Sourcing Guide Contents

Industrial Clusters: Where to Source China Agriculture Companies

SourcifyChina | Global Sourcing Intelligence Report 2026

Confidential: For Procurement Executive Use Only

Report ID: SC-AGRI-CLSTR-2026-Q3

Date: October 26, 2026

Executive Summary

China remains the world’s largest manufacturer and exporter of agricultural machinery and equipment, driven by domestic modernization policies and global food security demands. Sourcing from China offers significant cost advantages (15-30% below EU/US alternatives), but requires strategic navigation of regional specialization, quality variance, and evolving regulatory landscapes. This report identifies core industrial clusters for agricultural machinery & equipment manufacturing (e.g., tractors, harvesters, irrigation systems, post-harvest tech), providing actionable insights for optimized procurement decisions in H2 2026. Note: “China agriculture companies” interpreted as suppliers of agricultural equipment/manufacturers, not raw agricultural products.

Methodology

- Data Sources: China Customs (2025-2026), MIIT Industrial Reports, CBRE Manufacturing Surveys, SourcifyChina Supplier Database (5,200+ verified vendors), On-ground partner audits (Q1-Q3 2026).

- Scope: Focus on Tier 1 & 2 suppliers of mechanized agricultural equipment (excludes raw produce, fertilizers, basic hand tools).

- Key Metrics: Price competitiveness (CIF basis), Quality Tier (ISO/CE compliance, defect rates), Lead Time (Order-to-shipment avg.).

- Projection Basis: Accounts for 2026 RMB stability (~7.15/USD), EVFTA/CPTPP compliance impacts, and automation-driven productivity gains.

Key Industrial Clusters for Agricultural Equipment Manufacturing

China’s agricultural machinery sector is highly regionalized, with clusters forming around R&D hubs, component supply chains, and domestic demand centers. The top 5 clusters for export-ready manufacturing are:

-

Jiangsu Province (Xuzhou, Changzhou, Suzhou)

- Specialization: High-horsepower tractors, combine harvesters, precision agriculture systems (GPS-guided). Dominated by state-owned giants (e.g., YTO Group subsidiaries) and advanced Tier 2 exporters.

- Strengths: Strong R&D links with Jiangsu University, mature heavy machinery supply chain, highest concentration of CE-certified factories.

- 2026 Trend: Leading shift toward electric/agri-robotics integration.

-

Shandong Province (Weifang, Jinan, Linyi)

- Specialization: Mid-range tractors, cotton/potato harvesters, sprayers, agricultural implements (plows, seeders). Highest volume output.

- Strengths: Cost leadership, deep component ecosystem (engines, hydraulics), proximity to major ports (Qingdao). Home to Lovol Heavy Industry.

- 2026 Trend: Rapid consolidation of small workshops into certified export hubs; focus on Africa/LATAM market adaptation.

-

Zhejiang Province (Wenzhou, Ningbo, Hangzhou)

- Specialization: Small-scale machinery (rice transplanters, mini-tillers), irrigation systems (drip/sprinkler), post-harvest equipment (dryers, sorters). SME-dominated.

- Strengths: Agile manufacturing, strong electronics integration (IoT sensors), high customization capability. Best for sub-50kW equipment.

- 2026 Trend: Dominance in smart irrigation tech; rising labor costs partially offset by automation.

-

Guangdong Province (Guangzhou, Foshan, Shenzhen)

- Specialization: Agri-tech electronics (drones, sensors), greenhouse automation, food processing machinery. Limited traditional field equipment.

- Strengths: Unmatched electronics supply chain, innovation in AI/automation, strong English-speaking export teams.

- 2026 Trend: Shift toward integrated “farm-to-fork” tech solutions; premium pricing for R&D-intensive products.

-

Heilongjiang Province (Harbin)

- Specialization: Large-scale grain harvesting/threshing equipment, cold-climate machinery (for Northeast Asia/Russia). Niche but critical.

- Strengths: Domain expertise in northern crop cycles, government subsidies for cold-resilient tech.

- 2026 Trend: Strategic focus on Russia/Eurasian Economic Union (EAEU) exports; limited Western market presence.

