The global demand for 360-degree surround-view camera systems is accelerating rapidly, driven by increasing consumer preference for advanced driver assistance systems (ADAS) and the rise of semi-autonomous vehicles. According to Mordor Intelligence, the automotive camera market is projected to grow at a CAGR of over 12.5% from 2023 to 2028, with surround-view systems representing a significant share of this expansion. Similarly, Grand View Research estimates that the global automotive camera market size was valued at USD 13.6 billion in 2022 and is expected to expand at a CAGR of 11.8% through 2030. As safety regulations tighten and vehicle electrification advances, OEMs and aftermarket providers are increasingly integrating 360-view camera solutions to enhance visibility and reduce accidents. This growth trajectory has spurred innovation among technology manufacturers, positioning nine key players at the forefront of developing high-resolution, low-latency, and AI-enabled cameras that deliver seamless panoramic imaging. The following overview identifies the top nine 360-view car camera manufacturers shaping the future of automotive imaging and safety.

Top 9 360 View Car Camera Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

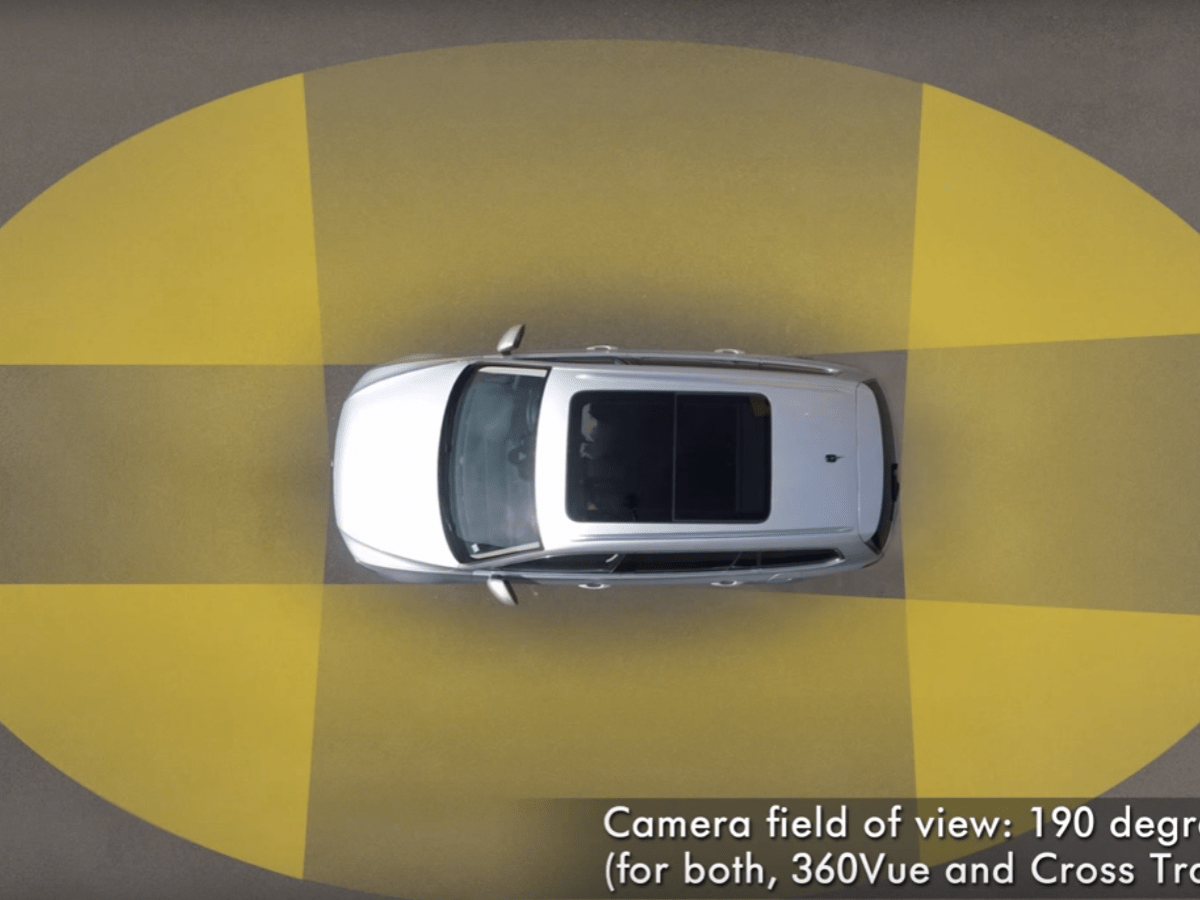

#1 Valeo 360Vue®

Domain Est. 1997

Website: valeo.com

Key Highlights: The new Valeo 360Vue 3D system gives not only full visibility right around the vehicle in a view from above, but also a 3-dimensional view of the vehicle’s ……

