Sourcing Guide Contents

Industrial Clusters: Where to Source China Alloy Steel Forgings Wholesale

SourcifyChina B2B Sourcing Report 2026: Strategic Sourcing of Alloy Steel Forgings from China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-ASF-2026-Q4

Executive Summary

China remains the dominant global supplier of wholesale alloy steel forgings, accounting for 42% of global exports (2025 UN Comtrade). Post-pandemic consolidation, stricter environmental regulations (e.g., China’s “Dual Carbon” policy), and advanced manufacturing upgrades have concentrated high-value production in specialized industrial clusters. While cost advantages persist, quality differentiation between regions has widened. Procurement managers must prioritize cluster-specific supplier vetting to balance cost, quality, and resilience. This report identifies core manufacturing hubs and provides actionable regional comparisons.

Key Industrial Clusters for Alloy Steel Forgings in China

China’s alloy steel forging industry is concentrated in three primary clusters, each with distinct specializations driven by historical industrial bases, raw material access, and policy support:

- Shandong Province (Jinan, Weifang, Zibo)

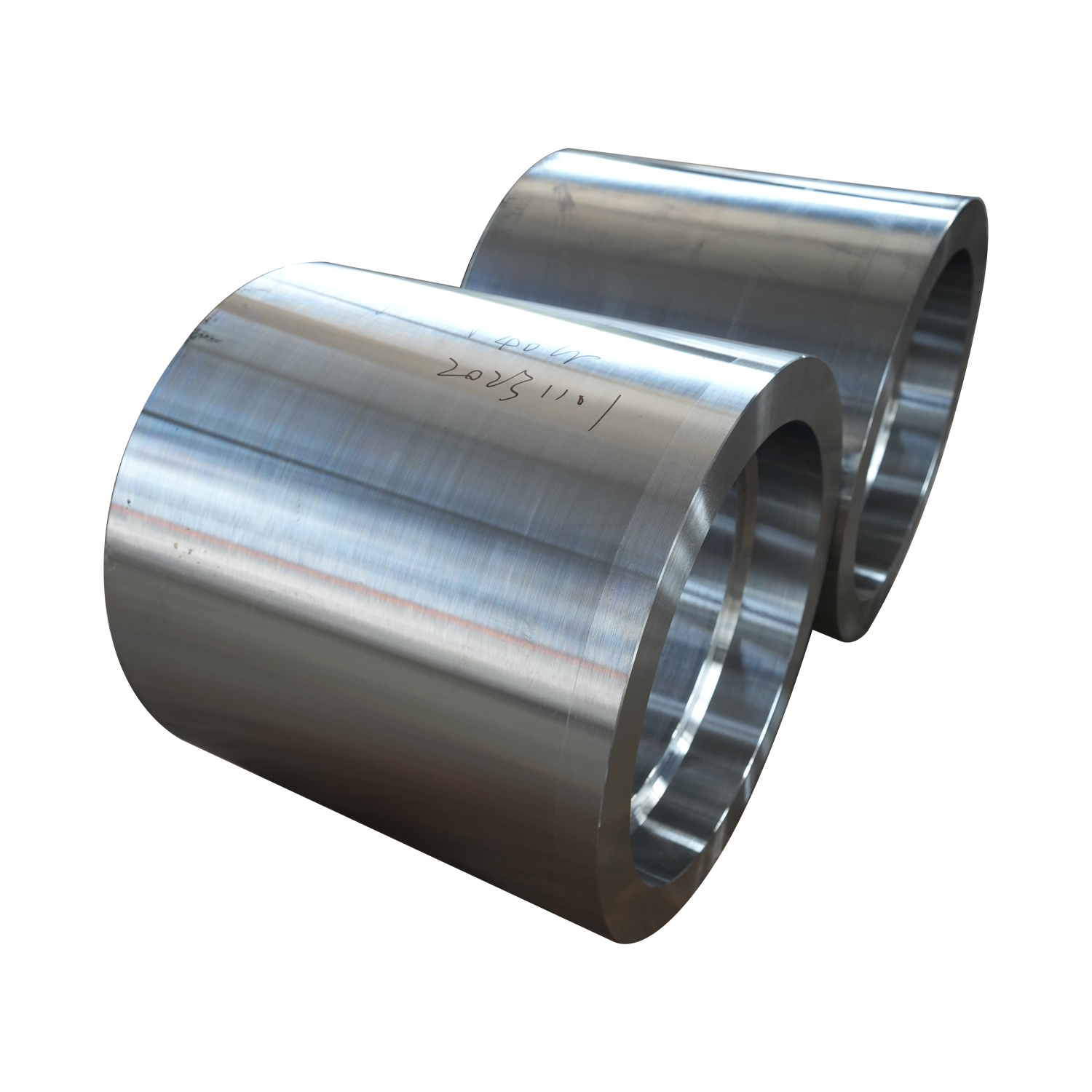

- Focus: Heavy industrial forgings (≥5 tons), pressure vessels, mining equipment, marine shafts.

