The global chainsaw market is experiencing steady growth, driven by increasing demand across residential landscaping, agriculture, and forestry sectors. According to Grand View Research, the global chainsaw market was valued at USD 4.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is supported by rising homeowner investment in garden maintenance tools and ongoing infrastructure development in emerging economies. Within this landscape, 100cc chainsaws—known for their high power-to-weight ratio and suitability for heavy-duty applications—have gained prominence among professional users and large-scale operators. As demand for durable, fuel-efficient, and technologically advanced models rises, a select group of manufacturers have emerged as leaders in innovation, production scale, and global distribution. Based on market presence, product performance data, and technological investment, the following eight companies represent the top manufacturers of 100cc chainsaws worldwide.

Top 8 100Cc Chainsaw Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Black Max Chainsaw Manufacturers

Domain Est. 1997

Website: accio.com

Key Highlights: Looking for reliable Black Max chainsaw manufacturers? Discover certified suppliers offering professional-grade chainsaws for forestry and ……

#2 Farmertec

Domain Est. 2012

#3 Husqvarna 455 Rancher Chainsaw

Domain Est. 1995

Website: husqvarna.com

Key Highlights: Free delivery over $49.99 30-day returnsThe 455 Rancher is an ideal saw for landowners and part-time users who require a high powered, heavy-duty and responsive workmate for all cu…

#4 EPA and CARB Emission Standards To Control Nonroad Exhaust …

Domain Est. 1997

Website: fs.usda.gov

Key Highlights: Chain saws over 45 cc are limited to Federal EPA control. CARB has authority over all handheld engines, except those established as farm and construction ……

#5 Selecting A Chain Saw and Chain

Domain Est. 1998

Website: fireapparatusmagazine.com

Key Highlights: The 3⁄8-inch chain can handle up to a 100-cc chain saw engine (approximately 8.5 hp). The bigger the chain saw bar, the more force you need ……

#6 Oregon Product Catalog

Domain Est. 2001

Website: oregonproducts.com

Key Highlights: 50 → 100 cc An ideal chain for professional woodcutters who use 3/8“ pitch saws. Low-vibration, full chisel cutters offer top performance. Offset depth gauges ……

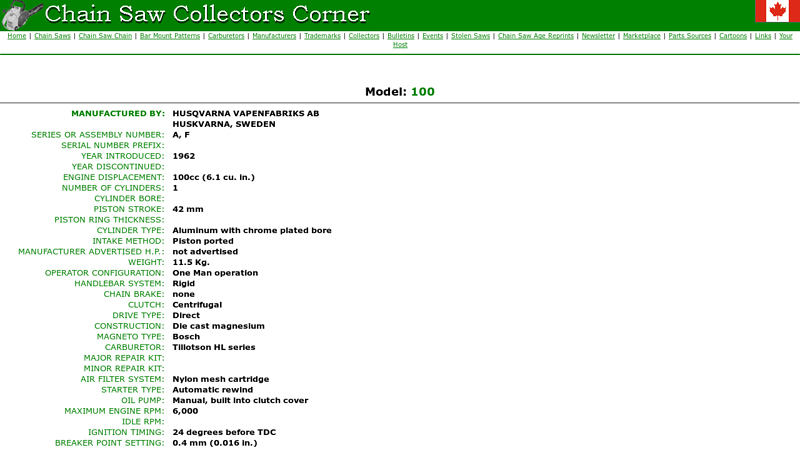

#7 Model Profile

Domain Est. 2001

Website: acresinternet.com

Key Highlights: WEIGHT: 11.5 Kg. OPERATOR CONFIGURATION: One Man operation. HANDLEBAR SYSTEM: Rigid. CHAIN BRAKE:….

#8 Chainsaw

Domain Est. 2020

Website: bscpowertools.com

Key Highlights: BSC Power BSC-10500P Chain Saw Heavy Duty with 105.7CC 2 Stroke… Rated 5.00 out of 5. image/svg+xml Read more. Add to Wishlist. Add to Wishlist….

Expert Sourcing Insights for 100Cc Chainsaw

2026 Market Trends for 100Cc Chainsaws

The 100cc chainsaw market is poised for notable transformation by 2026, driven by shifting consumer demands, environmental regulations, and technological advancements. As one of the higher-capacity segments in the professional-grade chainsaw category, 100cc models are primarily used in forestry, construction, and large-scale landscaping. This analysis explores key trends shaping the industry through 2026.

Increased Demand for Fuel-Efficient and Low-Emission Engines

Environmental regulations are tightening globally, particularly in North America and Europe. By 2026, manufacturers of 100cc chainsaws are expected to prioritize compliance with stricter emissions standards such as the U.S. EPA Phase 3 and EU Stage V. This will drive innovation in fuel-injected two-stroke and advanced four-stroke engine technologies that reduce hydrocarbon and particulate emissions. Expect widespread adoption of cleaner combustion systems and catalytic converters in high-displacement models.