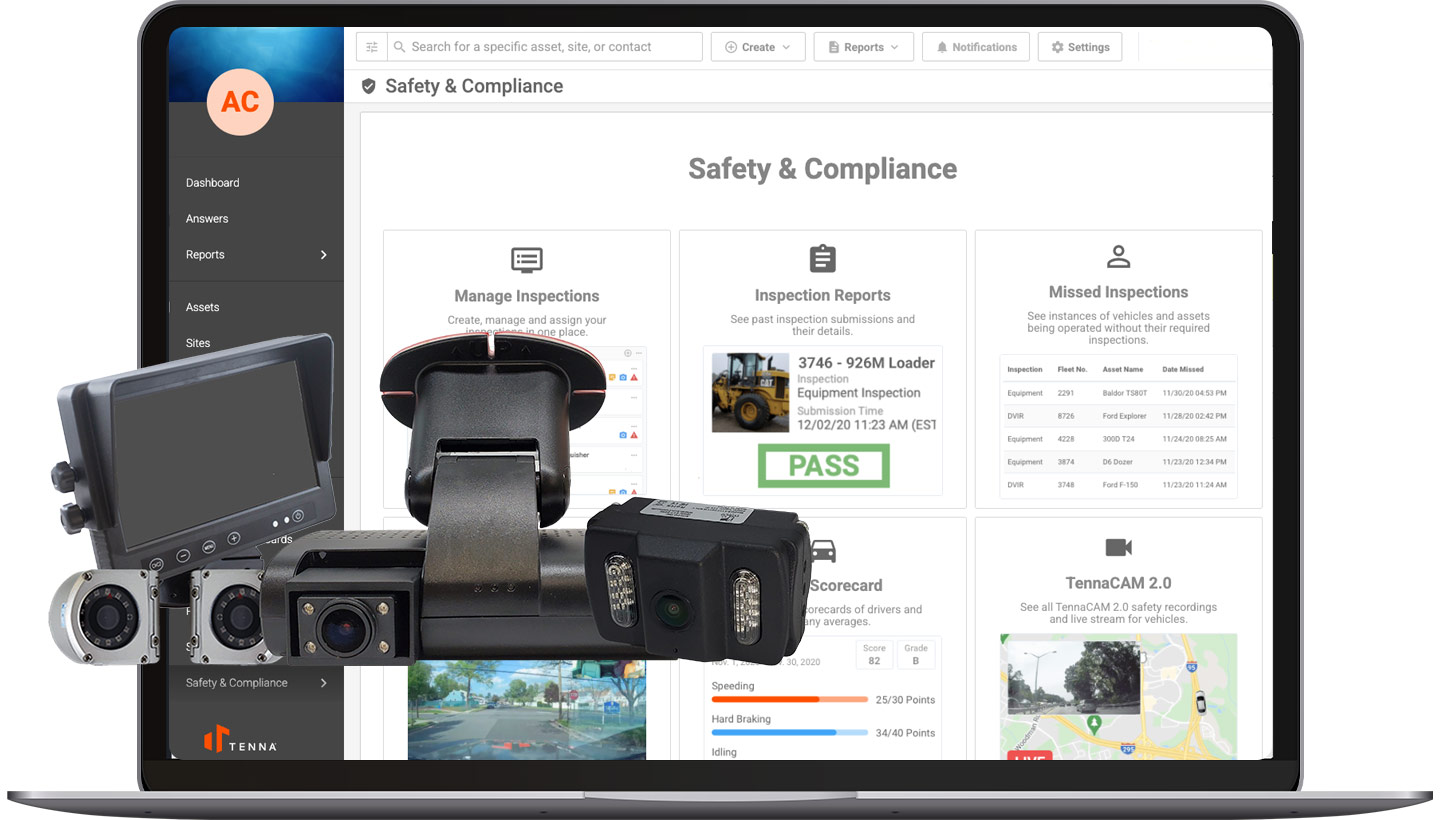

#2 Transform Fleet Safety with AI Dashcams

Domain Est. 2002

Website: verizonconnect.com

Key Highlights: 360-degree view. Improve situational awareness with extended view cameras. An in-cab monitor shows rear and side camera footage to reduce blind spots and help ……

#3 BOYO VT

Domain Est. 2006

Website: visiontechamerica.com

Key Highlights: In stock Free delivery over $120BOYO VT-BP2 – 360-Degree Camera Surround View Monitoring System for Car, Truck or Van (Discontinued)….

