The global 3D scanning market is experiencing robust expansion, driven by rising demand for precision measurement and digital prototyping across industries such as automotive, healthcare, aerospace, and construction. According to Mordor Intelligence, the 3D scanning market was valued at USD 7.48 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2029. Complementary insights from Grand View Research reinforce this trajectory, forecasting a CAGR of 7.5% from 2023 to 2030, underpinned by advancements in optical scanning technologies and the integration of 3D scanning with AI and automation. At the core of this evolution are innovative manufacturers specializing in high-performance 3D scanner heads—critical components that determine accuracy, speed, and adaptability in data capture. As industries shift toward digital twins, quality control automation, and custom manufacturing, the demand for reliable, high-resolution scanning solutions continues to escalate. This has positioned leading scanner head manufacturers at the forefront of industrial digitization, driving both technological breakthroughs and market competition. The following overview highlights the top nine companies shaping this dynamic landscape through engineering excellence, R&D investment, and global market reach.

Top 9 3D Scaner Head Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Scanlab

Website: scanlab.de

Key Highlights: SCANLAB GmbH is the world-leading, independent OEM manufacturer of high end scan heads and scanning solutions….

#2 LMI Technologies

Domain Est. 2009

Website: lmi3d.com

Key Highlights: Our smart 3D laser, snapshot, and line confocal sensors improve factory production by providing fast, accurate, reliable machine vision inspection ……

#3 3DMakerpro: Portable 3D Scanners

Domain Est. 2022

Website: store.3dmakerpro.com

Key Highlights: Explore high-precision portable 3D scanners for design, modeling, and industrial use. Ideal for engineers, creators, and professionals….

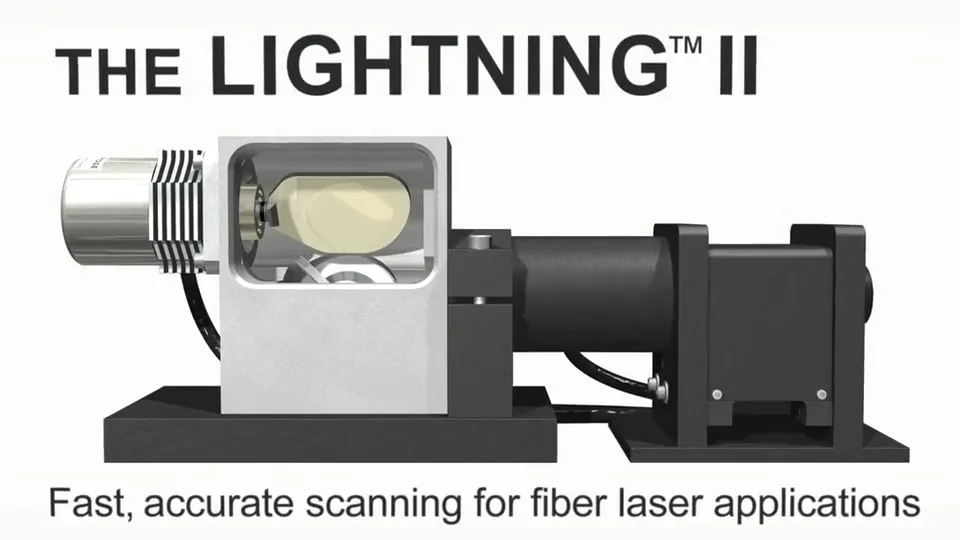

#4 Laser Scanning Heads

Domain Est. 1994

Website: aerotech.com

Key Highlights: Aerotech supplies high-performance 2D, 3D and 5D laser scan heads to meet a diverse range of precision manufacturing challenges….

