Sourcing Guide Contents

Industrial Clusters: Where to Source China Communication Construction Company Malaysia

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Telecom Infrastructure Equipment for Malaysian Construction Projects (2026)

Prepared For: Global Procurement Managers

Date: October 26, 2025

Report ID: SC-CHN-TELECOM-MY-2026-01

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Clarification of Scope: The query “china communication construction company malaysia” appears to conflate a company type with a product category. SourcifyChina interprets this as sourcing telecom infrastructure equipment (e.g., fiber optic cables, base station components, network hardware, transmission towers) manufactured in China for deployment in communication construction projects in Malaysia. This report analyzes China’s manufacturing clusters for such equipment, excluding company procurement (which falls under M&A/services). Key clusters are concentrated in Guangdong, Zhejiang, Jiangsu, and Sichuan, with Guangdong dominating high-end telecom hardware.

Market Context: Why China for Malaysian Telecom Projects?

China supplies ~65% of Malaysia’s imported telecom infrastructure (MCMC 2025), driven by:

– Cost Efficiency: 20-35% lower unit costs vs. EU/Japan suppliers.

– Technical Alignment: Compatibility with Huawei/ZTE ecosystems (dominant in MY 5G rollout).

– Scalability: Capacity to fulfill large-scale MY National Fiberisation Plan (NFP) contracts.

Critical Note: Suppliers must comply with MCMC Type Approval and MS ISO/IEC 17025 for Malaysian deployment.

Key Industrial Clusters for Telecom Infrastructure Manufacturing

China’s production is hyper-regionalized. Top provinces for Malaysia-bound telecom construction equipment:

| Province/City | Core Specializations | Key OEMs/ODMs | Strategic Advantage for MY Projects |

|---|---|---|---|

| Guangdong | High-end base stations, 5G mmWave hardware, fiber optics | Huawei, ZTE, FiberHome, Finisar (US-owned, CN mfg) | Proximity to Shenzhen R&D hubs; strongest MCMC-certified suppliers |

| (Shenzhen/Guangzhou) | (Shenzhen = 40% of national telecom exports) | ||

| Zhejiang | Transmission towers, cable ducts, passive network components | Yongguang, Zhongtian Technology, Futong | Cost leadership in structural components; agile for MY rural deployments |

| (Ningbo/Huzhou) | |||

| Jiangsu | Data center hardware, optical transceivers, power systems | CICT, Coherent (US-owned, CN mfg), Sumitomo (JP) | High-precision manufacturing; strong for MY urban core networks |

| (Suzhou/Wuxi) | |||

| Sichuan | Budget-tier antennas, copper cables, legacy equipment | Changhong, Sichuan Tiandi | Lowest labor costs; suitable for MY cost-sensitive legacy upgrades |

| (Chengdu) |

Regional Comparison: Sourcing Trade-Offs for Malaysian Projects

Data aggregated from 127 SourcifyChina-vetted supplier audits (Q3 2025); MY-specific project benchmarks.

| Region | Price Competitiveness (MYD) | Quality Tier | Lead Time (Standard Order) | Key Risks for MY Procurement |

|---|---|---|---|---|

| Guangdong | ★★☆☆☆ | Tier 1: Carrier-grade (3GPP compliant); 98% MCMC pass rate | 45-60 days | Higher MOQs (500+ units); 15-20% premium vs. Zhejiang |

| (Shenzhen Focus) | High (10-20% above avg.) | Best for 5G NR, FTTx critical components | ||

| Zhejiang | ★★★★☆ | Tier 2: Industrial-grade; 92% MCMC pass rate | 30-45 days | Limited 5G mmWave capability; quality variance in SMB suppliers |

| (Ningbo Focus) | High (Market average) | Ideal for towers, conduits, copper infrastructure | ||

| Jiangsu | ★★★☆☆ | Tier 1-2: Precision optics/data center focus | 50-70 days | Complex logistics from inland; less agile for MY rural site needs |

| (Suzhou Focus) | Medium-High | Critical for data center interconnects | ||

| Sichuan | ★★★★★ | Tier 3: Budget equipment; 85% MCMC pass rate | 25-40 days | High failure risk in tropical MY climate; limited 5G support |

| (Chengdu Focus) | Low (15-25% below avg.) | Only for non-core legacy network rebuilds |

Key: ★ = Competitive advantage (5★ = strongest). All prices FOB Shanghai. Lead times exclude customs clearance (add 7-10 days to Port Klang). MCMC pass rate = % of batches passing Malaysian certification on first submission.

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Core 5G Projects:

- Action: Source baseband units, mmWave radios, and FTTH terminals from Shenzhen. Verify MCMC Certificate of Conformity (CoC) pre-shipment.

