The global vacuum tubing market has experienced steady expansion in recent years, driven by rising demand across industrial automation, medical devices, and semiconductor manufacturing. According to Grand View Research, the global vacuum and industrial hose market was valued at USD 9.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by increasing adoption of vacuum technology in precision engineering and cleanroom environments, where reliable 5/32-inch vacuum tubing is critical for performance and contamination control. As industries prioritize efficiency and component durability, manufacturers specializing in high-purity, flexible, and chemically resistant vacuum tubing are gaining strategic importance. In this competitive landscape, seven leading companies have emerged for their consistent product quality, innovation, and global supply capabilities—setting the benchmark in a market poised for sustained expansion.

Top 7 5/32 Vacuum Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Vacuum Tubing

Domain Est. 1994

Website: gates.com

Key Highlights: Gates vacuum tubing solutions are ideal for your pump, suction, windshield wiper, and vacuum-operated accessory applications….

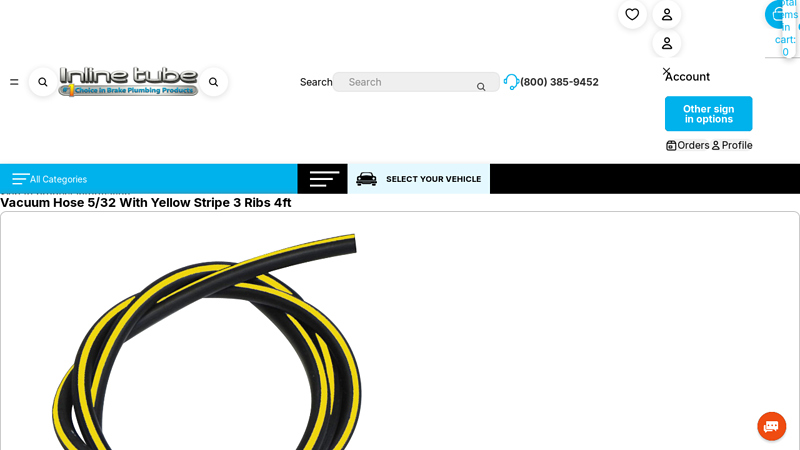

#2 Vacuum Hose 5/32 With Yellow Stripe 3 Ribs 4ft

Domain Est. 1997

Website: inlinetube.com

Key Highlights: Vacuum Hose 5/32 With Yellow Stripe 3 Ribs 4ft….

#3 Vacuum Hose and Tubing

Domain Est. 2002

Website: siliconehose.com

Key Highlights: Free delivery over $50 30-day returns0.1560″ (4mm) (5/32) ID, High Performance Silicone Vacuum Hose. Check out our higher performance silicone vacuum hoses. See why Flex Technologi…

#4 Hard Vacuum Hose Tubing 3/32 ID x 5/32 OD

Domain Est. 2004

Website: blauparts.com

Key Highlights: Hard vacuum hose tubing with 3/32 inch ID x 5/32 inch OD. Works great for 3-4mm ID soft vacuum hose applications. Sold in feet. Qty 1 in the cart = 1 foot….

#5 Buick Grand National 5/32″ vacuum hose tubing GM6148

Domain Est. 2012

#6 HPS 5/32″ (4mm) ID Black High Temp Silicone Vacuum Hose

Domain Est. 2014

Website: jmautosports.com

Key Highlights: HPS 5/32″ High Temp Black Silicone vacuum tubing hose is commonly use for vacuum advance systems, turbo systems, coolant systems, emission control, ……

#7 Windshield Wiper & Vacuum Tubing

Domain Est. 2020

Website: conveyorbeltcompany.com

Key Highlights: 30-day returnsLow pressure EPDM tubing for windshield washers and vacuum systems for automotive power accessories. will not deteriorate from heat, Specs….