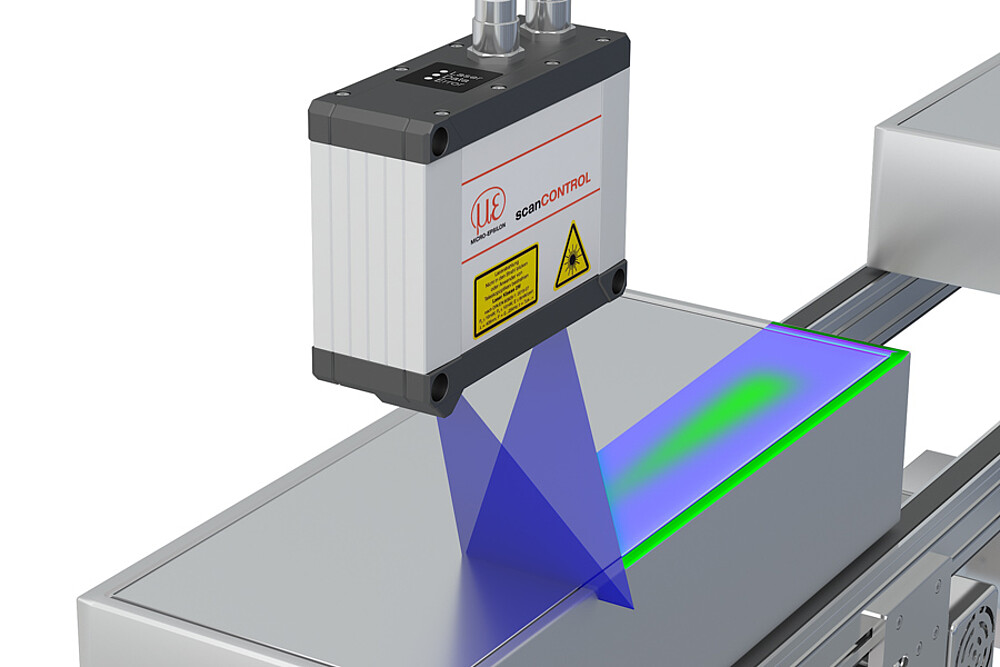

#5 scanCONTROL 3D laser scanners

Domain Est. 1997

Website: micro-epsilon.com

Key Highlights: scanCONTROL 3D scanners are used for precise inline 3D measurements in numerous applications. Scans are performed by moving the scanner or the target….

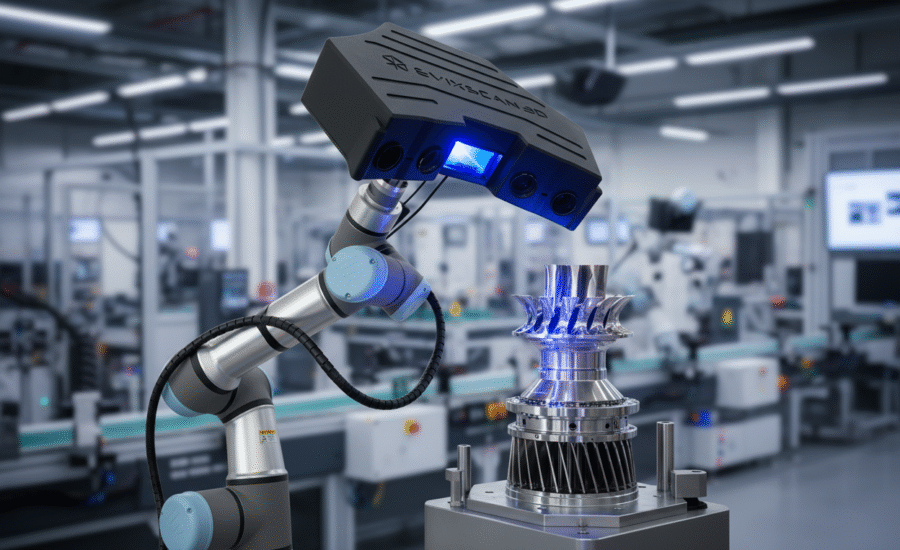

#6 Professional 3D Scanners

Domain Est. 2003

Website: it3d.com

Key Highlights: Our Robotic 3D Scanners offer semi-automated and fully automated measurement stations that combine an optical 3D scanner with a collaborative robot. Discover ……

#7 SHINING 3D

Domain Est. 2008

Website: shining3d.com

Key Highlights: SHINING 3D develops high-accuracy 3D scanners for a wide range of applications. Our solutions are ideal for use in high-precision metrology, digital dentistry, ……

#8 3D Scan Store

Domain Est. 2012

Website: 3dscanstore.com

Key Highlights: 3d models for download from 3dscanstore. Our 3d models are generated from high quality 3d scans.Use in CG projects,VR / AR, animation, games, 3D projects….

#9 3D Object Scanner Artec Eva

Domain Est. 2009

Website: artec3d.com

Key Highlights: Free delivery 14-day returnsThis structured-light 3D scanner is the ideal choice for making quick, textured, and accurate 3D models of medium-sized objects….

