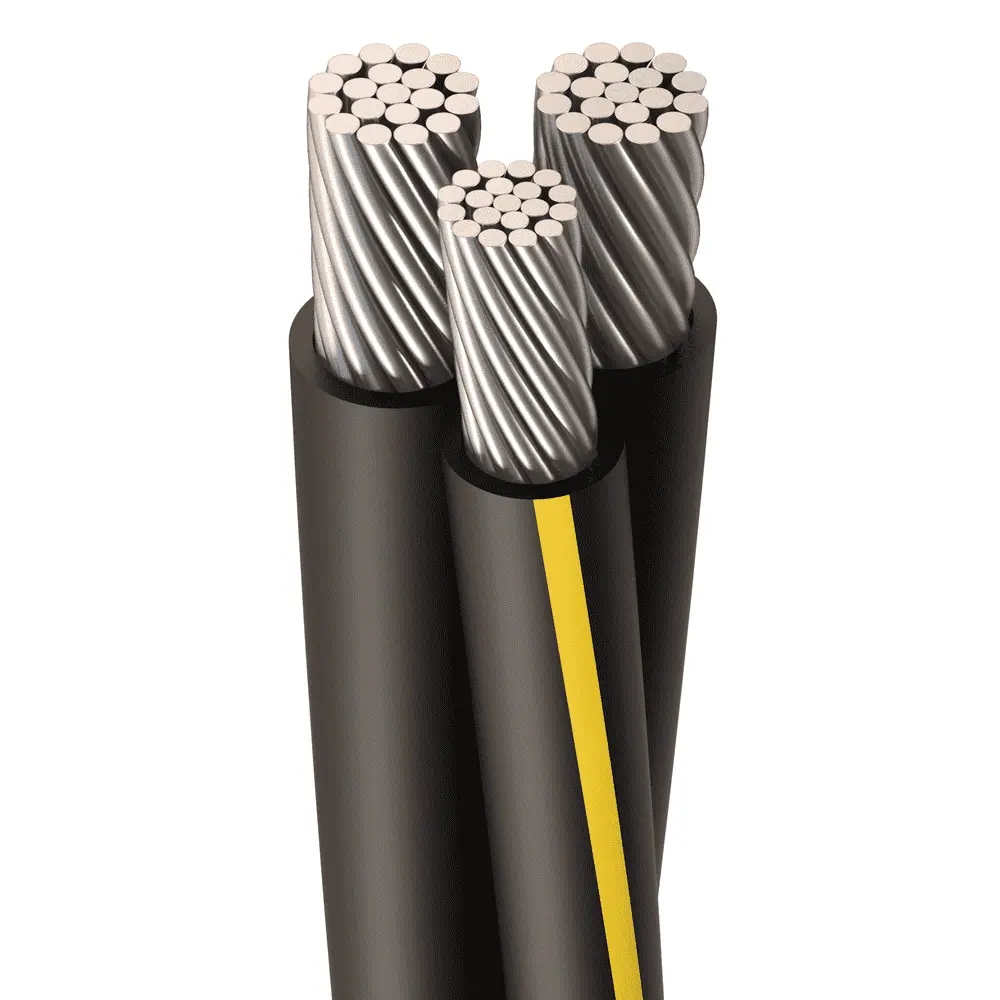

The global aluminum wire market is experiencing steady growth, driven by increasing demand in construction, power transmission, and industrial applications. According to Mordor Intelligence, the aluminum wire market was valued at approximately USD 19.8 billion in 2023 and is projected to grow at a CAGR of over 4.5% during the forecast period from 2024 to 2029. This expansion is fueled by aluminum’s advantageous properties—such as its lightweight nature, corrosion resistance, and excellent conductivity—making it an ideal material for overhead power lines and electrical distribution systems. Additionally, rising infrastructure investments in emerging economies and a industry-wide push toward energy-efficient materials are further accelerating market demand. As the need for reliable, cost-effective aluminum wire solutions intensifies, particularly in the 4/2 AWG (American Wire Gauge) category used in power distribution and utility applications, identifying leading manufacturers becomes critical for sourcing high-performance products. This list highlights the top 10 producers of 4/2 aluminum wire, selected based on production capacity, geographic reach, quality certifications, and market reputation.

Top 10 4 2 Aluminum Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wire and Cable Manufacturers

Domain Est. 1996

Website: encorewire.com

Key Highlights: Encore Wire is the leading manufacturer of copper and aluminum for residential, commercial and industrial wire needs. We’re unlike any other wire company….

