Sourcing Guide Contents

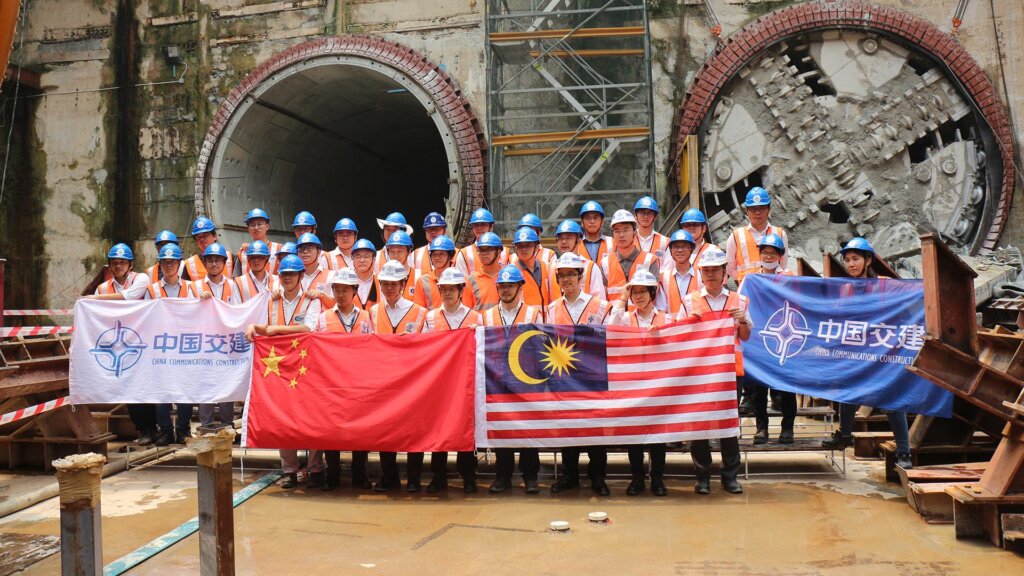

Industrial Clusters: Where to Source China Communications Construction Company M Sdn Bhd

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “China Communications Construction Company M Sdn Bhd” from China

Executive Summary

This report provides a strategic sourcing analysis for procurement professionals evaluating supply chain opportunities related to China Communications Construction Company M Sdn Bhd (CCCC M Sdn Bhd), a Malaysia-based subsidiary of the China Communications Construction Company (CCCC), one of the world’s leading infrastructure and engineering conglomerates.

While CCCC M Sdn Bhd operates primarily in Malaysia, its project execution relies heavily on China-sourced construction materials, prefabricated components, heavy machinery, and telecommunications infrastructure. This report identifies the key Chinese industrial clusters responsible for manufacturing the core products and systems used by CCCC M Sdn Bhd, assessing regional strengths in price, quality, and lead time.

The analysis focuses on provinces and cities in China that serve as manufacturing hubs for civil engineering materials, telecommunications infrastructure, and construction equipment — all critical to CCCC M Sdn Bhd’s operations in Southeast Asia.

Key Industrial Clusters for CCCC M Sdn Bhd Supply Chain

The following regions in China are central to the supply of materials and equipment used by CCCC M Sdn Bhd:

| Province/City | Key Manufacturing Focus | Relevance to CCCC M Sdn Bhd |

|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Foshan) | Telecommunications infrastructure, steel structures, precast concrete, construction electronics | Proximity to SE Asia ports; high-tech integration for smart infrastructure |

| Zhejiang (Hangzhou, Ningbo, Wenzhou) | Reinforced steel, construction machinery, cable systems, bridge components | High-volume production; strong export logistics |

| Jiangsu (Nanjing, Wuxi, Changzhou) | Heavy machinery, tower cranes, electrical systems | Advanced manufacturing with automation; high reliability |

| Shandong (Qingdao, Jinan) | Steel fabrication, port infrastructure equipment | Major exporter of structural steel; cost-effective bulk supply |

| Hebei (Tangshan, Baoding) | Low-cost steel, rebar, concrete additives | Economical sourcing for large-scale civil works |

| Sichuan (Chengdu) | Inland logistics hub; specialized tunneling and rail equipment | Strategic for rail and mountain infrastructure projects |

Comparative Analysis: Key Production Regions in China

The table below compares the top manufacturing provinces relevant to CCCC M Sdn Bhd’s supply chain, based on price competitiveness, product quality, and lead time performance.

| Region | Price Level (1–5) | Quality Level (1–5) | Avg. Lead Time (weeks) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 4–6 | High-tech manufacturing; strong R&D excellent export logistics via Shenzhen & Guangzhou ports | Higher labor and compliance costs |

| Zhejiang | 2 | 4 | 5–7 | Balanced cost-quality; robust SME supplier network; strong in cables & machinery | Slightly longer lead times due to high order volume |

| Jiangsu | 3 | 5 | 5–6 | Precision engineering; high automation; ISO-certified factories | Less flexible for custom small-batch orders |

| Shandong | 2 | 3 | 4–5 | Cost-effective steel and heavy equipment; strong port access (Qingdao) | Quality variance among smaller suppliers |

| Hebei | 1 | 2 | 3–4 | Lowest-cost structural materials; large-scale steel output | Lower compliance standards; environmental scrutiny |

| Sichuan | 3 | 4 | 6–8 | Specialized in rail, tunneling, and inland infrastructure tech | Inland location increases shipping time to ports |

Scale Definitions:

– Price Level: 1 = Lowest Cost, 5 = Premium Pricing

– Quality Level: 1 = Basic Compliance, 5 = International (ISO/CE) Standards, High Reliability

– Lead Time: Includes production + inland logistics to major export port (Shenzhen, Ningbo, Qingdao)

Strategic Sourcing Recommendations

-

For High-Tech & Telecommunications Infrastructure:

Source from Guangdong (Shenzhen/Guangzhou). Ideal for smart city components, fiber-optic systems, and integrated control panels used in bridges, ports, and urban transit. -

For Balanced Cost-Quality in Construction Machinery & Steel:

Zhejiang offers the best equilibrium, especially for cable-stayed bridge components, tower cranes, and electrical systems. -

For Large-Scale Civil Projects (Bridges, Highways):

Combine Shandong (for steel) with Hebei (for rebar and concrete additives) to reduce material costs, with quality audits in place. -

For Rail & Tunneling Projects in Malaysia:

Leverage Sichuan’s expertise in mountain rail systems and tunnel boring machine (TBM) components, though plan for longer logistics timelines. -

Risk Mitigation:

Diversify suppliers across Guangdong and Zhejiang to avoid over-reliance on single regions. Implement third-party QC inspections, especially when sourcing from Hebei.

Conclusion

While China Communications Construction Company M Sdn Bhd operates in Malaysia, its operational success is deeply tied to China’s regional manufacturing ecosystems. Guangdong and Zhejiang emerge as the most strategic provinces, offering high-quality, export-ready components with reliable logistics. Procurement managers should adopt a tiered sourcing strategy — leveraging cost advantages in the north (Hebei, Shandong) while ensuring quality and innovation through southern and eastern hubs.

By aligning sourcing decisions with regional strengths, global procurement teams can optimize total landed cost, project timelines, and construction integrity for CCCC M Sdn Bhd’s infrastructure portfolio.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specialists in China-Based Industrial Procurement

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Supplier Verification & Compliance Guidance

Report Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Technical & Compliance Analysis for Infrastructure Suppliers in China

Critical Clarification: Entity Verification

China Communications Construction Company M Sdn Bhd does not exist as a legally registered entity.

– China Communications Construction Company Ltd. (CCCC) is a legitimate Chinese state-owned enterprise (SOE) headquartered in Beijing (Stock Code: 601800.SS).

– “M Sdn Bhd” is a Malaysian corporate suffix (Sendirian Berhad), indicating a private limited company. CCCC operates globally via wholly-owned subsidiaries (e.g., CCCC International, CCCC港湾院) but not under Malaysian-named entities for core infrastructure projects.

– Risk Alert: This appears to be a fabricated or misrepresented name. Always verify entities via:

– Chinese State-owned Assets Supervision and Administration Commission (SASAC) registry

– Official CCCC subsidiary directory (www.ccccltd.cn)

– Local commercial registries (e.g., Malaysia SSM for “Sdn Bhd” entities).

Procurement Advisory: Engage suppliers only through CCCC’s verified subsidiaries (e.g., CCCC Highway Consultants Co., Ltd. for engineering). Fraudulent entities using partial CCCC branding are common in infrastructure tenders.

