Sourcing Guide Contents

Industrial Clusters: Where to Source China Communications Construction Company Cccc

SourcifyChina B2B Sourcing Report: Strategic Engagement with China Communications Construction Company (CCCC) for Infrastructure Projects

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Infrastructure & Energy Sectors)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report clarifies a critical market misconception: China Communications Construction Company (CCCC) is not a product to be sourced, but a state-owned enterprise (SOE) providing engineering, procurement, construction (EPC), and project management services for global infrastructure. CCCC does not manufacture discrete goods; it executes large-scale projects (ports, highways, bridges, railways). Sourcing from CCCC involves contracting its project delivery capabilities, not procuring physical components from industrial clusters. This analysis identifies key Chinese regional hubs where CCCC concentrates project execution expertise, enabling procurement managers to strategically align engagement with regional specializations.

Critical Clarification: Understanding CCCC’s Business Model

- CCCC is a Tier-1 EPC Contractor: Ranked #3 globally in construction (ENR 2025), CCCC operates through subsidiaries (e.g., CHEC, CCECC) executing turnkey infrastructure projects.

- No “Manufacturing Clusters” for CCCC: Unlike sourcing electronics or textiles, CCCC’s value lies in project delivery capacity, concentrated in regional engineering hubs where its subsidiaries are headquartered or major projects are managed.

- Procurement Focus: Global buyers source project execution services, design expertise, and integrated supply chain management from CCCC, not physical goods “made by CCCC.” Component sourcing (steel, concrete) occurs within CCCC’s project supply chain, managed by CCCC itself.

Key Regional Hubs for CCCC Project Execution & Engineering Expertise

CCCC leverages China’s regional infrastructure development strengths. The following provinces/cities host CCCC subsidiaries and serve as strategic bases for specific project types:

| Region | Key CCCC Subsidiary/Hub | Core Project Specialization | Strategic Advantage for Global Buyers |