Shift Toward Hybrid and Electric Alternatives

While 100cc chainsaws remain dominant in heavy-duty applications, a growing trend is the emergence of hybrid and high-power battery-electric alternatives. By 2026, improvements in lithium-ion battery density and fast-charging technology may challenge the traditional dominance of gas-powered models. However, 100cc gas chainsaws will retain market share in remote or prolonged-use scenarios where refueling is faster than recharging. Hybrid systems—combining battery assistance with internal combustion—could emerge as a transitional solution, especially in urban and noise-sensitive areas.

Growth in Professional and Rental Markets

The professional forestry and land management sectors continue to drive demand for high-performance 100cc chainsaws. With increased focus on wildfire prevention, forest thinning, and urban tree maintenance, demand is expected to grow in regions like the western United States, Canada, Scandinavia, and Australia. Additionally, equipment rental companies are expanding inventories of 100cc models, catering to contractors and municipalities. This trend supports product durability, ease of maintenance, and fleet management compatibility.

Emphasis on Ergonomics and Operator Safety

By 2026, user-centric design will be a key differentiator. Antivibration systems, improved weight distribution, and low-handle configurations will become standard in premium 100cc models. Integrated safety features such as chain brakes with enhanced responsiveness, kickback reduction technology, and smart sensors (e.g., fatigue detection) are expected to gain traction. Regulatory bodies and insurance providers may begin incentivizing the use of such safety-enhanced equipment.

Smart Technology Integration

The integration of IoT and smart diagnostics is an emerging trend. High-end 100cc chainsaws may feature onboard diagnostics, usage tracking, and predictive maintenance alerts via Bluetooth or RFID tags. These capabilities appeal to fleet operators and large-scale users seeking to optimize equipment lifespan and reduce downtime. While still niche in 2026, smart features could become a competitive advantage for leading brands like Husqvarna, Stihl, and ECHO.

Regional Market Dynamics

North America and Europe will remain the largest markets for 100cc chainsaws due to extensive forested areas and robust forestry industries. However, growth in the Asia-Pacific region—particularly in countries like Japan, South Korea, and parts of Southeast Asia—is expected to accelerate due to urban greening initiatives and disaster recovery efforts. Manufacturers may tailor models to regional preferences, such as compact designs for Japanese forestry or rugged models for Australian bush conditions.

Supply Chain and Material Innovation

Manufacturers are increasingly focused on sustainable sourcing and supply chain resilience. By 2026, expect greater use of recycled metals and bio-based composites in housing and components. Additionally, localized production hubs may emerge to reduce logistics costs and respond faster to regional demand fluctuations, especially in the wake of recent global supply chain disruptions.

Conclusion

The 100cc chainsaw market in 2026 will be shaped by a balance between tradition and innovation. While internal combustion engines will remain essential for high-intensity tasks, pressure to reduce emissions and improve efficiency will push manufacturers toward cleaner, smarter, and safer designs. Companies that adapt to regulatory changes, embrace digital integration, and focus on user experience will lead the market in the coming years.

Common Pitfalls When Sourcing a 100cc Chainsaw (Quality and Intellectual Property)

Sourcing high-powered equipment like a 100cc chainsaw, especially from international suppliers, involves significant risks related to both product quality and intellectual property (IP) protection. Failing to address these pitfalls can result in substandard products, legal liabilities, financial losses, and reputational damage. Below are key challenges to watch for:

Overlooking Build Quality and Material Standards

Many suppliers, particularly in cost-driven markets, may use inferior materials (e.g., low-grade steel, plastic components, underpowered engines) to cut costs. A 100cc chainsaw demands robust construction to handle heavy-duty use. Poor build quality leads to frequent breakdowns, safety hazards, and high maintenance costs. Buyers should verify metallurgical specs, conduct factory audits, and demand third-party testing reports (e.g., ISO, CE) to ensure durability and performance.

Misrepresenting Engine Specifications and Performance

Some manufacturers exaggerate engine output, claiming “100cc” when actual displacement is lower, or boast inflated power metrics. This misleading data can result in underperforming tools unsuitable for intended applications. Always request verified performance data, conduct independent engine testing, and look for consistent naming conventions (e.g., actual vs. nominal cc) to avoid being misled.

Ignoring Safety Certification and Compliance

Non-compliant chainsaws may lack essential safety features such as chain brakes, kickback protection, or proper emission controls. Sourcing units without recognized certifications (e.g., EPA, CARB, CE, GS) can block market entry and expose buyers to legal liability. Ensure all units meet target market regulations and include full documentation for compliance verification.

Falling Victim to Counterfeit or IP-Infringing Designs

A major IP risk involves sourcing chainsaws that copy patented designs, logos, or technical innovations from established brands (e.g., Husqvarna, Stihl, Echo). Suppliers may produce look-alike products with minor modifications, risking customs seizures, lawsuits, and brand damage. Conduct thorough IP due diligence, including patent searches and legal opinions, and include IP indemnity clauses in supplier contracts.

