The global threaded rod market is experiencing steady expansion, driven by rising demand across construction, infrastructure, and industrial manufacturing sectors. According to Grand View Research, the global fasteners market—of which threaded rods are a critical component—was valued at USD 118.1 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing urbanization, infrastructure development in emerging economies, and the surge in modular construction techniques that rely heavily on precision-engineered fastening solutions. Mordor Intelligence further supports this trajectory, noting a CAGR of approximately 6.2% for the fasteners market through 2028, with threaded rods maintaining a strong foothold due to their versatility in structural support, plumbing, and electrical installations. As demand intensifies, a select group of manufacturers have emerged as leaders, combining scalable production, material innovation, and global distribution networks to dominate the 3/8-inch and 1/2-inch diameter segments—the most widely used in commercial and industrial applications. Here, we profile the top eight manufacturers shaping the future of the threaded rod industry through quality, compliance, and market reach.

Top 8 3 4 Threaded Rod Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Threaded rod Gr2 Galv 3/4

Domain Est. 2001

#2 Threaded Rod

Domain Est. 1997

Website: vulc.com

Key Highlights: Vulcan Steel Products is the nation’s largest domestic manufacturer and supplier of threaded products. … Diameters: 3/8” to 4”; Finishes: Plain, Zinc (RoHs), ……

#3 3/4”

Domain Est. 1998

#4 Threaded rod, B7 alloy steel plain finish, 3/4″

Domain Est. 1999

Website: boltdepot.com

Key Highlights: In stock $27.80 deliveryA fully threaded rod with no head or drive. Commonly used in manufacturing, automotive, electrical, plumbing and general construction applications. For ……

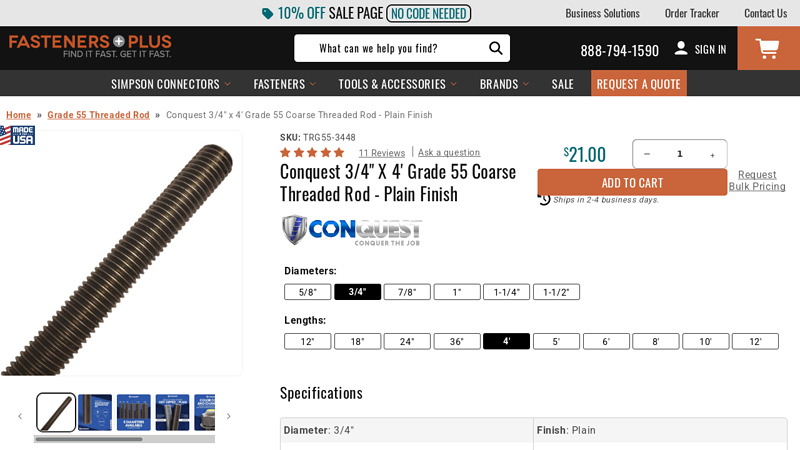

#5 Conquest 3/4″ x 4′ Grade 55 Coarse Threaded Rod

Domain Est. 2003

Website: fastenersplus.com

Key Highlights: In stock Rating 5.0 (11) Our ASTM F1554 grade 55 hardened threaded rod is manufactured in the USA to the highest quality standards. Call us today for any of your custom cut order…

#6 Threaded Rod

Domain Est. 2009

Website: aatprod.com

Key Highlights: Large inventories of Threaded Rod in stock in a variety of sizes, materials and finishes. Low Carbon Steel, T304/316 Stainless, ASTM, Brass, Zinc, Aluminum….

#7 3/4″

Domain Est. 2018

Website: unistrutstore.com

Key Highlights: In stock $32.94 deliveryUnistrut channel nuts are manufactured from mild steel cold rolled coil, and after stamping and machining operations are completed, they are case hardened….

