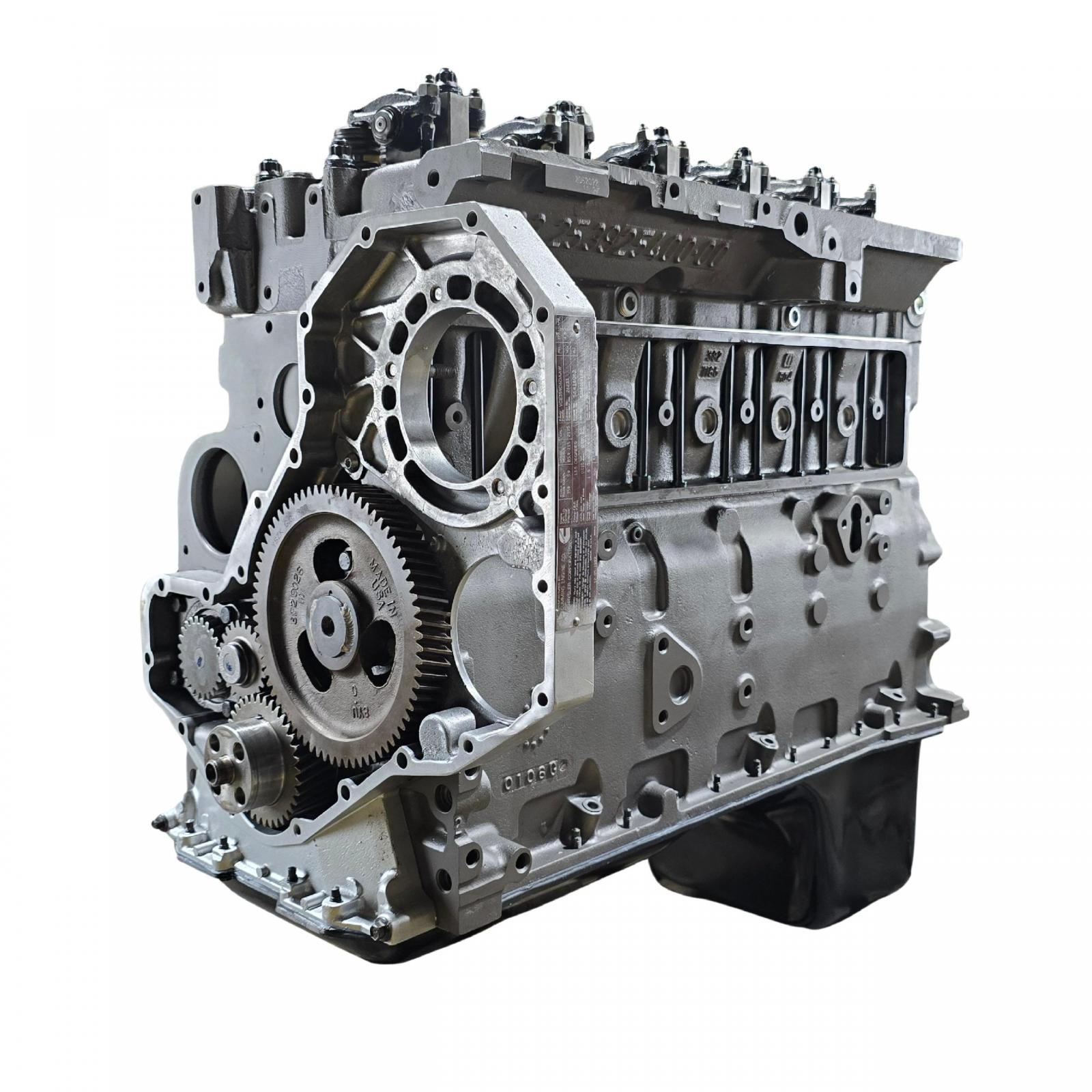

The global diesel engine parts market, driven by rising demand for heavy-duty vehicles and industrial machinery, is projected to grow at a CAGR of approximately 4.2% from 2023 to 2028, according to Mordor Intelligence. With the iconic 5.9L Cummins engine remaining a staple in medium-duty trucks, agricultural equipment, and off-road applications, the aftermarket for reliable, high-performance components continues to expand. As fleet operators and enthusiasts prioritize durability and uptime, the demand for OEM-equivalent and upgraded parts has led to a competitive landscape among manufacturers specializing in 5.9 Cummins components. Based on market analysis, product availability, and performance reputation, the following six manufacturers stand out as leading suppliers in this segment.