Inadequate After-Sales Support and Spare Parts Availability

High-performance chainsaws require regular maintenance and spare parts. Many low-cost suppliers offer little to no after-sales support, leading to downtime and customer dissatisfaction. Assess the supplier’s spare parts inventory, warranty terms, and service network before committing. A lack of long-term support undermines product reliability.

Failing to Secure Proper IP Ownership in Custom Designs

If sourcing a custom-branded or OEM chainsaw, ensure that design rights, technical drawings, and tooling IP are explicitly assigned to your company. Some suppliers retain ownership of molds or designs, creating dependency and blocking future sourcing flexibility. Use clear legal agreements to transfer full IP rights upon payment.

Relying Solely on Samples Without Ongoing Quality Control

Initial samples may meet standards, but mass production often sees quality drift. Without a quality control plan—such as pre-shipment inspections (PSI), in-line checks, or third-party audits—defective batches may go undetected. Implement a structured QC process throughout production to maintain consistency.

By proactively addressing these quality and IP pitfalls, businesses can mitigate risks, ensure product reliability, and protect their brand and legal standing when sourcing 100cc chainsaws.

Logistics & Compliance Guide for 100cc Chainsaw

Product Classification & Regulations

100cc chainsaws fall under heavy-duty outdoor power equipment and are subject to strict international and domestic regulations. Accurate classification under the Harmonized System (HS) Code is essential—typically categorized under HS 8467.21 or 8467.22, depending on power source (gasoline-powered). Import/export documentation must include detailed technical specifications, including engine displacement (100cc), fuel type, noise levels, and emission data. Compliance with local regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Union’s CE marking directives is mandatory.

Emissions & Environmental Compliance

Gasoline-powered 100cc chainsaws must meet stringent emissions standards. In the United States, EPA Phase 3 standards regulate exhaust emissions, requiring certified engines that minimize hydrocarbons (HC), carbon monoxide (CO), and nitrogen oxides (NOx). In the EU, compliance with Stage V of the EU Non-Road Mobile Machinery (NRMM) regulation is required. Manufacturers must provide emission compliance certificates and ensure that all units are labeled with the appropriate certification marks. Failure to comply may result in shipment rejection or fines.

Noise & Vibration Standards

100cc chainsaws generate high noise and vibration levels, regulated under occupational safety standards. The EU mandates conformity with the Machinery Directive (2006/42/EC), requiring noise emission declarations in operating manuals. The U.S. Occupational Safety and Health Administration (OSHA) sets permissible exposure limits (PELs) for noise (90 dBA over 8 hours). Chainsaws must include anti-vibration systems and meet ISO 11681-1 (safety requirements for hand-held chainsaws). Documentation must include noise and vibration test reports from accredited laboratories.

Safety & Certification Requirements

All 100cc chainsaws must be certified to relevant safety standards before market entry. In North America, UL 1778 or CSA C22.2 No. 68 compliance may apply depending on components. In Europe, CE marking is required under the Machinery Directive and often the EMC Directive. Key safety features include chain brakes, throttle interlocks, and kickback protection. Technical files, risk assessments, and Declaration of Conformity (DoC) must accompany shipments.

Packaging & Shipping Requirements

Due to size and weight, 100cc chainsaws require robust packaging to prevent damage during transit. Use of wooden crates or heavy-duty corrugated boxes with internal foam supports is recommended. Fuel tanks must be completely drained prior to shipping in accordance with IATA/IMDG regulations for dangerous goods (UN 1202, Gasoline). Spare fuel containers (if shipped separately) must comply with Class 3 flammable liquid packaging standards. Label packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators.

Import Duties & Customs Clearance

Customs duties vary by destination country and depend on the HS code classification. Importers must provide commercial invoices, packing lists, certificates of origin, and compliance documentation (EPA, CE, etc.). Some countries impose additional environmental or energy efficiency taxes on gasoline-powered equipment. Accurate valuation and tariff classification prevent delays. Use of a licensed customs broker is recommended for smooth clearance, especially when entering regulated markets like the EU, U.S., or Australia.

Battery & Electrical Compliance (if applicable)

If the 100cc chainsaw includes electric-start systems or onboard electronics, compliance with electromagnetic compatibility (EMC) standards is required (e.g., FCC Part 15 in the U.S., EN 55014 in the EU). Lithium-ion batteries (if used for starting or auxiliary functions) must meet UN 38.3 testing requirements and be shipped under special provisions (e.g., IATA PI 965). Include battery safety data sheets (SDS) and proper labeling for hazardous components.

Documentation & Recordkeeping

Maintain comprehensive records for at least five years, including product compliance certificates, test reports, shipment manifests, and customs filings. Digital copies should be securely stored and accessible for audits. For EU exports, appoint an Authorized Representative if the manufacturer is outside the EEA. U.S. importers must register with U.S. Customs and Border Protection (CBP) and ensure chainsaws are reported under the appropriate HTSUS code.

End-of-Life & Take-Back Compliance

In jurisdictions like the EU, the Waste Electrical and Electronic Equipment (WEEE) