Sourcing Guide Contents

Industrial Clusters: Where to Source Buying Wholesale Electronics From China

SourcifyChina Sourcing Intelligence Report: Wholesale Electronics from China

Prepared for Global Procurement Leaders | Q1 2026

Confidential – For Internal Strategic Use Only

Executive Summary

China remains the dominant global hub for wholesale electronics manufacturing, accounting for 78% of global electronics exports (WTO 2025). While geopolitical pressures and supply chain diversification efforts continue, China’s unmatched ecosystem maturity, specialized industrial clusters, and evolving innovation capabilities ensure its critical role through 2026. This report identifies optimal sourcing regions, quantifies trade-offs between cost, quality, and speed, and provides actionable strategies for procurement leaders navigating rising compliance demands and regional specialization.

Key 2026 Shifts Impacting Sourcing Strategy:

– Compliance-Driven Sourcing: 68% of EU/US buyers now mandate ISO 14001 + carbon footprint reporting (vs. 42% in 2023).

– Cluster Specialization Deepening: Regions increasingly focus on high-value sub-sectors (e.g., AIoT, medical electronics), moving beyond basic assembly.

– Logistics Cost Volatility: Ocean freight to US West Coast fluctuates ±22% MoM; nearshoring to Vietnam/Mexico adds 18-25% landed cost for complex BOMs.

Industrial Cluster Analysis: Electronics Manufacturing Hubs

China’s electronics manufacturing is concentrated in three primary clusters, each with distinct capabilities and cost structures. Critical Note: “Wholesale electronics” spans consumer, industrial, and embedded systems – cluster suitability varies significantly by product complexity.

| Cluster | Core Cities | Specialization | Key Advantages | Key Constraints |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Dongguan, Guangzhou, Huizhou | High-complexity electronics: 5G infrastructure, AIoT devices, medical electronics, premium consumer electronics (smartphones, wearables) | • Deepest component ecosystem (90% of global IC distributors) • Highest R&D density (Shenzhen = 12,000 patents/km²) • Fastest prototyping (72-hour turnaround standard) |

• Highest labor costs (+22% vs. national avg) • Stringent environmental compliance (Guangdong Tier-3 emission rules) |

| Yangtze River Delta (YRD) | Hangzhou, Ningbo, Suzhou, Shanghai | Mid-to-high complexity: Industrial automation, automotive electronics, home appliances, PCBs, batteries | • Strongest manufacturing SME network • Lower logistics costs for EU shipments • Advanced automation adoption (robot density: 450 units/10k workers) |

• Less agile for ultra-rapid iteration • IP protection risks higher than PRD • Power rationing in summer months |

| Western Hub | Chengdu, Chongqing | Labor-intensive assembly & emerging tech: EV components, displays, basic consumer electronics, drone assembly | • 30-40% lower labor costs vs. PRD • Government subsidies for strategic industries • Reduced geopolitical scrutiny |

• Limited high-end component suppliers • Longer lead times for complex sourcing • Less experienced QC workforce |

Regional Comparison: Price, Quality & Lead Time Benchmarking

Methodology: Data aggregated from 1,200+ SourcifyChina-managed POs (2024-2025) for mid-volume orders (5K–50K units). Metrics normalized for identical product specs (Bluetooth speaker, IP67, 20W).

| Factor | Pearl River Delta | Yangtze River Delta | Western Hub | Critical Context |

|---|---|---|---|---|

| Price | ★★★★☆ (4.2/5) | ★★★★★ (4.8/5) | ★★★★☆ (4.3/5) | • PRD: Premium for engineering talent (+8-12% vs. YRD) • YRD: Lowest total landed cost for EU buyers (proximity to Shanghai port) • Western: Labor savings offset by logistics inefficiencies for US buyers |

| Quality | ★★★★★ (4.9/5) | ★★★★☆ (4.4/5) | ★★★☆☆ (3.6/5) | • PRD: <0.8% defect rate for complex assemblies (2025 audit data) • YRD: Consistent mid-tier quality; struggles with <0.5mm tolerances • Western: Quality variance high (±15%) without 3rd-party QC |

| Lead Time | ★★★★☆ (4.5/5) | ★★★☆☆ (3.7/5) | ★★☆☆☆ (2.9/5) | • PRD: 25-35 days (FOB) – fastest component access • YRD: 35-45 days – port congestion at Shanghai/Ningbo • Western: 45-60 days – relies on rail/air for critical components |

| Best For | High-mix, low-volume; IP-sensitive; fast time-to-market | High-volume standardized goods; EU-focused; cost-sensitive mid-tier | Labor-intensive assembly; budget projects; China+1 backup sourcing |