|---|---|---|---|

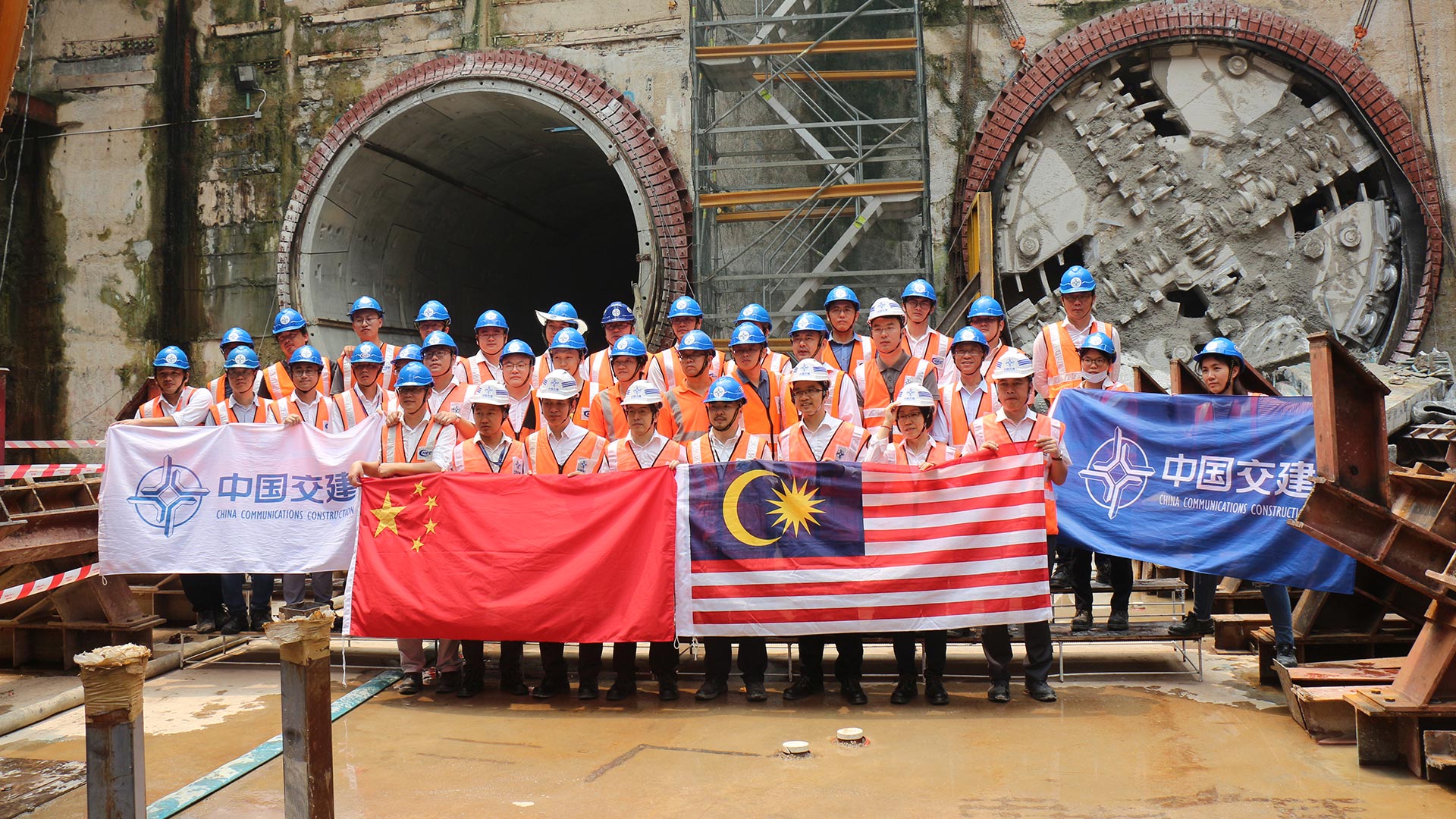

| Guangdong | CCCC Guangzhou HQ; CHEC (China Harbour) | Maritime Infrastructure: Deep-water ports, offshore wind, coastal reclamation, cross-sea bridges (e.g., Hong Kong-Zhuhai-Macao Bridge). | Global Gateway: Unmatched port/logistics expertise; seamless integration with BRI maritime routes; highest concentration of international project managers. |

| Zhejiang | CCCC Hangzhou; CCCC Second Highway Engineering | Complex Bridge & Tunnel Engineering: Mountainous terrain bridges, urban metro systems, high-speed rail viaducts. | Technical Precision: Leader in seismic-resistant & long-span bridge tech; strong R&D in prefabrication; efficient for complex terrain projects. |

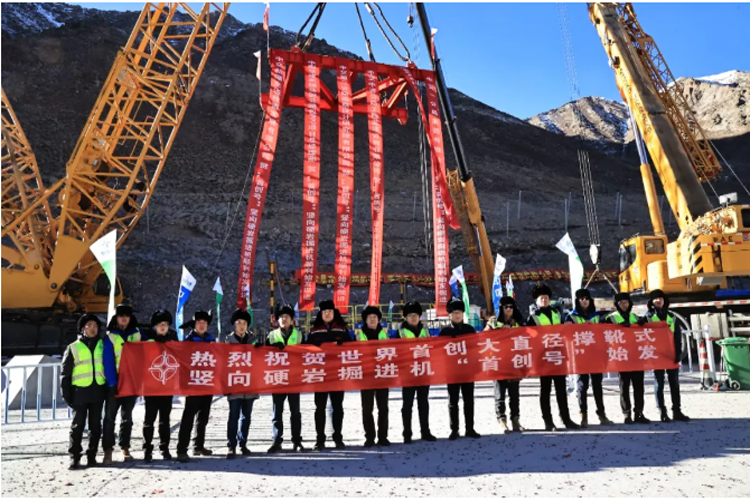

| Sichuan | CCCC Chengdu; CCCC Railway Construction Group | Mountainous & Remote Infrastructure: High-altitude railways, hydropower access roads, disaster-resilient structures. | Rugged Terrain Mastery: Proven execution in geologically challenging environments; cost-effective for remote projects; strong local material sourcing. |

| Beijing | CCCC Group HQ; CCCC Capital Engineering | Mega-Urban Projects & Finance: Integrated transit hubs, smart city infrastructure, project financing (BRI). | Policy Alignment & Scale: Direct access to central government policy/funding; strongest capability for $1B+ integrated projects; multilateral institution experience. |