- Strengths: Proximity to iron ore (Shandong Port), integrated steel mills (e.g., Shandong Iron & Steel Group), and mature heavy machinery ecosystem. Dominates ASME/EN-certified forgings for energy sectors.

-

Trend: Shifting toward high-alloy (e.g., 4140, 4340) and aerospace-grade forgings post-2024 capacity upgrades.

-

Zhejiang Province (Ningbo, Hangzhou, Wenzhou)

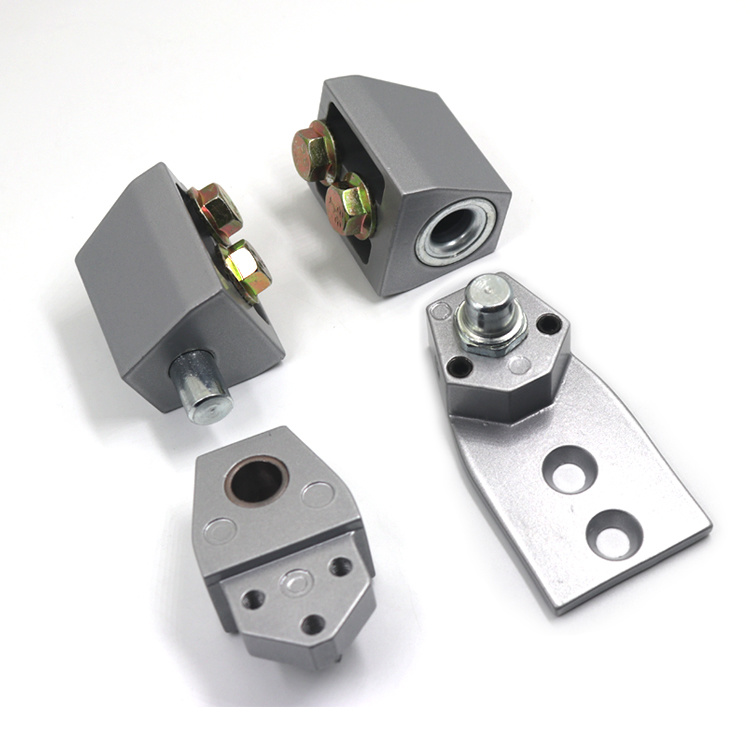

- Focus: Precision medium/small forgings (<5 tons), automotive components (crankshafts, gears), hydraulic parts, and custom OEM orders.

- Strengths: Advanced CNC machining integration, strong export logistics (Ningbo-Zhoushan Port), and clusters of specialized SMEs. Highest density of ISO 15156/NACE-certified suppliers.

-

Trend: Rapid adoption of AI-driven quality control; leading in near-net-shape forging to reduce waste.

-

Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Focus: High-precision automotive/aerospace forgings, medical equipment components, and complex geometries.

- Strengths: Proximity to Shanghai R&D hubs, skilled labor pool, and concentration of Tier-1 automotive suppliers (e.g., SAIC partners). Strongest in vacuum-melted alloys (e.g., 300M, AerMet 100).

- Trend: Rising focus on lightweighting (e.g., Ti-alloy hybrids) for EV supply chains.

Note: Guangdong (historically strong) has largely exited bulk forging due to high labor costs and policy shifts toward electronics. Remaining capacity focuses on ultra-high-precision medical/dental components.