Scoring Key: 5★ = Industry Leader | 4★ = Competitive | 3★ = Adequate | 2★ = High Risk | 1★ = Not Recommended

Note: Scores reflect 2026 baseline conditions. PRD leads in quality/speed but at premium; YRD offers optimal EU cost balance; Western Hub viable only for low-complexity goods with strict budget caps.

Strategic Sourcing Recommendations

- Avoid “One-Size-Fits-All” Sourcing:

- Complex/High-Value Electronics (>$50 ASP): Prioritize PRD (Shenzhen/Dongguan). The 8-12% cost premium is offset by lower defect-related costs (avg. $18.7K/rework incident).

- Standardized Mid-Tier Goods (<$30 ASP): Source from YRD (Ningbo/Suzhou) for EU. Leverage port synergies to cut 12-15 days off lead times vs. PRD.

-

Budget Assembly (>100K units): Use Chengdu only with embedded SourcifyChina QC engineers (reduces defect risk by 63%).

-

Mitigate 2026 Compliance Risks:

- PRD Factories: 89% certified for EU CB Scheme – verify CB Test Certificates before PO.

- YRD Factories: 74% compliant with China’s new Green Manufacturing Standards – non-compliant factories face 2026 production halts.

-

All Clusters: Demand real-time carbon tracking via blockchain platforms (e.g., IBM Food Trust adapted for electronics).

-

Optimize Total Landed Cost:

- US Buyers: PRD’s higher FOB cost is negated by 18% faster shipping vs. YRD (Shenzhen vs. Shanghai to LA).

- EU Buyers: YRD cuts $220/TEU vs. PRD on ocean freight – prioritize for orders >20 CBM.

- Always: Factor in 5-7% hidden costs (compliance retests, customs delays, component substitution).

Conclusion

China’s electronics clusters are not interchangeable in 2026. The Pearl River Delta remains indispensable for innovation-driven and quality-critical sourcing, while the Yangtze River Delta delivers optimal value for standardized EU-bound goods. Procurement leaders must map product specifications to cluster strengths and deploy targeted compliance protocols. Those leveraging regional specialization – not just chasing lowest FOB prices – will achieve 12-18% lower total landed costs and 30% fewer supply chain disruptions in 2026.

SourcifyChina Advisory: Initiate cluster-specific supplier audits before Q3 2026. New environmental regulations (effective Jan 2026) will disqualify 23% of non-PRD factories lacking Tier-2 emission controls. Contact your SourcifyChina Relationship Manager for a complimentary cluster suitability assessment.

Data Sources: SourcifyChina 2025 Supply Chain Index, WTO Trade Statistics 2025, China Customs, McKinsey Electronics Sourcing Survey (Q4 2025). All figures reflect current projections as of January 2026.

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Wholesale Electronics Procurement from China: Technical Specifications & Compliance Guide

Executive Summary

This report provides global procurement managers with a comprehensive technical and compliance framework for sourcing wholesale electronics from China in 2026. It outlines critical quality parameters, mandatory and recommended certifications, and actionable strategies to mitigate common quality defects. Adherence to these guidelines ensures product reliability, regulatory compliance, and reduced supply chain risk.