Expert Sourcing Insights for 3D Scaner Head

H2: 2026 Market Trends for 3D Scanner Heads

The global market for 3D scanner heads is poised for significant transformation by 2026, driven by rapid technological advancements, expanding industrial applications, and growing demand across key sectors. Below is an analysis of the major trends shaping the 3D scanner head market in 2026:

-

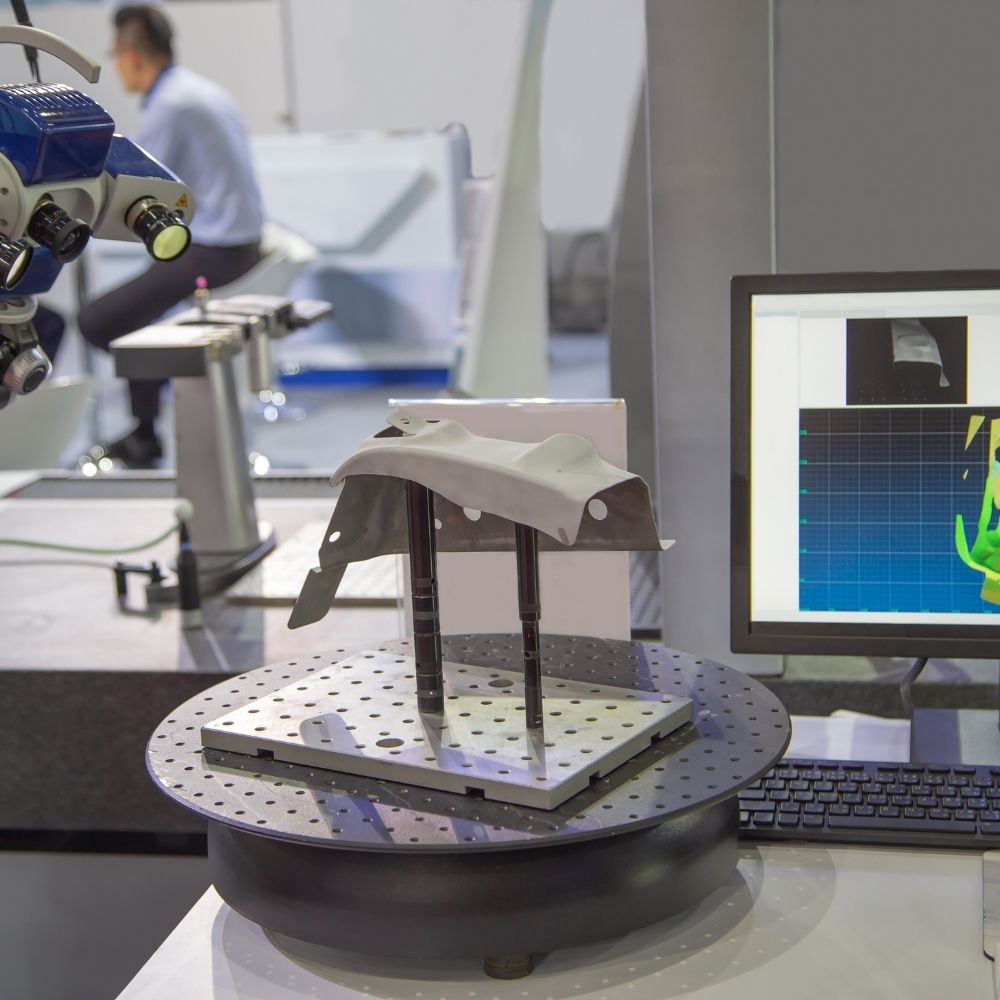

Increased Adoption in Industrial Automation and Quality Control

Manufacturing and industrial sectors are increasingly integrating 3D scanner heads into automated inspection and metrology systems. By 2026, the demand for high-precision, real-time scanning in production lines—especially in automotive, aerospace, and electronics—will drive innovation in compact, high-speed scanner heads with improved resolution and integration capabilities. -

Miniaturization and Portability

There is a clear trend toward smaller, lightweight 3D scanner heads suitable for handheld devices and robotic arms. Advances in sensor technology and optics are enabling manufacturers to produce scanner heads that maintain accuracy while being more portable and easier to deploy in confined or complex environments. -

Integration with AI and Machine Learning

By 2026, intelligent 3D scanner heads equipped with on-board AI algorithms will become more prevalent. These systems can perform real-time data processing, defect detection, and adaptive scanning path optimization, significantly enhancing efficiency in quality assurance and reverse engineering applications. -

Growing Use in Healthcare and Biometrics

The medical sector is adopting 3D scanner heads for applications such as custom prosthetics, orthodontics, and facial recognition systems. The trend toward personalized medicine and non-invasive diagnostics will fuel demand for high-resolution, safe (e.g., structured light or safe laser-class) scanner heads tailored for human scanning. -

