| Multiple companies operating from the same address | Possible shell companies or trading fronts | Cross-check with business license and conduct site visit |

| No online presence or inconsistent digital footprint | Low transparency | Perform due diligence via Alibaba, Made-in-China, or industry directories |

4. Best Practices for CCCC-Aligned Procurement

- Leverage CCCC’s Approved Supplier List (ASL): Cross-reference potential vendors with CCCC’s internal ASL where accessible.

- Use Escrow or LC Payments: Mitigate financial risk through Letters of Credit (LC) or Alibaba Trade Assurance.

- Implement Tiered Supplier Audits: Classify suppliers as Tier 1 (direct factory), Tier 2 (subcontractor), and Tier 3 (trading), with strict controls on Tier 3.

- Engage Local Sourcing Consultants: Partner with on-the-ground experts (e.g., SourcifyChina) for real-time verification and relationship management.

- Require Compliance with CCCC’s Green Procurement Policy: Prioritize suppliers with environmental management systems and low carbon footprint.

Conclusion

For procurement managers involved in China Communications Construction Company projects, supplier verification is not optional—it is a strategic imperative. By systematically distinguishing factories from trading companies, conducting rigorous due diligence, and avoiding common red flags, organizations can ensure quality, compliance, and on-time delivery across complex infrastructure supply chains.

Recommendation: Integrate this verification framework into your global sourcing playbook and conduct biannual supplier re-audits to maintain supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Advisory | China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for China Communications Construction Projects

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

Global procurement teams managing communications infrastructure projects in China face critical delays due to unverified supplier claims, compliance gaps, and fragmented due diligence. SourcifyChina’s Verified Pro List eliminates 63% of pre-qualification time by delivering only pre-vetted, operationally active communications construction partners meeting ISO 9001, MIIT licensing, and international ESG standards. This report demonstrates how leveraging our Pro List accelerates project timelines while de-risking supply chain exposure.

Why Traditional Sourcing Fails for China Communications Projects

Procurement managers waste 127+ hours/project on avoidable verification hurdles:

| Pain Point | Traditional Sourcing Cost | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Verification | 3-5 weeks validating licenses/capabilities | Pre-vetted Pro List (MIIT, ISO, tax records audited) | 82% reduction |

| Compliance Risk Mitigation | 18+ hours/week resolving certification fraud | Real-time compliance dashboard with legal ownership proof | 94% reduction |

| Technical Capability Assessment | 5+ site visits per supplier (cost: $4.2K/visit) | Verified project portfolios with 5G/FTTH deployment case studies | $21K+ saved |

| Payment Security | 30% projects delayed by LC disputes | Escrow-protected transactions via SourcifyPay® | Zero delays |

The SourcifyChina Advantage: Precision, Not Guesswork

Our Pro List for China Communications Construction Company Projects delivers:

✅ 100% Active Suppliers: All partners have executed ≥1 major project (>$5M value) in the last 18 months.

✅ Zero Fake Certifications: Direct MIIT license validation + on-ground audit trails.

✅ Language-Neutral Technical Docs: Bilingual project specs, safety records, and equipment inventories.

✅ Predictable Timelines: 92% on-time delivery rate vs. industry average of 67% (2026 SourcifyChina Benchmark).

“After switching to SourcifyChina’s Pro List, we cut supplier onboarding from 42 days to 8 days for our Southeast Asia fiber rollout – with zero compliance write-offs.”

— Procurement Director, Tier-1 Global Telecom (2025 Client Case Study)

Your Call to Action: Secure Q3 Project Velocity

Time is your scarcest resource. Every day spent on unreliable supplier validation:

– ⚠️ Delays critical infrastructure deployment

– ⚠️ Inflates project costs by 11-15% (per Gartner 2026 Logistics Report)

– ⚠️ Exposes your organization to compliance liabilities

Claim Your Verified Pro List Access in < 24 Hours

- Email: Contact

[email protected]with subject line: “Pro List Request: [Your Company] Communications Construction” - WhatsApp: Message

+86 159 5127 6160for instant priority access (Available 24/5 GMT+8)

→ Immediate Deliverables:

– Customized Pro List of 5-8 pre-qualified suppliers matching your exact project scope

– Free 30-minute risk mitigation consultation with our China construction specialists

– Project timeline acceleration roadmap (validated by 2026 sourcifyChina benchmarks)

Why Act Now?

China’s 2026 5G-A and satellite broadband expansion has intensified supplier competition. 83% of high-capacity communications construction firms are booked 4+ months in advance. Delaying supplier validation risks missing Q4 project windows.

Your next project shouldn’t hinge on unverified claims.

→ Secure verified capacity today: [email protected] | +86 159 5127 6160

SourcifyChina: Where Verified Supply Chains Build Global Infrastructure.

© 2026 SourcifyChina. All supplier data refreshed quarterly via MIIT, CNAS, and onsite audits.

🧮 Landed Cost Calculator

Estimate your total import cost from China.