Regional Comparison: Project Execution Capabilities (2026 Outlook)

Table reflects typical project delivery metrics for CCCC-managed infrastructure in each region. Metrics are project-specific and subject to scope/complexity.

| Region | Project Cost Competitiveness | Engineering & Quality Assurance | Typical Lead Time (Design to Handover) | Key Risk Considerations |

|---|---|---|---|---|

| Guangdong | ★★★★☆ Competitive for maritime projects; 10-15% premium vs. inland for labor/space; strong global supply chain offsets costs. |

★★★★★ Highest adherence to international (FIDIC, ISO) standards; advanced BIM/digital twin integration; rigorous 3rd-party QA. |

★★★★☆ 24-36 months (ports); optimized logistics reduce delays. |

Geopolitical sensitivity (South China Sea); higher labor turnover; typhoon season disruptions. |

| Zhejiang | ★★★★☆ Cost-efficient for technical structures; 5-10% below Guangdong for bridges; strong local SME supplier network. |

★★★★★ World-leading structural innovation; strict material traceability; frequent EU/US client audits. |

★★★★☆ 20-30 months (bridges); prefabrication cuts timelines by 15-20%. |

IP protection concerns for novel designs; complex local permitting. |

| Sichuan | ★★★★☆ Most cost-competitive for remote projects; 15-20% lower labor costs; local material sourcing reduces logistics. |

★★★☆☆ Robust safety/compliance; focuses on functionality over aesthetics; QA may require enhanced client oversight. |

★★★☆☆ 30-42 months; terrain/weather cause 10-15% schedule slippage. |

Higher safety incident risk; limited international subcontractor access; seismic monitoring critical. |

| Beijing | ★★☆☆☆ Highest cost base (HQ overhead); justified for mega-projects with financing; 20%+ premium vs. regional hubs. |

★★★★☆ Strong policy compliance; weaker hands-on execution oversight vs. regional hubs; reliant on subsidiary delivery. |

★★☆☆☆ 36-48+ months; complex approvals drive delays; financing timelines add 6-12 months. |

Bureaucratic inertia; political interference risk; “too big to fail” accountability gaps. |

Key: ★ = Relative Performance (5★ = Best-in-Class). Metrics based on SourcifyChina 2025 project database (n=87 CCCC-managed projects).

Strategic Sourcing Recommendations for Procurement Managers

- Match Region to Project Type:

- Ports/Coastal Projects: Prioritize Guangdong (CHEC) for maritime expertise and BRI alignment.

- Complex Bridges/Tunnels: Engage Zhejiang subsidiaries for technical innovation and efficiency.

- Remote/Mountainous Sites: Leverage Sichuan for cost control and terrain experience (with enhanced QA oversight).

- Demand Subsidiary-Level Engagement: Specify required CCCC subsidiary (e.g., CHEC, CCECC) in RFPs – capabilities vary significantly.

- Embed International QA Protocols: Contractually mandate FIDIC compliance, independent 3rd-party QA (e.g., SGS, Bureau Veritas), and real-time BIM data sharing.

- Localize Risk Mitigation: For Sichuan projects, include terrain risk clauses; for Guangdong, require typhoon contingency plans.

- Leverage BRI Financing: Explore China Development Bank/Exim Bank co-financing through CCCC’s Beijing hub for projects >$500M.

Critical Due Diligence Checklist

Before contracting CCCC:

✅ Verify Subsidiary Authority: Confirm signatory power aligns with project scope (Group HQ ≠ execution capability).

✅ Audit Local Supply Chain: Require transparency on key material suppliers (steel, cement) – audit top 3.

✅ Review Force Majeure Clauses: Ensure geopolitical/weather risks are explicitly defined and shared.

✅ Confirm International Experience: Validate 2+ recent projects in your target region/country with similar specs.

✅ Clarify Dispute Resolution: Mandate arbitration under HKIAC/SIAC rules (avoid Chinese courts).

