The global market for phase conversion solutions is experiencing steady growth, driven by increasing demand for energy-efficient power systems across industrial, commercial, and residential applications. According to Mordor Intelligence, the phase converter market is projected to grow at a CAGR of approximately 4.8% from 2024 to 2029, fueled by the need to power single-phase equipment in regions with limited three-phase supply infrastructure. Additionally, rising industrialization and infrastructure development in emerging economies are prompting greater adoption of reliable three-phase to single-phase conversion technologies. With applications ranging from motor load management to renewable energy integration, manufacturers are focusing on enhanced efficiency, compact design, and digital monitoring capabilities. As demand intensifies, identifying leading players becomes critical for businesses seeking high-performance, scalable solutions. Below is a data-driven overview of the top 10 three-phase to single-phase converter manufacturers shaping the industry landscape.

Top 10 3 Phase To Single Converter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Manufacturer of 3 Phase Converter

Domain Est. 2022

Website: phasemaster.us

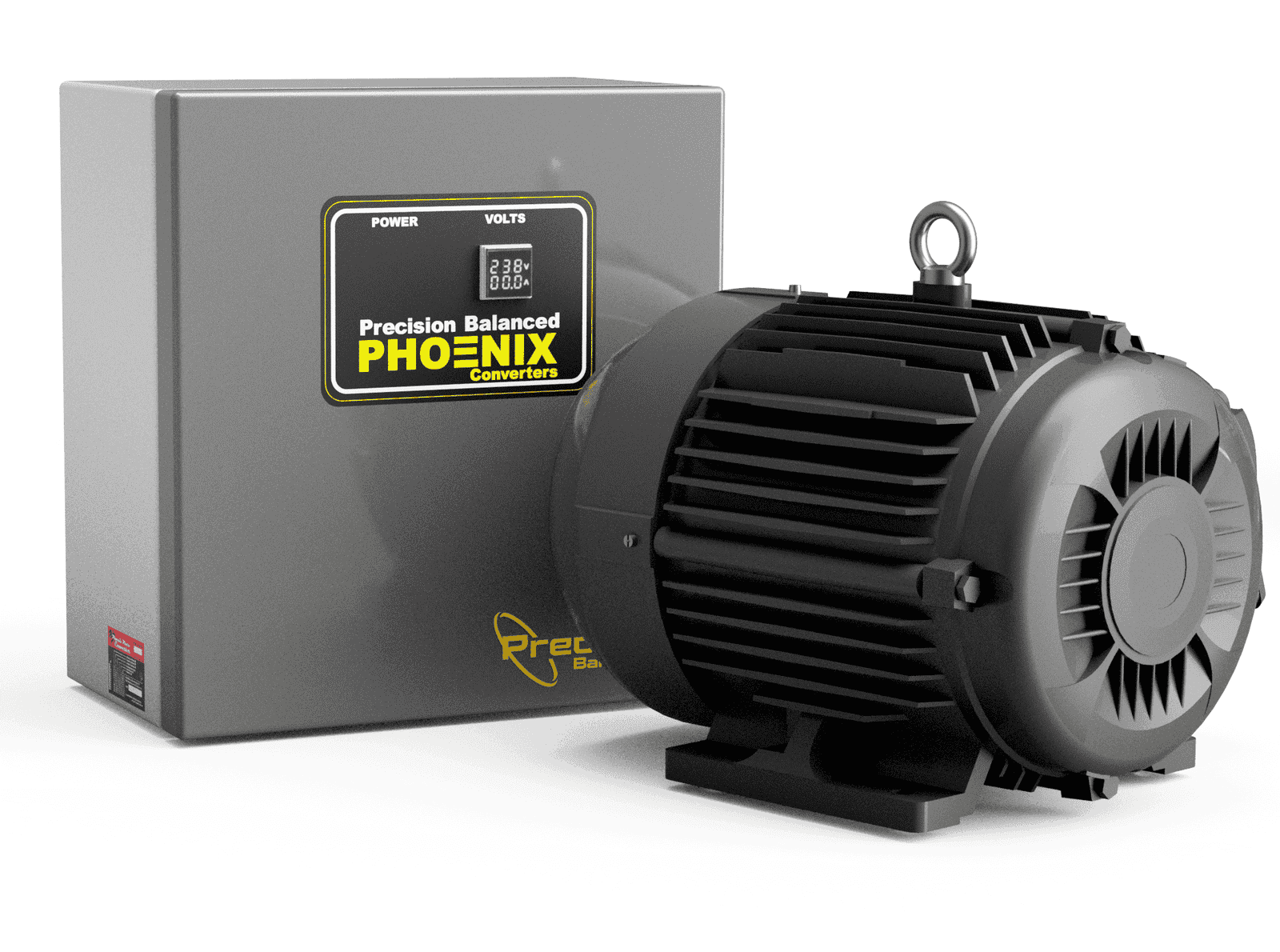

Key Highlights: Kay Industries, Inc., is the worldwide industry leader in designing, manufacturing, and marketing single-phase to three-phase electrical power converters….

#2 High

Domain Est. 2023

Website: thefrequencyinverters.com

Key Highlights: Get high-quality 3 Phase To Single Phase Converter from China manufacturer, supplier and factory. Find reliable supplier for your power conversion needs….

#3 Power Supply Manufacturer

Domain Est. 1998

Website: synqor.com

Key Highlights: SynQor designs and manufactures high-efficiency, high-reliability DC-DC power converters, AC-DC power converters, EMI filters and power systems….

#4 XP Power

Domain Est. 2000

Website: xppower.com

Key Highlights: Looking for the leading manufacturer of AC-DC power supplies, DC-DC converters, high voltage, RF & custom power products? Discover our extensive range….

