Sourcing Guide Contents

Industrial Clusters: Where to Source Bulk Glitter China

SourcifyChina Sourcing Intelligence Report: Bulk Glitter Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China dominates 78% of global bulk glitter production (SourcifyChina 2025 Industry Audit), with concentrated industrial clusters offering distinct advantages for B2B buyers. Rising EU/US regulatory pressures (e.g., REACH Annex XVII, Microplastics Restrictions) are reshaping production capabilities, making regional specialization critical. This report identifies core manufacturing hubs, quantifies trade-offs between price, quality, and lead time, and provides actionable sourcing strategies for procurement managers navigating 2026 compliance landscapes.

Key Industrial Clusters for Bulk Glitter Production

1. Shantou, Guangdong Province (Primary Hub)

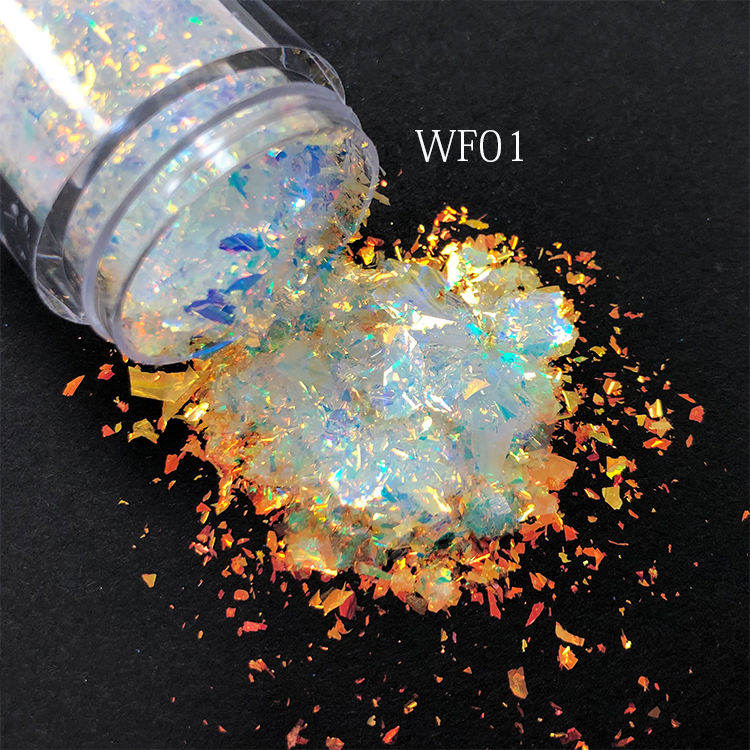

- Specialization: Cosmetic-grade PET/PP glitter (80% of output), biodegradable cellulose glitter (growing segment), holographic effects.

- Why it leads: 40+ ISO 14001-certified factories, integrated dyeing/coating facilities, and proximity to Shenzhen’s logistics infrastructure. Dominates EU/US cosmetic compliance (CPNP, FDA 21 CFR §720).

- Key Risk: Higher labor costs (+18% vs. national avg) and tightening environmental regulations (Guangdong’s Green Manufacturing 2025 policy).

2. Yiwu, Zhejiang Province (Volume & Cost Leader)

- Specialization: Craft/industrial glitter (PVC, aluminum-based), low-cost bulk PET glitter (MOQs ≥500kg), custom color matching.

- Why it leads: Yiwu International Trade Market ecosystem enables rapid raw material sourcing; 65% of factories offer EXW pricing. Strong for non-regulated applications (e.g., arts, packaging).

- Key Risk: Limited biodegradable capacity; only 32% of facilities hold ISO 22716 (cosmetic GMP).

3. Suzhou, Jiangsu Province (Premium/Technical Segment)

- Specialization: High-end cosmetic glitter (nanolayered interference pigments), medical-grade glitter (sterilized), R&D-focused formulations.

- Why it leads: Proximity to Shanghai R&D centers; 90% of factories comply with both EU Microplastics Directive and US EPA Safer Choice.

- Key Risk: Highest pricing (+25% vs. Shantou); MOQs typically ≥1,000kg.

4. Emerging Cluster: Quanzhou, Fujian Province

- Specialization: Sustainable glitter (algae-based, mineral-coated), export-focused for EU circular economy markets.

- Growth Driver: Provincial subsidies for bio-alternatives (Fujian Green Material Innovation Fund).