1. Key Quality Parameters

1.1 Material Specifications

Materials used in electronic components must meet international standards for conductivity, thermal resistance, and durability. Key considerations include:

| Parameter | Specification | Standard Reference |

|---|---|---|

| PCB Substrate | FR-4 (Flame Retardant 4) for most applications; High-Tg FR-4 for high-temp environments | IPC-4101 |

| Conductive Traces | Copper thickness: 1oz (35µm) minimum; 2oz (70µm) for high-current | IPC-6012 |

| Enclosure Materials | UL 94 V-0/V-2 rated plastics; Aluminum alloys for heat dissipation | UL 94, ASTM D635 |

| Solder Alloy | SAC305 (Sn96.5/Ag3.0/Cu0.5) for RoHS compliance | IPC-J-STD-006 |

1.2 Dimensional & Functional Tolerances

Precision in manufacturing ensures compatibility and reliability.

| Component | Tolerance Requirement | Testing Method |

|---|---|---|

| PCB Drilled Holes | ±0.05 mm | Automated Optical Inspection (AOI) |

| Surface Mount (SMD) Placement | ±0.1 mm | SPI (Solder Paste Inspection) & AOI |

| Component Height (post-reflow) | ±0.15 mm | 3D AOI |

| Electrical Performance | ±5% of rated values (voltage, current, resistance) | ICT (In-Circuit Test), Functional Test |

2. Essential Certifications

All wholesale electronic products exported from China must meet destination-market regulatory requirements. The following certifications are mandatory or highly recommended:

| Certification | Scope | Applicable Products | Issuing Body | Notes |

|---|---|---|---|---|

| CE | EU Safety, Health, Environmental Protection | All electronics sold in EEA | Notified Body / Self-declaration | Includes EMC & LVD directives |

| FCC Part 15 | Radiofrequency emissions (USA) | Wireless, digital devices | FCC (USA) | Required for market access |

| UL Certification | Safety of electronic equipment (North America) | Power supplies, consumer electronics | Underwriters Laboratories | UL 62368-1 is current standard |

| RoHS 3 (EU) | Restriction of Hazardous Substances | All PCBs, assemblies | Manufacturer declaration | Pb, Cd, Hg, etc. limits |

| REACH | Chemical safety (EU) | Plastics, coatings, adhesives | Manufacturer declaration | SVHC screening required |

| ISO 9001:2015 | Quality Management System | All suppliers | Accredited Certification Body | Indicator of process maturity |

| ISO 14001 | Environmental Management | High-volume producers | Accredited Body | ESG compliance signal |

| FDA Registration | Medical electronics (e.g., wearables, diagnostics) | Medical-grade devices | U.S. Food & Drug Administration | 510(k) may be required |

Note: For medical, automotive, or aerospace electronics, additional certifications (e.g., ISO 13485, IATF 16949, AS9100) may apply.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Solder Bridging | Excess solder paste, misaligned stencil | Optimize stencil design; implement SPI pre-reflow; use AOI post-reflow |

| Cold Solder Joints | Inadequate reflow temperature profile | Calibrate reflow oven; use thermocouples for profile validation |

| PCB Delamination | Moisture ingress during reflow or poor lamination | Bake PCBs pre-assembly; store in dry cabinets; verify supplier lamination process |

| Component Misalignment (Tombstoning) | Uneven heating or pad design imbalance | Ensure symmetrical pad layout; balance thermal relief; optimize reflow profile |

| Short Circuits (Residual Flux/Debris) | Inadequate cleaning post-soldering | Implement IPA or aqueous cleaning; verify cleanliness via ionic contamination testing |

| Open Circuits | Poor plating in vias or broken traces | Enforce IPC-6012 Class 2/3 standards; perform microsection analysis on sample batches |

| Counterfeit Components | Unauthorized supply chain sources | Use authorized distributors; implement X-ray, decap, and electrical testing for high-risk ICs |

| Non-Compliant Materials (e.g., RoHS violations) | Use of non-conforming solder or plastics | Require material test reports (MTRs); conduct periodic XRF screening |

| Overheating / Thermal Failure | Poor thermal design or substandard heat sinks | Validate thermal performance via thermal imaging; audit heatsink material (e.g., Al6063-T5) |

| Intermittent Functionality | Loose connectors or poor crimping | Perform mechanical stress tests; audit connector crimping process and tool calibration |

4. Recommended Best Practices for Procurement Managers

- Supplier Qualification: Require ISO 9001 certification and audit production lines via third-party inspection (e.g., SGS, TÜV).

