The global construction equipment market is witnessing robust expansion, driven by rising infrastructure development and urbanization, particularly across emerging economies. According to Mordor Intelligence, the construction equipment market is projected to grow at a CAGR of over 5.2% from 2023 to 2028, with excavators representing a significant share of equipment demand. Within this segment, 750-class hydraulic excavators—known for their balance of power, versatility, and efficiency—are increasingly favored for large-scale civil engineering, mining, and heavy-duty construction projects. This growing demand has spurred innovation and competition among manufacturers aiming to deliver high-performance, fuel-efficient, and technologically advanced models. Based on market presence, production capacity, technological integration, and global reach, the following six manufacturers stand out as the leading players in the 750 excavator segment.

Top 6 750 Excavator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

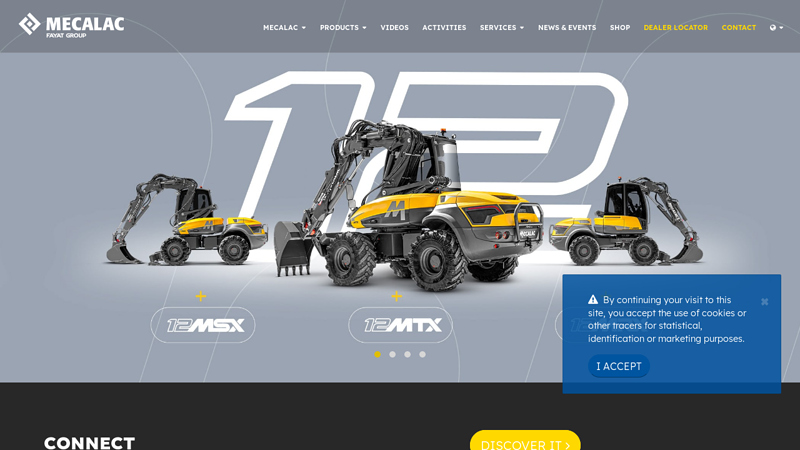

#1 MECALAC, Excavators, Loaders, Backhoe Loaders, Dumpers and …

Domain Est. 1999

Website: mecalac.com

Key Highlights: Mecalac is an international manufacturer of wheel excavators, crawler excavators and wheel loaders. So many innovative and compact machines adapted to the wide ……

#2 CX750D Large Crawler Excavator

Domain Est. 1995

Website: casece.com

Key Highlights: Giant jobs call for giant machines. Like the CASE CX750D excavator. It features a whopping 512 hp and over 75,000 lbs. of bucket breakout force….

#3 Link Belt Excavators

Domain Est. 1998

Website: en.lbxco.com

Key Highlights: Link-Belt Excavators is proud to offer a wide range of Link-Belt excavators, scrap/material handlers, and forestry equipment….

#4 Crawler Excavator EC750E

Domain Est. 2000

Website: volvoce.com

Key Highlights: The 75 ton crawler excavator offers the perfect combination of power and stability to handle a higher capacity in any application….

#5 Volvo CE launches the EC750E HR, its largest high

Domain Est. 2004

Website: volvogroup.com

Key Highlights: The EC750E HR can reach up to 118 feet high and is capable of handling up to 8000-pound tools, making it a versatile and powerful demolition ……

#6 case cx750d full size excavator

Domain Est. 2018

Website: product.global-ce.com

Key Highlights: Move. More. Dirt. Introducing the all-new CASE CX750D excavator, our largest and most powerful excavator yet. From 512 horsepower to 75,000 lbs. of digging ……

Expert Sourcing Insights for 750 Excavator

H2: 2026 Market Trends for 750 Excavators

As the global construction and infrastructure sectors continue to evolve, the market for large-scale excavation equipment—particularly 750-ton class hydraulic excavators—is poised for significant transformation by 2026. These ultra-heavy excavators, commonly used in large mining, quarrying, and major civil engineering projects, are influenced by technological innovation, environmental regulations, regional infrastructure development, and shifts in raw material demand. Below is an analysis of key market trends expected to shape the 750-ton excavator segment in 2026.

1. Increased Demand in Emerging Markets

Infrastructure expansion in emerging economies—particularly in Southeast Asia, Africa, and Latin America—will drive demand for high-capacity excavation machinery. Countries like Indonesia, India, and Nigeria are investing heavily in mining and transportation infrastructure, requiring large excavators to handle bulk earthmoving tasks. The 750-ton class offers unmatched productivity in open-pit mining and large-scale quarry operations, making it a preferred choice for such projects.