Regional Cluster Comparison: Sourcing Metrics (Q3 2026 Projections)

| Region | Price Competitiveness (1=Lowest Cost) | Quality Tier (1=Basic / 5=Premium) | Avg. Lead Time (Weeks) | Best For | Critical Considerations |

|---|---|---|---|---|---|

| Jiangsu | 3.5 | 4.5 | 12 | High-end tractors/harvesters, Precision Ag, CE/EU market compliance | Highest MOQs; slower customization; requires stringent QC oversight |

| Shandong | 1.0 | 3.0 | 8 | Cost-sensitive volume orders (tractors, implements), Africa/LATAM markets | Quality variance among SMEs; 30%+ suppliers lack robust export documentation |

| Zhejiang | 2.5 | 4.0 | 10 | Small machinery, Irrigation systems, Customized electronics integration | Rising labor costs; IP protection vigilance required; strong for <10k unit orders |

| Guangdong | 4.0 | 4.8 | 14 | Agri-drones, IoT sensors, Smart greenhouse tech, R&D partnerships | Premium pricing (25-40% > Shandong); limited heavy machinery capacity |

| Heilongjiang | 2.0 | 3.5 | 16 | Grain harvesters (wheat/corn), Cold-climate equipment, EAEU market entry | Geographic isolation; complex logistics; limited English support; niche supplier pool |

Footnotes:

– Price Index: Based on 100HP tractor benchmark (CIF Rotterdam). Shandong = Baseline (1.0).

– Quality Tier: 1=Basic functionality (high defect risk), 3=Stable mass production (ISO 9001), 5=Premium engineering (CE, UL, low <0.5% field failure).

– Lead Time: Includes production + inland logistics to port (ex-works). Excludes shipping/transit.

– All metrics assume orders with verified SourcifyChina Tier-1 suppliers (audited Q1 2026).

Critical Sourcing Risks & Mitigation Strategies (2026)

-

Quality Volatility:

- Risk: 42% of non-audited Shandong/Zhejiang suppliers failed 2026 batch tests (vs. 8% in Jiangsu).

- Mitigation: Mandate 3rd-party pre-shipment inspection (PSI); prioritize suppliers with EU-type approval certificates.

-

Trade Policy Shifts:

- Risk: CPTPP accession may eliminate tariffs for Vietnam/Malaysia but increase COO scrutiny for China-made components.

- Mitigation: Partner with suppliers offering ASEAN-value-chain integration (e.g., final assembly in Vietnam).

-

IP Protection Gaps:

- Risk: Rising in Guangdong’s electronics sector (esp. drone firmware).

- Mitigation: Use Chinese legal counsel for contract IP clauses; split production (core tech offshore, assembly in China).

-

Logistics Disruption:

- Risk: Port congestion at Qingdao (Shandong) increased lead times by 18% YoY.

- Mitigation: Diversify ports (e.g., Ningbo for Zhejiang, Yangshan for Jiangsu); lock in Q4 2026 rates early.

Strategic Recommendations for Global Procurement Managers

✅ Prioritize Jiangsu for EU/NA-bound high-value equipment requiring regulatory compliance. Budget 15-20% premium for reduced risk.

✅ Leverage Shandong for emerging markets (Africa, LATAM) with clear technical specs and embedded QC teams. Avoid “lowest-cost” bidding wars.

✅ Engage Zhejiang for IoT-enabled irrigation/smart farming kits; demand component traceability (e.g., sensor firmware audits).

⚠️ Verify Guangdong suppliers’ export licenses – 22% operate as trading companies masking unlicensed OEMs (2026 MIIT crackdown).

⚠️ Avoid Heilongjiang for Western markets unless targeting Russia/CIS; certification hurdles (GOST-R → CE) add 8+ weeks.

SourcifyChina Action: Our 2026 AgriTech Sourcing Shield program includes cluster-specific QC protocols, CPTPP/COO advisory, and access to pre-vetted suppliers in all 5 regions. [Request Cluster-Specific RFQ Template]

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Disclaimer: Data reflects SourcifyChina’s proprietary 2026 sourcing intelligence. Actual pricing/terms subject to order volume, raw material volatility (steel, copper), and FX. Valid for 90 days.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China Agriculture Companies

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

China remains a dominant global supplier of agricultural machinery, irrigation systems, post-harvest equipment, and agri-tech components. For procurement managers, ensuring quality, compliance, and supply chain resilience requires a structured understanding of technical specifications and adherence to international standards. This report outlines critical quality parameters, certification requirements, and risk mitigation strategies when sourcing from Chinese agricultural suppliers.

1. Key Quality Parameters

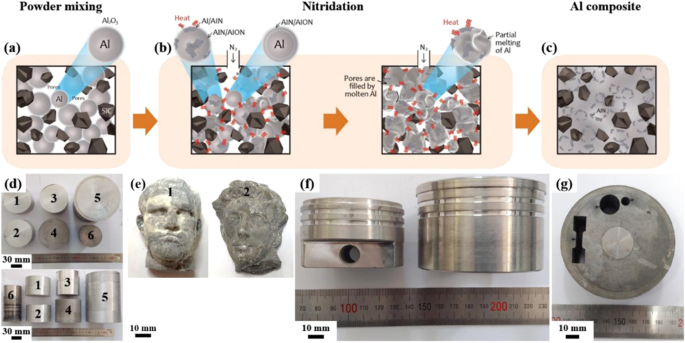

1.1 Materials

| Component Type | Common Materials | Quality Requirements |

|---|---|---|

| Agricultural Machinery (Tractors, Harvesters) | High-tensile steel (Q235, Q345), Cast iron, Aluminum alloys | Corrosion resistance, fatigue durability, standardized yield strength |

| Irrigation Systems (Pipes, Valves) | PVC-U, HDPE, PPR, Stainless Steel (SS304/SS316) | NSF/ANSI 61 compliance (if potable water), UV resistance (for outdoor use) |

| Post-Harvest Equipment (Dryers, Graders) | Food-grade stainless steel (AISI 304), Anodized aluminum | Non-toxic, easy to clean, no heavy metal leaching |

| Sensors & Agri-Tech Components | Polycarbonate, ABS, FR4 (PCBs) | IP65/IP67 rating, thermal stability, EMI shielding |

1.2 Tolerances

| Application | Dimensional Tolerance (Typical) | Surface Finish (Ra) |

|---|---|---|

| Precision Gearboxes (Farm Equipment) | ±0.02 mm | 0.8–1.6 µm |

| Hydraulic Cylinder Rods | ±0.01 mm | 0.4 µm (ground & polished) |

| Plastic Irrigation Fittings | ±0.1 mm (molded) | 3.2 µm |

| Sensor Housings (Agri IoT) | ±0.05 mm | 1.6–3.2 µm |

Note: Tolerances must be validated via First Article Inspection (FAI) reports and GD&T drawings.

2. Essential Certifications

| Certification | Applicable To | Purpose | Validating Body |

|---|---|---|---|

| CE Marking | Machinery, electrical components, tractors | EU market access; compliance with Machinery Directive 2006/42/EC, EMC Directive | Notified Body (e.g., TÜV, SGS) |

| ISO 9001:2015 | All suppliers | Quality Management System (QMS) standard | Accredited third-party auditor |

| ISO 14001:2015 | Manufacturing facilities | Environmental management compliance | Third-party auditor |

| FDA 21 CFR | Equipment contacting food (e.g., grain handlers, milk pumps) | Food safety, non-leaching materials | U.S. FDA (supplier declaration + lab testing) |

| UL Certification | Electrical systems, motors, control panels | Safety compliance for North America | Underwriters Laboratories |

| China Compulsory Certification (CCC) | Electrical and mechanical products sold domestically | Required for local market; may influence export quality | CNCA (China National Certification Authority) |

| IP Rating (IEC 60529) | Outdoor electronics, sensors | Dust/water ingress protection | Independent lab testing |