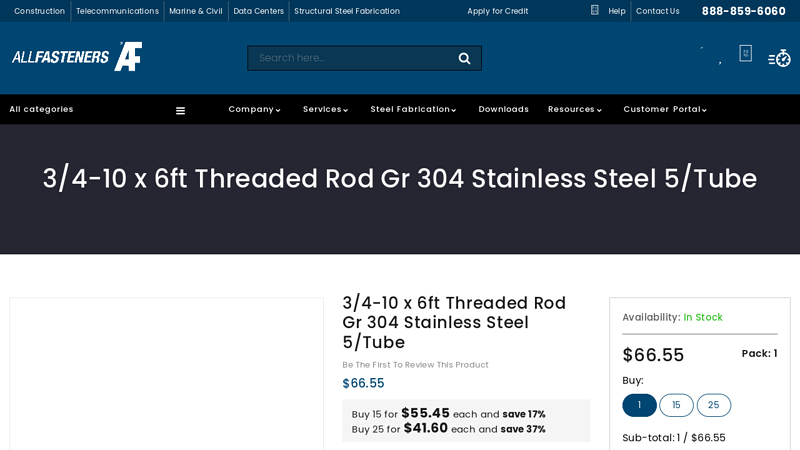

#8 3/4

Website: allfasteners.com

Key Highlights: 3/4-10 x 6ft Threaded Rod Gr 304 Stainless Steel 5/Tube · Buy 15 for $55.45 each and save 17% · Buy 25 for $41.60 each and save 37%….

Expert Sourcing Insights for 3 4 Threaded Rod

H2: Projected 2026 Market Trends for 3/4-Inch Threaded Rod

The global market for 3/4-inch threaded rod—a critical fastener used extensively in construction, infrastructure, industrial manufacturing, and mechanical applications—is expected to experience steady growth and notable shifts by 2026. Driven by macroeconomic factors, construction booms, material innovations, and supply chain evolution, the following trends are anticipated to shape the 3/4-inch threaded rod market:

-

Increased Demand from Construction and Infrastructure Sectors

By 2026, government-led infrastructure investments—particularly in North America, Europe, and parts of Asia-Pacific (e.g., India and Southeast Asia)—are expected to drive demand for structural fasteners. The U.S. Infrastructure Investment and Jobs Act and similar programs globally are fueling construction of bridges, highways, and public buildings, where 3/4-inch threaded rods are commonly used in anchoring, bracing, and seismic retrofitting. This sustained public and private investment will boost consumption. -

Growth in Industrial and Renewable Energy Applications

The expansion of renewable energy projects, including wind turbine installations and solar panel mounting systems, is increasing the need for high-strength fasteners. 3/4-inch threaded rods made from galvanized or stainless steel are favored for their durability and load-bearing capacity in these harsh environments. Additionally, industrial automation and modular construction techniques are adopting standardized threaded rods for assembly efficiency. -

Material and Coating Innovations

By 2026, there will be a greater emphasis on corrosion-resistant and high-tensile materials. Demand for hot-dip galvanized, stainless steel (particularly Grade 304 and 316), and epoxy-coated 3/4-inch threaded rods is expected to rise, especially in coastal, humid, or chemically aggressive environments. Manufacturers are investing in advanced coatings and alloy development to meet new building codes and longevity requirements. -

Supply Chain Resilience and Localization

Following disruptions from global supply chain bottlenecks, companies are increasingly localizing production and sourcing. Regional manufacturing hubs in North America and Europe are expected to expand threaded rod output to reduce dependency on imports, particularly from Asia. This shift supports faster delivery times and compliance with Buy America and similar domestic content regulations. -

Sustainability and Regulatory Pressures

Environmental regulations and green building standards (e.g., LEED, BREEAM) are influencing material choices. Recyclability of carbon and stainless steel threaded rods enhances their appeal. By 2026, manufacturers may face pressure to adopt low-carbon production methods and provide Environmental Product Declarations (EPDs), affecting production costs and market positioning. -

Price Volatility and Raw Material Costs

Fluctuations in steel prices—driven by iron ore, energy costs, and geopolitical factors—will continue to impact 3/4-inch threaded rod pricing. However, long-term supply contracts and hedging strategies are expected to become more common among large distributors and construction firms to mitigate volatility. -

Digitalization and Smart Inventory Management

The integration of digital platforms, such as construction management software and e-procurement systems, will streamline the ordering and tracking of threaded rods. Just-in-time inventory models supported by AI forecasting are expected to reduce waste and improve supply chain efficiency by 2026.