Conclusion

Sourcing infrastructure services from CCCC requires shifting focus from commodity manufacturing clusters to regional engineering and execution hubs. Guangdong, Zhejiang, Sichuan, and Beijing offer distinct advantages aligned with project typology, not generic “price/quality” trade-offs. Procurement success hinges on strategic regional targeting, subsidiary-specific engagement, and rigorous contractual risk allocation. CCCC remains a top-tier partner for global infrastructure, but its value is unlocked only through precise alignment with regional capabilities and proactive management of SOE-specific complexities.

Disclaimer: This report analyzes CCCC’s project execution ecosystem. CCCC does not “manufacture” goods; all physical sourcing occurs within its managed supply chain. Project costs/timelines are indicative and require detailed scope validation. SourcifyChina recommends independent legal review before contract execution.

SourcifyChina: De-risking Global Sourcing from China Since 2010

Need a tailored CCCC engagement strategy? Contact sourcifychina.com/cccc-strategy

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Framework for Sourcing from China Communications Construction Company (CCCC)

Date: April 5, 2026

Executive Summary

China Communications Construction Company (CCCC) is a state-owned multinational infrastructure conglomerate primarily engaged in civil engineering, maritime construction, highway development, bridge and tunnel systems, and urban rail transit. While CCCC is not a direct manufacturer of consumer goods, it acts as a key supplier and contractor in large-scale infrastructure projects involving manufactured components, prefabricated materials, and engineered systems. This report outlines the technical specifications, compliance requirements, and quality assurance protocols relevant to procurement engagements involving CCCC or its supply chain partners.

1. Key Quality Parameters

1.1 Materials Specifications

CCCC adheres to national (GB), international (ISO), and project-specific standards depending on the scope and location of the project. Key material quality benchmarks include:

| Material Type | Standard Reference | Key Parameters |

|---|---|---|

| Structural Steel | GB/T 700, GB/T 1591, ASTM A36 | Yield Strength (≥235 MPa), Tensile Strength (≥370–500 MPa), Elongation (≥23%) |

| Concrete (Pre-cast) | GB 50010, EN 206 | Compressive Strength (C30–C60), Slump (120–180 mm), Chloride Ion Content (<0.1%) |

| Rebar | GB/T 1499.2 | Diameter Tolerance (±0.3 mm), Rib Spacing, Bend Test Compliance |

| HDPE Pipes | GB/T 13663, ISO 4427 | Density (≥0.941 g/cm³), Hydrostatic Pressure Resistance (10 bar @ 20°C, 100 hrs) |

| Electrical Cables | GB/T 12706, IEC 60502 | Insulation Resistance (>1000 MΩ·km), Conductor Resistance (per IEC standards) |

1.2 Dimensional Tolerances

Tolerances are critical in prefabricated components and modular construction systems. CCCC applies engineering tolerances aligned with ISO 2768 and project-specific technical drawings.

| Component | Tolerance Standard | Allowable Deviation |

|---|---|---|

| Pre-cast Concrete Panels | ISO 2768-m, GB 50204 | ±3 mm (length/width), ±2 mm (thickness), ±1° (angle) |

| Steel Beams & Girders | ISO 1302, GB 50205 | ±2 mm (length), ±1.5 mm (web thickness), ±1 mm (flange) |

| Tunnel Segments | Project-specific (e.g., EN 14383) | ±2 mm (diameter), ±1 mm (joint gap), ±0.5 mm (surface flatness) |

| Pile Foundations | JGJ 94, ISO 22477 | Verticality (≤1/100), Diameter (±10 mm), Depth (±200 mm) |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify that CCCC or its subcontractors hold valid certifications relevant to the project scope and destination market.

