The global above-ground pool pump market is experiencing steady growth, driven by rising residential and commercial swimming pool installations, particularly in North America and Europe. According to Grand View Research, the global swimming pool equipment market was valued at USD 12.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key segment within this market is 1 horsepower (1HP) above-ground pool pumps, which balance energy efficiency, performance, and cost-effectiveness for mid-sized pools. With increasing demand for durable, reliable, and energy-saving pumps, manufacturers are focusing on innovation in motor technology, filtration integration, and noise reduction. As of 2024, North America remains the largest regional market, supported by high homeowner investment in outdoor living spaces. This growing demand has intensified competition among manufacturers, leading to a diverse range of 1HP pool pumps tailored for reliability, ease of maintenance, and compliance with energy regulations such as the U.S. Department of Energy’s (DOE) updated efficiency standards. Based on market presence, product innovation, customer reviews, and performance metrics, the following are the top 10 manufacturers leading the 1HP above-ground pool pump segment.

Top 10 1Hp Pool Pump Above Ground Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Grundfos USA

Domain Est. 1995

Website: grundfos.com

Key Highlights: The full range supplier of pumps and pump solutions. As a renowned pump manufacturer, Grundfos delivers efficient, reliable, and sustainable solutions all over…

#2 Energy Efficient Pool Pump Manufacturers

Domain Est. 1997

Website: usa.speck-pumps.com

Key Highlights: Speck Pumps manufacturers’ complete lines of world renowned high-quality pool pump products that are used in spas, residential and commercial swimming pools….

#3 Swimming Pool Pumps & Spa Pumps

Domain Est. 1996

Website: pentair.com

Key Highlights: Our variable speed and flow pool pumps adjust to meet your pool’s changing needs. *Savings based on variable speed pump compared to a single ……

#4 Jandy Pool Pumps

Domain Est. 1996

Website: jandy.com

Key Highlights: Most Jandy variable-speed pool pumps are ENERGY STAR certified, saving homeowners more than $1,100 per year* over energy consuming single-speed pumps. Estimate ……

#5 Doheny’s Above Ground Pool Pump, 115V, 1 HP (0.9 THP)

Domain Est. 1996

Website: doheny.com

Key Highlights: In stock Rating 4.8 (542) Get reliable performance with Doheny’s 1 HP Above Ground Pool Pump. Quiet, energy-efficient, and affordable—perfect for keeping your pool crystal clear….

#6 Pool Pumps

Domain Est. 1997

Website: energystar.gov

Key Highlights: Pool pumps that have earned the ENERGY STAR are independently certified to save energy, save you money, and help protect the environment….

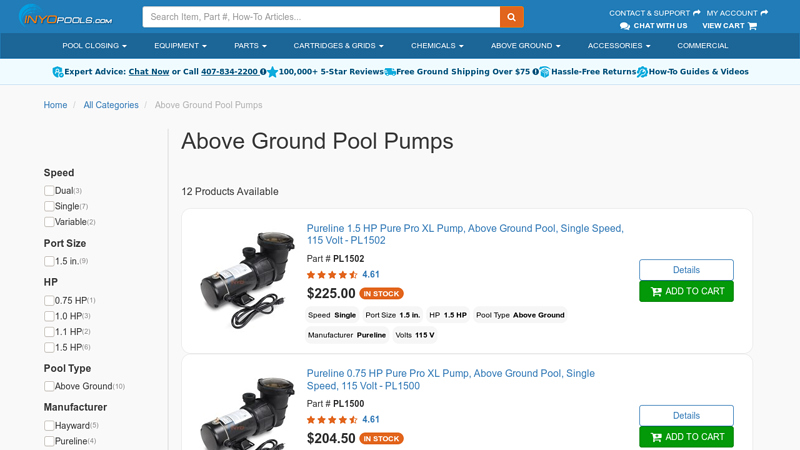

#7 Above Ground Pool Pumps

Domain Est. 2001

Website: inyopools.com

Key Highlights: Free delivery over $75Explore our selection of above ground pool pumps at Inyo Pools. Find efficient and reliable pumps designed specifically for above ground pools to keep your …..