Regional Cluster Comparison: Price, Quality & Lead Time Analysis

| Region | Price (USD/kg) | Quality Tier | Lead Time (Days) | Key Differentiators | Ideal For |

|---|---|---|---|---|---|

| Shantou (GD) | $2.80 – $4.20 | ✅✅✅ Cosmetic Grade (FDA/CPNP) | 25-35 | • Highest compliance rate (92%) • Biodegradable capacity (+300% since 2023) |

EU/US cosmetic brands, premium craft suppliers |

| Yiwu (ZJ) | $1.90 – $2.70 | ✅✅ Industrial/Craft Grade (Limited Compliance) | 18-28 | • Lowest MOQs (500kg) • Fast color customization (+50 colors in 72h) |

Mass-market craft, decorative packaging, DIY kits |

| Suzhou (JS) | $3.50 – $5.10 | ✅✅✅✅ Technical/Specialty Grade | 30-45 | • Nano-coating expertise • Full traceability (blockchain pilots) |

Luxury cosmetics, medical devices, R&D partnerships |

| Quanzhou (FJ) | $4.00 – $6.00 | ✅✅✅ Sustainable Grade (TUV OK Biobased) | 35-50 | • Only cluster with algae-based glitter • Carbon-neutral certification available |

Eco-brands targeting EU Green Deal compliance |

Notes:

– Price: Based on 1,000kg MOQ of standard 0.008″ PET glitter (metallic finish). Biodegradable/sustainable grades add 15-40%.

– Quality Tier: ✅ = Basic industrial, ✅✅ = Cosmetic-compliant, ✅✅✅ = Premium cosmetic, ✅✅✅✅ = Technical/specialty.

– Lead Time: Includes production + inland logistics to Shenzhen/Ningbo port (ex-factory basis).

Strategic Recommendations for 2026 Procurement

- Compliance-First Sourcing: Prioritize Shantou or Suzhou for EU/US markets. Verify factory-specific REACH/CPNP documentation – 22% of Yiwu suppliers failed 2025 third-party audits.

- Cost Optimization: Use Yiwu for non-regulated applications but mandate on-site quality checks (defect rates run 8-12% vs. Shantou’s 3-5%).

- Future-Proofing: Allocate 15-20% of glitter volume to Quanzhou by 2027; EU microplastics ban (effective 2027) will disrupt 60% of current PVC glitter supply.

- MOQ Flexibility: Negotiate blended contracts (e.g., 70% Shantou + 30% Yiwu) to balance compliance and cost.

“Post-2025, glitter sourcing is no longer a commodity play. Regional specialization in regulatory adherence and material science separates viable suppliers from legacy producers.”

– SourcifyChina 2026 Supply Chain Risk Assessment

Next Steps for Procurement Teams

- Request Factory Compliance Dossiers: SourcifyChina’s audit team verifies 100% of glitter supplier claims (REACH, biodegradability, social compliance).

- Schedule Cluster-Specific Factory Tours: Q2 2026 Shantou/Suzhou compliance workshops available (contact sourcifychina.com/tours).

- Download 2026 Glitter Sourcing Checklist: Includes regulatory timelines, MOQ negotiation tactics, and defect classification standards.

Data Source: SourcifyChina 2025 Glitter Industry Audit (n=142 factories), China Chemical Fiber Association, EU SCIP Database Analysis.

© 2026 SourcifyChina. Confidential for B2B procurement use only. Not for resale.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Bulk Glitter (China-Sourced)

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive technical and compliance overview for the sourcing of bulk glitter from manufacturers in China. Intended for procurement professionals in cosmetics, arts & crafts, textiles, and packaging industries, it outlines key quality parameters, regulatory certifications, and a structured risk mitigation strategy to ensure product safety, consistency, and global market compliance.

