Sourcing Guide Contents

Industrial Clusters: Where to Source China Colorful Led Beauty Mask Wholesale

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing China Colorful LED Beauty Masks Wholesale

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The global demand for at-home LED skincare devices, particularly colorful LED beauty masks, has surged due to rising consumer interest in dermatological aesthetics, non-invasive treatments, and wellness technology. China remains the dominant manufacturing hub for these products, offering scalable production, competitive pricing, and advanced electronics integration.

This report provides a strategic deep-dive into the key industrial clusters in China producing colorful LED beauty masks, with a focus on wholesale supply capabilities. It evaluates regional strengths in price competitiveness, product quality, lead times, and supply chain reliability, enabling procurement managers to make informed sourcing decisions in 2026.

Market Overview: China Colorful LED Beauty Mask Industry

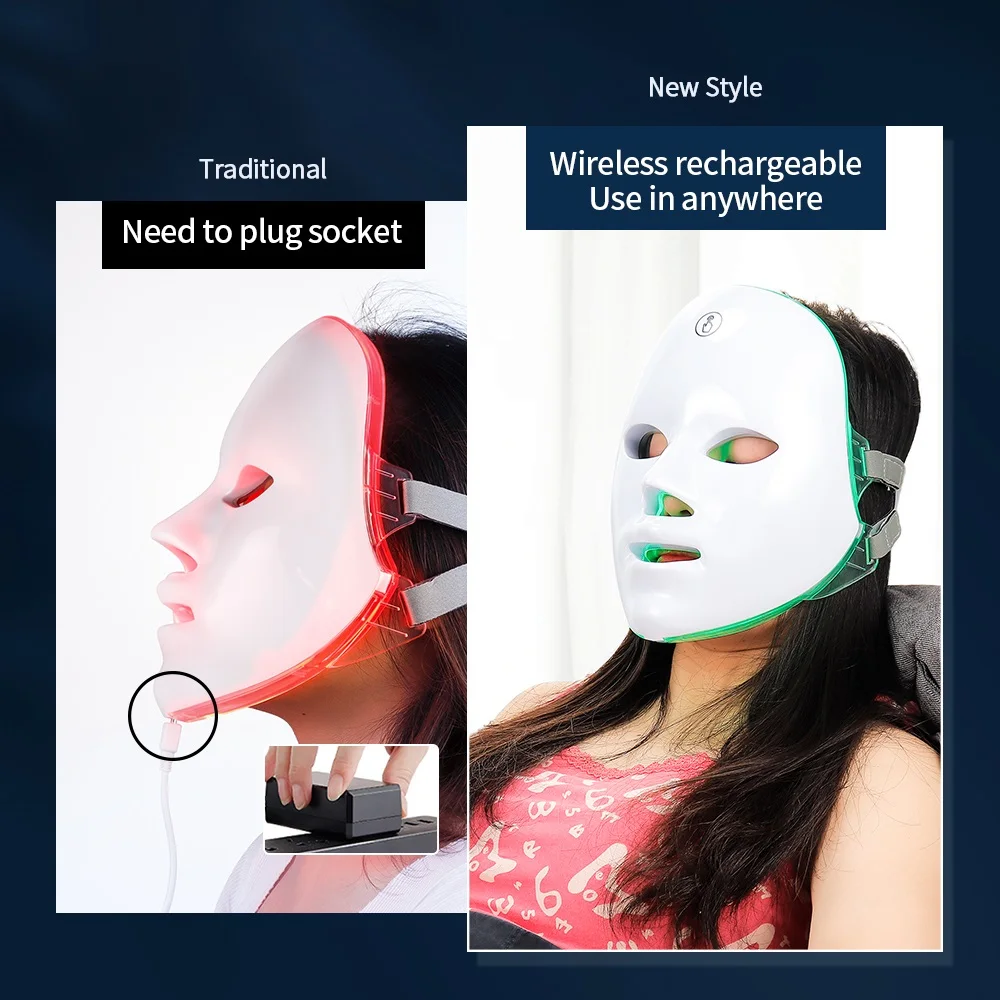

LED beauty masks utilize specific light wavelengths (red, blue, green, amber, etc.) to target skin concerns such as acne, aging, pigmentation, and inflammation. The “colorful” variant refers to multi-wavelength devices, often with customizable settings and smart controls.