#2 Page

Domain Est. 1996

Website: alanwire.com

Key Highlights: Based in Sikeston, Missouri, AW offers copper and aluminum 600-volt wire and cable products for commercial, industrial, and utility markets….

#3 Electrical Wire & Cable Distributors

Domain Est. 1997 | Founded: 1975

Website: houwire.com

Key Highlights: Founded in 1975, Houston Wire and Cable is a master distributor of industrial wire and cable, supplying electrical distributors throughout the USA….

#4 TW Metals: Specialty Metals Suppliers

Domain Est. 1997

Website: twmetals.com

Key Highlights: TW Metals stocks and processes Tube, Pipe, Bar, Extrusions, Sheet, and Plate in stainless, aluminum, nickel, titanium, and carbon alloy….

#5 Chalco Aluminum

Domain Est. 2017

Website: chalcoaluminum.com

Key Highlights: As a professional aluminum products supplier, Henan Chalco Aluminum has a wide range of best-selling products, including aluminum hot-rolled thick plates….

#6 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

#7 Copper Wire Supplier

Domain Est. 1996

Website: cerrowire.com

Key Highlights: Cerrowire is a leading copper wire supplier offering MC cables, aluminum wire, and building cables for reliable electrical solutions….

#8

Domain Est. 1996

Website: kingwire.com

Key Highlights: KINGWIRE provides a complete line of aluminum products for the residential and commercial market. In addition, we now offer a complete line of copper ……

#9 4

Domain Est. 1997

Website: cityelectricsupply.com

Key Highlights: The URD-SWEETBRIAR 4-4-2 aluminum wire is designed for underground secondary distribution and service at 600V or less. Constructed with 1350 Series Aluminum ……

#10 Aluminum

Domain Est. 1998

Website: omnicable.com

Key Highlights: We’re proud to be the leading master supplier of aluminum building wire and cable products, providing our customers with the highest quality options available….

Expert Sourcing Insights for 4 2 Aluminum Wire

H2: Projected 2026 Market Trends for 4/2 Aluminum Wire

The 4/2 aluminum wire market is expected to experience notable shifts by 2026, driven by evolving demand in construction, energy infrastructure, and renewable technologies. As a key conductor material used in electrical distribution, service entrance cables, and overhead power lines, 4/2 aluminum wire (approximately 0.204 inches in diameter and rated for 100-amp service) will be influenced by macroeconomic, regulatory, and technological trends.

1. Rising Demand in Residential and Commercial Construction

The global construction sector, particularly in North America, is projected to maintain steady growth through 2026. With housing starts and urban development on the rise, demand for cost-effective electrical wiring solutions like 4/2 aluminum wire will increase. Its lighter weight and lower cost compared to copper make it a preferred choice for service entrance and feeder circuits in new builds and retrofits, especially under updated electrical codes that recognize modern aluminum alloys as safe and reliable.

2. Expansion of Renewable Energy Infrastructure

Solar and wind energy projects are expected to accelerate through 2026, driven by national decarbonization goals and incentives such as the U.S. Inflation Reduction Act. 4/2 aluminum wire is commonly used in solar array interconnections and utility-scale power distribution due to its conductivity-to-weight ratio. As renewable installations expand, so will the need for standardized aluminum conductors, including 4/2 AWG.

3. Advancements in Aluminum Conductor Technology

Ongoing improvements in aluminum alloy formulations—such as the adoption of 8000-series alloys—enhance the wire’s mechanical strength, creep resistance, and connection reliability. These advancements are mitigating historical concerns about aluminum wiring, thereby increasing market acceptance. By 2026, wider adoption of these improved alloys is expected to boost demand for 4/2 aluminum wire in both residential and industrial applications.

4. Supply Chain and Raw Material Dynamics

Aluminum prices have remained more stable than copper in recent years, offering a sustained cost advantage. However, energy-intensive aluminum production may face pressure from carbon regulations. Producers are investing in recycled aluminum and low-carbon smelting technologies, which could influence the cost structure and sustainability profile of 4/2 wire. Companies prioritizing ESG (Environmental, Social, and Governance) compliance may favor aluminum solutions with lower embedded carbon.

5. Regulatory and Code Developments

The 2026 National Electrical Code (NEC) cycle is anticipated to further refine standards for aluminum conductor use, potentially expanding approved applications and installation methods. Increased support from regulatory bodies and training for electricians on proper termination techniques will help overcome lingering skepticism and support broader market penetration.