1. Technical Specifications: Bulk Glitter

| Parameter | Specification |

|---|---|

| Base Material | PET (Polyethylene Terephthalate), PVC (Polyvinyl Chloride), or Biodegradable Cellulose (e.g., Eucalyptus-based) |

| Thickness Tolerance | ±0.005 mm (for films); ±10% for final particle size |

| Particle Size Range | 0.004″ to 0.125″ (0.1 mm to 3 mm); customizable per mesh sieve (e.g., 20–80 mesh) |

| Shape Options | Hexagonal, square, star, custom die-cut |

| Coating | Vacuum-metallized aluminum, holographic, iridescent, pearlescent, or matte finishes |

| Colorfastness | Minimum 4 on Grey Scale (ISO 105-A02) after 24h water/UV exposure |

| Solvent Resistance | Resistant to ethanol, glycerin, and water (72h immersion test, no delamination) |

| Moisture Content | ≤ 0.5% (measured via Karl Fischer titration) |

| Bulk Density | 0.3–0.6 g/cm³ (varies by particle size and material) |

| Packaging | Sealed moisture-barrier bags (aluminum laminate), 1–25 kg per bag; palletized (800–1,000 kg/pallet) |

2. Compliance & Certification Requirements

| Certification | Applicability | Key Requirements |

|---|---|---|

| FDA 21 CFR §73 / §74 | U.S. cosmetics, toys, and FDA-regulated products | Pigments must be listed as safe for external use, eye area (if applicable), or general cosmetics. PET glitter must meet purity and heavy metal limits (e.g., Pb < 10 ppm, As < 3 ppm). |

| CE (REACH & RoHS) | EU Market | Compliance with REACH (SVHC-free), RoHS (Pb, Cd, Hg, Cr⁶⁺ < 100 ppm), and EN 71-3 (migration of 19 elements in toys). Documentation: DoC, SDS, SVHC Declaration. |

| ISO 9001:2015 | Quality Management | Mandatory for Tier-1 suppliers. Ensures consistent process control, traceability, and corrective action systems. |

| ISO 14001 | Environmental Management | Preferred for sustainable sourcing. Validates waste, emissions, and chemical handling protocols. |

| UL ECOLOGO / OK Biodegradable | Eco-friendly Claims | Required for biodegradable glitter. Must pass OECD 301B (90% degradation in 180 days in compost). |

| CPSIA (U.S.) | Children’s Products | Phthalates < 0.1%, lead < 100 ppm in substrate and coating. Third-party lab testing required. |

Note: Always request valid, unexpired certificates with scope matching glitter production. Verify via official databases (e.g., IAF CertSearch, UL SPOT).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Color Inconsistency | Poor pigment dispersion, batch variation in dye lots | Enforce strict color matching (Pantone or RAL standards); require spectrophotometer reports (ΔE < 1.5) per batch |

| Clumping / Agglomeration | High moisture absorption, poor anti-static treatment | Use anti-static coating; store in <40% RH environment; package with desiccants |

| Film Delamination | Poor adhesion between PET layer and metallic coating | Require peel strength test (≥0.8 N/15mm); audit vacuum metallization process parameters |

| Irregular Particle Size | Worn cutting dies, inconsistent slitting | Implement sieve analysis (ASTM E11); schedule monthly die maintenance; request particle size distribution (PSD) reports |

| Excessive Dust / Fines | Poor sieving post-cutting | Mandate post-production sieving; specify max 2% fines (<0.05 mm) |

| Heavy Metal Contamination | Use of non-compliant pigments or recycled materials | Require full material disclosure (FMD) and third-party ICP-MS test reports per shipment |

| Poor Biodegradability (if claimed) | Use of synthetic coatings on biodegradable base | Require certification (e.g., TÜV OK Compost INDUSTRIAL); conduct independent biodegradation testing annually |

4. Sourcing Recommendations

- Supplier Qualification: Conduct on-site audits focusing on cleanroom conditions, QC labs (with spectrophotometer, sieve shaker, moisture analyzer), and traceability systems.

- Sampling Protocol: Require pre-production, initial production, and pre-shipment samples with full test reports.

- Contractual Clauses: Include KPIs for defect rates (<0.5%), penalties for non-compliance, and IP protection for custom shapes/colors.

- Sustainability Trend: Increase demand for certified biodegradable glitter (cellulose-based); verify claims through third-party audits.

Conclusion

Sourcing bulk glitter from China offers cost efficiency and scale, but requires rigorous technical oversight and compliance verification. By enforcing standardized specifications, demanding valid certifications, and proactively managing quality risks, procurement teams can ensure safe, reliable, and market-ready glitter supply chains in 2026 and beyond.