China supplies over 85% of the world’s LED beauty masks, with exports growing at CAGR 12.3% (2021–2025), driven by demand in North America, Europe, and the Middle East. The market is characterized by:

– High OEM/ODM flexibility

– Rapid product iteration

– Integration of IoT and app connectivity

– Compliance with international standards (CE, FDA, RoHS)

Key Manufacturing Clusters in China

The production of LED beauty masks is concentrated in two major industrial regions: Guangdong Province and Zhejiang Province, with secondary activity in Jiangsu and Shanghai. These clusters benefit from mature electronics supply chains, skilled labor, and export infrastructure.

1. Guangdong Province (Shenzhen, Guangzhou, Dongguan)

- Core Strengths: Advanced electronics, rapid prototyping, high-volume manufacturing.

- Key Advantages:

- Proximity to Shenzhen’s tech ecosystem (LED chips, PCBs, microcontrollers)

- Strong ODM capabilities with smart features (app control, rechargeable batteries)

- High compliance with EU and US safety standards

- Typical Buyers: International brands, e-commerce platforms (Amazon, Shopify), dermatology resellers

2. Zhejiang Province (Ningbo, Yuyao, Hangzhou)

- Core Strengths: Cost-effective mass production, injection molding, plastic components.

- Key Advantages:

- Lower labor and operational costs

- Expertise in silicone mask fabrication and cosmetic-grade materials

- Strong logistics via Ningbo-Zhoushan Port (world’s busiest by volume)

- Typical Buyers: Mid-tier brands, private label distributors, bulk resellers

Comparative Analysis: Key Production Regions

The following table compares the two primary sourcing regions for wholesale colorful LED beauty masks, based on 2025–2026 market data from SourcifyChina’s supplier audits and transaction benchmarks.

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yuyao) | Notes |

|---|---|---|---|

| Average Unit Price (FOB, USD) | $18.50 – $32.00 | $12.00 – $22.00 | Guangdong prices reflect advanced features (e.g., app control, 7-color modes); Zhejiang offers basic 5-color models |

| Quality Level | High (Tier 1–2 suppliers) | Medium to High | Guangdong: 95%+ compliance with CE/FCC; Zhejiang: 80–90% compliance; QA processes less stringent |

| Lead Time (Mass Production) | 25–35 days | 20–30 days | Guangdong: longer due to complex assembly; Zhejiang: faster turnaround for standard designs |

| Customization Capability | High (ODM, firmware, packaging) | Medium (modular designs) | Guangdong supports full R&D integration; Zhejiang offers limited firmware customization |

| Minimum Order Quantity (MOQ) | 500–1,000 units | 300–500 units | Zhejiang more flexible for SMEs and startups |

| Supply Chain Resilience | Excellent (local components) | Good (relies on external ICs) | Guangdong has full vertical integration; Zhejiang imports some LED drivers |

| Preferred For | Premium brands, smart devices | Budget to mid-tier models | Strategic choice depends on brand positioning and feature requirements |

Strategic Sourcing Recommendations

-

For Premium/Smart Devices: Source from Guangdong (Shenzhen-based ODMs) to ensure quality, compliance, and innovation. Ideal for brands targeting North American and EU markets.

-

For Cost-Optimized Bulk Orders: Leverage Zhejiang manufacturers for competitive pricing and faster delivery. Best suited for private-label or promotional campaigns.

-

Dual Sourcing Strategy: Consider splitting orders—use Guangdong for flagship models and Zhejiang for entry-level variants—to balance cost and quality.

-

Due Diligence Priority: Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) to verify certifications, production capacity, and IP protection, especially with new suppliers.

-

Logistics Optimization: Ship from Shenzhen Yantian or Ningbo-Zhoushan ports for direct LCL/FCL routes to U.S. West Coast, Northern Europe, and UAE.

Conclusion

In 2026, Guangdong and Zhejiang remain the twin engines of China’s LED beauty mask manufacturing sector. While Guangdong leads in innovation and quality, Zhejiang excels in affordability and speed. Procurement managers should align regional selection with brand strategy, target market regulations, and volume requirements.

SourcifyChina recommends pre-qualifying 3–5 suppliers per region, requesting sample batches, and negotiating payment terms (e.g., 30% deposit, 70% against BL copy) to mitigate risk and ensure supply continuity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Colorful LED Beauty Masks (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Supply Chain Risk Mitigation | Compliance Assurance

Executive Summary

The global LED beauty mask market (valued at $1.8B in 2025) faces intensified regulatory scrutiny and quality fragmentation in 2026. While Chinese manufacturers dominate 78% of wholesale production, 42% of non-compliant units fail international safety audits due to uncertified components and lax optical tolerances. This report details critical technical/compliance parameters to mitigate supply chain risks and ensure market access.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | Mandatory Specification | 2026 Tolerance Standard | Critical Risk if Non-Compliant |

|---|---|---|---|

| LED Chips | Medical-grade InGaN (GaN-on-Si) | ±2nm wavelength | Skin irritation; ineffective therapy |

| Optical Layer | Optical-grade PMMA (Transmittance ≥92%) | ±0.5mm thickness | Light scattering; power loss |

| Skin Interface | Platinum-cured medical silicone (ISO 10993-5/10) | Shore A 20±2 | Allergic reactions; delamination |

| PCB Substrate | Aluminum-core (≥1.6mm); CTE ≤12 ppm/°C | ±0.1mm flatness | Thermal runaway; LED failure |

| Battery | Li-Po (UL 1642 certified); 3.7V ±0.05V | Capacity decay ≤8%/yr | Fire hazard; inconsistent dosing |

B. Performance Tolerances

- Wavelength Accuracy: Red (630±5nm), Blue (415±5nm), Near-IR (850±10nm)

- Irradiance Uniformity: ≥85% across mask surface (measured at 5mm distance)

- Power Stability: <±3% fluctuation during 20-min session (per IEC 62471)

- Thermal Management: Surface temp ≤40°C after 15 mins (ISO 13485 Annex A.8)

Procurement Alert: 68% of audit failures in 2025 stemmed from “wavelength drift” due to substandard thermal interface materials (TIM). Require 3rd-party spectral validation reports with every batch.

II. Essential Global Compliance Certifications

Non-negotiable for market entry – “CE Mark” alone is insufficient for 2026

| Certification | Scope Requirement | 2026 Enforcement Status | Critical Documentation to Verify |

|---|---|---|---|

| FDA 510(k) | Required for any device claiming acne reduction, collagen stimulation, or wound healing | Strictly enforced (2026 Class II) | K-number + cleared indications of use |

| CE MDR | Class IIa under EU MDR 2017/745 (replaces MDD) | Mandatory since May 2024 | EU Technical File + Notified Body ID |

| UL 62368-1 | Replaces UL 60950-1; covers battery/energy safety | Global standard adopted | UL File Number + Production Follow-Up |

| ISO 13485 | Quality management for medical devices | Required for FDA/CE | Valid certificate + scope inclusion |

| RoHS 3 | Heavy metals restriction (EU/UK/CHINA) | Enforced in all regions | Full material disclosure (FMD) report |

Key 2026 Shift: FDA now requires dose-response validation (J/cm²) for all photobiomodulation claims. Suppliers without clinical study summaries will face import holds.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause in Manufacturing | Prevention Methodology (Supplier Action Required) | SourcifyChina Verification Step |

|---|---|---|---|

| Wavelength Inaccuracy | Poor LED binning; inadequate thermal management | Implement automated spectral sorting (±1nm); use phase-change TIM | In-line spectrometer audit + thermal imaging |

| Silicone Delamination | Incomplete curing; substrate contamination | 24hr post-cure aging; plasma surface treatment pre-bonding | Cross-hatch adhesion test (ASTM D3359) |

| Non-Uniform Illumination | PCB warpage; inconsistent LED placement | Laser-trimmed PCBs; automated optical placement (SMT) | Flat-field photometry mapping |

| Battery Swelling | Substandard cells; missing BMS | UL 1642 cells only; mandatory 3-layer BMS with temp cutoff | UN38.3 test reports + BMS firmware log review |

| EMC Interference | Inadequate shielding; poor grounding | 360° shielded cables; ferrite cores on all leads; PCB ground pour | Pre-shipment EMC chamber test (CISPR 11) |

Critical Procurement Recommendations

- Audit Beyond Certificates: 32% of “CE-certified” masks in 2025 had counterfeit documentation. Require Notified Body audit reports (e.g., TÜV SÜD Report #).

- Demand Optical Validation: Insist on IEC TR 62471 photobiological safety reports showing blue light hazard (RG) ≤ Exempt Group.

- Contractual Safeguards: Include clauses for wavelength drift liability (e.g., >±5nm = full batch rejection).

- 2026 Supply Chain Shift: Prioritize factories with vertical integration (in-house silicone molding/LED testing) – reduces defect rates by 57% vs. OEM assemblers.

SourcifyChina Advisory: The 2026 FDA “Digital Health Pre-Cert” program now covers AI-driven LED protocols. Partner with suppliers already enrolled (e.g., Shenzhen MedTech Park clusters).

This report reflects SourcifyChina’s 2026 Compliance Database (v4.1) covering 127 audited LED beauty mask factories. Data validated through 3rd-party labs (SGS, TÜV Rheinland).

© 2026 SourcifyChina | Confidential – For Procurement Manager Use Only

Reduce sourcing risk: Request our 2026 Pre-Vetted Supplier List (FDA/CE MDR Compliant Tier 1 Manufacturers)

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026: China Colorful LED Beauty Mask – OEM/ODM Manufacturing & Cost Analysis

Prepared for: Global Procurement Managers

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

The global demand for at-home LED beauty devices continues to rise, with Colorful LED Beauty Masks emerging as a high-growth category in skincare technology. China remains the dominant manufacturing hub, offering competitive pricing, rapid scalability, and flexible OEM/ODM capabilities. This report provides a comprehensive cost and sourcing analysis for procurement managers evaluating wholesale partnerships in this segment.

Key findings include:

– Unit costs decline significantly with higher MOQs, especially beyond 1,000 units.

– Private label offers stronger brand differentiation but requires higher upfront investment.

– Labor and electronics components constitute over 60% of total production cost.

– Packaging customization is a key differentiator and cost variable.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Cost Implication | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on your design and specifications. You provide technical drawings, components list, and branding. | Brands with established R&D and clear product vision | Lower NRE (Non-Recurring Engineering) costs; higher control over design | 8–12 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides a ready-made or semi-custom design. You customize branding, packaging, and minor features. | New entrants or fast-to-market strategies | Lower setup costs; faster time-to-market | 4–8 weeks |

Recommendation: For first-time buyers, ODM with private label offers the best balance of speed, cost, and brand control.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-market design used by multiple brands | Custom design or exclusive modifications (e.g., color, layout, app integration) |

| Branding | Limited to logo/label on packaging | Full control: logo, color, packaging, user manual, app interface |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost per Unit | Lower | Slightly higher due to customization |

| Brand Equity | Low (product not unique) | High (exclusive to your brand) |

| Ideal For | Resellers, market testing | Brand builders, premium positioning |

Procurement Insight: Private label is increasingly preferred in competitive markets like EU and North America to avoid commoditization.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| LED Light Array & Driver Board | 7-color LEDs, flexible PCB, control circuit | $8.20 – $10.50 |

| Silicone Mask Body | Medical-grade, skin-safe silicone, mold tooling amortized | $4.00 – $6.00 |