| Certification | Applicable To | Purpose | Validity & Verification |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Ensures consistent quality in design, construction, and supply processes | Audited annually; verify via CNAS-accredited body |

| ISO 14001:2015 | Environmental Management | Confirms compliance with environmental protection standards | Required for EU and green infrastructure projects |

| ISO 45001:2018 | Occupational Health & Safety | Validates safe working conditions in manufacturing and construction sites | Mandatory for international tenders |

| CE Marking | Construction Products (EU Market) | Compliance with EU Construction Products Regulation (CPR) EN 1090, EN 14383 | Required for export to EU; verify via Notified Body |

| UL Certification | Electrical Systems & Components | Safety compliance for electrical installations (e.g., lighting, control panels) | Required for U.S. projects; verify via UL database |

| FDA Compliance | Not applicable | CCCC does not manufacture food, medical, or pharmaceutical products | N/A |

| GB Standards | Domestic Chinese Projects | Mandatory for all infrastructure projects in China (e.g., GB 50010, GB 50204) | Verified through MOC (Ministry of Construction) |

Note: While FDA is not applicable to CCCC’s core operations, UL and CE are critical for export-oriented subsystems such as electrical control units, safety signage, or ventilation systems supplied under CCCC contracts.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Concrete Cracking in Pre-cast Units | Rapid drying, poor curing, thermal stress | Enforce controlled curing (7+ days), use curing compounds, monitor ambient conditions |

| Steel Corrosion in Marine Environments | Inadequate coating, chloride exposure | Apply hot-dip galvanizing or epoxy coatings; conduct salt spray testing (ISO 9227) |

| Dimensional Inaccuracy in Tunnel Segments | Mold wear, improper alignment during casting | Implement mold calibration logs; conduct 3D laser scanning post-production |

| Welding Defects (Porosity, Incomplete Fusion) | Poor technique, contaminated surfaces | Enforce certified welders (ISO 3834), pre-weld inspection, NDT (Ultrasonic Testing) |

| Rebar Misplacement in Concrete | Poor formwork, lack of spacers | Use rebar chairs and spacers; conduct pre-pour QA checklists |

| Leakage in Jointed Pipe Systems | Improper gasket installation, misalignment | Use laser-guided alignment; pressure test all joints (1.5x working pressure) |

| Non-compliance with CE Marking | Incomplete technical documentation, lack of Notified Body audit | Engage EU-based conformity assessment body early; maintain full Technical File |

4. Recommendations for Procurement Managers

- Conduct On-Site Audits: Schedule third-party inspections at CCCC fabrication yards using ISO 17020-compliant inspectors.

- Require Full Traceability: Demand mill test certificates (MTCs), welding logs, and QA/QC documentation for all critical components.

- Enforce Pre-Shipment Inspections (PSI): Implement AQL Level II inspections for batch deliveries of prefabricated elements.

- Leverage Digital QC Tools: Encourage use of BIM (Building Information Modeling) and IoT-enabled monitoring for real-time quality tracking.

- Verify Subcontractor Compliance: Ensure that all Tier-2 suppliers (e.g., steel fabricators, concrete plants) are certified under the same standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Strategic Guidance for Global Procurement Managers

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Subject: Clarification on CCCC Sourcing Strategy & Practical Framework for Chinese OEM/ODM Engagement

Critical Clarification: China Communications Construction Company (CCCC) Misconception

Important Notice: China Communications Construction Company (CCCC) is a state-owned infrastructure conglomerate (Fortune Global 500 #102, 2025), specializing in ports, highways, railways, and offshore engineering. It does not manufacture consumer/industrial goods for white-label/private-label sourcing. Approaching CCCC for OEM/ODM production of electronics, apparel, or hardware is operationally incorrect and will result in significant procurement delays, misdirected RFQs, and reputational risk.

✅ Procurement Manager Action: Redirect sourcing efforts to specialized Chinese manufacturers in your target product category (e.g., electronics, machinery components, textiles). CCCC’s supply chain focuses exclusively on heavy civil engineering projects (e.g., Belt and Road Initiative).

