The global industrial container market, including 30-gallon drum manufacturing, continues to expand driven by rising demand across sectors such as chemicals, pharmaceuticals, food & beverage, and hazardous waste management. According to a 2023 report by Mordor Intelligence, the global steel drums and barrels market was valued at USD 19.8 billion in 2022 and is projected to grow at a CAGR of 4.7% from 2023 to 2028. This growth is fueled by stringent regulatory standards for safe transportation and storage of materials, particularly in North America and Europe, where compliance with UN/DOT specifications is mandatory. Additionally, increasing emphasis on recyclability and sustainable packaging solutions has spurred innovation in drum design and material efficiency. As demand for standardized containers like the 30-gallon drum remains consistent—offering an optimal balance between capacity and handling—manufacturers are investing in automation, lightweight materials, and advanced coating technologies to improve performance and reduce environmental impact. In this competitive landscape, eight key players have emerged as leading producers of 30-gallon drums, combining scale, quality, and global reach to serve diverse industrial needs.

Top 8 30 Gallon Drum Size Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Specialized 30 Gallon Steel Drums

Domain Est. 1996

Website: skolnik.com

Key Highlights: Skolnik supplies specialized 30-gallon drums in various configurations. Shop for the industrial 30-gallon barrels and drums you need for storage and ……

#2 Encore Container

Domain Est. 2012

Website: encorecontainer.com

Key Highlights: Encore Container is a manufacturer and reconditioner of totes and plastic drums. Our core values are integrity, quality, and service….

#3 30 Gallon Plastic Drum Manufacturers Suppliers

Website: 55gallondrumcompanies.com

Key Highlights: Access the leading 30 gallon plastic drum manufacturers and suppliers in the USA who offer high quality products available with expedited shipping….

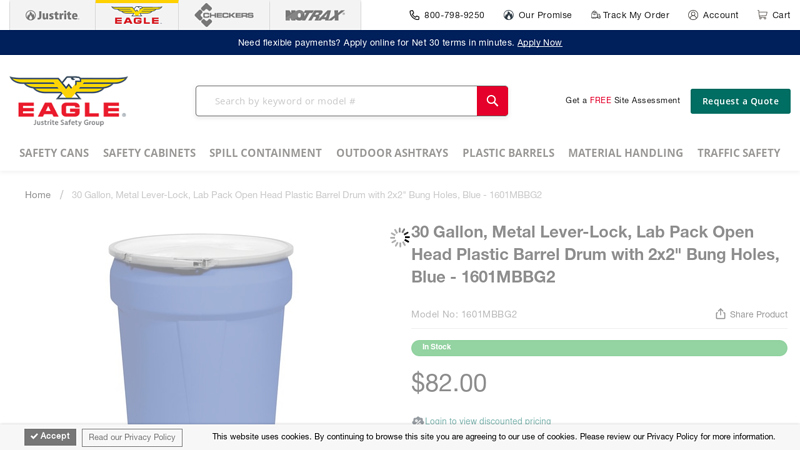

#4 Blue 30 Gal Plastic Drum Metal Lever-Lock

Domain Est. 1997

Website: eagle.justrite.com

Key Highlights: Eagle 30 Gallon Lab Pack / Open Head Drum is constructed of blue blow-molded high-density polyethylene (HDPE) with UV inhibitors, is durable and lightweight….

#5 30 Gallon Steel Drums

Domain Est. 1997

#6 Plastic Drums

Domain Est. 1997

Website: greif.com

Key Highlights: Greif offers a wide variety of large, intermediate, and specialty plastic drum containers designed to fit a wide array of customer applications….

#7 30 Gallon Blue Plastic Open Head Drum, UN Rated

Domain Est. 2012

Website: pipelinepackaging.com

Key Highlights: Our 30-Gallon Blue Plastic Open Head Drum is just one of many drum options available to choose from Pipeline Packaging, including steel, plastic, fiber, as ……

#8 Guide to Steel Drums

Domain Est. 1999

Website: thecarycompany.com

Key Highlights: These reconditioned steel drums are available in 30 gallon, 50 gallon, and 55 gallon sizes. … Company stocks steel drums in various sizes, from 4 to 85 gallons….

