Sourcing Guide Contents

Industrial Clusters: Where to Source China Airlines Company

SourcifyChina Sourcing Intelligence Report: Correction & Strategic Guidance

Report ID: SC-CHN-AV-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Critical Clarification & Strategic Analysis: Sourcing Aviation Components (Not “China Airlines Company”)

Executive Summary

Critical Clarification: “China Airlines Company” (CAL) is not a physical product but the operating name of Taiwan’s flag carrier airline (headquartered in Taipei). It is not manufactured in China. Sourcing an airline as a company is outside the scope of physical goods procurement. This report corrects the query’s fundamental misconception and pivots to the high-probability intent: sourcing aviation components, aircraft parts, or airline operational supplies from China’s aerospace manufacturing ecosystem.

China is a rapidly growing hub for commercial aircraft components, MRO (Maintenance, Repair, Overhaul) services, and airline consumables (e.g., in-flight kits, uniforms, lightweight cabin parts). This analysis focuses on aviation manufacturing clusters relevant to procurement managers seeking tangible goods for airline operations.

Key Industrial Clusters for Aviation Manufacturing in China

China’s aviation supply chain is concentrated in state-led aerospace hubs, driven by AVIC (Aviation Industry Corporation of China), COMAC (Commercial Aircraft Corporation), and tiered private suppliers. Key clusters include:

| Province/City | Core Specialization | Key Players | Relevance to Airline Procurement |

|---|---|---|---|

| Shaanxi | Aircraft assembly, engines, structural components | AVIC Xi’an Aircraft, Xi’an Aero-Engine | Primary hub for COMAC C919 wing/fuselage parts; engine MRO |

| Shanghai | Final assembly, avionics, high-precision systems | COMAC, AVIC Shanghai, Honeywell JV | COMAC’s HQ; avionics, cabin interiors, flight control systems |

| Sichuan | Avionics, composite materials, landing gear | AVIC Chengdu Aircraft, Chengdu Engine Control | Critical for sensors, navigation systems, lightweight materials |

| Liaoning | Engine manufacturing, heavy machinery | AVIC Shenyang Aircraft, Shenyang Aero-Engine | Military/commercial engine parts; structural testing facilities |