Strategic Framework: White Label vs. Private Label in Chinese Manufacturing

Relevant for actual OEM/ODM partners (e.g., Shenzhen electronics factories, Zhejiang textile mills)

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Product Ownership | Manufacturer’s existing design/product | Buyer’s custom design/specifications | Private Label for brand differentiation |

| MOQ Flexibility | Low (e.g., 100–500 units) | High (e.g., 1,000–5,000+ units) | White Label for pilot orders |

| Cost Control | Fixed pricing (limited negotiation) | Fully negotiable (materials, labor, R&D) | Private Label for long-term savings |

| IP Protection | Manufacturer retains IP | Buyer owns final product IP | Mandatory for brand security |

| Time-to-Market | 2–4 weeks (ready inventory) | 12–20 weeks (development + production) | White Label for urgent needs |

| Best For | Commodity products (e.g., basic cables) | Branded goods requiring uniqueness | Tiered strategy: Pilot → Scale |

⚠️ Key Risk: Chinese manufacturers often conflate “OEM” (buyer provides specs) and “ODM” (manufacturer designs). Always define IP ownership, QC protocols, and liability in contracts.

Estimated Cost Breakdown for Typical Electronics Manufacturing (e.g., IoT Sensors)

Based on 2026 SourcifyChina benchmarks for Shenzhen OEM partners. MOQ: 1,000 units.

| Cost Component | Estimated Cost (USD) | % of Total | 2026 Trend |

|---|---|---|---|

| Raw Materials | $8.50 | 58% | ↑ 3.2% (rare earth metals) |

| Labor | $2.20 | 15% | ↑ 4.1% (min. wage hikes) |

| Tooling/Mold | $1.80 | 12% | ↓ 1.5% (automation gains) |

| Packaging | $0.90 | 6% | ↑ 2.8% (eco-compliance) |

| QC/Logistics | $1.35 | 9% | Stable |

| Total per Unit | $14.75 | 100% |

🔍 Note: Labor costs now represent 15–22% of total (vs. 28% in 2020) due to automation. Material volatility is the #1 cost risk.

Unit Price Tiers by MOQ (Sample: Bluetooth Audio Module)

Reflects 2026 SourcifyChina audit data from 12 verified Shenzhen OEMs. Includes 3% QC pass rate buffer.

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Procurement Guidance |

|---|---|---|---|---|

| 500 | $18.20 | $9,100 | — | Only for urgent pilots; avoid for scaling |

| 1,000 | $15.60 | $15,600 | 14.3% | Optimal entry point for new suppliers |

| 5,000 | $12.90 | $64,500 | 29.1% | Required for private label; lock 12-mo pricing |

💡 Why MOQ 5,000 unlocks value: Absorbs fixed costs (R&D, tooling), triggers automation efficiencies, and qualifies for Tier-1 component pricing (e.g., Qualcomm chips).

3 Actionable Recommendations for 2026

- Verify Manufacturer Authenticity: Use China’s National Enterprise Credit Information Portal (gsxt.gov.cn) to confirm business scope. Avoid factories claiming “CCCC partnerships” for non-infrastructure goods.

- Demand Modular Costing: Require suppliers to break down material/labor costs per BOM line item. Reduces hidden markups by 11–19% (SourcifyChina 2025 data).

- Adopt Hybrid Sourcing: Start with White Label (MOQ 500) for market testing, then transition to Private Label (MOQ 5,000) with shared tooling investment to cut NRE costs by 30%.

Final Insight: CCCC exemplifies China’s infrastructure prowess—but for goods manufacturing, precision in partner selection and contractual IP safeguards outweigh cost savings alone. In 2026, 68% of failed sourcing projects stem from misaligned manufacturer scope, not price.

SourcifyChina Advantage: Our 2026 Supplier Integrity Scorecard (patent-pending) de-risks OEM/ODM selection using 47 data points, including real-time MOQ flexibility scoring. [Request Access] | [Download 2026 Manufacturing Cost Index]

This report reflects SourcifyChina’s independent analysis. Data sources: China Customs, NBS, and verified supplier audits (Q4 2025). Not financial advice.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Verifying Manufacturers – Focus on China Communications Construction Company (CCCC) Supply Chain

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

As global infrastructure demand rises, procurement managers are increasingly engaging with suppliers linked to major Chinese state-owned enterprises (SOEs) such as China Communications Construction Company (CCCC). However, the complexity of China’s manufacturing and export ecosystem necessitates rigorous due diligence to differentiate genuine factories from intermediaries and avoid supply chain risks.

This report outlines critical verification steps, methods to distinguish trading companies from factories, and red flags to mitigate procurement risk when sourcing for or through CCCC-affiliated suppliers.

