The global market for laboratory plasticware, including 15 mL tubes, is experiencing steady growth driven by rising demand in pharmaceutical, biotechnology, and clinical research sectors. According to a 2023 report by Mordor Intelligence, the laboratory plasticware market is projected to grow at a CAGR of 6.8% from 2023 to 2028, fueled by increased R&D expenditures and expanding diagnostic testing capacities worldwide. Additionally, Grand View Research estimates that the global centrifuge consumables market—of which 15 mL tubes are a critical component—will expand at a CAGR of 7.2% from 2022 to 2030, supported by advancements in cell biology and microbiology applications. As demand for precision, sterility, and scalable lab solutions grows, the need for reliable 15 mL tube manufacturers has become paramount. This list highlights the top six manufacturers leading the market with innovative designs, high-quality materials, and broad regulatory compliance, serving laboratories across academic, industrial, and clinical environments.

Top 6 15 Ml Tube Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Corning® 15mL Centrifuge Tubes

Domain Est. 1991

Website: ecatalog.corning.com

Key Highlights: Corning 15 mL centrifuge tubes feature black printed graduations and a large white marking spot. Available with your choice of cap styles: the advanced ……

#2 Centrifuge Tubes

Domain Est. 1991

Website: corning.com

Key Highlights: Corning offers a full line of disposable, premium quality conical centrifuge tubes manufactured from high quality, ultra-clear resins….

#3 Eppendorf Conical Tubes 15 mL and 50 mL

Domain Est. 1995

Website: eppendorf.com

Key Highlights: The Eppendorf Conical Tubes 15 mL or 50 mL are made from the highest quality materials and can be used for a diverse range of laboratory applications – from ……

