The global wheels market is experiencing robust growth, driven by rising demand from the automotive and industrial sectors. According to Grand View Research, the global automotive wheel market size was valued at USD 47.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This expansion is fueled by increasing vehicle production, a shift toward lightweight materials such as aluminum alloys, and growing aftermarket demand for high-performance and aesthetically enhanced wheels. As one of the most competitive segments within the industry, the 3-piece wheel market stands out for its customizability, strength, and popularity in premium and performance vehicle segments. With manufacturers investing heavily in advanced engineering and modular designs, the landscape is dominated by companies that combine innovation, scalability, and precision manufacturing. Based on market presence, production capabilities, technological expertise, and global reach, the following are the top 10 three-piece wheel manufacturers shaping the future of the industry.

Top 10 3 Pieces Wheels Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 WELD Racing Wheels: Forged & Flow

Domain Est. 2000

Website: weldwheels.com

Key Highlights: Free delivery 30-day returnsWELD Racing Wheels is a manufacturer of advanced, street & strip, drag racing, oval racing and heavy duty truck high-performance, professional forged……

#2 3SDM Wheels

Domain Est. 2017

Website: 3sdm-wheels.com

Key Highlights: 3SDM is a manufacturer of luxury and performance cast, spin forged and fully forged 1pc and 3pc alloy wheels. Hampshire, UK and California, USA….

#3 Forgeline

Domain Est. 1996

Website: forgeline.com

Key Highlights: Forgeline Motorsports designs, engineers, and manufactures the world’s finest custom made-to-order lightweight forged aluminum street and racing performance ……

#4 Wheel Landing

Domain Est. 1998

Website: hrewheels.com

Key Highlights: S204H. 2-Piece FMR-X® 3-Piece · S207H. 2-Piece FMR-X® 3-Piece · S267H. 2-Piece FMR-X® 3-Piece · S209H. 2-Piece FMR-X® 3-Piece. Series S2. S200. 2-Piece FMR-X® 3 ……

#5 TSW Alloy Wheels

Domain Est. 1999

Website: tsw.com

Key Highlights: TSW Alloy Wheels engineers custom wheels to precisely fit your car or SUV. With 35 breathtaking designs, from 17″ to 22″, our selection is only surpassed by ……

#6 Savini Wheels

Domain Est. 2005

Website: saviniwheels.com

Key Highlights: View wheel collection. Discover the SV1 X-Series: premium wheels crafted from the finest aluminums, specifically designed for SUVs….

#7 GEN

Domain Est. 2006

Website: vossenwheels.com

Key Highlights: Vossen’s GEN Series features three meticulously crafted configurations of center cap options, each designed to transform your vehicle’s look and feel….

#8 VR Wheels: of the Three

Domain Est. 2010

Website: vrwheels.com

Key Highlights: We are the wheel specialists. Check out our inventory of wheels updated daily! We are also the largest distributor of 3 piece wheel parts (lips and barrels)…

#9 Brixton Forged™ wheels

Domain Est. 2013

Website: brixtonforged.com

Key Highlights: Brixton Forged™ wheels – Highest quality custom forged 1-piece, 2-Piece, 3-piece, Carbon and Flow Forged wheels for high-performance sports….

#10 3 PIECE

Domain Est. 2014

Website: esrwheels.com

Key Highlights: $300 delivery 30-day returnsWheels · New Releases · AP Series · CS Series · CR Series · ForgeTech® · SR Series · Custom Wheels · Garage Sale · $100 WHEEL SALE · BUY 2 GET 2 FREE · …