In summary, the 3/4-inch threaded rod market in 2026 will be characterized by robust demand from infrastructure and industrial sectors, enhanced material performance, regional supply chain adaptations, and growing sustainability considerations. Stakeholders who invest in quality, compliance, and digital integration will be best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing 3/4-Inch Threaded Rod (Quality and IP Considerations)

Sourcing 3/4-inch threaded rod may seem straightforward, but overlooking critical quality and International Procurement (IP) factors can lead to project delays, safety hazards, and increased costs. Below are key pitfalls to avoid:

Poor Material Quality and Non-Compliance with Standards

One of the most frequent issues is receiving threaded rods made from substandard materials that do not meet required mechanical properties. Suppliers may offer rods labeled as ASTM A307 or ASTM A193 Grade B7 but deliver inferior steel with inadequate tensile strength, poor hardness, or inconsistent chemical composition. This is especially common with offshore or unverified suppliers. Always require mill test certificates (MTCs) and verify compliance with relevant standards such as ASTM, ISO, or DIN. Avoid suppliers who cannot provide traceable documentation.

Inaccurate or Inconsistent Thread Quality

Thread inaccuracies—such as out-of-tolerance pitch, diameter, or thread form—can prevent proper nut engagement or lead to cross-threading. Poor threading can also reduce load-bearing capacity and create weak points. This is particularly critical in structural or high-vibration applications. Ensure rods are fully threaded per specification (e.g., Unified National Coarse – UNC) and inspect random samples using thread gauges. In international sourcing, differences in thread standards (e.g., metric vs. imperial) can compound this issue if not clearly specified.

Lack of Corrosion Resistance for Intended Environment

Many buyers assume all threaded rods are equally resistant to rust and corrosion. However, standard carbon steel rods will degrade quickly in humid, outdoor, or chemically aggressive environments. Failing to specify appropriate coatings (e.g., hot-dip galvanizing, zinc plating) or stainless steel grades (e.g., 304 or 316) can lead to premature failure. When sourcing internationally, confirm that protective coatings meet ASTM A153 or ISO 1461 standards and are applied uniformly.

Inadequate Tensile and Yield Strength for Application

Using rods with insufficient strength—especially in structural, lifting, or seismic applications—poses serious safety risks. Some suppliers may misrepresent strength grades or supply rods that have not undergone proper heat treatment. For critical applications, specify high-strength grades like ASTM A193 B7 (quenched and tempered alloy steel) and verify through third-party testing if necessary. Do not rely solely on supplier claims.

Supply Chain and Lead Time Risks in International Procurement

Sourcing threaded rod from distant suppliers can introduce delays due to customs clearance, port congestion, or inconsistent production schedules. Longer lead times may not be apparent until after purchase, disrupting project timelines. Always confirm realistic delivery windows, consider geopolitical risks, and evaluate supplier reliability through references or past performance. Dual sourcing or maintaining safety stock can mitigate these risks.

Inconsistent Lengths and Dimensional Tolerances

Rods supplied in non-standard or inaccurate lengths require on-site cutting, increasing labor costs and waste. Some international suppliers apply looser dimensional tolerances than required by ASTM or ISO standards. Clearly specify acceptable tolerances for length, straightness, and diameter in purchase orders to avoid rework or rejection upon delivery.

Counterfeit or Misrepresented Products

In global markets, counterfeit materials are a growing concern. Some suppliers may rebrand lower-grade rods or use fake certification documents. This is particularly prevalent in regions with weak regulatory oversight. Conduct supplier audits, request batch traceability, and consider using independent inspection services (e.g., SGS, Bureau Veritas) for high-volume or critical orders.

Lack of Technical Support and Traceability

Reliable suppliers should provide technical data, application guidance, and full traceability from raw material to finished product. Sourcing from vendors who lack engineering support or cannot trace material heat numbers increases risk, especially in regulated industries (e.g., construction, oil & gas). Prioritize suppliers with robust quality management systems (e.g., ISO 9001 certified).

Avoiding these pitfalls requires due diligence, clear specifications, and strong supplier qualification processes—especially when sourcing internationally. Investing time upfront ensures the threaded rod performs safely and reliably throughout its service life.

H2: Logistics & Compliance Guide for 3/4″ Threaded Rod

Product Overview

3/4″ threaded rod (also known as all-thread rod or continuous threaded rod) is a steel rod with uniform threading along its entire length, commonly used in construction, mechanical assemblies, and infrastructure projects for anchoring, suspension, and structural support. Material types typically include ASTM A307 (general purpose), ASTM A193 Grade B7 (high strength, heat-treated alloy steel), or stainless steel (e.g., 304 or 316).

1. Packaging & Handling

- Packaging:

- Rods are typically bundled in quantities of 50–100 feet per bundle, secured with steel or plastic strapping.