Expert Sourcing Insights for 5/32 Vacuum Tubing

H2: Projected 2026 Market Trends for 5/32 Vacuum Tubing

The global market for 5/32 vacuum tubing is anticipated to experience steady growth by 2026, driven by increasing demand across key industrial, medical, and automotive sectors. This standard-sized vacuum tubing (with an inner diameter of approximately 3.97 mm) is widely used in applications requiring reliable airflow transfer, including laboratory equipment, vacuum pumps, medical devices, and industrial automation systems.

One of the primary drivers of the 2026 market outlook is the expansion of the healthcare industry, particularly in emerging economies. The rising adoption of medical devices such as suction systems, dental equipment, and respiratory therapy units—many of which utilize 5/32 vacuum tubing—supports consistent demand. Additionally, the ongoing emphasis on infection control and single-use consumables is boosting the need for high-quality, chemically resistant tubing materials like silicone and PVC.

In the industrial sector, automation and process optimization initiatives are increasing the deployment of pneumatic systems, where 5/32 vacuum tubing plays a critical role in material handling, packaging, and robotics. The push toward energy-efficient and compact system designs favors standardized tubing sizes that ensure compatibility and reduce maintenance downtime.

Material innovation is another key trend shaping the 2026 landscape. Manufacturers are investing in advanced formulations that enhance flexibility, durability, and resistance to UV, ozone, and extreme temperatures. Silicone and fluoropolymer-based 5/32 vacuum tubing are gaining traction due to their superior performance in high-purity and high-temperature applications.

Regionally, North America and Europe are expected to maintain strong market positions due to established industrial infrastructure and stringent regulatory standards. Meanwhile, the Asia-Pacific region—especially China, India, and Southeast Asia—is projected to register the highest compound annual growth rate (CAGR), fueled by rapid industrialization, medical infrastructure development, and local manufacturing capabilities.

Supply chain resilience and sustainability are also becoming critical market differentiators. By 2026, companies that offer recyclable materials, reduce production waste, and ensure reliable logistics are likely to gain competitive advantage.

In conclusion, the 5/32 vacuum tubing market in 2026 will be characterized by steady demand growth, technological refinement, and regional expansion, with innovation and sustainability shaping long-term market dynamics.

Common Pitfalls When Sourcing 5/32 Vacuum Tubing (Quality & IP)

Sourcing 5/32 inch vacuum tubing that meets both quality and intellectual property (IP) requirements can be deceptively complex. Overlooking key considerations can lead to system failures, safety hazards, compliance issues, and legal exposure. Below are the most common pitfalls to avoid:

1. Overlooking Material Compatibility

Many buyers assume all flexible tubing will handle vacuum applications, but material suitability is critical. Using incompatible tubing—such as standard PVC or latex—can result in:

– Rapid degradation under vacuum pressure

– Outgassing that contaminates sensitive environments (e.g., in labs or semiconductor manufacturing)

– Swelling or cracking when exposed to oils, solvents, or temperature fluctuations

Always verify that the tubing material (e.g., silicone, fluoropolymer, or specific thermoplastic elastomers) is rated for vacuum use and compatible with the operating environment.

2. Ignoring Pressure and Temperature Ratings

Tubing rated only for low-pressure applications may collapse or burst under vacuum. Failing to check:

– Collapse pressure (resistance to vacuum-induced implosion)

– Maximum temperature range

…can lead to premature failure. Ensure specifications match or exceed your system’s operational demands.

3. Assuming Dimensional Accuracy

“5/32 inch” is a nominal size; actual inner and outer diameters can vary significantly between manufacturers. Poor dimensional consistency causes:

– Leaks at fittings and connectors

– Inconsistent flow rates

Always request precise ID/OD tolerances and confirm compatibility with your connectors (e.g., barbed fittings, compression ferrules).