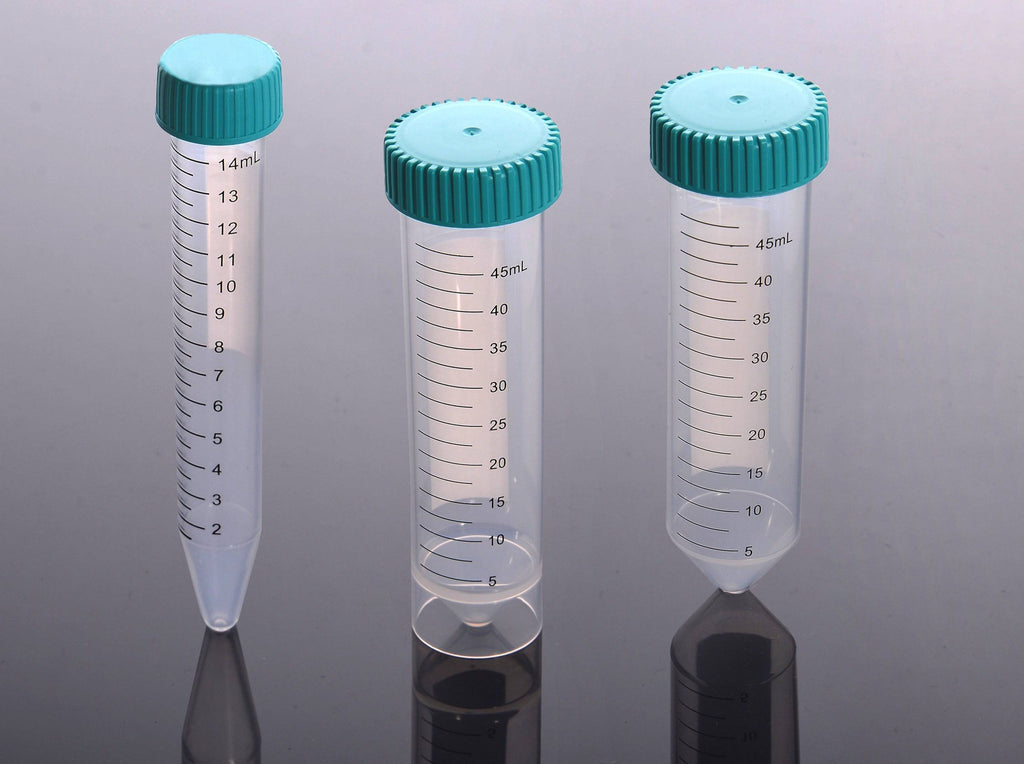

#4 General Purpose 15 & 50mL Centrifuge Tubes

Domain Est. 1997

Website: globescientific.com

Key Highlights: 6-day delivery 90-day returnsGeneral Purpose 15 & 50mL Centrifuge Tubes. Globe Scientific offers a large selection of high-quality general purpose scew cap centrifuge tubes to choo…

#5 15 ml centrifuge tubes

Domain Est. 1998

Website: sigmaaldrich.com

Key Highlights: 1–3 day deliveryFind 15 ml centrifuge tubes and related products for scientific research at MilliporeSigma….

#6 15mL and 50mL Centrifuge Tubes

Domain Est. 2007

Website: celltreat.com

Key Highlights: Free deliveryAvailable in bags or paper (cardboard), foam, or plastic racks. Specialty designs like leak proof caps, unique printing & bulk options available….

Expert Sourcing Insights for 15 Ml Tube

H2: Market Trends for 15 mL Tubes in 2026

The global market for 15 mL conical tubes—widely used in laboratories for sample collection, storage, centrifugation, and transport—is poised for steady growth and transformation by 2026. Driven by advancements in life sciences, increasing demand in biopharmaceutical R&D, and the expansion of diagnostic and clinical testing infrastructure, several key trends are shaping the 15 mL tube market in the second half of the decade.

1. Rising Demand in Biopharmaceutical and Academic Research

The continued expansion of biopharmaceutical research, particularly in personalized medicine, vaccine development, and cell and gene therapies, is fueling demand for high-quality consumables such as 15 mL tubes. These tubes are essential for cell culture, media preparation, and sample aliquoting. Academic and government research institutions are also increasing their use of standardized labware, supporting market growth.

