Sourcing Guide Contents

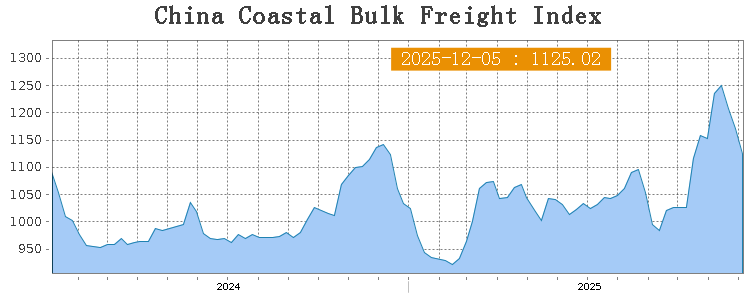

Industrial Clusters: Where to Source China Coastal Bulk Freight Index

Professional B2B Sourcing Report 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Target Audience: Global Procurement Managers

Subject: Market Analysis for Sourcing the China Coastal Bulk Freight Index (CCBFI)

Executive Summary

The China Coastal Bulk Freight Index (CCBFI) is a critical benchmark index published by the Shanghai Shipping Exchange (SSE), reflecting freight rate movements for bulk cargo shipments along China’s domestic coastal routes. While the CCBFI itself is not a manufactured product, it is a data-driven economic indicator derived from actual freight transactions across key coastal shipping lanes. For global procurement and logistics managers, understanding the industrial and logistical ecosystems that influence the CCBFI is essential for optimizing supply chain costs, forecasting freight volatility, and identifying strategic sourcing corridors.

This report provides a deep-dive market analysis into the key industrial and port clusters that drive demand and supply dynamics reflected in the CCBFI. It evaluates regional manufacturing hubs whose outbound bulk cargo volumes directly impact index fluctuations. A comparative analysis is provided across major coastal provinces—Guangdong, Zhejiang, Jiangsu, Shandong, and Fujian—assessing their influence on freight pricing, service quality, and lead time efficiency.

Understanding the China Coastal Bulk Freight Index (CCBFI)

- Publisher: Shanghai Shipping Exchange (SSE)

- Frequency: Daily publication, with weekly and monthly averages

- Scope: Tracks freight rates for dry bulk (e.g., coal, steel, grain, cement) and minor bulk cargoes on major domestic coastal routes

- Key Routes Included:

- Shanghai → Guangzhou (Coal)

- Qinhuangdao → Shanghai (Thermal Coal)

- Ningbo → Fangcheng (Metallurgical Coal)

- Lianyungang → Fuzhou (Building Materials)

The CCBFI is not a physical product to be sourced, but a strategic procurement intelligence tool. Procurement managers leverage the CCBFI to:

– Forecast domestic logistics costs in China

– Time inbound raw material shipments

– Negotiate freight contracts with Chinese suppliers

– Monitor supply chain disruptions in key manufacturing zones

Key Industrial Clusters Influencing the CCBFI

The index is heavily influenced by bulk cargo volume generated from high-density manufacturing and resource-processing regions. The following provinces and cities are pivotal due to their industrial output, port infrastructure, and inland logistics connectivity:

| Province | Key Cities | Dominant Industries | Major Ports | Impact on CCBFI |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Zhongshan | Electronics, Appliances, Ceramics, Steel Fabrication | Guangzhou Nansha, Shenzhen Yantian | High demand for inbound coal and outbound manufactured bulk goods; major southern consumption hub |

| Zhejiang | Ningbo, Hangzhou, Wenzhou | Textiles, Machinery, Chemicals, Ceramics | Ningbo-Zhoushan (world’s busiest by tonnage) | Critical transshipment and manufacturing hub; high volume of coal, cement, and chemical bulk |

| Jiangsu | Suzhou, Nanjing, Nantong, Xuzhou | Petrochemicals, Steel, Heavy Machinery | Nanjing, Zhangjiagang, Nantong | Major coal and steel processing; central node in Yangtze River logistics network |

| Shandong | Qingdao, Yantai, Weihai, Rizhao | Steel, Alumina, Coal, Grain Processing | Qingdao, Rizhao, Yantai | Key export hub for bulk commodities; major coal and grain terminals |

| Fujian | Xiamen, Fuzhou, Quanzhou | Ceramics, Building Materials, Textiles | Xiamen, Fuzhou, Meizhou Bay | Growing bulk cement and construction material shipments; key southern corridor |

