The global alkaline battery market continues to expand steadily, driven by rising demand across consumer electronics, healthcare devices, and portable lighting applications. According to Grand View Research, the global primary battery market was valued at USD 12.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Mordor Intelligence further highlights that increasing usage of 1.5 V AA and AAA batteries in household and industrial devices is a significant growth driver. With sustained demand and technological improvements in energy density and shelf life, the competitive landscape has seen key manufacturers scaling production and investing in sustainable innovations. Against this backdrop, eight leading companies have emerged as dominant players in the 1.5 V alkaline battery segment, combining extensive R&D, global distribution networks, and high-volume manufacturing capabilities to capture significant market share worldwide.

Top 8 1.5 V Alkaline Battery Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 D Size 1.5v Alkaline Battery

Domain Est. 1997

Website: mecampbell.com

Key Highlights: The Duracell PC1300 Procell 1.5-Volt Alkaline Button Top D-Cell Batteries are manufactured specially for professional and industrial applications; these ……

#2 1.5-volt, alkaline C battery PC1400BKD

Domain Est. 1993

Website: spi.com

Key Highlights: 30-day returns1.5-volt, alkaline C battery PC1400BKD: 99.9% mercury free, easily recyclable Alkaline strength for extreme applications….

#3 Duracell: Batteries

Domain Est. 1995

Website: duracell.com

Key Highlights: Explore AA batteries, rechargeable batteries, chargers, coin button batteries and more from Duracell, the longer-lasting and #1 trusted battery brand….

#4 Procell Alkaline Intense Batteries

Domain Est. 2001

Website: procell.com

Key Highlights: Procell Alkaline Intense Batteries ; Procell Alkaline Intense AA, 1.5V · PX1500 ; Procell Alkaline Intense C, 1.5V · PX1400 ; Procell Alkaline Intense D, 1.5V….

#5 Procell® Size AAA Alkaline Battery

Domain Est. 2002

Website: catalog.mccallacompany.com

Key Highlights: Free deliveryProcell® Size AAA Alkaline Battery – 1.5 Volt | Long lasting and dependable – even after seven years of storage. Long service life at high drain discharges….

#6 AA & AAA Battery

Domain Est. 2015

Website: xtar.cc

Key Highlights: Seeking wholesale Chinese aa batteries from XTAR. We export rechargeable 1.5V aa lithium batteries for professional devices. Contact for samples….

