The global copper wire and cable market is experiencing robust growth, driven by rising demand across industries such as construction, automotive, energy, and telecommunications. According to Grand View Research, the market was valued at USD 188.4 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.1% from 2024 to 2030. Increasing investments in renewable energy infrastructure, coupled with the global push toward electrification and smart grid development, are key factors fueling demand for high-performance copper conductors—including 2 AWG copper wire. As a standard gauge used in electrical power distribution, grounding systems, and renewable energy installations, the reliability and conductivity of 2 AWG copper have made it a critical component in modern electrical systems. With market expansion accelerating, a select group of manufacturers has emerged as leaders in producing high-quality 2 AWG copper products, combining advanced metallurgical processes, stringent quality control, and large-scale production capabilities to meet global demand. This list highlights the top seven manufacturers shaping the future of copper wire production, based on market presence, innovation, and product performance.

Top 7 2 Awg Copper Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

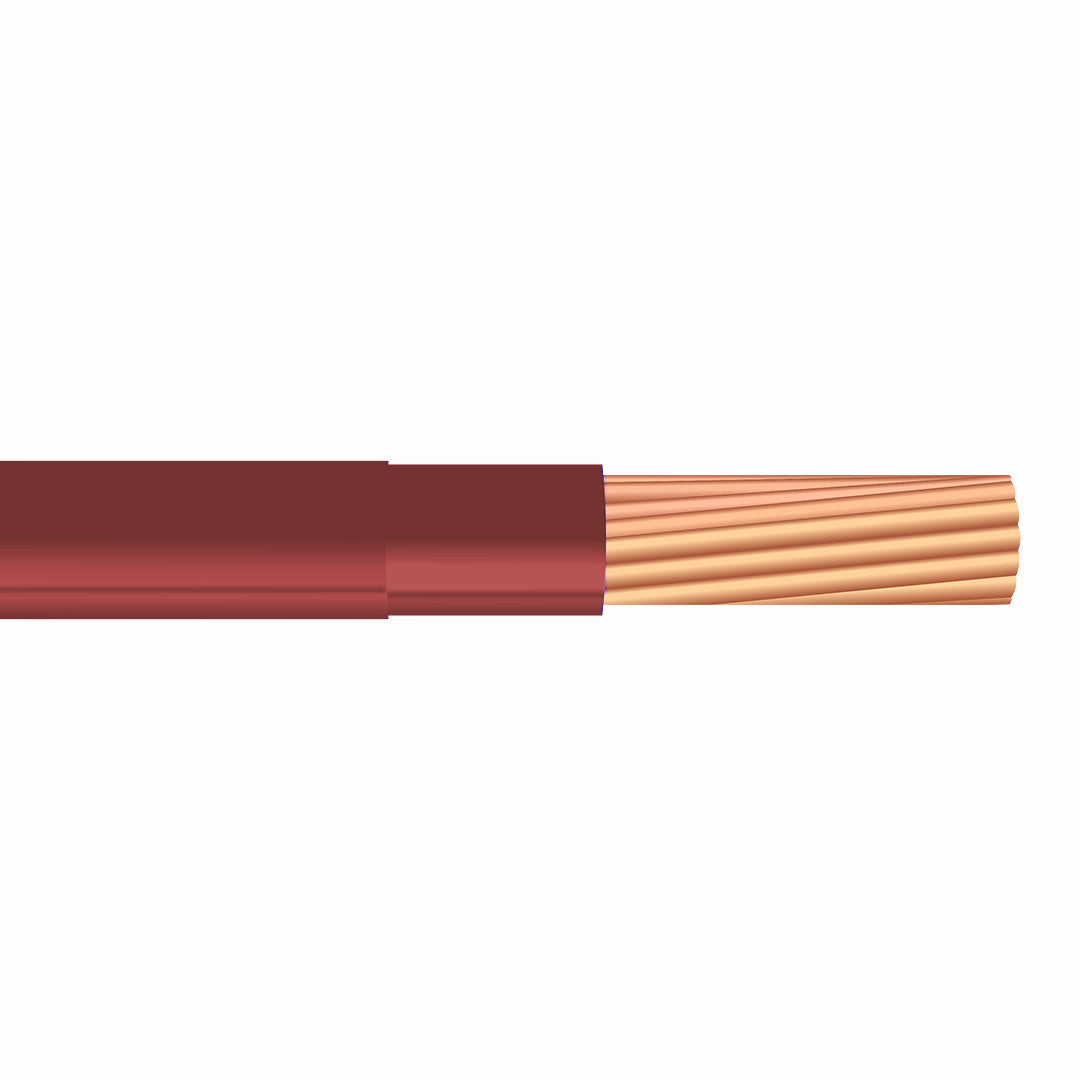

#1 Bare Copper, Stranded, 2 AWG, Copper,Soft Drawn

Domain Est. 1996

Website: stateelectric.com

Key Highlights: In stock $12 deliveryWire Copper. Bare Copper, Stranded, 2 AWG, Copper,Soft Drawn. SKU: WCUBASTR7SD2. Manufacturer Part Number: BASTR7SD2. $3.51/foot. Login for your price. In Stoc…