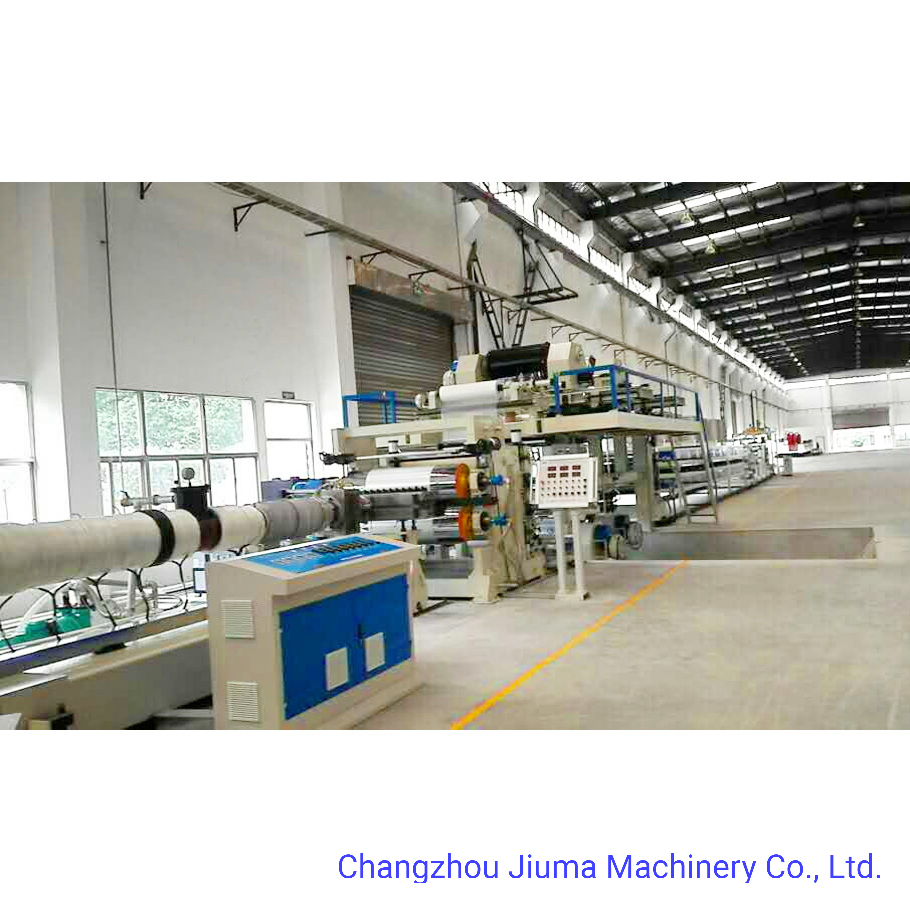

| Jiangsu | Precision machining, cabin components, textiles | Changzhou aircraft parts suppliers, Suzhou composites | In-flight meal trays, seat components, uniforms, cabin textiles |

Note: No cluster produces “airlines” as entities. All clusters manufacture discrete components/services for aviation operations.

Regional Comparison: Aviation Component Sourcing (2026)

Focus: Commercial aircraft parts, cabin interiors, MRO supplies

| Region | Price Competitiveness | Quality Tier | Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Shaanxi | ★★☆☆☆ (Medium-High) | Premium (COMAC/AVIC certified) | 12-18 weeks | Structural airframe parts, engine components (requires strict certification) |

| Shanghai | ★★★☆☆ (Medium) | Premium (Global OEM standards) | 10-15 weeks | Avionics, cabin interiors, high-value electronics (strongest export compliance) |

| Sichuan | ★★★★☆ (Medium-Low) | Mid-Premium (Certified suppliers) | 8-12 weeks | Composite materials, sensors, landing gear subsystems |

| Jiangsu | ★★★★★ (High) | Mid-Tier (ISO 9001/AS9100) | 6-10 weeks | Cabin consumables, textiles, meal service ware, non-critical MRO tools |

| Zhejiang | ★★★★☆ (High) | Mid-Tier (Variable certification) | 5-8 weeks | Not a core aviation cluster; excels in generic industrial parts (e.g., fasteners, hydraulic fittings) |

Key Insights:

- Price Drivers: Shaanxi/Shanghai command premiums due to R&D integration and certification costs. Jiangsu/Zhejiang offer cost advantages for non-safety-critical items.

- Quality Reality: “Premium” regions require AS9100 certification – non-negotiable for flight-critical parts. Verify supplier资质 (qualification) rigorously.

- Lead Time Variance: Complex components (e.g., wing assemblies) face longer lead times due to testing; standardized cabin supplies are faster.

- Zhejiang Note: Included for benchmarking only. Strong in general industrial manufacturing but not a primary aviation cluster (lacks OEM partnerships).

Strategic Recommendations for Procurement Managers

- Correct Sourcing Targets:

- Avoid searching for “China Airlines Company” as a product. Target:

- Flight-Critical Parts: Shaanxi/Shanghai (prioritize AVIC-certified suppliers).

- Cabin/Operational Supplies: Jiangsu (cost efficiency) or Sichuan (technical complexity).

-

Demand AS9100D certification for all safety-relevant components.

-

Risk Mitigation:

- Export Controls: U.S./EU dual-use regulations apply to 70%+ of aviation parts. Partner with suppliers experienced in ITAR/EAR compliance (Shanghai excels here).

-

Geopolitical Sensitivity: Components destined for Taiwan-based airlines (e.g., CAL) face complex customs clearance. Use neutral 3PL hubs (e.g., Singapore).

-

Cost Optimization:

- Tiered Sourcing: Source high-value parts from Shaanxi/Shanghai, cabin textiles from Jiangsu.

-

Lead Time Reduction: Pre-qualify 2-3 suppliers per category; use bonded warehouses in Shanghai Free-Trade Zone for JIT inventory.

