The global 18650 lithium-ion battery market is experiencing robust growth, driven by rising demand in electric vehicles (EVs), consumer electronics, and energy storage systems. According to market research from Grand View Research, the global lithium-ion battery market size was valued at USD 58.2 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 14.6% from 2024 to 2030. The 18650 format—named for its 18mm diameter and 65mm height—remains one of the most widely used cylindrical cell types due to its high energy density, reliability, and scalability. With expanding applications in power tools, e-bikes, and grid storage, manufacturers are investing heavily in production capacity and cell technology improvements. As competition intensifies, a small group of key players dominate supply, innovation, and performance benchmarks. Based on market presence, production volume, cell performance metrics, and industry adoption, the following is a data-informed ranking of the top 10 18650 lithium cell manufacturers shaping the energy storage landscape in 2024.

Top 10 18650 Lithium Cells Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China Primary Lithium Battery Custom Rechargeable Li Ion Cell …

Domain Est. 2021

Website: enhcb.com

Key Highlights: HCB Battery Co., Ltd is a leading Chinese manufacturer of primary lithium battery packs and rechargeable Li ion cells, providing custom lithium battery ……

#2 Lithium ion Batteries

Domain Est. 1990

Website: energy.panasonic.com

Key Highlights: Lithium ion Batteries offer high energy density, light weight, and a long cycle life, which makes them useful in a wide range of consumer devices….

#3 Molicel

Domain Est. 2001

Website: molicel.com

Key Highlights: A leading manufacturer of high-performance lithium-ion batteries designed for energy storage, electric vehicles, and advanced applications….

#4 DNK Power

Domain Est. 2010

Website: dnkpower.com

Key Highlights: We own 10 cells production line and we have rich channel for Panasonic, Samsung, Sanyo Cell,from 18650 battery ,li-ion battery, lithium polymer battery, and ……

#5 Cells – APR18650m1B

Domain Est. 2016

Website: lithiumwerks.com

Key Highlights: Lithium Werks’ 18650 cells are capable of delivering very high power due to their use of patented Nanophosphate® battery technology….

#6 Sunpower New Energy: Lithium

Domain Est. 2023

Website: sunpowernewenergy.com

Key Highlights: As an outstanding lithium-ion battery manufacturer, Sunpower New Energy offers a wide selection of high rate cylindrical battery cells, including 18650 Li-ion ……

#7 South 8

Domain Est. 2008

Website: south8.com

Key Highlights: South 8’s LiGas cells are engineered to deliver unmatched performance and safety in the most demanding environments….

#8 Li

Domain Est. 2014

Website: liionwholesale.com

Key Highlights: 3-day deliveryVapcell N40 18650 10A Flat Top 4000mAh Battery – GenuineA 4000mAh 18650? Yep it’s real. This is the highest capacity 18650 battery in existence….