2. Electrification and Hybrid Technology Integration

Environmental regulations and carbon reduction targets are accelerating the development of electric and hybrid-powered heavy equipment. By 2026, major manufacturers like Caterpillar, Komatsu, and Liebherr are expected to launch or expand hybrid or fully electric variants of their 750-ton models. These models will offer lower operating costs, reduced emissions, and improved energy efficiency, particularly in mining operations with access to renewable energy sources.

3. Automation and Smart Excavation Systems

Autonomous and semi-autonomous operation systems are becoming standard in large excavators. In 2026, 750-ton models will increasingly feature advanced telematics, AI-driven bucket control, GPS-guided operation, and remote monitoring. These technologies enhance precision, reduce operator fatigue, and improve safety in hazardous environments like deep mines. Mining companies are anticipated to adopt such smart systems to optimize productivity and reduce downtime.

4. Focus on Sustainability and Lifecycle Management

End-users and regulators are placing greater emphasis on equipment sustainability. Manufacturers are responding with modular designs that allow for easier repairs, component reuse, and extended lifecycle management. By 2026, remanufactured or refurbished 750-ton excavators are expected to gain market share, particularly in cost-sensitive regions, as part of circular economy strategies.

5. Supply Chain Resilience and Localization

Geopolitical tensions and past supply chain disruptions have prompted OEMs to localize production and secure critical components (e.g., high-capacity hydraulic systems, electric drivetrains). In 2026, companies may establish regional manufacturing hubs to serve key markets more efficiently, reducing lead times and import dependencies.

6. Commodity Prices and Mining Investment

The demand for 750-ton excavators is closely tied to commodity cycles. Rising demand for lithium, copper, and rare earth elements for green technologies is expected to fuel mining investments, particularly in Australia, Chile, and Canada. This will directly increase the need for ultra-large excavators capable of high-volume material handling.

7. Regulatory Pressures and Emission Standards

Stricter emissions standards—such as EU Stage V and potential new U.S. EPA regulations—will push manufacturers to innovate cleaner power solutions. While diesel-powered 750-ton excavators will still dominate in 2026, especially in remote mining areas, the transition toward low-emission alternatives will gain momentum, supported by government incentives.

Conclusion:

The 750-ton excavator market in 2026 will be shaped by a confluence of technological advancement, sustainability imperatives, and robust infrastructure demand. While traditional diesel models remain prevalent, electrification, automation, and smart systems will define the next generation of ultra-heavy excavation equipment. Companies that invest in innovation, adapt to regional regulatory environments, and support sustainable operations will lead the market.

Common Pitfalls When Sourcing a 750 Excavator (Quality and Intellectual Property)

Sourcing a large, high-value machine like a 750-ton hydraulic excavator involves significant risks, particularly concerning quality and intellectual property (IP). Being aware of these pitfalls is crucial for making a sound investment and avoiding costly problems.

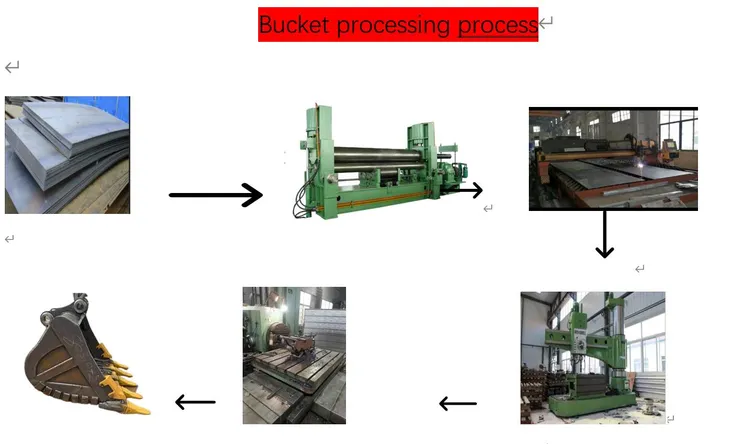

Poor Build Quality and Substandard Components

One of the most significant risks, especially when considering lower-cost or non-OEM options, is receiving an excavator constructed with inferior materials and components. This includes thin-gauge steel in the undercarriage and boom, low-grade hydraulic hoses prone to bursting, and under-spec’d motors and pumps. Such machines suffer from premature wear, frequent breakdowns, and reduced operational safety, leading to high maintenance costs and extended downtime.