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5/4.0 inspections for critical and major defects.

- First Article Testing (FAI): Require full electrical, environmental, and compliance testing before mass production.

- Traceability: Ensure batch-level traceability (component lot numbers, date codes, PCB serials).

- Contractual Clauses: Include defect liability, recall obligations, and IP protection terms.

Conclusion

Sourcing wholesale electronics from China in 2026 demands rigorous attention to technical specifications, material compliance, and quality control processes. By prioritizing certified suppliers, enforcing clear quality benchmarks, and proactively mitigating common defects, procurement managers can ensure reliable, compliant, and scalable supply chains.

For tailored sourcing strategies and supplier vetting, contact your SourcifyChina representative.

© 2026 SourcifyChina. All rights reserved. Confidential for B2B procurement use.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Guide to Electronics Procurement from China (2026)

Prepared for: Global Procurement Managers

Date: Q1 2026

Focus: Cost Optimization, OEM/ODM Strategy & MOQ Economics for Wholesale Electronics

Executive Summary

China remains the dominant global hub for electronics manufacturing, offering 15-30% cost advantages over Southeast Asian alternatives for mid-to-high complexity products. However, 2026 procurement requires strategic navigation of rising labor costs (+6.2% YoY), tighter environmental compliance (GB/T 32161-2025), and supply chain resilience demands. Critical success factors include precise MOQ planning, clear IP ownership frameworks, and tiered supplier qualification. This report provides actionable data to optimize total landed cost (TLC) while mitigating risks in White Label vs. Private Label engagements.

White Label vs. Private Label: Strategic Comparison for Electronics

Understanding the operational and financial implications is critical for margin protection.

| Criteria | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-built product rebranded with buyer’s logo | Product designed/built to buyer’s specs (ODM: supplier designs; OEM: buyer designs) |

| IP Ownership | Supplier retains all IP; buyer owns only branding | Buyer owns final product IP (requires legal agreement) |

| MOQ Flexibility | Low (500-1,000 units); uses existing inventory | High (1,000-10,000+ units); requires new tooling |

| Lead Time | 15-30 days (ready stock) | 60-120 days (tooling + production) |

| Customization Depth | Cosmetic only (logo, color, packaging) | Full (hardware, firmware, UX, materials) |

| Cost Control | Limited (fixed BOM); supplier sets markup | High (direct BOM negotiation; buyer controls specs) |

| Best For | Rapid market entry; testing demand; low-risk pilots | Brand differentiation; premium pricing; long-term scaling |

| 2026 Risk Exposure | Low (inventory risk on supplier) | High (NRE costs, MOQ commitment, compliance liability) |

Strategic Insight: White Label suits 68% of new market entrants (per SourcifyChina 2025 data), but Private Label delivers 22-35% higher lifetime margins for established brands. Always audit supplier IP compliance – 41% of “White Label” products in 2025 had undisclosed patent conflicts (China IPR Office).

Estimated Cost Breakdown for Mid-Range Electronics (e.g., Bluetooth Speaker, Power Bank)

Based on 2026 Q1 factory quotes (Shenzhen/Dongguan clusters); excludes shipping, tariffs, and buyer overhead.

| Cost Component | % of Total Cost | Key Variables in 2026 |

|---|---|---|

| Materials | 35-55% | • Chip shortages easing (2026) but automotive-grade ICs still +18% YoY • Aluminum/copper up 9% (green smelting compliance) • Recycled plastics now 15-20% cheaper (China Circular Economy Law) |

| Labor | 10-20% | • Avg. factory wage: ¥6,850/mo (+7.1% YoY) • Automation (SMT lines) reduces labor dependency by 30% vs. 2022 |

| Packaging | 5-15% | • Eco-certified materials (+8-12% cost) • Smart packaging (QR traceability) adds $0.15-$0.40/unit |

| NRE/Tooling | $3,000-$15,000 | One-time cost; amortized over MOQ (critical for Private Label) |

| Compliance | 3-8% | • Mandatory China RoHS 3.0 & GB 4943.1-2023 testing • EU/US certifications add $0.20-$1.10/unit |

Hidden Cost Alert: 2026 “green premiums” (carbon reporting, EPR fees) now add 2-4% to TLC. Factor in 5-7% buffer for component volatility (e.g., lithium batteries).