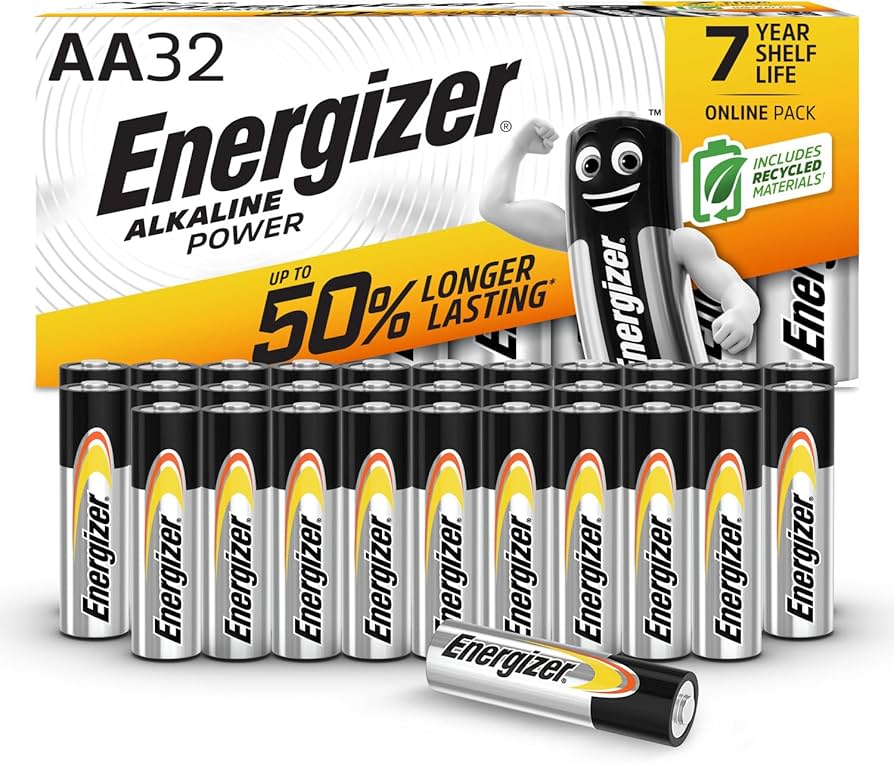

#7 Energy AA Batteries

Domain Est. 2015

Website: varta-ag.com

Key Highlights: Our VARTA Energy range provides the best energy for those low-drain devices. Keep all your options with reliable performance every minute of the day….

#8 GMCELL Wholesale 1.5V Alkaline AA Battery

Domain Est. 2023

Website: gmcellgroup.com

Key Highlights: Get long-lasting power for your devices with GMCELL Wholesale 1.5V Alkaline AA Batteries. Buy in bulk to save money and never run out of power again!…

Expert Sourcing Insights for 1.5 V Alkaline Battery

H2: Market Trends for 1.5V Alkaline Batteries in 2026

The global market for 1.5V alkaline batteries is expected to experience moderate but steady evolution by 2026, shaped by technological inertia, environmental regulations, shifting consumer behavior, and competition from alternative power sources. While alkaline batteries remain a staple in low-drain consumer electronics, several key trends are emerging that will influence their market trajectory in the coming years.

1. Declining Growth in Developed Markets, Resilience in Emerging Economies

In North America and Western Europe, demand for 1.5V alkaline batteries is projected to remain flat or decline slightly by 2026. This stagnation is driven by widespread adoption of rechargeable devices (e.g., smartphones, wireless earbuds), increased use of lithium-ion batteries, and growing consumer preference for eco-friendly alternatives. However, in emerging markets across Asia-Pacific, Africa, and Latin America, alkaline battery demand is expected to grow modestly due to rising disposable incomes, expanding access to consumer electronics (remote controls, flashlights, toys), and limited charging infrastructure. These regions will act as the primary growth drivers for the alkaline battery segment.

2. Environmental Regulations and Sustainability Pressures

Environmental concerns are increasingly influencing battery design and disposal practices. By 2026, stricter regulations—such as the EU’s Battery Regulation (effective 2023 onward)—will require improved labeling, collection targets, and the eventual phase-out of non-rechargeable batteries with low sustainability profiles. While alkaline batteries are less toxic than older zinc-carbon or mercury-containing types, they are still largely single-use and contribute to electronic waste. As a result, manufacturers are investing in recyclability initiatives and exploring “greener” formulations, such as mercury- and cadmium-free chemistries. However, without significant advances in closed-loop recycling, alkaline batteries may face long-term regulatory headwinds.

3. Competition from Rechargeable Alternatives

The rise of low-self-discharge (LSD) NiMH and emerging lithium primary batteries poses a growing challenge to alkaline batteries. By 2026, advancements in rechargeable AA/AAA technology—offering similar voltage (1.5V), longer cycle life, and reduced environmental impact—are expected to capture market share in mid- to high-drain applications (e.g., digital cameras, gaming peripherals). Price reductions in rechargeable systems and bundled chargers are making them more accessible, further eroding the dominance of single-use alkaline cells. Nevertheless, alkaline batteries retain advantages in shelf life (up to 10 years), reliability in extreme temperatures, and lower upfront cost, ensuring continued use in emergency and low-drain devices.

4. Innovation in Product Differentiation and Branding

To maintain relevance, major players like Energizer, Duracell, and Panasonic are focusing on product differentiation. By 2026, expect to see enhanced alkaline formulations with longer runtime, better performance in cold environments, and eco-conscious packaging (e.g., recyclable cardboard, reduced plastic). Some brands are introducing “hybrid” or “premium alkaline” lines that bridge the performance gap with rechargeables. Additionally, marketing strategies emphasizing reliability, brand trust, and emergency preparedness will continue to resonate, particularly during natural disasters or power outages.