#8 1 HP Swimming Pool Pumps

Domain Est. 2002

#9 Pumps for Pools, Spas, and Fountains

Domain Est. 2009

Website: carvinpool.com

Key Highlights: At Carvin, we design above ground pool pumps that deliver powerful circulation, superior filtration, and easy operation — all while staying energy-efficient and ……

#10 OptiFlow Above Ground Swimming Pool Pump

Domain Est. 2023

Expert Sourcing Insights for 1Hp Pool Pump Above Ground

2026 Market Trends for 1HP Pool Pumps for Above Ground Pools

The market for 1 horsepower (1HP) pool pumps designed specifically for above ground pools is poised for significant evolution by 2026, driven by shifting consumer priorities, regulatory pressures, and technological advancements. While the basic need for water circulation remains constant, the definition of a “1HP” pump and consumer expectations are undergoing a transformation.

1. Dominance of Variable Speed (VS) and Dual Speed Technology: The most critical trend shaping the 2026 landscape is the rapid shift away from traditional single-speed 1HP pumps. While single-speed models will still be available, particularly in budget segments, variable speed (VS) pumps will become the dominant choice for new installations and major replacements. By 2026, consumers will increasingly recognize the substantial long-term energy savings (often 50-90% compared to single-speed) and noise reduction offered by VS technology. Dual-speed pumps will remain a popular mid-tier option, offering a significant efficiency boost over single-speed at a lower initial cost than full VS. The term “1HP” in marketing will often refer to the maximum output of these VS or dual-speed models, not a constant draw.

2. Regulatory Pressure and Energy Efficiency Mandates: Federal and state energy efficiency regulations (like those stemming from the U.S. Department of Energy’s standards) will continue to tighten. By 2026, these regulations will effectively render traditional single-speed 1HP pumps obsolete for new installations in many markets. This regulatory push is a primary driver forcing manufacturers to innovate and consumers to adopt more efficient technologies. The focus will shift from raw horsepower to metrics like Hydraulic Horsepower (HHP) and Total Dynamic Head (TDH) efficiency, emphasizing actual water-moving capability per watt consumed.

3. Integration of Smart Technology and Connectivity: The “smart home” trend will deeply penetrate the pool equipment market. By 2026, demand for Wi-Fi or Bluetooth-enabled 1HP-equivalent pumps (primarily VS) will surge. Consumers will expect features like remote control via smartphone apps, scheduling, energy usage monitoring, performance diagnostics, and integration with broader smart home ecosystems (e.g., Alexa, Google Home). This connectivity enhances convenience, allows for optimized scheduling (e.g., running at off-peak rates), and provides valuable insights into system health, justifying a higher price point.

4. Focus on Noise Reduction and Aesthetics: As pools become more integrated into living spaces, minimizing operational noise will be a key differentiator. Variable speed pumps inherently operate much quieter, especially at lower speeds used for most filtration. Manufacturers will continue to refine motor design, housing materials, and vibration dampening. Furthermore, aesthetic design will gain importance. Pumps will feature more modern, compact, and visually pleasing enclosures to blend better with backyard environments, moving away from purely utilitarian industrial looks.

5. Consolidation of Brands and Market Competition: The market will likely see further consolidation among manufacturers as the shift to complex VS technology raises R&D and production costs. Established players (like Hayward, Pentair, Sta-Rite) will leverage their brand trust and service networks, while innovative challengers (like Water TechniX, PureLine) will compete on price and feature sets for VS pumps. Competition will intensify, particularly in the value-oriented VS segment, driving down prices and improving features.

6. Emphasis on Durability and Long-Term Value: While initial cost remains a factor, consumers will increasingly prioritize long-term value, reliability, and warranty length. The higher upfront cost of a quality VS 1HP-equivalent pump will be justified by its energy savings, quieter operation, and longer lifespan (often 10+ years vs. 3-7 for single-speed). Warranties of 3 years or more, with some premium models offering 5-10 years, will become standard for VS pumps. Focus will also increase on corrosion-resistant materials for the harsh outdoor environment.