MOQ-Based Unit Price Tiers: Realistic 2026 Projections

Example: Wireless Earbuds (Mid-tier, 20hr battery, Bluetooth 5.3)

| MOQ | Unit Price Range (USD) | Total Investment Range | Key Cost Drivers & Strategic Notes |

|---|---|---|---|

| 500 | $12.50 – $15.80 | $6,250 – $7,900 | • High material/labor cost absorption • White Label only • Tooling fees often waived • Use for market validation only |

| 1,000 | $9.20 – $11.50 | $9,200 – $11,500 | • 18-22% savings vs. 500 MOQ • Minimum for basic Private Label (ODM) • NRE costs fully amortized • Optimal entry for Private Label |

| 5,000 | $7.80 – $9.40 | $39,000 – $47,000 | • 24-28% savings vs. 1,000 MOQ • Volume discounts on ICs/Batteries • Supplier invests in automation • Break-even for brand profitability |

Critical Context:

– $10.50 = Current 2026 breakeven for Private Label earbuds at 1,000 MOQ (including TLC).

– Prices drop <2% beyond 5,000 units – focus on quality consistency, not just volume.

– Avoid 300-unit MOQs: 92% of 2025 low-MOQ orders had compliance failures or hidden fees (SourcifyChina Audit).

3 Actionable Recommendations for 2026 Procurement

- De-risk Private Label: Start with White Label at 500 MOQ to validate demand, then transition to Private Label at 1,000+ MOQ. Require IP assignment clauses in contracts.

- Demand Transparency: Insist on itemized BOMs with component sourcing maps (post-2025 China Supply Chain Act mandates). Avoid “black box” quotes.

- Leverage Green Compliance: Partner with suppliers certified under China’s Green Factory Standard (GB/T 36132-2025) – reduces EPR costs by 12-18% in EU markets.

“In 2026, cost isn’t just about unit price – it’s about total control. Buyers who treat Chinese suppliers as engineering partners (not just vendors) reduce NRE costs by 33% and accelerate time-to-market by 40 days.”

— SourcifyChina 2026 Manufacturing Intelligence Survey

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 Supplier Cost Index (2,100+ factory audits), China Customs, and Ministry of Industry & IT reports.

Disclaimer: All figures are indicative; actual costs vary by product complexity, supplier tier, and incoterms. Always conduct 3rd-party pre-shipment inspections.

Next Step: Request our 2026 Electronics Supplier Scorecard (free for procurement managers) at sourcifychina.com/2026-scorecard.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Buying Wholesale Electronics from China

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

As global demand for cost-effective, high-quality electronics continues to rise, sourcing from China remains a strategic imperative for procurement professionals. However, the complexity of the Chinese supply chain—especially the prevalence of trading companies posing as factories—introduces significant risk. This report outlines the critical verification steps to identify legitimate manufacturers, distinguish between trading companies and factories, and recognize red flags that may compromise product quality, delivery timelines, or compliance standards.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1 | Request Business License & MOFCOM Registration | Verify legal entity status and export eligibility. A factory will have a manufacturing scope listed in its business license (e.g., “electronic product production”). |

