The global medium-density fiberboard (MDF) market is experiencing steady growth, driven by rising demand in furniture, construction, and interior design sectors. According to Grand View Research, the global MDF market size was valued at USD 73.5 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by increasing urbanization, the expansion of residential and commercial infrastructure, and a shift toward cost-effective, sustainable engineered wood products. Among the various thicknesses produced, 18mm MDF is especially popular for its structural strength and versatility in cabinetry, flooring, and architectural millwork. As demand intensifies, especially in emerging economies across Asia-Pacific and Latin America, manufacturers are scaling production and investing in eco-friendly technologies to meet stringent environmental standards. In this evolving landscape, identifying the leading 18mm MDF manufacturers becomes critical for sourcing high-quality, reliable materials. Based on production capacity, geographic reach, and sustainability credentials, here are the top 10 18mm MDF manufacturers shaping the industry today.

Top 10 18Mm Mdf Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

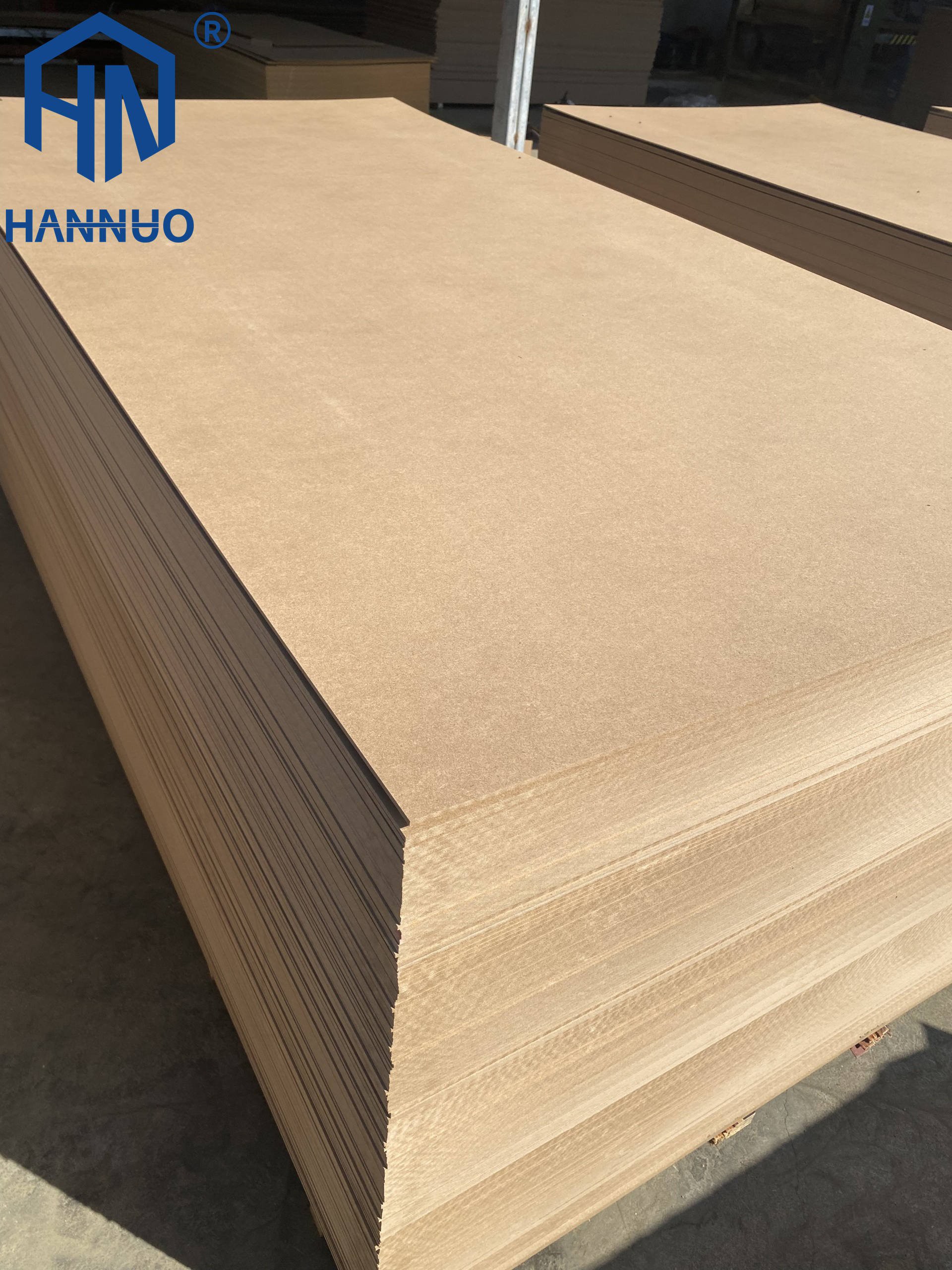

#1 18mm MDF Manufacturer, Supplier and Factory

Domain Est. 2023

Website: tlplywood.com

Key Highlights: At our MDF factory, we specialize in producing high-quality 18mm MDF that meets the diverse needs of various industries. As a reliable ODM, we pride ourselves ……

#2 High Quality 18mm Mdf Manufacturer and Supplier, Factory

Domain Est. 2015

Website: dongstar.com

Key Highlights: 18mm Mdf Manufacturers, Factory, Suppliers From China, With our rules of business reputation, partner trust and mutual benefit, welcome all of you to work ……

#3 Xingang 18mm Moisture Resistant Green MDF Factory Directly …

Domain Est. 2021

Website: xingang-wood.com

Key Highlights: Xingang 18mm Moisture Resistant Green MDF Factory Directly Produce For Furniture. Size:1220*2440mm. Thickness:2-25mm….

#4 Crosta Panels

Domain Est. 2022

Website: crostapanels.com

Key Highlights: Crosta Panels is one of the leading MDF board manufacturers in Yamuna Nagar, Haryana, India. We provide affordable and feasible MDF board price in Yamuna ……

#5 MDF Ultralight Trupan 18mm

Domain Est. 1999

Website: plywoodcompany.com

Key Highlights: It offers a smooth, sanded surface, homogenous surface and uniform color, making it ideal for moulding, millwork and furniture making. 18mm (3/4″) – 48″ x 96″…

#6 Greenpanel : MDF Ka Doosra Naam

Domain Est. 2000

Website: greenpanel.com

Key Highlights: We manufacture high-performance HDWR boards, MDF, Pre-Laminated MDF, Plywood, and Wooden Flooring, all crafted in our state-of-the-art plants in Uttarakhand and ……

#7 Standard MDF Boards

Domain Est. 2001

Website: madar.com

Key Highlights: High-density EN-compliant MDF boards with low formaldehyde (E1/E2). Available in 1.8–25mm thicknesses. Ideal for furniture, cabinetry & interiors. Shop now!…

#8 Al

Domain Est. 2009

Website: alnoormdf.com

Key Highlights: Al-Noor Lasani is the market leader and pioneer of decorative laminate surfaces in Pakistan. From home to commercial décor, from kitchens to furniture….