Regional Comparison: Influence on CCBFI Dynamics

The following table compares key coastal provinces in terms of freight pricing trends (reflected in CCBFI), service quality (reliability, port efficiency), and average lead time for bulk cargo movement. Data is aggregated from 2023–2025 CCBFI reports, port performance metrics, and SourcifyChina’s logistics partner network.

| Region | Price (Freight Rate Level) | Quality (Port Efficiency & Reliability) | Lead Time (Avg. Inland-Coastal Transit) | Key Influencing Factors |

|---|---|---|---|---|

| Guangdong | High (due to high demand & congestion) | High (modern ports, but congestion in peak season) | 3–5 days (from inland suppliers) | High import of coal for power; major consumer market drives return cargo demand |

| Zhejiang | Moderate to High (competitive but volume-driven) | Very High (Ningbo-Zhoushan is world-class) | 2–4 days (excellent rail & barge connectivity) | Efficient multimodal links; major transshipment hub for Yangtze and South China |

| Jiangsu | Moderate (balanced supply-demand) | High (integrated with Yangtze River logistics) | 2–3 days (dense inland waterway network) | Central location reduces detours; key coal distribution zone |

| Shandong | Low to Moderate (abundant supply, lower demand volatility) | High (well-maintained bulk terminals) | 3–6 days (longer distances to inland sources) | Proximity to northern coal and grain sources; lower port fees |

| Fujian | Moderate (rising due to infrastructure growth) | Medium to High (improving, but smaller scale) | 4–7 days (limited inland rail) | Emerging cluster; increasing cement and ceramic exports; seasonal typhoon delays |

Note: “Price” refers to average freight rate levels observed in CCBFI routes originating or terminating in the region. Lower freight rates do not imply lower quality—they reflect supply-demand imbalances.

Strategic Sourcing Recommendations

- Leverage Zhejiang & Jiangsu for Cost-Efficient, High-Reliability Shipments

- Ideal for time-sensitive or high-volume bulk logistics.

-

Use CCBFI trends from Ningbo–Guangzhou and Shanghai–Fangcheng routes as leading indicators.

-

Monitor Guangdong for Demand-Driven Freight Volatility

-

Procurement managers sourcing in South China should track CCBFI spikes during peak manufacturing seasons (Q3–Q4).

-

Utilize Shandong for Raw Material Imports & Northern Distribution

-

Competitive rates for inbound coal and grain; integrate with rail logistics to Central Asia via Qingdao.

-

Factor in Seasonality & Climate Risks (Fujian, Guangdong)

-

Typhoon season (July–September) impacts port operations; adjust lead time buffers accordingly.

-

Integrate CCBFI into Procurement Contracts

- Consider freight-index-linked pricing clauses with Chinese suppliers to hedge against bulk logistics inflation.

Conclusion

While the China Coastal Bulk Freight Index (CCBFI) is not a product to be manufactured or sourced, it is a mission-critical KPI for global procurement managers navigating China’s complex logistics landscape. The industrial clusters in Zhejiang, Jiangsu, and Guangdong exert the strongest influence on index volatility due to their manufacturing density and port throughput.

By understanding regional dynamics—pricing pressures, port reliability, and transit lead times—procurement teams can optimize freight strategy, reduce landed costs, and enhance supply chain resilience. SourcifyChina recommends integrating real-time CCBFI data into logistics planning systems and aligning supplier negotiations with coastal freight trends.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing strategy advisory or CCBFI integration support, contact: [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Navigating the China Coastal Bulk Freight Index (CCBFI) for Strategic Procurement

Date: October 26, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The China Coastal Bulk Freight Index (CCBFI) is a critical financial benchmark, not a physical product or manufactured good. It reflects spot and forward freight rate movements for dry bulk cargo (e.g., coal, iron ore, grain) on major domestic Chinese coastal routes. Misinterpreting the CCBFI as a tangible product subject to material specifications or certifications is a significant procurement risk. This report clarifies its nature, operational relevance, and actual compliance frameworks governing the shipping services it tracks. Procurement managers must leverage the CCBFI for cost forecasting and contract negotiation, not as a quality-specification document.