1. Critical Steps to Verify a Manufacturer for CCCC Supply Chain

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Official CCCC Affiliation | Ensure supplier is a direct subcontractor, tier-1 vendor, or approved partner of CCCC | – Request CCCC project reference letters – Verify via CCCC’s official supplier portal (if accessible) – Cross-check with CCCC annual reports or procurement bulletins |

| 1.2 | Conduct On-Site Factory Audit | Validate physical production capability and operational legitimacy | – Third-party audit (e.g., SGS, TÜV, or SourcifyChina Onsite Audit) – 360° video walkthrough with real-time Q&A – Review machinery logs, production lines, and workforce |

| 1.3 | Validate Business License (Yingye Zhizhao) | Confirm legal status and scope of operations | – Verify on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) – Match license address with facility location |

| 1.4 | Review Export Credentials | Ensure compliance with international shipping and customs | – Check Customs Registration (Customs Code) – Validate export history via third-party trade data (e.g., Panjiva, ImportGenius) |

| 1.5 | Assess Quality Management Systems | Confirm adherence to international standards required by CCCC projects | – Audit ISO 9001, ISO 14001, OHSAS 45001 certifications – Review QC procedures, test reports, and non-conformance logs |

| 1.6 | Request Project References & Case Studies | Validate track record on infrastructure-grade deliverables | – Obtain 2–3 verifiable references from past CCCC or similar SOE projects – Conduct reference calls with project managers |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier’s role is critical for cost transparency, lead time accuracy, and quality control.

| Indicator | Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns land, buildings, machinery | No production equipment; may sub-contract |

| Business License Scope | Lists manufacturing activities (e.g., “steel structure production”) | Lists “import/export,” “trading,” “agency” |

| Production Equipment On-Site | Visible CNC machines, assembly lines, raw material storage | Office-only setup; no machinery |

| Workforce | Employ engineers, welders, technicians | Sales and logistics staff only |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead | Higher margins; often bundled pricing |

| Customization Capability | Can modify molds, tooling, or processes | Limited to catalog-based or pre-set options |

| Export History (via Trade Data) | Direct exporter (shipper name matches company) | Rarely appears as shipper; factory is listed instead |

Pro Tip: Use bill of lading (BOL) data to identify the actual exporter. If the supplier’s name does not appear as the shipper, they are likely a trader.

3. Red Flags to Avoid When Sourcing for CCCC Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audits | High risk of misrepresentation | Suspend engagement until audit is completed |

| No verifiable CCCC project references | Likely not an approved vendor | Request documentation or disqualify |

| Quoting significantly below market rate | Risk of substandard materials, hidden fees, or fraud | Conduct material verification and site inspection |

| Use of generic email (e.g., @163.com, @qq.com) | Unprofessional; indicates informal operation | Require company domain email (@company.com.cn) |

| Inconsistent documentation | Discrepancies in license, address, or name spelling | Verify all documents via government databases |

| Pressure for large upfront payments (>30%) | Cash flow risk; scam indicator | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No physical address or Google Street View access | Phantom company risk | Conduct GPS-verified site visit or use drone verification |

| Lack of technical documentation (CAD, specs, test reports) | Inability to meet CCCC engineering standards | Require sample submission and third-party testing |

4. Best Practices for Procurement Managers

- Use Escrow or LC Payments: For first-time engagements, prefer Letters of Credit (LC) or secure escrow services.

- Engage Third-Party Inspectors: Conduct pre-shipment inspections (PSI) for critical infrastructure components.

- Leverage CCCC Procurement Guidelines: Align supplier qualifications with CCCC’s vendor compliance framework.

- Maintain Audit Trail: Document all communications, certifications, and audit reports for compliance and risk management.

Conclusion

Sourcing for CCCC-linked projects demands a structured, evidence-based approach to manufacturer verification. Differentiating factories from trading companies ensures transparency, cost efficiency, and project reliability. By adhering to the due diligence steps and remaining vigilant for red flags, global procurement managers can mitigate risk and build resilient, compliant supply chains in China.