Expert Sourcing Insights for 30 Gallon Drum Size

H2: Projected 2026 Market Trends for 30-Gallon Drum Size

The global market for 30-gallon drums is anticipated to experience steady growth and strategic shifts by 2026, driven by evolving industrial demands, regulatory standards, and sustainability initiatives. As a standard intermediate bulk container, the 30-gallon drum—slightly smaller than the conventional 55-gallon model—offers niche advantages in handling, transport efficiency, and end-user accessibility. Key trends shaping the 2026 market landscape include:

-

Increased Demand in Specialty Chemicals and Pharmaceuticals

The 30-gallon drum is gaining traction in sectors requiring precise batch handling and reduced waste, such as specialty chemicals, agrochemicals, and pharmaceuticals. Its smaller size reduces contamination risks and improves dosage control, aligning with stringent quality standards. By 2026, this segment is expected to drive a significant portion of demand, particularly in emerging markets with expanding manufacturing bases. -

Shift Toward Sustainable and Reusable Packaging

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals are pushing industries to adopt reusable, recyclable drum solutions. Steel and high-density polyethylene (HDPE) 30-gallon drums designed for multiple lifecycle use are expected to gain preference. Innovations in lightweight composite materials and closed-loop return programs will further enhance sustainability, reducing carbon footprint in logistics. -

Regional Market Diversification

While North America and Europe remain dominant due to mature industrial infrastructure, the Asia-Pacific region—especially India, Vietnam, and Indonesia—is projected to show the highest growth rate. Localized production, rising investments in chemical processing, and improved supply chain logistics are key enablers. Latin America and parts of Africa are also emerging as potential growth markets due to expanding agricultural and industrial activities. -

Digital Integration and Smart Drum Technology

By 2026, smart packaging solutions—such as RFID tagging, IoT-enabled sensors, and QR code tracking—are expected to be increasingly integrated into 30-gallon drums. These technologies improve inventory management, traceability, and compliance, especially for hazardous materials. Demand will be strongest in regulated industries like petrochemicals and food-grade transport. -

Customization and Niche Applications

Manufacturers are responding to customer needs with customized drum designs, including corrosion-resistant linings, vented caps, and ergonomic handles. The 30-gallon size is particularly suited for niche applications such as food flavorings, cosmetics, and small-batch industrial lubricants, where product integrity and ease of handling are paramount. -

Cost Pressures and Raw Material Volatility

Fluctuations in steel and resin prices may impact production costs. However, economies of scale, regional sourcing, and the adoption of recycled materials are expected to mitigate these challenges. Drum leasing and pooling models may also grow in popularity as cost-effective alternatives.

In summary, the 30-gallon drum market in 2026 will be shaped by sustainability mandates, technological innovation, and expanding industrial applications. While smaller in volume than 55-gallon counterparts, its strategic benefits ensure continued relevance and growth across high-value sectors.

H2: Common Pitfalls When Sourcing 30-Gallon Drums (Quality and IP Considerations)

Sourcing 30-gallon drums, particularly for industrial, chemical, or regulated applications, presents several potential pitfalls related to quality and intellectual property (IP) concerns. Being aware of these issues can help avoid operational disruptions, compliance violations, and legal risks.

-

Inconsistent Material Quality and Specifications

A frequent issue is receiving drums that do not meet the required material standards (e.g., HDPE, steel, or composite). Some suppliers may use substandard resins or thinner walls to reduce costs, compromising durability, chemical resistance, and structural integrity. This can lead to leaks, ruptures, or contamination—especially critical when transporting hazardous materials. -

Lack of Compliance with Regulatory Standards

Many 30-gallon drums must comply with regulations such as UN/DOT certification for hazardous materials transport. Sourcing non-compliant drums—either due to mislabeling or inadequate testing—can result in regulatory fines, shipment rejections, or safety incidents. Always verify certification documentation and drum markings (e.g., UN rating, closure type, and compatibility). -

Counterfeit or Unauthorized Reconditioned Drums

The market for reconditioned drums is prone to counterfeiting. Some suppliers may falsely claim drums are reconditioned to original equipment manufacturer (OEM) standards. Using such drums risks contamination and failure, especially if previous contents were incompatible with new use. -

Intellectual Property (IP) Infringement Risks

Using or sourcing drums that replicate patented designs (e.g., proprietary closure systems, venting mechanisms, or labeling) without authorization can expose buyers to IP litigation. This is especially relevant when dealing with off-brand or third-party manufacturers that mimic branded drum features protected by design or utility patents. -

Inadequate Traceability and Documentation

Poor recordkeeping from suppliers—such as missing lot numbers, manufacturing dates, or material certifications—can hinder traceability during audits or in the event of a product failure. In regulated industries like pharmaceuticals or food-grade storage, this lack of documentation can lead to compliance issues. -

Misrepresentation of Drum Compatibility

Suppliers may inaccurately claim chemical compatibility. For example, a drum labeled as suitable for acids may degrade when exposed to specific concentrations. Always request compatibility charts backed by testing data, not just marketing claims. -

Hidden Costs from Poor Quality Control

Drums with inconsistent dimensions or faulty closures may not fit standard handling equipment (e.g., drum pumps, lifters, or palletizers), leading to downtime and added labor costs. These hidden inefficiencies often stem from lax quality control at the supplier level.

To mitigate these risks, conduct thorough supplier vetting, request samples and certifications, and audit manufacturing practices—especially when sourcing internationally. Prioritizing quality and IP compliance ensures long-term safety, regulatory adherence, and operational efficiency.

H2: Logistics & Compliance Guide for 30 Gallon Drums

Transporting and handling 30-gallon drums requires strict adherence to regulations to ensure safety, environmental protection, and legal compliance. This guide covers key logistics and compliance considerations for hazardous and non-hazardous materials.

1. Regulatory Frameworks

-

DOT (Department of Transportation – 49 CFR):

- Hazard Classification: Correctly classify contents per the Hazardous Materials Table (§172.101). Key classes include Flammables (Class 3), Corrosives (Class 8), Toxic (Class 6.1), Oxidizers (Class 5.1), and Gases (Class 2).

- Packaging: Use UN/DOT-specification 30-gallon steel or plastic drums (e.g., UN1A2/Y or UN1H2/Y). Ensure certification markings are legible and valid. Perform periodic reconditioning/inspection (every 2.5-5 years for non-excepted packaging).

- Marking & Labeling: Display:

- Proper Shipping Name and UN Number (e.g., “FLAMMABLE LIQUID, N.O.S. (Xylene), UN1993”).

- Primary Hazard Class Label (e.g., red flame for flammables).

- Subsidiary Hazard Label if applicable (e.g., skull & crossbones for toxicity).

- Orientation arrows (if liquid).

- Shipper/Consignee information.

- Placarding: Vehicles carrying ≥1,001 lbs gross weight of hazardous materials require appropriate placards (e.g., FLAMMABLE, CORROSIVE) on all four sides. Use “DANGEROUS” placard if multiple hazard classes meet threshold.

- Shipping Papers: Include accurate description, UN#, class, packing group (I, II, III), quantity, emergency contact, and emergency response info (SDS accessible). Must accompany the driver.

-

EPA (Environmental Protection Agency – 40 CFR):

- Hazardous Waste (RCRA): If contents are hazardous waste (D/I/F/U-listed or exhibiting characteristics), comply with generator rules (registration, manifests, storage time limits <90/180 days), labeling (“HAZARDOUS WASTE”), and manifest requirements (EPA Form 8700-22).

- Spill Prevention (SPCC): Facilities storing ≥1,320 gal of oil must have an SPCC plan. 30-gallon drums contribute to this threshold; secondary containment (e.g., spill pallet holding 110% of largest drum) is mandatory.

