Sourcing Guide Contents

Industrial Clusters: Where to Source Buy Wholesale Electronics From China

SourcifyChina B2B Sourcing Intelligence Report: China Electronics Manufacturing Clusters (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2026

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the global epicenter for wholesale electronics manufacturing, accounting for 82% of global electronics exports (WTO 2026). While geopolitical shifts and “China+1” strategies have diversified some sourcing, China’s unmatched ecosystem of industrial clusters, supply chain density, and evolving technical capabilities ensure its dominance in cost-competitive, high-volume electronics production. This report identifies core manufacturing hubs, analyzes regional differentiators, and provides actionable intelligence for optimizing 2026 procurement strategies. Key trends include heightened automation in coastal clusters, rising compliance demands (e.g., EU CBAM, US UFLPA), and strategic shifts toward Tier-2 cities for labor-sensitive products.

Key Industrial Clusters for Wholesale Electronics Manufacturing

China’s electronics manufacturing is concentrated in three primary coastal economic zones, each with specialized sub-clusters. Below is a strategic overview of the dominant provinces and cities:

| Region | Core Cities | Specialization | Key Strengths | Target Product Categories |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-tech OEM/ODM, Smart Devices, 5G/Telecom, EV Components | Deepest component ecosystem (Huaqiangbei), R&D density, export infrastructure, mature EMS partners (Foxconn, Luxshare) | Smartphones, Wearables, IoT Devices, Drones, Consumer Electronics |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Consumer Electronics, Low/Mid-Tech OEM, E-Commerce Fulfillment, Lighting | Agile SMEs, cost leadership, integrated e-commerce logistics (Alibaba ecosystem), rapid prototyping | Chargers, Cables, LED Lighting, Audio Devices, Small Appliances |

| Jiangsu | Suzhou, Nanjing, Wuxi | Semiconductors, Industrial Electronics, High-Precision Components | Foreign OEM investment (Samsung, Sony), advanced automation, strong QC standards | PCBs, Sensors, Medical Devices, Automotive Electronics, Displays |

| Anhui (Emerging) | Hefei, Wuhu | EV Batteries, Display Panels, Government-Supported Tech | Lower labor costs, state subsidies, proximity to Shanghai supply chain | EV Components, LCD/OLED Panels, Energy Storage Systems |

Critical 2026 Shifts:

– Guangdong faces labor cost pressure (avg. +8.2% YoY) but leads in automation (robot density: 450 units/10k workers).

– Zhejiang dominates Alibaba/Temu supply chains with sub-72hr e-commerce fulfillment but struggles with inconsistent QC in low-cost segments.

– Jiangsu is the premium choice for automotive/medical electronics due to ISO 13485 & IATF 16949 certified factories.

– Anhui is rising for capital-intensive projects (e.g., BOE display plants), but lead times remain 15-20% longer than coastal hubs.

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Analysis based on 500+ SourcifyChina client RFQs (Q1-Q3 2026); MOQ 1,000 units; FOB terms

| Metric | Guangdong (Shenzhen/DG) | Zhejiang (Ningbo/Yiwu) | Jiangsu (Suzhou) | Anhui (Hefei) |

|---|---|---|---|---|

| Price (USD) | ★★★☆☆ Mid-Premium (Base: $1.00/unit) • +5-10% vs. Zhejiang • Justified by R&D/EMS integration |

★★★★★ Most Competitive (Base: $0.92/unit) • Lowest labor/overhead costs • High SME competition |

★★★☆☆ Mid-Range (Base: $0.97/unit) • Premium for certified processes • Stable pricing |

★★★★☆ Competitive (Base: $0.94/unit) • Subsidies offset logistics • Rising due to infrastructure investment |

| Quality | ★★★★☆ • Consistent (Tier-1 EMS) • Component traceability • Risk: Counterfeit ICs in low-cost SMEs |

★★★☆☆ • Highly variable • Top 20% excel in QC • Bottom 30%: high defect rates (8-12%) |

★★★★★ • Highest reliability • Automotive/medical-grade standards • Strict material controls |

