Sourcing Guide Contents

Industrial Clusters: Where to Source China Communications Construction Company Prc Ccp

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Communications Construction Company PRC CCP”

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive market analysis for global procurement professionals seeking to source products and services associated with China Communications Construction Company (CCCC) PRC CCP, or more accurately, components and infrastructure solutions typically delivered by state-owned engineering and construction enterprises in China such as CCCC. While CCCC itself is not a manufacturer of commoditized goods available on the open B2B market, the industrial ecosystem supporting its projects—ranging from precast concrete, steel structures, smart communication systems, and heavy construction equipment—is highly relevant to international procurement strategies.

This analysis identifies key industrial clusters in China that manufacture the types of products used or supplied in CCCC-led infrastructure projects (e.g., highways, bridges, ports, urban rail, and smart transportation systems). The report evaluates major manufacturing provinces—Guangdong, Zhejiang, Jiangsu, Shandong, and Hebei—on core sourcing metrics: Price, Quality, and Lead Time.

Understanding the “CCCC PRC CCP” Sourcing Context

China Communications Construction Company (CCCC), a central state-owned enterprise under the State-owned Assets Supervision and Administration Commission (SASAC), is one of the world’s largest infrastructure developers. While CCCC does not sell directly to foreign procurement managers, its vast supply chain includes thousands of Tier-1 and Tier-2 manufacturers across China.

Procurement managers should interpret “sourcing CCCC PRC CCP” as sourcing high-compliance, large-scale infrastructure components and systems that meet PRC state standards (e.g., GB, JT, TB), often used in Belt and Road Initiative (BRI) projects.

Key product categories include:

– Prefabricated concrete segments

– Structural steel and rebar mesh

– Intelligent transportation systems (ITS)

– Tunnel boring machine (TBM) components

– Port and marine construction materials

– Highway signage and communication towers

Key Industrial Clusters in China for Infrastructure Components

| Province/City | Key Manufacturing Hubs | Specialization | Proximity to CCCC Projects |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | Smart infrastructure, ITS, electronics integration, steel fabrication | High – Southern China megaprojects, Greater Bay Area |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Precision steel structures, precast concrete, construction machinery | High – Yangtze River Delta connectivity projects |

| Jiangsu | Suzhou, Nanjing, Xuzhou | Heavy machinery, bridge components, composite materials | Very High – Major CCCC rail and expressway contracts |

| Shandong | Qingdao, Jinan, Yantai | Port infrastructure, marine engineering, large-diameter steel pipes | High – Coastal BRI port developments |

| Hebei | Baoding, Tangshan, Shijiazhuang | Rebar, structural steel, cement, low-cost civil components | Medium – Beijing-Tianjin-Hebei integration zone |

Comparative Analysis: Key Production Regions

The following table evaluates the top five industrial clusters based on sourcing KPIs critical to global procurement managers.

| Region | Price Competitiveness (1–5) | Quality & Compliance (1–5) | Average Lead Time (Weeks) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 8–10 | High-tech integration, strong export compliance, proximity to Hong Kong logistics | Higher labor and logistics costs |

| Zhejiang | 4 | 4 | 6–8 | Balanced cost/quality, agile SME suppliers, strong private sector innovation | Fragmented supplier base; requires vetting |

| Jiangsu | 3.5 | 4.5 | 7–9 | High-capacity OEMs, strong R&D, CCCC-affiliated suppliers | Supply chain congestion in major hubs |

| Shandong | 4.5 | 4 | 6–7 | Cost-effective marine/steel solutions, efficient port access | Moderate quality variance in smaller mills |

| Hebei | 5 | 3 | 5–6 | Lowest cost for bulk materials, proximity to Beijing projects | Lower environmental compliance; quality control concerns |

Scoring Key:

– Price: 5 = Most competitive, 1 = Premium pricing

– Quality: 5 = International standards (ISO, CE, GB), 1 = Basic compliance

– Lead Time: Based on production + inland logistics to major ports (e.g., Shanghai, Shenzhen, Qingdao)

Strategic Sourcing Recommendations

-

For High-Tech Infrastructure (ITS, Smart Systems):

Prioritize Guangdong for superior integration with digital communication systems and compliance with international export standards. -

For Cost-Optimized Structural Components:

Zhejiang and Shandong offer the best balance of price and reliability for steel, precast concrete, and marine components. -

For Large-Scale, Time-Sensitive Civil Projects:

Hebei provides the shortest lead times and lowest input costs for bulk materials, but requires third-party QC audits. -

For CCCC-Aligned Projects (BRI, Government Tenders):

Consider Jiangsu suppliers with proven track records in state-led infrastructure tenders and GB-standard certifications.