5. Supply Chain and Raw Material Dynamics

The cost and availability of zinc and manganese dioxide—the primary materials in alkaline batteries—are expected to remain relatively stable through 2026. However, supply chain resilience will be a growing concern, with manufacturers diversifying sourcing and increasing regional production to mitigate geopolitical risks and shipping disruptions. Additionally, potential carbon taxation or “green” tariffs could increase production costs, which may be passed on to consumers or absorbed through operational efficiencies.

Conclusion

By 2026, the 1.5V alkaline battery market will occupy a shrinking but still essential niche in the broader portable power ecosystem. While facing pressure from environmental policies and rechargeable alternatives, alkaline batteries will persist due to their affordability, reliability, and widespread compatibility. Growth will be concentrated in developing regions and specific use cases (e.g., smoke detectors, remote controls). Long-term viability will depend on the industry’s ability to innovate sustainably and adapt to a world increasingly focused on circular economy principles.

H2: Common Pitfalls When Sourcing 1.5 V Alkaline Batteries (Quality and Intellectual Property Risks)

Sourcing 1.5 V alkaline batteries—commonly used in consumer electronics, medical devices, and industrial equipment—can expose buyers to several quality and intellectual property (IP) pitfalls if due diligence is not exercised. These risks are especially pronounced when sourcing from third-party manufacturers or low-cost suppliers in competitive global markets.

1. Substandard Quality and Performance

A major pitfall is receiving batteries that do not meet claimed specifications. Common issues include:

– Lower capacity or shorter shelf life: Counterfeit or inferior batteries may use subpar chemicals or reduced zinc/manganese dioxide content, leading to premature voltage drop and reduced runtime.

– Inconsistent voltage output: Poor manufacturing control can result in voltage instability, damaging sensitive electronics.

– Leakage and corrosion: Inferior seals or casing materials increase the risk of electrolyte leakage, which can ruin devices and pose safety hazards.

– Exaggerated performance claims: Some suppliers misrepresent battery life or endurance without independent testing certification (e.g., IEC 60086).

2. Misrepresentation of Branding and Trademarks (IP Infringement)

– Counterfeit branded batteries: Unscrupulous suppliers may pass off generic batteries as premium brands (e.g., Duracell, Energizer), violating trademark laws.

– Unauthorized use of logos or packaging: Suppliers may replicate packaging designs to mimic genuine products, exposing buyers to legal liability for IP infringement.

– Grey market goods: Batteries sourced from unauthorized channels may lack warranty or regulatory compliance, and their resale could breach brand protection agreements.

3. Lack of Compliance and Certification

– Missing safety certifications: Reputable batteries should comply with standards such as IEC 60086, RoHS, and REACH. Non-compliant products may be unsafe or illegal to sell in certain regions.

– Improper labeling or MSDS: Absence of proper material safety data sheets or hazard labeling can lead to regulatory penalties, especially in the EU or North America.

4. Supply Chain Transparency Issues

– Opaque manufacturing origins: Some suppliers obscure the actual production facility, increasing the risk of counterfeit or conflict-material components.

– No batch traceability: Without lot numbers or traceability, recalls become impossible if quality issues emerge.

5. Hidden Costs from Poor Reliability

While low-cost batteries may seem economical upfront, poor reliability can lead to:

– Increased device failure rates

– Higher warranty and support costs

– Damage to end-product reputation

Mitigation Strategies

– Source from authorized distributors or OEMs with verifiable quality management systems (e.g., ISO 9001).

– Require test reports, safety certifications, and batch traceability.

– Audit suppliers and conduct independent product testing.

– Avoid suppliers offering “premium equivalent” batteries at suspiciously low prices.

– Ensure contracts include IP indemnification clauses to protect against trademark infringement claims.

In summary, sourcing 1.5 V alkaline batteries requires careful vetting to avoid quality defects and IP violations. Prioritizing reliability, compliance, and brand integrity over low prices helps mitigate long-term risks.