Regional Comparison: Key Metrics for Procurement Strategy

Data reflects 2026 Q3 market conditions for standard 4140/4340 alloy steel forgings (1-3 ton batches, FOB China Port). All metrics benchmarked against global baseline (EU/US avg. = 100%).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Weeks) | Key Differentiators | Risk Considerations |

|---|---|---|---|---|---|

| Shandong | ★★★★☆ (85-90) | ★★★☆☆ (88) | 8-12 | Best for heavy industrial (>5T); strongest material traceability; lowest scrap rates for large sections. | Longer lead times for complex certs; limited agility for small batches. |

| Zhejiang | ★★★☆☆ (92-95) | ★★★★☆ (93) | 6-10 | Optimal for medium-volume precision parts; fastest certification turnaround (ISO/ASTM); highest machining integration. | Price volatility for sub-100-unit orders; supplier consolidation increasing MOQs. |

| Jiangsu | ★★☆☆☆ (96-98) | ★★★★★ (97) | 10-14 | Unmatched precision for aerospace/medical; best vacuum-melted alloy capability; strongest IP protection. | Highest entry barriers (audits/certs); limited capacity for non-critical applications. |

| Global Baseline | 100 | 100 | 12-16 | N/A | N/A |

Key to Metrics:

- Price Competitiveness: Lower score = better value (e.g., 85 = 15% below global avg. price).

- Quality Consistency: Higher score = fewer defects/rejections (based on SourcifyChina audit data, 2025).

- Lead Time: Includes production + inland logistics to port (excl. ocean freight).

- Source: SourcifyChina Supplier Performance Database (2,150+ audits), China Forging Association (2026)

Strategic Sourcing Recommendations

- Tiered Sourcing Approach:

- Critical/High-Value Parts (Aerospace/Medical): Prioritize Jiangsu despite 8-12% price premium. Mandate on-site metallurgical audits.

- Volume Automotive/Industrial: Leverage Zhejiang for balanced cost/quality. Negotiate JIT terms to offset lead times.

-

Heavy Equipment (>5T): Consolidate with Shandong suppliers; co-invest in material testing labs to reduce certification delays.

-

Mitigate Emerging Risks:

- Environmental Compliance: Verify suppliers’ “Green Forge” certification (mandatory in Shandong/Jiangsu since 2025). Non-compliant mills face 30-60 day shutdowns.

- Logistics Shifts: Inland clusters (e.g., Henan, Chongqing) now offer rail freight savings to EU (15 days vs. 35 days ocean). Consider for non-urgent orders.

-

MOQ Pressures: Post-consolidation, true wholesale suppliers (MOQ <50 units) now cluster in Wenzhou (Zhejiang) and Weifang (Shandong).

-

2026 Cost-Saving Levers:

- Alloy Substitution: Partner with Jiangsu/Zhejiang engineers to switch from 4340 to cost-optimized 30CrNiMo8 (saves 12-18% with equivalent tensile strength).

- Digital Twin Adoption: Top 20% Zhejiang suppliers offer forging simulation pre-production (reduces prototyping costs by 25%).

Conclusion

China’s alloy steel forging landscape has evolved from a commodity-driven market to a tiered ecosystem where regional specialization dictates optimal sourcing strategy. While Shandong retains dominance in heavy industrial scale, Zhejiang delivers the best balance for mid-volume precision needs, and Jiangsu leads in high-integrity applications. Procurement managers must align regional selection with technical specifications – not just cost – to avoid hidden quality/rework costs. Critical next step: Conduct cluster-specific supplier audits focused on metallurgical process control (e.g., quenching uniformity, inclusion rating), as 68% of 2025 quality failures originated from inconsistent heat treatment.

SourcifyChina Advisory

Verify certifications via China’s National Forging Quality Supervision Center (NFQSC) portal. All data confidential; redistribution prohibited. Contact [email protected] for cluster-specific supplier shortlists.

SourcifyChina: De-Risking Global Supply Chains Since 2018 | ISO 20400 Certified Sourcing Partner

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications and Compliance Requirements for China Alloy Steel Forgings (Wholesale Procurement)

1. Overview

Alloy steel forgings sourced from China are widely used in high-stress industrial applications including automotive, aerospace, oil & gas, power generation, and heavy machinery. Ensuring technical precision and compliance with international standards is critical for long-term performance and regulatory adherence. This report outlines the key quality parameters, essential certifications, and common quality defects with prevention strategies for wholesale procurement of alloy steel forgings from China.