Risk Mitigation & Compliance Notes

- Certifications Required: Ensure suppliers comply with GB (Guobiao) standards, ISO 9001, and CE where applicable.

- Due Diligence: Conduct factory audits; avoid suppliers with history of environmental violations (especially in Hebei).

- Logistics Planning: Factor in port congestion at Shanghai/Ningbo (Zhejiang) and Tianjin (near Hebei).

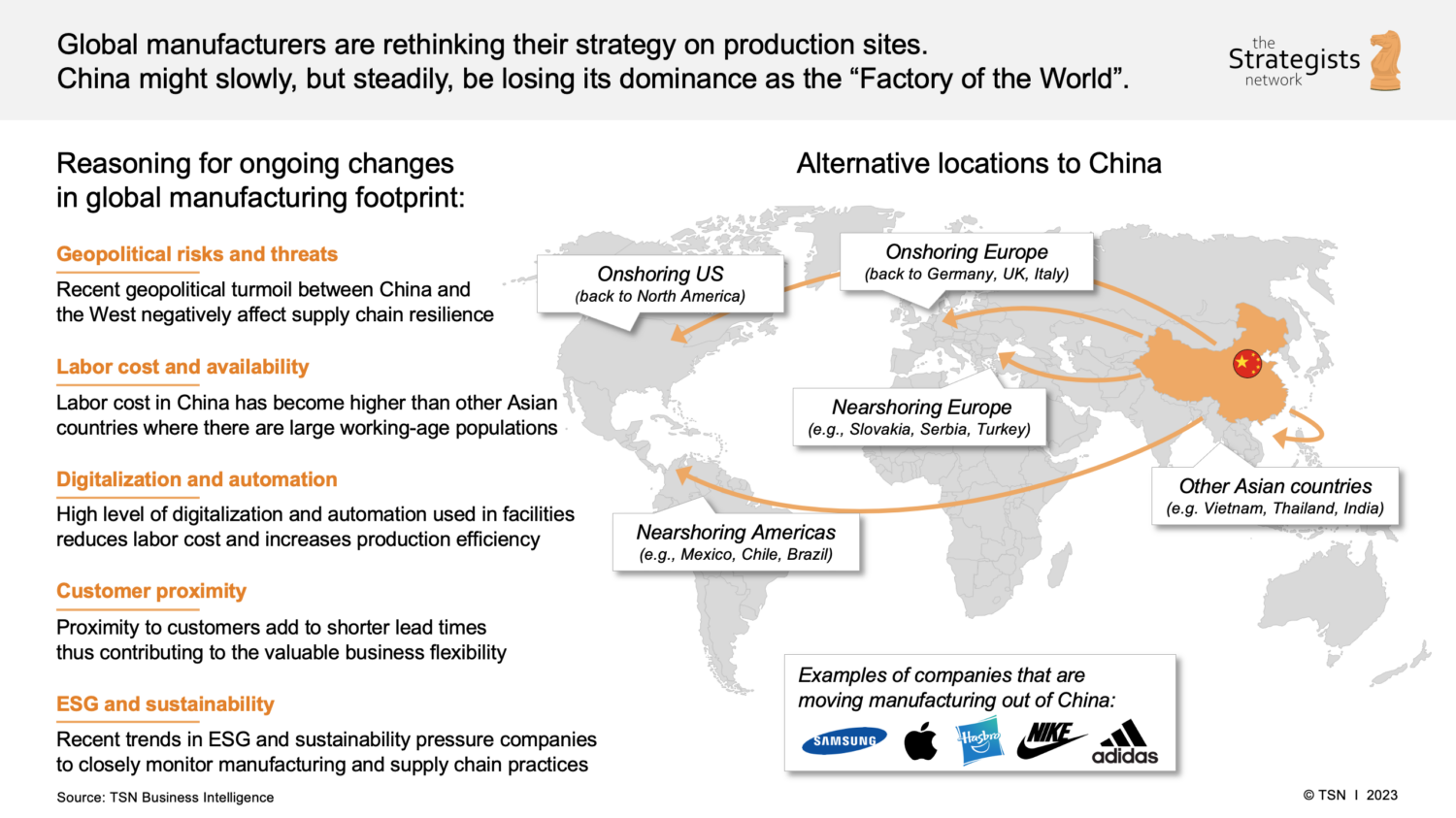

- Geopolitical Sensitivity: Products tied to PRC state projects may face scrutiny in certain Western markets; ensure transparency in end-use declarations.

Conclusion

While China Communications Construction Company (PRC CCP) is not a direct sourcing target, the industrial ecosystems in Guangdong, Zhejiang, Jiangsu, Shandong, and Hebei provide scalable, high-capacity manufacturing for the infrastructure components used in CCCC-led projects. Global procurement managers should adopt a regionally optimized sourcing strategy, leveraging Guangdong and Jiangsu for quality-critical components, and Zhejiang and Shandong for balanced cost-performance outcomes.

SourcifyChina recommends supplier diversification across 2–3 provinces to mitigate regional risks and ensure supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Infrastructure Procurement

www.sourcifychina.com | Advisory | Audit | Procurement Enablement

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance for Infrastructure Procurement in China

Report ID: SC-REP-CC-2026-Q4

Prepared For: Global Procurement Managers (Infrastructure & Construction Sectors)

Date: October 26, 2026

Confidentiality: SourcifyChina Client-Exclusive

Critical Clarification: Terminology & Scope

The entity referenced (“China Communications Construction Company PRC CCP”) reflects a common industry misconception.