#2 2 AWG, Solid Bare Copper Wire

Domain Est. 2004

Website: internationalwire.com

Key Highlights: Browse 2 AWG, Solid Bare Copper Wire in the International Wire Group, Inc. (Omega Wire, Inc.) catalog including Package Code,List Price,Product Description ……

#3 257.6 MILS (2 AWG SOL) CU SD 125 FT

Domain Est. 1994

Website: southwire.com

Key Highlights: Bare Copper Solid, Compressed Class B and C. SPEC: 10080. 257.6 MILS (2 AWG SOL) CU SD 125 FT SPEC10080 10650002. Southwire #: 10650002 ……

#4 Building Wire

Domain Est. 1998

Website: copperweld.com

Key Highlights: Copperweld Building Wire is a Copper-Clad Aluminum (CCA) bimetallic conductor that, when installed to NEC requirements, offers greater current-carrying ……

#5 American Wire Group

Domain Est. 2000

Website: buyawg.com

Key Highlights: Empower your next project with AWG! Turn to us for aluminum, copper, steel, fiber optic, specialty cables and more. View all Products….

#6 2 AWG STRANDED SOFT DRAWN BARE COPPER

Domain Est. 2014

#7 2 AWG THHN/THWN

Domain Est. 2015

Website: wireandcableyourway.com

Key Highlights: In stock Free delivery over $1,000Our 2 AWG THHN/THWN-2 copper building wire can be cut to your desired length and purchased by the foot. We offer free shipping on all orders over …

Expert Sourcing Insights for 2 Awg Copper

H2: 2026 Market Trends for 2 AWG Copper Cable

The global market for 2 AWG copper cable is projected to experience notable shifts in 2026, driven by macroeconomic conditions, evolving energy infrastructure demands, and technological advancements. As a mid-sized conductor widely used in renewable energy installations, electric vehicle (EV) charging stations, solar power systems, and industrial applications, 2 AWG copper cable is poised to benefit from key structural trends in the global economy.

1. Growth in Renewable Energy and Electrification

The continued global push toward decarbonization and energy transition will be a primary driver of demand for 2 AWG copper cable in 2026. Solar photovoltaic (PV) arrays and wind farms frequently use 2 AWG conductors for grounding, DC wiring, and interconnections between inverters and combiner boxes. With countries enhancing clean energy targets under agreements such as the Paris Accord and national green energy mandates, installations are expected to grow—particularly in North America, Europe, and parts of Asia-Pacific—boosting copper cable demand.

2. Expansion of EV Charging Infrastructure

As electric vehicle adoption accelerates, supported by government incentives and automaker commitments, the deployment of EV charging stations (especially Level 2 and DC fast-charging hubs) will increase. 2 AWG copper is commonly used in EVSE (Electric Vehicle Supply Equipment) for high-current circuits. The Biden administration’s National Electric Vehicle Infrastructure (NEVI) program in the U.S., along with similar initiatives in the EU and China, will stimulate procurement of copper wiring, including 2 AWG, throughout 2026.

3. Copper Supply Constraints and Price Volatility

Copper prices are expected to remain volatile in 2026 due to supply chain constraints, declining ore grades, and geopolitical risks in major producing regions such as Chile, Peru, and the Democratic Republic of Congo. While recycling and improved efficiency may offset some demand pressure, tight supply could lead to price spikes, affecting the cost structure for 2 AWG cable manufacturers and end-users. Producers may increasingly adopt hedging strategies or vertical integration to manage input costs.

4. Technological and Efficiency Improvements

In response to cost and sustainability pressures, manufacturers are likely to focus on optimizing copper utilization through better insulation materials, compact stranding, and hybrid designs. While 2 AWG remains a standard, innovations may lead to alternatives or complementary solutions (e.g., aluminum-copper hybrids) in non-critical applications. However, copper’s superior conductivity and reliability will maintain its dominance in safety-critical and high-efficiency systems.

5. Regional Market Dynamics

– North America: Strong infrastructure investment under the U.S. Inflation Reduction Act (IRA) and IIJA (Infrastructure Investment and Jobs Act) will drive demand for 2 AWG copper in grid modernization and EV infrastructure.

– Europe: Green Deal initiatives and building electrification will support steady demand, although economic headwinds may moderate growth.