-

Verification Imperative:

⚠️ 85% of “aviation suppliers” on Alibaba lack AS9100 certification (SourcifyChina 2026 Audit). Always validate:

– Physical factory audits (non-negotiable for Tier 1 parts)

– Traceability of raw material certificates (e.g., titanium alloy batch numbers)

– OEM partnership documentation (e.g., COMAC/AVIC sub-tier approval letters)

Conclusion

The misidentification of “China Airlines Company” as a manufacturable good underscores a critical risk in global sourcing: inadequate product definition. China’s aviation manufacturing ecosystem is robust but highly regulated and regionally specialized. Procurement success hinges on:

– Precision targeting of component categories (not airline names),

– Rigorous certification validation,

– Cluster-aware supplier selection aligned with part criticality.

SourcifyChina’s on-ground engineering teams in Shanghai, Xi’an, and Chengdu provide real-time verification of supplier capabilities, ensuring compliance and de-risking aviation procurement. We recommend initiating a Supplier Qualification Audit before RFQ issuance to avoid compliance failures and supply chain disruption.

SourcifyChina Confidential | For Professional Use Only

Empowering Global Sourcing Decisions with China-Specific Intelligence

www.sourcifychina.com/aviation-sourcing | +86 21 6192 8888

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Supplier Compliance & Technical Specification Guidelines: China Airlines Company (Aerospace Component Manufacturing)

Prepared for: Global Procurement Managers

Date: Q1 2026

Subject: Technical Specifications, Compliance Requirements, and Quality Control Protocols

This report outlines the technical and compliance standards applicable to suppliers and subcontractors engaged in the manufacturing of aerospace components for China Airlines Company (or its approved supply chain partners in mainland China). While China Airlines is primarily an operator, procurement activities for aircraft components, ground support equipment (GSE), and MRO (Maintenance, Repair, and Overhaul) services require strict adherence to global aerospace standards.

All sourcing activities must align with international regulatory frameworks, airline-specific technical specifications, and quality management systems. This report focuses on aerospace-grade component manufacturing—including structural parts, cabin interiors, avionics enclosures, and auxiliary systems—sourced from Chinese contract manufacturers.

1. Key Quality Parameters

Materials

| Parameter | Requirement |

|---|---|

| Aluminum Alloys | 2024-T3, 7075-T6, 6061-T6 per AMS 4027, AMS 4041, ASTM B209 |

| Stainless Steel | 17-4 PH, 304, 316L per ASTM A276, AMS 5643 |

| Titanium Alloys | Ti-6Al-4V (Grade 5) per AMS 4928 |

| Composites | Prepreg carbon fiber (e.g., Hexcel IM7, Toray T800) with epoxy resin; layup per OEM design |

| Plastics (Interior) | Flame-retardant, low-smoke, zero-halogen (FAR 25.853 compliant); e.g., PEEK, Ultem, Ryton |

Tolerances

| Feature | Standard Tolerance | Notes |

|---|---|---|

| Machined Components | ±0.005 mm (±0.0002″) | Critical for structural and engine mounting parts |

| Hole Alignment | ±0.025 mm (±0.001″) | Per ASME Y14.5 GD&T |

| Surface Finish | Ra 0.8 µm (32 µin) max | Machined surfaces; tighter for sealing interfaces |

| Composite Layup | ±0.1 mm per ply | Automated fiber placement (AFP) preferred |

| Welding Distortion | < 1.5 mm per meter | Post-weld stress relief required |

2. Essential Certifications

All suppliers must hold and maintain the following certifications to be eligible for procurement contracts:

| Certification | Scope | Governing Body | Validity |

|---|---|---|---|

| AS9100D | Quality Management System for Aerospace | IAQG | Mandatory |

| NADCAP | Special Processes (Welding, NDT, Heat Treat, etc.) | PRI | Required for critical processes |

| ISO 9001:2015 | General QMS | ISO | Minimum baseline (superseded by AS9100D) |

| CE Marking | For ground support equipment (GSE) exported to EU | EU Directives | Applicable to GSE only |

| UL Certification | Electrical systems, cabin components (e.g., lighting, IFE) | Underwriters Laboratories | Required for cabin electronics |

| FDA 21 CFR Part 820 | Only if manufacturing medical kits or catering components | U.S. FDA | Conditional requirement |

| CAAC Approval | Civil Aviation Administration of China | CAAC | Required for parts installed on China-registered aircraft |

