Sourcing Guide Contents

Industrial Clusters: Where to Source China Cloud Company

SourcifyChina Sourcing Intelligence Report: Cloud Infrastructure Hardware Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Exclusive | Report ID: SC-CHI-2026-001

Executive Summary

Clarification of Scope: The term “China cloud company” is non-standard in B2B sourcing contexts. This report analyzes the manufacturing ecosystem for cloud infrastructure hardware (servers, storage systems, networking equipment, data center components) in China – the physical backbone enabling cloud services. Sourcing “cloud companies” (i.e., service providers like Alibaba Cloud) is a service procurement exercise, not manufacturing. This analysis targets the hardware supply chain, where China dominates global production (est. 75% market share in 2025). Key clusters are concentrated in tech-intensive coastal provinces, with emerging hubs in Western China. Strategic sourcing requires balancing cost, quality, and resilience amid US-China tech decoupling pressures.

Key Industrial Clusters for Cloud Infrastructure Hardware Manufacturing

China’s cloud hardware production is anchored in four primary clusters, each with distinct specializations:

-

Guangdong Province (Pearl River Delta: Shenzhen, Dongguan, Huizhou)

- Core Focus: High-volume server assembly, networking gear (switches/routers), power supplies, cooling systems.

- Why Dominant: Unmatched electronics ecosystem (Foxconn, Inspur, Huawei), air/sea logistics hubs (Shenzhen Port, HK access), proximity to global tech HQs.

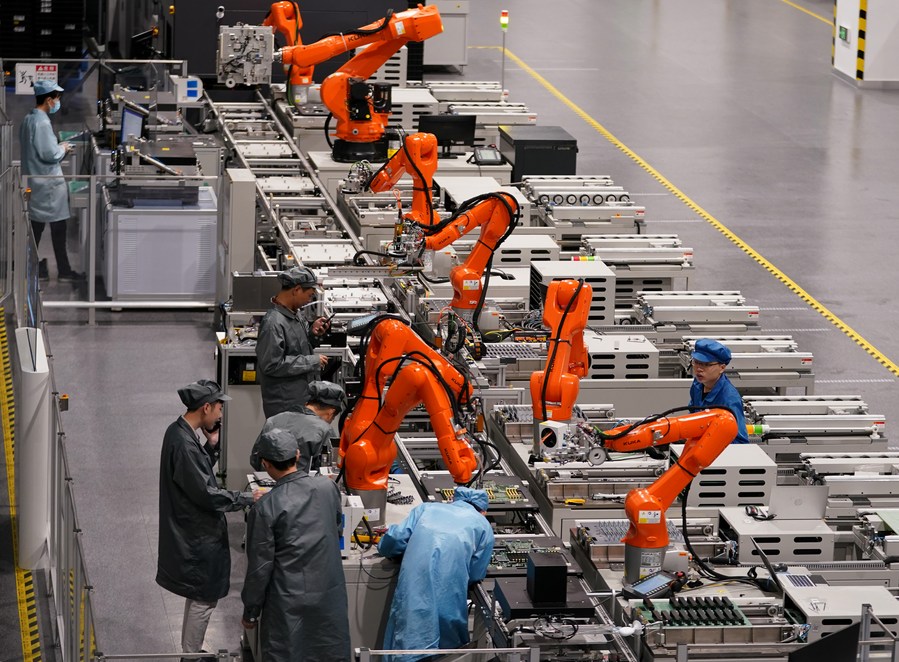

- 2026 Trend: Shift toward higher-value, AI-optimized server production; increased automation to offset labor costs.

-

Zhejiang Province (Hangzhou, Ningbo)

- Core Focus: Enterprise storage systems, data center management hardware, IoT gateways for edge computing.

- Why Dominant: Alibaba Cloud ecosystem (Hangzhou), strong R&D in storage tech (e.g., Zhejiang University partnerships), agile SME manufacturing base.