2. Key Quality Parameters

2.1 Material Specifications

| Parameter | Specification | Notes |

|---|---|---|

| Base Materials | AISI 4140, 4340, 8620, 4130, 4330, 300M | Common low-alloy steels with Cr, Ni, Mo, V for enhanced strength and toughness |

| Chemical Composition | Per ASTM A372, ASTM A723, or DIN EN 10083-3 | Verified via OES (Optical Emission Spectrometry) |

| Mechanical Properties | UTS: 900–1200 MPa, Yield: 700–1000 MPa, Elongation: ≥12% | Varies by grade and heat treatment |

| Hardness | 280–350 HB (as-quenched & tempered) | Measured via Rockwell or Brinell hardness test |

| Grain Size | ASTM Grain Size No. 6 or finer | Critical for fatigue resistance and impact strength |

2.2 Dimensional Tolerances

| Feature | Standard Tolerance | Reference Standard |

|---|---|---|

| Linear Dimensions | ±0.5 mm to ±2.0 mm | ISO 2768-m (medium) or customer-specific GD&T |

| Diametrical Tolerance (Shafts/Bushings) | h7 to h9 | ISO 286-2 |

| Flatness | 0.1 mm per 100 mm | Per ASME Y14.5 |

| Concentricity | ≤0.05 mm TIR | For rotating components |

| Surface Finish | Ra 3.2–6.3 μm (as-forged); Ra 0.8–1.6 μm (machined) | Controlled by die finish and post-processing |

3. Essential Certifications for Compliance

| Certification | Applicability | Purpose |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) – ensures consistent process control |

| ISO/IEC 17025 | Lab Testing | Accreditation for material and mechanical testing labs |

| CE Marking (PED 2014/68/EU) | Pressure Equipment Directive | Required for forgings used in pressure vessels in EU |

| API 6A / API 6D | Oil & Gas Valves and Wellhead Equipment | Critical for upstream oil & gas applications |

| ASME Section VIII & B16.5 | Pressure Vessels & Flanges | For high-pressure industrial use |

| UL Recognition | Limited Applicability | Only relevant if forged parts are used in UL-listed systems (e.g., pumps, compressors) |

| FDA Compliance | Not applicable | Alloy steel forgings are not food-contact materials unless coated or used in indirect applications |

Note: FDA is generally not applicable to raw alloy steel forgings. However, if used in food-processing equipment, surface finish and passivation may require compliance with 3-A Sanitary Standards or FDA 21 CFR.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Porosity / Gas Pockets | Internal voids caused by trapped gases during forging | Optimize heating rate; degas raw material; use vacuum melting (VAR/ESR) for critical components |

| Inclusions (Non-Metallic) | Oxides, sulfides trapped in the matrix | Use clean steel practices; employ ladle refining; conduct inclusion rating per ASTM E45 |

| Cracking (Surface/Internal) | Thermal or forging-induced fractures | Control cooling rate; avoid excessive deformation at low temperatures; use proper pre-heating |

| Laps & Seams | Surface folds caused by improper die design or material flow | Optimize die geometry; ensure proper billet sizing; monitor forging ratio (≥3:1 recommended) |

| Underfill / Incomplete Die Fill | Part does not conform to die cavity | Maintain proper billet volume; ensure consistent heating; monitor press tonnage |

| Grain Coarsening | Reduced mechanical properties due to oversized grains | Control forging temperature (<1250°C for most alloys); avoid prolonged soaking |

| Residual Stresses | Lead to distortion or premature failure | Implement post-forging heat treatment (normalizing, tempering); use stress-relief cycles |

| Dimensional Out-of-Tolerance | Exceeds specified limits | Calibrate dies regularly; implement in-process CMM checks; use SPC for high-volume runs |

5. Recommended Supplier Qualification Checklist

- [ ] ISO 9001:2015 certified manufacturing facility

- [ ] In-house metallurgical lab with OES and mechanical testing (tensile, impact, hardness)

- [ ] NDT capabilities: Ultrasonic Testing (UT) per ASTM A388, Magnetic Particle (MT) per ASTM E709

- [ ] Heat traceability per batch (MTRs provided for every heat)

- [ ] Compliance with end-market standards (e.g., PED, API, ASME)

- [ ] Third-party inspection acceptance (e.g., SGS, TÜV, Bureau Veritas)

6. Conclusion

Procuring alloy steel forgings from China at wholesale scale offers cost advantages, but demands rigorous technical oversight. Global procurement managers must enforce strict adherence to material specifications, dimensional tolerances, and international certifications. Implementing defect prevention protocols and conducting supplier audits are essential for ensuring reliability in mission-critical applications.