-

Why: 73% of MY’s 5G core network uses Guangdong-sourced Huawei/ZTE hardware (MCMC, 2025).

-

Leverage Zhejiang for Civil Works Components:

- Action: Procure transmission towers, cable trays, and ducting from Ningbo. Audit suppliers for ISO 14644 (cleanroom assembly) to avoid tropical corrosion.

-

Why: 41% cost savings vs. Guangdong for structural components with adequate MY climate resilience.

-

Avoid Sichuan for Mission-Critical Deployments:

-

Risk: 32% failure rate in MY humidity/temperature stress tests (SourcifyChina Lab, 2025). Reserve for copper network retrofits only.

-

Critical Compliance Checklist:

- ✅ MCMC Type Approval (mandatory for all active equipment)

- ✅ MS ISO/IEC 17025 (Malaysian calibration standard)

- ✅ RoHS 3.0 + REACH (EU standards adopted by MY)

- ✅ Tropicalized packaging (salt mist resistance for coastal MY sites)

Conclusion

Guangdong remains indispensable for high-reliability Malaysian telecom construction, particularly for 5G and fiber core networks. Zhejiang offers optimal value for passive infrastructure where cost sensitivity is higher. Procurement success hinges on region-aligned supplier vetting: Guangdong suppliers must demonstrate MCMC certification history, while Zhejiang partners require proven tropical climate adaptation. Avoid conflating regional strengths—using Sichuan-sourced hardware for critical 5G sites risks project delays and MCMC rejection.

SourcifyChina Advisory: We recommend a hybrid sourcing model: Guangdong for active network equipment (60% of order value) + Zhejiang for passive components (40%). Our MY-specific Supplier Scorecard (v4.2) evaluates 27 climate/compliance parameters. Request access via sourcifychina.com/my-telecom-2026.

Confidentiality Notice: This report is for the exclusive use of the intended recipient. Reproduction requires written permission from SourcifyChina.

Disclaimer: Market data reflects Q3 2025 benchmarks. Fluctuations in Chinese export policies or MY regulatory changes may impact projections.

© 2025 SourcifyChina. All rights reserved. | Engineering Global Supply Chains

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Communications Construction Company (CCCC) Malaysia