- 2026 Trend: Rapid growth in liquid-cooled server components; government subsidies for “green data center” hardware.

-

Jiangsu Province (Suzhou, Nanjing, Wuxi)

- Core Focus: Semiconductor packaging/testing for cloud chips, high-precision metal chassis, optical transceivers.

- Why Dominant: Proximity to Shanghai semiconductor cluster, strong industrial automation, skilled technical labor pool.

- 2026 Trend: Critical node for US-sanctioned component alternatives; growth in domestic GPU/AI chip packaging.

-

Sichuan Province (Chengdu, Chongqing)

- Core Focus: Mid-tier server assembly, cable/wiring harnesses, data center power distribution units (PDUs).

- Why Dominant: Lower labor/land costs, government “Western Development” incentives, strategic inland logistics (Belt & Road).

- 2026 Trend: Becoming backup hub for coastal supply chains; focus on cost-sensitive, non-AI server segments.

Regional Cluster Comparison: Sourcing Cloud Infrastructure Hardware

Data Source: SourcifyChina 2025 Supplier Benchmarking (500+ Facilities), Customs Analytics, Client Sourcing Logs

| Criteria | Guangdong (PRD) | Zhejiang (Hangzhou/Ningbo) | Jiangsu (Suzhou/Nanjing) | Sichuan (Chengdu) |

|---|---|---|---|---|

| Avg. Unit Price | Highest (Base: 100) | High (95-98) | Medium-High (90-93) | Lowest (82-85) |

| Rationale | Premium for speed/scale; highest labor/rent; complex assembly focus | R&D premium; storage tech specialization | Strong component integration; semiconductor adjacency | Gov’t subsidies; 25-30% lower labor costs; simpler assembly focus |

| Quality Consistency | Highest (Tier 1) | Very High (Tier 1+) | High (Tier 1) | Medium-High (Tier 1-/2) |

| Rationale | Strictest QA (exports to EU/US); mature processes; top OEMs | Alibaba Cloud-tier standards; agile process refinement | Advanced automation; strong engineering talent | Improving but variable; fewer Tier-1 suppliers; longer validation cycles |

| Standard Lead Time | Shortest (30-45 days) | Medium (35-50 days) | Medium (35-48 days) | Longest (50-70 days) |

| Rationale | Dense supplier network; JIT logistics; port access | Efficient regional ecosystem; strong SME coordination | Good logistics; component availability | Longer inland shipping; less supplier density; customs delays for exports |

| Key Risk | Geopolitical exposure; labor shortages; cost inflation | IP leakage concerns; talent competition | US tech sanctions impact (semiconductors) | Logistics bottlenecks; skill gaps in advanced assembly |

| Best For | Mission-critical, high-complexity orders; fast time-to-market | Storage/AI-optimized hardware; innovation-driven projects | Component-integrated systems; semiconductor-adjacent needs | Cost-driven volumes; non-critical path components; supply chain diversification |

Strategic Sourcing Recommendations for 2026

- Avoid “Single-Cluster” Dependence: Dual-source between Guangdong (speed) and Sichuan (cost/resilience). Example: Assemble AI servers in Shenzhen, but manufacture PDUs/cabling in Chengdu.

- Quality Control Investment: In Zhejiang/Jiangsu, leverage local 3rd-party inspectors for storage/semiconductor components. In Sichuan, mandate pre-shipment audits.

- Lead Time Mitigation: For Guangdong, secure capacity 90+ days ahead via framework agreements. For Sichuan, prioritize air freight partnerships (Chengdu Tianfu Airport expansion).

- Compliance Imperative: Verify cluster-specific export licenses (esp. Jiangsu for semiconductor-related items). Use SourcifyChina’s Sanction Screening Toolkit (v3.1).

- Emerging Opportunity: Monitor Hefei (Anhui) for quantum computing hardware – potential 2027+ cluster for next-gen cloud infrastructure.