Expert Sourcing Insights for 3 Pieces Wheels

H2: 2026 Market Trends for 3-Piece Wheels

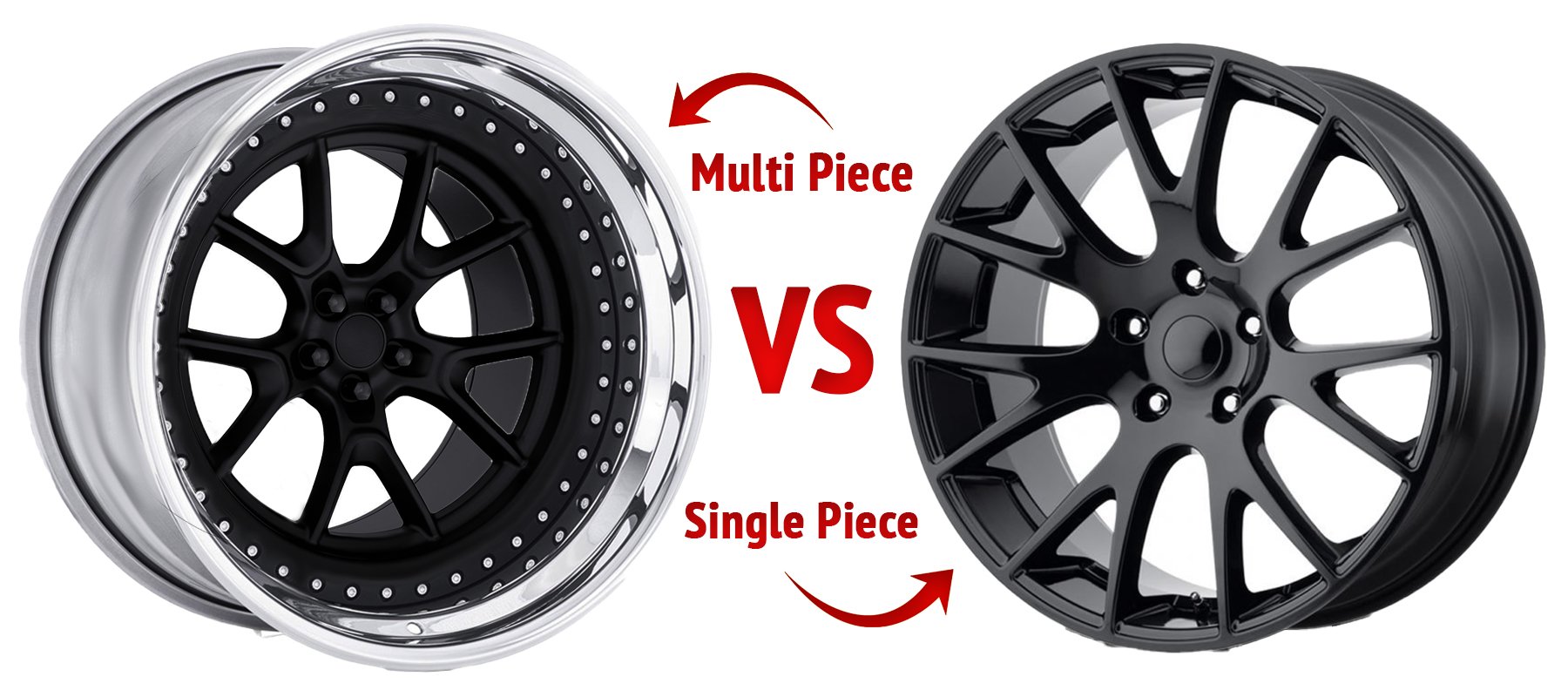

The global market for 3-piece wheels is poised for significant evolution by 2026, driven by advancements in materials, growing demand for customization, and shifts in consumer preferences toward high-performance and luxury vehicles. As modular wheels composed of three separate components—two outer rims and a center barrel—3-piece wheels offer unmatched flexibility in design, repairability, and sizing options, making them a preferred choice in both aftermarket and OEM applications.