Expansion in Cultural Heritage and Digital Preservation

Museums, archaeologists, and preservationists are increasingly using 3D scanner heads to digitize artifacts and historical sites. By 2026, demand will grow for scanner heads with ultra-high resolution and color fidelity, enabling photorealistic digital replicas with minimal physical contact. -

Advancements in Sensor Technology

Emerging technologies such as time-of-flight (ToF), structured light, and laser triangulation are evolving to deliver higher accuracy, faster capture speeds, and better performance in diverse lighting and surface conditions. Solid-state and MEMS-based scanner heads are expected to gain traction due to their durability and scalability. -

Rise of 3D Scanning in Consumer Electronics and AR/VR

Consumer devices, including smartphones and AR/VR headsets, are beginning to incorporate 3D scanner heads for facial recognition, gesture control, and immersive experiences. This trend will push the development of low-cost, energy-efficient scanner heads suitable for mass-market integration. -

Sustainability and Cost Efficiency

Manufacturers are focusing on reducing production costs and environmental impact through modular designs and recyclable materials. By 2026, there will be greater emphasis on scalable manufacturing and repairability, supporting broader market penetration across emerging economies. -

Regional Growth and Market Expansion

Asia-Pacific is expected to emerge as a key growth region due to rising industrial automation in countries like China, Japan, and India. North America and Europe will maintain strong demand in high-tech sectors, supported by investments in R&D and digital twin technologies. -

Standardization and Interoperability

As 3D scanning becomes more integrated into digital workflows (e.g., CAD/CAM, BIM, and Industry 4.0), there will be increased demand for standardized data formats and plug-and-play compatibility between scanner heads and software platforms. This will drive collaboration among hardware manufacturers, software developers, and industry consortia.

In summary, the 3D scanner head market in 2026 will be characterized by smarter, smaller, and more versatile devices serving a broadening range of industries. Innovation will be fueled by cross-sectoral demand, digital transformation, and the integration of emerging technologies, positioning 3D scanner heads as critical components in the future of digital manufacturing and immersive computing.

Common Pitfalls When Sourcing a 3D Scanner Head: Quality and Intellectual Property Concerns

Inadequate Quality Verification and Testing

One of the most frequent pitfalls when sourcing 3D scanner heads—especially from third-party or overseas suppliers—is the lack of thorough quality validation. Many buyers rely solely on vendor specifications or demonstrations, which may not reflect real-world performance. Critical aspects such as scanning accuracy, resolution, repeatability, and stability under varying environmental conditions (e.g., temperature, lighting) are often not rigorously tested before integration. This can lead to inconsistent data output, increased post-processing effort, or system failure in production environments.

Additionally, long-term durability and component wear (e.g., laser diodes, cameras, optics) are frequently overlooked. Without access to comprehensive test reports, lifecycle data, or sample units for in-house evaluation, companies risk integrating a scanner head that degrades quickly or fails prematurely, undermining the reliability of the entire scanning system.

Unclear or Infringed Intellectual Property (IP) Rights

Sourcing scanner heads from suppliers—particularly in regions with less stringent IP enforcement—poses significant intellectual property risks. A major pitfall is inadvertently acquiring a component that infringes on existing patents, trademarks, or proprietary designs. Some suppliers may reverse-engineer leading commercial models and offer “compatible” or “clone” versions at lower prices, but these often violate IP laws and expose the buyer to legal liability, including product recalls, fines, or injunctions.

Moreover, unclear IP ownership can limit customization, future development, or resale rights. If the supplier retains full IP over firmware, calibration algorithms, or mechanical design, the buyer may face restrictions in modifying or improving the scanner. This lack of control can hinder innovation and create dependency on a single vendor, increasing long-term costs and reducing competitive advantage.

Hidden Integration and Calibration Challenges

Even when a scanner head appears to meet quality specifications on paper, hidden integration issues can emerge post-purchase. Differences in communication protocols (e.g., USB, Ethernet, SDK compatibility), power requirements, or physical mounting interfaces may require costly adaptations. Poor factory calibration or lack of calibration traceability can result in subpar scanning performance that is difficult to correct without specialized tools or expertise.

Suppliers may not provide sufficient technical documentation, SDKs, or calibration certificates, making it difficult to ensure consistent performance across multiple units. This lack of transparency increases the risk of delays, rework, and higher total cost of ownership.