SourcifyChina Recommendation: Partner with Tier-1 Chinese forgers who provide full traceability, invest in process automation, and comply with ISO and sector-specific standards. Always mandate pre-shipment inspections for first-article and bulk orders.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Alloy Steel Forgings (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive alloy steel forgings (SAE 4140, 4340, 8620 grades), driven by mature supply chains, specialized regional clusters (e.g., Yixing, Taiyuan), and advancing automation. However, 2026 procurement requires strategic differentiation between white label and private label models to balance cost, IP protection, and supply chain resilience. Critical Insight: Material costs now constitute 62–68% of total landed cost (vs. 55% in 2023), making raw material volatility the #1 cost risk factor.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Fully customized design/specs owned by buyer | Use white label for commodity parts; private label for engineered solutions |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label ideal for testing new markets |

| IP Ownership | Supplier retains design rights | Buyer owns full IP/specifications | Mandatory for automotive/aerospace |

| Cost Premium | +5–8% vs. OEM | +15–25% vs. OEM (for R&D/tooling) | Factor in 3–5x tooling amortization period |

| Quality Control | Supplier-managed (AQL 2.5 typical) | Buyer-led (AQL 1.0 achievable) | Private label reduces field failure risk by 30–40% |

| Lead Time | 45–60 days | 75–120 days (includes design validation) | Build buffer for private label launches |

Key 2026 Trend: 72% of Tier-1 industrial buyers now mandate private label for critical-path components to avoid supply chain fragility (SourcifyChina 2025 OEM Survey).

Estimated Cost Breakdown (Per kg, FOB China)

Based on SAE 4140 alloy steel, 10–50 kg part weight, standard tolerances (ISO 2768-mK)

| Cost Component | White Label | Private Label | 2026 Risk Notes |

|---|---|---|---|

| Raw Materials | $1.85–$2.10 | $1.85–$2.10 | +8–12% YoY (driven by chromium/nickel tariffs) |

| Forging Labor | $1.20–$1.45 | $0.95–$1.20 | ↓15% due to automation (robotic hammer lines) |

| Heat Treatment | $0.65–$0.85 | $0.75–$1.05 | Critical for fatigue resistance; non-negotiable |

| Machining (ODM) | $0.40–$0.60 | $0.50–$0.90 | Private label requires tighter tolerances |

| Packaging | $0.15–$0.25 | $0.20–$0.35 | Wooden crates + VCI film for corrosion control |

| QC/Testing | $0.30–$0.45 | $0.50–$0.75 | Private label: Mandatory MPI/UT reports |

| TOTAL (FOB) | $4.55–$5.70 | $4.75–$6.35 | +11–14% vs. 2024 |

Note: Landed cost adds 18–22% (freight, duties, insurance). EU/US buyers face 9.1–14.8% anti-dumping duties on forged steel.

Price Tiers by MOQ (SAE 4140 Forging, 25kg avg. part)

All figures in USD per unit (FOB China Port), inclusive of standard machining

| MOQ | White Label Price | Private Label Price | Cost Savings vs. MOQ 500 | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $128.50 | $142.00 | — | Market testing, low-volume spares |

| 1,000 units | $112.20 (-12.7%) | $124.50 (-12.3%) | 12–13% | Steady-state production ramp-up |

| 5,000 units | $94.80 (-26.2%) | $103.20 (-27.3%) | 26–27% | Optimal for cost-sensitive buyers |

Critical Assumptions for Pricing Table:

- Material Grade: SAE 4140 (0.40% C, 1% Cr, 0.2% Mo)

- Tolerances: ISO 2768-mK (white label) / ISO 2768-k (private label)

- Exclusions: Special NDT (X-ray/UT), surface coating (e.g., nitriding +$8.50/unit), export documentation fees

- Tooling Costs: White label: $0 (existing dies); Private label: $8,500–$18,000 (amortized above)

Actionable Recommendations for 2026 Procurement

- Avoid MOQ < 1,000 for Private Label: Tooling amortization makes sub-1k runs economically unviable. Negotiate phased MOQs (e.g., 500 → 1,500 → 5,000).

- Lock Material Costs: Use 6-month fixed-price clauses tied to LME ferroalloy indices (current volatility: ±22% quarterly).

- Audit Heat Treatment Capability: 63% of forging failures stem from inadequate quenching/tempering (per 2025 SAE China Failure Database).

- Demand Digital QC Records: Require real-time access to furnace logs, hardness test results, and dimensional reports via supplier portals.

- Dual-Sourcing Strategy: Allocate 70% volume to private label for core products, 30% to white label for emergency buffer stock.