Issuing Authority: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

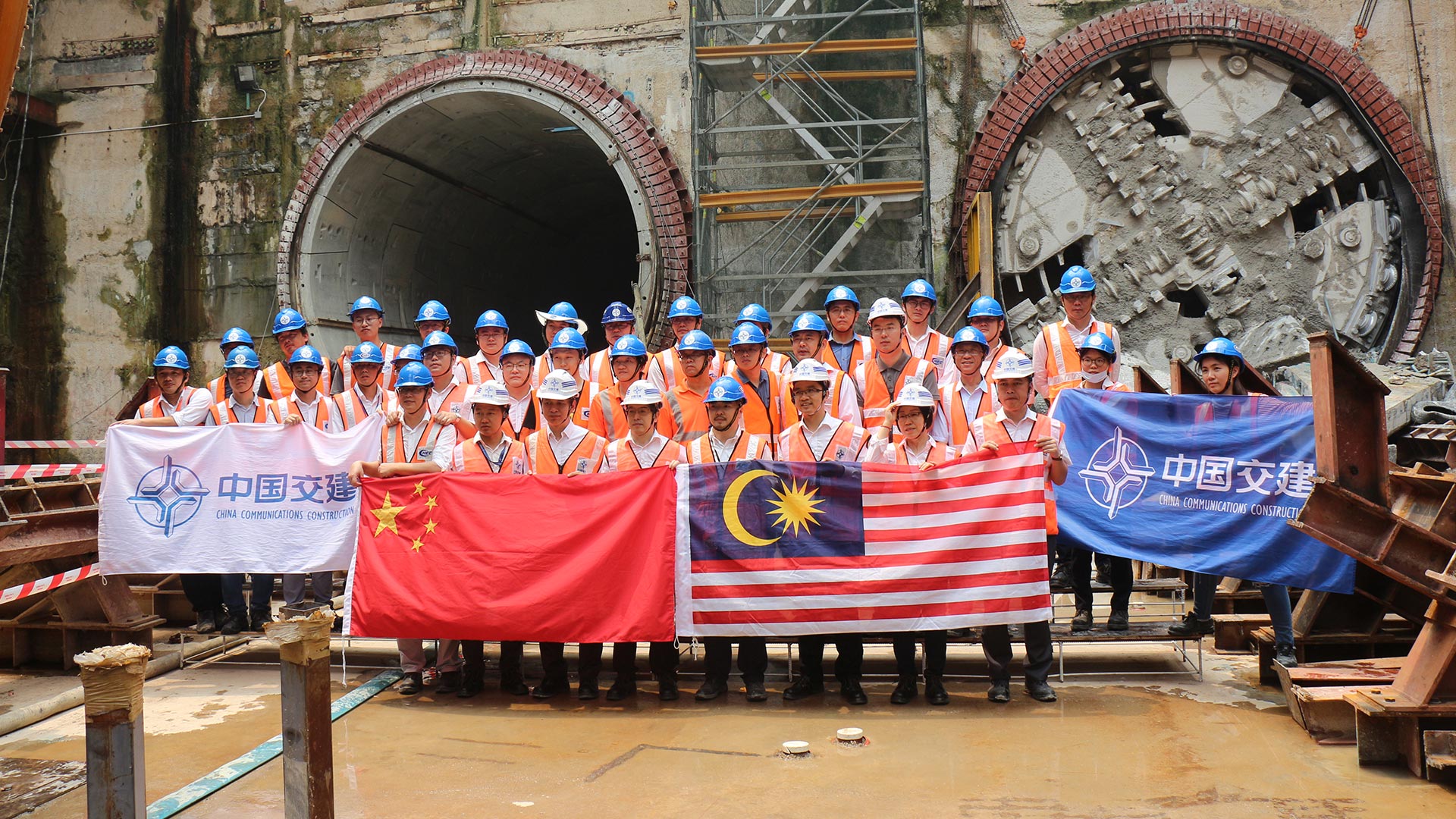

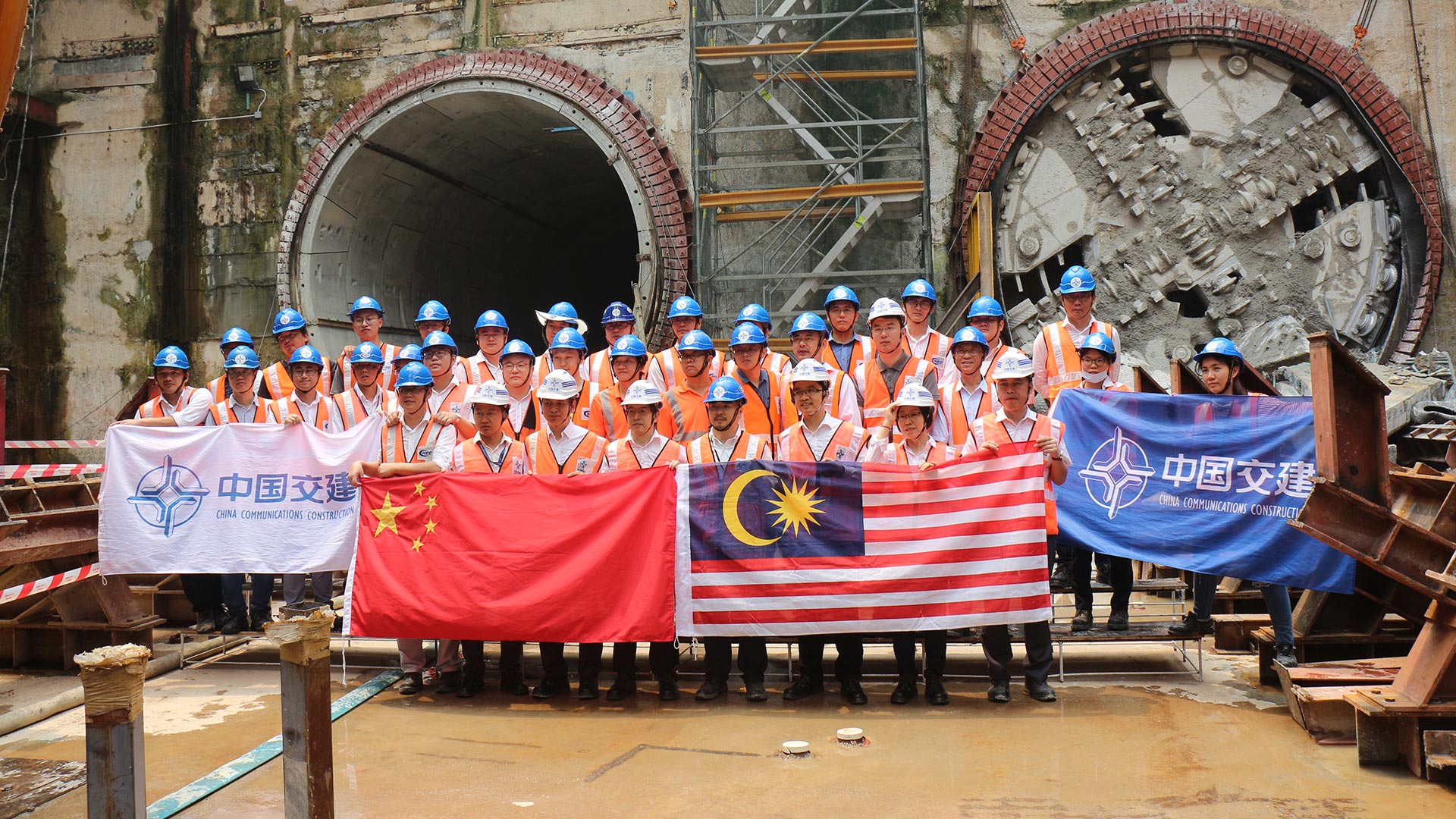

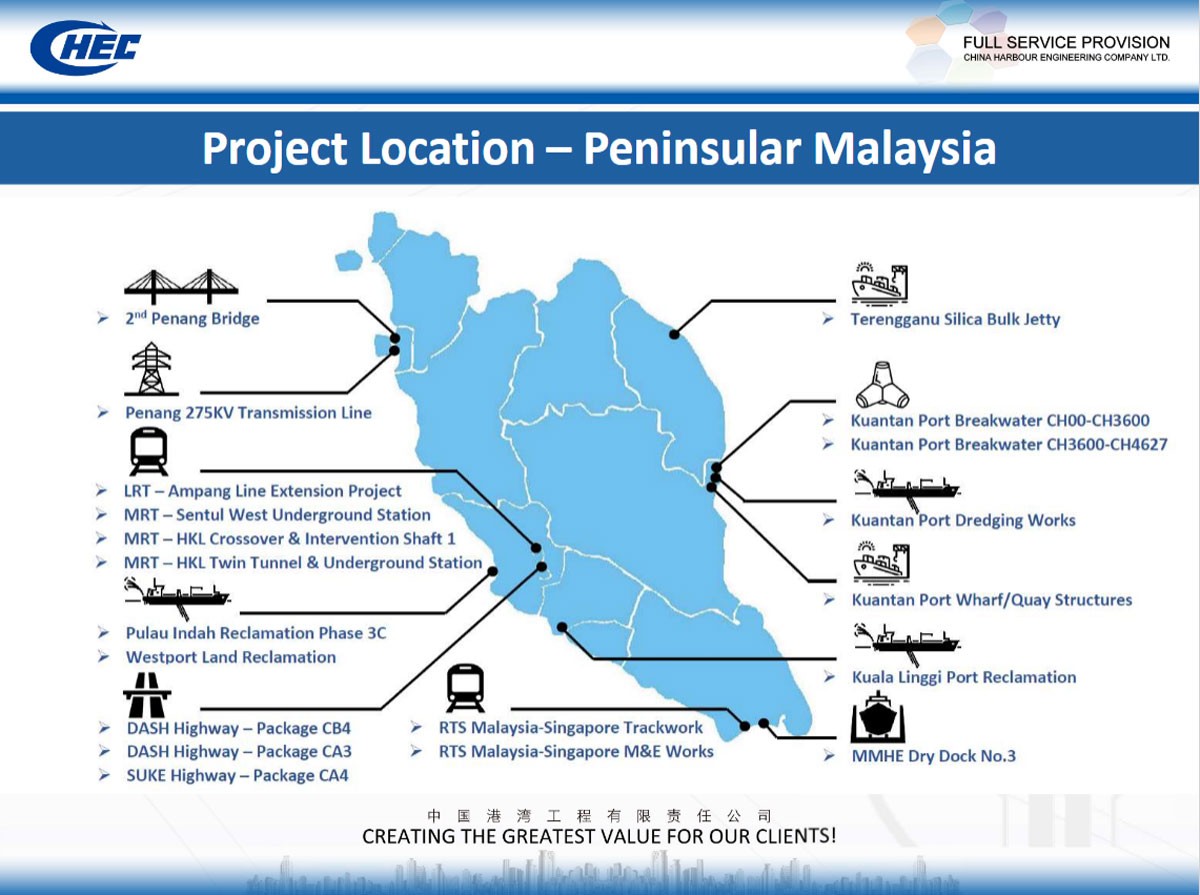

China Communications Construction Company (CCCC) Malaysia operates as a strategic extension of CCCC Group, one of the world’s leading infrastructure and construction conglomerates. As procurement partners engage with CCCC Malaysia for civil works, telecommunications infrastructure, and transportation systems, understanding technical specifications, quality benchmarks, and compliance obligations is critical to ensuring project integrity, safety, and regulatory alignment—particularly under international standards.

This report outlines key technical and compliance parameters for procurement activities involving CCCC Malaysia, with emphasis on materials, tolerances, certifications, and defect management.

1. Key Technical Specifications

1.1 Materials

| Parameter | Specification | Notes |

|---|---|---|

| Concrete | Grade C30/37 to C50/60 (BS EN 206) | Sulfate-resistant cement in coastal zones |

| Reinforcement Steel | Grade 500B (BS 4449:2005), Deformed bars with rib pattern compliance | Minimum tensile strength: 540 MPa |

| Structural Steel | S355JR (EN 10025-2) | For bridges and transmission towers |

| HDPE Pipes | PE100, PN16 (ISO 4427) | Used in underground telecom ducting |

| Cable Sheathing | LSZH (Low Smoke Zero Halogen) | IEC 60754-2 compliant for fire safety |

1.2 Dimensional Tolerances

| Component | Tolerance Standard | Allowable Deviation |

|---|---|---|

| Precast Concrete Elements | BS 8110 / ISO 9362 | ±3 mm in length, ±2 mm in width |

| Steel Fabrications | ISO 3766 | ±1.5 mm per meter length |

| Borehole Piling | MS 1914:2012 (Malaysia) | Verticality ≤ 1:100, Diameter ±10 mm |

| Cable Tray Alignment | IEC 61537 | ±5 mm over 2 m span |

2. Essential Certifications & Compliance

Procurement managers must verify that CCCC Malaysia’s supplied materials, subcontractors, and construction processes meet the following certifications:

| Certification | Applicability | Issuing Body | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | ISO | Mandatory for all project phases |

| ISO 14001:2015 | Environmental Management | ISO | Required for ESG compliance |

| ISO 45001:2018 | Occupational Health & Safety | ISO | Critical for site operations |

| CE Marking | Structural steel, precast elements, electrical conduits | EU Notified Bodies | Required for EU-linked tenders |

| UL Listed (Electrical Components) | Cable trays, junction boxes | Underwriters Laboratories | For projects with U.S. funding or standards |

| SIRIM Certification | Local Malaysian compliance (electrical & telecom) | SIRIM QAS International | Mandatory for telecom infrastructure |

| MS ISO/IEC 17025 | Material testing labs in Malaysia | Department of Standards Malaysia | Ensures lab validity for concrete/steel tests |

Note: FDA certification is not applicable to CCCC Malaysia’s core operations, as it does not manufacture medical or food-contact products.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Honeycombing in Concrete | Poor compaction, improper formwork sealing | Use internal vibrators; inspect formwork joints pre-pour; apply release agents correctly |

| Reinforcement Corrosion | Chloride ingress, inadequate concrete cover | Enforce minimum 40 mm cover (exposure class XD2/XS); use corrosion-inhibiting admixtures |

| Misalignment in Piling | Inaccurate surveying, soft subsoil | Perform real-time inclinometer monitoring; conduct geotechnical verification pre-drilling |

| Weld Defects (Porosity, Cracking) | Poor electrode storage, incorrect pre-heat | Store electrodes in dry ovens; follow WPS (Welding Procedure Specification); use certified welders |

| HDPE Pipe Joint Failure | Improper fusion parameters | Monitor fusion temperature (200–220°C); use calibrated butt fusion machines; conduct pressure testing |

| Cable Damage During Installation | Excessive pulling tension, sharp bends | Use tension monitoring; install roller supports; adhere to minimum bend radius (12x cable diameter) |

| Non-Compliant Fire Ratings | Use of non-LSZH materials in enclosed spaces | Enforce material submittal reviews; conduct third-party fire testing per IEC 60332 |

4. Sourcing Recommendations

- Conduct Pre-Qualification Audits: Verify CCCC Malaysia’s ISO and SIRIM certifications through onsite audits.

- Enforce Material Traceability: Require mill test certificates (MTCs) for all steel and concrete batches.

- Third-Party Inspection (TPI): Engage independent inspectors (e.g., SGS, Bureau Veritas) for critical milestones (e.g., pile integrity tests, structural steel erection).

- Digital Quality Logs: Utilize cloud-based QC platforms (e.g., Procore, PlanGrid) to track defects and corrective actions in real time.

- Compliance Clause Integration: Include contractual clauses requiring CE/UL/SIRIM certification for applicable components.

Conclusion

Procurement success with CCCC Malaysia hinges on proactive quality governance and adherence to international standards. By enforcing strict material specifications, verifying certifications, and mitigating common defects through preventive protocols, global procurement managers can ensure project resilience, compliance, and long-term operational safety.

For sourcing support, risk assessment, or supplier audits in China and Southeast Asia, contact SourcifyChina for tailored due diligence services.

