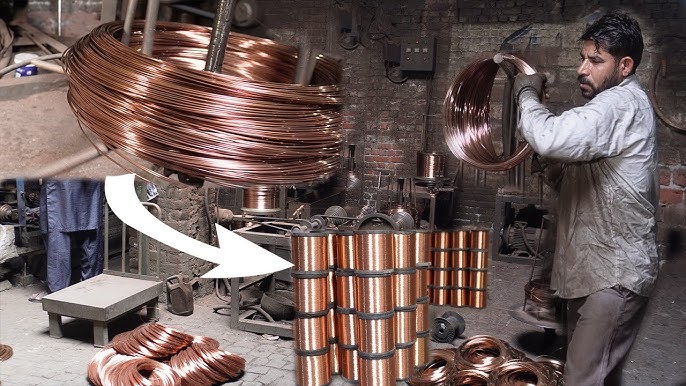

The global copper wire market is experiencing robust growth, driven by rising demand in electrical and electronics, automotive, and renewable energy sectors. According to a 2023 report by Mordor Intelligence, the market was valued at USD 67.8 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.5% from 2023 to 2028, reaching an estimated USD 88.6 billion by the end of the forecast period. This expansion is fueled by increasing urbanization, infrastructure development, and the global shift toward electrification and energy-efficient systems. With over 2.0 mm diameter copper wire (2/0 AWG) being a critical component in high-current applications such as power transmission, industrial machinery, and electric vehicle charging infrastructure, the need for reliable and high-performance manufacturers has never been greater. As demand intensifies, a select group of industry leaders has emerged, combining scale, technological innovation, and stringent quality standards to dominate the 2/0 copper wire segment. Here are the top five manufacturers leading the market today.

Top 5 2 0 Cu Wire Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 SIMpull® THHN/THWN

Domain Est. 1994

Website: southwire.com

Key Highlights: 600 Volts. Copper Conductor. PVC Insulation/Nylon Sheath THHN/THWN-2. Heat, Moisture, Gasoline and Oil Resistant II. SIMpull Technology for Easier Pulling….

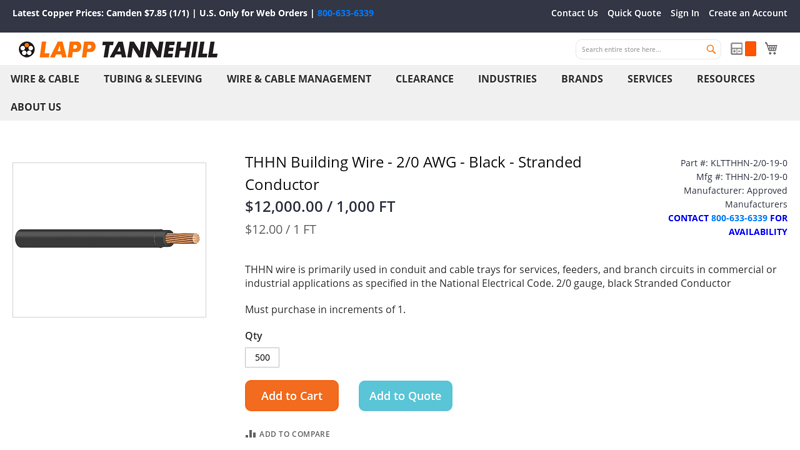

#2 THHN Wire, Stranded, 2/0 AWG, 1 Conductor, Copper, 600 Volts …

Domain Est. 1996

#3 2/0, Stranded, THHN Wire, Copper, Red, 1 Conductor, Cut Length

Domain Est. 1997

#4 THHN Building Wire

Domain Est. 2007

#5 2/0 THHN/THWN

Domain Est. 2015

Website: wireandcableyourway.com

Key Highlights: In stock Free delivery over $1,0002/0 THHN Building Wire. Sold by the foot cut to length. Same day shipping and best prices anywhere at WireAndCableYourWay.com….

Expert Sourcing Insights for 2 0 Cu Wire

H2: Market Trends for 2.0 Cu Wire in 2026

The global market for 2.0 mm diameter copper (Cu) wire is poised for significant evolution by 2026, driven by shifts in industrial demand, technological advancements, and sustainability initiatives. As a standard gauge in electrical and electronic applications, 2.0 Cu wire—commonly used in power transmission, motor windings, building wiring, and renewable energy systems—is influenced by macroeconomic trends and sector-specific developments.