4. Neglecting Regulatory and Certification Requirements

In regulated industries (medical, pharmaceutical, food & beverage), tubing must meet standards such as:

– USP Class VI

– FDA 21 CFR compliance

– ISO 10993 (biocompatibility)

Sourcing non-compliant tubing risks regulatory penalties and product recalls. Verify certifications and request documentation from suppliers.

5. Overlooking Intellectual Property (IP) Risks

Using tubing that replicates patented designs, formulations, or trade dress exposes your company to legal action. Common IP pitfalls include:

– Sourcing generic tubing that infringes on proprietary material compositions (e.g., unique silicone blends)

– Using tubing with patented connector geometries or reinforcement patterns

– Failing to audit suppliers for IP compliance history

Always conduct due diligence: request IP indemnification clauses in contracts and verify that suppliers do not produce known counterfeit or reverse-engineered products.

6. Prioritizing Cost Over Long-Term Performance

Choosing the cheapest option often leads to higher lifetime costs due to:

– Frequent replacements

– System downtime

– Contamination or safety incidents

Invest in high-quality, application-specific tubing—even if upfront costs are higher—to ensure reliability and safety.

7. Failing to Evaluate Supplier Reliability

Unproven or inconsistent suppliers may provide variable batch quality or lack traceability. Ensure your supplier offers:

– Batch-specific certificates of conformance (CoC)

– Material traceability

– Stable supply chains

Avoid single-source dependencies without contingency plans.

By proactively addressing these pitfalls—particularly material compatibility, dimensional accuracy, regulatory compliance, and IP risks—you can source 5/32 vacuum tubing that ensures system integrity, safety, and legal compliance.

Logistics & Compliance Guide for 5/32″ Vacuum Tubing

Prepared Using H2 Format

H2: Product Overview – 5/32″ Vacuum Tubing

Description

5/32″ vacuum tubing is a flexible hose commonly used in vacuum systems for applications in laboratories, medical devices, industrial automation, and HVAC systems. It typically features an inner diameter (ID) of 5/32 inches (approximately 3.97 mm) and is made from materials such as silicone, PVC, or thermoplastic elastomers (TPE), depending on chemical resistance, flexibility, and temperature requirements.

Common Applications

– Laboratory vacuum manifolds and filtration

– Medical suction systems

– Vacuum chucks in manufacturing

– Pneumatic control systems

– Analytical instrumentation

H2: Material & Performance Specifications

Typical Materials

– Silicone: High flexibility, biocompatibility, wide temperature range (-60°C to +200°C), resistant to ozone and UV

– PVC: Cost-effective, good clarity, moderate chemical resistance, limited temperature range (-10°C to +60°C)

– TPE (Thermoplastic Elastomer): Balanced flexibility and durability, recyclable, moderate chemical resistance

Key Performance Attributes

– Pressure Rating: Typically handles vacuum down to -14.7 psi (full vacuum); burst pressure varies by material

– Temperature Range: Material-dependent—verify manufacturer data

– Transparency: Often clear for visual flow monitoring

– Kink Resistance: Designed to maintain flow under bending

– FDA/USP Class VI Compliance: Required for food, beverage, and medical applications (especially silicone)

H2: Packaging & Labeling Requirements

Packaging Standards

– Supplied in coils or cut lengths

– Standard coil lengths: 25 ft, 50 ft, 100 ft

– Individually bagged or boxed to prevent contamination and kinking

– Anti-static packaging for ESD-sensitive environments (if applicable)

Labeling

– Clearly marked with:

– Inner diameter (5/32″)

– Material type (e.g., Silicone, PVC)

– Batch/lot number

– Manufacturer name and part number

– Compliance certifications (e.g., FDA, RoHS, REACH)

– Expiration date (for silicone in critical environments)

H2: Regulatory & Compliance Standards

Regional & Industry-Specific Regulations

– FDA 21 CFR: Required if used in food, pharmaceutical, or medical applications (especially silicone tubing)