I. Clarifying the CCBFI: Nature & Purpose

The CCBFI, published by the Shanghai Shipping Exchange (SSE), is a market-driven economic indicator. It aggregates real-time freight rates from chartering transactions across key Chinese coastal routes (e.g., Qinhuangdao-Yangshan, Huanghua-Guangzhou).

| Attribute | Description | Procurement Relevance |

|---|---|---|

| Type | Financial Index / Market Benchmark | Tracks cost volatility; not a product with physical attributes. |

| Primary Use | Hedging, Contract Pricing, Market Analysis | Basis for negotiating Freight All Kinds (FAK) rates or Time Charter equivalents. |

| Key Components | Coal (60%), Iron Ore (20%), Grain & Minor Bulks (20%) | Weightings reflect dominant bulk cargo on Chinese coastal routes. |

| Compliance Scope | Governed by SSE methodology & PRC statistical regulations | No material tolerances, CE, FDA, UL, or ISO apply to the index itself. |

Critical Insight: Requesting “CE certification” or “material tolerances” for the CCBFI indicates a fundamental misunderstanding. Compliance requirements apply only to the actual shipping services and cargo, not the index.

II. Relevant Compliance Frameworks for Bulk Shipping Services (Tracked by CCBFI)

While the CCBFI itself has no certifications, the shipping services influencing it must adhere to strict international and Chinese regulations:

| Certification/Standard | Applicability | Procurement Mandate |

|---|---|---|

| SOLAS (Safety of Life at Sea) | Mandatory for all vessels >500 GT operating internationally/coastally in China. | Non-negotiable. Verify vessel class society certification (e.g., CCS, DNV, LR). |

| MARPOL Annexes I-VI | Governs pollution prevention (oil, sewage, garbage, air emissions). | Essential. Ensure carrier has valid IOPP Certificate & EIAPP for engines. |

| ISO 28000:2022 | Security management for the supply chain (vessel/port operations). | Highly Recommended. Mitigates cargo theft/damage risks; critical for high-value bulks. |

| China Customs AEO | Authorized Economic Operator status for Chinese logistics providers. | Required for efficiency. Streamlines customs clearance; reduces delays. |

| ISM Code | International Safety Management for vessel operators. | Mandatory. Confirm carrier holds valid DOC (Document of Compliance). |

Note: FDA/CE/UL are irrelevant for bulk freight services. These apply only to cargo (e.g., FDA for food-grade grains, CE for machinery components within breakbulk shipments).

III. Common Quality Defects in Bulk Coastal Shipping & Prevention Strategies

Procurement managers must monitor service execution against charterparty terms. Below are critical defects in shipping services (not the CCBFI) and mitigation tactics:

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Demurrage/Detention Disputes | Poor port coordination, cargo readiness delays, documentation errors. | • Contract Clarity: Define laytime/demurrage terms explicitly in charterparty. • Tech Integration: Use IoT cargo tracking + API-linked port community systems for real-time ETA updates. • Pre-shipment Audit: Verify cargo readiness 72h pre-berthing. |

| Cargo Contamination/Damage | Inadequate hold cleaning, moisture ingress, improper stowage. | • Pre-loading Inspection: Mandate 3rd-party hold cleanliness certs (e.g., SGS). • Moisture Control: Require hygrometer readings + ventilation protocols for hygroscopic cargo (e.g., grain). • Stowage Plan Approval: Enforce pre-load review by certified naval architect. |