Top 6 5.9 Cummins Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Parts, Sales and Service

Domain Est. 1990

Website: cummins.com

Key Highlights: Cummins Genuine Parts Browse our parts catalog, find your Engine Serial Number, and learn more about why Genuine Parts are the best for your Cummins products. ……

#2 Cummins

Domain Est. 2000

#3 Cummins

Domain Est. 2006

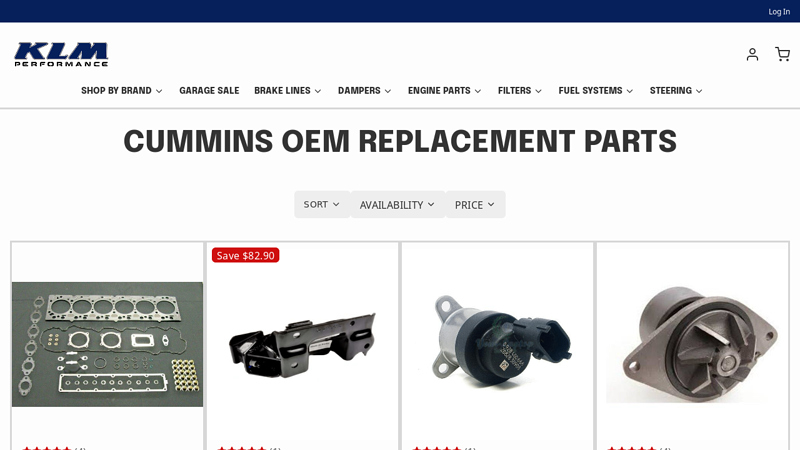

Website: klmperformance.com

Key Highlights: 1–7 day delivery 14-day returnsPremium Cummins OEM replacement parts for all your car maintenance and repair needs in one place! Explore our available assortment of products….

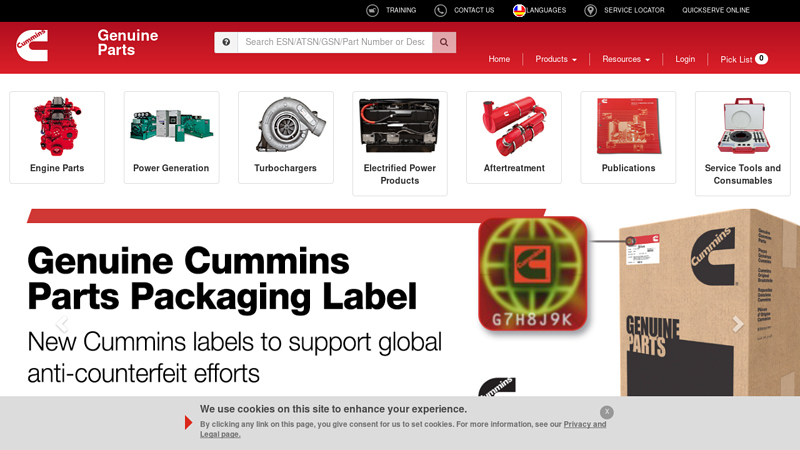

#4 Genuine Cummins Parts

Domain Est. 1990

Website: parts.cummins.com

Key Highlights: https://parts.cummins.com is the Genuine online catalog for Holset®, Fleetguard®, Onan and Cummins parts….

#5 Ram 5.9L & 6.7L Cummins Parts

Domain Est. 2002

Website: dieselpowerproducts.com

Key Highlights: Shop performance parts for Ram 5.9L & 6.7L Cummins diesel trucks. Exhaust, turbos, fuel systems, tuning & more from top brands….

#6 5.9 Cummins Engine Parts

Domain Est. 2020

Expert Sourcing Insights for 5.9 Cummins Parts

H2: 2026 Market Trends for 5.9L Cummins Parts – Resilience Amid Transition

While the 5.9L Cummins (particularly the 6BT and early ISB iterations) is a mature platform, the market for its parts in 2026 remains surprisingly robust, shaped by a confluence of enduring demand, economic pressures, and evolving aftermarket dynamics. Here’s a breakdown of key trends:

-

Enduring Fleet Longevity & High Utilization:

- Core Driver: The primary factor sustaining the 5.9L parts market is the sheer number of these engines still in demanding service. Thousands of Dodge Ram 2500/3500 pickups (1989-2007), medium-duty trucks, agricultural equipment, industrial generators, and marine applications rely on this engine’s legendary durability.