- Air Emissions (NESHAP): For volatile organics, use closed systems and vapor controls during filling/emptying.

-

OSHA (Occupational Safety and Health Administration – 29 CFR):

- Hazard Communication (HazCom): Provide Safety Data Sheets (SDS) and train employees on drum contents, hazards, and PPE.

- PPE: Mandate gloves, goggles, and aprons for handling corrosive/toxic materials. Use chemical-resistant materials (e.g., nitrile, neoprene).

- Hearing Protection: Required if noise >85 dBA during drum handling (e.g., forklift operations).

- Confined Spaces: Follow entry procedures if drums are stored in tanks/containers requiring entry.

-

International (IMDG/ICAO/IATA): For air/sea transport, comply with:

- IATA DGR: Air transport (packaging, labeling, documentation).

- IMDG Code: Sea transport (stowage, segregation).

- ADR: Road transport in Europe.

2. Logistics & Handling Best Practices

- Drum Integrity: Inspect for dents, leaks, or corrosion before use. Never ship damaged drums.

- Filling: Fill ≤95% capacity (5% ullage) for liquids to prevent pressure build-up. Use grounding/bonding for flammables to prevent static discharge.

- Closure: Securely tighten bungs (primary) and gaskets. Use inner seals for volatile chemicals.

- Stacking: Stack no higher than 3 drums. Use interlocking patterns. Store on level, dry surfaces. Adhere to manufacturer’s stacking limits.

- Secondary Containment: Use spill pallets or berms holding ≥55 gallons (110% of largest drum) under all storage/transfer areas.

- Handling Equipment: Use drum handlers, forklifts with drum clamps, or pallet jacks. Never roll drums on edges.

- Storage: Segregate incompatible materials (e.g., acids away from bases). Use dedicated, ventilated storage areas with “No Smoking” signs.

3. Documentation & Training

- Maintain records of:

- Shipping papers (retention: 2+ years).

- Training certifications (HazCom, DOT, emergency response).

- Drum inspection/reconditioning logs.

- SPCC plans and spill reports.

- Train employees annually on:

- Hazard recognition and SDS use.

- Spill response procedures.

- Proper drum handling and PPE use.

- Emergency protocols (fire, exposure).

4. Emergency Preparedness

- Spill Kits: Keep kits (absorbents, PPE, neutralizers) accessible near drum storage. Size kits for largest potential spill (e.g., 30-gallon capacity).

- Response Plan: Establish procedures for leaks, fire, or exposure. Include evacuation routes and emergency contacts (e.g., CHEMTREC: 1-800-424-9300).

- Reporting: Report spills ≥ reportable quantities (RQ) to NRC (1-800-424-8802) and state authorities immediately.

Key Compliance Tip: Always verify local/state regulations (e.g., California’s Cal/OSHA, DTSC) which may exceed federal requirements. Consult SDS Section 14 (Transport) and Section 15 (Regulatory) for material-specific rules.

Conclusion on Sourcing 30-Gallon Drum Size:

After evaluating availability, cost-efficiency, logistics, and compatibility with current operational needs, sourcing 30-gallon drums presents a viable and strategic option. While less common than standard 55-gallon drums, 30-gallon drums offer advantages in manageability, reduced material waste for lower-volume applications, and improved handling safety due to lighter weight. Suppliers offering UN-rated, durable steel or plastic options are available, though lead times and unit costs may be slightly higher due to lower production volumes.

Additionally, the smaller size supports just-in-time inventory practices and reduces storage footprint per unit, which is beneficial in space-constrained environments. Compatibility with existing filling, transportation, and disposal systems should be confirmed to ensure seamless integration.

In conclusion, sourcing 30-gallon drums is recommended for operations requiring intermediate bulk quantities, improved handling, and flexibility—provided that supply chain reliability and total cost of ownership are carefully assessed. Establishing relationships with reliable vendors and considering bulk purchasing agreements can further enhance supply continuity and cost performance.