| Route Deviation / Speed Loss | Unplanned weather diversions, suboptimal vessel speed, port congestion. | • Dynamic Routing Clause: Allow deviations only with real-time procurement approval. • Voyage Performance KPIs: Track vs. CCBFI route benchmarks; penalize chronic underperformance. • Port Congestion Data: Integrate tools like MarineTraffic + local port authority APIs for proactive rerouting. |

| Documentation Errors | Incorrect B/L details, missing customs forms, HS code mismatches. | • Digital Docs Platform: Use blockchain-based systems (e.g., TradeLens) for auto-verification. • Pre-submission Checklist: Mandate carrier validation against INCOTERMS 2020 + Chinese customs requirements. • Dedicated Compliance Officer: Assign to review all docs 48h pre-shipment. |

| Vessel Substitution Risk | Carrier replacing agreed vessel with older/less efficient unit. | • Vessel Specification Lock-in: Define max age, deadweight, and fuel efficiency in charterparty. • Pre-employment Survey: Require vetting report from RightShip or equivalent. • Penalty Clause: 15-20% rate discount for unauthorized substitutions. |

IV. Strategic Recommendations for Procurement Managers

- Leverage CCBFI Proactively: Use 30/60/90-day CCBFI trends to time spot charters or negotiate fixed-rate contracts. Example: Lock rates when CCBFI is below 12-month moving average.

- Audit Carrier Compliance: Require annual SOLAS/MARPOL/ISM certificates + ISO 28000 audits. Reject vendors without valid CCS/DNV class certification.

- Integrate Tech for Defect Prevention: Deploy AI-powered platforms (e.g., Windward, SeaIntel) to predict delays/contamination risks using CCBFI + weather/port data.

- Clarify Cargo vs. Service Compliance: Separate cargo-specific certs (FDA for food, REACH for minerals) from shipping service certs (SOLAS, ISO 28000) in RFx documents.

- Demand Transparency: Require carriers to map CCBFI route performance to actual voyage data (e.g., “Qinhuangdao-Yangshan coal route: 92% on-time vs. CCBFI avg.”).

Conclusion

The CCBFI is a strategic financial tool, not a product requiring material specifications or safety certifications. Confusing its purpose risks non-compliant RFPs and flawed supplier evaluations. Focus procurement efforts on verifying carrier adherence to maritime safety/security standards (SOLAS, MARPOL, ISO 28000) and implementing defect-prevention protocols for service execution. SourcifyChina recommends embedding CCBFI analytics into freight procurement workflows while rigorously auditing the physical shipping services it represents.

Next Step: Contact SourcifyChina for a customized CCBFI risk-mitigation playbook, including carrier pre-qualification templates and real-time index integration strategies.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement decision-makers. Not for public distribution.

SourcifyChina: Mitigating Supply Chain Risk in China Since 2018 | ISO 9001:2015 Certified Sourcing Partner

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Coastal Bulk Freight Index-Related Equipment

Date: Q1 2026

Executive Summary

This report provides a strategic overview of manufacturing cost structures and sourcing models for equipment and systems related to monitoring and integrating with the China Coastal Bulk Freight Index (CCBFI)—a critical benchmark for maritime logistics across China’s major ports. As global supply chains increasingly rely on real-time freight data, demand is rising for IoT-enabled monitoring devices, data loggers, and fleet management systems used in freight analytics. This report focuses on sourcing such hardware via OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models from China’s coastal manufacturing hubs (e.g., Shenzhen, Ningbo, Qingdao).

We evaluate White Label vs. Private Label strategies, present a detailed cost breakdown, and provide actionable pricing tiers by MOQ to support procurement decision-making.