H2: Logistics & Compliance Guide for 1.5 V Alkaline Batteries

1. Product Overview

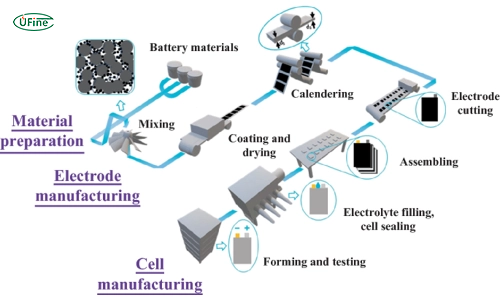

1.5 V alkaline batteries are single-use primary batteries commonly used in household, medical, industrial, and consumer electronic devices. They are typically manufactured in standard sizes such as AA, AAA, C, D, and 9V (though 9V batteries are 9 volts, they are composed of six 1.5 V cells). These batteries use zinc and manganese dioxide as active materials with an alkaline (potassium hydroxide) electrolyte.

2. Regulatory Classification & Compliance

2.1 UN/DOT Classification (Transportation)

– UN Number: UN 1600

– Proper Shipping Name: BATTERIES, WET, NON-SPILLABLE, or BATTERIES, WET, NON-SPILLABLE, WITH ACID

Note: This applies to non-spillable lead-acid batteries.

✅ For 1.5 V Alkaline Batteries:

– Alkaline batteries are not classified as hazardous under DOT 49 CFR when shipped by themselves (not contained in equipment).

– Classification: Not Restricted under IATA, IMDG, and ADR when properly packaged.

– UN Number: Not applicable (non-hazardous for transport in most cases).

– IATA (Air): Allowed in passenger and cargo aircraft under Special Provision A123 when installed in equipment or shipped alone in small quantities.

– IMDG (Sea): Not subject to the IMDG Code when shipped as standalone batteries.

– ADR (Road, Europe): Not classified as dangerous goods under ADR when transported alone.

2.2 Environmental & Safety Regulations

– RoHS (EU): Compliant with Restriction of Hazardous Substances Directive 2011/65/EU. Alkaline batteries contain minimal or no mercury, cadmium, or lead, meeting RoHS requirements.

– REACH (EU): Substances of Very High Concern (SVHC) must be declared if present above threshold (0.1%). Alkaline batteries typically do not contain SVHCs.

– Battery Directive 2006/66/EC (EU):

– Requires labeling with a crossed-out wheeled bin symbol.

– Limits mercury content to <0.0005% by weight (5 ppm).

– Mandates recycling and collection schemes.

– US EPA: Alkaline batteries are not considered hazardous waste under RCRA when disposed of in the US (due to mercury phase-out). However, recycling is encouraged.

– Proposition 65 (California): Requires warning labels if batteries contain listed chemicals (e.g., nickel, cobalt—though typically not in high levels in alkaline batteries). Check specific formulations.

3. Packaging & Labeling Requirements

3.1 Packaging

– Use sturdy, non-conductive, and non-combustible packaging.

– Prevent short circuits:

– Terminals must be insulated (e.g., tape over terminals, individual blister packs, or non-conductive dividers).

– Batteries should not contact metal objects or each other.

– Use packaging that prevents movement during transit.

– For bulk shipments, use inner packaging within an outer box meeting ISTA or ASTM standards.

3.2 Labeling

– Product Label: Include:

– Voltage (1.5 V)

– Battery type (Alkaline)

– Size (e.g., AA, AAA)

– Manufacturer name and contact

– Date of manufacture or expiry (if applicable)

– RoHS, CE, or other compliance marks (if applicable)

– Recycling Symbol: Crossed-out wheeled bin (per EU Battery Directive).

– No Hazard Labels Required for standalone alkaline batteries in most transport modes.

– For batteries packed with equipment: Comply with IATA/IMDG/ADR rules for “batteries contained in equipment.”

4. Transportation Guidelines

4.1 Air Transport (IATA)

– Allowed in passenger and cargo aircraft under Special Provision A123 (IATA DGR 2024):

– Up to 2 kg per package for standalone batteries.

– Batteries must be protected from short circuits and damage.

– Batteries installed in equipment: No limit on quantity, but equipment must be protected against accidental activation.

4.2 Ocean Freight (IMDG Code)

– Not regulated as dangerous goods when shipped standalone.

– Follow general cargo handling practices.

– Avoid exposure to seawater or moisture.