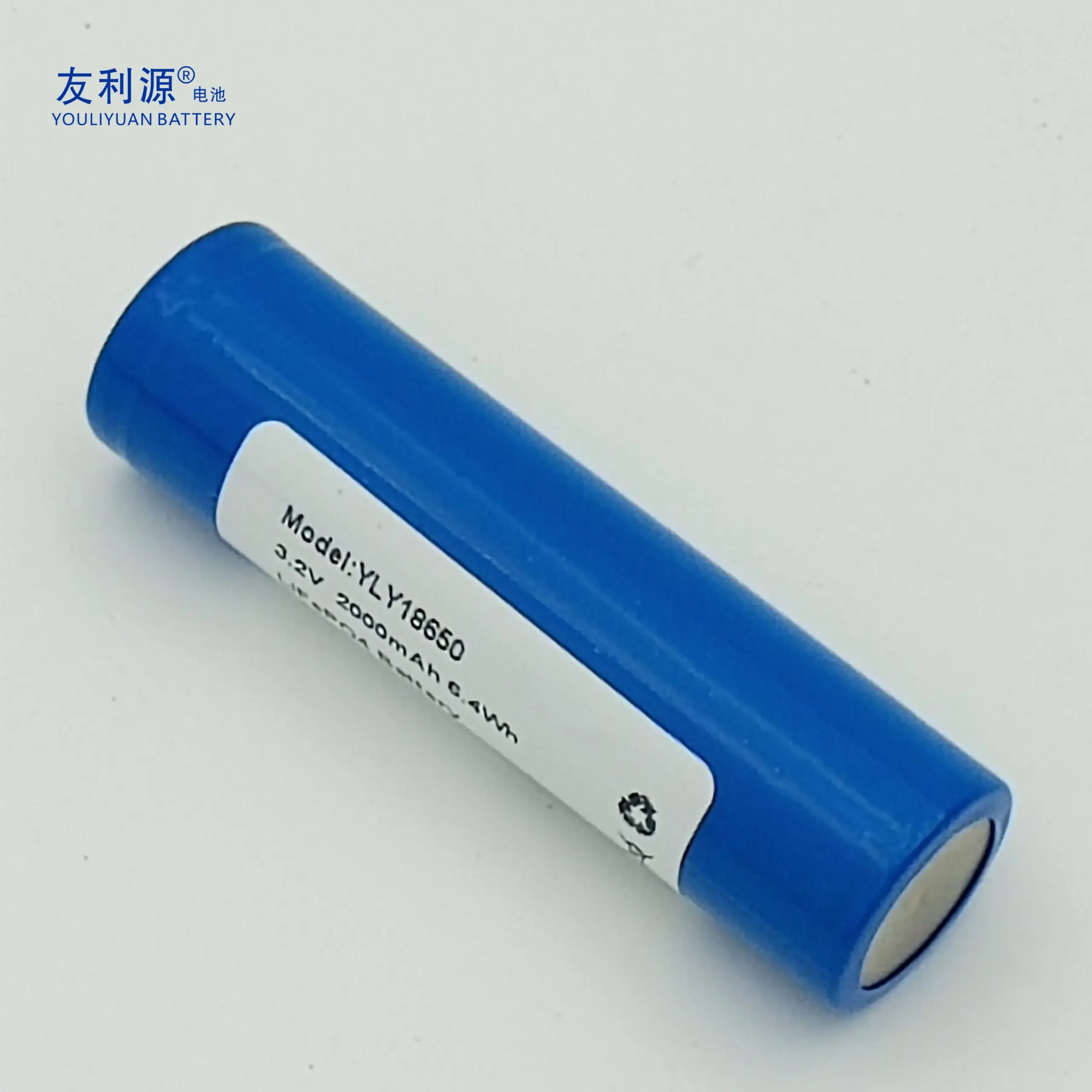

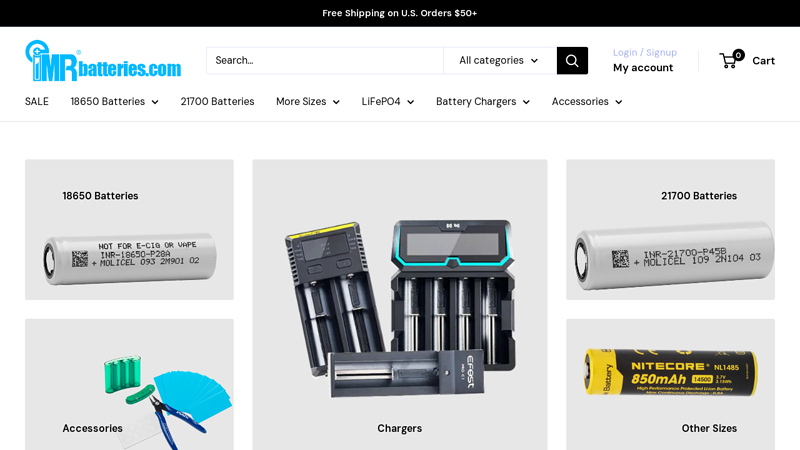

#9 IMR Batteries

Domain Est. 2014

Website: imrbatteries.com

Key Highlights: Free delivery over $50Browse a wide range of 18650 batteries at IMR Batteries. Enjoy reliable performance and trusted quality for all your power needs….

#10 Voltaplex Energy: Lithium

Domain Est. 2016

Website: voltaplex.com

Key Highlights: $4.90 deliveryExplore Voltaplex’s advanced lithium-ion batteries and cells for powerful and lasting device performance. Discover energy solutions designed for efficiency….

Expert Sourcing Insights for 18650 Lithium Cells

H2: 2026 Market Trends for 18650 Lithium-Ion Cells – Niche Resilience Amidst Intensifying Competition

While the broader lithium-ion battery market surges towards larger formats and solid-state technologies, the venerable 18650 cell faces a complex 2026 landscape defined by niched resilience, intense cost pressure, and strategic adaptation. Once the undisputed king of consumer electronics, its role is evolving rapidly.