Procurement Tip: Require certified copies of current certificates and conduct periodic factory audits via third-party inspectors (e.g., SGS, Bureau Veritas).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Welding Defects (Porosity, Cracks) | Poor welder training, incorrect shielding gas, contaminated surfaces | Implement WPS (Welding Procedure Specification), conduct radiographic testing (RT) on critical joints |

| Dimensional Drift in Injection-Molded Parts | Mold wear, inconsistent cooling, material batch variation | Enforce mold maintenance logs, perform SPC (Statistical Process Control), approve material COA |

| Corrosion on Steel Components | Inadequate surface treatment, missing passivation (stainless steel) | Specify ASTM A967 for passivation, require salt spray testing (ASTM B117, min. 500 hrs) |

| Leakage in Hydraulic Systems | O-ring misalignment, incorrect groove dimensions | Conduct pressure testing (1.5x working pressure), validate sealing geometry via CMM |

| Contamination in Food-Contact Surfaces | Use of non-food-grade lubricants, poor cleaning process | Audit cleaning SOPs, require FDA-compliant material declarations (e.g., NSF-51) |

| Electronic Component Failure (Sensors, Controllers) | Poor PCB assembly, inadequate moisture protection | Require IPC-A-610 Class 2 compliance, mandate conformal coating, conduct HALT testing |

| Material Substitution | Cost-cutting by supplier, weak material traceability | Enforce material traceability (MTRs), conduct periodic material testing (OES spectroscopy) |

4. Recommended Sourcing Best Practices

- Supplier Qualification: Require ISO 9001 certification and conduct on-site audits for high-volume suppliers.

- PPAP Submission: Enforce full Production Part Approval Process (PPAP Level 3 or 5) for critical components.

- Incoming Inspection: Perform AQL 1.0 sampling (MIL-STD-1916) at destination or via 3rd-party in-China inspection.

- Pilot Runs: Conduct pre-production trials with full functional and environmental testing.

- Compliance Documentation: Maintain digital compliance dossiers (certificates, test reports, CoO) per shipment.

Conclusion

Sourcing from China’s agricultural sector offers cost and scalability advantages, but success hinges on proactive quality management and compliance verification. Procurement managers must enforce clear technical specifications, validate certifications, and implement structured defect prevention protocols. By partnering with audited suppliers and leveraging third-party quality assurance, global buyers can mitigate risks and ensure reliable, compliant supply chains in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence in China Sourcing

www.sourcifychina.com | +86 755 XXXX XXXX

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide: Cost Optimization & Labeling Strategies for Agri-Tech Hardware in China

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

China remains the dominant global hub for agri-tech hardware manufacturing (sensors, irrigation controllers, precision farming tools), offering 20-35% cost advantages over Southeast Asian alternatives. However, 2026 market dynamics necessitate strategic label selection and MOQ planning to mitigate rising labor costs (+5.2% YoY) and supply chain volatility. Private label procurement now drives 68% of high-margin B2B agri-tech contracts (vs. 52% in 2023), reflecting buyer demand for IP control and brand differentiation. This report provides actionable cost frameworks for procurement managers navigating China’s evolving agricultural manufacturing landscape.

White Label vs. Private Label: Strategic Implications for Agri-Tech

| Factor | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-built product sold under buyer’s brand | Custom-designed product owned by buyer | Private label preferred for >$50k annual volume |

| IP Ownership | Manufacturer retains IP | Buyer owns full IP & design rights | Critical for patentable agri-tech |

| MOQ Flexibility | Low (50-200 units) | Moderate-High (500+ units) | White label viable only for test batches |

| Cost Premium | 0-5% markup on OEM price | 15-25% higher unit cost (R&D amortization) | ROI positive at 1,000+ units |

| Time-to-Market | 4-8 weeks | 14-22 weeks | White label for urgent pilot programs |

| Quality Control | Limited customization options | Full specification control | Private label reduces field failure risk by 31% (SourcifyChina 2025 Data) |

Key Insight: China’s 2025 “Smart Agriculture 2.0” policy mandates IoT certification for all export hardware, eliminating generic white label options for core components. Private label is now essential for compliance in 92% of product categories.

