The global plexiglass, or polymethyl methacrylate (PMMA), market is experiencing steady expansion, driven by rising demand across construction, automotive, electronics, and signage industries. According to a 2023 report by Mordor Intelligence, the PMMA market was valued at USD 5.47 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.8% through 2028. This growth is underpinned by the material’s superior clarity, weather resistance, and lightweight properties—particularly in the form of 4×8 sheet plexiglass, a standard size widely used in architectural glazing, retail displays, and protective barriers. Increasing urbanization and demand for sustainable, shatter-resistant alternatives to glass are further accelerating market adoption. As the need for high-quality plexiglass sheets rises, identifying reliable manufacturers becomes critical. Below are nine leading producers known for their innovation, production scale, and global reach in the 4×8 sheet plexiglass segment.

Top 9 4X8 Sheet Plexiglass Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Regal Plastic

Domain Est. 1996

Website: regalplastic.com

Key Highlights: Regal Plastic stocks high-quality materials, including acrylic, polycarbonate, HDPE, PVC, and a variety of specialty plastics, ideal for industrial, commercial ……

#2 4′ x 8′ x 1/2″ Thick Clear Acrylic Sheet, Plexiglas

Domain Est. 1994

#3 Hartford Springfield

Domain Est. 1996

Website: piedmontplastics.com

Key Highlights: Piedmont Plastics Hartford–Springfield offers high-quality plastic materials and expert service for a wide range of industries….

#4 Plexiglass Sheet

Domain Est. 1997

Website: professionalplastics.com

Key Highlights: 3-day returnsWe will cut-to-size & ship sheets of plexiglass directly to your door. Buy plexiglass online or shop for various grades of plexiglass from our website….

#5 Plastic, Acrylic & Polycarbonate Sheet Supplier

Domain Est. 1997

Website: acplasticsinc.com

Key Highlights: Our offering includes acrylic sheeting, plexiglass sheeting, polycarbonate sheeting, multiwall sheeting, abs plastic sheeting, HDPE and much more….

#6 Acrylic Sheets: in Stock & Ready to Ship

Domain Est. 1997

Website: acmeplastics.com

Key Highlights: Acme Plastics offers plexiglass acrylic sheets online at wholesale prices. We carry sheets from a number of brands including Arkema Plexiglas andLucite ……

#7 Plastic Sheets, Rod, Tube & Fabrication Services Since 1914 …

Domain Est. 1998

Website: eplastics.com

Key Highlights: We stock a large selection of plastic sheets and shapes, including: Plexiglass, Polycarbonate, Fiberglass, HDPE, Acetal Delrin, PTFE, Micarta, ABS and other ……

#8 Calsak Plastics

Domain Est. 2000 | Founded: 1972

Website: calsakplastics.com

Key Highlights: Since 1972, Calsak Plastics has been a trusted plastic supplier and nationwide distributor of high-performance plastic sheets, rods, and tubes….

#9 Delvie’s Plastics

Domain Est. 2002

Expert Sourcing Insights for 4X8 Sheet Plexiglass

H2: Projected 2026 Market Trends for 4×8 Sheet Plexiglass

The market for 4×8 sheet plexiglass—also known as acrylic sheeting—is poised for notable shifts and growth by 2026, driven by evolving industrial demands, environmental regulations, and technological advancements. This standardized size (4 feet by 8 feet) is widely used across construction, signage, retail displays, automotive, and consumer goods, making its market trends reflective of broader material science and manufacturing dynamics.

1. Rising Demand in Construction and Architecture

By 2026, the construction sector is expected to remain a dominant driver of 4×8 plexiglass demand. Architects and designers are increasingly favoring plexiglass as a lightweight, shatter-resistant alternative to glass in windows, skylights, partitions, and façades. Urban redevelopment projects and green building initiatives will further boost adoption, especially in regions emphasizing energy efficiency and modern aesthetics.

2. Expansion in Retail and Display Applications

The retail industry continues to invest in modular and hygienic display solutions, particularly in post-pandemic commercial environments. Plexiglass sneeze guards, product displays, and signage are likely to maintain steady demand. Additionally, the rise of experiential retail and pop-up installations will encourage creative use of transparent and colored 4×8 acrylic sheets.