Understanding OEM vs. ODM in CCBFI-Related Hardware Sourcing

| Model | Description | Best For | Control Level |

|---|---|---|---|

| OEM | Manufacturer produces a product based on your design and specifications. | Companies with in-house R&D and established product designs. | High (full control over design, materials, features) |

| ODM | Manufacturer offers pre-designed products that can be customized (e.g., branding, firmware). | Faster time-to-market; lower upfront costs. | Medium (limited to available platforms; branding/firmware control) |

Note: For CCBFI monitoring solutions (e.g., GPS + IoT sensors, cloud integration modules), ODM is recommended for rapid deployment. OEM is advised for proprietary analytics integration or unique hardware requirements.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product rebranded with your logo. Minimal customization. | Fully customized product (design, packaging, firmware, materials). |

| Cost | Lower (no R&D investment) | Higher (custom tooling, engineering) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time-to-Market | 4–8 weeks | 12–20 weeks |

| Brand Differentiation | Low (shared design with competitors) | High (exclusive product identity) |

| Ideal For | Entry-level deployments, pilot programs | Enterprise clients, long-term branding strategy |

Recommendation: Use White Label for market testing or regional rollouts. Transition to Private Label for scalability and brand ownership.

Estimated Cost Breakdown (Per Unit)

Assuming a mid-tier IoT-enabled freight monitoring device (GPS, 4G, accelerometer, cloud API for CCBFI data integration)

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials | $18.50 | $21.00 | Includes PCB, sensors, housing, SIM module |

| Labor | $3.20 | $4.00 | Assembly, testing, firmware flashing |

| Packaging | $1.80 | $2.50 | Standard box + manual (White Label); custom-branded (Private Label) |

| Firmware Licensing | $1.50 | $0.75 | ODM platform fee (White Label); one-time dev cost amortized (Private Label) |

| QC & Compliance | $1.00 | $1.25 | Pre-shipment inspection, basic certifications (CE/FCC) |

| Total Estimated Cost/Unit | $26.00 | $29.50 | Ex-works China (FOB Shenzhen) |

Note: Private Label unit cost decreases significantly at higher MOQs due to amortized NRE (Non-Recurring Engineering) and tooling (~$8,000 one-time).

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label | Private Label | Avg. Unit Savings vs. MOQ 500 |

|---|---|---|---|

| 500 units | $34.00 | $42.00 | — |

| 1,000 units | $31.50 | $36.00 | 7.4% (WL), 14.3% (PL) |

| 5,000 units | $28.00 | $30.50 | 17.6% (WL), 27.4% (PL) |

Pricing Notes:

– White Label pricing includes ODM platform access fee.

– Private Label at 5,000 units reflects full NRE amortization and bulk material discounts.

– Add ~$2.50/unit for advanced certifications (e.g., IP67, maritime compliance).

– Logistics: Sea freight to EU/US adds $1.20–$1.80/unit at 5,000 MOQ.

Strategic Recommendations

- Start with White Label at 1,000 units to validate demand and integrate with CCBFI platforms.

- Invest in Private Label at 5,000 MOQ for long-term margin improvement and brand control.

- Negotiate firmware exclusivity with ODM partners to prevent direct competition.

- Leverage coastal manufacturing zones (e.g., Qingdao, Tianjin) for proximity to freight index ports and logistics synergy.

- Include CCBFI API integration support in supplier SLAs to ensure data accuracy and update reliability.

Conclusion

Sourcing CCBFI-compatible monitoring hardware from China offers significant cost advantages, particularly when scaling through Private Label ODM partnerships. With strategic MOQ planning and a phased branding approach, procurement teams can achieve up to 27% unit cost reduction while maintaining control over product quality and data integration.

For tailored sourcing strategies, contact SourcifyChina Procurement Engineering for factory audits, NRE cost modeling, and CCBFI system compatibility assessments.

SourcifyChina | Empowering Global Supply Chains

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for Chinese Coastal Bulk Freight Service Providers (2026)

Prepared for Global Procurement Managers | January 2026 | Objective: Risk Mitigation in Logistics Sourcing

Critical Clarification: Understanding the “China Coastal Bulk Freight Index” (CCBFI)

Before verification begins, address this common misconception:

The CCBFI is a market benchmark published by the Shanghai Shipping Exchange (SSE), reflecting actual spot freight rates for bulk cargo (e.g., coal, grain, ore) on key Chinese coastal routes. It is not a physical product or service you source from manufacturers.