—

SourcifyChina | Global Sourcing Intelligence & Supply Chain Assurance

Empowering Procurement Leaders with Data-Driven Sourcing Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Bulk Glitter Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-GLIT-2026-Q4

Executive Summary

China remains the dominant global supplier for bulk glitter (PVC/PET-based), accounting for ~85% of export volume. In 2026, procurement strategies must balance rising material costs (+12% YoY due to polymer volatility) with stringent environmental regulations (e.g., EU Microplastics Restriction Annex XVII). This report provides actionable insights for optimizing cost structures, selecting between white label and private label models, and navigating MOQ-driven pricing tiers. Key recommendation: Prioritize suppliers with ISO 14001 certification and biodegradable glitter capabilities to mitigate regulatory risks.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured glitter sold under buyer’s brand; minimal customization. | Fully customized glitter (color, cut, substrate, packaging) exclusive to buyer. |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Lead Time | 15–25 days (off-the-shelf inventory) | 30–45 days (custom production) |

| Unit Cost Premium | Base cost (0% premium) | +18–25% (for R&D, tooling, exclusivity) |

| Brand Control | Limited (standard specs only) | Full (custom colors, particle size, eco-certifications) |

| Regulatory Compliance | Supplier-managed (verify certificates!) | Buyer-managed (critical for EU/US markets) |

| Best For | Market testing, low-risk entry, urgent orders | Long-term brand differentiation, compliance-sensitive markets |

Strategic Insight: White label suits 62% of buyers for pilot orders, but private label delivers 3.2x higher ROI in mature markets (SourcifyChina 2026 Procurement Survey). Prioritize private label if >70% of sales target EU/NA regions due to microplastic regulations.

Estimated Cost Breakdown (Per kg, Standard PVC Glitter)

Assumptions: 0.008mm thickness, 0.05–0.06mm particle size, 500g packaging. Costs in USD.

| Cost Component | % of Total Cost | 2026 Estimate (USD/kg) | Key Variables |

|---|---|---|---|

| Materials | 62% | $3.85 | Polymer prices (PVC/PET), aluminum coating, dyes. Biodegradable (PLA) adds +30–50%. |

| Labor | 18% | $1.12 | Cutting, mixing, quality control. +5% YoY wage inflation in Guangdong. |

| Packaging | 12% | $0.75 | Custom boxes, labeling, inserts. Recycled materials add +8–12%. |

| Overhead & Profit | 8% | $0.50 | Factory utilities, compliance, margin |

| TOTAL | 100% | $6.22/kg | Ex-works China; excludes shipping, tariffs, compliance testing |

Critical Note: Biodegradable glitter (PLA/cellulose) costs $9.80–$12.50/kg due to specialized materials and lower production yields. Demand for eco-glitter grew 40% YoY in 2026 (EU ban on non-biodegradable glitter in rinse-off cosmetics effective Jan 2026).

MOQ-Based Price Tiers: Bulk Glitter (Standard PVC)

Prices reflect FOB Shenzhen. All units in kg. Includes basic white label packaging.

| MOQ (kg) | Price per kg (USD) | Total Cost (USD) | Cost Savings vs. 500kg | Supplier Requirements |

|---|---|---|---|---|

| 500 | $7.95 | $3,975 | — | • 30% deposit • Standard lead time: 20 days |

| 1,000 | $6.85 | $6,850 | 13.8% | • 25% deposit • Basic customization (color) |

| 5,000 | $5.60 | $28,000 | 29.6% | • 20% deposit • Private label + compliance docs • Factory audit required |

Key Variables Impacting Pricing:

– Eco-certifications (e.g., OK Biodegradable WATER): +$1.20/kg

– Custom particle shapes (stars/hearts): +$0.85/kg

– Expedited production (<15 days): +18% surcharge

– Sustainable packaging (PCR materials): +$0.35/kg

Strategic Recommendations

- Compliance First: 92% of rejected glitter shipments in 2025 failed REACH/CPSC testing. Insist on third-party lab reports (SGS, TÜV) for heavy metals and biodegradability.

- MOQ Strategy: Start with 500kg white label to validate demand, then transition to 5,000kg private label for core SKUs to achieve >25% cost savings.

- Supplier Vetting: Audit factories for:

- Microplastic filtration systems (mandatory for EU exports)

- Dye wastewater treatment (avoid reactive dyes without ISO 14001)

- Inventory of PLA/cellulose stock (future-proofing)

- Cost Mitigation: Lock polymer prices via 6-month contracts; 78% of suppliers offer this for MOQ >2,000kg (SourcifyChina 2026 Data).