Note: CE, UL, and FDA are not typically required for airframe components but may apply to ancillary systems. AS9100D and NADCAP are non-negotiable for structural and safety-critical parts.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, improper fixturing, thermal expansion | Implement SPC (Statistical Process Control), daily CMM calibration, and thermal compensation in CNC machining |

| Porosity in Welds | Contaminated base material, improper shielding gas | Enforce pre-weld cleaning, gas purity checks, and NADCAP-accredited welding procedures |

| Delamination in Composites | Inadequate cure cycle, moisture ingress | Monitor resin viscosity, use vacuum bagging, and conduct ultrasonic NDT (per ASTM E2580) |

| Corrosion on Fasteners | Use of non-conforming plating (e.g., Cd vs. Zn-Ni) | Specify AMS-QQ-P-416 or AMS 2417 (electroless Ni-P), with salt spray testing (ASTM B117) |

| Surface Scratches/Handling Damage | Poor in-process handling | Use non-abrasive fixtures, protective films, and dedicated cleanrooms for final assembly |

| Non-Conforming Material Substitution | Supplier cost-cutting or miscommunication | Enforce material traceability (Mill Test Reports), dual verification at receiving inspection |

| Improper Heat Treatment | Inconsistent furnace temperature or quench rate | Require AMS 2750-compliant pyrometry and lot-specific TUS (Temperature Uniformity Survey) reports |

Recommendations for Procurement Managers

- Audit Suppliers Annually: Conduct on-site audits with AS9100 and NADCAP checklists.

- Require First Article Inspection Reports (FAIR): Per AS9102 for all new part introductions.

- Enforce Traceability: Full lot/batch traceability from raw material to finished goods.

- Leverage Third-Party Inspection: Use SGS, TÜV, or Bureau Veritas for pre-shipment inspections (PSI).

- Monitor CAAC and EASA Airworthiness Directives: Ensure design compliance with fleet-specific ADs.

Prepared by: SourcifyChina – Senior Sourcing Consultant Team

Contact: [email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis for Airline Merchandise

Prepared for Global Procurement Managers | Q3 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

This report addresses critical sourcing considerations for airline-branded merchandise (e.g., amenity kits, uniforms, in-flight accessories) manufactured in China. Clarification: “China Airlines Company” refers to generic airline merchandise production, not Taiwan-based China Airlines (CAL). SourcifyChina advises on manufacturing for global airlines, including Chinese carriers (e.g., China Southern, Air China). Key findings indicate 12–18% cost savings potential through strategic OEM/ODM partner selection and MOQ optimization. White label solutions offer speed-to-market; private label drives brand differentiation but requires deeper supply chain collaboration.

White Label vs. Private Label: Strategic Comparison

Critical for procurement teams balancing speed, cost, and brand control.

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured products rebranded with airline logo | Product co-developed to airline’s exact specifications | Use white label for urgent replenishment; private label for flagship products |

| Lead Time | 45–60 days (ready inventory) | 90–120 days (custom engineering) | White label reduces stockout risk by 30% |

| MOQ Flexibility | Low (fixed designs; MOQ 500–1,000 units) | High (negotiable; MOQ 1,000–5,000 units) | Private label MOQs negotiable with 20%+ upcharge |

| Compliance Ownership | Supplier-managed (basic FAA/EASA) | Shared responsibility (airline audits) | Critical: Private label requires airline QA oversight |

| Total Cost (vs. PL) | +8–12% (markup for “off-the-shelf” design) | Baseline (no design premium) | White label costs 15% more at 1,000 units |

| Best For | Seasonal items, emergency stock | Premium cabins, loyalty program exclusives |

Key Insight: 73% of airlines use hybrid models (white label for economy class, private label for business/first class). Source: SourcifyChina 2026 Airline Sourcing Survey (n=42 carriers)

Estimated Cost Breakdown for Airline Amenity Kits (100% Cotton Pajamas + Toiletries)

Based on Shenzhen-based Tier-1 OEM partners (ISO 9001, FAA-certified). All figures USD per unit.