Insufficient Supplier Transparency and Support

Many low-cost scanner head suppliers offer limited technical support, poor documentation, or non-disclosure of component sources. This opacity makes it difficult to assess the true origin of critical components (e.g., sensors, lenses), verify compliance with industry standards (e.g., ISO, CE), or troubleshoot issues. In the event of defects or performance issues, lack of responsive support can halt development or production timelines.

Additionally, suppliers may not offer firmware updates, security patches, or long-term availability guarantees, risking obsolescence or vulnerabilities in deployed systems. Without a reliable service agreement or warranty, buyers bear the full burden of maintenance and replacement.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Request sample units for independent performance testing under real-world conditions.

– Conduct due diligence on supplier reputation, IP compliance, and component provenance.

– Require full technical documentation, SDK access, and calibration certificates.

– Verify IP rights through legal review, especially for commercial product integration.

– Establish service-level agreements (SLAs) for support, updates, and spare parts availability.

Proactive evaluation of both technical quality and IP integrity is essential to ensure a reliable, legally sound, and scalable 3D scanning solution.

Logistics & Compliance Guide for 3D Scanner Head

Product Classification and Documentation

Ensure accurate classification of the 3D scanner head under the appropriate Harmonized System (HS) code, typically falling under 9027.50 (optical measuring instruments) or a similar category depending on technical specifications. Maintain comprehensive technical documentation, including user manuals, safety data sheets, and product specifications, translated into the local language of the destination country. Accurate classification and documentation are essential for customs clearance and regulatory compliance across international borders.

Export Controls and Licensing

Verify whether the 3D scanner head is subject to export control regulations such as the Export Administration Regulations (EAR) in the U.S. or the EU Dual-Use Regulation. High-resolution or long-range scanning systems may be classified as dual-use items due to potential military or surveillance applications. Determine if an export license or license exception is required based on the destination country, end-user, and technical capabilities. Always screen end-users against denied party lists to prevent violations.

Packaging and Shipping Requirements

Package the 3D scanner head using shock-resistant, anti-static materials to protect sensitive optical and electronic components during transit. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and include necessary compliance markings such as CE, FCC, or RoHS, as applicable. Use certified carriers experienced in shipping high-value technical equipment and ensure all shipments are fully insured. Maintain shipping records for audit and traceability purposes.

Import Regulations and Duties

Research import requirements in the destination country, including conformity assessment procedures, local certification (e.g., KC mark in South Korea, CCC in China), and applicable tariffs. Provide a detailed commercial invoice, packing list, and bill of lading or air waybill. Be prepared to pay import duties and Value Added Tax (VAT), or coordinate with the recipient for duty payment. Engage a licensed customs broker if necessary to facilitate smooth entry and avoid delays.

Environmental and Safety Compliance

Ensure the 3D scanner head complies with environmental standards such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) in the EU. Confirm adherence to electromagnetic compatibility (EMC) and laser safety standards (e.g., IEC 60825) where applicable. Provide required safety warnings and laser classification labels on the product and packaging to meet occupational health and safety regulations in target markets.

After-Sales Support and Warranty Logistics

Define clear procedures for handling warranty claims, repairs, and returns in accordance with local consumer protection laws. Establish authorized service centers or partner with local technicians to minimize downtime for customers. Maintain compliance with WEEE (Waste Electrical and Electronic Equipment) directives by offering take-back and recycling options in applicable regions. Ensure spare parts and technical support are available to sustain long-term customer compliance and satisfaction.

Conclusion for Sourcing a 3D Scanner Head:

After thorough evaluation of available options, technical specifications, supplier reliability, and cost-effectiveness, sourcing a 3D scanner head requires a strategic balance between performance, integration capability, and long-term support. The selected scanner head should align with the intended application—whether for high-precision metrology, reverse engineering, or real-time scanning—ensuring compatibility with existing systems, software, and workflow requirements.

Key factors such as scanning accuracy, resolution, speed, portability, and ease of integration play a critical role in determining the most suitable model. Additionally, supplier reputation, warranty terms, availability of technical support, and potential for future upgrades should be prioritized to ensure sustained operational efficiency.

Based on the analysis, a mid-to-high-tier structured light or laser-based 3D scanner head from a reputable manufacturer offers the optimal blend of precision, reliability, and scalability. Final selection should be accompanied by testing and validation in real-world conditions to confirm performance benchmarks. Ultimately, investing in a high-quality scanner head not only enhances data capture fidelity but also contributes to long-term cost savings and improved project outcomes.