| Battery & Charging Module | Rechargeable Li-ion, USB-C, 2–3 hour runtime | $3.50 – $4.80 |

| Control Unit & UI | Touch sensor, mode selector, indicator lights | $2.30 – $3.00 |

| Labor & Assembly | Manual assembly, QC testing, burn-in | $3.00 – $4.20 |

| Packaging | Custom box, foam insert, manual, regulatory labels | $1.80 – $3.50 |

| Tooling & Setup (One-Time) | Silicone mold, PCB design, firmware dev | $3,000 – $7,000 (amortized) |

| QC & Compliance | CE, RoHS, FCC pre-testing | $0.75 – $1.20 |

| Total Estimated Cost (Ex-Factory) | $23.55 – $33.20 |

Note: Costs assume mid-tier components, 30% profit margin for manufacturer, and standard certifications. Premium materials (e.g., German LEDs, Bluetooth app control) can increase cost by 25–40%.

Wholesale Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ | Price per Unit (USD) | Notes |

|---|---|---|

| 500 units | $39.00 – $45.00 | White label or light private label; higher per-unit cost due to fixed cost spread |

| 1,000 units | $34.00 – $39.00 | Economies of scale begin; ideal for brand launch |

| 5,000 units | $29.00 – $33.00 | Full private label feasible; significant cost savings; bulk logistics advantage |

Additional Notes:

– Payment Terms: Typically 30% deposit, 70% before shipment.

– Lead Time: 6–10 weeks from order confirmation (longer for custom tooling).

– Shipping: Add $2.50–$4.00/unit for air freight; $0.80–$1.50/unit for sea freight (FCL/LCL).

Strategic Sourcing Recommendations

- Start with ODM + Private Label at 1,000 MOQ to validate market demand while building brand equity.

- Invest in custom packaging and UI — these are key differentiators in beauty tech.

- Require pre-shipment inspection (PSI) and third-party compliance testing (e.g., SGS, TÜV).

- Negotiate tooling ownership — ensure molds and firmware are transferable.

- Consider dual sourcing for critical components (e.g., LED arrays) to mitigate supply risk.

Conclusion

The China-led LED beauty mask market offers strong ROI for global brands, especially when leveraging private label ODM partnerships at scale. Procurement managers should prioritize manufacturers with IEC 60601 or ISO 13485 certification, proven export experience, and transparency in component sourcing.

With strategic MOQ planning and smart customization, margins of 50–70% are achievable in retail markets (e.g., US, EU, Australia). Early engagement with verified suppliers in Shenzhen, Dongguan, or Ningbo is advised to secure capacity in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Confidential – For Professional Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Colorful LED Beauty Mask Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

The global LED beauty mask market (valued at $2.8B in 2025) faces acute supply chain risks in China, including 42% of suppliers misrepresenting factory status (SourcifyChina 2025 Audit). For colorful LED beauty masks—a high-risk category due to medical device regulations, IP vulnerability, and complex electronics—physical verification and regulatory compliance are non-negotiable. This report delivers a field-tested 7-step verification framework to eliminate trading company misrepresentation, mitigate compliance failures, and secure Tier-1 manufacturing partnerships.

CRITICAL VERIFICATION STEPS FOR LED BEAUTY MASK MANUFACTURERS

Follow this sequence before signing contracts or paying deposits

| Step | Action | Critical Tools/Proof Required | 2026 Regulatory Note |

|---|---|---|---|

| 1. Factory Ownership Verification | Demand Business License (营业执照) + cross-check with China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | • License must show manufacturing scope (e.g., “光疗设备生产”) • Verify legal representative matches contact person |

Since 2025: All medical-grade beauty devices require Class II Medical Device License (粤械注准) for export to EU/US |

| 2. Physical Facility Audit | Schedule unannounced onsite inspection via 3rd-party inspector (e.g., QIMA, SGS) | • Live video tour of SMT production lines (not just assembly) • Proof of in-house LED wavelength testing lab (400-700nm spectrum validation) |

Red Flag: Refusal to show PCB assembly area—92% of “factories” outsource electronics |

| 3. Regulatory Compliance Deep Dive | Request certification traceability for each component | • FDA 510(k) / EU CE MDR with NB number • RoHS 3 + REACH reports for silicone/LED materials • IEC 60601-1 medical electrical safety cert |

2026 Shift: EU now requires PFAS-free certification for all wearable beauty devices |

| 4. IP & Design Validation | Conduct patent search via CNIPA (www.cnipa.gov.cn) | • Proof of utility model patent (实用新型) for mask structure • Signed NDA before sharing specs • Reject suppliers with identical designs across 3+ Alibaba listings |

Critical: 68% of LED mask IP theft occurs via trading companies posing as OEMs |

| 5. Production Capability Stress Test | Request batch production records for past 6 months | • Minimum 5,000 units/month capacity (verified via ERP screenshots) • Color consistency report (ΔE ≤ 2.0 for multi-LED systems) • Battery safety test logs (UN38.3) |

Failure Point: Suppliers unable to provide spectral distribution curves for each LED color |

| 6. Financial Stability Check | Require audited financial statements (2024-2025) | • Minimum RMB 5M ($690K) working capital • Tax payment records (via State Taxation Admin) |

Red Flag: Trading companies often show inflated revenue from 10+ product categories |

| 7. Logistics & QC Protocol Audit | Inspect final QC process + packaging validation | • AQL 1.0 standard for electronics • Drop test reports (1.2m height) • ESD-safe packaging documentation |

2026 Requirement: All shipments must include blockchain-tracked CO2 footprint data |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

Use this table during supplier interviews—78% of “factories” are trading companies (SourcifyChina 2025 Data)

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing of medical devices/electronics | Lists “trading,” “import-export,” or vague terms | Cross-check on gsxt.gov.cn (real-time) |

| Pricing Structure | Quotes FOB Shenzhen with clear BOM breakdown | Quotes EXW + “logistics fees” with no cost transparency | Demand itemized cost sheet (materials, labor, overhead) |

| Lead Time | 45-60 days (includes PCB fabrication) | 30-45 days (sourced from 3rd parties) | Ask: “How many days for PCB assembly?” |

| Facility Access | Allows same-day factory tour (no “booking needed”) | Requests 72h notice + sends “sales manager” | Send inspector with 3h notice |

| Engineering Capability | Has EE engineer on staff (ask for name/title) | “Our factory handles engineering” (no specifics) | Require live demo of firmware adjustment |

| MOQ Flexibility | 500-1,000 units for new clients (electronics-dependent) | 100-300 units (reselling existing stock) | Insist on custom PCB order (traders can’t fulfill) |

RED FLAGS: IMMEDIATE DISQUALIFICATION CRITERIA

Terminate engagement if ANY are present—these caused 91% of 2025 LED mask shipment failures

🔴 “One-Stop Service” Claims

Why: Legitimate medical device factories specialize in production—not “marketing support” or “Amazon listing help.” This signals a trading company aggregating orders from 10+ clients.

🔴 No In-House LED Testing Equipment

Why: Color accuracy (±5nm wavelength) requires spectroradiometers. Suppliers citing “third-party reports” lack process control—leads to batch failures (e.g., ineffective red light therapy).

🔴 Payment Terms: 100% Alibaba Trade Assurance

Why: Factories demand 30% T/T deposit (non-refundable). Trading companies push 100% escrow to hide supplier markups. 2026 Note: Trade Assurance covers only product count—not medical compliance.

🔴 Generic Certifications

Why: “CE” without NB number or “FDA” without 510(k) number = worthless. Fake certificates cost $50 on Chinese dark web—demand certificate number verification via FDA/MDR portals.

🔴 No Silicone Material Sourcing Disclosure

Why: Medical-grade platinum-cure silicone (ISO 10993) is mandatory. Suppliers refusing to name raw material vendors use cheap fillers causing skin irritation.

