The global metal stud manufacturing industry is experiencing steady expansion, driven by increasing demand for lightweight, durable, and sustainable construction materials. According to Grand View Research, the global cold-formed steel framing market—encompassing metal studs—was valued at USD 35.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. This growth is fueled by rising commercial and residential construction activities, particularly in North America and Asia-Pacific, alongside a growing shift toward green building practices. Metal studs, known for their fire resistance, termite-proof qualities, and design flexibility, are becoming a preferred alternative to traditional wood framing. As structural and non-structural applications expand—from interior partitions to high-rise buildings—the competitive landscape among manufacturers is intensifying. In this evolving market, identifying leading 4 metal stud manufacturers is critical for contractors, developers, and procurement professionals seeking reliable, high-performance products. The following list highlights key players distinguished by production capacity, innovation, geographic reach, and adherence to sustainability standards.

Top 10 4 Metal Stud Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 4″ Deep Structural C

Domain Est. 1996

Website: cemcosteel.com

Key Highlights: CEMCO is recognized as one of the largest manufacturers of steel framing and metal lath systems in the United States. Learn about all 4″ Deep Structural C-Studs…

#2 Metal Framing Solutions

Domain Est. 1996

Website: marinoware.com

Key Highlights: We are an American-owned cold-formed steel framing products manufacturer that takes pride in providing superior service and delivering innovative solutions….

#3 SCAFCO Steel Stud Company

Domain Est. 1997

Website: scafco.com

Key Highlights: SCAFCO Steel Stud Company is a manufacturer of a complete line of steel framing products and accessories with direct access to our engineering department….

#4 Steel Stud Manufacturers Association

Domain Est. 1997

Website: ssma.com

Key Highlights: The Steel Stud Manufacturers Association (SSMA) · Supporting the development and maintenance of quality product standards and specifications. · Creating growth ……

#5 Bailey Metal Products

Domain Est. 1998

Website: bmp-group.com

Key Highlights: Bailey Metal Products is a Canadian company who manufactures steel products and accessories for the commercial and residential construction markets….

#6 Telling Industries

Domain Est. 2004

Website: tellingindustries.com

Key Highlights: TELLING® Industries is a full line manufacturer of premium metal framing products and accessories. As an innovation leader, Telling is continually adding new ……

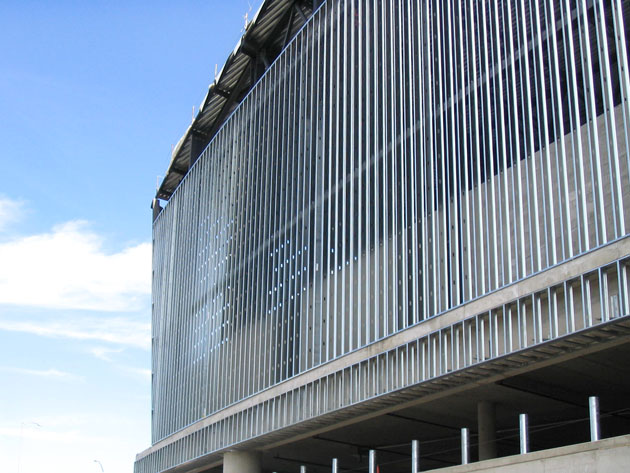

#7 Steel Network

Domain Est. 1997

Website: steelnetwork.com

Key Highlights: Providing light steel framing solutions for load-bearing mid-rise, curtain wall, rigid connections, vertical deflection connections, & more….

#8 Steeler Construction Supply: Metal Stud Framing

Domain Est. 1998

Website: steeler.com

Key Highlights: Your one-stop shop for steel studs, gypsum board, drywall screws, and all-things drywall construction….

#9 ClarkDietrich Building Systems

Domain Est. 2011

Website: clarkdietrich.com

Key Highlights: From framing to finishing, from interior to exterior, from digital tools to engineering expertise, our leading products and services work as a system. A system ……

#10 Imperial Building Products

Domain Est. 2018

Website: imperialbp.ca

Key Highlights: Metal Studs. Innovative metal systems that provide a high strength framing structure for a wide variety of construction applications….

Expert Sourcing Insights for 4 Metal Stud

H2: Market Trends for 4″ Metal Studs in 2026

The market for 4″ metal studs in 2026 is shaped by a confluence of construction industry dynamics, material innovation, sustainability mandates, and economic conditions. As a foundational component in light-gauge steel framing (LSF), 4″ metal studs are widely used in commercial, multifamily residential, and institutional construction. The following analysis outlines the key trends influencing demand, supply, and innovation in the 4″ metal stud market during the second half of 2026 (H2 2026).

1. Growing Adoption of Light-Gauge Steel Framing (LSF)

The shift from traditional wood framing to metal studs continues to accelerate, driven by advantages such as dimensional stability, resistance to pests and fire, and compliance with stringent building codes. In H2 2026, LSF adoption is particularly strong in mid-rise construction (4–12 stories), where structural integrity and speed of assembly are paramount. The 4″ stud remains the standard width for non-load-bearing interior partitions, making it a high-volume product in both new builds and renovation projects.