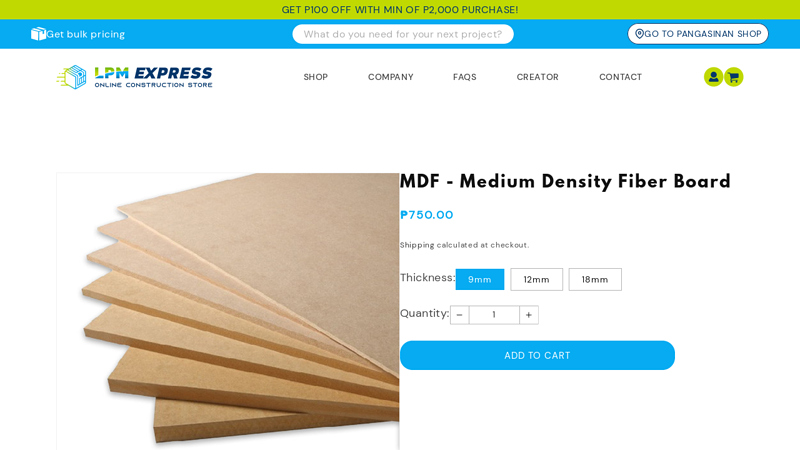

#9 MDF

Domain Est. 2021

Website: lpmexpress.com

Key Highlights: In stockMedium Density Fiber (MDF) boards – bare, ideal for furniture-making and partitions. Board Size: 4ft x 8ft / sheet. Items available for Delivery or Same Day ……

#10 MDF Board Manufacturer, MDF Sheet at Best Price in India

Domain Est. 2013

Website: vir-mdf.com

Key Highlights: India’s leading MDF Board manufacturer brand – VIRMDF. We are a supplier of MDF sheets at a competitive price which is available in different styles….

Expert Sourcing Insights for 18Mm Mdf

H2: Market Trends for 18mm MDF in 2026

As we approach 2026, the global market for 18mm Medium-Density Fiberboard (MDF) is poised for notable shifts driven by evolving construction demands, sustainability imperatives, technological advancements, and regional economic dynamics. This analysis outlines key trends shaping the 18mm MDF segment in the second half of 2025 and into 2026.

1. Increased Demand in Residential and Commercial Interiors

The 18mm thickness is particularly favored in furniture manufacturing, cabinetry, and interior architectural applications due to its optimal balance of strength, stability, and machinability. With continued growth in urban housing, modular homes, and renovations—especially in emerging markets like India, Southeast Asia, and parts of Africa—demand for 18mm MDF is expected to rise. The trend toward space-efficient and customizable furniture further supports its adoption.

2. Sustainability and Eco-Friendly Product Shift

Environmental regulations and consumer awareness are pushing manufacturers toward low-emission and formaldehyde-free MDF. By 2026, ultra-low-emitting formaldehyde (ULEF) and no-added-formaldehyde (NAF) MDF products are expected to capture over 40% of the premium 18mm MDF market, particularly in Europe and North America. Certification standards such as CARB2 (California Air Resources Board), FSC (Forest Stewardship Council), and PEFC are becoming prerequisites for market access.

3. Rise of Engineered and Moisture-Resistant MDF

Moisture-resistant (MR) and waterproof 18mm MDF variants are gaining traction in humid climates and for use in kitchens, bathrooms, and exterior applications. Innovations in resin technology and surface treatments are enhancing durability, expanding MDF’s application scope. In 2026, moisture-resistant 18mm MDF is projected to grow at a CAGR of 6.8%, outpacing standard grades.

4. Regional Production Shifts and Supply Chain Optimization

Asia-Pacific, particularly China and Vietnam, remains the dominant production hub for MDF due to cost advantages and robust wood supply chains. However, rising labor costs and environmental scrutiny are prompting some manufacturers to relocate or diversify production to countries like Indonesia, Malaysia, and Eastern Europe. Nearshoring trends in North America and Western Europe are also encouraging localized production to reduce logistics costs and carbon footprint.