-

Growing Demand in Renewable Energy and EV Infrastructure

By 2026, the expansion of renewable energy installations—particularly solar photovoltaic (PV) systems and wind turbines—will drive increased demand for high-conductivity copper wire. 2.0 Cu wire is frequently used in grounding, busbar connections, and internal cabling within inverters and charge controllers. Concurrently, the global electric vehicle (EV) boom will elevate requirements for copper in charging stations and onboard electronics. While finer wires dominate motor windings, 2.0 Cu wire supports structural and high-current distribution systems in EV charging infrastructure, especially Level 2 and DC fast-charging stations. -

Construction and Smart Building Growth

Urbanization and the rise of smart building technologies in Asia-Pacific, North America, and parts of Europe will sustain demand for standard-gauge copper wiring. The 2.0 Cu wire is often utilized in residential and commercial electrical circuits carrying moderate to high loads. Regulatory emphasis on energy efficiency and electrical safety will favor copper over aluminum in critical applications, supporting steady market growth. -

Supply Chain and Material Cost Volatility

Copper prices are expected to remain volatile in 2026 due to geopolitical tensions, mining output constraints, and fluctuating demand from major economies like China and the U.S. Recycling of copper wire will gain importance, with advancements in recovery technologies improving the economics of secondary copper. This may partially offset raw material cost pressures and support sustainable manufacturing practices. -

Competition from Aluminum and Hybrid Solutions

While copper maintains superior conductivity and durability, aluminum-based conductors are gaining traction in cost-sensitive markets and large-scale power distribution. However, 2.0 Cu wire will retain dominance in applications requiring reliability, compact design, and long-term performance. Hybrid systems combining Cu and Al may emerge, but copper’s role in high-efficiency circuits remains unchallenged. -

Technological Innovation and Automation

Automation in wire manufacturing and precision winding technologies will enhance production efficiency and reduce waste. Coated or tinned 2.0 Cu wire variants are expected to grow in popularity for corrosion resistance in harsh environments, especially in automotive and marine applications. -

Regional Market Dynamics

- Asia-Pacific: China, India, and Southeast Asia will lead consumption due to infrastructure development and manufacturing activity.

- North America: Driven by the Inflation Reduction Act (IRA) and investments in grid modernization and EV adoption.

- Europe: Green energy mandates and building retrofit programs will support demand, aligned with EU Green Deal objectives.

Conclusion

By 2026, the 2.0 Cu wire market will benefit from structural growth in clean energy, electrification, and construction. While cost and material substitution pose challenges, copper’s irreplaceable electrical properties ensure continued demand. Producers who invest in sustainable sourcing, recycling, and application-specific innovation will be best positioned to capture value in this evolving landscape.

H2: Common Pitfalls When Sourcing 2.0 mm² Copper Wire – Quality and Intellectual Property Risks

Sourcing 2.0 mm² copper wire is a critical step in many electrical and construction projects, but several pitfalls can compromise project integrity, safety, and compliance—particularly concerning quality and intellectual property (IP). Being aware of these risks ensures better procurement decisions.

1. Substandard Material Quality

A major pitfall is receiving copper wire that does not meet industry specifications (e.g., IEC 60228, ASTM B3). Some suppliers may offer wire labeled as 2.0 mm² that is undersized or made with impure copper (e.g., copper-clad aluminum or recycled copper with high impurities). This leads to increased resistance, overheating, and fire hazards.

2. Lack of Certification and Traceability

Reputable copper wire should come with certifications (e.g., CE, RoHS, UL) and mill test reports (MTRs) verifying conductivity, tensile strength, and purity. Sourcing from suppliers without proper documentation increases the risk of non-compliant materials, especially from unverified overseas vendors.

3. Counterfeit or Misrepresented Products

Some suppliers falsely claim compliance with standards or mimic branded packaging. This not only degrades performance but may also infringe on trademarks or registered product designs—posing both quality and IP risks.

4. Intellectual Property Infringement in Branded Products

When sourcing branded 2.0 mm² cables (e.g., Prysmian, Nexans, or Belden), using counterfeit or reverse-engineered versions infringes on IP rights. Unauthorized replication of cable designs, insulation technology, or trademarked labeling can result in legal liability and supply chain disruptions.

5. Inadequate Insulation and Jacketing Quality

Even if the copper conductor meets specs, poor-quality insulation (e.g., substandard PVC or PE) can lead to early failure, especially in harsh environments. Some generic suppliers cut costs with non-compliant materials that don’t meet flame retardancy or UV resistance standards.

6. Unreliable Supply Chain and Vendor Credibility

Sourcing from unknown or unvetted suppliers—especially via online marketplaces—increases exposure to inconsistent quality and potential IP violations. These vendors may lack transparency about origin, manufacturing processes, or raw material sourcing.

Best Practices to Avoid Pitfalls

– Source from certified, reputable suppliers with verifiable track records.

– Require full technical documentation and test reports.

– Conduct third-party inspections or batch testing.

– Avoid unusually low prices—a red flag for substandard or counterfeit goods.

– Ensure branding and product designs are legally licensed when applicable.

By addressing both quality and IP concerns proactively, businesses can ensure the safety, reliability, and legal compliance of their 2.0 mm² copper wire procurement.

H2: Logistics & Compliance Guide for 2.0 Cu Wire

1. Product Overview

2.0 Cu Wire refers to copper wire with a diameter of 2.0 millimeters. It is commonly used in electrical wiring, motor windings, transformers, and various industrial applications due to copper’s high electrical conductivity and mechanical strength. Ensuring safe and compliant logistics is essential due to the material’s value, weight, and regulatory considerations.