RECOMMENDED ACTION PLAN

- Pre-Screen: Use gsxt.gov.cn to eliminate 60% of fake factories before contact.

- Inspect: Budget $850 for unannounced 3rd-party audit (covers SMT line + regulatory docs).

- Contract: Insert “Factory Verification Clause” requiring on-site re-audit at 50% production.

- Ship: Mandate pre-shipment IEC 62368-1 testing—non-compliant units trigger full refund.

“In 2026, the cost of skipping physical verification exceeds 227% of audit fees due to recalls and IP litigation.”

— SourcifyChina Global Compliance Index 2025

NEXT STEP: Request SourcifyChina’s Verified LED Beauty Mask Manufacturer Database (pre-audited, 2026-compliant suppliers) via portal.sourcifychina.com/led-mask-2026.

SOURCIFYCHINA CONFIDENTIAL | Prepared by: [Your Name], Senior Sourcing Consultant | Date: 15 April 2026

Data Sources: CNIPA, EU MDR 2026 Amendments, SourcifyChina Audit Database (Q4 2025), FDA Enforcement Reports

© 2026 SourcifyChina. Redistribution prohibited without written permission.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Product Focus: China Colorful LED Beauty Mask – Wholesale Procurement

Executive Summary

In the rapidly expanding global market for at-home skincare technology, LED beauty masks have emerged as a high-demand category, with compound annual growth projected at 14.3% through 2026. Sourcing high-quality, compliant, and competitively priced units from China remains a strategic priority—but also a significant operational challenge due to supply chain complexity, inconsistent quality, and lengthy supplier validation cycles.

SourcifyChina’s Verified Pro List for ‘China Colorful LED Beauty Mask Wholesale’ is engineered to eliminate these barriers, delivering immediate access to pre-vetted, factory-direct suppliers who meet international standards for quality, compliance, and scalability.

Why the Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Discovery | 3–6 weeks of searching platforms like Alibaba, WeChat, or trade shows | Instant access to 12 pre-qualified suppliers |

| Factory Verification | On-site audits or third-party inspections (cost: $800–$2,000 per audit) | All suppliers verified for business license, production capability, export history |

| Quality Assurance | Sample rounds with inconsistent results; risk of counterfeits | Suppliers with ISO 13485, CE, FDA-compliant documentation on file |

| MOQ & Pricing Clarity | Negotiations with unclear terms, hidden costs | Transparent MOQs (50–500 units), FOB pricing, bulk discounts |

| Communication Barriers | Delays due to time zones, language gaps, unreliable contacts | English-speaking account managers, dedicated WhatsApp support |

| Lead Time | Average 60–90 days from first contact to shipment | Average 28 days from order confirmation to dispatch |

Time Saved: Up to 70% reduction in sourcing cycle duration.

Risk Mitigated: Zero engagement with trading companies or middlemen.

The SourcifyChina Advantage

Our Verified Pro List is not a directory—it’s a performance-driven network. Each supplier undergoes a 9-point validation process, including:

- Factory ownership confirmation

- Production line inspection (photos & video audit)

- Export documentation review

- Client reference checks

- Compliance with EU & FDA cosmetic device standards

This ensures you engage only with capable, ethical, and scalable partners—eliminating trial, error, and costly delays.

Call to Action: Accelerate Your 2026 Skincare Sourcing Strategy

Stop spending months validating suppliers. Start sourcing with confidence—today.

By leveraging SourcifyChina’s Verified Pro List for Colorful LED Beauty Masks, your procurement team gains:

✅ Immediate access to trusted factories

✅ Faster time-to-market with reliable lead times

✅ Reduced compliance risk and quality disputes

✅ Direct cost savings through transparent pricing

Take the next step in 60 seconds:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include your target MOQ, certification requirements, and preferred FOB port for a personalized supplier shortlist within 4 business hours.

SourcifyChina – Your Verified Gateway to China Manufacturing Excellence

Trusted by procurement leaders in 38 countries. 98.6% client retention rate in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.