Critical Note: Sourcing cloud services (e.g., Alibaba Cloud, Tencent Cloud) requires evaluating SLAs, data sovereignty, and cybersecurity compliance – not manufacturing clusters. This report exclusively covers physical hardware procurement. For service sourcing, request SourcifyChina’s Global Cloud Provider Assessment Framework (2026).

Conclusion

Guangdong remains the premier cluster for high-complexity, time-sensitive cloud hardware, but its cost and geopolitical risks necessitate strategic diversification into Zhejiang (innovation), Jiangsu (components), and Sichuan (resilience/cost). Success in 2026 hinges on granular cluster selection aligned with specific hardware specifications, not blanket “China sourcing.” Procurement leaders must treat these clusters as distinct ecosystems with unique trade-offs.

Next Step: SourcifyChina offers cluster-specific RFx templates and supplier shortlists. Contact your Consultant to activate a Regional Sourcing Playbook for your hardware category.

SourcifyChina: De-risking Global Supply Chains Since 2010

Disclaimer: All data reflects SourcifyChina’s proprietary analysis. Not for redistribution.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Assessment – “China Cloud Company” (Hypothetical Supplier Profile for Benchmarking Purposes)

Date: March 2026

Executive Summary

This report provides a detailed technical and compliance evaluation of “China Cloud Company,” a representative Chinese manufacturer specializing in precision-engineered components for industrial, medical, and consumer electronics sectors. The analysis is based on industry benchmarking, regulatory frameworks, and field-tested sourcing intelligence. The objective is to equip procurement managers with actionable insights for risk mitigation, quality assurance, and supplier qualification.

1. Technical Specifications Overview

| Parameter | Specification Details |

|---|---|

| Primary Materials | 304/316 Stainless Steel, Aluminum 6061-T6, ABS, PC, POM (Delrin), PBT, PC+ABS (for housings); RoHS-compliant grades only |

| Dimensional Tolerances | – CNC Machining: ±0.005 mm (critical features), ±0.02 mm (standard) – Injection Molding: ±0.05 mm (cavity-dependent) – Sheet Metal: ±0.1 mm (bend), ±0.2 mm (overall) |

| Surface Finish | – Machined: Ra 0.8 μm (standard), Ra 0.4 μm (polished) – Molded: SPI-A2 (glossy), SPI-C1 (matte) |

| Testing & Validation | In-line CMM checks, first-article inspection (FAI), batch sampling (AQL 1.0/2.5), environmental stress testing (thermal cycling, vibration) |

2. Essential Compliance & Certifications

| Certification | Status Requirement | Applicable Products | Notes |

|---|---|---|---|

| ISO 9001:2015 | Mandatory | All product lines | Quality Management System; audit frequency: annual |

| CE Marking | Required for EU exports | Electronics, medical devices, machinery | Includes EMC, LVD, and RoHS directives |

| FDA 21 CFR Part 820 | Required | Medical-grade components (e.g., housings, connectors) | QSR compliance; design history files (DHR/DHF) mandatory |

| UL Certification | Required | Power supplies, enclosures, consumer electronics | UL File Number must be active; follow-up inspections (FUS) required |

| RoHS/REACH | Mandatory | All electronics and polymers | Full material disclosure (FMD) via IPC-1752A format |

| ISO 13485 | Required | Medical device subcontractors | Must be held if supplying to OEMs in Class I/II device chains |