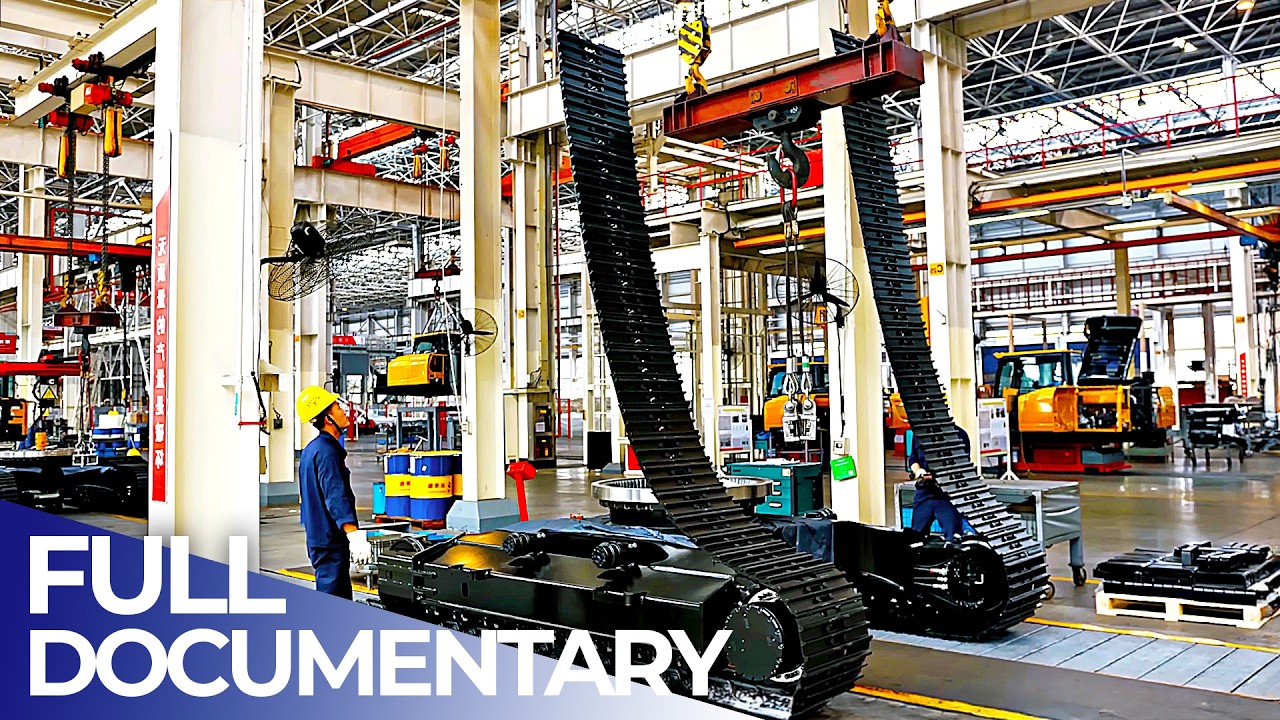

Inadequate Manufacturing Standards and Processes

Even if components appear adequate, the overall build quality can be compromised by poor manufacturing practices. Inconsistent welding, improper torque on critical fasteners, misaligned structures, and lack of proper quality control checks during assembly can all lead to structural failures, leaks, and unreliable performance. Without adherence to international manufacturing standards (e.g., ISO), the machine’s longevity and safety cannot be guaranteed.

Counterfeit or Unlicensed Replicas (IP Infringement)

A major intellectual property concern is the proliferation of unauthorized replicas or “knock-offs” of well-known 750 excavator models. These machines copy the design, branding, and technical specifications of original equipment manufacturers (OEMs) like Komatsu, Liebherr, or Caterpillar without licensing. Purchasing such equipment exposes the buyer to legal risks, including potential seizure, fines, or liability for contributory IP infringement, especially in jurisdictions with strong IP enforcement.

Lack of Genuine OEM Support and Parts Compatibility

Excavators produced without proper IP licenses often cannot access genuine OEM technical support, software updates, or diagnostic tools. Furthermore, spare parts may be reverse-engineered and incompatible or lower in quality, leading to operational inefficiencies. Without access to official service manuals and trained technicians, maintenance becomes more complex and error-prone.

Misrepresentation of Technical Specifications

Suppliers may exaggerate the machine’s capabilities—such as engine output, digging force, or lifting capacity—either through misleading marketing or outright falsification. These inflated specs can lead to the machine being unsuitable for the intended application, resulting in poor productivity and increased wear. Independent verification of performance data is essential before purchase.

Absence of Certification and Compliance Documentation

Reputable 750 excavators must meet stringent safety, emissions, and operational standards (e.g., CE, EPA, ISO). Illegitimate or low-quality manufacturers may lack proper certifications or provide forged documentation. Operating a non-compliant machine can result in project delays, regulatory fines, and insurance complications, especially on international or environmentally sensitive sites.

Limited Warranty and After-Sales Support

Many non-OEM or IP-infringing models offer weak or unenforceable warranties. The absence of a reliable service network means that repairs require long downtimes and costly third-party interventions. Without robust after-sales support, maintaining machine uptime becomes a significant operational challenge.