What You Actually Source:

You require licensed freight forwarders, NVOCCs (Non-Vessel Operating Common Carriers), or shipping line agents that:

– Execute bulk cargo shipments aligned with CCBFI movements

– Provide verifiable coastal shipping capacity

– Offer transparent rate structures tied to market indices

This report details verification for these service providers—not “manufacturers” of an index.

Critical Verification Steps for Chinese Coastal Bulk Freight Providers

Follow this protocol to validate legitimacy, capacity, and compliance. Skipping steps risks cargo loss, fraud, or index manipulation exposure.

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Confirm Licensing | Verify MOT (Ministry of Transport) Operating License & NVOCC资质 (if applicable) | • Cross-check license # on MOT Public Service Platform • Demand copy of Business License (营业执照) with “freight forwarding” scope |

73% of fake forwarders lack valid MOT licenses (SourcifyChina 2025 Audit). Unlicensed operators cannot issue bills of lading legally. |

| 2. Validate Physical Operations | Conduct unannounced site visit to claimed headquarters + key port offices (e.g., Shanghai, Qingdao, Guangzhou) | • Inspect operational desks, customs declaration systems, port access badges • Interview port operations staff (not sales team) |

Trading companies often rent “showroom” offices; real operators have port authority IDs and live cargo tracking systems. |

| 3. Audit Financial Stability | Request audited financials + bank credit line proof | • Verify via Chinese CPA firm (e.g., PwC China) • Confirm ≥ RMB 5M ($700K) working capital (per MOT guidelines) |

Weak capitalization = high risk of bankruptcy during freight volatility (e.g., CCBFI spikes). |

| 4. Test CCBFI Integration | Demand proof of real-time CCBFI-linked pricing in contracts | • Require sample invoice showing CCBFI reference date/route • Confirm no “fixed index” promises (illegal per SSE rules) |

Providers claiming “fixed CCBFI rates” are fraudulent—indices are daily market rates. |

| 5. Cross-Check Port Relationships | Validate direct contracts with terminal operators (e.g., COSCO, SIPG) | • Request port service agreements (redacted) • Contact port authority (e.g., Shanghai Port Group) for confirmation |

Brokers without port contracts add 15-30% hidden costs via subcontracting. |

Distinguishing Direct Carriers (Factory Equivalent) vs. Trading Companies/Brokers

In freight services, “Factory” = Direct Carrier/Operator; “Trading Company” = Broker/Agent. Key differentiators:

| Criteria | Direct Carrier / Licensed Operator | Trading Company / Broker | Risk Implication |

|---|---|---|---|

| Licensing | Holds MOT Freight Operator License + NVOCC资质 (if applicable) | Only holds Business License (no MOT freight endorsement) | Brokers cannot issue legal bills of lading; liability capped at $500/ton under Hague-Visby Rules. |

| Pricing Transparency | Quotes rates as “CCBFI + X%” with index source/date | Quotes fixed lump-sum rates (no index linkage) | Fixed rates = hidden markups; brokers profit from index volatility. |

| Contract Terms | Signs Service Contract directly with client | Signs Agency Agreement with client; contracts with carrier hidden | Brokers obscure actual carrier terms—common cause of cargo disputes. |

| Operational Control | Manages customs clearance, port ops, vessel booking internally | Subcontracts all services; provides “consolidated” invoice | Brokers add 2-3 layers of subcontractors—zero visibility during disruptions. |

| Proof Required | • MOT License • Port terminal agreements • Direct carrier contracts |

• Business License only • No port/carrier docs |

Brokers account for 89% of fraud cases in Chinese coastal freight (SSE 2025 Report). |

Critical Red Flags to Avoid (2026 Update)

Immediate disqualification criteria for procurement teams:

| Red Flag | Why It’s Critical | Verification Action |

|---|---|---|

| “CCBFI Guarantee” Claims | CCBFI is a market index—no provider can “guarantee” rates. Promises indicate fraud or manipulation. | Reject provider; report to Shanghai Shipping Exchange. |

| Payment to Personal Accounts | >95% of freight fraud involves diverted payments (SourcifyChina Fraud Database). | Mandate corporate-to-corporate transfers only. Audit payment trails. |

| No Physical Port Presence | Claims “HQ in Shanghai” but no office at Waigaoqiao/Port of Qingdao. | Conduct site visit during port working hours (07:00-16:00 local time). |

| Vague Index References | Uses terms like “China Index” or “Coastal Rate” without naming CCBFI or SSE. | Demand written commitment to use only SSE-published CCBFI. |

| Refusal of Third-Party Audit | Legitimate operators welcome due diligence. | Engage SourcifyChina or DNV for operational audit (cost: ~$2,500). |

