The global market for electric ovens, particularly 120V models prevalent in residential and light commercial applications across North America, is experiencing steady growth driven by rising demand for energy-efficient appliances and smart kitchen technology. According to Grand View Research, the global electric oven market size was valued at USD 8.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This expansion is fueled by urbanization, increasing disposable incomes, and the modernization of kitchen infrastructure in both developed and emerging economies. Furthermore, Mordor Intelligence reports a growing preference for compact, high-efficiency ovens in multifamily housing and modular kitchens, reinforcing the relevance of 120V models that align with standard U.S. electrical systems. As competition intensifies, a select group of manufacturers are leading innovation in safety, precision cooking, and IoT integration. Based on market presence, product range, and technological advancements, the following ten companies represent the top 120V oven manufacturers shaping the future of home and light commercial baking.

Top 10 120V Oven Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TurboChef

Domain Est. 1997

Website: turbochef.com

Key Highlights: TurboChef Rapid Cook Ovens are designed with advanced technology utilizing high-speed impinged air and microwave assist to significantly reduce cook times ……

#2 5-in-1 Ovens with Advantium Speedcook Technology

Domain Est. 2007

#3 Shop All Wall Ovens

Domain Est. 1996

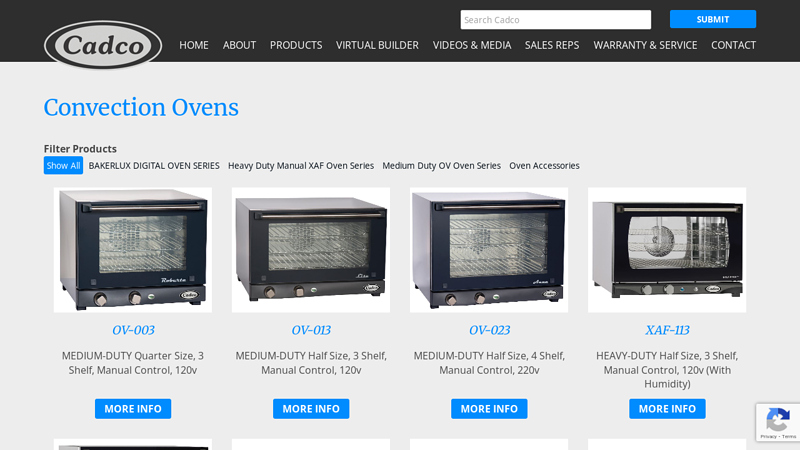

#4 Convection Ovens

Domain Est. 1998

Website: cadco-ltd.com

Key Highlights: Products: Bakerlux Digital Oven Series, Heavy Duty Manual, XAF Oven Series, Medium Duty OV Oven Series, Oven Accessories….

#5 SEW24115

Domain Est. 1998

Website: summitappliance.com

Key Highlights: 1-day deliveryOne of the industry’s only 110-120V wall ovens built for full cooking functionality with settings for bake, broil, convection, proofing, & more….

#6 Fivestar Range

Domain Est. 1999

Website: fivestarrange.com

Key Highlights: The convection oven cooks faster and more evenly than a conventional oven. · We love our FiveStar so much we bought a second one. · The burners are easy to clean….

#7 Cooking Equipment

Domain Est. 1999

Website: springusa.com

Key Highlights: Spring USA is the leader in commercial foodservice equipment, including induction ranges, buffetware, cookware, induction cooking stations, mobile cooking ……

#8 Wolf Built

Domain Est. 2002

Website: subzero-wolf.com

Key Highlights: Experience remarkable flavor with Wolf Built-in Ovens including state-of-the-art convection ovens, convection steam and convection speed ovens….

#9 RV Ovens & Cooktops

Domain Est. 2007

Website: furrion.com

Key Highlights: Free delivery 30-day returnsWith electric induction and gas options, Furrion RV ovens and cooktops make it easy to cook your favorite meals on the road….

#10 THOR Stove

Domain Est. 2015

Website: thorstove.com

Key Highlights: All THOR ranges are constructed in stainless steel and equipped with spacious convection ovens, electronic ignition systems, and infrared oven broilers….