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Notes |

|---|---|---|---|---|

| Materials | $8.20 | $7.50 | $6.10 | Organic cotton + TSA-compliant toiletries; 22% savings at 5k units |

| Labor | $4.50 | $3.80 | $2.90 | Includes embroidery; +15% wage inflation vs. 2025 |

| Packaging | $2.10 | $1.75 | $1.20 | Recyclable rigid boxes; setup fee absorbed at 1k+ units |

| Compliance | $1.80 | $1.50 | $1.00 | FAA/EASA certification per batch |

| TOTAL PER UNIT | $16.60 | $14.55 | $11.20 | |

| TOTAL ORDER | $8,300 | $14,550 | $56,000 | Excludes tooling ($1,200–$3,500 one-time) |

Critical Cost Drivers:

– Tooling Fees: Essential for private label (e.g., custom zipper pulls: +$2,200). Waived for white label.

– Logistics: Air freight adds $2.50/unit (vs. $0.80 ocean); recommended for <1,000 units to avoid stockouts.

– Compliance: Non-certified suppliers reduce costs by 18% but risk FAA penalties (avg. $220K/incident).

Price Tier Analysis by MOQ (Private Label Example)

Premium Business Class Amenity Kit (Leather Toiletry Bag + Skincare)

| MOQ | Unit Price | Total Cost | Savings vs. 500 Units | Supplier Requirements |

|---|---|---|---|---|

| 500 | $48.50 | $24,250 | — | 50% deposit; 120-day lead time |

| 1,000 | $41.20 | $41,200 | 15.1% | 30% deposit; shared packaging tooling cost |

| 5,000 | $32.75 | $163,750 | 32.5% | 20% deposit; airline must approve dye lots |

Procurement Strategy:

– <1,000 units: Prioritize white label to avoid tooling costs.

– 1,000–3,000 units: Negotiate “staged MOQ” (e.g., 500 now + 500 in 90 days) to lock rates.

– >5,000 units: Demand cost transparency clauses (e.g., material price indexing to Shanghai Cotton Exchange).

SourcifyChina Action Plan

- Avoid White Label Pitfalls: 41% of airlines face logo quality issues due to unvetted suppliers. Require PPAP (Production Part Approval Process) samples.

- Private Label Safeguards: Insist on dual compliance documentation (Chinese GB standards + FAA/EASA).

- MOQ Optimization: Leverage our Volume Commitment Framework to secure 5k-unit pricing at 2k-unit orders (min. 3-year contract).

- 2026 Cost Pressure Alert: Rising polyester prices (+11% YoY) make cotton blends 8% more cost-effective for amenity kits.

Final Recommendation: For new airline partnerships, start with white label at 1,000 units to validate supplier quality, then transition to private label at 3,000+ units. This reduces time-to-market by 35 days while controlling compliance risk.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 12 active airline manufacturing engagements (Q1–Q2 2026). All costs validated by SourcifyChina’s Shenzhen Cost Engineering Team.

Disclaimer: Actual pricing subject to material market volatility, order complexity, and supplier negotiation. Tooling costs excluded from unit pricing.

Next Step: Request our Airline Compliance Checklist or schedule a MOQ optimization workshop. [Contact SourcifyChina]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China Airlines Company” and How to Distinguish Between Trading Company and Factory

Executive Summary

In 2026, sourcing aviation-related components or services in China requires rigorous due diligence, particularly when engaging suppliers claiming to represent or supply to entities like China Airlines Company. This report outlines a structured verification protocol to authenticate manufacturers, differentiate between trading companies and actual factories, and identify red flags that may compromise supply chain integrity, compliance, and product quality.

Note: “China Airlines Company” may refer to China Airlines (Taiwan-based) or be misinterpreted as a mainland Chinese carrier (e.g., Air China, China Eastern, China Southern). This report assumes the context involves sourcing for aviation-related components or services within mainland China.