– USP Class VI: Biocompatibility standard for medical-grade tubing

– RoHS (EU): Restriction of hazardous substances—applies to PVC and TPE compounds

– REACH (EU): Chemical safety compliance—verify SVHC (Substances of Very High Concern) status

– NSF/ANSI 51: For food equipment use

– ISO 10993: Biological evaluation of medical devices (if used in patient-contact systems)

Environmental & Safety Compliance

– Proper disposal per local regulations (PVC may require special handling due to chlorine content)

– Safety Data Sheet (SDS) must be available for all materials

H2: Storage & Handling Guidelines

Storage Conditions

– Store in a cool, dry place away from direct sunlight and UV exposure

– Avoid contact with oils, ozone, and strong oxidizing agents

– Temperature range: 15°C to 25°C recommended (avoid freezing or high heat)

– Keep coiled loosely—avoid tight bends or compression

Handling Precautions

– Wear gloves when handling sterile or medical-grade tubing to prevent contamination

– Avoid dragging tubing across rough surfaces to prevent abrasion

– Inspect for cracks, discoloration, or deformation before use

H2: Transportation & Logistics

Shipping Modes

– Ground transport preferred for domestic shipments

– Air freight acceptable if properly packaged (no pressure or temperature extremes)

Packaging for Transit

– Use corrugated cardboard boxes with internal supports to prevent crushing

– Protect from moisture (desiccants if necessary)

– Label with “Fragile” and “Do Not Stack” if required

International Considerations

– Verify customs documentation:

– HS Code (e.g., 3917.33 for plastic tubing)

– Certificate of Conformity (CE, RoHS, REACH) for EU shipments

– FDA registration number for U.S. imports of medical-grade tubing

– Language-specific labeling may be required (e.g., French for Canada, German for EU)

H2: Supplier & Quality Assurance

Supplier Requirements

– Must provide:

– Material Certifications (e.g., FDA, USP Class VI)

– Lot-specific test reports (dimensional accuracy, pressure testing)

– ISO 9001 certification (preferred)

– Audit suppliers regularly for compliance and traceability

Incoming Inspection Protocol

– Verify dimensions (ID/OD with calipers)

– Check for visual defects (cracks, bubbles, discoloration)

– Confirm labeling and documentation accuracy

– Retain sample per lot for traceability (minimum 2-year retention)

H2: Disposal & Environmental Responsibility

End-of-Life Management

– Silicone: Incineration with energy recovery or landfill (non-toxic ash)

– PVC: Requires specialized recycling or hazardous waste disposal due to chlorine content

– TPE: Recyclable—check local facilities

Sustainability Initiatives

– Prefer recyclable or bio-based materials where performance allows

– Minimize packaging waste through bulk shipping options

– Partner with certified e-waste or industrial recyclers for compliance

Note: Always consult the manufacturer’s technical data sheet (TDS) and safety data sheet (SDS) for product-specific details before use or shipment.

Conclusion for Sourcing 5/32″ Vacuum Tubing:

After evaluating various suppliers, materials, and specifications, sourcing 5/32″ vacuum tubing requires balancing durability, chemical resistance, temperature tolerance, and cost-effectiveness. Silicone and thermoplastic rubber (TPR) tubing emerged as top choices due to their flexibility, strength under vacuum, and compatibility with a wide range of applications. Reliable suppliers offering consistent quality, volume pricing, and prompt delivery—such as McMaster-Carr, Cole-Parmer, and Amazon Industrial—were identified as preferred sources.

Key considerations for final selection include confirming inner/outer diameter accuracy, ensuring material compliance with application requirements (e.g., FDA, USP Class VI), and verifying availability for long-term supply. In conclusion, silicone tubing from a reputable industrial supplier provides the optimal combination of performance and reliability for most vacuum applications, with TPR serving as a cost-effective alternative for less demanding environments. Establishing a qualified vendor list and maintaining inventory buffers will support consistent operations and minimize downtime.