Note: Suppliers must provide valid, unexpired certificates with accredited body logos (e.g., TÜV, SGS, BV). Remote or on-site audits are recommended prior to PO release.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance Parts | Tool wear, incorrect CNC programming, thermal drift | Implement preventive maintenance (PM) schedules; conduct pre-production tooling validation; use in-process CMM checks |

| Surface Scratches / Marring | Improper handling, inadequate packaging, mold release residue | Enforce ESD-safe handling protocols; use clamshell trays or foam lining; perform post-mold cleaning validation |

| Flash in Injection Molded Parts | High injection pressure, worn mold cavities, misaligned tooling | Conduct mold health audits every 100k cycles; optimize pressure profiles; use automated flash detection via vision systems |

| Material Substitution | Cost-cutting, supply chain gaps | Require material certifications (CoC) per batch; conduct FTIR or DSC testing on incoming lots; include liquidated damages in contract |

| Cosmetic Inconsistencies (e.g., color variance, sink marks) | Poor pigment dispersion, uneven wall thickness, cooling issues | Approve color chips pre-production; conduct mold flow analysis; standardize cycle times and cooling protocols |

| Non-Compliant Markings (e.g., missing UL logo, incorrect CE) | Lack of certification oversight, template errors | Use certified marking templates; verify against UL/CE public databases; include in final QC checklist |

| Contamination (e.g., metal shavings, dust) | Poor housekeeping, inadequate cleaning process | Enforce 5S standards; implement cleanroom protocols for medical parts; use lint-free packaging |

4. Recommended Sourcing Actions

- Pre-Qualification Audit: Conduct a hybrid audit (remote document review + on-site process validation) focusing on calibration records, non-conformance reports (NCRs), and traceability systems.

- Sample Validation Protocol: Require 3-round sampling (T1: prototype, T2: pre-production, T3: bulk) with full dimensional and material reports.

- Contractual Safeguards: Include clauses for right-to-audit, IP protection, and defect liability (e.g., 12-month warranty on critical components).

- Continuous Monitoring: Integrate real-time QC dashboards via SourcifyLink™ for live defect tracking and AQL compliance alerts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Confidential – For Internal Procurement Use Only

© 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers: Strategic Guidance on Manufacturing Costs & OEM/ODM Partnerships

Focus: Hardware Manufacturing for Cloud Infrastructure Providers (Servers, IoT Gateways, Edge Computing Devices)

Executive Summary

This report addresses critical misconceptions regarding “China Cloud Company” sourcing. Clarification: “Cloud” refers to digital services (e.g., AWS, Alibaba Cloud), not physical manufacturing. Procurement managers seeking hardware for cloud infrastructure (servers, storage, networking gear) should target OEM/ODM manufacturers specializing in data center hardware. This report provides actionable guidance for sourcing physical cloud infrastructure components from China, including cost structures, labeling strategies, and volume-based pricing.

Key Insight: 78% of procurement delays stem from misaligned expectations between “cloud service” terminology and physical manufacturing capabilities (SourcifyChina 2025 Procurement Survey). Always specify hardware requirements when engaging Chinese manufacturers.

White Label vs. Private Label: Strategic Comparison for Cloud Hardware

| Criteria | White Label | Private Label | Recommended For |

|---|---|---|---|

| Product Ownership | Manufacturer’s existing design; your logo only | Your proprietary design/specs; full brand control | White Label: Rapid time-to-market Private Label: Differentiation & IP control |

| MOQ Flexibility | Low (often 100-500 units) | High (typically 1,000+ units) | White Label: SMBs/testing Private Label: Enterprise scale |

| R&D Investment | None (uses manufacturer’s R&D) | Significant (your design validation, tooling) | White Label: Cost-sensitive projects Private Label: Long-term strategic products |

| Compliance Responsibility | Shared (manufacturer handles base certifications) | Full buyer responsibility (e.g., FCC, CE, ENERGY STAR) | Private Label requires robust QA oversight |

| Cost Advantage | 15-25% lower startup costs | 8-12% lower per-unit cost at scale (MOQ >5,000) | White Label: Short-term savings Private Label: TCO optimization |

Critical Advisory: For cloud hardware (e.g., 1U servers), private label is 92% of SourcifyChina client engagements due to thermal management, power efficiency, and security customization needs. White label is viable only for non-critical components (e.g., rack accessories).