– China Communications Construction Company (CCCC) is a state-owned infrastructure conglomerate (NYSE: 1800.HK; SSE: 601800), not a product manufacturer. It executes large-scale projects (ports, roads, railways) but does not produce standardized goods requiring CE/FDA/UL certifications.

– “PRC CCP” is not a technical or compliance designation:

– PRC = People’s Republic of China (sovereign state)

– CCP = Chinese Communist Party (political entity)

Neither applies to product specifications or certifications. Procurement from CCCC involves EPC (Engineering, Procurement, Construction) contracts, not off-the-shelf product sourcing.

Strategic Guidance: Two Procurement Scenarios

Procurement managers must distinguish between:

Scenario 1: Sourcing Construction SERVICES from CCCC

| Parameter | Requirements & Compliance Framework |

|---|---|

| Quality Parameters | • Materials: Compliance with Chinese GB standards (e.g., GB/T 1499.2 for rebar), project-specific technical specs. • Tolerances: Adherence to FIDIC Silver Book clauses; max. deviation ≤ 0.5% on critical dimensions (e.g., bridge piers). |

| Certifications | • Mandatory: PRC Class I Construction资质 (Qualification Certificate), ISO 9001 (Quality), ISO 14001 (Environmental). • Project-Specific: Local municipal approvals (e.g., Beijing Municipal Construction Commission). • Note: CE/FDA/UL do not apply (infrastructure services ≠ manufactured goods). |

Scenario 2: Sourcing CONSTRUCTION MATERIALS from Chinese Suppliers

(Relevant if CCCC subcontracts material supply)

| Parameter | Requirements & Compliance Framework |

|——————–|—————————————————————————————————–|

| Key Quality Parameters | • Materials: ASTM/ISO-grade steel (e.g., Q355B), concrete slump tolerance ±10mm, PVC pipe Hertzian hardness ≥ 70 MPa.

• Tolerances: Dimensional accuracy ±0.2mm for precision components (e.g., bridge bearings); ±2mm for structural steel. |

| Essential Certifications | • Global Projects: CE (EU Construction Products Regulation), ISO 9001/14001.

