The global LED driver market is experiencing robust growth, fueled by rising demand for energy-efficient lighting solutions across residential, commercial, and industrial sectors. According to Grand View Research, the global LED driver market size was valued at USD 11.5 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. A key driver of this growth is the increasing adoption of dimmable LED lighting systems, particularly those operating at 24V, which are preferred for their efficiency, safety, and compatibility with low-voltage lighting applications such as architectural accents, signage, and smart home systems. Mordor Intelligence further projects that the shift toward smart lighting and the integration of IoT-enabled controls will accelerate demand for high-performance, dimmable LED drivers. As market competition intensifies, a select group of manufacturers have emerged as leaders in innovation, reliability, and scalability. Below, we spotlight the top 8 24V dimmable LED driver manufacturers shaping the future of modern lighting.

Top 8 24V Dimmable Led Driver Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Drivers

Domain Est. 1996

Website: americanlighting.com

Key Highlights: Drivers ; MICRO-DRJ Transformers w/Junction Box · 12V DC / 24V DC • 60W / 96W • Dimmable ; MICRO-DR Transformers · 12V DC / 24V DC • 60W / 96W • Dimmable ; Navi Dim ……

#2 12V & 24V LED Drivers

Domain Est. 1997

Website: noralighting.com

Key Highlights: 24V 288W (3 x 96W Channels) Constant Voltage Class 2 Dimmable Driver (Phase, 0-10V & PWM dimming)…

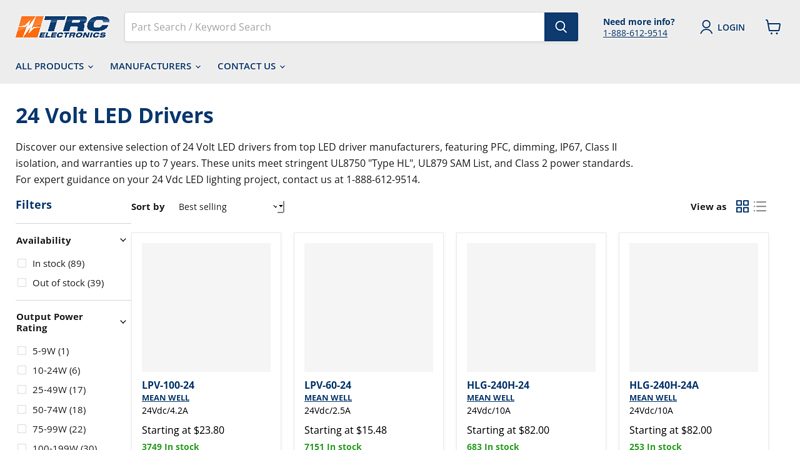

#3 24 Volt LED Drivers in Stock

Domain Est. 1998

Website: trcelectronics.com

Key Highlights: $9.99 delivery24 Volt LED Drivers ; LPV-100-24 · 24Vdc/4.2A · $23.80 ; LPV-60-24 · 24Vdc/2.5A · $15.48 ; HLG-240H-24 · 24Vdc/10A · $82.00 ; HLG-240H-24A · 24Vdc/10A · $82.00 ; HLG-…

#4 Tridonic LED Drivers – Energy

Domain Est. 1998

Website: tridonic.com

Key Highlights: A dimmable LED driver allows you to adjust the brightness of the light using analog or digital dimming signals. A non-dimmable driver provides constant light ……

#5 DiodeLED OMNIDRIVE 24V LED Driver

Domain Est. 2000

Website: prolighting.com

Key Highlights: Utilize this 60 watt 24V driver to power your Diode LED 24V LED tape light. OMNIDRIVE® Electronic Dimmable LED Drivers are Diode LED’s best-selling dimmable ……

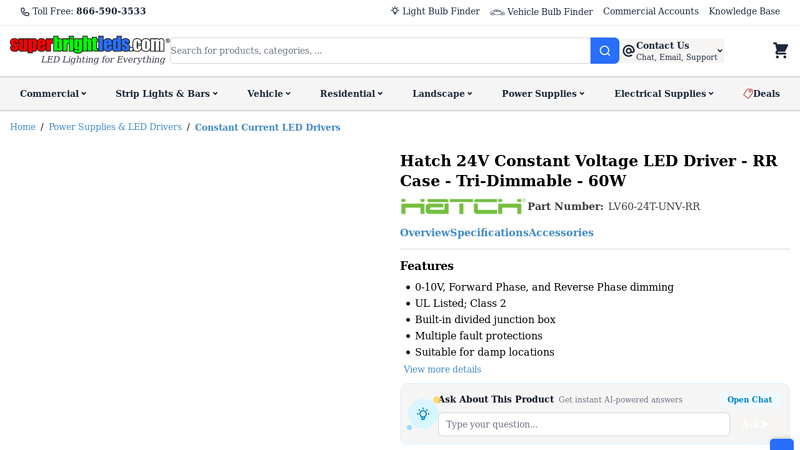

#6 Hatch 24V Constant Voltage LED Driver

Domain Est. 2002

Website: superbrightleds.com

Key Highlights: In stock $13.22 deliveryThe LED drivers are available in 60W and 96W models with a 120V to 277V input range and a 24V output rating. Product Details: Metal housing with wiring side…

#7 Drivers & Controls

Domain Est. 2006

Website: led-linear.com

Key Highlights: Dimensions (L x W x H): 225 mm × 43 mm × 30 mm. Not dimmable. Product on secondary side dimmable with IN.Finite controller range. 16000407-060, piece (pc), 5….

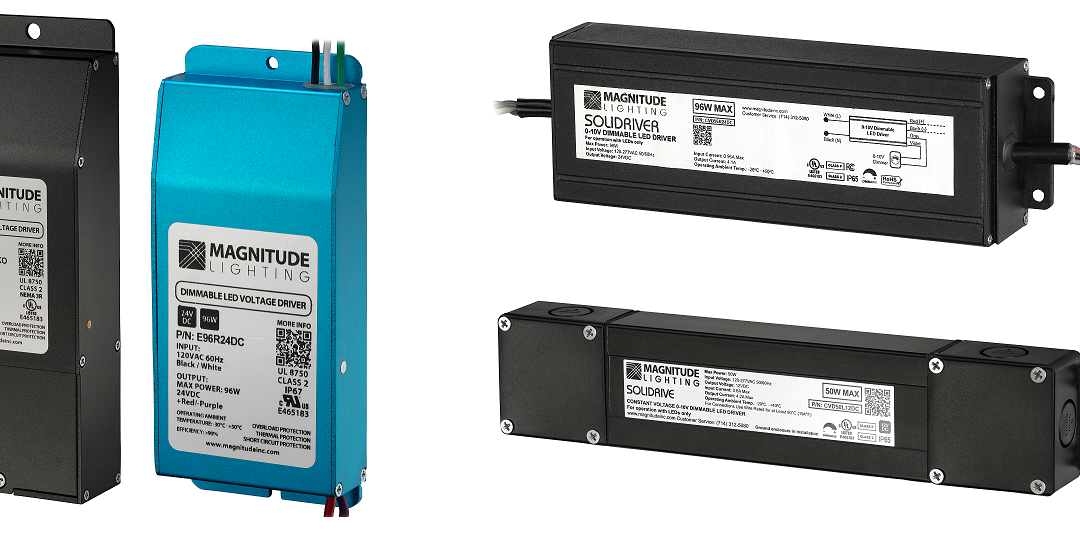

#8 24V DC Dimmable LED Power Supply

Domain Est. 2007

Website: ledworldlighting.com

Key Highlights: UL listed 24V DC indoor/outdoor rated dimmable power supply delivers smooth, stable, flicker-free dimming. LED Drivers are fully dimmable with any standard ……

Expert Sourcing Insights for 24V Dimmable Led Driver

H2: 2026 Market Trends for 24V Dimmable LED Drivers

The global market for 24V dimmable LED drivers is poised for significant growth and transformation by 2026, driven by advancements in lighting technology, rising energy efficiency standards, and expanding applications across residential, commercial, and industrial sectors. Several key trends are expected to shape the market landscape in the coming years.