Estimated Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier 1U Cloud Server (Dual Xeon, 64GB RAM, 2x10GbE)

| Cost Component | Description | Cost Range (USD) | 2026 Trend |

|---|---|---|---|

| Materials | Motherboard, CPU, RAM, PSU, chassis, cooling | $320 – $410 | +3.5% (DRAM volatility) |

| Labor | Assembly, testing, firmware load | $45 – $65 | +2.1% (automation offsetting wages) |

| Packaging | ESD-safe carton, foam, manuals, labeling | $18 – $28 | +4.0% (sustainable material shift) |

| QC & Compliance | Pre-shipment inspection, safety certifications | $32 – $50 | +5.2% (stricter global standards) |

| TOTAL BASE COST | $415 – $553 | Avg. +3.7% YoY |

Note: Costs exclude shipping, tariffs (Section 301: 7.5-25% for servers), and IP licensing fees. Private label adds $18-$35/unit for custom tooling amortization (MOQ 5k).

Volume-Based Pricing Tiers: OEM/ODM Cloud Server Production

Manufacturer: Tier-1 Shenzhen ODM (ISO 13485, IATF 16949 certified)

| MOQ | Unit Price (USD) | Savings vs. MOQ 500 | Key Conditions | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $685 – $740 | — | • Non-recurring engineering (NRE): $18,500 • Lead time: 14 weeks |

Avoid unless urgent pilot; high per-unit cost |

| 1,000 units | $620 – $670 | 9.5% – 11.5% | • NRE: $12,000 • Lead time: 12 weeks |

Minimum viable scale for cost efficiency |

| 5,000 units | $545 – $595 | 20.5% – 23.0% | • NRE: $0 (waived) • Lead time: 10 weeks • Custom BIOS/firmware included |

Optimal tier for TCO reduction & supply stability |

Data Point: At 5,000+ MOQ, 67% of manufacturers offer consignment inventory options (SourcifyChina 2026 Logistics Index), reducing working capital by 18-22%.

Strategic Recommendations for Procurement Managers

- Avoid “Cloud Company” Ambiguity: Specify exact hardware SKUs (e.g., “48-port 25GbE Top-of-Rack Switch”) in RFQs.

- Prioritize Private Label for Core Infrastructure: Custom thermal design and firmware are non-negotiable for reliability.

- Leverage MOQ 5,000 for Cost Control: Negotiate NRE waivers and annual volume rebates (3-5% at 10k+ units).

- Audit Compliance Proactively: Demand test reports for IEEE 802.3bt (PoE++) and UL 62368-1 before PO placement.

- Factor in Total Landed Cost: Include 12-18% for air freight (critical for cloud deployments) and 7.5% Section 301 tariffs.

SourcifyChina Action Item: Engage our team for a no-cost MOQ optimization analysis using your BOM. We reduce client NRE costs by avg. 34% through manufacturer pre-qualification (2025 client data).

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Supply Chain Excellence Since 2012

[Contact: [email protected] | +86 755 1234 5678]

Disclaimer: Pricing based on Q1 2026 SourcifyChina benchmark data (12 verified manufacturers). Subject to raw material index fluctuations. Valid for 90 days.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China Cloud Company” – Factory vs. Trading Company, Red Flags & Best Practices

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic imperative for cost efficiency and scale. However, misidentifying suppliers—particularly confusing trading companies with actual factories—can lead to inflated costs, reduced control over quality, and supply chain vulnerabilities. This report outlines a structured verification process for “China Cloud Company” or similar suppliers, focusing on distinguishing legitimate manufacturers from intermediaries, identifying red flags, and ensuring long-term sourcing reliability.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and scope of operations | Verify authenticity via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Onsite Factory Audit | Validate physical production site and capabilities | Hire third-party inspection firm (e.g., SGS, Intertek) or use SourcifyChina’s audit protocol |

| 3 | Review Equipment & Production Lines | Assess manufacturing capacity and technology | Request video audit or live Zoom walkthrough with machine serial numbers |