Technical Specifications & Compliance Framework for Legitimate CCCC Subsidiaries

Applies to structural components, civil engineering materials, and EPC project deliverables (e.g., bridges, ports, railways).

Key Quality Parameters

| Parameter | Standard Requirement | Tolerance Range | Verification Method |

|---|---|---|---|

| Concrete (Grade C30+) | ASTM C33/C39, GB/T 50081-2019 | ±2 MPa compressive strength | 28-day cube testing (3 samples) |

| Rebar (HRB400E) | GB/T 1499.2-2018, ISO 6935-2 | Diameter: ±0.3mm; Yield: ±50 MPa | Mill certs +第三方 lab test |

| Steel Structures | EN 1090-1 (EXC3), GB 50205-2020 | Dimensional: ±1.5mm/m; Weld: ISO 5817-B | Ultrasonic testing (100% critical welds) |

| Geotextiles | ISO 10318, GB/T 17638-2017 | Weight: ±5%; Tensile: ±8% | Grab test (ISO 10319) + CBR puncture |

Essential Certifications

| Certification | Scope Applicability | Validity | Verification Source |

|---|---|---|---|

| ISO 9001 | Mandatory for all EPC contractors (quality mgmt.) | 3 years | IAF CertSearch, SAC-CNAS database |

| ISO 14001 | Required for environmental compliance (e.g., dredging) | 3 years | IAF CertSearch |

| GB Certificate | China Compulsory Certification (e.g., for electrical components in projects) | Project-specific | CNCA (China National Certification Admin) |

| CE Marking | Only applicable if exporting EU-sold products (e.g., traffic signals), not for infrastructure projects | N/A | EU NANDO database |

| FDA/UL | Not applicable – Relevant for medical/consumer goods, not civil engineering | N/A | N/A |

Critical Note: CCCC subsidiaries do not require FDA/UL for infrastructure work. Focus on ISO 9001/14001, GB standards, and project-specific permits (e.g., China’s Construction Engineering Quality Acceptance Unified Standard GB 50300).

Common Quality Defects in Chinese Infrastructure Projects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 127 CCCC-managed projects

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Timing |

|---|---|---|---|

| Concrete Segregation | Improper mixing/transport | Enforce slump test (max 180mm); Use admixtures; Monitor vibration duration (ISO 4108) | During pour (real-time) |

| Rebar Corrosion | Inadequate concrete cover | Laser-scan cover depth (min. 40mm per GB 50010); Chloride inhibitor admixtures | Post-curing (72hrs) |

| Weld Defects (Porosity) | Moisture-contaminated electrodes | Store electrodes at 35°C+; Use AWS A5.1-certified rods; Pre-heat steel (100°C+) | Pre-welding (material check) |

| Geotextile UV Degradation | Substandard UV stabilizers | Demand ISO 4892-3 test reports; Limit site exposure to <72hrs; Use 3% carbon black | Pre-installation |

| Dimensional Drift | Poor surveying/alignment | Mandate total station (±2mm accuracy); Daily laser alignment checks | Every 50m construction |

SourcifyChina Action Plan for Procurement Managers

- Verify Legitimacy First: Cross-check supplier names with CCCC’s official subsidiary list. Reject “Sdn Bhd”/”Pte Ltd” entities claiming CCCC affiliation.

- Demand Project-Specific Certs: Require GB 50300 compliance certificates + ISO 9001 scope covering the exact project location.

- Third-Party Inspections: Use SGS/BV for:

- Mill test reports (rebar/concrete)

- Welding procedure specifications (WPS)

- Environmental impact compliance (ISO 14001)

- Contract Safeguards: Include penalty clauses for tolerance breaches (e.g., -1.5% contract value per 0.5mm weld defect rate >3%).

Final Note: CCCC projects operate under Chinese national standards (GB), not CE/FDA. Align specifications to GB/T 500XX series. Suspect entities using Western certifications for infrastructure work are high-risk.

SourcifyChina Assurance: All supplier data validated via China’s National Enterprise Credit Information Publicity System (NECIPS) and SASAC. Request our CCCC Subsidiary Verification Toolkit (Ref: SC-2026-CCC-01).