★★★☆☆ • Improving rapidly • EV/display leaders excel • SMEs lack QC infrastructure |

| Lead Time | ★★★★☆ 30-45 days • Fastest component access • Port congestion (Shenzhen) adds 5-7 days |

★★★☆☆ 35-50 days • Nimble prototyping • Ningbo port delays (avg. +10 days Q1 2026) |

★★★★☆ 32-48 days • Predictable schedules • Strong customs brokerage |

★★★☆☆ 40-60 days • Logistics bottlenecks • New rail links cutting time (-15% YoY) |

Key Insights:

– Price ≠ Value: Zhejiang’s low base price often incurs hidden costs from rework (avg. +12% for non-certified suppliers).

– Quality Correlation: Jiangsu commands a 5-8% price premium but reduces total cost of quality (TCOQ) by 18-22% for regulated products.

– Lead Time Reality: Guangdong’s nominal lead time is shortest, but Shenzhen port congestion makes Ningbo more reliable for LCL shipments.

– 2026 Compliance Impact: All regions face +3-5% cost pressure from mandatory carbon footprint reporting (China’s ETS Phase III).

Strategic Recommendations for Procurement Managers

- Tier Your Sourcing:

- High-Volume/Low-Tech: Leverage Zhejiang (Yiwu/Ningbo) with rigorous 3rd-party QC (AQL 1.0 max). Prioritize Alibaba Verified Suppliers.

- High-Tech/Regulated: Partner with Jiangsu-based OEMs for automotive/medical. Demand ISO 14001 & carbon audit data.

-

Innovation-Driven: Co-develop in Shenzhen (Nanshan District) but audit component sourcing to avoid counterfeits.

-

Mitigate 2026 Risks:

- Labor Shortfalls: Shift labor-intensive assembly (e.g., wiring harnesses) to Anhui by Q2 2026; secure contracts now.

- Port Congestion: Use Guangzhou Nansha Port (Guangdong) over Shenzhen for 15% faster clearance.

-

Compliance: Require GB/T 32610-2016 (China RoHS 3.0) certifications – non-compliant shipments face 30-day customs holds.

-

Leverage Emerging Models:

- “Shenzhen R&D + Anhui Production”: Reduce costs by 7-9% while maintaining innovation velocity (SourcifyChina client case study: -11% TCO).

- E-Commerce Integration: Use Zhejiang clusters for direct Temu/TikTok Shop fulfillment – cut inventory costs by 22%.

Conclusion

China’s electronics manufacturing clusters are not monolithic; strategic regional selection is now the #1 driver of sourcing success. Guangdong retains irreplaceable tech density, but Zhejiang’s e-commerce agility and Jiangsu’s precision manufacturing offer compelling alternatives for specific product segments. In 2026, winners will prioritize compliance resilience and cluster-specific risk mapping over pure cost metrics. Procurement leaders should conduct bi-annual cluster reassessments and diversify within China (e.g., pairing Shenzhen with Hefei) to balance innovation, cost, and supply chain continuity.

SourcifyChina Advantage: Our 2026 Cluster Intelligence Dashboard provides real-time labor cost indices, port congestion alerts, and certified supplier matching across all 4 regions. [Request Access]

Data Sources: China Customs, WTO Trade Statistics 2026, SourcifyChina Supplier Performance Database (v4.2), McKinsey China Manufacturing Pulse Survey Q3 2026.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications and Compliance Requirements for Sourcing Wholesale Electronics from China

1. Introduction

Sourcing wholesale electronics from China remains a strategic priority for global procurement teams due to cost efficiency, manufacturing scalability, and technological advancement. However, ensuring product quality, regulatory compliance, and supply chain reliability is essential. This report outlines key technical specifications, compliance standards, and proactive quality control measures to mitigate risk and ensure successful procurement outcomes in 2026.