Supply Chain and Vendor Reliability Issues

Sourcing from unknown or unverified suppliers increases the risk of project delays, contract breaches, or receiving a machine that doesn’t match the agreed specifications. Due diligence on the vendor—including site visits, reference checks, and legal vetting—is critical to ensure reliability and avoid fraud.

Avoiding these pitfalls requires thorough due diligence, engagement with reputable suppliers, verification of IP legitimacy, and independent technical assessments before finalizing any purchase of a 750 excavator.

Logistics & Compliance Guide for 750 Excavator

This guide outlines the key logistical considerations and compliance requirements for transporting and operating a 750 Excavator. Always verify specifications with the manufacturer and local authorities, as models and regulations may vary.

Transportation Planning

Proper planning ensures safe and legal movement of the excavator. Consider weight, dimensions, and route restrictions.

Weight and Dimensions

Measure the excavator’s total operational weight, including attachments. Confirm track width, length, height, and counterweight overhang. These values determine trailer requirements and permit needs.

Trailer Selection

Use a heavy-duty lowboy or RGN (Removable Gooseneck) trailer rated for the excavator’s weight. Ensure proper load distribution, securing points, and deck length to accommodate the machine without overhang violations.

Route Survey

Evaluate the transport route for bridge weight limits, low overpasses, narrow roads, and turning radius challenges. Adjust travel times to avoid peak traffic and secure necessary escort vehicles if required.

Regulatory Compliance

Adherence to regional and national regulations is mandatory for legal transport and operation.

Permits and Documentation

Obtain oversized/overweight load permits from relevant transportation departments. Carry proof of registration, insurance, and equipment certification. Display required signage (e.g., “Oversize Load”) and permit documentation during transit.

Transportation Laws

Comply with hours-of-service rules for drivers, axle weight limits, and lighting/signaling requirements. Follow local regulations for travel times (e.g., restrictions on weekends or night travel).

Environmental Regulations

Ensure the excavator meets emissions standards (e.g., EPA Tier 4 or equivalent). Confirm compliance with noise ordinances at job sites. Implement spill prevention measures for fuel and hydraulic fluids.

Site Delivery and Setup

Safely offload and prepare the excavator for operation upon arrival.

Delivery Coordination

Schedule delivery during off-peak hours to minimize disruptions. Confirm site access, ground stability, and clear pathways for offloading.

Rigging and Offloading

Use certified rigging equipment and trained personnel. Follow manufacturer guidelines for lifting points. Inspect the excavator post-transport for damage or loose components.

Initial Inspection and Compliance Check

Conduct a pre-operation inspection: verify fluid levels, track tension, lights, and safety devices. Ensure all required decals (capacity, warning labels) are present and legible.

Operational Compliance

Maintain ongoing compliance during use to ensure safety and legality.

Operator Certification

Only trained and certified operators may use the excavator. Maintain up-to-date records of operator training and equipment-specific qualifications.

Worksite Safety Protocols

Adhere to OSHA (or local equivalent) regulations. Implement site-specific safety plans, including hazard assessments, exclusion zones, and communication procedures.

Maintenance and Recordkeeping

Follow the manufacturer’s maintenance schedule. Keep logs of inspections, repairs, and compliance checks for audit purposes.

International Considerations (if applicable)

For cross-border movement, additional compliance steps are required.

Customs and Import Regulations

Prepare commercial invoices, bills of lading, and certificates of origin. Comply with import duties and temporary importation under bond (TIB) rules where applicable.

Homologation and Standards

Verify that the excavator meets destination country’s safety and emissions standards (e.g., CE marking in the EU). Adapt lighting, signage, or controls if needed.

Language and Documentation

Provide operation and safety manuals in the local language. Translate critical labels and warning signs as required.

Conclusion for Sourcing a 750 Excavator

Sourcing a 750-ton class excavator is a significant capital investment that requires careful consideration of technical specifications, operational requirements, supplier reliability, total cost of ownership, and long-term maintenance support. After thorough evaluation, it is evident that selecting the right model—whether from industry leaders such as Liebherr, Caterpillar, Komatsu, or Hitachi—must align with the project’s scale, site conditions, and productivity goals.

Key factors such as fuel efficiency, dig depth, lifting capacity, availability of spare parts, and after-sales service play a crucial role in maximizing uptime and operational efficiency. Additionally, exploring options between new, refurbished, or leased units can offer financial flexibility depending on project duration and budget constraints.

In conclusion, successful sourcing of a 750 excavator hinges on a strategic approach that balances performance, reliability, and cost-effectiveness. Engaging with reputable suppliers, conducting site-specific assessments, and planning for long-term maintenance will ensure optimal return on investment and enhanced productivity in large-scale mining or heavy construction operations.