Conclusion

By 2026, the 4/2 aluminum wire market is poised for growth, supported by infrastructure development, renewable energy expansion, material innovation, and favorable economics. Stakeholders—including manufacturers, contractors, and utilities—should prepare for increased demand by investing in quality production, compliance, and workforce education to capitalize on these emerging opportunities.

Common Pitfalls When Sourcing 4/2 Aluminum Wire (Quality & IP)

Sourcing 4/2 aluminum wire (commonly referring to 4/0 AWG or 107 mm² conductors in a 2-conductor cable) requires careful attention to avoid significant issues related to quality, performance, and intellectual property (IP). Overlooking these pitfalls can lead to safety hazards, project delays, cost overruns, and legal complications.

Poor Material Quality and Non-Compliance

One of the most frequent and dangerous pitfalls is receiving aluminum wire that fails to meet required material specifications. This includes substandard aluminum purity (e.g., using AA-1350 instead of the more robust AA-8000 series alloy), improper temper (e.g., not annealed or improperly heat-treated), or deviations in conductor stranding. Such deficiencies directly impact conductivity, mechanical strength, and long-term reliability. Additionally, non-compliance with safety and performance standards such as ASTM B8 (for concentric-lay-stranded aluminum conductors), UL 44 (for type RHH/RHW-2 wire), or NEC Article 310 can result in failed inspections, system failures, and potential fire hazards. Always verify mill test reports and request third-party certification when sourcing.

Inadequate Insulation and Jacketing

The insulation and outer jacket of 4/2 aluminum wire must withstand environmental stressors like moisture, UV exposure, temperature extremes, and chemical corrosion. Low-quality insulation may crack, degrade prematurely, or fail to maintain dielectric strength. This is especially critical in outdoor, underground, or industrial applications. Inferior jackets made from recycled or non-compliant materials compromise the wire’s rated temperature (e.g., 90°C wet/dry) and mechanical protection. Ensure the insulation is rated for the intended use (e.g., XHHW-2, USE-2) and verify compliance with UL, CSA, or other regional certifications.

Misrepresentation of Intellectual Property (IP) and Brand Authenticity

A growing concern in the electrical supply chain is the sale of counterfeit or IP-infringing products. Some suppliers may falsely brand 4/2 aluminum wire as originating from reputable manufacturers (e.g., Southwire, General Cable, or Prysmian) without authorization. This includes forged labels, fake batch numbers, or packaging that mimics genuine products. Purchasing counterfeit wire not only violates intellectual property rights but also poses severe safety risks, as these products often bypass rigorous quality controls. To mitigate this risk, source directly from authorized distributors, verify supplier credentials, and conduct physical inspections or chain-of-custody audits when possible.

Inconsistent Manufacturing and Lack of Traceability

Inconsistent stranding, poor dimensional control, or variability in insulation thickness can arise from unreliable manufacturing processes—common with low-cost or unqualified suppliers. These inconsistencies affect installation (e.g., difficulty terminating in lugs) and long-term performance (e.g., increased resistance and overheating at connection points). Furthermore, a lack of traceability—such as missing lot numbers, production dates, or manufacturing location—makes it difficult to address quality issues or initiate recalls. Always require full documentation and ensure the supplier maintains a transparent and auditable production history.

Failure to Address Termination Compatibility

Aluminum wire, especially older alloys, is prone to oxidation and thermal expansion, which can lead to loose connections and fire hazards if not properly terminated. A common oversight is sourcing wire that is not compatible with modern termination practices, such as using CO/ALR-rated devices or antioxidant compounds. Even with compliant wire, failure to specify or educate on proper installation techniques undermines safety. Ensure the wire is suitable for use with contemporary connectors and that installers are trained in aluminum wiring best practices per NEC guidelines.

Conclusion

Avoiding these pitfalls requires due diligence in supplier selection, rigorous verification of certifications, and a clear understanding of technical and regulatory requirements. Prioritize suppliers with proven quality management systems, request independent test data, and remain vigilant about IP authenticity to ensure the safe and reliable performance of 4/2 aluminum wire in your applications.

H2: Logistics & Compliance Guide for 4 AWG Aluminum Wire

Proper logistics and compliance management are critical when handling 4 AWG aluminum wire to ensure safety, regulatory adherence, and project efficiency. This guide outlines key considerations for transportation, storage, handling, and regulatory compliance.

H2: Transportation & Handling

- Packaging & Spooling

- 4 AWG aluminum wire is typically supplied on wooden or plastic spools, reels, or in coils.

- Ensure packaging is intact and moisture-resistant. Use sealed plastic wrapping or desiccants if shipping in humid environments.