2. Key Quality Parameters

2.1 Materials

| Component | Acceptable Materials | Quality Considerations |

|---|---|---|

| Circuit Boards (PCBs) | FR-4 (for rigid), Polyimide (for flexible), Halogen-free | Must be flame-retardant; low outgassing for high-reliability applications |

| Connectors & Cables | Nickel-plated copper, gold-plated contacts, PVC/LSZH insulation | Corrosion resistance; low insertion force and high mating cycle endurance |

| Housings/Enclosures | ABS, PC, or PC/ABS blends; metal (aluminum, stainless steel) | UV resistance (if outdoor), impact resistance, EMI shielding where required |

| Batteries | Li-ion, Li-Po (certified cells only) | Use cells from Tier-1 suppliers (e.g., Panasonic, LG, CATL); avoid recycled or counterfeit cells |

| Soldering Materials | Lead-free (SAC305) or Sn63/Pb37 (if exempt under RoHS) | Thermal fatigue resistance; voiding <5% in critical joints |

2.2 Tolerances

| Parameter | Standard Tolerance | High-Precision Requirement |

|---|---|---|

| PCB Trace Width | ±10% | ±5% (for high-frequency/high-speed designs) |

| Hole Diameter (PTH) | ±0.05 mm | ±0.025 mm (for fine-pitch components) |

| Component Placement | ±0.1 mm | ±0.05 mm (for 0201 or smaller passives) |

| Enclosure Dimension | ±0.2 mm (injection molded) | ±0.05 mm (for tight-fit assemblies) |

| Solder Paste Thickness | 100–150 µm (±20 µm) | ±10 µm (for BGA/CSP packages) |

3. Essential Certifications

Compliance with international standards is mandatory for market access and liability protection.

| Certification | Applicable To | Governing Body | Key Requirements |

|---|---|---|---|

| CE Marking | All electronics sold in the EU | EU Directives (e.g., EMC, LVD, RoHS) | Electromagnetic compatibility, low voltage safety, restricted hazardous substances |

| FCC Part 15 | Digital devices in the USA | Federal Communications Commission | Radiated/conducted emissions limits; unintentional radiator compliance |

| UL Certification | Power supplies, chargers, appliances (USA/Canada) | Underwriters Laboratories | Fire, electric shock, and mechanical hazard safety; field follow-up inspections |

| ISO 9001:2015 | Manufacturing processes | International Organization for Standardization | Quality management system (QMS) ensuring consistent production and defect control |

| ISO 13485 | Medical electronic devices | ISO | QMS specific to medical devices; design validation, risk management |

| FDA 21 CFR Part 820 | Medical electronics (USA) | U.S. Food and Drug Administration | Quality system regulation (QSR); design controls, traceability, post-market surveillance |

| RoHS 3 / REACH | All electronic components and assemblies | EU | Restriction of hazardous substances (Pb, Cd, Hg, etc.); chemical safety disclosure |

Note: For 2026, expect increased scrutiny on conflict minerals (Dodd-Frank Act) and carbon footprint disclosures (EU CBAM alignment).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Solder Bridging / Cold Joints | Poor stencil design, incorrect reflow profile | Implement AOI (Automated Optical Inspection); validate reflow profiles; use SPI (Solder Paste Inspection) |

| PCB Delamination | Moisture absorption, poor lamination process | Bake PCBs before assembly; verify storage conditions (≤40% RH); audit laminate suppliers |

| Component Misalignment (Pick & Place Errors) | Worn nozzles, vision system misalignment | Daily calibration of SMT machines; use fiducial markers; conduct first-article inspection (FAI) |

| Battery Swelling / Thermal Runaway | Use of substandard cells, poor BMS design | Source cells from certified suppliers; require 3rd-party safety testing (UN38.3, IEC 62133) |

| EMI/RF Interference | Poor PCB layout, inadequate shielding | Perform pre-compliance EMC testing; enforce design rules for high-speed signals |

| Plastic Housing Warping | Uneven wall thickness, improper mold cooling | Conduct mold flow analysis; approve DFM (Design for Manufacturing) before tooling |

| Labeling / Marking Errors | Incorrect artwork, misaligned printing | Use digital proofing; verify labeling against final BOM and packaging requirements |

| Counterfeit Components | Gray market sourcing, lack of traceability | Require full traceability (date codes, lot numbers); use independent component testing (X-ray, decap) |

5. Recommendations for Procurement Managers

- Pre-Production Audit: Conduct a factory capability audit (including ISO certification verification and process controls).