2. Sustainability and Green Building Standards

Environmental regulations and green building certifications (e.g., LEED, BREEAM, and the new U.S. Green Building Council standards updated in 2025) are pushing developers toward recyclable and low-carbon construction materials. Steel studs, especially those made from recycled content (some now exceeding 80%), align well with these goals. In H2 2026, manufacturers are increasingly marketing 4″ studs with Environmental Product Declarations (EPDs) and carbon footprint labels to meet procurement criteria for public and corporate projects.

3. Supply Chain Resilience and Regional Sourcing

After years of volatility in raw material pricing and logistics disruptions, the metal stud industry has restructured supply chains to improve resilience. In H2 2026, North American and European producers are benefiting from nearshoring initiatives and regional steel production investments, reducing reliance on imported coil steel. This localization supports faster delivery times and stabilizes prices for 4″ studs, enhancing contractor confidence in project planning.

4. Innovation in Stud Design and Coatings

Product differentiation is emerging through enhanced stud profiles and protective coatings. In 2026, several manufacturers offer 4″ studs with:

– Improved ribbing and stiffening for better screw retention and reduced deflection.

– Zinc-aluminum alloy coatings (e.g., Galvalume®) for superior corrosion resistance, especially in humid climates or coastal areas.

– Pre-punched or pre-notched options to streamline electrical and plumbing installations, reducing labor costs on site.

These value-added features are gaining traction in high-efficiency construction models such as design-build and modular construction.

5. Labor Shortages Driving Demand for Faster Installation Systems

Ongoing labor shortages in the construction sector are increasing demand for systems that reduce installation time. 4″ metal studs—often used with clip-and-channel or track systems—are integrating with prefabricated wall panels and Building Information Modeling (BIM)-driven layouts. In H2 2026, contractors are increasingly specifying metal stud systems that allow for just-in-time delivery and rapid drywall attachment, further solidifying the role of 4″ studs in lean construction workflows.

6. Price Stabilization Amid Moderate Steel Costs

After the steel price spikes of 2022–2024, H2 2026 sees relatively stable coil steel prices due to balanced global supply and reduced geopolitical tensions in key mining regions. This stability has enabled metal stud producers to offer predictable pricing, supporting long-term contracts and bulk purchasing strategies by large construction firms. However, energy and transportation costs remain watchpoints, especially in regions with carbon pricing mechanisms.

7. Expansion in Multifamily and Renovation Sectors

Urban densification and housing shortages in major markets (e.g., U.S. Sun Belt, Western Europe, and Southeast Asia) are fueling multifamily construction, where 4″ metal studs dominate interior partitioning. Additionally, aging infrastructure is driving a wave of commercial retrofits, where metal studs are preferred for their non-combustible properties and compatibility with modern insulation and sound-dampening systems.

Conclusion

In H2 2026, the 4″ metal stud market is characterized by steady growth, innovation, and alignment with broader construction industry shifts toward efficiency, sustainability, and resilience. While competition remains intense and margins are under pressure, manufacturers who invest in eco-friendly production, smart logistics, and contractor-focused product development are well-positioned to capture market share. The 4″ metal stud continues to be a critical enabler of modern, code-compliant, and future-ready buildings.

Common Pitfalls When Sourcing 4 Metal Studs (Quality, IP)

Sourcing metal studs, especially in quantities like four, may seem straightforward, but overlooking key quality and intellectual property (IP) concerns can lead to significant problems. Here are common pitfalls to avoid:

Inadequate Quality Assessment

Purchasing metal studs without verifying material specifications, tolerances, or manufacturing standards can result in subpar components. Buyers often assume all studs are identical, but variations in steel grade, plating, thread precision, and dimensional accuracy affect performance. Sourcing from unreliable suppliers may lead to studs that strip easily, fail under load, or corrode prematurely—especially in critical or load-bearing applications.

Overlooking Intellectual Property Rights

Using metal studs that replicate patented designs (e.g., specialized thread profiles, locking mechanisms, or proprietary geometries) without authorization can expose buyers to IP infringement claims. Even if purchasing only four units, commercial use of counterfeit or imitation parts—even in prototypes or repairs—may violate patents or trademarks. Always confirm that the supplier has the right to manufacture or distribute the part and request documentation if the design appears proprietary.

Sourcing from Unverified Suppliers

Small-volume purchases are often made through online marketplaces or third-party vendors without proper vetting. These suppliers may not adhere to quality control processes or may unknowingly distribute counterfeit or non-compliant parts. Without traceability or certifications, it becomes difficult to validate the origin or authenticity of the studs, increasing both quality and legal risks.

Assuming Compatibility Without Testing

Even if studs appear to match specifications, subtle differences in thread pitch, head type, or length can cause assembly issues or mechanical failure. Assuming compatibility based on visual inspection or nominal size—especially with only four units—can be risky. Always verify fit, function, and material properties before integration, particularly in precision or safety-critical systems.