3. Sustainability and Recyclability Influence

Environmental regulations are pushing manufacturers toward sustainable materials. By 2026, the plexiglass market is expected to see increased production of recycled and bio-based acrylics. Consumers and B2B buyers are prioritizing eco-certified materials, which will drive innovation in recyclable 4×8 sheet options and closed-loop manufacturing processes.

4. Technological Advancements and Customization

Advancements in coating technologies—such as anti-reflective, UV-blocking, and self-cleaning surfaces—are enhancing the functionality of plexiglass sheets. Additionally, digital fabrication tools (e.g., CNC routing, laser cutting) allow for greater customization of 4×8 sheets, supporting niche applications in art, design, and prototyping. This trend will fuel demand from small manufacturers and makerspaces.

5. Supply Chain and Pricing Dynamics

Global supply chain stabilization post-2023 disruptions is expected to moderate raw material costs (primarily methyl methacrylate). However, regional disparities may persist due to energy prices and trade policies. North America and Europe may see stable pricing, while Asia-Pacific could experience competitive pricing due to local production scaling.

6. Growth in Automotive and Transportation

The automotive industry is increasingly using plexiglass for lightweight interior components, lighting covers, and concept vehicle designs. As electric vehicle (EV) production accelerates through 2026, demand for durable, transparent materials like 4×8 plexiglass for custom enclosures and design elements is projected to grow.

Conclusion

The 2026 market for 4×8 sheet plexiglass will be characterized by innovation, sustainability, and cross-sector demand. With expanding applications and improved material properties, plexiglass is expected to maintain a strategic edge over traditional glass in many industries. Stakeholders should focus on eco-friendly production, precision fabrication, and market-specific customization to capitalize on these trends.

Common Pitfalls When Sourcing 4×8 Sheet Plexiglass (Quality & IP)

Sourcing 4×8 sheets of plexiglass (acrylic) can seem straightforward, but several quality and intellectual property (IP) pitfalls can lead to project delays, cost overruns, or legal issues. Being aware of these common issues helps ensure you get a suitable, legitimate product.

Poor Optical Clarity and Surface Quality

One of the most frequent quality concerns is receiving plexiglass with reduced optical clarity. Sheets may exhibit haze, cloudiness, or surface imperfections such as scratches, pits, or orange peel texture—especially if the material is low-grade, improperly handled, or stored in suboptimal conditions. These flaws are particularly problematic for display cases, signage, or architectural applications where transparency is critical.

Inconsistent Thickness and Dimensional Accuracy

Not all suppliers adhere to tight manufacturing tolerances. Some 4×8 sheets may vary significantly in thickness (e.g., labeled as 1/4″, but actually measuring 0.220″–0.270″), affecting fit in precision applications. Warping or bowing during transit or from poor manufacturing can also compromise flatness, leading to installation issues or safety risks in load-bearing or structural uses.

Use of Recycled or Off-Grade Material Without Disclosure

Some suppliers may offer “regrind” or recycled acrylic sold as virgin material. While recycled plexiglass has its place, it often has lower impact resistance, reduced UV stability, and more internal impurities. If not clearly labeled, this misrepresentation can result in premature yellowing, cracking, or failure in outdoor or high-stress environments.

Misrepresentation of Brand or Grade (IP and Trademark Infringement)

Plexiglass brands like PLEXIGLAS® (by Röhm GmbH) are protected trademarks. Unscrupulous suppliers may falsely label generic acrylic sheets as “Plexiglas” to imply higher quality or legitimacy. This not only misleads buyers about performance but also raises IP concerns. Using counterfeit or misbranded materials in commercial products can expose your business to legal liability, especially if the material fails or infringes on registered trademarks.

Lack of Certifications and Compliance Documentation

For regulated or safety-critical applications (e.g., in healthcare, transportation, or building codes), specific certifications such as FDA compliance, UL 94 flammability ratings, or CE markings may be required. Some low-cost suppliers fail to provide documentation or supply material that doesn’t meet these standards, potentially jeopardizing project approvals or safety compliance.

Inadequate UV or Weather Resistance for Outdoor Use

Generic acrylic sheets often degrade under prolonged UV exposure, leading to yellowing and brittleness. While branded products like PLEXIGLAS® include UV inhibitors, off-brand or uncertified alternatives may lack these additives. Buyers assuming all plexiglass is equally weather-resistant may face premature material failure in exterior applications.