– Asia-Pacific: China and India will remain key markets due to urbanization and renewable energy expansion, though local production of cables may reduce import dependency.

6. Sustainability and Regulatory Pressures

Environmental regulations and ESG (Environmental, Social, Governance) reporting requirements will influence sourcing practices. Consumers and contractors may prefer certified sustainable copper, prompting manufacturers to adopt traceability and responsible mining practices. This could affect pricing and supply chains for 2 AWG copper products.

Conclusion

In 2026, the market for 2 AWG copper cable will be shaped by the convergence of energy transition, infrastructure investment, and material economics. While demand is expected to grow—particularly in clean tech applications—price volatility and supply challenges will require strategic planning by stakeholders. Companies that secure reliable copper sources, innovate in product design, and align with sustainability goals will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing 2 AWG Copper Cable (Quality and IP Considerations)

Sourcing 2 AWG copper cable seems straightforward, but overlooking key quality and Ingress Protection (IP) factors can lead to performance issues, safety hazards, and costly failures. Below are common pitfalls to avoid:

1. Assuming All 2 AWG Copper is the Same

One of the most frequent mistakes is treating all 2 AWG copper cables as interchangeable. Differences in copper purity, strand count, insulation materials, and manufacturing standards significantly impact performance. Low-quality copper may have higher resistance, reduced current-carrying capacity, and poor durability. Always verify that the copper meets ASTM B3 or equivalent standards for electrical conductivity and purity.

2. Ignoring Insulation and Jacket Material Quality

The insulation and outer jacket play a critical role in safety and longevity. Substandard materials may crack under UV exposure, degrade in high temperatures, or fail to resist chemicals and abrasion. For outdoor or harsh environments, ensure the cable uses UV-resistant, high-temperature-rated materials like XLPE or THHN/THWN—2. Avoid PVC-insulated cables in high-heat applications due to lower thermal tolerance.

3. Overlooking IP Rating Requirements

Failing to match the cable’s IP rating to the installation environment is a major oversight. For example, using non-IP-rated or low-IP cables (e.g., IP54) in wet or dusty areas (such as outdoor enclosures or industrial settings) exposes connections to moisture and particulate ingress, leading to short circuits or corrosion. For wet locations, cables with at least IP67 (submersion-resistant) or higher may be needed, especially when used with appropriately rated connectors and conduits.

4. Selecting Inadequate Stranding for Application

2 AWG cables come in solid or stranded variants. Using solid conductors in applications requiring flexibility (e.g., portable equipment or vibrating machinery) increases the risk of conductor fatigue and breakage. Conversely, overly fine stranding may compromise mechanical strength. Choose fine-stranded (class K or higher) for flexible applications and verify strand count meets industry norms.

5. Skipping Verification of Third-Party Certifications

Cables lacking certifications such as UL, CSA, or CE may not meet safety or performance claims. Counterfeit or uncertified cables are common in the market and often fail under load or during inspections. Always request test reports or certification documentation and purchase from reputable suppliers with traceable quality control processes.

6. Mismatching Voltage and Temperature Ratings

Using a cable with insufficient voltage or temperature rating for the application can lead to insulation breakdown and fire hazards. For instance, a 600V-rated cable should not be used in a 1000V solar array. Similarly, ensure the cable’s temperature rating (e.g., 90°C wet/dry) aligns with the environmental and load conditions.

7. Neglecting Mechanical Protection Needs

Even with a high IP rating, cables installed in high-traffic or industrial areas may require additional mechanical protection (e.g., conduit or armored sheathing). Assuming IP68-rated cables are indestructible can lead to damage from crushing or rodent attacks. Evaluate the full installation path and protect accordingly.

By paying close attention to material quality, certifications, environmental ratings, and application-specific needs, you can avoid these common pitfalls and ensure reliable, safe performance from your 2 AWG copper cable installations.

H2: Logistics & Compliance Guide for 2 AWG Copper Wire

This guide outlines key logistics and compliance considerations for the transportation, handling, and regulatory adherence related to 2 AWG (American Wire Gauge) copper wire, commonly used in electrical power distribution, automotive, and industrial applications.

H2: Regulatory & Safety Compliance

1. Material Classification & Hazardous Status

– Non-Hazardous Classification: 2 AWG copper wire (bare or insulated) is generally classified as non-hazardous for transport under international regulations (e.g., DOT 49 CFR, IATA DGR, IMDG Code), provided it contains no hazardous insulation materials (e.g., lead-based compounds or PCBs).

– Insulation Materials: Verify the jacketing compound (e.g., PVC, XLPE, THHN). Certain insulations may be subject to environmental or flame-spread regulations. Obtain Safety Data Sheets (SDS) from the manufacturer to confirm compliance.