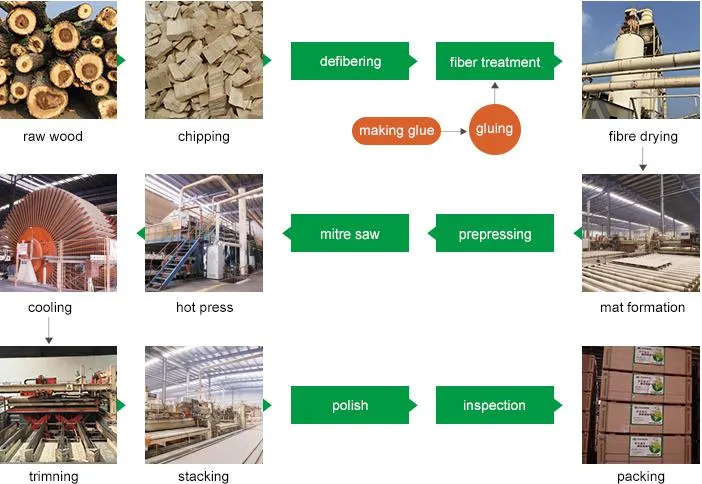

5. Digitalization and Smart Manufacturing

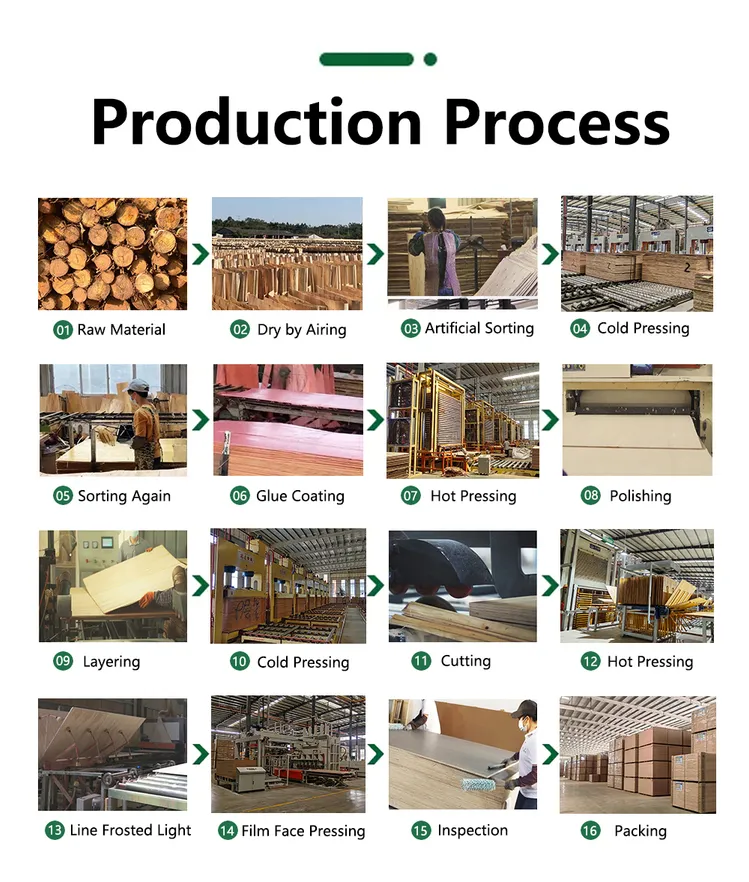

Adoption of Industry 4.0 technologies—such as AI-driven quality control, automated cutting systems, and digital inventory management—is improving efficiency in MDF production. By 2026, over 30% of large-scale MDF producers are expected to integrate smart manufacturing platforms, reducing waste and enabling faster customization, which is critical for the 18mm segment used in made-to-order furniture.

6. Competition from Alternative Materials

While MDF maintains a strong position, it faces growing competition from engineered wood alternatives such as plywood, particleboard with veneers, and bio-composites. However, the superior surface finish and consistency of 18mm MDF continue to give it an edge in high-end interior applications. Innovations in hybrid boards (e.g., MDF with bamboo or recycled wood fibers) may further solidify its market position.

7. Price Volatility and Raw Material Constraints

Fluctuations in wood chip and resin prices—driven by supply chain disruptions, energy costs, and geopolitical factors—could impact MDF pricing. In 2026, producers are likely to mitigate risks through long-term supplier contracts and increased use of recycled fiber, with some forecasts suggesting recycled content in MDF could reach 30–40% in leading markets.

Conclusion:

By 2026, the 18mm MDF market will be characterized by a push toward sustainability, enhanced product performance, and digital transformation in manufacturing. While challenges related to raw materials and competition persist, strategic innovation and regional adaptation will enable continued growth, particularly in high-value applications across residential, commercial, and design sectors.