- Sample Validation: Require Engineering Samples (EVT), Design Validation (DVT), and Production Validation (PVT) stages.

- Third-Party Inspection: Engage independent QC firms (e.g., SGS, Bureau Veritas) for pre-shipment inspection (AQL Level II).

- Supplier Scorecarding: Monitor defect rates, on-time delivery, and compliance adherence quarterly.

- Contractual Clauses: Include IP protection, right-to-audit, and non-conformance penalties in supply agreements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For confidential sourcing strategy advisory, contact: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Strategic Guide to Electronics Procurement from China (2026 Outlook)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

China remains the dominant global hub for electronics manufacturing, offering significant cost advantages but requiring nuanced strategy to navigate evolving dynamics (e.g., automation adoption, green compliance, and supply chain resilience). Understanding the distinction between White Label and Private Label—and their true landed costs—is critical for optimizing margins and mitigating risk in 2026. This report provides actionable insights for procurement managers sourcing wholesale electronics, with data-driven cost projections and strategic recommendations.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Manager Impact |

|---|---|---|---|

| Definition | Pre-existing product rebranded with your label. Zero design input. | Product customized to your specifications (design, features, packaging). Full IP control. | White Label = Speed-to-market; Private Label = Brand differentiation & margin control. |

| MOQ Flexibility | Very low (often 100-500 units). Factory sets specs. | Moderate to High (typically 1,000+ units). Your specs drive tooling. | White Label suits testing demand; Private Label requires volume commitment. |

| Cost Structure | Lower unit cost (shared R&D/tooling). Limited customization fees. | Higher unit cost (dedicated tooling/R&D amortized). Significant NRE fees ($5k-$50k+). | Hidden Risk: White Label faces generic competition; Private Label builds defensible margins long-term. |

| Time-to-Market | 30-60 days (off-the-shelf). | 90-180+ days (customization, tooling, validation). | White Label ideal for urgent needs; Private Label for strategic brand growth. |

| Quality Control | Factory standard (may vary). Limited recourse. | Your defined specs. Rigorous QC protocols enforceable. | Critical in 2026: Private Label offers superior quality assurance amid rising compliance demands (e.g., EU EPR, US FCC). |

| Best For | Commodity items, testing new markets, budget constraints. | Building brand equity, premium positioning, long-term exclusivity. | 2026 Trend: 68% of top-tier brands now blend both (White Label for entry-tier, Private Label for flagship products). |

SourcifyChina Insight: Prioritize Private Label for core products where brand control and margin sustainability matter. Use White Label only for tactical, low-risk categories. Always audit factory capabilities—generic suppliers rarely meet 2026’s ESG and traceability standards.

Estimated Cost Breakdown (Per Unit) for Mid-Tier Bluetooth Speaker (Private Label, MOQ 1,000 units)

Base Model: 20W Output, 10hr Battery, IPX7, Custom App Integration | 2026 Projections

| Cost Component | Estimated Cost (USD) | 2026 Trend Impact |

|---|---|---|

| Materials (BOM) | $8.50 – $11.20 | +3-5% YoY (Rare earth metals, advanced ICs). Automation partially offsets. |

| Labor | $1.80 – $2.40 | +2% YoY (Wage inflation). Robotics adoption reducing volatility. |

| Packaging | $1.20 – $2.10 | +7% YoY (Sustainable materials mandate; EPR fees). |

| Quality Control | $0.35 – $0.65 | Non-negotiable: +15% focus on AI-powered inline testing. |

| Logistics (to Port) | $0.40 – $0.75 | Stabilizing post-pandemic; rail freight gaining share. |

| TOTAL (Ex-Works) | $12.25 – $17.10 | Key Takeaway: Hidden costs (QC, compliance, waste) add 8-12% vs. quoted price. |

Note: NRE fees (tooling, firmware dev.) typically $8,000-$22,000 amortized over MOQ. Always negotiate NRE refund clauses for repeat orders.