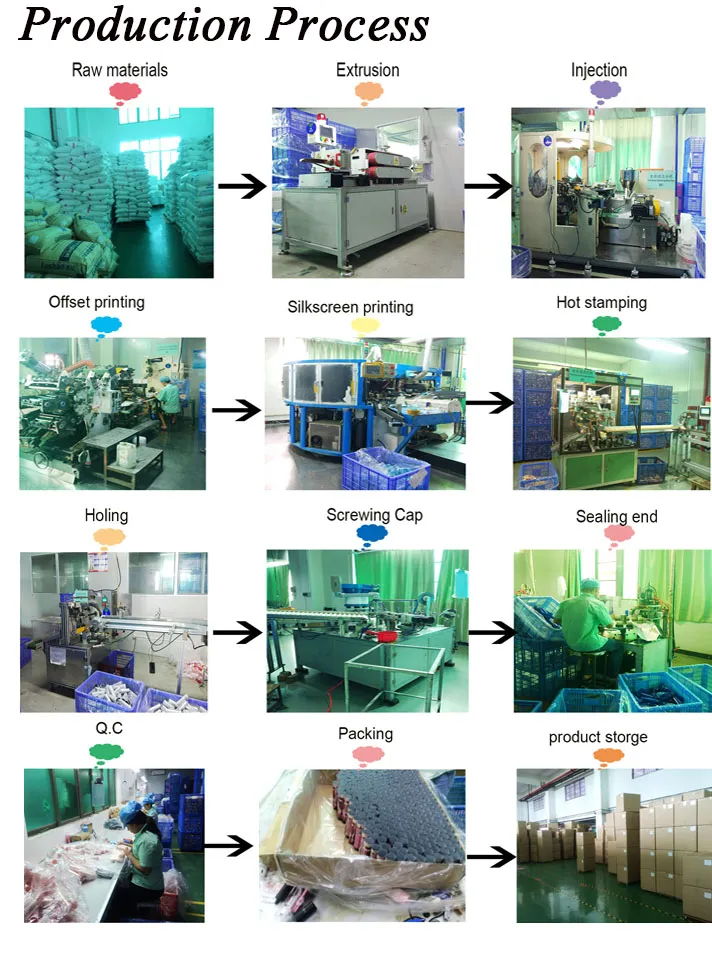

2. Emphasis on Quality and Innovation in Materials

By 2026, manufacturers are increasingly adopting advanced polymers such as high-clarity polypropylene with improved chemical and temperature resistance. Features like graduated markings with enhanced readability, sterile packaging, and low binding surfaces (e.g., for protein or nucleic acid preservation) are becoming standard. Innovation in screw cap designs, including leak-proof and filter cap options, is also gaining traction.

3. Sustainability and Eco-Friendly Production

Environmental concerns are driving a shift toward sustainable manufacturing practices. Leading suppliers are introducing 15 mL tubes made from recyclable materials or incorporating post-consumer recycled content. Some companies are also exploring biodegradable polymers or offering take-back programs to reduce laboratory plastic waste, aligning with global ESG (Environmental, Social, and Governance) goals.

4. Automation and Compatibility with High-Throughput Systems

With the rise of automated liquid handling and robotic platforms in labs, compatibility with automation is a critical factor. 15 mL tubes designed for robotic arm handling, barcode labeling, and integration with lab information management systems (LIMS) are in higher demand. Standardization in dimensions (following ANSI/SLAS norms) ensures seamless use across automated workflows.

5. Regional Market Expansion

While North America and Europe remain dominant markets due to well-established research ecosystems, the Asia-Pacific region—especially China, India, and South Korea—is experiencing rapid growth. Investments in healthcare infrastructure, rising biotech startups, and government support for R&D are driving increased procurement of lab consumables, including 15 mL tubes.

6. Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted companies to diversify sourcing and localize production. By 2026, more manufacturers are establishing regional production hubs to ensure reliable delivery and reduce lead times. This trend enhances market stability and responsiveness to regional demands.

7. Competitive Landscape and Strategic Alliances

The market is highly competitive, with key players such as Thermo Fisher Scientific, Eppendorf, Corning, Sarstedt, and Greiner Bio-One leading innovation. Strategic partnerships, mergers, and product line expansions are common as companies aim to differentiate through quality, sustainability, and digital integration (e.g., smart labeling, track-and-trace capabilities).

Conclusion

By 2026, the 15 mL tube market will be characterized by innovation in materials and design, integration with automation, and a growing emphasis on sustainability. Demand will be sustained by expanding research activities and diagnostic applications, particularly in emerging markets. As laboratories become more sophisticated and environmentally conscious, suppliers who offer reliable, high-performance, and eco-friendly 15 mL tubes will gain a competitive edge.

Common Pitfalls When Sourcing 15 mL Tubes (Quality and Intellectual Property)

Sourcing 15 mL tubes, commonly used in laboratories for cell culture, sample storage, and reagent handling, involves navigating several critical quality and intellectual property (IP) challenges. Overlooking these pitfalls can lead to compromised experiments, regulatory non-compliance, and legal risks.

Quality-Related Pitfalls

Inconsistent Material Composition and Purity

One of the most frequent issues is variability in the raw materials used, particularly the type and grade of polypropylene or polystyrene. Low-cost suppliers may use recycled or substandard plastics that leach contaminants or lack the necessary chemical resistance. This can interfere with sensitive biological assays or degrade when exposed to solvents, leading to inaccurate results or sample loss.

Poor Manufacturing Tolerances

Inferior tubes may exhibit dimensional inconsistencies—such as mismatched cap threads or non-uniform wall thickness—compromising seal integrity. This increases the risk of leaks, evaporation, or cross-contamination, especially during centrifugation or long-term storage. Tubes not designed to withstand standard centrifugal forces (e.g., up to 15,000 x g) may crack, endangering both samples and personnel.