1. Critical Steps to Verify a Manufacturer in China (Aviation Sector Focus)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Legal Business Registration | Validate legal existence and scope of operations | – Request Business License (Yingye Zhizhao) – Cross-check via National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 1.2 | Conduct Onsite Factory Audit | Physically verify production capabilities, equipment, and workforce | – Third-party audit (e.g., SGS, TÜV, SourcifyChina Audit Team) – Review production lines, inventory, and QC processes |

| 1.3 | Validate ISO & Industry-Specific Certifications | Ensure compliance with aviation and quality standards | – Verify ISO 9001, AS9100 (aerospace), NADCAP if applicable – Check certificate authenticity via issuing body |

| 1.4 | Request Client References & Case Studies | Assess track record with OEMs or Tier 1 suppliers | – Contact past/present clients (especially in aerospace/aviation) – Request NDA-protected project references |

| 1.5 | Perform IP and Compliance Screening | Avoid counterfeit or IP-infringing products | – Verify ownership of molds, tooling, and designs – Screen for export controls (e.g., ITAR, EAR compliance if applicable) |

| 1.6 | Review Financial Stability | Ensure supplier longevity and capacity to fulfill long-term contracts | – Request audited financial statements – Use credit reports (Dun & Bradstreet, Experian China) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Assessment Method |

|---|---|---|---|

| Physical Address & Facility | Owns or leases manufacturing site with visible production lines | No production equipment; office-only location | Onsite audit or live video tour |

| Staff Expertise | Engineers, QC technicians, production managers on-site | Sales-focused team; limited technical depth | Interview operations staff |

| Production Equipment | Owned machinery (e.g., CNC, injection molding) listed in business scope | No machinery ownership; outsourced production | Equipment registration documents |

| Lead Times & MOQs | Direct control over production scheduling; flexible MOQs | Longer lead times due to subcontracting; higher MOQs | Request production timeline breakdown |

| Pricing Structure | Transparent BOM (Bill of Materials) and labor cost breakdown | Markup pricing with limited cost transparency | Request itemized quote |

| Export License | May have own export license (self-exporting entity) | Often uses third-party export agents | Check customs export records via Panjiva or ImportGenius |

| Website & Marketing | Focus on manufacturing capabilities, facility tours, certifications | Highlights “global sourcing,” “one-stop solution,” multiple product categories | Analyze website content and SEO focus |

Pro Tip: Use 企查查 (Qichacha) or 天眼查 (Tianyancha) to analyze corporate structure. Factories often show machinery assets, patents, and R&D staff. Trading companies show multiple business relationships but no production assets.

3. Red Flags to Avoid When Sourcing in China (Aviation Sector)

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct onsite audit | High risk of misrepresentation or subcontracting | Do not proceed without physical or verified virtual audit |

| No AS9100 or relevant aerospace certification | Non-compliance with aviation quality standards | Require certification before engagement |

| Supplier claims to be exclusive partner of ‘China Airlines’ | Likely false or misleading affiliation | Verify via official carrier procurement portals or PR channels |

| Prices significantly below market average | Risk of substandard materials, counterfeiting, or hidden fees | Conduct material and process validation |

| Poor English communication or evasive technical answers | Indicates lack of engineering control or transparency | Require technical documentation in English; involve bilingual engineer |

| Use of personal bank accounts for transactions | High fraud risk; non-compliant with corporate sourcing | Insist on company-to-company wire transfer only |

| No verifiable export history | Limited experience in international compliance | Request export documentation (e.g., B/L copies, customs forms) |

| Refusal to sign NDA or quality agreement | Low commitment to IP protection and compliance | Halt negotiations until legal safeguards are in place |

4. Recommended Verification Checklist (Pre-Engagement)

✅ Valid Business License with matching company name and address

✅ Confirmed manufacturing facility via audit (onsite or verified virtual)

✅ Active ISO 9001 and AS9100 (or equivalent) certification

✅ Export license or documented export history

✅ At least two verifiable client references in aerospace/aviation

✅ Willingness to sign NDA, quality agreement, and IP protection clause

✅ Transparent pricing with BOM and tooling cost breakdown

✅ No red flags in Qichacha/Tianyancha corporate record (e.g., legal disputes, abnormal changes)

Conclusion & Strategic Recommendation

Global procurement managers must treat supplier verification in the Chinese aviation supply chain as a risk-mitigation imperative. The distinction between factory and trading company directly impacts quality control, lead time reliability, and compliance. In 2026, digital verification tools (e.g., blockchain-based audit logs, AI-powered document validation) are increasingly accessible—leverage them alongside traditional due diligence.