1. Shrinking Core Markets, Persistent Niche Strength:

* Consumer Electronics Fade: Demand from laptops, power tools, and some high-end flashlights continues its gradual decline. These segments are increasingly dominated by larger, higher-energy-density prismatic and pouch cells (e.g., 21700, 26650, custom shapes) offering better space efficiency and thermal management in modern, thinner devices.

* Niche Dominance Endures: The 18650 remains unbeatable in specific, high-volume applications:

* Power Tools & Garden Equipment: Proven reliability, high discharge rates (especially in NMC variants), robust mechanical design, and established manufacturing/supply chains make them the preferred choice for major brands (DeWalt, Milwaukee, Bosch). Demand here remains strong and stable.

* E-Bikes & E-Scooters (Mid-Tier): While premium e-bikes shift to larger formats, the vast mid-tier and budget e-bike/e-scooter market relies heavily on cost-effective 18650 packs. Their standardized form factor simplifies pack design and replacement.

* Vape Devices & Portable Electronics: High discharge rates (for sub-ohm vaping) and compact size ensure continued, albeit volatile, demand in the vaping sector. Smaller portable power banks and specialty devices also persist.

* Industrial & Legacy Equipment: Uninterruptible Power Supplies (UPS), medical devices, and industrial tools with long design cycles continue using 18650s due to certification, reliability, and cost.

2. Intensifying Cost Pressure & Marginalization:

* Commoditization & Price Squeeze: As production scales for larger formats and newer chemistries, 18650s face relentless downward pressure on prices. Margins are thinning, pushing manufacturers towards extreme cost optimization.

* “Good Enough” Strategy: For applications where ultimate energy density or cutting-edge performance isn’t critical, 18650s offer a proven, reliable, and often cheaper solution than newer formats, especially when considering the total pack integration cost. Their maturity means lower manufacturing risk.

* Secondary Market & Repurposed Cells: The market for lower-grade or repurposed 18650s (e.g., from retired laptop packs) grows, feeding into DIY projects, low-cost solar storage, and budget e-bike conversions, further impacting new cell pricing dynamics.

3. Technological Stagnation vs. Incremental Refinement:

* Chemistry Plateau: Significant breakthroughs in 18650-specific chemistry are unlikely by 2026. Dominant chemistries remain:

* NMC (Nickel Manganese Cobalt): Balances energy, power, and cost (e.g., NMC 532, 622). Still the workhorse for power tools.

* NCA (Nickel Cobalt Aluminum): High energy density for applications like Tesla’s legacy Model S/X (though transitioning), but higher cost and slightly lower safety margin.

* LFP (Lithium Iron Phosphate): Growing adoption due to exceptional safety, long cycle life, lower cost, and tolerance for full charge. Gaining traction in e-bikes, scooters, and some power tools where slightly lower energy density is acceptable for safety and longevity. This is a key growth vector within the 18650 format.

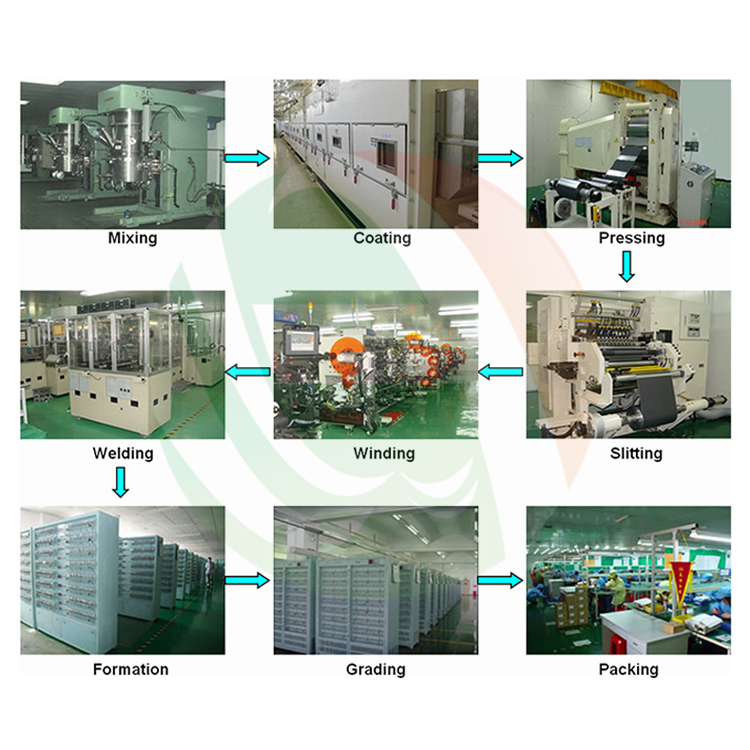

* Focus on Marginal Gains: Improvements focus on incremental increases in energy density (via higher nickel content or improved electrode engineering), cycle life, and safety (better separators, electrolyte additives) rather than revolutionary changes. Automation and yield improvements drive down costs.