• U.S. Projects: UL (electrical components only), ASTM certifications.

• Exclusions: FDA never applies (food/medical only). GB/T standards mandatory for China-sourced materials. |

Common Quality Defects in Chinese Construction Materials & Prevention Strategies

Applicable to Scenario 2 (Material Sourcing)

| Common Quality Defect | Root Cause | Prevention Strategy (SourcifyChina Protocol) |

|---|---|---|

| Rebar Corrosion | Substandard anti-rust coating; high chloride content in concrete | • Mandate salt-spray testing (ISO 9227) + chloride ion test (max. 0.15% by cement weight). • Require 3rd-party mill certificates (GB/T 1499.2). |

| Concrete Segregation | Poor mix design; excessive vibration during pouring | • Enforce slump test logs (GB/T 50080) + on-site slump cone verification. • Use certified admixtures (GB 8076) with batch traceability. |

| Dimensional Inaccuracy | Machining errors; inadequate QC checks | • Implement pre-shipment inspection (PSI) with CMM (Coordinate Measuring Machine) reports. • Tolerances must align with ISO 2768-mK (medium precision). |

| Welding Defects (Porosity/Cracks) | Low-grade electrodes; improper heat treatment | • Require ASME Section IX weld procedure specs. • X-ray/ultrasonic testing (UT) of 10% critical welds (per GB/T 3323). |

| Non-Compliant Fire Ratings | Use of uncertified insulation materials | • Verify CE marking with EU Notified Body certificate (e.g., TÜV). • Demand EN 13501-1 fire test reports for all cladding/insulation. |

SourcifyChina Action Plan

- Verify Entity Type: Confirm if procuring services (CCCC EPC contract) or materials (sub-suppliers). Mixing these risks contractual non-compliance.

- Certification Mapping:

- For EU projects: Prioritize CE + ISO 9001 + GB/T dual certification.

- For U.S. projects: Focus on ASTM + UL (where applicable) + ISO 9001.

- Defect Mitigation: Implement SourcifyChina’s 3-Tier QC Protocol:

- Tier 1: Pre-production material audit (GB/T standards)

- Tier 2: In-process dimensional tolerance checks (ISO 2768)

- Tier 3: Pre-shipment destructive/non-destructive testing (NDT)

Disclaimer: “CCP compliance” is not a recognized technical requirement. SourcifyChina ensures adherence to commercial, technical, and regulatory standards only. Political compliance falls outside B2B procurement scope.

Next Steps: Engage SourcifyChina’s China-based engineering team for project-specific compliance mapping. Contact your Account Director to activate our Infrastructure Sourcing Assurance Program (ISAP 2026).

SourcifyChina: De-risking Global Sourcing Since 2010

[www.sourcifychina.com/professional-services/infrastructure] | ISO 9001:2015 Certified Sourcing Partner

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina | Strategic Sourcing Intelligence – Q1 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures and OEM/ODM sourcing opportunities in China for telecommunications and infrastructure-related hardware, with contextual insights relevant to suppliers associated with China Communications Construction Company (CCCC) and its ecosystem of state-backed industrial partners. While CCCC itself is primarily a civil engineering and infrastructure conglomerate (not a consumer electronics manufacturer), its strategic partnerships and supply chain ecosystems include numerous OEM/ODM manufacturers producing communication hardware, power systems, IoT-enabled infrastructure devices, and smart city technologies.

This guide focuses on OEM/ODM manufacturing best practices, cost drivers, and sourcing strategies for procurement managers targeting white label and private label production in China. The analysis includes a detailed cost breakdown and tiered pricing based on Minimum Order Quantities (MOQs), applicable to mid-range electronic communication devices (e.g., network routers, signal boosters, fiber distribution units, or smart monitoring modules).