2. Packaging Requirements

Proper packaging prevents damage during transit and maintains product integrity:

- Coiling & Spooling: Wire should be wound tightly on durable spools made of wood, plastic, or metal to prevent kinking and tangling.

- Protective Wrapping: Use moisture-resistant plastic (e.g., polyethylene) or shrink wrap to protect against corrosion and environmental exposure.

- Palletization: Secure spools on wooden or plastic pallets using strapping or stretch film. Ensure even weight distribution.

- Labeling: Clearly label each package with:

- Product description (e.g., “2.0 mm Electrolytic Tough Pitch Copper Wire”)

- Net weight and total length

- Batch/lot number

- Handling instructions (e.g., “Do Not Drop”, “Keep Dry”)

- Manufacturer and contact information

3. Transportation & Handling

- Mode of Transport:

- Road: Most common for domestic shipments. Use enclosed, dry trailers to prevent moisture and theft.

- Sea: For international shipping. Use ISO containers with desiccants to control humidity.

-

Rail/Air: Air freight is uncommon due to high density and cost; rail is suitable for bulk land transport.

-

Weight & Load Limits:

- 2.0 mm copper wire is dense (~9.8 kg per km). Ensure transport vehicles comply with regional weight regulations.

-

Confirm axle load limits and bridge restrictions when transporting large coils.

-

Handling:

- Use forklifts or cranes with appropriate attachments (e.g., boom lifts, lifting beams) to move heavy spools.

- Avoid dragging or dropping spools to prevent deformation and safety hazards.

4. Storage Conditions

- Environment: Store in a dry, well-ventilated, temperature-controlled indoor area to prevent oxidation and moisture-induced corrosion.

- Stacking: Limit stack height to prevent crushing of lower spools. Use rack systems for organized storage.

- Segregation: Keep copper wire separate from corrosive chemicals, especially chlorides and sulfides.

5. Regulatory & Compliance Requirements

- International Trade:

- HS Code: Typically 7408.19 (uninsulated refined copper wire). Confirm with local customs authority.

- Export Controls: Copper may be subject to export reporting in some countries (e.g., U.S. requires reporting for large quantities under Census Bureau regulations).

-

Import Duties & Tariffs: Vary by country. Check destination regulations (e.g., EU, ASEAN, NAFTA/USMCA).

-

Environmental & Safety Regulations:

- REACH (EU): Copper is listed; ensure compliance with registration and restriction guidelines.

- RoHS (EU): Applies if wire is part of electrical equipment; copper itself is compliant.

-

OSHA (U.S.): Follow safe handling practices to avoid cuts or musculoskeletal injuries during manual handling.

-

Material Declaration:

- Provide a Certificate of Conformity (CoC) and Material Safety Data Sheet (MSDS/SDS) upon request.

- Include copper purity (e.g., >99.9% Cu) and alloy type (e.g., C11000 ETP copper).

6. Security & Theft Prevention

- Copper is a high-theft-risk material due to its scrap value.

- Use:

- GPS tracking on high-value shipments

- Sealed containers with tamper-evident seals

- Secure parking and monitored storage areas

- Marking spools with UV ink or company branding

7. Documentation Checklist

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin

- Certificate of Conformity (CoC)

- SDS (Safety Data Sheet)

- Export Declaration (if required)

8. Sustainability & Recycling Compliance

- Copper is 100% recyclable. Promote end-of-life recycling.

- Comply with local WEEE (Waste Electrical and Electronic Equipment) directives if wire is part of a larger product.

Conclusion

Proper logistics and compliance management for 2.0 mm Cu wire ensures product quality, regulatory adherence, and supply chain security. Always verify region-specific requirements and maintain detailed documentation throughout the shipping process.

Conclusion for Sourcing 2/0 AWG Copper Wire

After evaluating various suppliers, pricing, quality standards, and logistical considerations, sourcing 2/0 AWG copper wire requires a balanced approach that prioritizes both cost-efficiency and reliability. It is essential to procure wire that meets or exceeds industry standards such as ASTM B3 for conductivity and UL certification for safety and performance. While domestic suppliers may offer faster lead times and better customer support, international suppliers—particularly from regions with established copper manufacturing—can provide competitive pricing, especially for bulk orders.

Key factors in the final decision include wire type (bare vs. insulated, stranding type), compliance with project-specific requirements (e.g., NEC codes), and total landed cost including shipping, tariffs, and lead time. Establishing relationships with reputable suppliers and conducting periodic quality audits can mitigate risks related to material defects or delivery delays.

In conclusion, the optimal sourcing strategy for 2/0 AWG copper wire combines thorough supplier vetting, attention to technical specifications, and supply chain resilience to ensure consistent quality, on-time delivery, and long-term cost savings.