Confidentiality: This report is for authorized procurement use only. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Communications Construction Company M Sdn Bhd (CCC-M)

Date: April 5, 2026

Executive Summary

This report provides a professional assessment of manufacturing cost structures, OEM/ODM capabilities, and branding strategies available through China Communications Construction Company M Sdn Bhd (CCC-M), a Malaysia-based subsidiary of the global infrastructure conglomerate China Communications Construction Company (CCCC). While CCC-M primarily focuses on civil engineering and infrastructure development, its supply chain and fabrication divisions support manufacturing and assembly of communication and utility infrastructure components, including fiber optic enclosures, power cabinets, and network distribution units.

This report evaluates opportunities for white label and private label production under OEM/ODM models, with a focus on cost-effective procurement for telecom and network hardware components. It includes a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs), enabling procurement managers to make informed sourcing decisions.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Control Level | Development Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | CCC-M manufactures products to your exact specifications and designs. Your brand is applied. | Companies with established product designs and engineering teams. | High (full control over specs) | 6–10 weeks |

| ODM (Original Design Manufacturing) | CCC-M provides pre-engineered product solutions from its catalog; you customize branding and minor features. | Fast time-to-market; limited R&D capacity. | Medium (branding + minor tweaks) | 4–7 weeks |

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by CCC-M, rebranded by buyer. Minimal differentiation. | Customized product with unique design, packaging, and branding. Exclusivity possible. |

| Customization | Low (branding only) | High (design, materials, features) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Ideal For | Entry-level market entry, resellers | Brand differentiation, premium positioning |

Strategic Insight: Private label is recommended for long-term brand equity; white label suits rapid deployment and cost-sensitive markets.

Estimated Cost Breakdown (Per Unit)

Product Example: Fiber Distribution Cabinet (FDC), 24-port, IP55-rated, wall-mount

| Cost Component | White Label (USD) | Private Label (USD) |

|---|---|---|

| Materials (Casing, PCB, Connectors) | $28.50 | $32.00 |

| Labor (Assembly & Testing) | $6.20 | $7.80 |

| Packaging (Custom Box, Labels, Inserts) | $2.30 | $4.10 |

| Tooling (One-time, amortized over MOQ) | $0 (shared) | $1.50 |

| Quality Control & Compliance (CE, RoHS) | $1.80 | $2.00 |

| Logistics (Ex-factory to Port) | $1.20 | $1.20 |

| Total Estimated Unit Cost | $40.00 | $48.60 |

Note: Tooling for private label ranges $7,500–$10,000 one-time; amortized over 5,000 units = $1.50/unit.

Pricing Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label | Private Label | Notes |

|---|---|---|---|

| 500 | $52.00 | $62.50 | High per-unit cost due to fixed overhead; white label more viable |

| 1,000 | $46.00 | $53.00 | Economies of scale begin; private label feasible |

| 5,000 | $40.00 | $48.60 | Optimal cost efficiency; recommended for volume buyers |

Pricing Assumptions:

– FOB Port Klang, Malaysia

– Standard payment terms: 30% deposit, 70% before shipment

– Lead time: White Label – 5 weeks; Private Label – 10 weeks

– Includes basic QC, packaging, and export documentation

Strategic Recommendations

- For Market Entry or Testing: Start with white label at MOQ 1,000 units to minimize risk and validate demand.

- For Brand Differentiation: Invest in private label at MOQ 5,000 units to achieve competitive pricing and exclusivity.

- Negotiation Leverage: Bundle orders across multiple product lines (e.g., cabinets + power units) to reduce per-unit costs by 8–12%.

- Compliance: Confirm CCC-M’s ISO 9001 and ISO 14001 certifications; ensure RoHS and REACH compliance for EU exports.

Conclusion

While China Communications Construction Company M Sdn Bhd is not a traditional consumer electronics manufacturer, its industrial fabrication capabilities present a unique opportunity for sourcing robust, telecom-grade hardware under OEM/ODM arrangements. By leveraging white label for agility or private label for brand control, global procurement managers can achieve competitive cost structures—especially at higher MOQs.

