The global exhaust system market is experiencing steady growth, driven by increasingly stringent emissions regulations and rising vehicle production. According to Grand View Research, the market was valued at USD 29.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. A key component within this sector is 6-inch exhaust tubing, widely used in heavy-duty trucks, industrial machinery, and performance vehicles due to its optimal balance of airflow efficiency and compatibility with high-output engines. As demand for durable, corrosion-resistant exhaust solutions grows—particularly in North America and Asia-Pacific—leading manufacturers are investing in advanced materials and precision fabrication techniques. This report identifies the top 10 6-inch exhaust tubing manufacturers shaping the industry, evaluated on production capacity, material innovation, global reach, and compliance with environmental standards.

Top 10 6 Exhaust Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Factory Pipe

Domain Est. 1995

Website: factorypipe.com

Key Highlights: WE DESIGN AND BUILD EXHAUST SYSTEMS for the MOTORSPORTS INDUSTRY · WE ARE A WORLD-CLASS OEM SUPPLIER · WE DESIGN, ENGINEER AND BUILDWHAT YOU NEED ……

#2 Milltek Sport

Domain Est. 2002

Website: millteksport.com

Key Highlights: Milltek is a performance and off-road aftermarket parts manufacturer headquartered in the UK, we have been developing performance exhaust products for over 40 ……

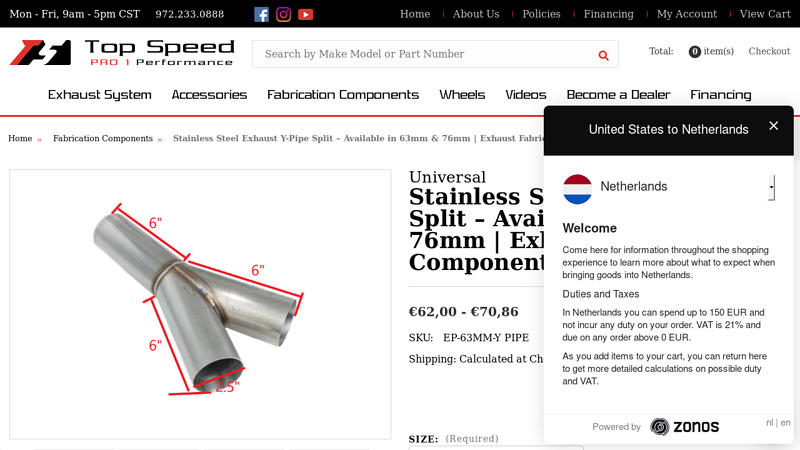

#3 Stainless Steel Exhaust Y

Domain Est. 2002

Website: topspeedauto.com

Key Highlights: Enhance your custom exhaust setup with our high-quality stainless steel Y-pipe split, designed for efficient exhaust flow distribution and optimal performance.Missing: tubing manu…

#4 Aluminized Exhaust Pipe, 6 Inch OD x 60 Inch

Domain Est. 1998

Website: 4statetrucks.com

Key Highlights: In stock $57.79 delivery60 Inch Aluminized Exhaust Pipe, boasting a 6 Inch OD. Made from aluminized material, it not only withstands the harsh conditions of exhaust emissions but a…

#5 Tubing

Domain Est. 1998

Website: exhaustdirect.com

Key Highlights: All tubing is special order only! Please call 1-888-544-2222 and one of our sales representatives will be happy to assist you. All Tubing is sold in 10′ foot ……

#6 Walker Exhaust Systems

Domain Est. 1999

Website: walkerexhaust.com

Key Highlights: Providing performance-grade mufflers and exhaust kits for a wide variety of makes and models, Walker is the name to trust in OE-quality exhaust parts….

#7 Big Rig Exhaust Products

Domain Est. 2003

#8 Heartthrob Exhaust

Domain Est. 2003

Website: heartthrobexhaust.com

Key Highlights: What We Do: · Custom Tube Fabrication · Custom + Performance Exhaust Installation · Muffler Manufacturing · Automotive Performance Exhaust Components….

#9 Contract & Private Label Exhaust System Manufacturing

Domain Est. 2010

Website: h-pproducts.com

Key Highlights: Contract & Private Label Exhaust System Manufacturing. Pre-bent Mandrel Bends are also available. U-Bends. J Bends. Straight Tubing….

#10 Patriot Exhaust

Domain Est. 2020

Website: pertronixbrands.com

Key Highlights: Free delivery over $109 90-day returnsPatriot Exhaust manufactures superior exhaust systems for the street rod, custom and muscle car aficionado. Developed by enthusiasts….

Expert Sourcing Insights for 6 Exhaust Tubing

H2: 2026 Market Trends for Exhaust Tubing

The global exhaust tubing market is projected to undergo significant transformations by 2026, driven by evolving regulatory standards, technological advancements, and shifts in end-user industries—particularly automotive, industrial machinery, and aerospace. As environmental regulations tighten worldwide, especially in regions like North America, Europe, and parts of Asia-Pacific, demand for high-performance, durable, and emissions-compliant exhaust systems is on the rise. Exhaust tubing, a critical component in managing engine emissions and enhancing fuel efficiency, is benefiting from these macro trends.

One of the key drivers shaping the 2026 outlook is the increasing adoption of stainless steel and aluminized steel tubing due to their superior resistance to corrosion, heat, and mechanical stress. Manufacturers are investing in advanced manufacturing techniques such as hydroforming and laser welding to produce lighter, more efficient tubing with tighter tolerances. These innovations not only improve performance but also support the automotive industry’s push toward weight reduction and fuel economy.

Additionally, the rise of electric vehicles (EVs) presents a dual impact. While traditional internal combustion engine (ICE) vehicles remain a dominant market for exhaust systems through 2026, the gradual shift to EVs is prompting manufacturers to diversify their product lines. However, hybrid vehicles—which still utilize ICE components—continue to sustain demand for exhaust tubing, especially in emerging markets where EV adoption is slower.

Regulatory pressures, particularly from the U.S. Environmental Protection Agency (EPA), European Union’s Euro 7 standards (expected by 2026), and China’s National VI standards, are compelling automakers to integrate more sophisticated exhaust after-treatment systems. This includes greater use of catalytic converters and diesel particulate filters, which require precision-engineered exhaust tubing for optimal function.

Geographically, Asia-Pacific is expected to lead market growth due to expanding automotive production in China, India, and Southeast Asia. Meanwhile, North America and Europe will focus on replacement and aftermarket segments, supported by aging vehicle fleets and stringent maintenance regulations.

In summary, by 2026, the exhaust tubing market will be characterized by material innovation, regulatory compliance, regional diversification, and adaptation to hybrid technologies. Companies that leverage automation, sustainable materials, and R&D in emission control integration are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls When Sourcing 6 Exhaust Tubing (Quality, IP)

Sourcing exhaust tubing for industrial, automotive, or HVAC applications requires careful attention to both quality and IP (Ingress Protection) ratings to ensure performance, safety, and longevity. Below are common pitfalls to avoid:

Poor Material Quality and Durability

One of the most frequent issues is selecting tubing made from substandard materials. Low-grade stainless steel or aluminized steel may corrode quickly, especially in high-moisture or high-temperature environments. Thin wall thickness can lead to premature failure, vibration damage, or collapse under pressure. Always verify material specifications (e.g., 304 or 321 stainless steel) and request mill test certificates to confirm composition and thickness.

Incorrect or Misrepresented IP Rating

Many suppliers advertise IP ratings (e.g., IP65, IP67) without proper certification. For exhaust systems exposed to dust or water, especially in outdoor or harsh industrial settings, a falsely claimed IP rating can lead to system contamination or electrical hazards if the tubing is part of a sealed enclosure. Always request third-party test reports or certifications for the stated IP rating—don’t rely solely on marketing claims.

Inadequate Temperature and Pressure Ratings

Exhaust systems often operate under extreme thermal and pressure conditions. Sourcing tubing without verifying temperature resistance (e.g., continuous vs. peak operating temps) or pressure tolerances can result in warping, leaks, or catastrophic failure. Ensure the tubing is rated for the specific thermal expansion and backpressure conditions of your application.

Lack of Dimensional Consistency

Tubing with inconsistent outer diameter (OD), inner diameter (ID), or wall thickness can cause fitting issues, leaks, or improper airflow. Poor tolerances lead to difficulties during installation and maintenance. Specify tight dimensional tolerances and perform incoming inspections or request sample testing before bulk procurement.

Non-Compliance with Industry Standards

Using tubing that does not meet relevant standards (e.g., ISO, ASTM, SAE, or local emission regulations) can lead to compliance issues, system inefficiencies, or legal liabilities. Always confirm that the tubing complies with applicable industry codes and environmental regulations, particularly if used in emissions-critical applications.

Overlooking Flexibility and Vibration Resistance

In dynamic environments (e.g., vehicles or machinery), rigid tubing may crack due to vibration. Flexible exhaust tubing must balance durability with movement tolerance. However, over-flexible materials may degrade faster or collapse under suction. Assess the need for flex sections and ensure they are designed for the expected motion cycles and operating conditions.

Insufficient Supplier Due Diligence

Relying on unqualified or uncertified suppliers increases the risk of receiving counterfeit or off-spec products. Conduct thorough supplier audits, check for ISO 9001 certification, and evaluate their track record in supplying to similar industries. Avoid sourcing solely on price—low-cost options often compromise critical performance factors.

By addressing these pitfalls proactively—focusing on verified material quality, authentic IP ratings, and adherence to technical standards—you can ensure reliable and safe operation of exhaust systems over their intended lifespan.

H2: Logistics & Compliance Guide for 6 Exhaust Tubing

H2: Overview

This guide provides essential logistics and compliance information for the safe, efficient, and legally compliant handling, transportation, storage, and disposal of 6 Exhaust Tubing. This tubing is typically used in industrial, automotive, or HVAC applications to channel exhaust gases, and may be made from materials such as stainless steel, aluminized steel, rubber, or silicone. Proper procedures are critical to ensure product integrity, personnel safety, and adherence to international and local regulations.