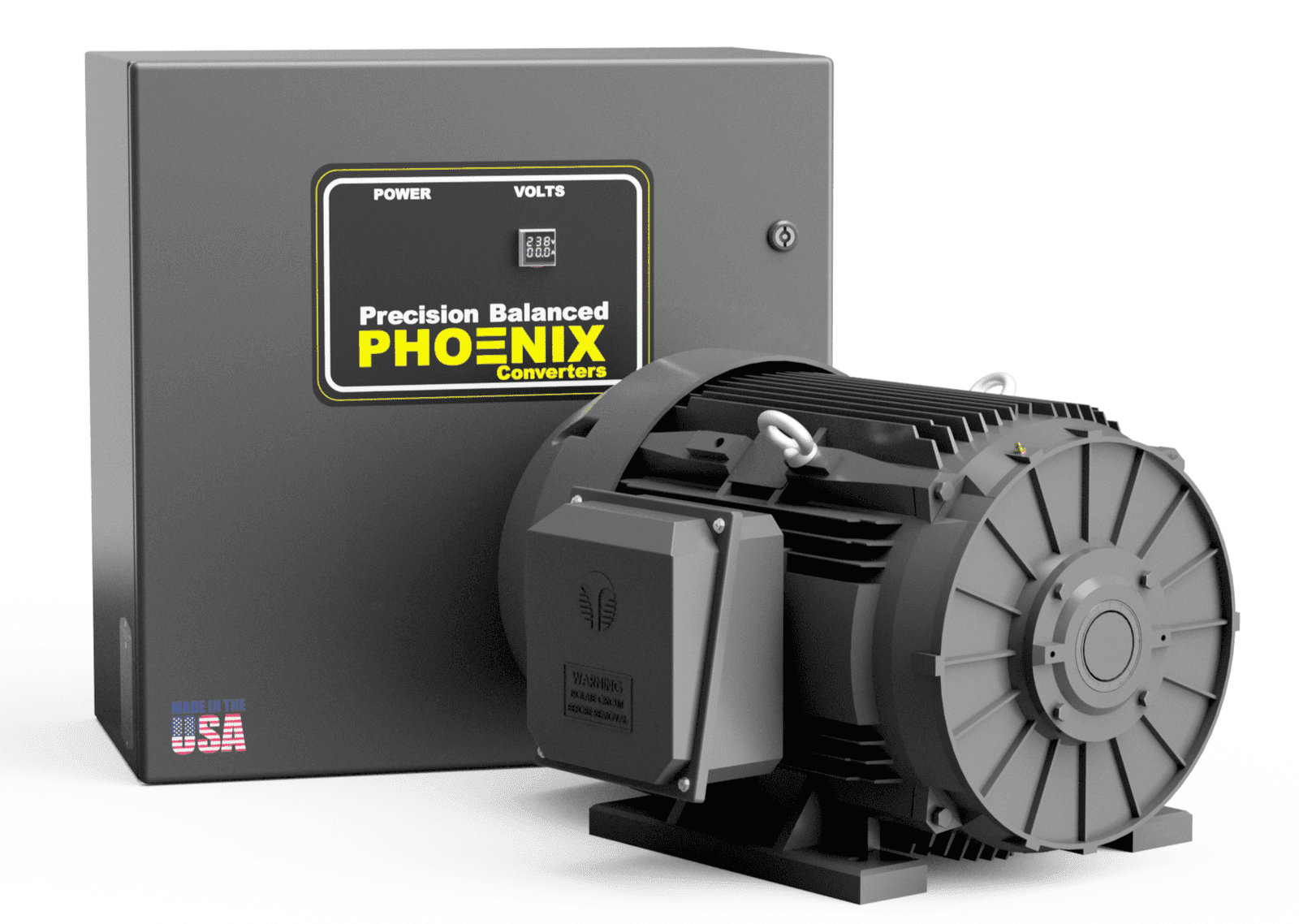

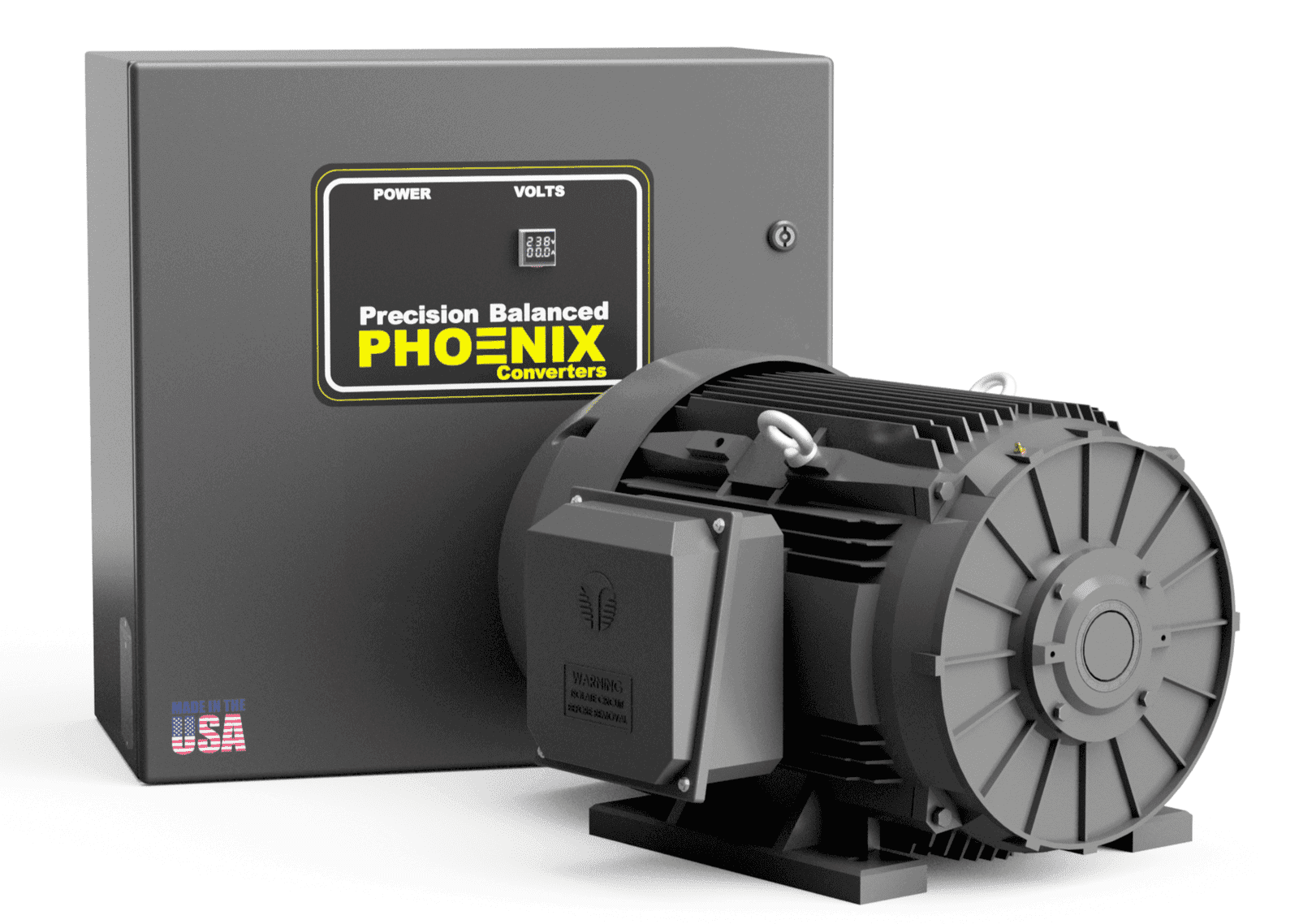

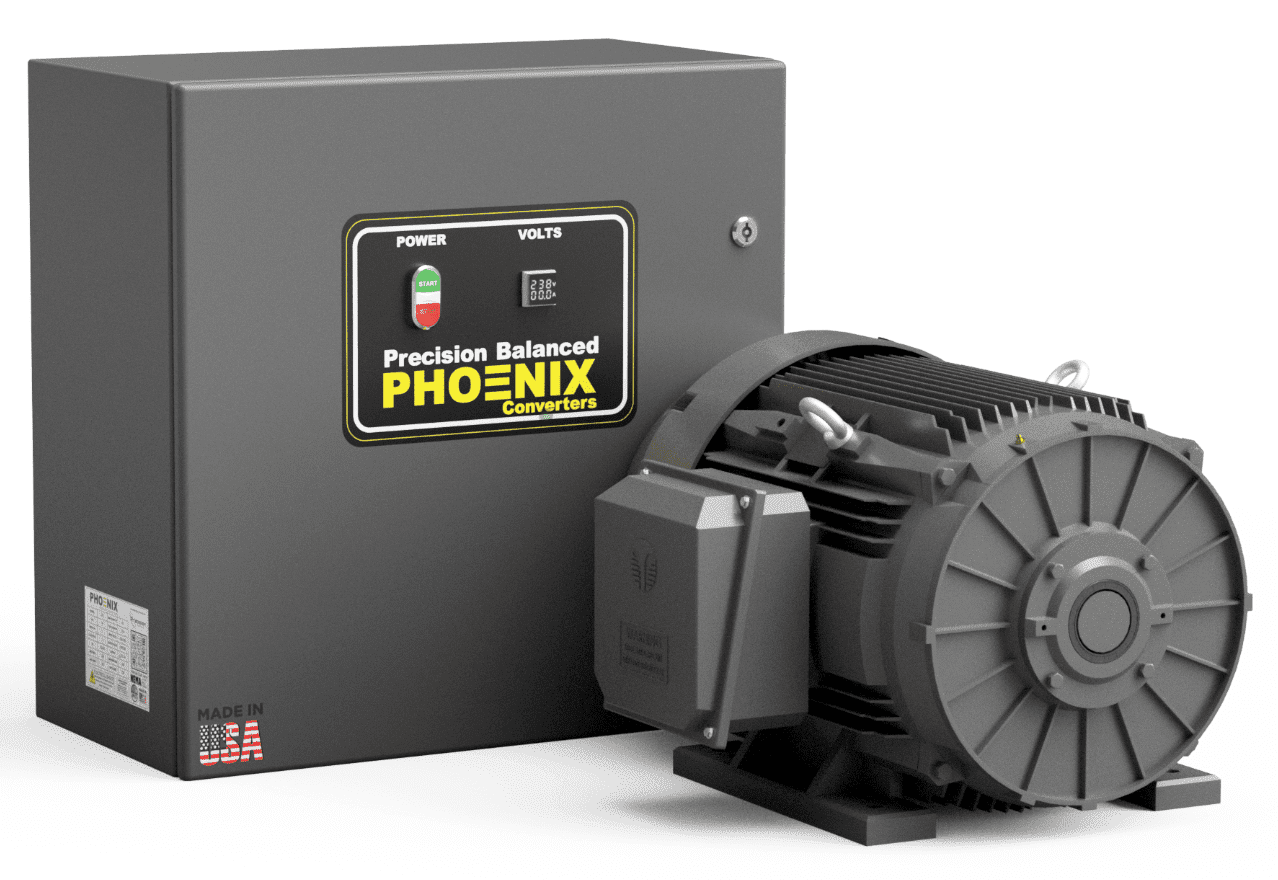

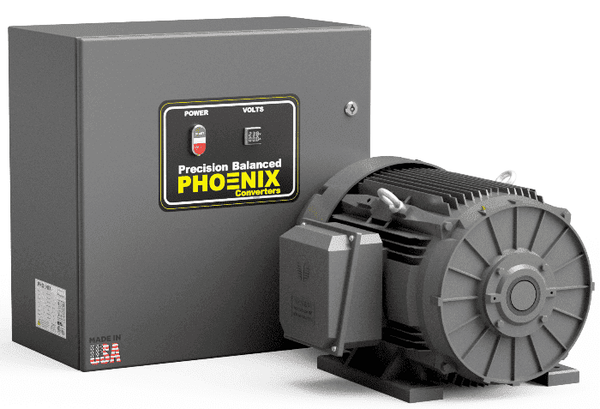

#5 American Rotary: High

Domain Est. 2004

Website: americanrotary.com

Key Highlights: American Rotary is the manufacturer and distributor of the largest selection of phase converters and transformers online! We are the only phase converter ……

#6 Phase

Domain Est. 1996

Website: phase-a-matic.com

Key Highlights: Convert Single-Phase into Three-Phase Power. We are very pleased to announce most of our Rotary Converters and Voltage Stabilizers are now UL Certified !! Phase ……

#7 Phase Converters

Domain Est. 2000

Website: ronkelectrical.com

Key Highlights: Quickly and easily convert your single phase source to useful three phase power for your motor load. Simple, feature rich, and specific, this converter is ……