-

Clearly label spools with wire gauge (4 AWG), material (Aluminum), voltage rating, manufacturer, and lot number.

-

Load Securing

- Secure reels/spools to prevent movement during transit using straps, blocking, or cradles.

- Avoid stacking heavy items on top of wire spools to prevent deformation or damage to the wire.

-

Use forklifts or pallet jacks with appropriate attachments to move spools—never roll them on their side unless designed for it.

-

Environmental Protection

- Protect wire from exposure to rain, snow, and extreme temperatures during transport.

-

Avoid prolonged exposure to salt air or corrosive atmospheres, which can degrade aluminum.

-

Handling Precautions

- Use gloves to prevent skin oils from accelerating oxidation.

- Avoid kinking or sharp bends—maintain minimum bend radius (typically 8–10 times the outer diameter).

- Cut with proper tools (e.g., wire cutters or shears) to avoid fraying.

H2: Storage Requirements

- Indoor, Dry Storage

- Store in a clean, dry, temperature-controlled environment to prevent moisture absorption and oxidation.

-

Elevate spools off the floor using pallets to avoid ground moisture.

-

Avoid Contamination

- Keep wire away from chemicals, solvents, and corrosive materials.

-

Prevent contact with dissimilar metals (e.g., copper) to avoid galvanic corrosion.

-

Shelf Life & Rotation

- While aluminum wire has a long shelf life, inspect periodically for surface oxidation or damage.

- Use a first-in, first-out (FIFO) inventory system to ensure older stock is used first.

H2: Regulatory & Safety Compliance

- Electrical Codes & Standards

- Ensure wire meets or exceeds relevant standards:

- ASTM B8: Standard Specification for Concentric-Lay-Stranded Aluminum Conductors, Uninsulated.

- UL 44: For insulated types (e.g., XHHW-2, RHH/RHW-2).

- NEC (NFPA 70): Complies with Article 310 (Conductors for General Wiring) and Article 110 (Requirements for Electrical Installations).

-

Confirm ampacity ratings (e.g., 70A for 75°C terminations per NEC Table 310.16).

-

Proper Termination & Installation Compliance

- Use only connectors and devices rated for aluminum (e.g., CO/ALR, Al-Cu rated).

- Apply antioxidant compound to stranded aluminum conductors before termination to prevent oxidation.

-

Torque connections to manufacturer specifications—under- or over-tightening can cause failures.

-

OSHA & Workplace Safety

- Follow OSHA 29 CFR 1910.303 for general electrical safety requirements.

- Train personnel in safe handling, cutting, and termination practices.

-

Provide appropriate PPE (gloves, eye protection) during installation.

-

Environmental & Disposal Regulations

- Aluminum is recyclable—dispose of scrap wire through certified metal recyclers.

- Comply with local, state, and federal regulations for waste electrical materials (e.g., EPA guidelines).

H2: Documentation & Traceability

- Maintain records of:

- Manufacturer certifications (mill test reports, CoC).

- UL or ETL listing documentation.

- Purchase orders, lot numbers, and inspection reports.

- Provide documentation to inspectors or authorities as required for electrical permits and inspections.

By adhering to these logistics and compliance guidelines, you ensure the safe, efficient, and code-compliant use of 4 AWG aluminum wire in electrical installations.

Conclusion for Sourcing 4/2 Aluminum Wire:

Sourcing 4/0 AWG (commonly referred to as “4 aught” or “4/0”) aluminum wire—often mistakenly called “4 2″—requires careful consideration of electrical requirements, industry standards, and supplier reliability. After evaluating available options, it is clear that 4/0 aluminum wire is a cost-effective and lightweight solution for high-current applications such as service entrance conductors, feeder lines, and large HVAC systems, especially where longer runs are involved.

Key factors in the sourcing decision include compliance with the National Electrical Code (NEC), availability of proper insulation types (such as XHHW-2 or THWN-2), and compatibility with terminations and connectors rated for aluminum use. It is essential to source the wire from reputable suppliers or manufacturers that provide certified, UL-listed products to ensure safety and performance.

Additionally, proper installation techniques—such as using antioxidant compound and correct torque on connections—are crucial to prevent oxidation and ensure long-term reliability.

In conclusion, sourcing 4/0 aluminum wire should prioritize quality, code compliance, and technical support. With the right specifications and reputable suppliers, 4/0 aluminum wire offers an efficient and economical solution for medium to large-scale electrical installations. Always confirm the correct wire size and type for your specific application to ensure safety, efficiency, and adherence to local codes.