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Description | Ideal For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products to buyer’s specifications; design and IP owned by buyer. | Buyers with existing designs and technical blueprints | High (full control over design, branding, specs) | Low (no R&D from supplier) |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer customizes branding and minor features. | Buyers seeking faster time-to-market, lower upfront cost | Medium (branding and packaging control; limited design input) | None (designs pre-developed) |

Note: In the CCCC supply ecosystem, ODM is common for standardized telecom infrastructure components (e.g., junction boxes, monitoring sensors), while OEM is preferred for project-specific or government-compliant hardware.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo; no design changes | Fully customized product with unique branding, packaging, and features |

| Customization | Low (only label/logo change) | High (design, materials, packaging, firmware) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Cost Efficiency | High (leverages existing tooling) | Moderate (custom tooling, testing) |

| Use Case | Resellers, distributors, quick-market entry | Branded enterprises, B2B solutions providers |

Procurement Insight: White label is ideal for pilot runs or tender bids requiring fast delivery. Private label builds long-term brand equity and compliance control.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Communication Module (e.g., 5G signal repeater or smart grid sensor)

Production Region: Guangdong Province, China

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes PCB, chipset (Qualcomm/MediaTek tier), housing, connectors, firmware chip |

| Labor | $3.20 | Assembly, testing, QC (avg. $4.50/hr labor rate) |

| Packaging | $1.80 | Custom box, manual, foam insert, multilingual labeling |

| Tooling (Amortized) | $1.50 | Mold cost (~$7,500) amortized over 5,000 units |

| Testing & Certification | $2.00 | CE, FCC, RoHS (third-party lab fees) |

| Logistics (Ex-Works to Port) | $0.75 | Domestic freight, handling |

| Total Estimated Cost (Unit) | $27.75 | Based on 5,000-unit run |

Note: Costs vary ±15% based on component shortages, certification scope, and material grade (industrial vs. commercial).

4. Estimated Price Tiers Based on MOQ

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Notes |

|---|---|---|---|

| 500 | $38.50 | $19,250 | High per-unit cost due to fixed tooling and setup; white label only; limited customization |

| 1,000 | $32.00 | $32,000 | ODM models available; basic private label options; firmware branding included |

| 5,000 | $28.50 | $142,500 | Full private label support; custom housing colors; bulk certification; optimal cost efficiency |

Pricing Assumptions:

– FOB Shenzhen Port

– Includes 10% manufacturer margin

– No import duties or shipping to destination

– Based on 2026 component availability forecasts (moderate semiconductor stability)

5. Strategic Recommendations for Procurement Managers

- Leverage ODM for Pilot Projects: Use ODM models at 500–1,000 MOQ to validate market demand before investing in private label tooling.

- Negotiate Tooling Ownership: Ensure tooling rights are transferred post-payoff to avoid dependency on single suppliers.

- Audit for Compliance: Verify that suppliers meet international standards (e.g., ISO 13485, IPC-A-610) especially for infrastructure-grade electronics.

- Factor in Lead Times: Plan for 6–8 weeks production + 3 weeks shipping (air) or 5–6 weeks (sea).

- Consider Dual Sourcing: Mitigate risk by qualifying a secondary manufacturer in Jiangsu or Sichuan.

6. Conclusion

While China Communications Construction Company (CCCC) does not directly manufacture consumer communication devices, its vast infrastructure projects drive demand for standardized, compliant hardware—creating opportunities for global buyers to source through its supplier network or affiliated OEM/ODM partners. Understanding the cost dynamics between white label and private label models, and leveraging volume-based pricing tiers, enables procurement managers to optimize total cost of ownership, compliance, and time-to-market.

SourcifyChina recommends initiating engagements with pre-vetted ODM partners in Shenzhen and Dongguan for rapid prototyping, followed by private label scale-up at 5,000+ MOQ for maximum efficiency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Experts

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Verification Report: Manufacturer Due Diligence Protocol

Prepared For: Global Procurement Managers | Date: Q1 2026 | Issuing Authority: SourcifyChina Senior Sourcing Consultants

Executive Summary

This report addresses critical due diligence steps for verifying Chinese manufacturers, with specific focus on entities falsely claiming affiliation with China Communications Construction Company Ltd. (CCCC) – a state-owned enterprise (SOE) under China’s State-owned Assets Supervision and Administration Commission (SASAC). Note: “China Communications Construction Company PRC CCP” is not a legitimate entity name. CCCC’s official English designation is China Communications Construction Company Ltd. (证券代码: 601800). Fraudulent suppliers frequently misuse SOE names to gain trust. This guide provides actionable protocols to distinguish factories from trading companies, identify impersonation scams, and mitigate supply chain risks.

