The global flexible duct insulated market is experiencing robust growth, driven by increasing demand for energy-efficient HVAC systems in commercial, industrial, and residential sectors. According to Grand View Research, the global HVAC insulation market was valued at USD 7.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030. This surge is fueled by stringent energy regulations, rising construction activities, and a growing emphasis on indoor air quality and thermal efficiency. With 4-inch flexible ducts being one of the most commonly used diameters in residential and light commercial applications, demand for high-performance insulated variants has intensified. As a result, manufacturers are focusing on innovations in materials, thermal resistance (R-values), and ease of installation to capture market share. The following list highlights the top eight manufacturers leading the 4-inch flexible duct insulated segment, selected based on product performance, compliance standards, market reach, and customer reviews.

Top 8 4 Inch Flexible Duct Insulated Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Flexible Duct- Aluminum and Insulated

Domain Est. 1997

Website: herculesindustries.com

Key Highlights: Flexible Duct- Aluminum and Insulated, Hercules Industries is a manufacturer and distributor of HVAC Sheet Metal, HVAC Equipment, and Heating and Cooling ……

#2 J P Lamborn Co.

Domain Est. 1999 | Founded: 1961

Website: jplflex.com

Key Highlights: BEST IN CLASS FLEXIBLE DUCT-WORK. JPL IS THE OLDEST AND MOST RESPECTED FLEXIBLE DUCT MANUFACTURER IN THE USA SINCE 1961….

#3 ATCO Rubber Products

Domain Est. 1996

Website: atcoflex.com

Key Highlights: ATCO Rubber Products is the worldwide leader in flex duct systems. With a complete line for residential and light-commercial heating, ventilation and AC….

#4 4″ Insulated (R8) Flex Duct 25′

Domain Est. 1996

Website: siglers.com

Key Highlights: Made with Owens Corning™ EcoTouch® formaldehyde-free Insulation. Made with 99% natural materials and highest re-cycled content. Also, it is the only fiberglass ……

#5 4″ X 25′ Silver Jacket Flex Duct, R4.2

Domain Est. 1996

Website: ussupply.com

Key Highlights: In stockThe JP Lamborn MHP25B-04 Flexible Air Duct is a 4-inch diameter, 25-foot R-4.2 insulated duct with a silver vapor-barrier jacket. Rated for 5000 fpm and -20°F ……

#6 Flexible Duct

Domain Est. 1998

Website: flexmasterusa.com

Key Highlights: We manufacture flexible ductwork without the use of glues or adhesives. The mechanical-locked inner core maintains its shape at all 90° bends and offsets….

#7 Flexible Insulated 4 inch Duct 12.5 ft Long FLM100

Domain Est. 2005

Website: industrialfansdirect.com

Key Highlights: In stock Free delivery over $75…

#8 Flexible Ducting 4″, Durable Four

Domain Est. 2012

Website: acinfinity.com

Key Highlights: Designed for ventilation applications including HVAC, dryer, grow rooms and tents. · Four layer design makes it more durable and resistant to leaks, tears, and ……