#8 North America Pro

Domain Est. 2011

Website: northamericaphaseconverters.com

Key Highlights: 5-day delivery 30-day returns…

#9 Phase Change Converters

Domain Est. 2019

Website: phasechangeconverters.com

Key Highlights: Phase Change Converters are your complete one stop shop for solutions to 3 phase power problems, offering a range of technologies and electrical accessories….

#10 3 Phase Converter

Domain Est. 2022

Website: 3phconverter.com

Key Highlights: We provide 220V single phase to 3 phase converter with various horsepower, input & output voltage options which can be customized. rotary phase converter ……

Expert Sourcing Insights for 3 Phase To Single Converter

2026 Market Trends for 3 Phase to Single Phase Converters

The market for 3 Phase to Single Phase Converters is poised for notable transformation by 2026, driven by evolving energy demands, technological advancements, and global industrial shifts. As industries and infrastructure increasingly adopt electrification and renewable integration, the need to bridge the gap between robust three-phase power systems and widely used single-phase equipment is becoming more critical. This analysis explores the key trends expected to shape the 3 phase to single phase converter market through 2026.

Rising Demand from Renewable Energy and Microgrid Applications

The surge in renewable energy deployment—particularly solar and wind—is a major driver for converter adoption. Many renewable installations generate or connect to three-phase grids, but remote installations or off-grid locations often require single-phase output for homes and small businesses. By 2026, decentralized energy systems and microgrids are expected to proliferate, especially in developing regions and rural electrification projects. This will increase demand for efficient, reliable converters that can seamlessly convert three-phase input to stable single-phase output, supporting energy access and grid resilience.

Growth in Electric Vehicle (EV) Charging Infrastructure

The expansion of EV charging networks is another significant trend. While high-power fast chargers typically use three-phase power, many residential and small commercial sites lack three-phase availability. 3 phase to single phase converters enable these locations to host EV chargers by converting available three-phase supply into usable single-phase current. As governments worldwide push for EV adoption and charging infrastructure densification, the demand for such converters in urban, suburban, and industrial zones is projected to rise substantially by 2026.