2. RoHS & REACH Compliance (EU Market)

– Ensure copper wire complies with RoHS (Restriction of Hazardous Substances) directives, limiting lead, cadmium, mercury, and other restricted substances.

– Confirm REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) compliance, especially if insulating materials contain SVHCs (Substances of Very High Concern).

3. UL & CSA Certification (North America)

– 2 AWG copper wire must be certified by recognized bodies such as UL (Underwriters Laboratories) or CSA (Canadian Standards Association) for use in electrical installations.

– Verify product markings include certification labels, wire type (e.g., THHN, XHHW), temperature rating, and voltage class.

4. Conflict Minerals Reporting (Dodd-Frank Act, U.S.)

– If supplying to U.S. public companies, be prepared to disclose whether copper originates from conflict-affected regions (e.g., DRC and adjoining countries). Maintain supply chain due diligence documentation.

H2: Packaging & Handling Requirements

1. Reel & Spool Specifications

– 2 AWG copper wire is typically shipped on wooden or plastic reels ranging from 250 ft to 1,000 ft in length.

– Reels must be structurally sound to prevent deformation during transit. Use protective end caps and banding to secure windings.

2. Moisture & Corrosion Protection

– For bare copper or uninsulated strands, use VCI (Vapor Corrosion Inhibitor) paper or sealed poly bags to prevent oxidation.

– Avoid exposure to salt air, high humidity, or acidic environments during storage and transport.

3. Labeling & Marking

– Each reel must be labeled with:

– AWG size (2 AWG)

– Conductor material (Copper)

– Insulation type and rating

– Length (ft/m)

– Manufacturer name and lot number

– Compliance marks (UL, CSA, RoHS, etc.)

H2: Transportation & Logistics

1. Domestic Transport (USA/Canada)

– Freight Classification: Typically falls under NMFTA Class 200–250 (based on density and handling). Confirm with carrier for accurate LTL (Less-Than-Truckload) or FTL (Full Truckload) pricing.

– Securement: Reels must be blocked and braced on pallets or flatbeds to prevent rolling. Use straps or dunnage to secure loads per FMCSA/CMVSS regulations.

2. International Shipping

– Containerization: Use standard 20′ or 40′ dry containers. Maximize cube utilization with stacked reels on pallets.

– Documentation: Include commercial invoice, packing list, bill of lading, and certificates of compliance (RoHS, REACH, UL).

– Import Duties: Check HTS codes—typically 8544.49.00 (insulated copper wire) or 7408.19.00 (uninsulated). Duty rates vary by country.

3. Temperature & Environmental Controls

– Avoid prolonged exposure to temperatures exceeding 60°C (140°F), which may degrade insulation.

– Store indoors in dry, well-ventilated areas away from direct sunlight to prevent jacket embrittlement.

H2: Environmental & Disposal Compliance

1. Recycling & End-of-Life Management

– Copper is 100% recyclable. Used 2 AWG wire must be processed in accordance with local e-waste or scrap metal regulations (e.g., EPA guidelines in the U.S.).

– Insulated wire may require shearing or stripping to separate copper from plastic before recycling.

2. Waste Disposal

– If insulation contains halogens (e.g., PVC), disposal must follow hazardous waste protocols where applicable. Check local regulations for landfill or incineration rules.

H2: Documentation & Traceability

- Maintain traceability from smelter to end product using lot numbers and material certifications.

- Provide Mill Test Reports (MTRs) upon request to verify copper purity (typically 99.9%+).

- Keep records of compliance certifications for a minimum of 5 years (or per customer/industry requirements).

Note: Always consult the latest version of applicable regulations and coordinate with legal, safety, and logistics teams to ensure full compliance based on destination and application.

Conclusion for Sourcing 2 AWG Copper:

Sourcing 2 AWG copper wire requires careful consideration of several key factors to ensure quality, cost-efficiency, and reliability. After evaluating suppliers, pricing, material specifications, lead times, and compliance with industry standards (such as ASTM B3 for soft copper and UL certification), it is clear that establishing relationships with reputable, certified suppliers is essential. While domestic suppliers may offer faster delivery and better quality control, international sources can provide cost advantages if logistics and import regulations are properly managed.

Additionally, monitoring copper market fluctuations is crucial to timing purchases effectively and mitigating cost volatility. Ensuring the copper meets required conductivity, insulation, and application-specific standards (e.g., for electrical, solar, or automotive use) will prevent performance issues down the line.

In conclusion, a strategic sourcing approach—balancing cost, quality, lead time, and supplier reliability—will ensure successful procurement of 2 AWG copper that supports project efficiency, safety, and long-term value. Regular supplier evaluations and staying informed on market trends will further strengthen supply chain resilience.