#4 Rosco Vision

Domain Est. 2006

Website: roscovision.com

Key Highlights: Introducing Rosco D•CAMS, the revolutionary mirrorless camera and monitoring system designed to replace traditional exterior rear vision mirrors. Engineered for ……

#5 360 Car Camera System & Vehicle Camera

Domain Est. 2007

#6 ProViu® 360

Domain Est. 2010

Website: continental-aftermarket.com

Key Highlights: ProViu®360 is full digital surround view system using megapixel cameras and providing HD image on monitor. The Surround View System provides a complete 360° ……

#7 360 degree surround view

Domain Est. 2011

Website: bosch-mobility.com

Key Highlights: The second generation of the multi-camera system gives drivers a 360 degree surround view to ensure easy, safe and comfortable parking and maneuvering….

#8 Insta360

Domain Est. 2014

Website: insta360.com

Key Highlights: Flagship 360 camera with unbeatable 8K image quality in any light and a revolutionary replaceable lens design. Insta360 X4 Air….

#9 MAN BirdView camera system

Website: man.eu

Key Highlights: The MAN BirdView camera system – consisting of 4 HD cameras – provides a 360-degree bird’s-eye view of the vehicle environment, including blind spots….

Expert Sourcing Insights for 360 View Car Camera

2026 Market Trends for 360 View Car Cameras: A H2 Outlook

The 360-degree surround-view camera (SVC) system market is poised for significant transformation by 2026, driven by converging technological advancements, evolving safety regulations, and shifting consumer expectations. The second half of the decade (H2) will see these systems move beyond premium vehicles into the mainstream, becoming a critical component of both active safety and autonomous driving ecosystems.

1. Accelerated Penetration into Mass-Market Vehicles:

By 2026, 360 view cameras will no longer be exclusive to luxury or high-end models. Falling component costs (especially for cameras and processing units), standardized architectures (e.g., automotive-grade SoCs), and competitive pressure will drive widespread adoption across compact SUVs, sedans, and even entry-level vehicles. This shift will be particularly pronounced in high-growth markets like India, Southeast Asia, and Latin America, where urban congestion and parking challenges amplify the value proposition.

2. Integration with ADAS and the Path to Autonomy:

SVC systems will evolve from standalone parking aids to integral sensors within broader Advanced Driver Assistance Systems (ADAS). In H2 2026, expect tighter integration with:

* Automated Parking (APA/LPA): Seamless handoff between driver and system for parallel and perpendicular parking, leveraging high-resolution 360° data for precise maneuvering.

* Blind Spot Detection & Cross-Traffic Alert: Enhanced accuracy and reduced false positives by fusing camera data with radar/ultrasonic sensors.

* Low-Speed Autonomy: Enabling features like low-speed traffic jam assistance and automated valet parking in controlled environments (e.g., garages), where 360° awareness is paramount. This positions SVC as a foundational sensor for L2+/L3 capabilities.

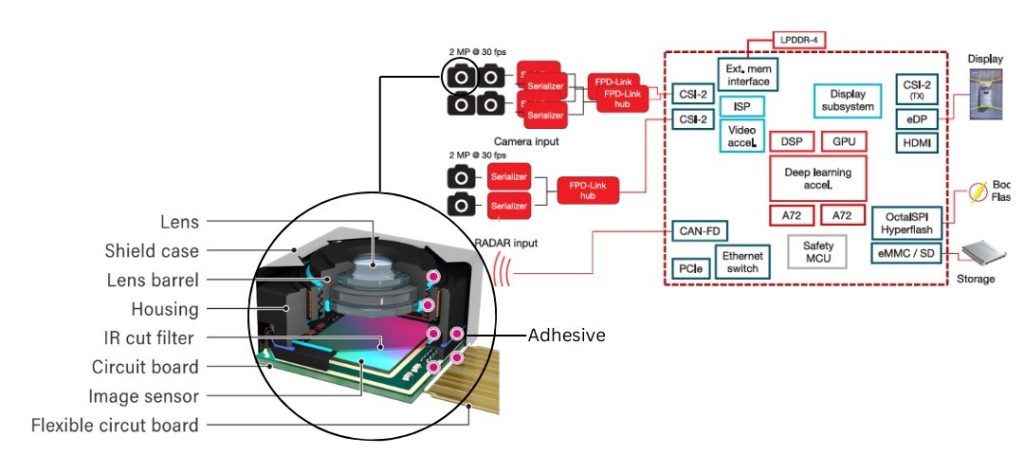

3. Technological Advancements: Resolution, AI, and Sensor Fusion:

Higher Resolution & Dynamic Range: Movement towards 4K or multi-megapixel cameras per view to provide crisper, more detailed imagery, especially crucial for object recognition in low-light or high-contrast conditions.