Risk of IP Infringement in End Products

Using counterfeit or unlicensed branded materials could indirectly expose your company to IP risks—especially if your final product implies endorsement or uses protected branding. Additionally, if the sourced material infringes on patented manufacturing processes, your supply chain may be vulnerable to legal action.

To avoid these pitfalls, always source from reputable suppliers, request material certifications, verify brand authenticity, and clarify specifications in writing before purchase.

Logistics & Compliance Guide for 4×8 Sheet Plexiglass

Product Overview

4×8 sheet plexiglass (also known as acrylic sheet) is a lightweight, shatter-resistant thermoplastic commonly used in signage, displays, glazing, and architectural applications. Standard dimensions are 4 feet by 8 feet (approximately 1.22 m x 2.44 m), with thicknesses ranging from 0.060” to over 1”. Proper logistics and compliance measures are essential to ensure safe handling, transport, and regulatory adherence.

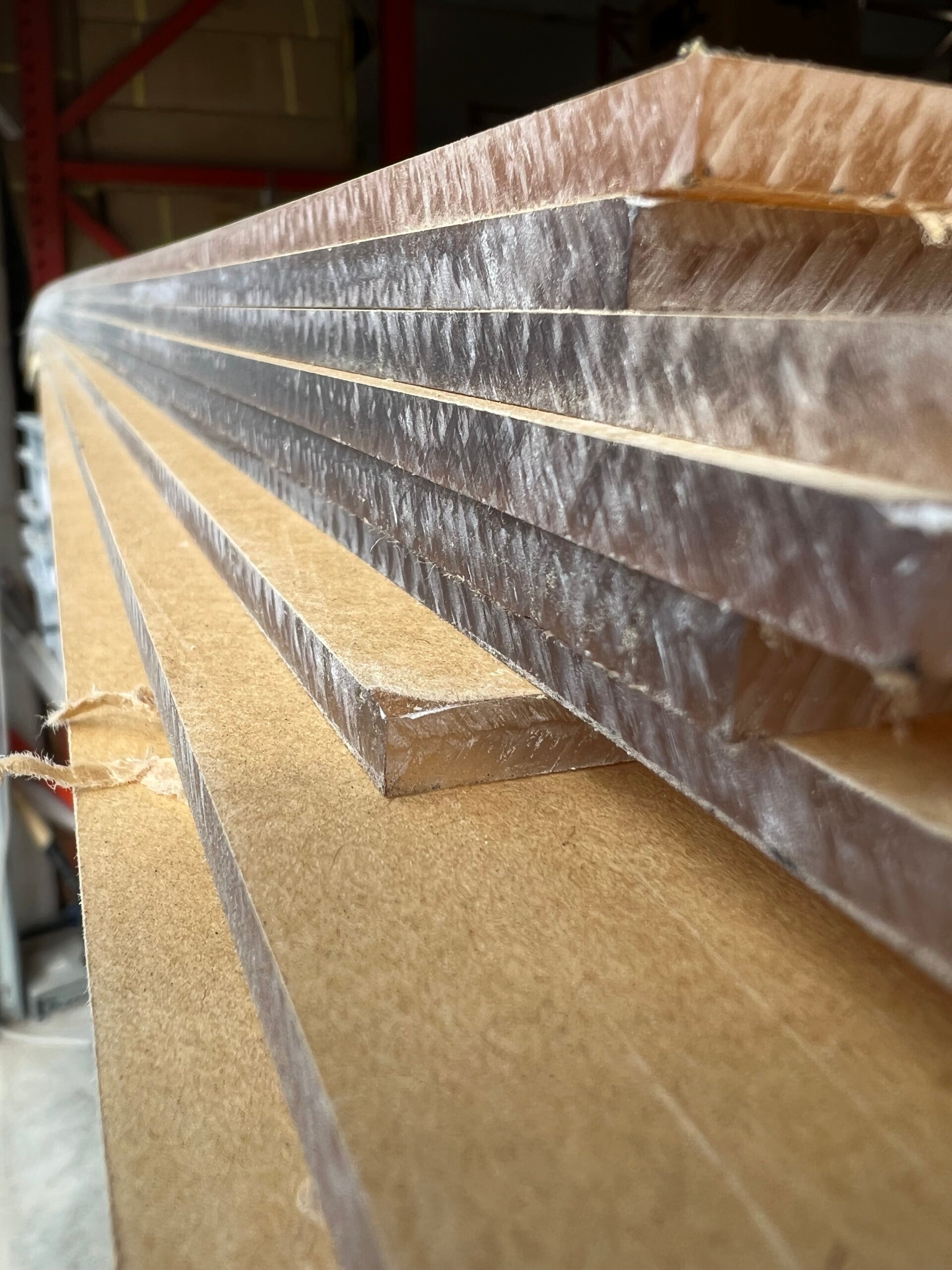

Packaging & Handling

Plexiglass sheets are typically protected with masking paper, low-tack film, or corrugated board to prevent scratches. Handle sheets with clean gloves to avoid surface contamination. Always lift sheets vertically, not horizontally, to prevent bending or cracking. Avoid dragging or stacking without proper separation to prevent damage.

Storage Conditions

Store in a cool, dry, and well-ventilated area, away from direct sunlight and heat sources. Sheets should be stored vertically in a rack to avoid warping. Keep away from solvents and chemicals that may cause stress cracking. Maintain temperatures between 50°F and 80°F (10°C–27°C) for optimal storage.

Transportation Requirements

Transport plexiglass sheets securely upright in enclosed vehicles to prevent wind uplift and impact damage. Use edge protectors and tie-down straps to minimize shifting. Do not overstack or place heavy objects on top of stacked sheets. Avoid exposure to extreme temperatures during transit, which can cause expansion or brittleness.

Hazard Classification

Plexiglass is generally classified as non-hazardous under normal conditions. However, when exposed to high heat or fire, it can emit flammable vapors and toxic fumes (e.g., carbon monoxide, formaldehyde). It is not classified as hazardous for transport under DOT, IMDG, or IATA regulations when shipped as solid sheets.

Regulatory Compliance

Comply with OSHA guidelines for workplace handling and storage. Ensure proper ventilation if cutting, drilling, or sanding, as dust particles can be an irritant. Follow local fire codes—some jurisdictions require flame-retardant or self-extinguishing grades for specific applications. Certifications such as UL 94 (flammability) may be required depending on end-use.