Expert Sourcing Insights for 120V Oven

H2: Projected 2026 Market Trends for 120V Ovens

The market for 120V ovens is expected to undergo significant transformation by 2026, driven by evolving consumer preferences, technological advancements, regulatory shifts, and the broader trend toward energy efficiency and smart home integration. As compact living spaces, urbanization, and demand for versatile kitchen appliances grow—particularly in North America—120V ovens are gaining traction as practical alternatives to traditional 240V models.

1. Increased Demand in Urban and Compact Living Environments

With the rise of micro-apartments, tiny homes, and modular housing, especially in major metropolitan areas, space-saving kitchen solutions are becoming essential. 120V ovens—often countertop or built-in compact models—offer a viable cooking solution where dedicated high-voltage circuits are unavailable or impractical. This trend is projected to accelerate through 2026, supported by urban planning initiatives and housing innovations.

2. Growth of Multi-Functional and Smart Appliances

Manufacturers are increasingly integrating smart technology into 120V ovens, including Wi-Fi connectivity, app-based controls, voice assistant compatibility (e.g., Alexa, Google Assistant), and AI-powered cooking programs. By 2026, smart 120V ovens are expected to capture a growing segment of the market, appealing to tech-savvy consumers seeking convenience and precision in meal preparation.

3. Focus on Energy Efficiency and Sustainability

As energy regulations tighten and environmental awareness increases, 120V ovens are being optimized for lower power consumption without sacrificing performance. Their inherent design—operating on standard household voltage—makes them more energy-efficient compared to full-sized electric ovens. In 2026, we anticipate stronger emphasis on ENERGY STAR® certification and eco-friendly materials in product design.

4. Expansion of Product Offerings and Design Innovation

Leading appliance brands and startups alike are expanding their 120V oven lines to include convection, steam, air fry, and combi-oven functionalities. Sleek, modern designs with stainless steel finishes, digital interfaces, and modular integration (e.g., under-cabinet or drawer-style ovens) will cater to aesthetic and functional demands in contemporary kitchens.

5. Shift in Consumer Demographics and Usage Patterns

Younger consumers, including Millennials and Gen Z, are driving demand for affordable, easy-to-use appliances that fit rental-friendly and minimalist lifestyles. The versatility of 120V ovens—suitable for baking, roasting, reheating, and air frying—aligns with the rise of home cooking and meal prep trends, further boosting market penetration.

6. Competitive Pricing and Market Accessibility

Compared to traditional wall ovens requiring professional installation and electrical upgrades, 120V ovens are generally more affordable and accessible. This cost advantage is expected to widen their appeal across diverse socioeconomic segments, particularly in regions with older housing infrastructure not equipped for 240V circuits.

7. Regulatory and Safety Standards Evolution

By 2026, updated electrical codes and safety standards may influence the design and deployment of 120V ovens, especially regarding thermal management, child safety locks, and fire prevention. Compliance with UL and IEC standards will remain critical for market entry and consumer trust.

In conclusion, the 120V oven market in 2026 will be characterized by innovation, convenience, and inclusivity. As consumers prioritize flexibility, efficiency, and smart integration, 120V ovens are poised to transition from niche appliances to mainstream kitchen essentials—reshaping how households approach cooking in the modern era.

Common Pitfalls When Sourcing a 120V Oven (Quality and Intellectual Property)

Sourcing a 120V oven—especially for commercial or industrial applications—requires careful evaluation beyond basic functionality. Two critical areas where buyers often encounter problems are product quality and intellectual property (IP) risks. Overlooking these can lead to safety hazards, costly downtime, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Compromised Safety and Compliance Standards

Many low-cost 120V ovens, particularly those sourced from unfamiliar manufacturers or third-party marketplaces, may lack proper safety certifications (e.g., UL, ETL, CSA). This increases the risk of electrical hazards, fire, or failure under sustained use. Always verify that the oven is certified for use in your region and meets relevant electrical and thermal safety standards.