- Bundles should be labeled with product specifications, material grade, length, and batch/lot number.

- For corrosion-prone materials (e.g., carbon steel), use protective coatings (oil, VCI paper) or plastic end caps.

- Handling:

- Use lifting slings or spreader bars to prevent bending during transport.

- Avoid dragging rods to prevent thread damage and surface corrosion.

- Store horizontally on flat, dry surfaces with adequate support to prevent sagging.

2. Storage Requirements

- Environment:

- Store indoors in a dry, temperature-controlled area to minimize rust (especially for carbon steel).

- Ensure adequate ventilation to prevent condensation.

- Stacking:

- Limit stack height to prevent deformation (max 5–6 bundles high depending on floor load capacity).

- Use wooden dunnage between layers to allow airflow and prevent moisture trapping.

- Segregation:

- Store different materials (e.g., carbon steel vs. stainless steel) separately to avoid galvanic corrosion.

- Clearly label storage zones by grade, diameter, and finish.

3. Transportation Guidelines

- Domestic (USA):

- Secure bundles to prevent shifting during transit using straps or load locks.

- Comply with FMCSA regulations for load securement (49 CFR Part 393, Subpart I).

- International Shipping:

- Use ISPM 15-compliant wood packaging materials if applicable.

- Declare accurate weight, dimensions, and material composition for customs clearance.

- For stainless or high-grade alloy rods, provide mill test reports (MTRs) upon request.

4. Regulatory & Compliance Standards

- Material Standards:

- ASTM A307: Standard specification for carbon steel bolts and studs.

- ASTM A193: For high-temperature or high-pressure service (e.g., B7 rod).

- ASTM A320: For low-temperature applications.

- ASTM A194: Companion nuts for high-pressure bolting.

- Certifications:

- Maintain mill test reports (MTRs) verifying chemical and mechanical properties.

- Provide traceability via heat numbers for quality audits.

- Safety & Labeling:

- Comply with OSHA 29 CFR 1910 for safe handling and workplace storage.

- Include hazard communication (HazCom) labels if coated with oil or protective chemicals.

5. Import/Export Considerations

- HTS Codes (Example – US):

- 7318.15.0030: Threaded rods, iron or steel, 3/4″ diameter.

- Confirm exact code based on material (carbon vs. stainless) and finish.

- Documentation:

- Commercial invoice, packing list, bill of lading, and certificate of origin.

- For regulated sectors (e.g., oil & gas), provide compliance with API, ASME, or NACE standards if required.

- Duties & Restrictions:

- Check for antidumping or countervailing duties on steel products from certain countries.

- Verify import permits for high-strength or specialty alloys in destination countries.

6. Sustainability & Disposal

- Recycling:

- Steel rods are 100% recyclable; coordinate with certified scrap metal recyclers.

- Waste Management:

- Dispose of protective coatings or oils per EPA and local hazardous waste regulations.

- Use Spill Prevention, Control, and Countermeasure (SPCC) plans if storing oil-coated rods in bulk.

7. Quality Assurance & Traceability

- Implement a lot-tracking system using heat numbers from the mill.

- Conduct periodic inspections for thread integrity, straightness, and corrosion.

- Retain documentation (MTRs, test reports) for a minimum of 7 years for compliance audits.

By adhering to this guide, distributors, contractors, and importers can ensure safe, compliant, and efficient handling of 3/4″ threaded rod across the supply chain.

Conclusion for Sourcing 3/4-Inch Threaded Rod:

After evaluating various suppliers, material options, and cost considerations, sourcing 3/4-inch threaded rod is both feasible and cost-effective when prioritizing quality, availability, and supplier reliability. Key factors such as material type (typically A307 or A193 Grade B7 for structural or high-temperature applications), length requirements, threading standards (UNC or UNF), and corrosion resistance (e.g., galvanized, stainless steel, or plain finish) play a critical role in ensuring suitability for the intended application.

Purchasing in bulk from reputable suppliers—including industrial hardware distributors, online platforms (e.g., Fastenal, Grainger, McMaster-Carr), or local steel suppliers—can lead to significant cost savings and consistent availability. Additionally, verifying compliance with ASTM or ASME standards ensures performance and safety, especially in structural or engineered systems.

In conclusion, a well-informed sourcing strategy that balances cost, material properties, and supplier credibility will ensure reliable supply and optimal performance of the 3/4-inch threaded rod for your project requirements.