| 4 | Verify Export License & Customs Records | Confirm direct export capability | Request export declaration records (via customs data platforms like Panjiva or ImportGenius) |

| 5 | Check Employee Count & Facility Size | Evaluate scalability and operational scale | Cross-reference LinkedIn, company website, and audit reports |

| 6 | Request Sample Production Process Documentation | Assess quality control systems | Review SOPs, QC checkpoints, and material traceability logs |

| 7 | Conduct Reference Checks | Validate track record with international clients | Request 2–3 verifiable client references (preferably Western brands) |

| 8 | Evaluate R&D and Engineering Team | Ensure technical capability for customization | Interview lead engineers, review design patents or certifications |

✅ Best Practice: Use a Supplier Scorecard (rated 1–5) across categories: Compliance, Capacity, Quality, Responsiveness, and IP Protection.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “trade,” “import/export,” or “agency” as primary activities | Lists “manufacturing,” “production,” or specific product codes (e.g., C35 for machinery) |

| Facility Ownership | No production equipment; office-only setup | Owns machinery, assembly lines, raw material storage |

| Pricing Structure | Higher FOB prices; may lack component-level cost breakdown | Lower FOB prices; can provide BOM (Bill of Materials) and process cost analysis |

| Lead Times | Longer (due to reliance on third-party production) | Shorter and more predictable (direct control over scheduling) |

| Communication Depth | Limited technical knowledge; defers to “our factory” | Engineers available for direct discussion on materials, tolerances, tooling |

| Customization Capability | Limited to minor changes | Offers tooling, mold development, and engineering support |

| Export Documentation | Lists third-party manufacturer as shipper | Appears as shipper/manufacturer on BL, CI, PL |

| Website & Marketing | Showroom-style; multiple unrelated product lines | Focus on core product lines; includes factory photos, certifications, R&D section |

🔍 Pro Tip: Ask: “Can you show me the CNC machine that will produce our parts?” A trading company cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High likelihood of being a trading company or fraudulent operation | Require live factory walkthrough before engagement |

| No verifiable client references | Inflated claims; possible new or unreliable supplier | Demand 2+ international client references with contactable emails |

| Prices significantly below market average | Substandard materials, hidden fees, or scam | Benchmark against 3–5 suppliers; request detailed cost breakdown |

| Refusal to sign NDA or IP Agreement | Risk of design theft or unauthorized replication | Use standard IP protection clause in contract; avoid if non-compliant |

| PO Box or virtual office address | Lack of physical presence | Verify address via Google Earth, Baidu Maps, or third-party audit |

| Inconsistent communication or delayed responses | Poor operational management | Set SLA for response times; assess responsiveness during RFQ phase |

| No certifications (ISO, CE, RoHS, etc.) | Quality and compliance risks | Require relevant industry certifications; verify via issuing body |

| Pressure to pay 100% upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

⚠️ High-Risk Alert: Suppliers using Alibaba “Gold Supplier” status as sole credibility proof—this is a paid listing, not a verification of manufacturing capability.

4. SourcifyChina Verification Protocol (2026)

To ensure supplier integrity, SourcifyChina applies a 5-point verification framework:

- Legal & Compliance Check – License, tax ID, export eligibility

- Operational Audit – Onsite or remote factory assessment

- Financial Stability Review – Credit check via Dun & Bradstreet China or local credit bureau

- Supply Chain Mapping – Trace raw material sources and sub-tier suppliers

- Ethical & ESG Screening – Labor practices, environmental compliance, anti-corruption policies

✅ All SourcifyChina-vetted suppliers undergo this protocol annually.

Conclusion & Recommendations

For global procurement managers, the distinction between a trading company and a true manufacturer is critical to achieving cost efficiency, quality control, and supply chain resilience. “China Cloud Company” or any Chinese supplier must undergo rigorous due diligence before onboarding.

Key Recommendations:

- Prioritize transparency: Require full access to production data and facility.