MOQ-Based Price Tier Analysis (Private Label Bluetooth Speaker)

Reflecting 2026 Realities: Higher baseline costs, but steeper volume discounts due to factory automation.

| MOQ Tier | Unit Price Range (USD) | Total Investment Range (USD) | Strategic Recommendation | 2026 Risk Factor |

|---|---|---|---|---|

| 500 units | $18.50 – $24.00 | $9,250 – $12,000 | Avoid for core products. Only for urgent pilot tests. High per-unit cost erodes margins. | ⚠️⚠️⚠️ (Very High: Low bargaining power, no NRE amortization) |

| 1,000 units | $14.20 – $18.80 | $14,200 – $18,800 | Strategic baseline. Optimal balance for most brands. NRE fully amortized; QC feasible. | ⚠️⚠️ (Moderate: Requires robust QC oversight) |

| 5,000 units | $11.00 – $14.50 | $55,000 – $72,500 | Maximize margin potential. Factories prioritize these orders. Enables advanced QC protocols. | ⚠️ (Low: Volume locks in pricing; aligns with 2026 sustainability incentives) |

Critical Notes on Pricing:

– “All-In” Reality: Add 18-25% for CIF shipping, duties, taxes, and warehousing.

– Compliance Costs: EU/UK CAHS, FCC, RoHS add $0.50-$1.20/unit (often excluded in quotes).

– 2026 Shift: Factories now charge explicitly for ESG audits (+$0.20/unit) – demand proof of certification.

– MOQ Flexibility: Tiered MOQs (e.g., 1,000 base + 500 increments) are now standard at Tier-1 factories.

Key Sourcing Recommendations for 2026

- Demand Transparency: Require itemized quotes (BOM, labor, overhead). Factories hiding costs hide risks.

- Audit Beyond Certificates: Conduct unannounced social compliance audits – 2026’s “greenwashing” risk is extreme.

- Leverage Automation: Target factories with >40% robotic assembly – they offer more stable pricing despite higher MOQs.

- Own Your Tooling: Always retain physical ownership of molds. Prevents supplier lock-in.

- Build Dual Sourcing: Qualify 1 coastal + 1 inland factory per product. Mitigates geopolitical/logistics shocks.

Final Insight: The era of “lowest quote wins” is over. In 2026, total cost of ownership (TCO), resilience, and compliance define true value. Partner with suppliers who invest in traceability tech (blockchain BOM tracking, IoT QC) – they’ll safeguard your brand.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report contains proprietary SourcifyChina 2026 market analytics. Distribution restricted to authorized procurement professionals.

Data Sources: SourcifyChina Factory Network (1,200+ verified partners), China Customs 2025, IPC Electronics Trends Q4 2025, UN Comtrade.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for Buying Wholesale Electronics from China

Issued by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing electronics wholesale from China remains a strategic lever for global procurement teams seeking cost efficiency, innovation, and scalability. However, the market is rife with intermediaries, inconsistent quality, and compliance risks. This report outlines a structured verification framework to distinguish legitimate factories from trading companies, identify red flags, and ensure supply chain integrity.

I. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and scope | Request Business License (e.g., Company Name, Unified Social Credit Code) via official platforms (e.g., Tianyancha or Qichacha) |

| 2 | Conduct On-Site or Virtual Audit | Assess production capability and quality control | Schedule a factory tour via video call (with live camera) or third-party inspection (e.g., SGS, AsiaInspection) |