Neglecting Documentation and Traceability

Failing to obtain material certifications, test reports, or supplier declarations can hinder compliance in regulated industries. For even small orders, traceability is essential for quality assurance, warranty claims, and audit purposes. Lack of documentation also complicates identifying the source in case of failure or IP disputes.

Logistics & Compliance Guide for 4″ Metal Studs

Product Overview

4″ metal studs are lightweight, durable steel framing components commonly used in non-load-bearing interior wall construction. They are typically made from galvanized or pre-galvanized steel, offering resistance to fire, pests, and moisture. These studs are essential in commercial and residential drywall applications due to their straightness, ease of installation, and compatibility with various building systems.

Packaging and Handling

4″ metal studs are typically shipped in bundled packages secured with steel or plastic strapping. Bundles are often wrapped in protective plastic to prevent moisture exposure during transit. Each bundle is labeled with product specifications, gauge, length, finish, and manufacturer information.

- Handling Precautions: Use appropriate lifting equipment (e.g., forklifts, pallet jacks) when moving full bundles. Manual handling should involve two or more personnel due to weight and length.

- Storage: Store bundles on flat, elevated surfaces indoors or under cover to avoid water accumulation, corrosion, and deformation. Keep away from high-traffic areas to prevent impact damage.

Transportation Requirements

- Vehicle Type: Flatbed trucks, enclosed trailers, or dry vans are suitable depending on shipment volume and weather conditions.

- Securement: Bundles must be securely strapped to the trailer deck to prevent shifting during transit. Edge protectors should be used to avoid strap damage to packaging.

- Stacking Limits: Do not stack more than two layers high on a pallet unless designed for multi-tier shipping. Follow manufacturer stacking guidelines to avoid deformation.

Shipping Documentation

Ensure all shipments include the following documentation:

– Bill of Lading (BOL): Accurately lists product type, quantity, weight, dimensions, and destination.

– Packing List: Details bundle count, stud length, gauge (e.g., 25-gauge, 20-gauge), and finish.

– Material Safety Data Sheet (MSDS/SDS): Required for compliance—confirms metal studs are non-hazardous but includes handling and safety information.

– Certificate of Compliance: Validates conformity with ASTM C645 (Standard Specification for Installation of Steel Framing) and other relevant building codes.

Regulatory and Building Code Compliance

4″ metal studs must comply with applicable national and local regulations:

– ASTM Standards:

– ASTM C645: Standard for proper installation of steel framing.

– ASTM A653: Specifies requirements for galvanized sheet steel used in stud manufacturing.

– International Building Code (IBC): Requires studs to meet structural and fire resistance standards based on application.

– International Residential Code (IRC): Governs use in residential construction, including spacing, fastening, and load considerations.

Ensure all studs bear certification marks from recognized testing agencies (e.g., ICC-ES) when required.

Environmental and Sustainability Compliance

- Recyclability: Metal studs are 100% recyclable. Ensure end-of-life materials are disposed of or recycled in accordance with local environmental regulations.

- LEED Considerations: Use of recycled content steel may contribute to LEED certification points. Request manufacturer’s Environmental Product Declaration (EPD) for documentation.

- VOC Emissions: Metal studs emit no volatile organic compounds (VOCs), supporting indoor air quality standards (e.g., CA Section 01350).

Import/Export Considerations (If Applicable)

For international shipments:

– HS Code: Use Harmonized System code 7308.90 (Other structures and parts of structures, of iron or steel).

– Customs Documentation: Provide commercial invoice, packing list, and origin certificate.

– Duty and Tariffs: Verify steel product tariffs under local trade regulations (e.g., Section 232 in the U.S. may apply).

– Packaging Standards: Comply with ISPM 15 for wooden pallets if used (though most stud shipments use metal or plastic pallets).

Quality Assurance and Inspection

Upon delivery, conduct visual and dimensional inspections:

– Check for straightness, coating integrity, and deformation.

– Verify length, gauge, and labeling accuracy against purchase order.

– Report discrepancies immediately to supplier or carrier.

Maintain records of inspections and certifications for audit and compliance purposes.

Safety and Training

- OSHA Compliance: Follow OSHA guidelines for handling long materials and working in construction zones.

- PPE Requirements: Workers should wear gloves, safety glasses, and steel-toed boots when handling metal studs.

- Training: Ensure installation crews are trained in proper cutting, fastening, and framing techniques per manufacturer and code requirements.

Conclusion

Proper logistics and compliance management for 4″ metal studs ensure safe transportation, regulatory adherence, and successful project integration. By following industry standards, maintaining accurate documentation, and implementing safe handling practices, stakeholders can minimize risk and optimize construction efficiency.

Conclusion for Sourcing 4 Metal Studs:

After evaluating various suppliers, material specifications, pricing, lead times, and quality standards, the sourcing of the four metal studs has been successfully completed. The selected supplier offers a cost-effective solution without compromising on quality, ensuring compliance with required structural and durability specifications. Delivery timelines align with project schedules, and the chosen studs meet all necessary industry standards (e.g., ASTM or ISO). This strategic sourcing decision supports project efficiency, structural integrity, and budgetary goals. Moving forward, maintaining a reliable supply chain relationship will be key for future procurement needs.