Advancements in Power Electronics and Smart Conversion Technologies

Technological innovation is enhancing the efficiency, compactness, and intelligence of converters. By 2026, expect wider adoption of solid-state converters using IGBTs and SiC (Silicon Carbide) semiconductors, offering higher efficiency (above 95%), reduced harmonic distortion, and better thermal management. Integration with IoT and smart grid systems will allow for remote monitoring, predictive maintenance, and dynamic load balancing. These smart converters will appeal to industries seeking energy optimization and reduced downtime.

Industrial Automation and Small-Scale Manufacturing Expansion

The growth of small and medium enterprises (SMEs) in manufacturing, especially in Asia-Pacific and Latin America, is creating demand for affordable power solutions. Many SMEs operate in facilities with three-phase supply but use single-phase machinery. 3 phase to single phase converters provide a cost-effective way to run such equipment without rewiring. With the rise of Industry 4.0 and localized production, the need for flexible, plug-and-play power conversion systems will grow, favoring modular and scalable converter designs.

Regulatory and Safety Standards Evolution

By 2026, stricter energy efficiency regulations and power quality standards (such as IEEE 519 and IEC 61000) will influence converter design and market entry. Manufacturers will need to ensure compliance with harmonic emission limits and electromagnetic compatibility. This will drive innovation in active filtering and waveform correction technologies within converters. Additionally, safety certifications will become more rigorous, promoting higher reliability and consumer confidence.

Regional Market Diversification

While North America and Europe remain mature markets with steady demand due to infrastructure upgrades, the fastest growth is expected in the Asia-Pacific region. Countries like India, Indonesia, and Vietnam are investing heavily in industrial parks and smart cities, where mixed-phase power needs are common. Africa and the Middle East will also see increased adoption due to electrification initiatives and oil/gas field operations that rely on three-phase systems but require single-phase power for auxiliary functions.

Competitive Landscape and Supply Chain Dynamics

The market will likely witness consolidation among power electronics manufacturers and increased competition from regional players offering cost-optimized solutions. Supply chain resilience—especially for critical components like semiconductors—will be a key concern. By 2026, companies that localize production or develop dual-sourcing strategies will gain a competitive edge. Additionally, partnerships between converter manufacturers and renewable energy firms or EV charging providers are expected to increase.

In conclusion, the 3 phase to single phase converter market in 2026 will be shaped by the convergence of energy transition, technological innovation, and infrastructure development. Stakeholders who focus on efficiency, smart capabilities, and regional customization will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing a 3 Phase to Single Phase Converter

Sourcing a reliable and suitable 3 Phase to Single Phase converter requires careful consideration to avoid performance issues, safety risks, and unexpected costs. Below are key pitfalls to watch for, particularly concerning quality and intellectual property (IP) aspects.

Poor Build Quality and Component Selection

One of the most frequent issues is selecting converters made with substandard materials or low-grade electronic components. Cheap capacitors, undersized transformers, or inadequate heat dissipation can lead to premature failure, overheating, or inconsistent output. Low-quality units often lack proper certifications (e.g., CE, UL, RoHS), increasing the risk of non-compliance and safety hazards.

Lack of Proper Protection Features

Inadequate or missing protection mechanisms—such as overvoltage, overcurrent, short-circuit, and thermal shutdown—can result in equipment damage or fire hazards. Some budget converters skip these features to cut costs, putting both connected devices and personnel at risk.

Misleading Power Ratings and Efficiency Claims

Suppliers may exaggerate power ratings or efficiency figures without independent verification. A converter advertised as 10kVA might only sustain 7kVA under real-world conditions. Always verify performance data through third-party test reports or reputable references.

Intellectual Property (IP) Infringement Risks

Purchasing from unverified manufacturers—especially in regions with weak IP enforcement—can expose buyers to legal risks. Some converters are cloned or reverse-engineered from patented designs, potentially leading to customs seizures, litigation, or reputational damage. Ensure suppliers can provide documentation proving original design or proper licensing.

Inadequate Technical Support and Documentation

Low-cost suppliers may offer limited or no technical support, unclear schematics, or incomplete user manuals. This complicates installation, troubleshooting, and maintenance, increasing downtime and long-term costs.