2. Inferior Materials and Construction

To cut costs, some manufacturers use substandard insulation, thin-gauge steel, or low-quality heating elements. This leads to poor heat retention, uneven temperature distribution, shorter lifespan, and higher energy consumption. Insist on detailed specifications and, if possible, request material certifications or third-party testing reports.

3. Inaccurate Temperature Control and Calibration

Low-quality ovens often have poorly calibrated thermostats or inadequate temperature sensors, resulting in inconsistent performance. This is especially problematic in applications requiring precise thermal control (e.g., laboratories, food service). Confirm the oven includes NIST-traceable calibration or allows for user calibration.

4. Lack of Durability and Serviceability

Cheaply made ovens may not be designed for heavy use or easy maintenance. Look for features like removable shelves, accessible heating elements, and modular components. Absence of spare parts or technical support can render the oven unusable after minor failures.

Intellectual Property (IP) Risks

1. Use of Counterfeit or Cloned Designs

Some suppliers offer ovens that closely mimic well-known branded models but are unauthorized replicas. These may infringe on design patents, trademarks, or utility patents. Purchasing such products exposes your organization to legal liability, especially if used commercially.

2. Misrepresentation of Brand and Origin

Suppliers may falsely label ovens as “compatible with” or “similar to” reputable brands to imply endorsement or quality. This can mislead buyers and may constitute trademark infringement. Always verify the actual manufacturer and request proof of brand authorization when applicable.

3. Lack of IP Due Diligence in Custom or Private-Label Ovens

If sourcing custom-designed ovens or private-label units, ensure that design rights, software (e.g., control systems), and technical documentation are properly assigned or licensed. Without clear IP agreements, you may face disputes over ownership or be unable to modify or service the equipment later.

4. Exposure to Infringement Claims

Using a 120V oven that incorporates patented technology without a license—even unknowingly—can result in cease-and-desist letters, product seizures, or lawsuits. Conduct IP screening, especially when sourcing from regions with lax IP enforcement, and include indemnification clauses in procurement contracts.

Mitigation Strategies

- Request certifications and test reports for electrical safety, EMC, and performance.

- Audit suppliers through third-party inspections or factory visits.

- Verify IP status through patent databases or legal counsel, particularly for custom or high-volume purchases.

- Include warranties and indemnification clauses in contracts to protect against quality defects and IP infringement.

By proactively addressing quality and IP concerns, buyers can avoid operational disruptions, ensure regulatory compliance, and protect their organization from legal and financial exposure.

H2: Logistics & Compliance Guide for 120V Oven

H2: Logistics & Compliance Guide for 120V Oven

This guide outlines the essential logistics and compliance considerations for importing, distributing, and selling a 120V oven in the United States. Adherence to these requirements ensures product safety, regulatory compliance, and smooth supply chain operations.

1. Regulatory Compliance

Electrical Safety Certification (Mandatory)

– UL 858 Standard: All 120V ovens sold in the U.S. must comply with UL 858 – Standard for Household Electric Cooking and Food Serving Appliances.

– Certification Body: Obtain listing from a Nationally Recognized Testing Laboratory (NRTL), such as UL, Intertek (ETL), or CSA.

– Labeling: Affix the NRTL certification mark visibly on the product and include certification details in technical documentation.

Energy Efficiency (Applies to Certain Models)

– DOE Appliance Standards: Ovens are subject to U.S. Department of Energy (DOE) energy conservation standards. Verify current efficiency requirements based on oven type (e.g., conventional, convection).

– ENERGY STAR (Optional): Participation is voluntary but enhances marketability. Check if the model qualifies under current ENERGY STAR program specifications.

Federal Communications Commission (FCC) Compliance

– If the oven includes electronic controls, Wi-Fi, Bluetooth, or other digital circuitry, it must comply with FCC Part 15 regulations for electromagnetic interference (EMI).

– Ensure the product bears the appropriate FCC ID or complies under FCC Class B (domestic use) emissions limits.