- 2026 Impact: As these vehicles and machines age further, preventative maintenance and component replacement cycles will accelerate. Expect consistent demand for wear items (injectors, fuel pumps, glow plugs, thermostats, water pumps, belts, hoses, filters) and common failure points (head gaskets on pre-2003 models, VP44 injection pumps on 1998.5-2002 models, lift pumps).

-

Economic Pressures Fueling Aftermarket Reliance:

- Cost-Conscious Ownership: With new vehicle costs high and inflation persistent, owners and operators are increasingly motivated to extend the life of existing 5.9L-powered equipment. Rebuilding or replacing a 5.9L is often significantly cheaper than purchasing new.

- 2026 Impact: This drives strong demand for high-quality aftermarket parts (OE-replacement and performance), remanufactured components (injectors, pumps, alternators, starters), and complete long-block or short-block assemblies. Budget-friendly options will remain popular, but quality perception will be crucial.

-

Performance & Customization Niche Strengthens:

- Established Enthusiast Base: The 5.9L has a massive, dedicated performance community. The “P-pumped” (HE351CW turbo, P7100 injection) era (1998.5-2002) is particularly revered for its tunability.

- 2026 Impact: Demand for performance parts (tuning modules, gauges, intercoolers, exhaust manifolds, upgraded fuel systems, clutches) remains steady. Expect continued innovation in supporting higher power levels reliably. The market for cosmetic and functional upgrades (engine dress-up kits, oil bypass systems) will also persist.

-

Shift Towards Remanufactured & Core-Driven Supply:

- Scarcity & Cost: Genuine OEM parts (especially Cummins-branded) are often expensive and may have longer lead times. Critical components like factory VP44 pumps are no longer produced.

- 2026 Impact: The remanufactured parts market will be dominant for complex components. Suppliers specializing in reman VP44s, P7100s, HE351CW turbos, and starters/alternators will be key players. The “core” (old part) return model will be essential for supply chain sustainability and cost control.

-

Consolidation & Specialization Among Suppliers:

- Market Maturation: The 5.9L parts market is well-established but faces pressure. Expect continued consolidation among distributors and retailers.

- 2026 Impact: Success will favor suppliers with deep technical expertise, strong reman programs, reliable logistics, and excellent customer support. Niche players focusing exclusively on Cummins (especially 5.9L) or heavy-duty diesel will thrive. Online marketplaces (eBay, specialized forums) will remain important, but trust in established brands and tech support will be paramount.

-

Knowledge Gap & Technical Support Value:

- Aging Workforce & DIY Focus: As original technicians retire, there’s a gap in deep 5.9L knowledge. Simultaneously, the DIY community remains large but diverse in skill level.

- 2026 Impact: Suppliers offering exceptional technical support, detailed installation guides, troubleshooting resources, and access to experienced advice will gain significant competitive advantage. This is a key differentiator beyond just price.

-

Gradual Erosion from Platform Retirement:

- The Long-Term Reality: Despite resilience, the total number of operational 5.9L engines will slowly decline as vehicles are scrapped, rust out, or become economically unviable to repair. New applications are virtually non-existent.

- 2026 Impact: This is a background trend. While the market remains healthy in 2026, suppliers are aware this is a finite resource. Focus will be on maximizing the value from the existing installed base rather than growth.

Conclusion for 2026:

The 5.9L Cummins parts market in 2026 will be characterized by resilient, high-volume demand driven by economic necessity and the engine’s inherent durability, particularly for maintenance and common repair items. The market will be dominated by the aftermarket and remanufactured components, with strong niches in performance and enthusiast modifications. Success will hinge on reliable supply chains, technical expertise, excellent customer support, and specialization. While the overall pool of engines slowly diminishes, the intense usage and owners’ commitment to keeping these workhorses running ensure a healthy and competitive market for 5.9L parts well into the latter half of the decade.

Common Pitfalls When Sourcing 5.9L Cummins Parts: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for 5.9 Cummins Parts

Overview

This guide outlines the essential logistics and compliance considerations when sourcing, transporting, storing, and installing 5.9 Cummins engine parts. Adherence to these practices ensures operational efficiency, regulatory compliance, and product integrity across the supply chain.