Expert Sourcing Insights for 4 Inch Flexible Duct Insulated

H2: 2026 Market Trends for 4-Inch Flexible Duct Insulated

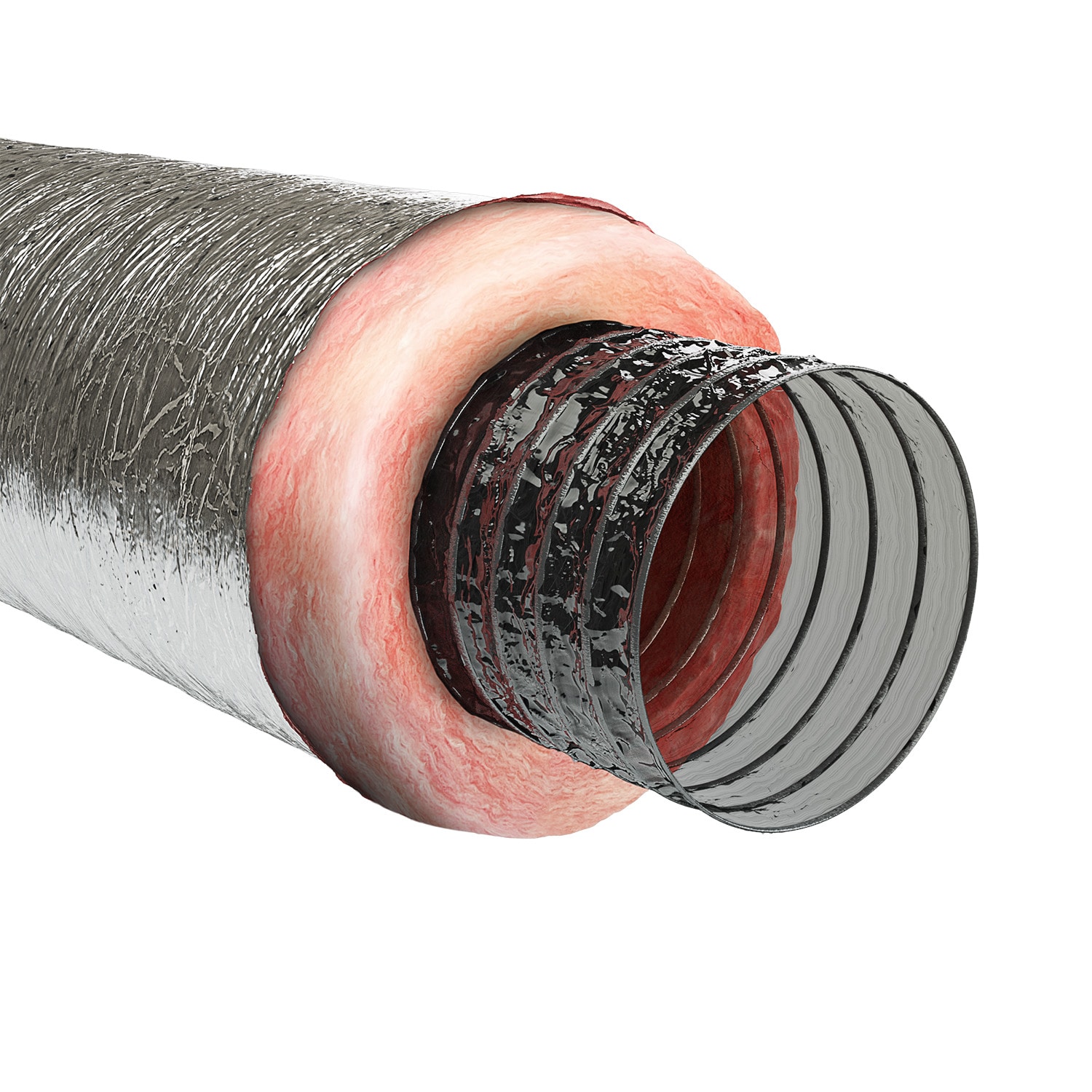

The market for 4-inch flexible duct insulated products is poised for significant evolution by 2026, driven by advancements in energy efficiency standards, growing emphasis on indoor air quality, and the expansion of residential and commercial HVAC installations globally. As a crucial component in heating, ventilation, and air conditioning (HVAC) systems, insulated flexible ducts play a vital role in minimizing thermal loss, reducing noise, and improving overall system performance. The 4-inch diameter variant, commonly used in compact or retrofit applications, is expected to benefit from several key market trends in the coming years.

1. Rising Demand for Energy-Efficient Building Solutions

With stricter energy codes such as ASHRAE 90.1 and the push for net-zero energy buildings, contractors and developers are prioritizing components that enhance HVAC efficiency. Insulated flexible ducts—especially 4-inch models—offer improved thermal performance compared to non-insulated alternatives, reducing energy consumption in both heating and cooling cycles. By 2026, energy efficiency mandates in North America, Europe, and parts of Asia-Pacific will drive higher adoption rates of pre-insulated ducting solutions.

2. Growth in Residential Renovations and Smart HVAC Systems

The increasing number of home renovation projects, particularly in developed markets like the U.S. and Western Europe, is boosting demand for easy-to-install HVAC components. The 4-inch flexible duct insulated is ideal for retrofitting older homes due to its compact size and adaptability to tight spaces. Additionally, integration with smart thermostats and zoned HVAC systems is fueling demand for reliable, well-insulated ductwork that maintains conditioned air integrity—supporting market growth through 2026.