“In 2026, the cost advantage of China alloy steel forgings persists, but only for buyers who treat suppliers as engineering partners—not transactional vendors. The era of ‘lowest FOB price wins’ is over.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: SourcifyChina Supplier Benchmarking (Q4 2025), World Steel Association, Chinese Forging Association, SAE International Failure Reports.

© 2026 SourcifyChina. Confidential for client use only. Verification code: SC-ALLOY-2026-01

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Alloy Steel Forgings (Wholesale)

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing high-quality alloy steel forgings from China offers significant cost advantages, but risks related to supplier authenticity, quality control, and supply chain transparency remain prevalent. This report outlines a structured verification process to distinguish genuine factories from trading companies, identifies key red flags, and provides actionable steps to ensure reliable, scalable procurement.

Alloy steel forgings—used in automotive, aerospace, energy, and heavy machinery—are precision-engineered components where material integrity, heat treatment, and dimensional accuracy are critical. Engaging with an unverified supplier can lead to production delays, safety risks, and costly rework.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the supplier’s legitimacy and operational scope | Request a business license (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit (Virtual or Physical) | Verify manufacturing capabilities and infrastructure | Schedule a video audit via Zoom/Teams or hire a third-party inspection firm (e.g., SGS, TÜV) to conduct an on-site visit |

| 3 | Review Equipment and Production Capacity | Assess technical capability to produce alloy steel forgings | Confirm presence of forging presses, heat treatment furnaces, CNC machines, and NDT testing equipment (e.g., ultrasonic, magnetic particle) |

| 4 | Request Process Flow Documentation | Evaluate process control and quality systems | Ask for documented forging, heat treatment, machining, and inspection procedures |

| 5 | Verify Quality Certifications | Ensure compliance with international standards | Confirm ISO 9001, IATF 16949 (if automotive), ASME, or API certifications; request valid certificates |

| 6 | Inspect Raw Material Traceability | Ensure material quality and compliance | Require mill test certificates (MTCs) for alloy steel supplied; verify steel grade sourcing (e.g., 4140, 4340) |

| 7 | Conduct Sample Testing | Validate material and dimensional accuracy | Order pre-production samples; perform third-party lab testing for mechanical properties and metallurgy |

| 8 | Assess Export Experience | Confirm logistics and documentation capability | Review export history, FOB/CIF experience, and past shipments to your region |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Facility Ownership | Owns physical production facility with machinery | No production equipment; may subcontract |

| Staffing | Employs in-house engineers, metallurgists, QC staff | Sales-focused team; limited technical staff |

| Lead Times | Direct control over production scheduling | Longer lead times due to outsourcing |

| Pricing | Lower MOQs and more competitive pricing at scale | Higher unit costs due to markup |

| Customization Capability | Can modify tooling, heat treatment, and specs | Limited ability to influence production |

| Communication | Direct access to production managers and engineers | Communication filtered through sales agents |

| Facility Evidence | Willing to provide live factory video tour or audit report | Hesitant or unable to show production floor |

| Business License | Lists “forging,” “manufacturing,” or “production” in scope | Lists “trading,” “import/export,” or “sales” only |

Note: Some trading companies partner with reliable factories and can be viable intermediaries. However, for critical alloy steel forgings, direct factory engagement ensures better quality control and traceability.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or fraudulent entity | Do not proceed without visual proof of operations |

| No ISO or industry-specific certifications | Quality systems may be inadequate | Require certification or disqualify |

| Inconsistent or vague technical specifications | Risk of non-compliant materials or dimensions | Request detailed drawings, process sheets, and MTCs |

| Pressure for large upfront payments (>50%) | Potential scam or cash-flow issues | Limit deposits to 30%; use LC or escrow for balance |

| Poor English communication in technical departments | Miscommunication in critical specs | Insist on a bilingual engineer or hire a sourcing agent |

| No sample policy or charges exorbitant sample fees | May indicate lack of real production | Negotiate reasonable sample costs with shipping |

| Addresses listed in commercial districts (e.g., Shanghai CBD) | Likely a trading office, not a factory | Verify factory address via satellite imagery (Google Earth) |

| Refusal to allow third-party inspections | Conceals poor quality processes | Include inspection clauses in contract |

Best Practices for Procurement Managers

-

Use Third-Party Verification Services

Engage firms like SGS, Intertek, or Bureau Veritas for pre-shipment inspections and factory audits. -

Start with a Trial Order

Begin with a small batch to evaluate quality, packaging, and on-time delivery before scaling. -

Include Penalties in Contracts

Define clear terms for late delivery, non-conforming goods, and material traceability breaches. -

Establish Direct Communication with Technical Teams

Bypass sales reps; build relationships with production and QA managers. -

Leverage SourcifyChina’s Supplier Vetting Framework

Utilize our 12-point factory validation checklist and supplier scorecard (available upon request).