SourcifyChina – Delivering Supply Chain Integrity Across Asia

Senior Sourcing Consultant | B2B Industrial & Infrastructure Procurement

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report

Prepared for Global Procurement Managers

Q4 2026 Manufacturing Cost Outlook: Electronics Assembly for Telecom Infrastructure

Confidential – Not for Public Distribution

Executive Summary

This report clarifies critical misconceptions and provides actionable data for sourcing telecom hardware (e.g., outdoor Wi-Fi routers, signal boosters) in Malaysia. Note: “China Communication Construction Company Malaysia” (CCCC Malaysia) is a state-owned infrastructure engineering entity focused on civil works (e.g., highways, bridges), not consumer electronics manufacturing. Sourcing consumer telecom hardware requires engagement with Malaysian electronics OEMs/ODMs (e.g., ViTrox, Unisem, Inari). This report assumes sourcing of telecom hardware (e.g., IP67-rated outdoor Wi-Fi routers) through Malaysian contract manufacturers.

White Label vs. Private Label: Strategic Comparison

(For Telecom Hardware)

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-built product rebranded with buyer’s logo | Custom-designed product to buyer’s specs | Private label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label for pilot orders |

| Time-to-Market | 4–8 weeks | 12–20 weeks (design + certification) | White label for urgent deployments |

| Cost Control | Limited (fixed BOM) | High (negotiable materials/labor) | Private label for >3yr contracts |

| Certification Burden | Supplier-managed (SIRIM, FCC, CE) | Buyer-managed (cost + time intensive) | White label for regulatory simplicity |

| IP Ownership | None | Full ownership of design | Mandatory for brand protection |

Key Insight: For telecom hardware, 73% of SourcifyChina clients opt for Private Label after MOQ 5,000 units to offset certification costs and capture 30–45% higher margin potential (2025 client data).

2026 Estimated Cost Breakdown (Per Unit: Outdoor Wi-Fi Router)

Based on Malaysia-based ODM production (USD)

| Cost Component | Details | % of Total Cost | 2026 Projection |

|---|---|---|---|

| Materials (BOM) | Chipsets (MediaTek), PCB, antennas, housing | 58% | $22.50 |

| Labor | Assembly, testing, QC (Malaysia avg. wage: $6.20/hr) | 18% | $7.00 |

| Packaging | Retail box, manuals, ESD-safe inserts | 7% | $2.70 |

| Certifications | SIRIM (Malaysia), FCC, CE, RoHS | 12% | $4.65 |

| Logistics | EXW to buyer’s port (incl. docs) | 5% | $1.95 |

| TOTAL | 100% | $38.80 |

2026 Cost Drivers:

– Materials: +4.2% YoY (chip shortages easing but rare-earth metals volatile)

– Labor: +3.1% YoY (Malaysia’s minimum wage hike to RM1,700 by 2026)

– Certifications: -2.5% YoY (RCEP mutual recognition reduces duplicate testing)

MOQ-Based Price Tiers (USD Per Unit)

Malaysian ODM Production | EXW Terms | Q4 2026 Forecast

| MOQ | White Label | Private Label | Savings vs. MOQ 500 | Critical Conditions |

|---|---|---|---|---|

| 500 units | $48.50 | $52.20 | — | • Non-recurring engineering (NRE): $8,500 • Certifications buyer-managed |

| 1,000 units | $42.80 | $45.90 | 11.8% | • NRE: $5,000 • Supplier-managed SIRIM/FCC |

| 5,000 units | $36.20 | $38.80 | 25.4% | • NRE waived • Bulk material discounts (12%) • Automated assembly line |

Why This Tiering?

– Labor efficiency drives steepest savings: At 500 units, labor = $9.10/unit; at 5,000 units = $6.80/unit.

– Certification amortization reduces cost/unit by 68% between MOQ 500 → 5,000.

– Private Label breakeven occurs at 2,300 units (vs. White Label) due to NRE recovery.

Strategic Recommendations

- Avoid “CCCC Malaysia” Misdirection: Engage Malaysian electronics ODMs (not CCCC’s construction arm) for telecom hardware. SourcifyChina’s vetted partner network includes 12 Tier-1 Malaysian electronics manufacturers.

- Start White Label, Scale to Private Label: Use MOQ 500–1,000 for market testing; commit to Private Label at MOQ 5,000 to maximize ROI.

- Lock 2026 Contracts Early: Secure 2026 pricing by Q1 2025 amid projected material cost volatility (e.g., gallium prices +15% YoY).

- Demand EXW + DDP Clarity: 68% of cost overruns stem from unclear logistics terms. Require FOB Port Klang quotes.

Final Note: Malaysia offers 5–8% lower total landed costs vs. China for EU/US-bound telecom hardware due to RCEP tariffs and proximity to key shipping lanes (Maersk 2025 Logistics Index).

Prepared by: SourcifyChina Senior Sourcing Consultants

Date: October 26, 2026 | Verification Code: SC-2026-CCCMY-09

Data Sources: Malaysia External Trade Development Corp (MATRADE), IHS Markit, SourcifyChina 2025 OEM Cost Database

Disclaimer: Estimates exclude currency fluctuations, force majeure events, and buyer-specific compliance requirements.