4. Competitive Landscape:

* Consolidation & Focus: The market is dominated by a few major players (Samsung SDI, LG Energy Solution, Panasonic, Murata, EnerSys, Shenzhen BAK) who leverage massive scale. Smaller players struggle to compete on cost and quality.

* Shift to Larger Formats: The R&D and capacity investment focus for these giants is overwhelmingly on 21700, 4680, and prismatic cells for EVs and ESS. The 18650 line is often seen as mature and lower priority.

* Chinese Competition: Numerous Chinese manufacturers (e.g., EVE Energy, Lishen, Hersh Energy) offer competitive 18650s, particularly in the mid-tier and LFP segments, intensifying price pressure.

5. Sustainability & Supply Chain:

* Recycling Focus: Regulatory pressure (EU Battery Regulation) and corporate ESG goals will drive increased focus on recycling 18650s. Their standardized form factor makes them relatively easier to collect and process compared to diverse pouch cells.

* Material Sourcing: Continued scrutiny of cobalt sourcing (ethical concerns, price volatility) benefits LFP adoption within the 18650 space. Nickel and lithium supply chains remain critical.

Conclusion for 2026:

The 18650 cell is not dead, but its era of dominance is over. In 2026, it will be a highly specialized component thriving in specific, cost-sensitive, power-demanding, or safety-critical niches where its proven reliability, robust mechanical design, and established supply chain outweigh the disadvantages of lower energy density compared to newer formats. The key trends are niching, cost pressure, and the rising importance of LFP chemistry within the 18650 form factor. Its future lies not in innovation, but in efficient, reliable, and cost-effective execution for applications where it remains the “good enough” or even “best” solution for specific requirements. Expect stable but non-growth markets, intense competition on price, and continued pressure to deliver maximum value from a mature technology platform.

Common Pitfalls Sourcing 18650 Lithium Cells (Quality, IP)

Sourcing 18650 lithium-ion cells presents significant challenges, particularly concerning quality consistency and intellectual property (IP) risks. Buyers, especially in industrial, medical, or consumer electronics sectors, must navigate these pitfalls carefully to avoid safety hazards, product failures, and legal liabilities.

Quality Inconsistencies and Counterfeiting

One of the most pervasive issues in sourcing 18650 cells is the prevalence of substandard or counterfeit products. Many suppliers, particularly on open marketplaces or from certain regions, rebrand or misrepresent lower-grade or recycled cells as premium branded cells (e.g., genuine Panasonic, Samsung, or LG). Key quality-related pitfalls include:

- Capacity Misrepresentation: Cells are often labeled with inflated capacity ratings (e.g., 3500mAh) far exceeding their actual performance, which can degrade rapidly under load.

- Poor Cycle Life and Degradation: Low-quality cells exhibit significantly reduced cycle life and faster capacity fade, leading to premature product failure.

- Inconsistent Internal Resistance: High or variable internal resistance increases heat generation and reduces efficiency, posing safety and performance risks.

- Lack of Safety Features: Counterfeit or unbranded cells may lack essential safety mechanisms (e.g., CID – Current Interrupt Device, PTC – Positive Temperature Coefficient), increasing risks of thermal runaway, fire, or explosion.

- Absence of Certification: Genuine cells typically carry certifications such as UL, IEC, or UN38.3. Many low-cost alternatives lack proper testing or documentation, making them non-compliant with international safety standards.

Intellectual Property (IP) and Branding Violations

Sourcing 18650 cells also carries IP-related risks, particularly when dealing with counterfeit or imitation products:

- Trademark Infringement: Using cells falsely branded as “Panasonic NCR18650B” or “Samsung 30Q” without authorization constitutes trademark infringement. Distributing or incorporating such cells into end products exposes companies to legal action from original manufacturers.

- Patented Cell Chemistry and Design: Leading manufacturers invest heavily in R&D to develop proprietary electrode materials, electrolyte formulations, and cell architectures. Unauthorized replication or reverse engineering of these technologies infringes on patents and trade secrets.

- Supply Chain Accountability: Integrating counterfeit or IP-violating cells into a product can result in liability for downstream manufacturers, including recalls, reputational damage, and breach of customer contracts requiring genuine components.