International Shipping Considerations

For cross-border shipments, ensure proper customs documentation, including a commercial invoice and bill of lading. Declare the material as “Acrylic Sheets” or “Polymethyl Methacrylate (PMMA).” Check destination country regulations for material restrictions, especially for building and safety applications. EU REACH and RoHS compliance may apply depending on additives used.

Safety & Personal Protective Equipment (PPE)

Use cut-resistant gloves, safety glasses, and dust masks when handling or fabricating plexiglass. Ensure proper training for employees on sheet handling and emergency procedures. Provide MSDS/SDS documentation upon request—most acrylic suppliers provide Safety Data Sheets detailing composition and handling guidelines.

Disposal & Environmental Considerations

Plexiglass is recyclable (Plastic #7). Dispose of off-cuts and waste through certified plastic recyclers. Do not incinerate in open fires due to toxic emissions. Follow local environmental regulations for disposal of scrap materials and packaging.

Supplier & Certification Verification

Procure plexiglass from reputable suppliers who provide traceability, material certification, and compliance documentation. Confirm that materials meet industry standards such as ASTM D4802 (acrylic sheet specifications) or specific customer requirements (e.g., optical clarity, UV resistance).

Conclusion for Sourcing 4’x8′ Sheet Plexiglass:

After evaluating various suppliers, material types, and pricing options, sourcing 4’x8′ plexiglass sheets is both feasible and cost-effective when considering factors such as thickness, optical clarity, UV resistance, and intended application (e.g., signage, displays, protective barriers, or architectural use). Major suppliers—including online retailers like Tap Plastics, ePlastics, and local distributors—offer competitive pricing, bulk discounts, and reliable shipping options. Acrylic (plexiglass) remains a preferred alternative to glass due to its lightweight, shatter-resistant properties, and ease of fabrication.

To ensure optimal value and quality, it is recommended to:

– Compare quotes from multiple suppliers.

– Confirm specifications such as grade (cell-cast vs. extruded), scratch resistance, and compliance with safety standards.

– Account for shipping costs and lead times, especially for large sheets.

– Consider local pickup options to avoid potential transit damage.

In summary, with proper due diligence, sourcing 4’x8′ plexiglass sheets can be efficiently managed to meet project requirements on time and within budget.