1. Surge in Smart Lighting Adoption

By 2026, the integration of smart home and building automation systems will continue to fuel demand for intelligent 24V dimmable LED drivers. Compatibility with protocols such as DALI, Zigbee, Bluetooth Mesh, and Wi-Fi is becoming essential. Consumers and businesses are increasingly seeking customizable lighting solutions that offer remote control, scheduling, and energy monitoring—capabilities enabled by advanced dimmable drivers.

2. Growth in Architectural and Hospitality Lighting

The architectural, hospitality, and retail sectors are prioritizing ambiance and energy efficiency. 24V dimmable LED drivers, particularly those supporting smooth dimming (0–10V, PWM, or phase-cut), are ideal for aesthetic and functional lighting in high-end applications. Designers are favoring these drivers for their ability to deliver flicker-free performance and precise light control.

3. Advancements in Driver Efficiency and Miniaturization

OEMs are focusing on developing more compact, efficient, and thermally stable 24V dimmable drivers. Innovations in semiconductor materials (e.g., GaN and SiC) are enabling higher power density and reduced energy losses. By 2026, expect widespread availability of drivers with efficiency ratings exceeding 90%, contributing to lower operational costs and compliance with global energy standards like Energy Star and ERP.

4. Emphasis on Sustainability and Regulations

Stringent energy regulations across Europe, North America, and parts of Asia are pushing lighting manufacturers to adopt energy-efficient components. The 24V dimmable LED driver market is benefiting from policies promoting LED retrofits and low-voltage lighting systems. Additionally, recyclability and reduced hazardous materials in driver production are becoming differentiating factors.

5. Expansion in Outdoor and Industrial Applications

While traditionally used indoors, 24V dimmable drivers are finding increased use in outdoor landscape lighting, signage, and industrial task lighting. Enhanced IP-rated (e.g., IP67) and surge-protected models are enabling reliable performance in harsh environments. The trend toward human-centric lighting in workplaces is also boosting demand for tunable white systems powered by 24V drivers.

6. Competitive Pricing and Market Consolidation

As technology matures and production scales, prices for 24V dimmable drivers are expected to decline moderately by 2026, increasing accessibility in emerging markets. However, competition will intensify, leading to consolidation among smaller manufacturers and greater innovation among leaders in the space.

In conclusion, the 2026 market for 24V dimmable LED drivers will be characterized by smart integration, regulatory alignment, and performance optimization. Stakeholders who invest in interoperability, energy efficiency, and application-specific design will be best positioned to capture market share in this evolving ecosystem.

Common Pitfalls When Sourcing 24V Dimmable LED Drivers (Quality & IP Rating)

Sourcing a reliable 24V dimmable LED driver involves navigating several potential pitfalls, especially concerning quality and Ingress Protection (IP) ratings. Overlooking these aspects can lead to premature failures, safety hazards, poor performance, and costly replacements. Here are the most common issues to watch for:

Inadequate or Misrepresented IP Rating

One of the biggest mistakes is assuming the listed IP rating reflects real-world performance. Many low-cost drivers, especially those marketed for outdoor or damp environments, fail to meet their claimed IP standards.

- False Claims: Some suppliers exaggerate IP ratings (e.g., claiming IP67 when the product is only IP20). Always request test reports or certifications from independent labs.

- Poor Sealing: Inadequate gaskets, substandard potting materials, or weak housing joints compromise water and dust resistance. Look for fully potted drivers in high-moisture areas.

- Ventilation vs. Protection: Drivers with cooling fins or vents often have lower IP ratings (e.g., IP20 or IP40), making them unsuitable for outdoor or washdown environments.

Compromised Build Quality and Component Selection

Low-cost drivers often cut corners on internal components, leading to reliability issues.

- Low-Grade Capacitors: Electrolytic capacitors with short lifespans (e.g., 1,000–2,000 hours at 105°C) instead of industrial-grade ones (8,000–10,000+ hours) lead to early driver failure.

- Insufficient Thermal Management: Poor heat dissipation causes overheating, reducing lifespan and increasing the risk of thermal shutdown or fire.

- Lack of Protection Features: Missing or poorly implemented protections against overvoltage, overcurrent, short circuit, and overheating can damage both the driver and connected LEDs.