1. Rising Demand in the Luxury and Performance Automotive Sectors

By 2026, the increasing production of high-performance sports cars, electric supercars, and premium SUVs will fuel demand for 3-piece wheels. These vehicles benefit from the lightweight construction and superior strength of forged aluminum or carbon fiber 3-piece wheel systems. Brands such as Porsche, Tesla (with its Cybertruck and high-end models), and emerging EV manufacturers are expected to drive OEM adoption, while the aftermarket segment will expand alongside the global car modification culture.

2. Growth in Aftermarket Customization

The aftermarket automotive industry will remain a primary growth engine for 3-piece wheels. Enthusiasts and tuners favor these wheels for their ability to be customized in width, diameter, finish, and offset. By 2026, digital configurators and AR/VR tools from manufacturers like Rotiform, HRE, and ADV.1 will enhance customer personalization, allowing buyers to visualize custom wheel designs before purchase—boosting conversion rates and brand engagement.

3. Sustainability and Material Innovation

Environmental regulations and consumer demand for sustainability will push manufacturers to adopt greener production methods. By 2026, expect wider use of recycled aluminum alloys and energy-efficient forging processes. Additionally, R&D into hybrid materials—such as aluminum-carbon composites—could yield lighter, stronger 3-piece wheels with reduced carbon footprints, aligning with global ESG goals.

4. Geographic Market Expansion

While North America and Europe remain dominant markets due to strong car culture and disposable income, Asia-Pacific—especially China, Japan, and South Korea—is projected to see the fastest growth. Rising disposable incomes, urbanization, and a growing middle class with an affinity for luxury vehicles will increase regional demand. Localized manufacturing and partnerships with regional distributors will be key strategies for global brands.

5. Technological Integration and Smart Wheels

Though still in early stages, by 2026, some 3-piece wheel manufacturers may begin integrating smart technologies—such as embedded sensors for tire pressure monitoring, load distribution, and road condition analysis—into their designs. This convergence of performance and connectivity could open new value propositions, especially in autonomous and electric vehicle ecosystems.

6. Challenges: Cost and Competition

Despite their advantages, 3-piece wheels remain high-cost products due to complex manufacturing and assembly. Price sensitivity in emerging markets and competition from advanced 1-piece forged wheels may limit market penetration. However, economies of scale and automation in production are expected to gradually reduce prices, broadening accessibility.

Conclusion

By 2026, the 3-piece wheel market will be shaped by innovation, customization, and sustainability. With strong demand from performance and luxury vehicle segments, coupled with technological advancements and geographic expansion, the market is set for robust growth. Companies that invest in design flexibility, eco-friendly manufacturing, and digital customer experiences will be best positioned to lead in this niche but high-value segment.

Common Pitfalls When Sourcing 3-Piece Wheels: Quality and Intellectual Property Risks

Logistics & Compliance Guide for 3-Piece Wheels

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to 3-piece wheels. These high-performance wheels—comprising a center, inner rim, and outer rim—are commonly used in automotive and motorsport applications. Due to their complex construction, value, and international shipping requirements, proper logistics and compliance protocols are critical to ensure safety, legal compliance, and product integrity.

Product Classification & HS Code

Accurate product classification is essential for international shipping and customs clearance.

– HS Code (Harmonized System Code): 8708.70 – “Wheels for vehicles, other than those of heading 8716.”

– Note: Confirm with local customs authorities, as sub-classifications may vary by country.

– Product Description: 3-piece forged or cast wheel assembly for automotive use, typically made from aluminum alloy.

Packaging Requirements

Proper packaging protects the components during transit and prevents damage.

– Individual Component Packaging:

– Center section: Wrap in foam or bubble wrap; place in a rigid box.

– Inner and outer rim halves: Use foam inserts or custom molded packaging to prevent movement.

– Full Assembly Packaging (if shipped assembled):

– Use wooden crates or heavy-duty double-walled cardboard boxes with internal bracing.

– Include desiccants to prevent moisture damage during ocean freight.

– Labeling:

– Mark packages as “Fragile,” “This Side Up,” and include handling instructions.

– Clearly display SKU, model number, and country of origin.