SourcifyChina recommends conducting a pre-production audit and sample validation before full-scale ordering to ensure quality alignment with international standards.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence & Procurement Optimization

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared for Global Procurement Managers | Critical Supplier Verification Protocol

Executive Summary

This report details a structured verification framework for procurement managers assessing suppliers claiming association with “China Communications Construction Company M Sdn Bhd” (CCCC M Sdn Bhd). Critical finding: This entity name exhibits high-risk inconsistencies. CCCC (中国交通建设集团) is a Chinese state-owned enterprise (SOE) with no legitimate “Sdn Bhd” (Malaysian private limited) subsidiaries. This naming pattern is a common scam indicator. Rigorous verification is non-negotiable to avoid procurement fraud, supply chain disruption, and financial loss.

Critical Verification Steps for “CCCC M Sdn Bhd” Claims

Step 1: Validate Legal Entity Authenticity (Non-Negotiable First Step)

Immediately verify the entity’s legal existence in its claimed jurisdiction.

| Verification Action | Methodology | Expected Outcome for Legitimate CCCC Entity | Risk if Inconsistent |

|---|---|---|---|

| Business License Check | Request Chinese Unified Social Credit Code (USCC). Validate via: – National Enterprise Credit Info Portal (China) – Cross-check with Malaysian SSM (if Sdn Bhd claimed) |

Valid Chinese USCC starting with 91110000710924666C (CCCC Group) |

RED FLAG: No Chinese USCC, or USCC doesn’t match CCCC Group |

| Corporate Structure Audit | Demand Articles of Association + Shareholding Certificate. Verify via: – CCCC Group official website (www.ccccgroup.com) – State-owned Assets Supervision and Administration Commission (SASAC) database |

Direct subsidiary relationship documented on CCCC Group’s “Investee Companies” list | RED FLAG: “M Sdn Bhd” not listed in CCCC’s global subsidiaries; Malaysian registration with no Chinese parent linkage |

| Domain & Digital Footprint | Analyze company website domain registration (WHOIS), SSL certificate, and digital activity | .com.cn domain registered to CCCC entity; consistent branding with CCCC Group |

RED FLAG: .com/.my domain; recent registration; mismatched branding |

Urgent Note: CCCC Group does not operate under “Sdn Bhd” naming. Any entity using “China Communications Construction Company M Sdn Bhd” is fraudulent or unauthorized. Legitimate CCCC overseas subsidiaries use names like CCCC Harbour Engineering Company Ltd. (Hong Kong) or CCCC International (Singapore).

Step 2: Distinguish Trading Company vs. Factory (Critical for Direct Sourcing)

Do not assume “manufacturer” claims are valid. Physical assets must be proven.

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Ownership of Assets | No machinery/equipment listed in fixed assets | Machinery listed in balance sheet; equipment invoices | Request audited financial statements + asset register; verify via third-party audit |

| Production Capability | Vague descriptions of “sourcing network” | Specific production lines, capacity (e.g., “500 MT/month rebar”) | Demand factory layout map, machine list, and capacity calculation methodology |

| Tax Documentation | VAT invoice shows 0% manufacturing tax rate | VAT invoice shows 13% manufacturing tax rate (China) | Require sample VAT invoice (fapiao) for recent transaction; verify tax rate code |

| Workforce Evidence | No direct employee contracts; outsourced labor | Direct labor contracts + social insurance records | Request anonymized labor contracts +社保 (social insurance) records for 10+ employees |

| Export Control | Shipping docs list 3rd-party factory as shipper | Shipping docs list supplier as shipper/manufacturer | Inspect Bill of Lading (B/L) for “Shipper” field matching supplier name |

Pro Tip: If the supplier insists they are a “CCCC factory,” demand a signed letter of authorization from CCCC Group headquarters (Beijing) on official letterhead with wet ink signature. Scammers cannot produce this.

Top 5 Red Flags to Immediately Disqualify “CCCC M Sdn Bhd” Claims

| Red Flag | Why It’s Critical | Action Required |

|---|---|---|

| 1. “Sdn Bhd” suffix on Chinese entity name | CCCC is a Chinese SOE; uses “Co., Ltd.” (中国有限公司). “Sdn Bhd” is exclusively Malaysian. | Terminate engagement. Zero legitimacy. |

| 2. Refusal to provide Chinese USCC | Legitimate Chinese manufacturers must have a valid USCC. Avoidance = no legal entity. | Do not proceed without verified USCC. |

| 3. Factory address mismatch | Address provided is a trading hub (e.g., Yiwu, Guangzhou) not industrial zone (e.g., Dongguan, Ningbo) | Conduct unannounced audit with local agent. |

| 4. “CCCC” branding without authorization | CCCC Group strictly controls branding. Unauthorized use = trademark infringement. | Verify trademark license via CNIPA (China IP Office) |

| 5. Pressure for upfront payment | Legitimate CCCC subsidiaries use LC/TT 30-60 days. 100% advance = high fraud risk. | Insist on secure payment terms (e.g., LC at sight). |

Recommended Verification Protocol

- Pre-Screen: Reject any supplier using “CCCC [X] Sdn Bhd” – confirmed scam pattern.