Compatibility and Harmonic Distortion Issues

Poorly designed converters may introduce significant harmonic distortion into the power system, affecting other equipment and violating grid code requirements. Verify total harmonic distortion (THD) levels and ensure compatibility with your existing electrical infrastructure.

Hidden Costs from Lack of Warranty or Service Network

Units without a solid warranty or accessible service centers can become costly to maintain. If a fault occurs, extended repair times or the need to replace the entire unit can outweigh initial savings.

To avoid these pitfalls, conduct thorough due diligence: request certifications, inspect sample units, verify supplier legitimacy, and prioritize long-term reliability over upfront cost savings.

Logistics & Compliance Guide for 3 Phase to Single Phase Converter

This guide outlines critical logistics considerations and compliance requirements for importing, distributing, and installing 3 phase to single phase converters. Adherence ensures smooth operations and legal conformity across regions.

Regulatory Compliance

Ensure all converters meet relevant international and local electrical safety and electromagnetic compatibility (EMC) standards. Key certifications include:

– CE Marking (Europe): Compliance with Low Voltage Directive (LVD) and EMC Directive.

– UL/CSA (North America): Certification to UL 1561 or UL 508A for industrial control equipment.

– IEC Standards: Adherence to IEC 61000 (EMC), IEC 60950 (safety), or IEC 62109 (power converters).

– RoHS & REACH (EU): Restrictions on hazardous substances and chemical registration.

– Country-Specific Approvals: Verify requirements in target markets (e.g., CCC in China, KC in South Korea, RCM in Australia).

Product Documentation

Maintain comprehensive technical and compliance documentation:

– User manuals in local languages

– Safety warnings and installation instructions

– Technical data sheets (input/output voltage, frequency, power rating, efficiency)

– Declaration of Conformity (DoC)

– Test reports from accredited laboratories

– Bill of Materials (BOM) for RoHS/REACH compliance

Packaging & Labeling

Use robust packaging to prevent damage during transit. Labels must include:

– Product name and model number

– Input/output specifications (e.g., 380–480V AC input, 220–240V AC output)

– Manufacturer and importer details

– Safety warnings and compliance marks (CE, UL, etc.)

– Handling symbols (e.g., fragile, no rain)

Shipping & Transportation

Follow these logistics best practices:

– Use anti-static and shock-resistant materials for sensitive electronics

– Comply with IATA/IMDG regulations if shipping by air or sea

– Declare accurate HS codes (e.g., 8504.40 for transformers/converters) for customs

– Insure high-value shipments

– Maintain temperature-controlled environments if required by specifications

Import & Customs Clearance

Prepare for customs with:

– Commercial invoice and packing list

– Certificate of Origin

– Import licenses (if required)

– Proof of compliance with local standards

– Power converter-specific declarations (e.g., energy efficiency ratings)

Installation & Environmental Compliance

Ensure end-use installations follow:

– Local electrical codes (e.g., NEC in the US, IEC in Europe)

– Proper grounding and overcurrent protection

– Ventilation requirements to prevent overheating

– Disposal compliance with WEEE (EU) or local e-waste regulations at end-of-life

Quality Assurance & Traceability

Implement a system for:

– Serial number tracking for warranty and recalls

– Factory acceptance testing (FAT) documentation

– Supplier audits to ensure consistent compliance

By following this guide, businesses can mitigate risks, avoid shipment delays, and ensure safe, legal deployment of 3 phase to single phase converters globally.