Transportation & Handling

3-piece wheels are often heavy and sensitive to impact, requiring careful logistics planning.

– Weight & Dimensions:

– Average weight per wheel: 25–40 lbs (11–18 kg), depending on size and material.

– Outer diameter: 18–24 inches; packaging must accommodate disassembled components.

– Mode of Transport:

– Air Freight: Recommended for high-value or time-sensitive shipments. Ensure IATA compliance.

– Ocean Freight: Suitable for bulk orders. Use containers with secure bracing and moisture control.

– Ground Transport: Use padded vehicles with tiedown straps to prevent shifting.

– Handling:

– Use mechanical aids (e.g., pallet jacks) for loads exceeding 50 lbs.

– Train personnel to avoid stacking packages improperly or dropping them.

Import/Export Compliance

Adherence to trade regulations ensures smooth cross-border movement.

– Export Documentation:

– Commercial Invoice

– Packing List

– Bill of Lading (B/L) or Air Waybill (AWB)

– Certificate of Origin (if required for preferential tariffs)

– Import Requirements (Examples by Region):

– USA: No specific DOT certification for aftermarket wheels unless sold as part of a complete vehicle. However, compliance with FMVSS No. 120 (for tire and wheel assemblies) may apply in certain cases.

– EU: CE marking is not required for wheels alone, but must comply with UNECE Regulation 124 (wheel safety standards) if marketed as replacement parts.

– Canada: Must meet CMVSS 120 requirements if installed on vehicles.

– Australia: Comply with ADR (Australian Design Rules) for vehicle components.

– Restricted Materials:

– Confirm aluminum alloy composition meets RoHS or REACH standards in applicable markets.

Quality & Safety Standards

Ensure all wheels meet recognized performance and safety benchmarks.

– Testing Standards:

– SAE J2530 (Aftermarket Wheels – Passenger Cars and Light Trucks)

– ISO 9001:2015 (Quality Management Systems)

– JWL/TUV (for load, impact, and fatigue testing)

– Labeling & Markings on Product:

– Manufacturer name, size designation, load rating, offset (ET), and manufacturing date.

– Compliance marks (e.g., JWL, VIA, TUV) if applicable.

Returns & Reverse Logistics

Establish clear return policies to manage defective or incorrect shipments.

– Return Authorization (RA): Require RA number for all returns.

– Inspection Protocol: Check for damage, assembly condition, and original packaging.

– Restocking Fees: May apply if wheels are returned without defect or outside return window.

Environmental & Sustainability Considerations

- Recycling: Aluminum components are 100% recyclable. Provide guidance on end-of-life disposal.

- Packaging: Use recyclable or biodegradable materials where possible to meet environmental regulations.

Conclusion

Shipping and managing 3-piece wheels requires attention to packaging, regulatory standards, and international trade compliance. By following this guide, businesses can ensure safe, efficient, and legally compliant logistics operations—protecting both product integrity and customer satisfaction. Always consult with freight forwarders and legal experts to stay updated on evolving regulations in target markets.

Conclusion for Sourcing 3-Piece Wheels:

After thorough evaluation of suppliers, pricing, quality, lead times, and logistical considerations, sourcing 3-piece wheels presents a viable and strategic opportunity to meet custom performance and aesthetic demands. The modular design of 3-piece wheels offers flexibility in sizing, finishes, and repairs, making them ideal for high-end, specialty, or aftermarket applications.

By partnering with reputable manufacturers—particularly those specializing in forged or flow-formed components—we can ensure durability, precision engineering, and compliance with industry standards. While initial costs may be higher compared to one-piece alternatives, the long-term value through reusability, customization, and premium market positioning justifies the investment.

Recommended next steps include finalizing supplier agreements, conducting sample testing for quality assurance, and establishing clear communication channels for ongoing production and quality control. In conclusion, sourcing 3-piece wheels aligns with our goals of delivering high-performance, customizable products to a discerning customer base.