* Advanced Image Processing & AI: Onboard AI will enable real-time object detection (pedestrians, cyclists, curbs, animals), distance estimation, anomaly detection (e.g., approaching vehicle in blind spot), and predictive path visualization. This reduces driver cognitive load and enhances safety.

* Sensor Fusion:* Deeper integration with radar, ultrasonic sensors, and LiDAR (where available) will create a more robust and reliable environmental model, overcoming individual sensor limitations (e.g., camera performance in fog or rain).

4. Enhanced User Experience and Visualization:

Immersive Displays: Wider adoption of larger, higher-resolution digital instrument clusters and center consoles will support more sophisticated 360° views, including bird’s-eye views, dynamic guidelines, transparent hood/undercarriage views, and selectable camera angles.

* Augmented Reality (AR) Overlays: AR will superimpose navigation cues, path predictions, and hazard warnings directly onto the 360° video feed, providing intuitive guidance.

* Customization & Connectivity:* Drivers will expect personalized settings (e.g., preferred camera views, sensitivity levels) and integration with smartphone apps for remote viewing (e.g., checking if the car is parked correctly).

5. Regulatory Tailwinds and Safety Standards:

Global safety regulations (like NCAP programs in Europe, ASEAN, Latin America, and potentially strengthened US NHTSA guidelines) are increasingly emphasizing parking safety and low-speed collision avoidance. Mandates or strong incentives for reversing cameras (already widespread) are likely to expand to include comprehensive 360° systems as standard equipment on new vehicles by 2026, accelerating market growth.

6. Commercial Vehicle & Fleet Adoption:

Beyond passenger cars, demand will surge in commercial fleets (delivery vans, trucks, construction vehicles, buses). Enhanced visibility reduces blind-spot incidents, improves safety in tight urban environments, aids in docking, and provides valuable video evidence for liability management, driving fleet-wide adoption.

7. Cybersecurity and Data Privacy:

As 360° systems generate vast amounts of visual data, often stored or transmitted, cybersecurity will become a paramount concern. Robust encryption, secure over-the-air (OTA) update mechanisms, and clear data privacy policies regarding video storage and usage will be essential for consumer trust and regulatory compliance.

Conclusion:

By H2 2026, the 360-view car camera market will be characterized by ubiquity, intelligence, and integration. It will transition from a convenience feature to a core safety and autonomy-enabling technology. Success will depend on manufacturers’ ability to deliver cost-effective, reliable systems with advanced AI-powered features, seamless integration into the vehicle’s digital ecosystem, and adherence to evolving safety and security standards. The market will be highly competitive, with opportunities for innovators in camera technology, image processing, AI software, and integrated ADAS solutions.

Common Pitfalls When Sourcing a 360 View Car Camera (Quality and IP Considerations)

Logistics & Compliance Guide for 360 View Car Camera

This guide outlines the essential logistics and compliance considerations for the distribution, importation, and sale of 360 View Car Cameras across various global markets. Adhering to these guidelines ensures smooth operations, regulatory compliance, and customer safety.

Product Classification & HS Code

Identify the correct Harmonized System (HS) code for customs declarations. For 360 View Car Cameras, the most common classification falls under:

- HS Code: 8525.80 – Transmission apparatus for television, digital cameras, and video recording devices.

- Note: Classification may vary by country and specific product features (e.g., integrated GPS or recording functions). Consult local customs authorities or a licensed customs broker for precise categorization.

Packaging & Labeling Requirements

Proper packaging and labeling are essential for compliance and consumer information.

- Packaging: Use durable, anti-static packaging to prevent damage during transit. Include protective foam or inserts for lenses and electronic components.

- Labeling:

- Product Label: Include model number, serial number (if applicable), manufacturer name, country of origin, power specifications (voltage, current), and compliance marks.

- Retail Box: Must display safety warnings, language-specific user manuals, and regulatory compliance logos.

- Language Requirements: Labels and manuals must be translated into the official language(s) of the destination country (e.g., English for the US/UK, French for Canada/France, German for Germany).

Regulatory Compliance Certifications

Ensure the 360 View Car Camera meets all regional regulatory standards before import or sale.