Common Pitfalls When Sourcing 18mm MDF (Quality and Intellectual Property)

Sourcing 18mm Medium Density Fiberboard (MDF) can present several challenges, particularly concerning material quality consistency and potential intellectual property (IP) issues, especially when procuring from international or less-regulated suppliers. Being aware of these pitfalls is critical for ensuring project success, compliance, and brand integrity.

Inconsistent Material Quality

One of the most frequent issues when sourcing 18mm MDF is variability in core density, moisture resistance, and surface smoothness. Lower-quality boards may contain voids, inconsistent fiber distribution, or excessive glue content, leading to warping, poor screw-holding strength, or surface defects after machining or finishing. Boards not meeting formaldehyde emission standards (e.g., CARB P2, E1, or F****) can also pose health and regulatory risks.

Misrepresentation of Core Composition

Some suppliers may falsely advertise MDF as using virgin wood fibers when in fact it contains excessive recycled or contaminated fiber content. This can compromise structural integrity and finish quality. Additionally, claims of “moisture-resistant” or “waterproof” MDF may be exaggerated without proper certification (e.g., ANSI A208.1 or EN 622-5), leading to premature failure in humid environments.

Lack of Traceability and Certifications

Sourcing MDF without proper chain-of-custody documentation (such as FSC or PEFC certification) increases the risk of using wood fiber from illegal or unsustainable sources. This not only raises environmental and ethical concerns but can also lead to non-compliance with import regulations in regions like the EU (EUTR) or the US (Lacey Act).

Intellectual Property Infringement Risks

When sourcing MDF for use in finished products (e.g., furniture, cabinetry, or decorative panels), there is a potential IP risk if the supplier uses patented manufacturing processes, surface treatments, or embossed textures without proper licensing. Unauthorized use of proprietary finishes or laminate patterns—especially those mimicking branded wood grains or designer surfaces—can expose the buyer to legal liability for trademark or design patent infringement.

Hidden Costs from Non-Standard Dimensions and Tolerances

Suppliers may offer 18mm MDF that deviates from standard thickness tolerances (±0.2mm per ISO 16894). Even slight variations can affect assembly precision in CNC machining or modular construction. Additionally, non-standard sheet sizes or warped panels increase waste and labor costs during fabrication.

Poor Packaging and Handling Leading to Damage

Inadequate packaging—such as missing edge protectors or moisture barriers—can result in chipped edges, surface scratches, or water damage during transit. This not only affects usability but may void warranties or quality guarantees, especially if the damage is not immediately apparent upon delivery.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough due diligence on suppliers, request material test reports, verify certifications, and include clear quality and IP indemnification clauses in procurement contracts. Regular quality audits and sample testing are also essential to maintain consistency and compliance.

Logistics & Compliance Guide for 18mm MDF (Medium Density Fiberboard)

Overview

18mm Medium Density Fiberboard (MDF) is a widely used engineered wood product known for its uniform density, smooth surface, and ease of machining. Proper logistics planning and adherence to compliance standards are essential to ensure safe handling, transportation, and use of this material across international and domestic supply chains.

Packaging & Handling

Secure Packaging

– 18mm MDF panels should be packed flat on sturdy wooden or plastic pallets to prevent warping or edge damage.

– Use edge protectors (cardboard or plastic) on all four sides of the stack to prevent chipping.

– Wrap the entire stack with stretch film or waterproof plastic to protect against moisture and dust.

– Clearly label each package with product details: thickness (18mm), dimensions, quantity, batch number, and handling instructions (e.g., “This Side Up”, “Protect from Moisture”).

Handling Precautions

– Always use mechanical lifting equipment (e.g., forklifts, pallet jacks) when moving palletized MDF.

– Avoid dragging or dropping panels to prevent cracking or delamination.

– Store panels horizontally on flat, level surfaces to prevent bowing or sagging.

Storage Requirements

Environmental Conditions

– Store MDF in a dry, well-ventilated indoor area with controlled humidity (ideally 40–60% RH) and temperature (15–25°C).