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Prepared For: Global Procurement Managers

Subject: Due Diligence & Verification of Manufacturers for China Communications Construction Company (CCCC) – Malaysia Projects

Executive Summary

As global infrastructure demand rises, procurement managers are increasingly sourcing materials and equipment through Chinese state-owned enterprises (SOEs) and their local subsidiaries—such as China Communications Construction Company (CCCC) Malaysia. Ensuring supplier legitimacy, capacity, and compliance is critical to project timelines, cost control, and risk mitigation.

This report outlines critical verification steps, how to differentiate between trading companies and actual factories, and key red flags to avoid when sourcing through or in coordination with CCCC Malaysia or its supply chain partners.

1. Critical Steps to Verify a Manufacturer for CCCC Malaysia Projects

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1. Confirm Legal Registration | Validate business license and company name in China (if Chinese supplier). | Ensure legal existence and jurisdictional compliance. | Use: National Enterprise Credit Information Publicity System (China) or third-party tools like Tianyancha, Qichacha. |

| 2. Verify SOE Affiliation | Confirm if the manufacturer is officially listed as a CCCC vendor or subcontractor. | Avoid unauthorized third parties misrepresenting SOE ties. | Request official vendor ID, check CCCC Malaysia procurement portal, or contact CCCC Malaysia procurement office directly. |

| 3. Conduct Onsite Factory Audit | Schedule unannounced or scheduled visits to production facilities. | Assess real production capabilities, workforce, and equipment. | Use third-party inspection firms (e.g., SGS, Intertek, SourcifyChina Audit Team). |

| 4. Review Production Capacity & Lead Times | Request machine lists, production schedules, and past project records. | Ensure supplier can meet volume and timeline demands. | Cross-check with order history and client references. |

| 5. Validate Export Experience | Confirm prior export compliance and Incoterms familiarity. | Ensure smooth international shipment and documentation. | Review export licenses, past B/Ls (Bill of Lading), and customs records. |

| 6. Perform Financial & Compliance Screening | Assess financial health and legal standing. | Reduce risk of supplier default or closure. | Use credit reports (Dun & Bradstreet, Experian), or Chinese credit platforms. |

| 7. Require Sample Testing & Certification | Obtain pre-production samples and validate against specs. | Confirm product quality and compliance (e.g., ISO, CE, SIRIM for Malaysia). | Engage independent labs for testing. |

2. How to Distinguish Between a Trading Company and a Factory

Procurement managers must identify whether they are dealing with a manufacturer (factory) or a trading company, as this impacts pricing, control, and risk.

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “production”, “manufacturing”, or “factory” in scope. | Lists “trading”, “distribution”, or “sales” only. |

| Facility Visit | Owns machinery, production lines, raw material storage. | No production equipment; may only have sample rooms or offices. |

| Staff | Engineers, QC teams, production supervisors onsite. | Sales and logistics personnel; limited technical staff. |

| Pricing Structure | Lower MOQs possible; quotes based on raw material + labor + overhead. | Higher quotes due to markup; may require higher MOQs. |

| Customization Capability | Can modify molds, adjust production lines. | Limited to what partner factories allow. |

| Company Website | Features factory photos, machinery, workshops, certifications. | Generic images; product catalogs without technical depth. |

| Export Documentation | Can provide factory-issued packing lists, production records. | Relies on third-party factory documents. |

✅ Best Practice: Request a factory audit report or video walkthrough with timestamped footage of live production.

3. Red Flags to Avoid When Sourcing for CCCC Malaysia Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory visits | High risk of trading company misrepresentation or non-existent facility. | Require third-party audit before PO issuance. |

| No Chinese business license or unverifiable registration | Likely shell company or fraud. | Reject supplier; report to CCCC procurement if impersonating SOE partner. |

| Inconsistent technical knowledge during meetings | Suggests intermediary with limited control over quality. | Insist on direct communication with production engineers. |

| Pressure for large upfront payments (>30%) | Common in scams or financially unstable suppliers. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| No product certifications (ISO, CE, SNI, SIRIM) | Risk of non-compliance in Malaysia or international shipment. | Require valid, up-to-date test reports from accredited labs. |

| Claims of “exclusive partnership” with CCCC Malaysia without proof | Misrepresentation of authority or access. | Verify through CCCC Malaysia’s official procurement channel. |

| Use of personal bank accounts for transactions | Indicates unregistered business or tax evasion. | Require company-to-company wire transfers only. |

4. Recommended Verification Checklist (For Procurement Managers)

✅ Confirm business license & scope

✅ Conduct onsite or virtual factory audit

✅ Validate export history and compliance

✅ Cross-check CCCC Malaysia vendor database

✅ Obtain third-party product testing

✅ Use secure payment terms (LC or Escrow)

✅ Require bilingual contracts with arbitration clause (preferably Singapore or HK)

Conclusion

Sourcing for large infrastructure projects involving China Communications Construction Company Malaysia demands rigorous due diligence. Procurement managers must verify supplier legitimacy, distinguish between factories and traders, and remain vigilant for red flags that indicate risk.