Dimming Compatibility and Performance Issues

Not all “dimmable” drivers perform equally across different dimming methods.

- Limited Dimming Range: Some drivers only dim down to 10–20%, not the advertised 1% or 0.1%, resulting in unwanted minimum brightness.

- Flickering or Buzzing: Incompatibility with certain dimmers (e.g., TRIAC, 0–10V, DALI) or poor PWM frequency design can cause visible flicker or audible noise.

- Protocol Mismatches: Assuming compatibility with DALI, Zigbee, or other smart systems without verifying firmware and protocol support can lead to integration failures.

Lack of Safety and Regulatory Certifications

Using uncertified drivers poses safety risks and may violate local electrical codes.

- Missing Certifications: Absence of essential marks like UL, CE, TÜV, or CCC indicates the product hasn’t undergone rigorous safety testing.

- Counterfeit Certifications: Some suppliers display fake certification logos. Always verify certification numbers through official databases.

- Non-Compliance with Regional Standards: A driver certified for use in Europe (CE) may not meet North American (UL/cUL) requirements, affecting insurance and liability.

Insufficient Power Derating and Environmental Tolerance

Operating a driver beyond its safe temperature range drastically shortens its life.

- Ignoring Derating Curves: Many drivers must be derated (operated below max load) at higher ambient temperatures. Failing to follow derating guidelines leads to overheating.

- Poor Performance in Extreme Conditions: Drivers not rated for wide temperature ranges (e.g., -30°C to +60°C) may fail in outdoor or industrial settings.

- Humidity and Corrosion: In coastal or high-humidity areas, lack of conformal coating or corrosion-resistant materials accelerates component degradation.

Opaque Supply Chain and Lack of Traceability

Sourcing from unreliable suppliers increases the risk of inconsistent quality.

- No Manufacturer Transparency: Vague or anonymous suppliers may rebrand low-quality units with inconsistent batch quality.

- Inconsistent Batch Performance: Lack of quality control leads to variability in output, efficiency, and lifespan between units.

- Poor Warranty and Support: Limited or no technical support and short warranty periods (e.g., 1 year vs. 5+ years) signal low confidence in product durability.

Conclusion

To avoid these pitfalls, prioritize suppliers with verifiable certifications, transparent specifications, proven component quality, and strong technical support. Always request test reports for IP ratings and safety certifications, and validate dimming compatibility with your control system before large-scale deployment. Investing in a high-quality 24V dimmable LED driver ensures long-term reliability, safety, and performance.

H2: Logistics & Compliance Guide for 24V Dimmable LED Driver

Successfully shipping and selling 24V dimmable LED drivers globally requires strict adherence to logistics best practices and regulatory compliance. This guide outlines key considerations for safe, efficient, and legal distribution.

H2: Packaging & Handling

- Protective Packaging: Use sturdy, recyclable corrugated cardboard boxes with internal cushioning (e.g., molded pulp, foam inserts, bubble wrap) to prevent damage during transit. Ensure drivers are immobilized within the box.

- ESD Protection: Handle drivers with ESD-safe practices (wrist straps, mats) during packing. Use static-dissipative or conductive bags if required by component sensitivity.

- Labeling:

- Clearly mark “Fragile,” “This Side Up,” and “Do Not Stack” icons.

- Include essential product info: Model Number, Input/Output Voltage (e.g., 100-240V AC In, 24V DC Out), Max Output Current/Wattage, Dimming Type (e.g., 0-10V, PWM, DALI).

- Apply barcodes/QR codes for inventory tracking.

- Include manufacturer/brand name and contact information.

- Palletization: Securely stack boxes on standard pallets (e.g., EUR/EPAL or ISO). Use stretch wrap or strapping to prevent shifting. Ensure pallet load is stable and within weight limits.

H2: Shipping & Transportation

- Mode Selection: Choose appropriate transport (air, ocean, ground) based on cost, speed, and volume. Air freight is faster but more expensive; ocean freight is economical for large volumes.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, EXW, DDP). DDP (Delivered Duty Paid) simplifies import for the buyer but increases seller liability.

- Documentation: Prepare accurate shipping documents:

- Commercial Invoice (detailed description, HS Code, value, origin).