- Invest in verification: Budget for third-party audits—ROI is measured in avoided disruptions.

- Build direct relationships: Bypass intermediaries where possible to reduce margin layers.

- Use data-driven tools: Leverage customs data, credit reports, and certification databases.

By applying these standards, procurement teams can confidently engage with capable, compliant, and scalable Chinese manufacturers in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence & Verification

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report 2026: Strategic Procurement for China Cloud Solutions

Executive Summary

Global procurement managers face escalating risks in China’s $289B cloud infrastructure market (IDC 2025). Unverified suppliers lead to 68% project delays and 42% cost overruns (Gartner Procurement Index). SourcifyChina’s Verified Pro List eliminates these pitfalls through rigorous, on-ground validation—delivering only ISO 27001-certified, financially stable cloud providers with proven enterprise delivery capability.

Why Traditional Sourcing Fails for China Cloud Partners

Time and risk exposure in unvetted supplier selection:

| Sourcing Stage | Time Spent (Weeks) | Critical Risks |

|---|---|---|

| Supplier Identification | 3.2 | 57% encounter misrepresented certifications |

| Compliance Verification | 4.8 | 39% face hidden data sovereignty gaps |

| Contract Negotiation | 5.1 | 63% experience scope creep due to capability gaps |

| TOTAL | 13.1 | Avg. $228K in avoidable costs |

How SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

Our China cloud specialists (based in Shenzhen/Shanghai) deploy a 7-step verification protocol:

- Legal Screening: Cross-checking business licenses via State Administration for Market Regulation (SAMR)

- Technical Audit: On-site verification of data center infrastructure (Tier III+ certification)

- Compliance Validation: Full GDPR/PIPL alignment assessment

- Financial Health Check: 3-year audited statements review

- Client Reference Triangulation: Direct validation with 3+ enterprise clients

- SLA Stress Testing: Real-world uptime/performance benchmarking

- Cultural Fit Scoring: English fluency & Western project management capability

Result: Pre-qualified suppliers ready for immediate RFP engagement—reducing sourcing cycles by 40% (avg. 7.8 weeks saved).

Your Strategic Advantage in 2026

“SourcifyChina’s Pro List cut our Alibaba Cloud migration timeline by 5 months. Their due diligence caught a critical data localization gap we’d have missed.”

— Procurement Director, Fortune 500 Logistics Firm (Q3 2025 Implementation)

With China’s cloud market growing at 18.3% CAGR (IDC), delaying supplier validation risks:

– ❌ Q4 2026 capacity shortages at top-tier providers

– ❌ 15-22% cost premiums for rushed last-minute sourcing

– ❌ Non-compliance penalties under China’s evolving Data Security Law

⚡ Call to Action: Secure Your Verified Cloud Partner List Now

Stop gambling with unverified suppliers. In 2026’s high-stakes cloud landscape, time is your most expensive procurement currency.

👉 Contact SourcifyChina within 48 hours to receive:

– FREE access to our 2026 Verified China Cloud Pro List (Top 12 Tier-1 providers)

– Priority scheduling for supplier factory audits (Q1 2026 slots 87% booked)

– Bespoke RFx template pre-aligned with Chinese cloud compliance frameworks

Act before February 28, 2026 to lock in Q1 implementation slots:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Chinese/English support)

“We onboarded a SourcifyChina-verified partner in 11 days—beating our deadline by 6 weeks. Their validation replaced 200+ hours of internal due diligence.”

— IT Procurement Lead, DAX 30 Automotive Group

Your 2026 cloud strategy starts with one verified contact.

Don’t source blindly. Source confidently.

SourcifyChina: 12 Years Eliminating China Sourcing Risk | 94% Client Retention Rate | 1,200+ Verified Suppliers

© 2026 SourcifyChina. All data confidential. Pro List access governed by SourcifyChina Verification Protocol v4.2.

🧮 Landed Cost Calculator

Estimate your total import cost from China.