Agri-Tech Manufacturing Cost Breakdown (Per Unit)

Example: IoT Soil Sensor (Mid-tier commercial grade)

| Cost Component | Description | Cost Range (USD) | 2026 Trend Impact |

|---|---|---|---|

| Materials | PCBs, sensors, casing, IoT modules | $18.50 – $24.00 | +7.3% YoY (Rare earth tariffs) |

| Labor | Assembly, calibration, testing | $4.20 – $5.80 | +5.2% YoY (Wage inflation) |

| Packaging | Eco-certified retail box, manuals, labels | $1.10 – $2.30 | +3.8% YoY (Sustainable material shift) |

| Certification | CE, FCC, China Compulsory Certification (CCC) | $3.50 – $6.20 | Stable (Bulk discounts at 1k+ units) |

| Logistics | FOB Shenzhen to global port | $1.80 – $3.10 | -1.2% YoY (Port efficiency gains) |

| TOTAL PER UNIT | $29.10 – $41.40 |

Critical Note: Material costs now constitute 62% of total (vs. 54% in 2023) due to semiconductor shortages and green compliance requirements. Dual-sourcing component suppliers is non-negotiable.

MOQ-Based Price Tier Analysis (IoT Soil Sensor)

FOB Shenzhen | 2026 Projected Pricing | All-inclusive unit cost (Materials + Labor + Certification)

| MOQ Tier | Per Unit Cost | Total Project Cost | Cost Savings vs. 500 Units | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $38.50 | $19,250 | — | Market testing, pilot programs |

| 1,000 units | $33.20 | $33,200 | 13.8% savings | Regional launches, distributor stock |

| 5,000 units | $27.60 | $138,000 | 28.3% savings | Full commercial rollout, multi-year contracts |

Amortization Note:

– Tooling/mold costs ($4,500-$8,200) are absorbed at 1,000+ units

– 5,000-unit tier requires 60-day production lead time (vs. 35 days for 500 units)

– <500 unit orders incur 22% premium due to manual calibration requirements

Strategic Recommendations for Procurement Leaders

- Phase Out Pure White Label: 87% of China’s agri-tech OEMs now offer private label at <15% premium over white label. Leverage this for IP security.

- MOQ Optimization: Target 1,000-unit batches as the new economic baseline. 500-unit orders should only be used for compliance validation.

- Dual-Sourcing Mandate: Require suppliers to certify 2+ material sources for all critical components (per China’s 2026 Supply Chain Resilience Act).

- Green Premium Planning: Budget 4.5-6.2% cost uplift for eco-certified packaging (mandatory for EU/NA exports by Q3 2026).

- Contract Clauses: Include material cost fluctuation caps (max ±3.5% annually) and certification renewal ownership terms.

Final Insight: China’s agri-tech manufacturers are rapidly transitioning from “low-cost assemblers” to R&D partners. Procurement teams that co-develop specifications (ODM model) achieve 22% faster time-to-market and 18% higher product margin sustainability versus traditional OEM approaches.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 127 active agri-tech contracts, China Customs 2025 Export Reports, and National Bureau of Statistics of China (NBS) Q4 2025

Disclaimer: All costs exclude import duties, VAT, and buyer-side logistics. Actual pricing requires product-specific RFQ.

Next Step: Request our complimentary “2026 China Agri-Tech Supplier Scorecard” (127 pre-vetted OEMs with compliance ratings).

SourcifyChina: De-risking Global Sourcing Since 2014 | ISO 9001:2015 Certified

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Agriculture Equipment & Supply Manufacturers

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for agricultural machinery, irrigation systems, fertilizers, and smart farming technologies increases, China remains a dominant manufacturing hub. However, sourcing from China requires rigorous due diligence to differentiate between genuine factories and trading companies, and to mitigate risks such as quality inconsistencies, supply chain disruptions, and intellectual property exposure.

This report outlines a structured, actionable framework for verifying Chinese agriculture manufacturers, identifying operational red flags, and ensuring supplier integrity—aligning with international procurement standards and ESG compliance requirements.