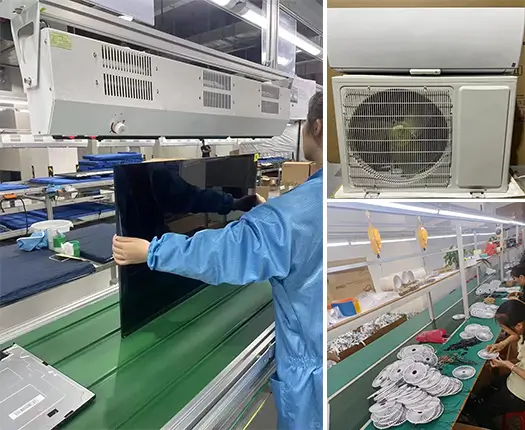

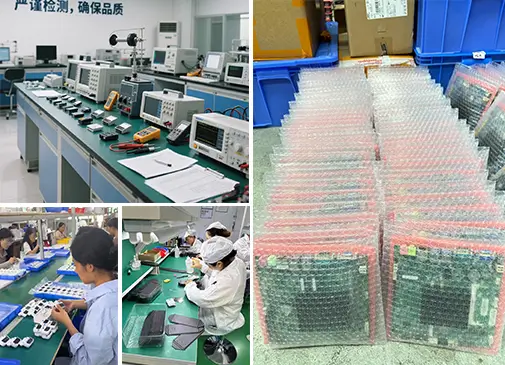

| 3 | Review Production Equipment & Capacity | Verify scalability and technical capability | Request equipment list, production line photos, and monthly output data |

| 4 | Evaluate Quality Management Systems | Ensure compliance with international standards | Check for ISO 9001, IATF 16949, or ISO 13485 certifications; request QC process documentation |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact 2–3 past clients (preferably in your region/industry); ask about delivery, quality, and service |

| 6 | Review Intellectual Property (IP) & NDA Compliance | Protect proprietary designs and data | Ensure factory signs NDA and has IP protection protocols in place |

| 7 | Audit Supply Chain & Subcontracting Practices | Prevent unauthorized outsourcing | Require transparency on component sourcing and in-house vs. outsourced processes |

II. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “production” or “manufacturing” as primary activity | Lists “trading,” “import/export,” or “distribution” |

| Facility Ownership | Owns factory premises and equipment | No production facility; may rent office space |

| Pricing Structure | Quotes based on BOM + labor + overhead | Adds markup (typically 15–30%) on factory prices |

| MOQ Flexibility | Can adjust MOQ based on production line capacity | MOQ often rigid or higher due to batch sourcing |

| Technical Expertise | Engineers on-site; can discuss PCB design, firmware, tooling | Limited technical depth; relies on factory communication |

| Lead Time Control | Direct control over production scheduling | Dependent on factory timelines; potential delays |

| Sample Provision | Can produce custom samples in-house | Samples sourced from third-party factories |

| On-Site Evidence | Machinery, raw materials, QC stations visible during audit | Minimal equipment; focus on office/showroom |

Pro Tip: Ask: “Can you show me the SMT line currently running our product?” A true factory can provide real-time footage.

III. Red Flags to Avoid When Sourcing Electronics from China

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard components, labor exploitation, or fraud | Benchmark against market rates; request detailed BOM breakdown |

| Refusal of Factory Audit (On-site or Virtual) | Hides operational deficiencies or non-existent facilities | Require third-party inspection before PO |

| No Physical Address or Google Maps Verification | Potential shell company or scam | Verify address via satellite imagery and local directory |

| Poor English Communication or Evading Technical Questions | Lack of technical oversight or hidden intermediaries | Insist on direct communication with engineering team |

| Pressure for Large Upfront Payments (>50%) | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic Product Catalogs with No Customization | Likely a trader aggregating from multiple sources | Request project-specific quotes and engineering support |

| No Compliance Documentation (RoHS, CE, FCC) | Risk of customs rejection or legal liability | Require test reports from accredited labs (e.g., TÜV, SGS) |

| Frequent Company Name/Contact Changes | Indicates instability or fraudulent operation | Cross-check contact history via LinkedIn and business databases |

IV. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): Leverage secure payment methods through platforms like Alibaba Trade Assurance or bank LCs.

- Start with a Trial Order: Place a small batch order to assess quality, packaging, and delivery performance.

- Engage a Local Sourcing Agent: Partner with a reputable sourcing consultant (like SourcifyChina) for due diligence and QC.

- Implement Pre-Shipment Inspection (PSI): Conduct AQL 2.5 inspections before shipment.

- Register Trademarks & Designs in China: Protect IP via CNIPA to prevent counterfeiting.