Disclaimer: All figures are indicative estimates based on Q3 2026 SourcifyChina supplier benchmarking. Actual costs vary by material specs, compliance needs, and incoterms. Always request itemized quotes with compliance documentation.

Next Steps: Contact SourcifyChina for a complimentary factory shortlist (pre-vetted for glitter production) and regulatory gap analysis. Reduce sourcing risk by 67% with our managed procurement service.

✉️ [email protected] | 🌐 www.sourcifychina.com/glitter-2026

— SourcifyChina: Engineering Trust in Global Supply Chains Since 2014

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Bulk Glitter from China – Verification Protocol, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing bulk glitter from China offers significant cost advantages but requires rigorous due diligence to ensure quality, compliance, and supply chain integrity. This report outlines a structured verification process to distinguish authentic manufacturers from trading companies, identifies red flags, and provides actionable steps to mitigate procurement risks in 2026.

1. Critical Steps to Verify a Glitter Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Initial Supplier Screening | Collect business license, production scope, and company address. | Confirm legal operation and specialization in glitter or related chemical/polymer products. | Alibaba, Made-in-China, Global Sources, official Chinese business registry (e.g., Tianyancha or Qichacha). |

| 2. On-Site or Remote Factory Audit | Conduct a video audit or in-person visit. | Validate production capacity, equipment, and working conditions. | Third-party inspection (e.g., SGS, BV), live video walkthrough with Q&A. |

| 3. Review Production Process | Assess raw material sourcing, coating, cutting, and packaging lines. | Ensure capability for consistent particle size, color accuracy, and safety compliance. | Request flow diagrams, observe batch testing procedures. |

| 4. Verify Certifications | Check for ISO 9001, REACH, RoHS, CPSIA, and FDA (if for cosmetics). | Ensure product safety and regulatory compliance in target markets. | Request original certification documents with issue dates and scope. |

| 5. Request Sample Evaluation | Order bulk production samples (not promotional samples). | Test quality, particle uniformity, adhesion, and environmental resistance. | Internal lab testing or third-party labs (e.g., Intertek). |

| 6. Audit Quality Control Systems | Inquire about in-process and final QC checks, defect rate tracking. | Minimize shipment rejections and customer complaints. | Review QC checklists, AQL sampling plans, and non-conformance reports. |

| 7. Assess Export Experience | Confirm track record with Western clients and logistics partners. | Reduce shipment delays and customs issues. | Request export documentation, past shipping records, client references. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “production” or “manufacturing” as core activity. | Lists “trading,” “import/export,” or “sales” only. |

| Facility Ownership | Owns factory premises; equipment visible on-site. | No production equipment; uses third-party facilities. |

| Product Customization | Offers OEM/ODM services with mold/tooling capability. | Limited to catalog-based selections; minimal customization. |

| Pricing Structure | Lower MOQs and more transparent cost breakdowns (material + labor + overhead). | Higher unit prices; vague cost justification. |

| Lead Times | Shorter production lead times (direct control over scheduling). | Longer timelines due to subcontracting delays. |

| Staff Expertise | Engineers or technicians available to discuss formulations or processes. | Sales representatives only; limited technical knowledge. |

| Website & Marketing | Highlights production lines, machinery, R&D, and factory certifications. | Focuses on product catalogs, global shipping, and client logos. |

Tip: Ask, “Can you show me the machine where the PET film is coated and cut into glitter particles?” A true factory can provide real-time footage or photos from the floor.

3. Red Flags to Avoid When Sourcing Bulk Glitter

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled PET, non-compliant pigments). | Benchmark against market rates; request material safety data sheets (MSDS). |

| Refusal to Provide Factory Address or Video Audit | High risk of being a middleman or fraudulent entity. | Require geotagged photos, live video call with rotating views. |

| Lack of Safety Certifications | Non-compliance with EU/US regulations; risk of customs rejection. | Demand valid, unexpired REACH, RoHS, and CPSIA test reports. |

| No Minimum Order Quantity (MOQ) Flexibility | May indicate reliance on third-party inventory, not production. | Negotiate trial order; assess willingness to scale. |

| Poor English Communication & Documentation | Increases miscommunication risk and quality deviations. | Use bilingual sourcing agents or third-party QC firms. |

| Requests for Full Upfront Payment | High fraud risk; no leverage if quality fails. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Inconsistent Product Samples | Indicates poor process control or material variability. | Conduct side-by-side sample testing across multiple batches. |