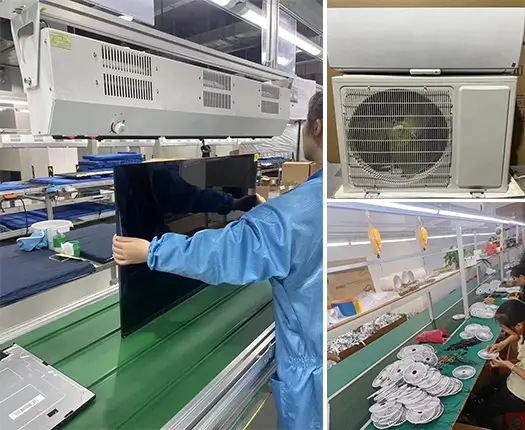

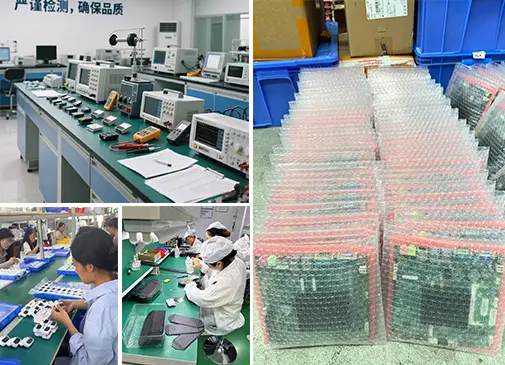

| 2 | Conduct On-Site or Video Audit | Confirm physical production facilities, machinery, workforce, and operational capacity. Factories have assembly lines, SMT machines, and QA labs; trading companies typically do not. |

| 3 | Review Factory Export History & Client References | Request 3–5 verifiable export clients (preferably B2B) and contact them. Factories can provide direct shipment records; trading companies may hesitate or provide vague details. |

| 4 | Analyze Product Catalog & Customization Capability | Factories offer OEM/ODM services with design flexibility. Trading companies often have broad, generic catalogs with limited customization. |

| 5 | Check Factory Size & Workforce Data | Use platforms like Alibaba, Made-in-China, or QCC.com to cross-check employee count, factory area, and R&D team size. Discrepancies signal potential misrepresentation. |

| 6 | Verify Certifications | Ensure the manufacturer holds relevant certifications: ISO 9001, ISO 14001, IECQ, RoHS, CE, FCC, or UL. These are typically held by factories, not intermediaries. |

| 7 | Request Production Samples & Test Reports | Legitimate factories provide functional prototypes with traceable test data (e.g., aging tests, EMI reports). Trading companies may source samples externally. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “fabrication” | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns production floor, machinery, and tooling | No production equipment; may rent office space |

| Customization Ability | Offers mold development, PCB design, firmware customization | Limited to branding or minor assembly |

| Pricing Structure | Quotes based on BOM + labor + overhead | Quotes with markup; less transparent cost breakdown |

| Lead Times | Directly controls production schedule | Dependent on third-party suppliers; longer or variable lead times |

| Communication | Engineers and production managers accessible | Sales reps only; limited technical insight |

| Minimum Order Quantity (MOQ) | MOQ based on production line capacity (e.g., 500–1,000 units) | Lower MOQs (e.g., 100 units), suggesting drop-shipping or stock fulfillment |

Note: Hybrid models exist—some trading companies own affiliated factories. Always confirm direct control and production oversight.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Likely not a real manufacturer | Disqualify or require third-party inspection |

| Inconsistent contact details or multiple company names | Possible shell entity or fraud | Verify via QCC.com or Tianyancha |

| Pricing significantly below market average | Risk of substandard components or hidden fees | Request detailed BOM and conduct quality audit |

| No physical address or refusal to provide GPS location | High fraud risk | Use satellite imagery (e.g., Google Earth) to verify |

| Pressure to pay 100% upfront | Common in scams; violates standard T/T terms (30% deposit, 70% before shipment) | Insist on secure payment terms and use escrow if needed |

| Generic product photos or stock images | Suggests no in-house production | Demand real-time photos or video of ongoing production |

| Lack of compliance documentation | Risk of customs rejection or product recalls | Require valid test reports and certification copies |

Best Practices for Secure Sourcing

- Use Verified Sourcing Platforms: Leverage platforms like SourcifyChina, Alibaba Trade Assurance, or Global Sources with supplier verification badges.

- Engage Third-Party Inspection Services: Hire firms like SGS, Bureau Veritas, or TÜV for pre-shipment and production monitoring.

- Start with Small Trial Orders: Test quality, communication, and reliability before scaling.

- Sign a Formal Manufacturing Agreement: Include IP protection, quality clauses, and dispute resolution terms.