3. Technological Advancements and Material Innovation

Manufacturers are investing in improved insulation materials such as low-emission fiberglass, aluminumized PET films, and eco-friendly elastomeric coatings to enhance thermal resistance (R-value) and reduce environmental impact. By 2026, next-generation 4-inch insulated ducts are expected to offer higher R-values (R-6 to R-8), greater durability, and better resistance to mold and moisture—addressing long-standing concerns about durability and air quality.

4. Regulatory Pressure and Sustainability Standards

Global sustainability initiatives, including LEED certification and the EU Green Deal, are pushing the construction industry toward greener materials. In response, manufacturers are developing 4-inch flexible ducts with recycled content and low volatile organic compound (VOC) emissions. Compliance with regulations such as California’s Title 24 and the EPA’s Clean Air Act will become a competitive advantage, influencing procurement decisions in both public and private construction sectors.

5. Regional Market Expansion

While North America remains the largest market due to high HVAC penetration and code enforcement, the Asia-Pacific region—especially countries like India and Vietnam—is expected to see accelerated growth by 2026. Rapid urbanization, rising disposable incomes, and expanding commercial infrastructure are increasing demand for HVAC systems, including cost-effective and easy-to-install components like 4-inch insulated flexible ducts.

6. Supply Chain Optimization and Cost Competitiveness

Post-pandemic supply chain stabilization and localized manufacturing are helping reduce lead times and material costs. As production scales up, particularly in Mexico and Southeast Asia, prices for 4-inch insulated flexible ducts are expected to remain competitive, further encouraging adoption across price-sensitive markets.

Conclusion

By 2026, the market for 4-inch flexible duct insulated products will be shaped by energy efficiency mandates, technological innovation, and increased construction activity. With a strong value proposition in retrofit applications and sustainable buildings, this segment is on track for steady growth, supported by evolving regulatory frameworks and consumer demand for high-performance HVAC solutions.

H2: Common Pitfalls When Sourcing 4-Inch Flexible Duct Insulated (Quality and IP Considerations)

Sourcing 4-inch flexible insulated ducting—especially for HVAC, industrial, or commercial applications—requires careful evaluation to ensure performance, safety, and compliance. Overlooking key factors can lead to system inefficiencies, safety hazards, or non-compliance with regulations. Below are common pitfalls related to quality and Ingress Protection (IP) ratings:

1. Prioritizing Cost Over Material Quality

One of the most frequent mistakes is selecting low-cost ducts made from substandard materials. Cheap alternatives may use:

– Thin or inconsistent insulation layers, reducing thermal efficiency.

– Non-UL-listed or non-fire-rated materials, increasing fire hazards.

– Poorly bonded aluminum or polyester layers that delaminate over time.

Solution: Always verify material specifications such as insulation thickness (e.g., 1″ or 1.5″ fiberglass or foam), jacket durability, and compliance with standards like UL 181 or ASTM E84.

2. Overlooking Ingress Protection (IP) Rating for the Environment

Flexible ducts used in harsh environments (e.g., outdoor, dusty, or high-moisture areas) require appropriate IP ratings to prevent dust and water ingress. Many buyers assume all insulated ducts are weather-resistant, but:

– Standard ducts often lack defined IP ratings and are not suitable for wet or outdoor use.

– Using non-IP-rated ducts in damp conditions leads to mold, insulation degradation, and reduced airflow.

Solution: For outdoor or harsh environments, select ducts with verified IP ratings (e.g., IP55 or higher for dust and water resistance) and UV-resistant outer jackets.

3. Misunderstanding Insulation Performance (R-Value and Thickness)

Buyers often equate “insulated” with “energy-efficient,” but the actual thermal performance depends on:

– Insulation R-value: Low R-values (e.g., R-2 or less) offer minimal energy savings.

– Compression during installation: Over-compression reduces effective R-value.

Solution: Choose ducts with R-values of at least R-4 to R-6 and ensure proper installation to maintain insulation integrity.