4.3 Road Transport (ADR/EU)

– Not classified as dangerous goods.

– No placards or ADR training required.

– Ensure packages are secured and terminals insulated.

4.4 Rail & Multimodal

– Follow IATA/IMDG/ADR standards as applicable.

– General cargo rules apply.

5. Storage & Handling

– Environment: Store in a cool, dry place (15–25°C; 59–77°F). Avoid extreme temperatures and humidity.

– Shelf Life: Typically 5–10 years; store upright and in original packaging.

– Safety:

– Do not mix old and new batteries.

– Do not recharge alkaline batteries (risk of leakage/explosion).

– Keep away from children and pets.

– Avoid puncturing, crushing, or incinerating.

6. End-of-Life & Recycling

– Disposal:

– In the US: Generally legal to dispose in household trash (non-hazardous), but recycling is preferred.

– In the EU: Must be collected and recycled per Battery Directive.

– In Canada: Provincially regulated; many require recycling (e.g., Ontario, BC).

– Recycling Programs:

– Use programs like Call2Recycle (North America), WEEE (EU), or local municipal collection.

– Retail take-back (e.g., hardware stores, electronics retailers).

– Labeling: Include recycling instructions on packaging (e.g., “Recycle or dispose of properly per local regulations”).

7. Documentation & Recordkeeping

– Maintain:

– Safety Data Sheet (SDS) – Section 14: Transport Information should state: “Not regulated as a hazardous material.”

– Certificate of Compliance (RoHS, REACH, Battery Directive)

– Shipping manifests (non-hazardous classification)

– Records of recycling partners and waste disposal

8. Key Compliance Summary

| Requirement | Status for 1.5 V Alkaline Batteries |

|——————————-|———————————————|

| UN Number (Transport) | Not applicable (non-hazardous) |

| IATA Regulation | Allowed under A123; no hazard label needed |

| IMDG Code | Not subject |

| ADR (Road) | Not restricted |

| RoHS (EU) | Compliant |

| Battery Directive (EU) | Compliant; labeling required |

| REACH | Check SVHC; typically compliant |

| US EPA (RCRA) | Not hazardous waste |

| Prop 65 (CA) | May require warning if applicable |

| Recycling Required (EU) | Yes |

| Recycling Required (US) | Encouraged, not mandatory federally |

9. Best Practices

– Always verify updated regulations (IATA, IMDG, ADR are updated annually).

– Use third-party testing labs for compliance verification (e.g., SGS, TÜV).

– Train logistics staff on battery-specific handling.

– Engage certified recyclers for end-of-life management.

– Monitor changes in battery chemistry and regulatory trends (e.g., push for greener batteries).

10. References

– IATA Dangerous Goods Regulations (2024)

– IMDG Code, Amendment 42

– ADR 2023

– EU Battery Directive 2006/66/EC

– RoHS Directive 2011/65/EU

– US DOT 49 CFR

– EPA Battery Management Guidelines

– Manufacturer SDS (e.g., Duracell, Energizer)

✅ Conclusion: 1.5 V alkaline batteries are generally non-hazardous for transport and widely compliant with global regulations when properly packaged and labeled. However, adherence to environmental directives (especially in the EU) and recycling obligations is critical for full compliance.

Conclusion for Sourcing 1.5V Alkaline Batteries

Sourcing 1.5V alkaline batteries requires a balanced approach that considers quality, cost, reliability, and sustainability. After evaluating various suppliers and procurement options, it is clear that partnering with reputable manufacturers or authorized distributors ensures consistent product performance and compliance with safety standards. While cost-efficiency is important, particularly for high-volume purchases, it should not compromise battery life, leakage resistance, or environmental impact.

Opting for well-known brands or ISO-certified suppliers provides assurance of quality and reduces the risk of device damage due to battery failure. Additionally, exploring bulk purchasing agreements, long-term contracts, and eco-friendly disposal or recycling programs can enhance supply chain efficiency and support corporate sustainability goals.

In conclusion, a strategic sourcing approach that prioritizes reliability, performance, and responsible procurement will ensure a steady supply of high-quality 1.5V alkaline batteries, meeting both operational needs and environmental responsibilities.