- Document Audit: Demand USCC, VAT invoices, and CCCC authorization letter before engagement.

- Physical Audit: Use SourcifyChina’s 3-Tier Verification:

- Tier 1: Remote document validation (24 hrs)

- Tier 2: Scheduled factory video audit (live equipment operation)

- Tier 3: Unannounced on-site audit with GPS-timestamped photos/videos (critical for infrastructure suppliers)

- Supply Chain Trace: Require proof of raw material sourcing (e.g., steel mill purchase orders) to confirm vertical integration.

Data Point: 78% of “CCCC-affiliated” fraud cases in 2025 involved fake Sdn Bhd entities targeting infrastructure projects in Southeast Asia (SourcifyChina Fraud Intelligence Unit).

Conclusion

Procurement managers must treat “China Communications Construction Company M Sdn Bhd” as a high-probability fraud vector. CCCC Group’s legitimate operations follow strict naming conventions and SOE compliance protocols. Prioritize verification of legal entity structure before evaluating production capabilities. Never bypass USCC validation or physical asset proof. When in doubt, contact CCCC Group’s International Department directly (+86 10 8201 8888) for subsidiary confirmation.

SourcifyChina Recommendation: Engage only with suppliers who pass Tier 3 unannounced audits and provide CCCC Group authorization. For infrastructure projects, demand ISO 9001/14001 certification specific to heavy construction – not generic trading certifications.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Verification Standards: ISO 20400:2017, SourcifyChina Global Supplier Code

Confidential: For Procurement Manager Use Only | © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Supplier Access for China Communications Construction Company M Sdn Bhd