7. Rise of Replacement Cartridge Motors and DIY Maintenance: To extend the life of pump housings (especially for VS models), the market for compatible replacement motors (both single-speed and VS) will grow. This allows consumers to upgrade an older single-speed pump to VS without replacing the entire wet end, offering a cost-effective retrofit. Simultaneously, ease of maintenance (e.g., accessible strainer baskets, simple impeller cleaning) will be a key selling point, appealing to the DIY pool owner.

8. Sustainability and Environmental Awareness: Growing consumer environmental consciousness will influence purchasing decisions. The dramatically lower energy consumption of VS pumps directly translates to a reduced carbon footprint, making them the “green” choice. Marketing will increasingly highlight energy savings in kWh and cost, alongside environmental benefits. Recyclability of components may also become a minor factor.

In conclusion, by 2026, the “1HP Above Ground Pool Pump” market will be defined not by the simple horsepower rating, but by advanced variable speed technology, smart connectivity, regulatory compliance, and a strong focus on energy efficiency, noise reduction, and long-term value. The traditional single-speed pump will persist mainly in the replacement or budget segment, while VS pumps become the new standard for performance and efficiency.

Common Pitfalls When Sourcing a 1HP Above-Ground Pool Pump

Sourcing a 1HP above-ground pool pump may seem straightforward, but several critical pitfalls can compromise performance, longevity, and safety—especially when cutting corners on quality or ignoring Ingress Protection (IP) ratings. Avoid these common mistakes to ensure efficient and reliable pool operation.

Choosing Low-Quality Motors and Components

One of the most frequent pitfalls is selecting a pump based solely on price without evaluating build quality. Cheap pumps often use inferior motors, seals, and housings that wear out quickly, leading to leaks, overheating, and premature failure. Look for reputable brands with UL or ETL certification, copper-wound motors (not aluminum), and corrosion-resistant materials like UV-stabilized plastic or stainless steel components.

Ignoring IP (Ingress Protection) Rating

The IP rating indicates how well the pump is protected against dust and moisture—critical for outdoor pool equipment exposed to splashes, rain, and humidity. A common mistake is choosing a pump without a sufficient IP rating. For above-ground installations, always select a pump with at least IPX5 (protected against water jets). Avoid pumps with no IP rating or indoor-rated units (e.g., IP20), which are not designed for wet environments and pose electrical hazards.

Undersizing or Oversizing the Pump

A 1HP rating doesn’t guarantee proper flow for your pool. Using a pump that’s too powerful can cause excessive strain on plumbing, increase energy costs, and lead to cavitation. Conversely, an undersized pump may not circulate water effectively, reducing filtration and chemical distribution. Always match the pump’s flow rate (GPM) to your pool volume and plumbing size—most 1HP pumps are ideal for pools up to 15,000–20,000 gallons with standard 1.5″ or 2″ plumbing.

Overlooking Energy Efficiency

Many low-cost pumps consume significantly more energy due to inefficient motor design. While a standard single-speed 1HP pump is common, consider models with energy-saving features or variable speed options (if compatible with your system). These can reduce operating costs by up to 70%, paying for themselves over time despite a higher upfront cost.

Failing to Verify Voltage and Electrical Requirements

Ensure the pump matches your power supply (typically 115V or 230V). Using a 230V pump on a 115V circuit—or vice versa—can lead to motor burnout or safety issues. Also, confirm whether the pump includes a GFCI (Ground Fault Circuit Interrupter) requirement and ensure your electrical setup complies with local codes.

Skipping Warranty and Support Evaluation

Low-cost pumps often come with limited or non-transferable warranties and poor customer support. Always check warranty length (preferably 1–2 years minimum), availability of replacement parts, and accessible technical support. A slightly more expensive pump with strong backing is often a better investment.

By avoiding these pitfalls—prioritizing quality, respecting IP ratings, sizing correctly, and verifying electrical specs—you’ll ensure reliable, safe, and efficient pool pump operation for years.