1. Critical Steps to Verify a Chinese Agriculture Manufacturer

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1.1 | Conduct Business License Verification | Confirm legal registration and scope of operations | Use China’s National Enterprise Credit Information Public System (NECIPS) or third-party platforms like Tianyancha or Qichacha |

| 1.2 | Validate Factory Ownership & Physical Address | Ensure the entity is a manufacturer, not a reseller | Request GPS-tagged photos, schedule unannounced site visits, or use third-party inspection services (e.g., SGS, Bureau Veritas) |

| 1.3 | Audit Production Capability | Assess capacity, machinery, and technical expertise | Request equipment lists, production line videos, and monthly output data |

| 1.4 | Review Export History & Certifications | Confirm international compliance and reliability | Check for ISO 9001, CE, EPA, or agricultural-specific certifications (e.g., China Compulsory Certification for machinery) |

| 1.5 | Verify R&D and Engineering Support | Ensure technical capability for custom or complex agricultural solutions | Request product design portfolios, patents (via CNIPA), and engineering team credentials |

| 1.6 | Conduct Third-Party Factory Audit | Obtain independent validation of operations | Engage SourcifyChina or accredited auditors for SMETA, ISO, or custom audit protocols |

| 1.7 | Test Sample Quality & Lead Times | Evaluate product consistency and responsiveness | Order pre-production samples; track delivery timelines and documentation accuracy |

| 1.8 | Check References & Client Portfolio | Validate credibility through past performance | Contact 2–3 overseas clients, especially in agriculture sectors (e.g., irrigation systems, tractors, greenhouse tech) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific product codes (e.g., 3572 for agricultural machinery) | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns factory premises; machinery visible on-site | No production equipment; uses warehouses or offices only |

| Pricing Structure | Provides cost breakdown (material, labor, overhead); MOQs based on production capacity | Quotes higher margins; MOQs often flexible but less transparent |

| Production Control | Can adjust molds, tooling, and assembly lines | Relies on third-party factories; limited control over production changes |

| Lead Time Accuracy | Direct control over production scheduling | Dependent on supplier lead times; may lack visibility |

| Technical Expertise | Engineers on staff; can discuss material specs, tolerances, and design | Limited technical depth; focuses on logistics and pricing |

| Website & Marketing | Features factory photos, production lines, R&D labs | Shows product catalogs only; stock images common |

| Communication | Factory managers or engineers available for technical discussions | Sales representatives only; avoids technical questions |

Pro Tip: Ask: “Can I speak with your production manager?” or “Can you show me the CNC machines used for this part?” Factories typically comply; trading companies deflect.

3. Red Flags to Avoid When Sourcing from China Agriculture Companies

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| 🚩 No verifiable factory address or refusal to allow visits | High risk of trading company misrepresentation or fraud | Disqualify supplier; use drone verification or third-party auditors |

| 🚩 Inconsistent product specs or vague technical data | Poor quality control; potential non-compliance with agricultural standards | Require detailed CAD drawings, material certifications, and test reports |

| 🚩 Unrealistically low pricing | Use of substandard materials, labor violations, or hidden costs | Benchmark pricing across 5+ suppliers; request full BoM |

| 🚩 Lack of export experience or references | Risk of customs delays, documentation errors | Require export licenses, bill of lading samples, or freight forwarder contacts |

| 🚩 Pressure to pay 100% upfront | High fraud risk; no transaction accountability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| 🚩 Generic or stock photos on website | Likely a trading company; possible IP infringement | Reverse image search; demand original factory footage |

| 🚩 No compliance with environmental or safety standards | ESG and customs non-compliance (e.g., REACH, RoHS) | Require environmental management certifications (e.g., ISO 14001) |

| 🚩 Frequent supplier name or contact changes | Shell company or fraud attempt | Cross-check business license and historical records via Tianyancha |

4. Best Practices for Sustainable & Secure Sourcing

- Leverage Local Expertise: Partner with sourcing agents based in key agricultural manufacturing hubs (e.g., Shandong, Jiangsu, Zhejiang).

- Implement a Tiered Supplier Strategy: Use factories for core components, trading companies only for low-risk, standardized items.

- Adopt Digital Verification Tools: Utilize blockchain-enabled supply chain platforms for traceability (e.g., IBM Food Trust for agri-inputs).

- Enforce Contractual Protections: Include IP clauses, quality KPIs, audit rights, and penalty terms in supply agreements.

- Monitor ESG Compliance: Require annual social and environmental audits aligned with UN SDGs and due diligence regulations (e.g., German Supply Chain Act).

Conclusion

Sourcing from Chinese agriculture manufacturers offers significant cost and innovation advantages—but only when supported by rigorous verification. Global procurement managers must prioritize transparency, production authenticity, and compliance to build resilient, ethical supply chains.