2. Product Labeling & Documentation

Required Labels

– Voltage & Rating: Clearly mark “120V AC, 60 Hz” on the rating plate.

– Power Consumption: Display wattage (e.g., “1500W”) and amperage.

– Manufacturer/Importer Information: Include name, brand, and contact details (U.S.-based address required).

– NRTL Mark: Display the certification mark (e.g., UL, ETL).

– FCC ID (if applicable): For models with digital electronics.

User Documentation

– Provide English-language installation, operation, and safety instructions.

– Include a warranty statement complying with federal and state requirements.

– Safety warnings must meet ANSI Z535 standards for hazard communication.

3. Import & Customs Clearance

Harmonized System (HS) Code

– Use HS Code 8516.60.00 – Electric ovens, cookers, cooking plates, boiling rings, grillers, and roasters.

– Confirm with U.S. Customs and Border Protection (CBP) for accuracy; incorrect coding may result in delays or penalties.

Import Documentation

– Commercial invoice

– Bill of lading/air waybill

– Packing list

– Certificate of Origin

– NRTL certification documentation (may be requested)

– FCC Declaration of Conformity (if applicable)

Duties & Tariffs

– Check current duty rates under HTS 8516.60.00; rates may vary based on country of origin.

– Monitor Section 301 tariffs if the oven is manufactured in China.

4. Logistics & Distribution

Packaging Requirements

– Use robust packaging to prevent damage during transit; include corner protectors and internal bracing.

– Clearly label packages with:

– Product model and voltage (120V)

– Fragile and “This Side Up” indicators

– NRTL mark and compliance labels (on outer carton if visible)

Transportation & Handling

– Coordinate with freight forwarders experienced in appliance logistics.

– Ensure carriers comply with dimensional weight and palletization standards.

– For retail distribution, verify compatibility with standard pallet sizes (e.g., 48″ x 40″) and warehouse racking systems.

Warehousing

– Store in dry, temperature-controlled environments to protect electrical components.

– Implement inventory management systems to track compliance documentation per batch/lot.

5. Post-Market Compliance & Support

Recall Preparedness

– Register with the U.S. Consumer Product Safety Commission (CPSC) via the Product Safety Portal.

– Maintain traceability (serial numbers, batch records) to facilitate recalls if needed.

– Develop a recall response plan in accordance with CPSC guidelines.

Warranty & Service

– Offer a minimum 1-year warranty (common industry standard).

– Provide accessible customer support and spare parts availability.

– Train service technicians on safety procedures and NRTL requirements.

State-Level Requirements

– Verify any additional state regulations (e.g., California Proposition 65 warning labels for potential chemical exposure).

– Check local building and electrical codes for installation compliance (e.g., NEC requirements for circuit breakers and outlets).

Summary Checklist

– [ ] UL 858 or equivalent NRTL certification obtained

– [ ] DOE energy compliance verified

– [ ] FCC compliance if applicable

– [ ] Correct HS code and customs documentation prepared

– [ ] Proper labeling (voltage, NRTL, FCC, warnings)

– [ ] English user manuals and safety instructions included

– [ ] Packaging designed for safe transport

– [ ] Recall and warranty processes in place

– [ ] State-specific compliance addressed (e.g., CA Prop 65)

Adhering to this guide ensures your 120V oven meets U.S. market requirements and operates within a compliant, efficient logistics framework.

In conclusion, sourcing a 120V oven requires careful consideration of power compatibility, performance expectations, and intended usage. While 120V ovens are more accessible for standard household outlets and ideal for spaces where 240V electrical infrastructure is unavailable—such as apartments, small kitchens, or office break rooms—they typically offer lower heating power and longer cook times compared to their 240V counterparts. When selecting a 120V oven, prioritize models with efficient insulation, reliable temperature control, and positive user reviews to ensure optimal performance within power limitations. Additionally, verify electrical circuit capacity to avoid overloading and ensure safety. For light cooking tasks like reheating, toasting, or baking small dishes, a 120V oven can be a practical and convenient solution. Proper research and matching the oven to your specific needs will lead to a successful and satisfactory purchase.