- Packing List (contents per box/pallet).

- Bill of Lading (B/L) or Air Waybill (AWB).

- Certificate of Origin (if required for tariffs).

- Hazard Classification: 24V LED drivers are typically NOT classified as hazardous goods (UN 3481, PI 966 Section IB might apply only if lithium batteries are integrated, which is uncommon). Confirm with SDS if needed. Standard IATA/IMDG/ADR regulations usually do not apply.

H2: Regulatory Compliance (Key Regions)

- Electrical Safety:

- EU/UK: CE Marking (covering LVD 2014/35/EU & EMC Directive 2014/30/EU) or UKCA Marking. Requires conformity assessment (often Module A – Internal Production Control) and Declaration of Conformity (DoC).

- USA/Canada: UL/cUL Listing (UL 8750 or UL 1310) or ETL Listing. FCC Part 15 Subpart B for EMC (radiated/conducted emissions).

- Australia/NZ: RCM Mark (AS/NZS 61347.1 & 61347.2.13).

- China: CCC Mark (GB 19510.1 & .14).

- EMC (Electromagnetic Compatibility):

- Must comply with limits for conducted/radiated emissions and immunity (e.g., EN 55015/CISPR 15, EN 61547 in EU; FCC Part 15B in US). Testing in accredited labs is mandatory.

- RoHS (Restriction of Hazardous Substances):

- EU: RoHS Directive 2011/65/EU (lead, mercury, cadmium, etc.). Requires Declaration of Conformity.

- China: China RoHS (GB/T 26572).

- USA: State-level regulations (e.g., California RoHS).

- REACH (EU): Registration, Evaluation, Authorisation of Chemicals. Requires SVHC (Substances of Very High Concern) declaration if applicable.

- WEEE (EU): Waste Electrical & Electronic Equipment. Requires registration with national schemes and financing recycling. Mark products with crossed-out wheelie bin symbol.

- Energy Efficiency: Comply with regional standards (e.g., DOE 6 in USA, Ecodesign Directive Lot 15 in EU) for efficiency and no-load power consumption.

- Dimming Standards: Ensure compatibility with major protocols (0-10V, DALI, PWM, TRIAC) and relevant standards (e.g., IEC 62386 for DALI).

H2: Import/Export Requirements

- HS Code: Use correct Harmonized System code for customs (e.g., 8504.40.xx for LED drivers – confirm exact subheading locally).

- Tariffs & Duties: Research applicable import tariffs, VAT, and excise duties for the destination country.

- Local Representation: Some regions (e.g., EU) require an Authorized Representative for non-EU manufacturers to handle compliance.

- Product Registration: Check if registration with national authorities (e.g., energy efficiency databases) is required.

H2: Documentation & Traceability

- Maintain comprehensive technical files (design, test reports, risk assessments, DoC).

- Keep records of component sourcing (RoHS/REACH compliance).

- Implement traceability (batch/lot numbers) for recalls or warranty claims.

Disclaimer: Regulations evolve. Consult legal experts, notified bodies, and customs brokers for specific product validation and market entry. Test reports from accredited laboratories are essential proof of compliance.

Conclusion: Sourcing a 24V Dimmable LED Driver

Sourcing a reliable 24V dimmable LED driver requires careful consideration of key factors such as dimming compatibility (PWM, 0–10V, DALI, or TRIAC), power output requirements, build quality, efficiency, and certifications (such as CE, UL, or ETL). It is essential to match the driver specifications with the connected LED load to ensure stable performance, avoid flickering, and prolong the lifespan of both the driver and lighting system. Additionally, evaluating thermal management, surge protection, and brand reputation helps ensure long-term reliability, especially in demanding environments.

Sourcing from reputable suppliers or manufacturers known for quality control and technical support can reduce the risk of product failure and simplify compliance with safety and regulatory standards. While cost is an important consideration, prioritizing performance and durability often results in better overall value and reduced maintenance over time.

In conclusion, a well-informed selection process—balancing technical specifications, dimming method compatibility, safety certifications, and supplier credibility—will ensure optimal performance and energy efficiency of your LED lighting installation when sourcing a 24V dimmable LED driver.