Regulatory Compliance

All 5.9 Cummins parts must comply with applicable federal, state, and international regulations, including but not limited to:

– EPA Emissions Standards: Replacement parts must meet or exceed original equipment manufacturer (OEM) emissions specifications to maintain engine certification.

– DOT Regulations: For commercial vehicle applications, parts must conform to Department of Transportation safety and performance standards.

– Customs & Import/Export Laws: International shipments require proper documentation (e.g., commercial invoices, certificates of origin) and adherence to HTS codes for diesel engine components.

– REACH & RoHS Compliance: Ensure materials used in parts (especially for EU markets) meet chemical restriction and environmental safety requirements.

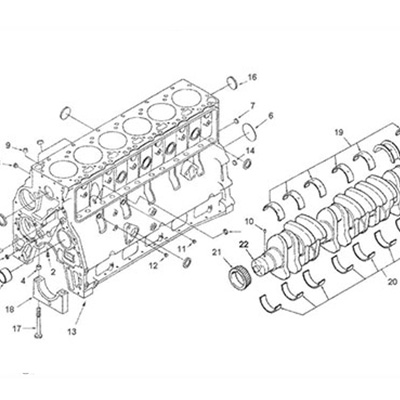

Part Authenticity & Traceability

- Source parts only from authorized Cummins distributors or certified suppliers to ensure authenticity.

- Verify part numbers against the Cummins Master Parts Catalog to prevent installation of non-conforming components.

- Maintain full traceability through batch/lot numbers, serial tracking, and digital inventory systems to support warranty claims and recalls.

Packaging & Labeling Requirements

- Use manufacturer-recommended packaging to protect parts from moisture, vibration, and physical damage during transit.

- Label all packages with:

- Part number and description

- Quantity

- Serial or batch number

- Handling instructions (e.g., “Fragile,” “This Side Up”)

- Compliance markings (e.g., EPA certification, CE mark if applicable)

Storage & Inventory Management

- Store parts in a clean, dry, temperature-controlled environment to prevent corrosion and degradation.

- Implement FIFO (First In, First Out) inventory rotation to minimize obsolescence.

- Segregate new, used, and remanufactured parts to avoid cross-contamination and compliance issues.

- Conduct regular inventory audits to ensure accuracy and detect discrepancies.

Transportation & Shipping

- Use carriers experienced in automotive or industrial freight with proper insurance and tracking capabilities.

- Secure hazardous materials (e.g., fuel injectors with residual diesel) per IATA/IMDG/49 CFR regulations when applicable.

- Provide shippers with accurate freight classifications (NMFC codes) and weight dimensions to avoid delays or surcharges.

- Confirm delivery requirements (e.g., liftgate service, appointment scheduling) in advance for large or bulk shipments.

Installation & Warranty Compliance

- Only trained technicians should install 5.9 Cummins parts using Cummins-recommended tools and torque specifications.

- Maintain detailed service records, including part numbers, installation dates, and technician information.

- Unauthorized modifications or use of non-OEM parts may void engine warranties and emissions certifications.

Returns & Reverse Logistics

- Follow the supplier’s return material authorization (RMA) process for defective or incorrect parts.

- Package returned items in original or equivalent protective materials with completed RMA documentation.

- Track and report return reasons to identify quality or logistics issues.

Environmental & Safety Considerations

- Dispose of packaging materials (e.g., plastic, foam) in accordance with local recycling regulations.

- Handle used parts (e.g., oil filters, injectors) as hazardous waste if contaminated with oil or fuel.

- Ensure personnel are trained in handling sharp components and following lockout/tagout (LOTO) procedures during installation.

Conclusion

Proper logistics and compliance management for 5.9 Cummins parts safeguards performance, legal standing, and customer satisfaction. By following this guide, distributors, repair facilities, and fleet operators can ensure parts are handled safely, legally, and efficiently from warehouse to installation.

In conclusion, sourcing 5.9L Cummins parts requires careful consideration of quality, compatibility, and reliability to ensure optimal performance and longevity of the engine. Whether sourcing new, remanufactured, or used components, it is essential to work with reputable suppliers, verify part specifications, and prioritize OEM or high-quality aftermarket options. Factors such as application (e.g., truck, industrial, or marine use), budget, and availability should guide the decision-making process. Additionally, leveraging online marketplaces, specialized diesel shops, and Cummins dealers can provide access to a wide range of parts and expert support. By conducting thorough research and due diligence, owners and mechanics can successfully source dependable 5.9L Cummins parts that maintain the rugged reliability the engine is known for.