– Keep panels off the ground using pallets or skids to avoid moisture absorption from concrete floors.

– Do not store near exterior doors, windows, or areas prone to water exposure.

Stacking Guidelines

– Stack no higher than 1.8 meters (6 feet) to prevent instability and damage.

– Place spacers (dunnage) between stacks if stored for extended periods to allow air circulation.

– Limit outdoor storage to no more than 72 hours and only under fully waterproof cover.

Transportation Standards

Domestic & International Shipping

– Secure pallets to truck beds or container floors using straps or load locks to prevent shifting.

– Use weatherproof tarpaulins or enclosed containers to protect against rain and humidity during transit.

– For sea freight, ensure compliance with ISPM 15 for wooden packaging materials (e.g., pallets must be heat-treated or fumigated and marked accordingly).

Labeling & Documentation

– Include shipping labels with consignee details, product description (18mm MDF), quantity, weight, and handling symbols.

– Provide a packing list and commercial invoice for international shipments.

– Include safety data sheet (SDS) if required by destination country.

Regulatory & Environmental Compliance

Formaldehyde Emissions

– Ensure 18mm MDF meets formaldehyde emission standards:

– CARB Phase 2 (USA): ≤ 0.05 ppm

– EPA TSCA Title VI (USA): Equivalent to CARB P2

– E1 (Europe): ≤ 0.124 mg/m³ (chamber test)

– F (Japan): ≤ 0.3 mg/L (desiccator test)

– Verify certification from the manufacturer (e.g., CARB, CE, FSC, PEFC).

Sustainable Sourcing

– Source MDF from suppliers with FSC (Forest Stewardship Council) or PEFC (Programme for the Endorsement of Forest Certification) certification to ensure responsible forestry practices.

– Maintain chain-of-custody documentation if marketing end products as sustainably sourced.

Hazard Communication

– Provide Safety Data Sheets (SDS) compliant with GHS (Globally Harmonized System).

– Warn end users about dust generation during cutting/sanding and recommend proper respiratory protection (e.g., N95 masks) and dust extraction systems.

Import/Export Considerations

Customs Documentation

– Accurately classify 18mm MDF under the correct HS Code:

– Typical HS Code: 4411.12 (MDF, density > 0.5 g/cm³, 18mm thickness).

– Declare formaldehyde compliance and wood treatment certifications where applicable.

Country-Specific Requirements

– EU: CE marking may be required under Construction Products Regulation (CPR) for certain applications.

– USA: Compliance with HUD and EPA regulations for indoor air quality.

– China: May require CNCA certification and compliance with GB 18580-2017 formaldehyde limits.

– Australia/NZ: Comply with AS/NZS 2985 for MDF standards.

Quality Assurance & Traceability

Inspection Protocols

– Verify panel thickness (18mm ± 0.3mm), density, moisture content (typically 4–8%), and surface quality upon receipt.

– Check for warping, delamination, or moisture damage before acceptance.

Batch Tracking

– Retain batch numbers and supplier certifications for at least 5 years to support traceability and compliance audits.

Summary

Proper logistics and compliance management for 18mm MDF ensures product integrity, regulatory adherence, and end-user safety. Key focus areas include moisture protection, formaldehyde compliance, sustainable sourcing, and accurate documentation. Always consult local regulations and work with certified suppliers to maintain supply chain reliability.

In conclusion, sourcing 18mm MDF (Medium-Density Fiberboard) requires careful consideration of quality, supplier reliability, cost-efficiency, and sustainability. It is essential to partner with reputable suppliers who can provide consistent thickness, smooth surface finish, and adherence to industry standards such as CARB or E0 for low formaldehyde emissions. Evaluating factors like delivery timelines, volume pricing, and logistical capabilities ensures a seamless supply chain. Additionally, prioritizing suppliers who offer eco-friendly or FSC-certified MDF options supports sustainability goals. By conducting thorough due diligence and maintaining strong supplier relationships, businesses can secure high-quality 18mm MDF that meets both performance requirements and environmental commitments.