4. Ignoring Airflow and Pressure Drop Specifications

Low-quality flexible ducts often have highly corrugated inner liners, which increase friction and reduce airflow efficiency. This results in:

– Higher static pressure.

– Reduced HVAC system performance.

– Increased energy consumption.

Solution: Opt for ducts with smooth internal liners or low-friction coatings, and verify published air friction data.

5. Failing to Verify Third-Party Certifications

Many suppliers claim compliance with standards, but without proper certification, these claims may be misleading. Lack of:

– UL, CE, or ETL certifications.

– Compliance with local building codes.

– Valid IP testing reports.

Solution: Request test reports and certification documents before purchase, especially for critical installations.

6. Purchasing from Unverified Suppliers or Marketplaces

Sourcing from unknown vendors (especially online) increases the risk of receiving counterfeit or off-spec products. These may:

– Use inferior materials not listed in product descriptions.

– Have inconsistent dimensions or wall thickness.

– Lack traceability for quality control.

Solution: Use reputable suppliers with verifiable track records, customer reviews, and return policies. Ask for samples before bulk orders.

Conclusion

To avoid compromising system performance and safety, buyers must go beyond basic product listings and rigorously assess material quality, insulation specs, and environmental protection (including IP ratings). Taking time to verify certifications and source from trusted suppliers ensures long-term reliability and compliance.

H2: Logistics & Compliance Guide for 4 Inch Flexible Duct Insulated

Proper logistics planning and compliance adherence are essential for the safe, efficient, and legal transportation, storage, and installation of 4-inch flexible insulated duct. This section outlines key considerations.

H2.1: Packaging & Handling Requirements

- Standard Packaging: Duct is typically shipped in compressed coils or straight lengths bundled together. Coils are secured with plastic banding or stretch wrap; straight lengths are strapped into manageable bundles (e.g., 25 ft, 50 ft).

- Handling Precautions:

- Avoid Kinking: Never bend the duct tighter than its minimum bend radius (usually 1-2 times the diameter, ~4-8 inches) during transport or installation, as this damages insulation and reduces airflow.

- Protect Jacket: Handle carefully to prevent punctures, tears, or abrasion to the outer foil or polymer jacket. Use gloves if necessary.

- Lifting: Lift coils/bundles by their secured bands, not by grabbing the duct material itself. Use appropriate manual handling techniques or equipment (dollies, forklifts) for heavy bundles.

- Stacking: Store vertically on end or horizontally in stable stacks. Limit stack height to prevent crushing lower layers (typically max 3-4 high for coils). Use pallets for stability and fork-lift access.

H2.2: Storage Conditions

- Environment: Store indoors in a clean, dry, well-ventilated area, protected from direct sunlight, rain, snow, and extreme temperatures (ideally 40°F – 100°F / 4°C – 38°C).

- Moisture Protection: Keep packaging intact until ready for use. Exposure to moisture can degrade fiberglass insulation, reduce R-value, promote mold growth, and compromise jacket integrity.

- Pest Protection: Store off the floor (on pallets) and away from areas prone to rodents or insects that may chew through the jacket or insulation.

- Shelf Life: While generally stable, prolonged exposure to harsh conditions (UV, moisture, extreme heat) degrades materials. Inspect older stock before use. Typical recommended storage life is 2-5 years; consult manufacturer’s data.

H2.3: Transportation

- Securement: Securely fasten coils/bundles on trucks or trailers using straps or chains to prevent shifting, rolling, or falling during transit. Protect from weather with a tarp if not in a closed container.

- Temperature: Avoid prolonged exposure to temperatures exceeding 140°F (60°C) during transport, which can degrade binders in fiberglass insulation or soften polymer jackets.

- Ventilation: Ensure adequate airflow around loads, especially in hot conditions, to prevent heat buildup.

H2.4: Key Regulatory & Compliance Standards

- Flame & Smoke Safety (Critical):

- UL 181A-B: Standard for Factory-Made Air Ducts and Air Connectors. Mandatory for ducts used in HVAC systems in the US. Requires testing for flame spread (max 25), smoke developed (max 50), and adhesion. Look for the UL “Listed” mark and the specific “181A-B” designation.