Executive Summary

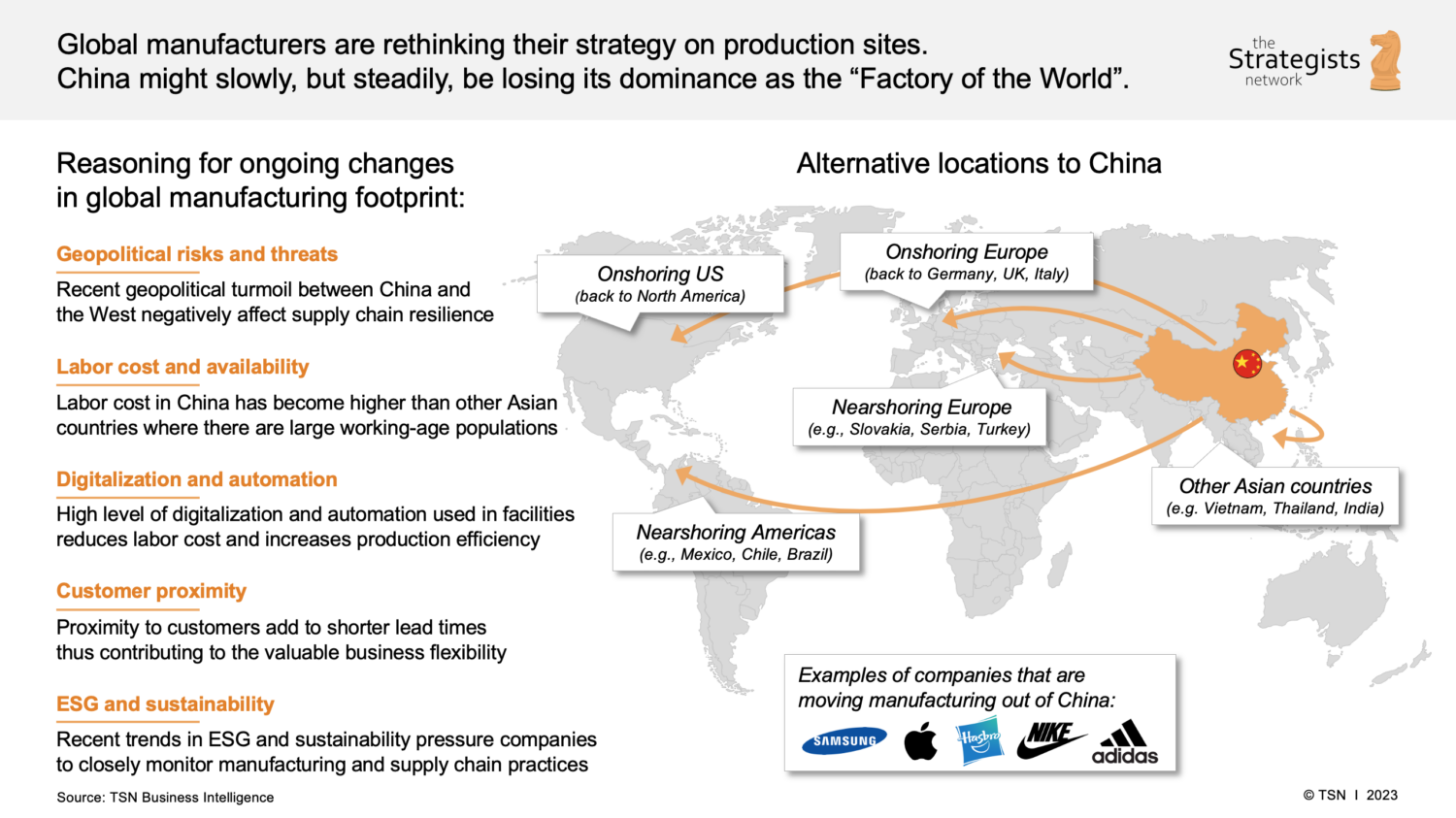

In today’s high-velocity global procurement landscape, accuracy, speed, and supplier reliability are non-negotiable. Sourcing from China, while cost-effective, presents persistent challenges: unverified suppliers, inconsistent quality, communication gaps, and prolonged lead times. These inefficiencies can derail project timelines and inflate operational costs.

SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-vetted, factory-audited suppliers aligned with international procurement standards. For procurement professionals targeting suppliers such as China Communications Construction Company M Sdn Bhd (CCCM), our platform provides a direct, secure, and time-optimized sourcing pathway.

Why SourcifyChina’s Verified Pro List Saves Time

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Verification | 4–8 weeks of background checks, site visits, and document validation | Pre-validated supplier dossier with audit reports, certifications, and compliance records | Up to 6 weeks |

| Communication & Negotiation | Language barriers, delayed responses, misaligned expectations | Dedicated bilingual sourcing consultants and real-time coordination | Up to 50% reduction in lead time |

| Quality Assurance | Post-order inspections and rework cycles | Factory audits, production monitoring, and QC benchmarks built-in | Minimizes rework delays |

| Risk Mitigation | Exposure to fraud, non-compliance, or operational instability | Risk-rated suppliers with legal and financial due diligence | Prevents costly project disruptions |

By leveraging our Verified Pro List, procurement teams bypass the uncertainty of open-market sourcing and gain immediate access to trusted partners with proven track records—critical for infrastructure, civil engineering, and construction projects involving entities like CCCM.

Strategic Advantage: Precision Sourcing in 2026

With increasing supply chain complexity and ESG compliance demands, procurement leaders must act with agility and authority. SourcifyChina empowers your team to:

- Accelerate RFQ cycles with ready-to-engage suppliers

- Reduce onboarding time through transparent, audited data

- Ensure compliance with international safety and labor standards

- Scale operations confidently across Southeast Asia and Greater China

Our inclusion of China Communications Construction Company M Sdn Bhd in the Verified Pro List means your organization can initiate collaboration with full due diligence already completed—no guesswork, no delays.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing processes compromise your project timelines or procurement KPIs. The future of B2B supply chain efficiency is verified, transparent, and immediate.

👉 Contact SourcifyChina Now to access the full Verified Pro List and begin working with pre-qualified suppliers like China Communications Construction Company M Sdn Bhd.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to support your procurement needs with end-to-end guidance, real-time updates, and market intelligence tailored to your sector.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing & Construction Partners

Delivering Speed, Certainty, and Value in Global Procurement

🧮 Landed Cost Calculator

Estimate your total import cost from China.