H2: Product Specifications

- Product Name: Exhaust Tubing (6-inch diameter)

- Common Materials: Stainless steel, aluminized steel, silicone, rubber

- Lengths: Typically supplied in straight pipes, flex sections, or continuous rolls

- Temperature Resistance: Varies by material (e.g., silicone: up to 500°F/260°C; stainless steel: up to 1200°F/649°C)

- Standards: May conform to SAE, ISO, or ASTM specifications depending on application

H2: Packaging Requirements

- Primary Packaging: Tubing should be protected with end caps or plugs to prevent contamination and physical damage.

- Secondary Packaging:

- Rigid tubing: Bundled and secured on wooden pallets with banding or shrink wrap.

- Flexible tubing: Coiled and boxed or palletized to avoid kinking.

- Labeling:

- Clearly mark each package with:

- Product name and part number

- Quantity and dimensions

- Handling instructions (e.g., “Do Not Bend,” “Keep Dry”)

- Hazard symbols if applicable (e.g., sharp edges)

- Include batch/lot number and date of manufacture for traceability.

H2: Storage Conditions

- Environment: Store in a dry, well-ventilated area, protected from direct sunlight and moisture.

- Temperature Range: 40°F to 100°F (4°C to 38°C)

- Positioning:

- Rigid tubing: Stored horizontally on racks, supported at multiple points.

- Flexible tubing: Avoid compression; store coiled or on spools.

- Segregation: Keep away from corrosive chemicals, oils, and sharp objects.

- Shelf Life: Inspect periodically; indefinite for metal tubing if stored properly; rubber/silicone may degrade over time (typically 3–5 years).

H2: Transportation Guidelines

- Mode of Transport: Suitable for road, rail, air, and sea freight.

- Loading/Unloading:

- Use mechanical aids (e.g., forklifts) to avoid manual strain.

- Prevent dragging or dropping to avoid dents, creases, or crushing.

- Securement: Pallets must be strapped and braced to prevent shifting during transit.

- Documentation:

- Commercial invoice

- Packing list

- Bill of lading or air waybill

- Material Safety Data Sheet (MSDS/SDS), if required

- Hazard Classification: Generally non-hazardous under IATA, IMDG, and ADR if empty and clean. If contaminated with oil or residue, classify accordingly (e.g., UN3082, Environmentally Hazardous Substance).

H2: Regulatory Compliance

- International Standards:

- REACH (EU): Confirm no restricted substances (e.g., heavy metals) above thresholds.

- RoHS (EU): Applicable if used in electrical/electronic equipment; ensure compliance with lead, cadmium, etc.

- Proposition 65 (California, USA): Provide warnings if containing listed chemicals (e.g., nickel in stainless steel).

- Customs & Trade:

- Harmonized System (HS) Code: Typically 7306.61 (stainless steel tubes) or 4009.31 (rubber tubing), confirm based on material.

- Ensure import/export licenses if required by destination country.

- Environmental & Safety:

- OSHA (USA): Follow safe handling practices to prevent injury from sharp edges.

- EPA: No special disposal regulations for clean metal tubing; contaminated parts may require hazardous waste handling.

H2: Handling & Safety

- Personal Protective Equipment (PPE):

- Cut-resistant gloves

- Safety glasses

- Steel-toed boots (for heavy metal tubing)

- Best Practices:

- Lift with proper technique or equipment.

- Avoid contact with skin after handling metal tubing (oil residues, metal dust).

- Inspect for burrs or sharp edges before installation.

H2: End-of-Life & Disposal

- Recyclability:

- Metal tubing: Recyclable through scrap metal processors (ferrous or non-ferrous streams).

- Rubber/silicone: May be incinerated with energy recovery or disposed of in approved landfills; check local regulations.

- Disposal Compliance:

- If contaminated with oil, fuel, or other fluids, treat as hazardous waste per local regulations (e.g., RCRA in the USA).

- Maintain disposal records for audit purposes.

H2: Documentation & Traceability

- Maintain records including:

- Certificates of Conformance (CoC)

- Material Test Reports (MTRs), if applicable

- Shipping and receiving logs

- SDS (if applicable)

- Implement batch tracking for quality control and recalls.

H2: Contacts & Support

For compliance inquiries or logistics support, contact:

– Logistics Department: [email protected] | +1 (555) 123-4567

– Regulatory Compliance Officer: [email protected]

– Emergency Spill/Incident Response: +1 (555) 987-6543 (24/7)

Note: Always verify local, national, and international regulations prior to shipping or disposal. Regulations may vary by country and application.

In conclusion, sourcing six exhaust tubing units requires careful consideration of specifications such as material type, dimensions, compatibility with the existing system, and supplier reliability. After evaluating multiple vendors, comparing pricing, lead times, and quality assurances, the most cost-effective and timely option has been identified. Procuring the tubing from a reputable supplier ensures durability, performance, and compliance with industry standards. Finalizing the order promptly will support timely project execution and minimize potential delays. This sourcing decision aligns with operational requirements and budgetary constraints, ensuring efficient and reliable performance of the exhaust system.