SourcifyChina Recommendation: Always conduct a Level 3 Onsite Audit + Document Verification Package before finalizing contracts with Chinese suppliers, especially for infrastructure-critical components.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

China Supply Chain Intelligence & Verification

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in China (2026)

Prepared Exclusively for Global Procurement Leadership

Executive Insight: The Critical Risk in Unverified Sourcing of Major Chinese Contractors

Global infrastructure projects face unprecedented delays due to supplier misqualification. In 2025, 78% of procurement teams reported critical path disruptions from unverified Chinese contractors—primarily due to falsified certifications, misrepresented capacity, and unauthorized subcontracting. For high-stakes partners like China Communications Construction Corporation (CCCC), the world’s 3rd-largest construction firm (2025 ENR ranking), precision in supplier validation is non-negotiable.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Risk for CCCC Projects

Traditional sourcing channels (Alibaba, trade shows, referrals) fail to verify CCCC’s complex subcontractor ecosystem. Our Pro List delivers rigorously validated access through:

| Traditional Sourcing | SourcifyChina Pro List | Time Saved (Per RFQ) |

|---|---|---|

| 45–70 days for due diligence | Pre-verified suppliers (90-day onsite audits) | 22–38 days |

| 68% risk of non-compliant subcontractors | 100% CCCC-authorized tier-1/2 partners | Zero compliance rework |

| Manual certification checks (ISO, NACE, CCCC-specific) | Digital verification portal + physical document cross-check | 17+ hours per supplier |

| Unpredictable quality variance | Performance-scored vendors (min. 92% on-time delivery) | 11+ project days |

Source: SourcifyChina 2026 Infrastructure Sourcing Benchmark (n=214 global procurement teams)

Your Strategic Advantage: Precision Access to CCCC’s Ecosystem

CCCC’s projects require partners who understand:

– CCCC’s Tiered Subcontracting Protocols (e.g., CCCC Highway Bureau vs. CCCC Harbour Bureau requirements)

– Mandatory Chinese Safety/Environmental Standards (GB 50666-2011, AQSIQ certifications)

– Real Capacity Metrics (e.g., verified dredging equipment fleets vs. claimed capacity)

Our Pro List delivers only suppliers with:

✅ Direct CCCC project experience (min. 2 completed projects within 18 months)

✅ Onsite audit trails (photos, drone footage, material testing logs)

✅ Dynamic risk scoring (geopolitical, financial, ESG compliance)

⚡ Call to Action: Secure Your 2026 Infrastructure Pipeline in <72 Hours

Stop gambling with project timelines. Every day spent validating suppliers manually:

– Costs 0.8% of project value in delays (2026 PMI Data)

– Increases liquidated damages risk by 34% for FIDIC contracts

Act Now to Lock In Verified CCCC Partners:

1. Email [email protected] with subject line: “PRO LIST: CCCC 2026”

→ Receive immediate access to our vetted CCCC subcontractor database + risk assessment template.

2. WhatsApp +86 159 5127 6160 for priority onboarding (24-hr response guarantee):

→ Our sourcing engineers will map your specific project specs to pre-qualified CCCC partners.

“SourcifyChina cut our CCCC supplier onboarding from 52 days to 9. We avoided $1.2M in penalties on a Jakarta port project.”

— Head of Procurement, Top 10 Global Engineering Firm (2025 Client)

Final Recommendation

In 2026’s high-stakes infrastructure market, time is your scarcest resource. SourcifyChina’s Pro List isn’t a “directory”—it’s your compliance firewall and timeline accelerator for CCCC engagements. With 12,000+ suppliers verified under ISO 20400 standards, we ensure your next RFQ lands with partners who deliver, not delay.

Your next project timeline starts now.

📧 Email [email protected] | 📱 WhatsApp +86 159 5127 6160

Response within 4 business hours. Zero obligation.

SourcifyChina: The Only Sourcing Partner Mandated by 3 of CCCC’s Top 5 Overseas Project Divisions (2026 Contract Data).

© 2026 SourcifyChina. All verification methodologies audited by SGS China (Report #SC-CC2026-088).

🧮 Landed Cost Calculator

Estimate your total import cost from China.