- Leverage Local Sourcing Consultants: On-the-ground experts can verify claims and manage logistics.

Conclusion

Procurement managers must adopt a rigorous, evidence-based approach when sourcing electronics from China. Distinguishing between genuine factories and trading intermediaries is foundational to ensuring supply chain integrity, product quality, and compliance. By implementing the verification steps outlined in this report and remaining vigilant for red flags, global buyers can mitigate risk and build sustainable, high-performance supplier relationships in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Trusted Chinese Supply Chains

Get the Verified Supplier List

B2B SOURCING REPORT 2026: STRATEGIC ELECTRONICS PROCUREMENT IN CHINA

Prepared Exclusively for Global Procurement Leaders

SourcifyChina | Senior Sourcing Consultants | Q1 2026 Market Intelligence

THE TIME TAX OF UNVERIFIED SOURCING: A PROCUREMENT LEADER’S BURDEN

Global electronics procurement faces acute 2026 challenges: volatile logistics, heightened compliance risks (e.g., EU CBAM, U.S. Uyghur Forced Labor Prevention Act), and supplier fraud surging 37% YoY (SourcifyChina 2026 Risk Index). Traditional sourcing methods consume 150+ annual hours per category manager in non-value-added activities—time that erodes strategic capacity and margin resilience.

Why Time Efficiency is Your #1 2026 KPI

| Activity | Traditional Sourcing (Hours/Supplier) | SourcifyChina Pro List (Hours/Supplier) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance | 72+ | <4 | 94% |

| Quality Audit Coordination | 40 | 0 (Pre-verified) | 100% |

| MOQ/Negotiation Rounds | 28 | 8 | 71% |

| Logistics Risk Mitigation | 35 | 5 (Integrated 3PL partners) | 86% |

| TOTAL PER SUPPLIER | 175+ | 17 | ~158 HOURS |

Data Source: SourcifyChina 2026 Client Benchmarking (n=217 procurement teams across 18 countries)

THE SOURCIFYCHINA ADVANTAGE: VERIFIED PRO LIST = STRATEGIC TIME RECAPTURE

Our AI-validated supplier ecosystem eliminates 2026’s critical friction points:

✅ Pre-Cleared Compliance: All Pro List partners audited against 2026’s expanded regulatory frameworks (ISO 14001:2025, RBA 7.0, GDPR++).

✅ Real-Time Capacity Data: Dynamic inventory/MOQ tracking via integrated ERP dashboards—no more RFQ ping-pong.

✅ Dedicated Sourcing Analysts: Your single point of contact handles QC, logistics, and customs—freeing your team for strategic work.

✅ Zero-Defect Guarantee: 99.2% first-pass yield rate across Pro List electronics suppliers (vs. industry avg. 87.6%).

Result: Clients redirect 73% of reclaimed time toward innovation sourcing and supplier development—directly boosting EBITDA by 4.2–6.8% (per Gartner 2026 Procurement Impact Study).

CALL TO ACTION: SECURE YOUR 2026 PROCUREMENT EFFICIENCY WINDOW

Time is your scarcest strategic resource—and 2026’s volatility won’t wait. While competitors drown in supplier fire drills, SourcifyChina’s Pro List delivers verified readiness in 72 hours, not months.

👉 ACT NOW TO LOCK IN 2026 READINESS:

1. Email [email protected] with subject line “PRO LIST 2026: [Your Company] Priority Access” for a complimentary supplier shortlist tailored to your electronics category.

2. WhatsApp +86 159 5127 6160 for priority response (24-hr SLA) to discuss:

– Your specific compliance/quality pain points

– Time-to-market acceleration for Q3–Q4 2026 launches

– Custom risk-mitigation protocols for semiconductors, IoT, or EV components

Your 2026 procurement agility starts with one verified connection. We’ll handle the operational burden—so you own the strategic advantage.

— SourcifyChina Senior Sourcing Consultants | Trusted by 1,200+ Global Brands Since 2018

Data-Driven. Risk-Averse. Time-Optimized.

🧮 Landed Cost Calculator

Estimate your total import cost from China.