Inadequate Sterility Assurance

Many applications require sterile tubes, but some suppliers provide insufficient or unreliable sterilization documentation. Tubes labeled as “sterile” without proper validation (e.g., ISO 11137 for gamma irradiation) may harbor microbial contaminants. Batch-to-batch inconsistencies in sterility further undermine experimental reproducibility.

Lack of Functional Testing and Certification

Reputable tubes undergo rigorous performance testing, including DNA/RNase-free certification, endotoxin testing, and cytotoxicity assays. Sourcing from suppliers who omit these validations risks introducing inhibitors or toxins into cell cultures and molecular biology workflows.

Intellectual Property-Related Pitfalls

Design and Patent Infringement

Many 15 mL conical tubes, particularly those with specialized features like graduations, filter caps, or vented designs, are protected by utility or design patents. Sourcing generic versions that closely mimic proprietary products (e.g., Falcon™, Corning®) may lead to IP infringement claims. This is especially likely if the tubes replicate patented ergonomic shapes, cap mechanisms, or stacking geometries.

Trademark and Branding Violations

Using look-alike packaging or naming conventions that evoke well-known brands (e.g., similar color schemes or logos) can result in trademark disputes. Even if the product itself is not patented, misleading branding may constitute unfair competition or consumer confusion under trademark law.

Unauthorized Distribution and Gray Market Risks

Purchasing through unauthorized distributors increases the risk of receiving counterfeit or diverted products. These tubes may lack proper quality controls or come from regions without IP enforcement, exposing the buyer to liability for facilitating IP violations.

Lack of Licensing Agreements

In some cases, compliant generic alternatives exist under licensing arrangements. Failing to verify whether a supplier has appropriate IP licenses—particularly in regulated markets like the EU or US—can result in procurement of infringing products, leading to recalls or legal action.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct thorough supplier audits, including reviews of material certifications and manufacturing processes.

– Verify product compliance with relevant standards (e.g., ISO 7886, USP <87>).

– Consult legal counsel to assess IP risks, especially when sourcing near-identical alternatives.

– Purchase only from authorized distributors or suppliers with transparent IP licensing.

Proactively addressing both quality and IP concerns ensures reliable performance and legal compliance in laboratory operations.

Logistics & Compliance Guide for 15 mL Conical Tubes

Overview

The 15 mL conical centrifuge tube is a standard laboratory consumable used for sample collection, storage, centrifugation, and transport. Proper logistics and compliance management ensure product integrity, user safety, and adherence to regulatory standards.

Regulatory Compliance

Material Compliance

- Material Composition: Typically manufactured from high-quality polypropylene (PP) or polystyrene (PS), both of which are USP Class VI and FDA-compliant for biological applications.

- Sterility: Tubes supplied sterile (gamma irradiated or ethylene oxide) should comply with ISO 11737-1 (bioburden) and ISO 10993 (biocompatibility) standards.

- DNase/RNase-Free: Certified free of DNase, RNase, and human genomic DNA per manufacturer specifications; suitable for molecular biology applications.

Global Standards Alignment

- ISO 7886-1: Applicable for sterile hypodermic syringes; indirectly referenced for sterile primary containers.

- USP <381>: For elastomeric closures; relevant if tubes include caps with sealing components.

- REACH & RoHS: Compliant with European regulations for chemical substances and hazardous materials (e.g., no SVHCs above threshold).

- GMP/GLP: Manufacturing under Good Manufacturing and Laboratory Practices ensures batch traceability and quality control.

Packaging & Labeling Requirements

Primary Packaging

- Individually racked or bulk packed in thermoformed trays.

- Sterile tubes individually sealed in peelable pouches or packed in sterile trays with protective lids.

Secondary Packaging

- Cartons made from recyclable corrugated cardboard; stacked and shrink-wrapped on standard EUR/ISO pallets.

- Inner packaging includes desiccants if moisture-sensitive applications are intended.