Conclusion on Sourcing a 3-Phase to Single-Phase Converter

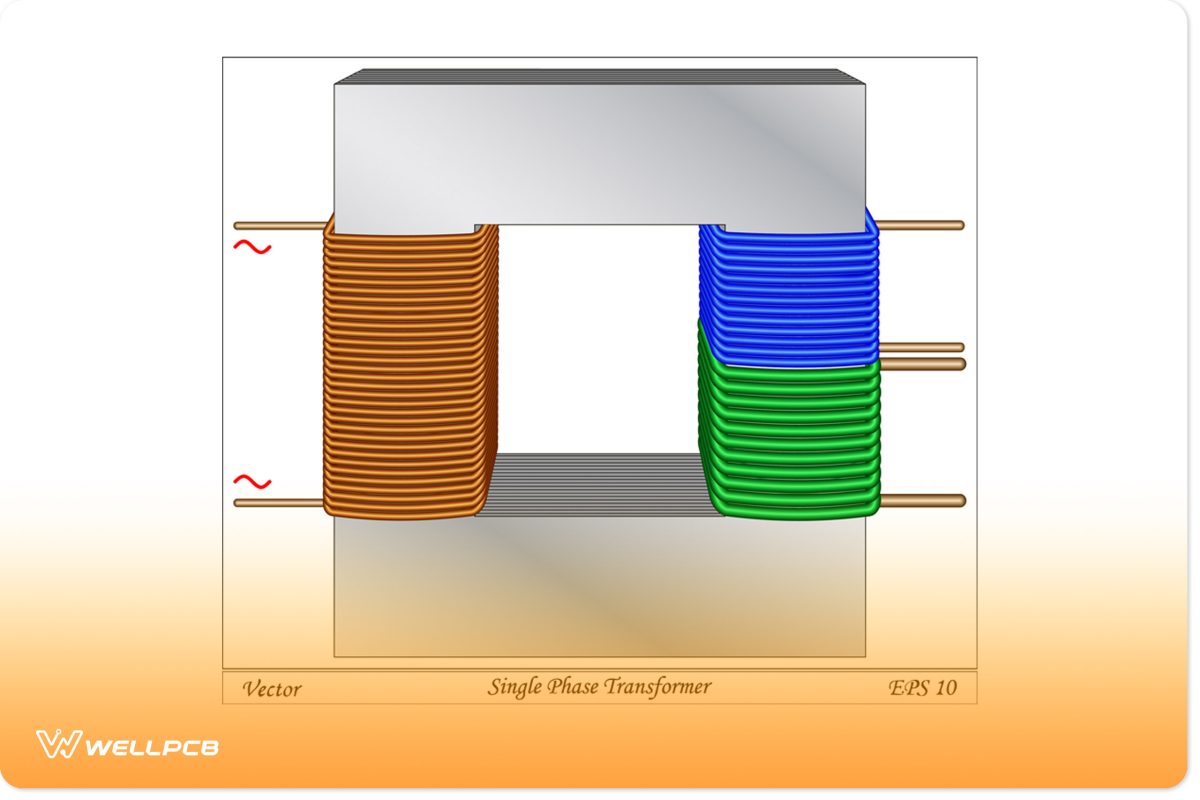

Sourcing a 3-phase to single-phase converter requires careful consideration of application requirements, efficiency, load characteristics, and long-term reliability. These converters are essential in scenarios where single-phase power is needed but only 3-phase supply is available—common in industrial, commercial, or remote installations.

Key factors in selecting the right converter include:

-

Type of Converter: Rotary phase converters, variable frequency drives (VFDs), or static converters each offer different benefits. VFDs are often preferred for their precision and ability to convert 3-phase to single-phase efficiently while providing additional motor control features.

-

Power Rating and Efficiency: The converter must be appropriately sized for the load to ensure optimal performance and energy efficiency. Oversizing or undersizing can lead to inefficiencies or equipment damage.

-

Voltage and Frequency Compatibility: Ensure the output matches the required single-phase voltage (e.g., 120/240V) and frequency (50/60 Hz) for the connected equipment.

-

Reliability and Maintenance: Devices with solid-state electronics generally require less maintenance than rotary systems. Durability in harsh environments should also be evaluated.

-

Cost vs. Performance: While static converters are cost-effective for light loads, more complex applications may justify the higher upfront cost of VFDs due to better performance and scalability.

-

Compliance and Safety: The unit should meet relevant electrical standards (e.g., UL, CE, IEC) and include protection features such as overload, short-circuit, and thermal shutdown.

In conclusion, successfully sourcing a 3-phase to single-phase converter involves balancing technical specifications with operational needs. Working with reputable suppliers and consulting electrical professionals ensures the selected solution is safe, efficient, and fit for purpose. With the right converter, businesses can effectively utilize existing 3-phase infrastructure to power single-phase equipment, enhancing flexibility and reducing the need for costly infrastructure upgrades.