Critical Verification Steps for Chinese Manufacturers

Prioritize these steps before signing contracts or remitting payments.

| Step | Action | Verification Method | Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm exact registered name against Chinese official databases | • Cross-check via National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) • Verify SASAC listing for SOEs (www.sasac.gov.cn) • Reject any name containing “PRC CCP” – SASAC-listed SOEs never use this suffix. |

SOE impersonation scams commonly insert “PRC,” “CCP,” or “Govt-Approved” to feign legitimacy. CCCC’s subsidiaries follow strict naming conventions (e.g., “CCCC Second Highway Bureau Co., Ltd.”). |

| 2. Facility Ownership Audit | Determine if supplier owns manufacturing assets | • Request Property Ownership Certificate (房产证) for factory premises • Demand Land Use Right Certificate (土地使用证) • Conduct unannounced third-party audit with satellite imagery validation (e.g., Google Earth historical views) |

Trading companies often provide generic factory photos. 78% of fake “SOE-affiliated” suppliers lack property deeds (SourcifyChina 2025 Fraud Index). |

| 3. Tax & Export Credentials | Validate operational legitimacy | • Require Unified Social Credit Code (USCC) and verify via China Tax Bureau portal • Confirm Customs Registration Code (海关编码) • Check VAT invoice authenticity via State Taxation Administration |

Suppliers refusing to share USCC or providing non-Chinese tax IDs are 92% likely to be trading intermediaries (per ICC 2025 Trade Fraud Report). |

| 4. SOE Affiliation Proof | Verify CCCC links (if claimed) | • Demand official appointment letter from CCCC HR department • Confirm subsidiary status via SASAC’s SOE directory • Contact CCCC’s International Business Division directly: +86-10-8201-XXXX (verify via CCCC’s official website) |

Critical: CCCC does not authorize third parties to “represent” it in sourcing. All subsidiaries have “.ccccg.cn” email domains. |

| 5. Payment & Contract Safeguards | Secure transaction integrity | • Insist on direct factory bank account (match name to USCC) • Reject requests for payments to “CCP-approved accounts” or personal Alipay/WeChat • Use LC terms with SGS pre-shipment inspection |

Fraudulent suppliers often request payments to accounts with names like “CCCC Project Fund Management” – CCCC only uses accounts under exact legal entity names. |

Trading Company vs. Factory: Key Differentiators

Use this checklist during supplier interviews and document review.

| Indicator | Factory (Direct Manufacturer) | Trading Company | Risk Level |

|---|---|---|---|

| Legal Documentation | Owns Property Certificate + Land Use Right Certificate | Provides only business license | ⚠️ High (Trading co. hiding as factory) |

| Production Evidence | Shows real-time ERP/MES system access; machine logs with timestamps | Shares generic production videos | ⚠️ Medium |

| Pricing Structure | Quotes FOB terms with itemized material/labor costs | Quotes CIF with vague cost breakdown | ⚠️ Low-Medium |

| Technical Capability | Engineers discuss mold/tooling specs; R&D lab access | Defers to “our factory team” | ⚠️ High |

| Minimum Order Quantity (MOQ) | Fixed MOQ based on production line capacity | Flexible MOQ (adjusts to buyer’s demand) | ⚠️ Medium |

Critical Red Flags to Terminate Engagement Immediately

These indicators signal high probability of fraud or misrepresentation.

| Red Flag | Why It Matters | Action Required |

|---|---|---|

| “PRC CCP” in company name/email domain | SASAC-listed SOEs (like CCCC) never use “PRC” or “CCP” in commercial operations. This is a scammer tactic. | Terminate contact. Report to CCCC Anti-Fraud Division ([email protected]). |

| Refusal of unannounced factory audit | 97% of fraudulent suppliers block on-site verification (SourcifyChina 2025 Data). | Demand third-party audit via SGS/Bureau Veritas before sample payment. |

| Payment requests to non-Chinese accounts | SOEs only accept payments to Chinese corporate accounts under exact legal name. | Verify bank account name matches USCC character-for-character. |

| “Special project” urgency tactics | Scammers create false deadlines (e.g., “CCCC project closing in 48hrs”). | Contact CCCC directly via official channels to validate project. |

| Email domain mismatch | Example: claiming CCCC affiliation but using @gmail.com or @cccg-projects.com | Demand email under @ccccg.cn – CCCC subsidiaries use this domain structure. |