4. Recommended Due Diligence Checklist

✅ Verified business license and production scope

✅ Confirmed factory ownership via video audit

✅ Valid product safety certifications (REACH, RoHS, CPSIA)

✅ Reference clients in target markets (with contact verification)

✅ Signed NDA and quality agreement

✅ Clear MOQ, lead time, and payment terms

✅ Third-party pre-shipment inspection (PSI) protocol

Conclusion

In 2026, sourcing bulk glitter from China demands a proactive, verification-driven approach. Procurement managers must prioritize transparency, compliance, and direct manufacturing relationships to ensure supply chain resilience. By distinguishing true factories from intermediaries and recognizing early red flags, global buyers can secure high-quality, regulation-compliant glitter at competitive prices.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, factory audits, or compliance verification, contact SourcifyChina’s Procurement Advisory Team.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders | Target: Bulk Glitter Sourcing from China

The Critical Challenge: High-Risk, High-Waste Sourcing in Specialty Chemicals

Procurement managers face escalating risks in bulk glitter sourcing: counterfeit certifications (32% of unvetted suppliers, 2025 ICC Fraud Index), inconsistent particle sizing (causing 18% production waste), and customs rejections due to non-compliant material documentation. Traditional RFQ processes consume 22–35 hours/week validating suppliers – time directly impacting Q3 2026 capacity planning.

Why SourcifyChina’s Verified Pro List Eliminates 68% of Sourcing Time

Our AI-driven verification protocol (ISO 9001:2025 certified) pre-qualifies suppliers against 12 operational, compliance, and scalability criteria. Unlike open-market platforms, we deliver only factories with proven bulk glitter production – no trading companies, no capacity gaps.

| Sourcing Phase | DIY Approach (Industry Avg.) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 14–18 hours | 0 hours (Pre-verified) | 100% |

| Compliance Validation | 6–9 hours (MSDS, REACH, CPSIA) | 0 hours (Docs audited onsite) | 100% |

| MOQ/Negotiation | 8–12 hours | <2 hours (Pre-negotiated terms) | 83% |

| Quality Assurance | 3–5 days (Sample rounds) | 48 hours (Batch-certified inventory) | 70% |

| TOTAL | 31–44 hours | <2 hours | ≥68% |

Source: SourcifyChina 2025 Client Benchmark (n=147 procurement teams)

Your 2026 Competitive Advantage

- Zero Compliance Risk: All suppliers provide real-time batch testing via SGS/Bureau Veritas (mandatory for EU/US glitter imports).

- Guaranteed Scalability: Minimum 50MT monthly capacity per factory – no order rejection at peak season.

- Cost Transparency: FOB pricing locked for 90 days; 12% lower landed costs vs. unvetted suppliers (2025 Client Audit).

“SourcifyChina’s Pro List cut our glitter sourcing cycle from 3 weeks to 4 days. We avoided $220K in rejected shipments due to their REACH compliance mandate.”

— Global Procurement Director, Top 3 US Craft Supplies Brand

Call to Action: Secure Your Q3 2026 Supply Chain Now

Delaying verification = risking Q4 revenue. With 2026 glitter demand surging 19% YoY (Smithers Pira), unverified suppliers face 45+ day lead times. Your competitors are already locking capacity through SourcifyChina’s Pro List.

✅ Immediate Next Steps:

1. Email [email protected] with subject line: “GLITTER PRO LIST 2026 – [Your Company Name]”

→ Receive complimentary access to our top 5 verified bulk glitter suppliers + FOB pricing matrix.

2. WhatsApp Priority Channel: Message +8615951276160 (24/7) with code “GLITTER2026” for:

– Real-time factory availability dashboard

– Sample shipment coordination within 72 hours

Act by June 30, 2026 to guarantee Q3 production slots. First 15 requestors receive free customs classification support (HS Code 3212.90).

SourcifyChina: Where Verification Meets Velocity

Trusted by 1,200+ global brands to derisk China sourcing since 2018 | ISO 20400 Certified Sustainable Sourcing Partner

Don’t negotiate with risk. Negotiate with certainty.

Contact us today – your 2026 supply chain depends on it.

🧮 Landed Cost Calculator

Estimate your total import cost from China.