Logistics & Compliance Guide for 1HP Pool Pump (Above Ground)

Product Classification & HS Code

The Harmonized System (HS) code for a 1HP above-ground pool pump is typically 8413.70.90. This classification covers “Pumps for liquids, whether or not fitted with a measuring device, other than pumps of heading 8413.11 to 8413.60, specifically electrically driven pumps for water circulation in swimming pools.” Confirm with your local customs authority, as interpretations may vary by country.

Packaging & Labeling Requirements

Ensure the pump is packaged in durable, corrugated cardboard with internal foam or molded inserts to prevent damage during transit. Labeling must include:

– Product name and model number

– 1HP motor rating and voltage (e.g., 115V/60Hz)

– Manufacturer name and contact information

– Safety certifications (e.g., UL, ETL, CE)

– Warning labels (electrical shock, moving parts)

– Direction of flow arrow on the pump housing

– Language compliance (e.g., English for U.S., bilingual for Canada)

Safety & Electrical Compliance

The 1HP above-ground pool pump must comply with regional safety standards:

– North America: UL 1081 (Standard for Safety for Swimming Pool Pumps, Filters, and Chlorinators) and ETL listing

– European Union: CE marking per Low Voltage Directive (2014/35/EU) and EMC Directive (2014/30/EU)

– Australia/NZ: RCM mark, compliant with AS/NZS 3112 and AS/NZS 60335.2.73

– Include GFCI (Ground Fault Circuit Interrupter) protection in installation instructions

Environmental & Energy Regulations

- Energy Efficiency: Comply with U.S. Department of Energy (DOE) standards for pool pumps (minimum energy efficiency levels). In the EU, adhere to Ecodesign Directive 2009/125/EC for energy-related products.

- RoHS Compliance (EU): Ensure the pump contains no restricted hazardous substances (e.g., lead, mercury, cadmium).

- REACH (EU): Register and disclose Substances of Very High Concern (SVHC) if present above thresholds.

Import & Customs Documentation

Prepare the following for international shipments:

– Commercial invoice (with HS code, value, and Incoterms)

– Packing list (item count, weight, dimensions)

– Certificate of Origin

– Test reports or compliance certificates (UL, CE, etc.)

– Bill of Lading or Air Waybill

– Import license (if required by destination country)

Transportation & Handling

- Use standard pallets (e.g., 48″ x 40″ in North America) for bulk shipments

- Secure pumps to prevent shifting; stack no higher than 5 layers

- Avoid exposure to extreme temperatures and moisture during transit

- Follow carrier-specific requirements for hazardous materials (if packaging contains foam with propellants)

Warranty & Post-Sale Compliance

- Provide a minimum 1-year manufacturer warranty

- Include multilingual installation and user manuals

- Offer online access to safety alerts and recall notices

- Maintain records for traceability (batch numbers, production dates) per consumer product safety regulations (e.g., CPSIA in the U.S.)

Disposal & End-of-Life

- Label product with WEEE symbol if sold in the EU to indicate proper electronic waste disposal

- Provide guidance for recycling motor components and plastic housing

- Comply with local e-waste take-back programs where applicable

Conclusion: Sourcing a 1 HP Above-Ground Pool Pump

Sourcing a 1 HP above-ground pool pump requires careful consideration of several key factors including energy efficiency, pump compatibility with your pool size, durability, brand reputation, and overall cost-effectiveness. A 1 HP pump strikes a balance between sufficient water circulation for medium to large above-ground pools and reasonable energy consumption, especially when selecting models with energy-saving features such as variable speeds or timer controls.

When sourcing, it is advisable to purchase from reputable suppliers or trusted retailers—online marketplaces like Amazon, Home Depot, or specialized pool supply stores often provide reliable options with customer reviews and warranties. Brands such as Intex, Hayward, Pentair, and PureLine are known for quality and performance in this category.

Additionally, ensure the pump meets local energy standards and includes essential safety certifications. While upfront cost is important, long-term savings on electricity and maintenance should also influence your decision. With proper research and attention to specifications, a 1 HP above-ground pool pump can deliver efficient, reliable performance, keeping your pool water clean and clear throughout the swimming season.