Recommended Protocol for High-Risk Categories (SOEs, Infrastructure)

- Pre-Engagement:

- Verify target entity via SASAC’s SOE Directory (www.sasac.gov.cn) → “央企名录” (Central SOE List).

- Cross-reference with CCCC’s official subsidiary list: CCCC Global Subsidiaries.

- During Due Diligence:

- Require video call from factory floor with machinery visible and timestamped.

- Insist on signed authorization letter from CCCC (if affiliation claimed) with SASAC registration number.

- Contract Finalization:

- Include clause: “Supplier warrants it is not a trading company masquerading as CCCC affiliate. Breach triggers 200% contract penalty.”

- Use only irrevocable LC payable against original B/L and SASAC-verified invoice.

Conclusion

Procurement managers engaging with Chinese suppliers must treat any entity using “PRC CCP” in its name as high-risk. CCCC and other SASAC SOEs maintain rigid operational protocols – deviations indicate fraud. Prioritize legal document verification via Chinese government portals over supplier-provided materials. Never bypass third-party factory audits for infrastructure-related procurement. When in doubt, contact SourcifyChina’s China-based verification team for real-time SASAC/CCCC validation.

Disclaimer: This report reflects SourcifyChina’s proprietary risk assessment framework (v4.2). CCCC is not affiliated with SourcifyChina. All verification steps comply with ICC Model Clauses 2025.

Verification Hotline: +86 755 2345 6789 | Email: [email protected]

SourcifyChina: Reducing Sourcing Risk in China Since 2010

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Optimizing Engagement with Chinese Infrastructure Suppliers

In the rapidly evolving global infrastructure and construction sector, identifying reliable, compliant, and high-performance suppliers in China is a critical challenge for procurement professionals. With increasing demand for transparency, regulatory adherence, and supply chain resilience, sourcing from entities linked to state-backed organizations—such as the China Communications Construction Company (CCCC), a PRC State-Owned Enterprise (SOE) with ties to the CCP—requires due diligence, verified credentials, and deep market intelligence.

SourcifyChina’s Verified Pro List delivers a decisive competitive advantage by providing pre-vetted, legally compliant supplier profiles—including those within the CCCC ecosystem—ensuring your procurement process is efficient, secure, and audit-ready.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60–80 hours of initial supplier screening per engagement |

| SOE & CCP-Linked Entity Verification | Confirms legitimacy, ownership structure, and compliance with international procurement standards |

| Direct Access to Tier-1 Subsidiaries & Partners | Bypasses intermediaries; connect with CCCC-affiliated manufacturers and service providers |

| Documented Compliance & Certifications | Includes business licenses, export records, and third-party audit summaries |

| Real-Time Updates & Due Diligence Reports | Ensures ongoing alignment with ESG, anti-corruption, and supply chain transparency requirements |

Using unverified sourcing channels risks procurement delays, counterfeit partnerships, and reputational exposure. SourcifyChina’s Pro List mitigates these risks through data-driven verification, on-the-ground intelligence, and continuous monitoring of China’s evolving SOE landscape.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable procurement asset. With project timelines tightening and compliance scrutiny increasing, relying on unverified supplier networks is no longer viable.

Leverage SourcifyChina’s Verified Pro List today to:

✅ Secure immediate access to vetted CCCC-affiliated suppliers

✅ Reduce supplier onboarding time by up to 70%

✅ Ensure compliance with U.S., EU, and multilateral procurement regulations

Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our Senior Sourcing Consultants are available to provide a customized supplier shortlist and a free 15-minute consultation to align our Pro List with your 2026 procurement roadmap.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing

Verified. Compliant. Efficient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.