- UL 181: Often listed generically, but 181A-B is required for flexible duct. UL 181A is for rigid duct board/pipe.

- ASTM E84 / UL 723: Standard Test Method for Surface Burning Characteristics of Building Materials. Results (Flame Spread Index, Smoke Developed Index) are used to meet UL 181A-B requirements.

- Insulation Performance:

- ASTM C177 / C518: Standard Test Methods for Steady-State Thermal Transmission Properties (R-value/Thermal Conductivity). Ensure product meets claimed R-value (e.g., R-4.2, R-6, R-8).

- Air Tightness:

- UL 181A-B: Includes requirements for leakage under pressure (Class 1 or Class 2). Class 1 has stricter leakage limits.

- SMACNA HVAC Duct Construction Standards: While not a legal standard, widely adopted best practice for proper sealing (joints, boots, plenums) to minimize energy loss.

- Material Restrictions:

- California Proposition 65 (Prop 65): Requires warning labels if duct contains chemicals known to the state of California to cause cancer or reproductive harm (e.g., certain fiberglass components). Check manufacturer’s Prop 65 compliance statement.

- REACH (EU): Registration, Evaluation, Authorisation and Restriction of Chemicals. Ensures safe use of chemicals in products sold in the EU. Verify compliance if applicable.

- RoHS (EU): Restriction of Hazardous Substances (primarily electronics, less relevant for duct, but check if components like connectors are included).

- Energy Codes:

- IECC (International Energy Conservation Code) / ASHRAE 90.1: Mandate minimum insulation R-values for ducts in conditioned and unconditioned spaces. Ensure the selected R-value (e.g., R-6, R-8) meets or exceeds local code requirements for the specific application (e.g., attic, crawlspace).

- Building Codes:

- International Mechanical Code (IMC) / Uniform Mechanical Code (UMC): Govern the installation of mechanical systems, including ductwork. Require UL 181A-B listing, proper supports, sealing, clearance from combustibles, and access for maintenance. Local amendments always take precedence.

H2.5: Documentation & Verification

- Manufacturer’s Cut Sheet/Specs: Obtain and retain for each product batch. Must include:

- UL 181A-B Listing Number and Marking

- R-value (per ASTM C177/C518)

- Dimensions (ID, OD, Length)

- Temperature Rating

- Pressure Rating (e.g., 2″ w.g.)

- Compliance Statements (Prop 65, REACH if applicable)

- Certificates of Compliance (CoC): May be required by project specifications or authorities having jurisdiction (AHJs) to verify UL listing and material standards.

- Installation Instructions: Follow the manufacturer’s specific guidelines for handling, supporting, connecting, and sealing the duct.

Critical Compliance Reminder: Never install 4-inch flexible insulated duct without verifying it carries the UL 181A-B listing. Using non-listed duct violates building and fire codes, voids insurance, creates significant fire and smoke hazards, and will result in failed inspections. Always check local codes for specific requirements and amendments.

Conclusion for Sourcing 4-Inch Flexible Duct (Insulated):

After evaluating various suppliers, product specifications, pricing, and performance requirements, sourcing 4-inch insulated flexible ducting requires a balanced approach that prioritizes thermal efficiency, durability, and compliance with building codes. Insulated flexible ducts are essential for minimizing energy loss, reducing condensation risks, and ensuring efficient HVAC system performance, particularly in unconditioned spaces such as attics or crawl spaces.

Key considerations in the sourcing decision include insulation R-value (typically R-4.2 or higher), UL or ASTM compliance, ease of installation, and resistance to compression and kinking. Reputable manufacturers such as Flex-conn, Newaire, and Sealtight offer reliable, code-compliant options that meet industry standards.

Cost-effectiveness should not compromise quality—low-cost alternatives may lead to long-term inefficiencies or code violations. Bulk purchasing from authorized distributors or HVAC supply houses can yield cost savings without sacrificing performance.

In conclusion, the recommended approach is to source 4-inch insulated flexible ducts from trusted suppliers offering products with at least R-4.2 insulation, UL 181 fire and safety certification, and strong vapor barrier properties. This ensures optimal energy efficiency, regulatory compliance, and long-term reliability in residential and commercial HVAC applications.