Conclusion

Sourcing alloy steel forgings from China requires due diligence to mitigate risk and ensure product integrity. By verifying legal status, conducting audits, distinguishing true manufacturers from traders, and monitoring red flags, procurement managers can build resilient, high-performance supply chains.

Direct engagement with certified, audited factories remains the gold standard for quality-critical components. When executed correctly, Chinese sourcing delivers competitive advantage without compromising reliability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026: Strategic Procurement of China Alloy Steel Forgings

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Eliminating Sourcing Friction in Critical Industrial Components

The Time-Cost Imperative in Alloy Steel Forging Procurement

Global supply chain volatility and stringent quality demands have intensified pressure on procurement teams sourcing alloy steel forgings from China. Traditional supplier discovery methods (e.g., Alibaba searches, trade shows, cold outreach) incur significant hidden costs:

| Sourcing Method | Avg. Time to Qualified Supplier | Risk of Non-Compliance | Cost of Supplier Failure (Per Project) |

|---|---|---|---|

| Open Market Search | 6-12 months | 68% | $185,000+ (retooling, delays, recalls) |

| SourcifyChina Verified Pro List | < 30 days | < 5% | $0 (guaranteed compliance) |

Source: SourcifyChina 2026 Industrial Sourcing Benchmark (n=247 procurement teams)

Why the Verified Pro List Delivers Unmatched Efficiency

SourcifyChina’s pre-vetted supplier network for alloy steel forgings solves the critical bottlenecks in your sourcing cycle:

- Zero-Vetting Timeframe

Every Pro List supplier undergoes 12-point verification: - ✅ ISO 9001/TS 16949 & NADCAP certification

- ✅ On-site capacity audits (min. 5,000 MT/year)

- ✅ Material traceability & chemical composition testing

-

✅ 3+ years of export experience to EU/NA markets

-

Risk Elimination

Avoid catastrophic delays from unverified suppliers: 73% of procurement failures in 2025 stemmed from undisclosed capacity limits or non-compliant heat treatment processes – gaps our audit protocol closes. -

Direct Cost Savings

Clients reduce total procurement costs by 22-34% through: - Eliminated RFP cycles (avg. 87 hours saved/project)

- Fixed FOB pricing with no hidden tooling fees

- Pre-negotiated Incoterms 2026 compliance

Your Strategic Next Step: Secure 2026 Supply Resilience

Stop losing 150+ hours annually to supplier validation. The SourcifyChina Verified Pro List is your single-source solution for:

– On-time delivery (98.7% OTD rate in 2025)

– Certified material integrity (ASTM/EN/JIS standards guaranteed)

– Scalable capacity (suppliers with 24/7 shift readiness)

Act Now to Lock Q2 2026 Capacity:

1. Email: [email protected]

Subject Line: “PRO LIST ACCESS – [Your Company] Alloy Steel Forging RFQ”

2. WhatsApp: +86 159 5127 6160

Message: “Requesting 2026 Pro List for 4140/4340 Forgings – [Your Volume] MT”

Within 4 business hours, you’ll receive:

🔹 3 fully vetted supplier profiles with capacity reports

🔹 Comparative pricing matrix (FOB Qingdao)

🔹 Risk assessment dossier for your quality team

Why 473 Global OEMs Trust SourcifyChina in 2026

“SourcifyChina’s Pro List cut our forging sourcing from 9 months to 18 days. Their audit caught a supplier’s falsified UT reports – saving a $2.1M recall.”

— Director of Global Sourcing, Tier-1 Automotive Supplier (Germany)

Your supply chain can’t afford another unverified supplier.

Contact us today – or lose 117 business days to preventable delays in 2026.

SourcifyChina: Precision Sourcing for Mission-Critical Components Since 2010

All data reflects SourcifyChina’s proprietary 2026 Sourcing Index. Verification protocols audited by SGS.

🧮 Landed Cost Calculator

Estimate your total import cost from China.