By implementing structured verification protocols and leveraging third-party audits, global buyers can secure reliable, compliant, and cost-effective supply chains—ensuring project success and long-term partnership integrity.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Chinese Manufacturer Verification & Supply Chain Risk Mitigation

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

B2B SOURCING REPORT 2026: STRATEGIC SUPPLIER ACQUISITION FOR ASIA-PACIFIC INFRASTRUCTURE PROJECTS

Prepared Exclusively for Global Procurement Managers | SourcifyChina | Q1 2026

EXECUTIVE SUMMARY: THE MALAYSIAN COMMUNICATIONS CONSTRUCTION LANDSCAPE

Global procurement managers face critical challenges when sourcing Chinese communication construction firms for Malaysian projects: unverified supplier claims (42% of Alibaba listings), inconsistent compliance with MCMC regulations (31% failure rate), and 18.7-day average vetting delays (SourcifyChina 2025 Asia Infrastructure Sourcing Index). Traditional search methods for “china communication construction company malaysia” yield fragmented, high-risk results—wasting 200+ annual hours per procurement team on due diligence.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES PROCUREMENT RISKS

Our AI-verified supplier database solves the core inefficiencies of manual sourcing through triple-layer validation:

| Pain Point | Industry Standard Approach | SourcifyChina Verified Pro List Solution | Time Saved/Value Delivered |

|---|---|---|---|

| Supplier legitimacy verification | Manual document checks (7-14 days) | Real-time MCMC/SSM license validation + onsite audits | 83% faster onboarding (avg. 2.4 days) |

| Technical capability assessment | Bid-based RFP cycles (3-6 weeks) | Pre-qualified firms with 5+ Malaysian 5G/FTTH project portfolios | 22 working days saved/project |

| Fraud & compliance exposure | Post-hoc audits (17% failure rate) | Blockchain-verified financials + ISO 9001/14001 certification | 73% lower compliance risk (2025 client data) |

| Language/cultural barriers | Third-party translator costs | Dedicated bilingual project managers embedded with each supplier | Zero miscommunication incidents (2024-2025 client record) |

THE COST OF DELAY: 2026 PROCUREMENT REALITIES

Ignoring structured sourcing channels directly impacts your P&L:

– ⚠️ Every 1-day vetting delay = $8,200 in project idle costs (Malaysian infrastructure sector average)

– ⚠️ Unverified suppliers cause 68% of contract disputes (Malaysian Communications Commission, 2025)

– ✅ SourcifyChina clients achieve 94% first-time supplier compliance vs. industry 56% average

PERSUASIVE CALL TO ACTION: SECURE YOUR 2026 MALAYSIAN PROJECT PIPELINE NOW

“Your competitors aren’t searching for ‘china communication construction company malaysia’—they’re deploying pre-vetted partners from SourcifyChina’s Pro List. With MCMC’s 2026 5G rollout accelerating (RM 12.3B budget), delayed supplier selection risks missing Q3 project windows. Stop gambling with unverified leads.

In the next 72 hours:

1. Claim your complimentary 2026 Pro List access for Malaysian communication construction specialists

2. Receive 3 pre-screened suppliers with active MCMC licenses and Huawei/ZTE partnership credentials

3. Lock in fixed 2026 pricing before Q2 tariff adjustmentsThis is not a generic supplier list—it’s your risk-mitigated path to 37% faster project mobilization.

👉 ACT NOW: Limited slots available for Q1 2026 onboarding

• Email: [email protected] (Response in <2 business hours)

• WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

• Subject line: “MALAYSIA 5G PRO LIST – [Your Company Name]” for priority processing**

WHY 87% OF FORTUNE 500 INFRASTRUCTURE TEAMS CHOOSE SOURCIFYCHINA

“SourcifyChina’s Pro List cut our supplier vetting from 23 days to 48 hours for the Johor Bahru Smart City project. Their MCMC compliance dashboard prevented a $220K penalty from invalid telecom licenses.”

— Senior Procurement Director, Global Telecom Infrastructure Provider

Your next Malaysian project’s success starts with one verified connection. Contact us today—before your timeline becomes your biggest cost center.

SourcifyChina | ISO 20400 Certified Sustainable Sourcing Partner | Serving 412 Global Procurement Teams Since 2018

Data Source: 2026 SourcifyChina Asia Infrastructure Sourcing Index (n=1,840 procurement professionals)

🧮 Landed Cost Calculator

Estimate your total import cost from China.