- Misleading Documentation: Some suppliers provide falsified datasheets or test reports mimicking those of reputable brands, further complicating due diligence and increasing IP exposure.

Mitigation Strategies

To avoid these pitfalls, buyers should:

- Source cells directly from authorized distributors or the original manufacturers.

- Require third-party test reports (e.g., from Intertek or TÜV) verifying capacity, internal resistance, and safety compliance.

- Conduct batch testing and cell authentication (e.g., checking laser markings, dimensions, weight).

- Include IP indemnification clauses in supplier contracts.

- Avoid suspiciously low prices, which are often indicative of counterfeit or salvaged cells.

Failure to address these quality and IP concerns can result in unsafe products, regulatory non-compliance, and costly legal disputes—undermining both product integrity and brand trust.

H2: Logistics & Compliance Guide for 18650 Lithium-Ion Cells

Transporting 18650 lithium-ion cells requires strict adherence to international regulations due to their classification as hazardous materials. This guide outlines key logistics and compliance considerations under the UN Manual of Tests and Criteria, IATA Dangerous Goods Regulations (DGR), IMDG Code (for sea transport), and 49 CFR (for U.S. ground transport).

H2.1 Classification & Identification

- UN Number: UN 3480

- Proper Shipping Name: Lithium-ion batteries (including cells)

- Class: Class 9 – Miscellaneous Dangerous Goods

- Packing Group: Not assigned (varies based on test results)

- Lithium Content: Not applicable (lithium-ion), but watt-hour (Wh) rating is critical

✅ Each 18650 cell typically has a nominal capacity of 2,000–3,500 mAh and a voltage of 3.6–3.7 V.

Example: A 3,000 mAh 18650 cell = 3.0 Ah × 3.7 V = 11.1 Wh

H2.2 Transport Modes & Regulatory Frameworks

| Mode | Primary Regulation | Key Authority |

|——|——————–|————-|

| Air | IATA DGR (current edition) | IATA / FAA / EASA |

| Sea | IMDG Code (Amendment 41-22) | IMO |

| Ground (USA) | 49 CFR Parts 100–185 | DOT / PHMSA |

| Ground (EU) | ADR | UNECE |

⚠️ Always use the latest edition of the relevant regulation, updated annually.

H2.3 Packaging Requirements

- Cell-Level Shipments (UN 3480, PI 965)

- Section IA: Cells packed alone (not in equipment) – Strictest requirements

- Must be packed in strong, rigid outer packaging

- Prevent short circuits (individually insulated or placed in inner packs)

- Protection against physical damage and movement

-

Max 2.5 kg per package for air transport (some exceptions apply)

-

Battery-Level Shipments (e.g., 18650s assembled into packs)

- Classified under same UN 3480 but may qualify for different provisions (e.g., PI 966, PI 967 if packed with or contained in equipment)

✅ Recommended: Use plastic clamshells or individual plastic sleeves for 18650s

✅ Use non-conductive inner packaging and cushioning (e.g., bubble wrap, foam)

H2.4 State of Charge (SoC) Limitations

- Air Transport (IATA DGR):

- Cells must not exceed 30% state of charge when shipped alone (PI 965, Section IA)

-

Manufacturer’s documentation must confirm SoC compliance

-

Sea & Ground:

- No universal SoC limit, but best practice is ≤30% for safety

- Some carriers may impose SoC restrictions

📄 Maintain test reports or certificates from suppliers verifying SoC

H2.5 Marking & Labeling

Each package must display:

- Proper Shipping Name: “LITHIUM ION BATTERIES”

- UN Number: UN 3480

- Class 9 Hazard Label (diamond-shaped)

- Cargo Aircraft Only Label (if applicable – e.g., large shipments exceeding passenger aircraft limits)

- Shipper/Consignee Name & Address

- Lithium Battery Handling Label (IATA/IMDG compliant)

✅ Label must be durable, visible, and at least 120 x 110 mm

✅ Include “Lithium Ion” and not “Lithium Metal”

H2.6 Documentation

- Shipper’s Declaration for Dangerous Goods (required for air transport if >1 package under PI 965 IA)

- Safety Data Sheet (SDS) – Required under OSHA/GHS (at least Section 14: Transport Information)

- Origin & Compliance Statement – Confirming UN 38.3 test compliance

📄 UN 38.3 Test Summary must be available upon request (mandatory since 2020 under IATA DGR)

H2.7 UN 38.3 Testing Requirements

All 18650 cells must pass UN Manual of Tests and Criteria, Part III, Subsection 38.3, including:

- Altitude Simulation (T.1)

- Thermal Test (T.2)

- Vibration (T.3)

- Shock (T.4)

- External Short Circuit (T.5)

- Impact/Crush (T.6/T.7)

- Overcharge (T.8)

- Forced Discharge (T.9)

✅ Suppliers must provide UN 38.3 test summary (not just a certificate)

✅ Test reports must be <5 years old and issued by accredited lab

H2.8 Quantity Limits & Exceptions

- Passenger Aircraft:

- Limited to 2.5 g lithium content equivalent per cell (not applicable to lithium-ion)

- Practical limit: ≤100 Wh per battery for consumer exceptions

-

100 Wh but ≤160 Wh: Max 2 spare batteries allowed in carry-on (not applicable to wholesale)

-

Cargo-Only Aircraft:

-

Higher limits permitted with proper documentation and packaging

-

De Minimis Exception (49 CFR & IATA):

- Shipments with <2.5 kg gross weight may qualify for limited quantity relief (check current thresholds)

H2.9 Carrier-Specific Requirements

- DHL, FedEx, UPS: Require approved packaging, Shipper’s Declaration, and advance notification

- Air Freight Forwarders: May require lithium battery shipment approval forms

- Vessel Operators (Sea): Require dangerous goods manifest and proper stowage plans

✅ Pre-clear shipments with carrier before tendering

H2.10 Storage & Handling Best Practices

- Store in fire-resistant, non-conductive containers

- Avoid extreme temperatures (>60°C or <-20°C)

- Use anti-static materials during packing

- Train staff in hazardous materials handling (DOT/IATA training required every 2 years)

H2.11 Penalties for Non-Compliance

- Fines up to $100,000+ per violation (DOT/FAA)

- Cargo rejection, flight delays, or destruction of goods

- Criminal liability in cases of willful violation

- Loss of shipping privileges with carriers

Summary Checklist (H2)

| Task | Required? |

|——|———|

| Confirm UN 38.3 test summary | ✅ |

| Limit SoC to ≤30% (air) | ✅ |

| Use Class 9 label & lithium mark | ✅ |

| Prevent short circuits (insulate terminals) | ✅ |

| Complete Shipper’s Declaration (if needed) | ✅ |

| Verify carrier-specific requirements | ✅ |

| Train personnel annually | ✅ |

H2 Final Note:

Compliance is non-negotiable. Always consult the latest regulatory text and involve a certified Dangerous Goods Safety Advisor (DGSA) for high-volume or international shipments.

Conclusion on Sourcing 18650 Lithium-Ion Cells

Sourcing high-quality 18650 lithium-ion cells requires careful consideration of safety, performance, authenticity, and long-term reliability. While numerous manufacturers and suppliers offer these cells globally—ranging from reputable OEMs like Samsung, LG, Panasonic, and Sony to lesser-known brands—there is a significant risk of counterfeit or substandard products in unregulated markets.

Key conclusions for responsible sourcing include:

-

Prioritize Reputable Manufacturers: Stick to proven brands known for stringent quality control, high energy density, and reliable safety features. Cells like the Samsung 30Q, LG M50LT, or Panasonic NCR18650B are trusted choices for high-performance applications.

-

Verify Authenticity: Use trusted distributors or purchase directly from authorized suppliers to avoid counterfeit cells, which pose serious safety and performance risks. Counterfeit cells often fail prematurely or present fire and explosion hazards.

-

Evaluate Specifications Critically: Ensure datasheets match actual performance. Pay attention to key parameters such as capacity (mAh), continuous discharge rate (A), internal resistance, cycle life, and safety certifications.

-

Consider Application Needs: Matching cell specifications to the intended use—whether for high-drain devices (e.g., power tools), energy storage systems, or consumer electronics—is essential for optimal performance and safety.

-

Factor in Total Cost of Ownership: While cheaper cells may reduce upfront costs, poor quality can lead to early failures, safety incidents, and higher long-term expenses. Investing in genuine, high-quality cells provides better ROI and safety assurance.

-

Adhere to Safety and Regulatory Standards: Ensure supplied cells meet relevant safety standards (e.g., UL, CE, IEC 62133) and are handled, stored, and integrated in accordance with best practices.

In conclusion, sourcing 18650 cells should prioritize safety, authenticity, and performance over cost alone. Establishing relationships with trustworthy suppliers and conducting due diligence on product quality are critical steps in building reliable and safe battery systems.