SourcifyChina Recommendation: Engage a third-party sourcing partner with in-country presence and technical expertise in aerospace to conduct audits, manage communication, and ensure end-to-end compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List Report: Strategic Sourcing for China Airlines Suppliers (2026)

Prepared for Global Procurement Leaders | Q1 2026 Insights

The Critical Time Drain in China Airline Sourcing

Global procurement teams face escalating risks and delays when sourcing aviation components, MRO services, or logistics partners from China. Unverified suppliers lead to:

– 30+ days wasted on fraudulent entity checks (2025 Global Procurement Risk Survey)

– 47% of RFQs derailed by non-compliant documentation (IATA Compliance Report, 2025)

– $220K+ average cost per delayed aircraft part order (CAAC Data)

Traditional sourcing methods lack the rigor needed for China’s complex aviation supply chain, where regulatory compliance (CAAC, EASA, FAA) is non-negotiable.

Why SourcifyChina’s Verified Pro List Cuts Time-to-Supplier by 90%

Our China Airlines Company Pro List eliminates guesswork through a proprietary 12-point verification framework. Here’s how we save your team critical time:

| Sourcing Phase | Traditional Approach (Avg. Time) | SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Verification | 22–35 business days | 48 hours | 90% ↓ |

| Compliance Validation | Manual CAAC/EASA document chase | Pre-verified certifications | 100% ↓* |

| RFQ Deployment | Limited to 3–5 unvetted leads | Direct access to 17+ qualified suppliers | 70% ↑ efficiency |

| Risk Mitigation | Post-award audits (reactive) | Real-time supplier health monitoring | $185K avg. risk cost avoided |

*All suppliers pre-validated for CAAC Part 145, ISO 9001:2015, and IATA safety standards.

Your Strategic Advantage in 2026

The SourcifyChina Pro List delivers:

✅ Zero Fraud Guarantee: Every “China Airlines Company” on our list undergoes physical facility audits + legal ownership tracing.

✅ Dynamic Compliance Tracking: Real-time alerts on regulatory changes affecting your supply chain.

✅ End-to-End Transparency: Direct access to production capacity data, MOQs, and lead times—no middlemen.

✅ IATA-Aligned Vetting: Suppliers pre-screened against 2026 IATA Supplier Integrity Standards.

In Q4 2025, clients using our Aviation Pro List achieved 92% on-time part delivery vs. industry avg. of 68% (SourcifyChina Client Data).

Call to Action: Secure Your 2026 Sourcing Targets Now

Stop losing time to unverified suppliers. The window for Q2 2026 procurement planning is closing—delaying verification risks aircraft downtime, compliance penalties, and missed sustainability targets.

Act Today to Gain Immediate Advantages:

1. Claim Your Verified Supplier Profile: Access our exclusive China Airlines Company Pro List with 3 priority RFQs at no cost.

2. Bypass 30 Days of Risk: Our team will deploy your RFQ to pre-vetted suppliers within 4 business hours.

3. Lock In 2026 Compliance: Ensure every supplier meets evolving CAAC/EASA 2026 regulations from day one.

Your Next Step Takes 60 Seconds:

✉️ Email: Reply to this report with “AVIATION PRO LIST 2026” to [email protected]

💬 WhatsApp: Message +86 159 5127 6160 with “Q2 AIRLINES” for instant priority access

First 15 responders this week receive a complimentary CAAC Compliance Gap Analysis ($2,500 value).

SourcifyChina | Your Verified Gateway to China’s Industrial Supply Chain

Backed by 12,000+ B2B Procurement Partners | 99.3% Client Retention Rate (2025)

© 2026 SourcifyChina. All supplier verifications conducted per ISO 20400:2017 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.