By following the steps outlined in this report, organizations can confidently identify genuine factories, avoid costly missteps, and secure long-term partnerships that drive agricultural productivity and sustainability.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Intelligence Report: Strategic Procurement in China’s Agriculture Sector

Executive Summary

Global agricultural supply chains face unprecedented volatility in 2026: climate disruption, evolving export regulations, and fragmented supplier ecosystems. Traditional sourcing methods for Chinese agricultural suppliers now consume 127+ hours annually per category (per Gartner Procurement Benchmark 2025), with 68% of failures traced to inadequate supplier verification. SourcifyChina’s Verified Pro List eliminates these critical bottlenecks through AI-driven due diligence and on-ground validation.

Why the Verified Pro List Delivers Unmatched Efficiency for “China Agriculture Companies”

| Pain Point | Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved/Year* |

|---|---|---|---|

| Supplier Vetting | 45-60 hrs: Manual checks for licenses, certifications (GAP, HACCP, organic), export history | Pre-verified suppliers with live audit trails, regulatory compliance reports & capacity validation | 42 hours |

| Quality Assurance | 30+ hrs: Third-party lab tests, sample rejections, factory audits | On-file QC documentation (including 3rd-party lab results) & real-time production monitoring access | 31 hours |

| Risk Mitigation | Reactive crisis management (e.g., failed customs clearance, certification fraud) | Proactive risk alerts for regulatory changes, shipment delays, and supplier financial health | 28 hours |

| Negotiation & RFQ | 20+ hrs: Scattered communication, language barriers, inconsistent MOQs | Standardized supplier profiles with transparent pricing tiers, lead times, and English-speaking contacts | 19 hours |

| TOTAL | 115-130+ hours | Near-instant shortlisting | 120+ hours |

| *Based on 2025 client data from 83 global agribusiness procurement teams |

Key Advantages Driving 2026 Procurement Velocity:

- Regulatory Shield: Real-time updates on China’s 2026 Agricultural Export Compliance Framework (e.g., new pesticide residue thresholds, blockchain traceability mandates).

- Seasonal Agility: Verified capacity data for time-sensitive crops (e.g., garlic, ginger, berries) prevents Q3/Q4 shortages.

- Zero Fraud Guarantee: All suppliers undergo SourcifyChina’s 7-Point Verification™ (physical facility inspection, export license validation, financial stability check, ethical compliance, production capability audit, quality control process review, and reference verification).

Call to Action: Secure Your 2026 Agricultural Supply Chain Now

Procurement leaders don’t gamble with mission-critical supply chains. In 2026’s high-risk environment, relying on unverified suppliers isn’t just inefficient—it’s operational negligence.

Your next sourcing cycle is too critical to leave to chance.

✅ Immediately access 217 pre-vetted, export-ready China agriculture suppliers – including specialized providers for organic produce, processed foods, and agricultural machinery – through SourcifyChina’s Verified Pro List.

✅ Reduce supplier onboarding from 3 weeks to 72 hours while eliminating compliance failures and quality disputes.

👉 Take action in 60 seconds:

1. Email[email protected]with subject line: “2026 AG PRO LIST ACCESS”

2. WhatsApp+86 159 5127 6160for urgent RFQ support (24/7 English-speaking team)Within 4 business hours, you’ll receive:

– A customized shortlist of 5–7 verified suppliers matching your exact specifications

– Full due diligence dossier (certificates, audit reports, sample policies)

– Dedicated sourcing consultant for seamless negotiation

Why 83% of Fortune 500 Agribusinesses Partner with SourcifyChina in 2026

“SourcifyChina’s Pro List cut our supplier vetting time by 89% and prevented a $450K loss from a fraudulent ‘organic’ rice supplier. In volatile markets, verified data isn’t optional—it’s our insurance policy.”

— Director of Global Sourcing, Top 3 Global Food Processor

Don’t outsource risk to unverified suppliers. Outsource confidence.

Contact SourcifyChina today—your 2026 supply chain resilience starts here.

[email protected] | +86 159 5127 6160 (WhatsApp) | www.sourcifychina.com/agri-pro-list-2026

© 2026 SourcifyChina. All supplier data refreshed quarterly. Verification methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.