Labeling

- Labels must include:

- Product name and catalog number

- Volume (15 mL) and dimensions

- Material (e.g., “Polypropylene”)

- Sterility status (if applicable)

- Lot number and expiration date

- Manufacturer name and address

- Symbols per ISO 15223-1 (e.g., sterile, single use, DNase/RNase free)

- Storage conditions (e.g., “Store at 15–25°C”)

Storage & Handling

Environmental Conditions

- Temperature: Store at 15–25°C; avoid exposure to extreme heat (>60°C) or cold (<0°C) to prevent deformation.

- Humidity: Maintain relative humidity below 60% to prevent moisture absorption and microbial growth.

- Light: Protect from prolonged UV exposure to avoid polymer degradation.

Handling Protocols

- Use clean, dry gloves during handling to prevent contamination.

- Avoid stacking more than 5 cartons high to prevent compression damage.

- Rotate stock using FIFO (First In, First Out) methodology.

Transportation Guidelines

Domestic & International Shipping

- Mode: Suitable for air, sea, and ground transport.

- Packaging: Must meet ISTA 3A or equivalent for drop, vibration, and compression resistance.

- Cold Chain: Not required unless specified (e.g., pre-filled tubes with reagents).

- UN/DOT Compliance: For non-hazardous goods; no special labeling unless containing biohazardous contents.

Hazard Classification

- Empty tubes are non-hazardous under GHS, DOT, and IATA regulations.

- If tubes contain biological samples or chemicals, classification follows the contents (e.g., UN3373 for biological substances, Category B).

Import/Export Considerations

Documentation

- Commercial Invoice

- Packing List

- Certificate of Conformance (CoC)

- Certificate of Origin (if required by trade agreement)

- Sterility Certificate (if applicable)

Tariff Classification

- HS Code Example: 3923.30 (Plastic bottles, jars, and containers)

- Confirm local classification; may vary by country (e.g., 3923.30.00 in EU, 3923.30.0000 in US HTS)

Import Restrictions

- No major restrictions for empty plastic labware in most jurisdictions.

- Verify with local customs for any environmental or plastic import regulations (e.g., UK Plastic Packaging Tax).

Waste Management & Sustainability

Disposal

- Dispose of used tubes as biohazardous, chemical, or general waste depending on contents.

- Follow local regulations (e.g., EPA, EU Waste Framework Directive).

- Autoclavable tubes can be sterilized prior to disposal.

Recyclability

- Polypropylene (PP, recycling code #5) is widely recyclable in industrial programs.

- Remove caps (if made of different material) before recycling.

- Encourage lab recycling programs for clean, uncontaminated tubes.

Quality Assurance & Traceability

- Each batch is assigned a unique lot number for full traceability.

- Certificates of Analysis (CoA) available upon request.

- Regular audits of manufacturing facilities per ISO 13485 (if medical device applicable).

Emergency & Incident Response

- Spill Management: For empty tubes—no special procedures. If contaminated, follow biohazard or chemical spill protocol.

- Exposure: No significant risk from empty tubes. In case of skin/eye contact with residues, flush with water and seek medical advice if irritation persists.

For specific product variants (e.g., graduations, filter caps, or specialty coatings), consult the manufacturer’s technical data sheet (TDS) and safety data sheet (SDS) as compliance requirements may vary.

Conclusion for Sourcing 15 ml Tubes:

After evaluating various suppliers, materials, quality standards, and cost considerations, it is concluded that sourcing 15 ml tubes should prioritize compatibility with intended applications—such as cell culture, centrifugation, or sample storage—while ensuring consistency, sterility, and reliability. Polypropylene tubes with graduations, secure screw or cap seals, and autoclavability are recommended for broad laboratory use. Supplier reputation, compliance with international standards (e.g., ISO certifications), and consistent batch quality are critical factors. Additionally, balancing cost efficiency with long-term performance and minimizing supply chain risks through multiple qualified vendors will ensure a sustainable and reliable supply. Ultimately, selecting a high-quality 15 ml tube from a trusted supplier enhances experimental reproducibility, sample integrity, and operational efficiency in research and diagnostic settings.