- United States (FCC):

- FCC Part 15, Subpart B – Ensures the device does not cause harmful interference and can withstand interference.

-

Required for any electronic device that emits radio frequency energy.

-

European Union (CE Marking):

- EMC Directive (2014/30/EU) – Electromagnetic compatibility.

- RoHS Directive (2011/65/EU) – Restriction of hazardous substances.

- RED (Radio Equipment Directive 2014/53/EU) – Applies if the camera uses wireless transmission (e.g., Wi-Fi or Bluetooth).

-

CE marking must be visibly affixed to the product and packaging.

-

United Kingdom (UKCA):

- Post-Brexit, UKCA marking is required for products sold in Great Britain.

-

Similar requirements to CE, covering EMC, RoHS, and RED as applicable.

-

Canada (ISED):

- Certification under Innovation, Science and Economic Development Canada (formerly IC).

-

Compliance with RSS-247 or RSS-Gen for digital devices and radio equipment.

-

Other Regions:

- Australia (RCM): Regulatory Compliance Mark, covering EMC and telecommunications standards.

- South Korea (KC Mark): Mandatory safety and EMC certification.

- China (CCC Mark): Required for certain electronic products; confirm if applicable based on product specifications.

Import & Customs Documentation

Prepare accurate documentation to avoid delays at customs.

- Commercial Invoice: Itemized list with product description, HS code, unit value, total value, currency, and Incoterms.

- Packing List: Details per shipment including weight, dimensions, and quantities.

- Bill of Lading (B/L) or Air Waybill (AWB): Proof of shipment contract.

- Certificate of Origin: May be required for preferential tariffs under trade agreements.

- Test Reports & Certificates: Copies of FCC, CE, ISED, or other compliance documents.

- Import Licenses: Check if required by the destination country (rare for consumer electronics but confirm).

Shipping & Logistics Considerations

Optimize logistics for cost, speed, and product safety.

- Mode of Transport: Air freight for speed (sample units or urgent orders), sea freight for bulk shipments.

- Temperature & Humidity Control: Avoid extreme conditions, especially during long sea voyages.

- Insurance: Full coverage for loss, damage, or theft during transit.

- Incoterms: Clearly define responsibilities (e.g., FOB, DDP) in contracts with suppliers or buyers.

- Warehousing: Use climate-controlled facilities with ESD-safe storage if holding inventory.

Environmental & Disposal Compliance

Adhere to environmental regulations throughout the product lifecycle.

- WEEE (EU): Register with national WEEE authorities and provide take-back options for end-of-life products.

- Battery Regulations: If the camera includes a backup battery, comply with transport rules (e.g., IATA for lithium batteries) and local recycling laws.

- Packaging Waste Directives: Follow local requirements for recyclable or reduced packaging (e.g., German Packaging Act).

After-Sales & Warranty Compliance

Ensure post-purchase obligations are met.

- Warranty Registration: Provide multilingual support and clear warranty terms.

- Customer Support: Offer local language technical support and repair services where feasible.

- Recall Preparedness: Maintain traceability (e.g., serial numbers) and have a product recall plan in place if non-compliance is identified.

Conclusion

Compliance with logistics and regulatory requirements is critical for the successful global distribution of 360 View Car Cameras. Manufacturers and distributors must stay updated on changing regulations, maintain accurate documentation, and partner with certified testing labs and logistics providers to ensure seamless operations and market access.

Conclusion: Sourcing a 360-Degree View Car Camera System

In conclusion, sourcing a 360-degree view car camera system requires careful consideration of several key factors including image quality, system compatibility, durability, ease of installation, and after-sales support. As demand for enhanced vehicle safety and situational awareness continues to grow, investing in a reliable and high-performing 360-degree camera system has become essential for both OEMs and the aftermarket sector.

A successful sourcing strategy involves evaluating reputable suppliers, comparing technical specifications, and ensuring compliance with industry standards such as IP ratings for weather resistance and ISO/TS certifications for automotive components. Additionally, considering integration capabilities with existing vehicle electronics (e.g., ADAS, infotainment systems) ensures a seamless user experience.

Cost-effectiveness should not compromise performance or safety. Therefore, balancing budget constraints with quality and long-term reliability is crucial. Partnering with manufacturers that offer strong warranties, technical support, and scalable solutions can provide a competitive advantage.

Ultimately, sourcing the right 360-degree view camera system enhances driver confidence, reduces accidents, and adds significant value to modern vehicles—making it a strategic investment in the future of automotive safety and innovation.