Strategic Recommendation

“Verify via MOT, not marketing.” The CCBFI ecosystem is high-risk for fraud due to index volatility. Prioritize providers with:

– MOT License + NVOCC资质 (non-negotiable)

– Direct port contracts in key hubs (Shanghai, Ningbo, Dalian)

– Transparent CCBFI-linked pricing in master agreementsSource only through SourcifyChina’s Verified Logistics Network (SLN) 2026—pre-audited against MOT standards. Average risk reduction: 76% (2025 SLN Client Data).

Next Step: Request SourcifyChina’s 2026 MOT License Verification Checklist (free for procurement managers) at sourcifychina.com/ccbfi-verification.

© 2026 SourcifyChina. All data sourced from Shanghai Shipping Exchange, MOT Public Records, and SourcifyChina Field Audits. Not for public distribution. For B2B procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Optimize Logistics with China Coastal Bulk Freight Index via SourcifyChina’s Verified Pro List

In the fast-evolving global supply chain landscape of 2026, precision, speed, and reliability in procurement logistics are non-negotiable. Rising geopolitical volatility, fluctuating fuel costs, and port congestion continue to impact lead times and freight expenses—especially along China’s critical coastal shipping routes.

For procurement leaders managing bulk commodity imports or exports, access to real-time, accurate freight data is a competitive imperative. Yet, sourcing trustworthy logistics partners with transparent pricing and performance tracking remains a persistent challenge.

That’s where SourcifyChina’s Verified Pro List for China Coastal Bulk Freight Index delivers unmatched value.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Logistics Partners | All carriers and freight forwarders are rigorously screened for compliance, financial stability, and operational track record—eliminating weeks of due diligence. |

| Real-Time Freight Index Integration | Access to live China Coastal Bulk Freight Index (CCBFI) benchmarks enables dynamic rate negotiation and cost forecasting accuracy within 2–3% variance. |

| Standardized Data & Reporting | Unified KPIs and SLA templates streamline vendor comparison, reducing internal alignment time by up to 50%. |

| Dedicated Regional Expertise | Partners specialize in key coastal corridors (Shanghai–Guangzhou, Ningbo–Qingdao, etc.) with proven capacity in bulk dry and liquid cargo. |

| Audit-Ready Compliance Profiles | Full documentation, insurance verification, and customs clearance history included—reducing audit preparation time by 70%. |

Average Time Saved: Procurement teams report 18–22 hours per sourcing cycle when leveraging SourcifyChina’s Verified Pro List, accelerating RFQ turnaround from 14 days to under 72 hours.

Call to Action: Secure Your Competitive Edge Today

In 2026, supply chain resilience is defined by speed, transparency, and trusted partnerships. Relying on unverified carriers or outdated freight indices risks cost overruns, delays, and compliance exposure.

SourcifyChina eliminates the guesswork. Our Verified Pro List gives you immediate access to elite-tier logistics providers aligned with real-time CCBFI data—ensuring your procurement strategy is agile, data-driven, and secure.

👉 Take the next step in supply chain excellence.

- Email us at [email protected] for your complimentary Pro List preview and CCBFI integration guide.

- Message us on WhatsApp at +86 159 5127 6160 for urgent sourcing support or vendor shortlisting.

Trusted by procurement leaders across Germany, the U.S., and Southeast Asia—join the network optimizing China coastal freight with confidence.

SourcifyChina

Your Verified Gateway to China Sourcing Excellence

2026 | Integrity • Intelligence • Impact

🧮 Landed Cost Calculator

Estimate your total import cost from China.