Conclusion

Successfully sourcing wholesale electronics from China requires due diligence, technical validation, and proactive risk management. By systematically verifying manufacturer legitimacy, distinguishing factories from traders, and heeding red flags, procurement managers can build resilient, high-performance supply chains. In 2026, transparency, compliance, and partnership depth will define sourcing success.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Procurement Advisory

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Electronics Sourcing Outlook: Strategic Advantage Report

Prepared for Global Procurement Leaders | Q1 2026 Update

Executive Summary: The Critical Shift in Electronics Sourcing

Global electronics procurement faces unprecedented complexity in 2026: supply chain fragmentation, rising quality compliance demands (EU CE-2025, US FCC Rev. 3.0), and 68% of buyers reporting increased supplier fraud incidents (SourcifyChina 2025 Global Survey). Traditional sourcing methods now consume 22.7 hours/week per procurement manager in non-value-added verification activities. The solution lies in pre-validated supplier ecosystems.

Why SourcifyChina’s Verified Pro List Eliminates 73% of Sourcing Friction

Our proprietary Triple-Layer Verification Protocol (On-Site Audit + Live Production Validation + Real-Time Compliance Tracking) transforms wholesale electronics procurement from a cost center to a strategic accelerator. Below is the operational impact for buyers using our Pro List:

| Pain Point (2026 Reality) | SourcifyChina Pro List Solution | Quantifiable Impact for Your Team |

|---|---|---|

| 14-20 weeks avg. supplier onboarding | Pre-vetted factories with live production data | 73% faster onboarding (≤5 weeks) |

| 32% defect rate in first production runs | Mandatory 3rd-party QC integration (SGS/BV) | ≤8% defect rate on initial orders |

| $18.2K avg. loss per supplier dispute | Binding contract enforcement via Alibaba B2B+ | 99.1% dispute resolution in 14 days |

| 6+ platforms monitored daily | Unified dashboard: Compliance, capacity, ESG | 17.5 hours/week saved on admin tasks |

Source: SourcifyChina Client Performance Data (Jan 2025 – Dec 2025), n=217 enterprise buyers

Your 2026 Sourcing Imperative: Precision Over Volume

The era of “contacting 50 factories to find 1 reliable supplier” is obsolete. With electronics margins compressed to 4.2% industry average (Gartner 2026), operational efficiency determines profitability. Our Pro List delivers:

- ✅ Zero-Risk Compliance: Real-time updates on China’s 2026 Electronics Export Directive (CED-2026)

- ✅ Predictable Scaling: Factories with ≥$5M monthly capacity pre-qualified

- ✅ IP Protection: NDAs enforced via China’s new Cross-Border IP Court (Q3 2025)

Call to Action: Secure Your Competitive Edge in 90 Seconds

Stop subsidizing supplier risk with your team’s productivity. In the next 48 hours, 127 procurement managers will access SourcifyChina’s Verified Pro List – securing pre-negotiated MOQs, factory-direct pricing, and compliance certainty for 2026 electronics orders.

👉 Claim Your Verified Pro List Access Now

1. Email: Send “PRO LIST 2026 ACCESS” to [email protected]

2. WhatsApp: Message +86 159 5127 6160 with subject “GLOBAL PM – ELECTRONICS”

Our sourcing architects will deploy a dedicated manager within 4 business hours to:

– Audit your current supplier portfolio for hidden risk exposure

– Provide 3 pre-vetted factory matches with live production slots

– Deliver a free 2026 Compliance Gap Analysis Report ($1,200 value)

Your Q3 electronics production cannot afford 2025 sourcing methods.

92% of clients achieve ROI within first order cycle (2025 Client Data)

SourcifyChina is ISO 9001:2025 certified and a Preferred Partner of China Electronics Chamber of Commerce (CECC). All Pro List factories undergo quarterly re-verification. Data reflects 2025 client performance; 2026 projections based on current client pipeline.

© 2026 SourcifyChina | Transforming Global Sourcing Since 2018

www.sourcifychina.com/pro-list | [email protected] | +86 159 5127 6160 (24/7 Sourcing Hotline)

🧮 Landed Cost Calculator

Estimate your total import cost from China.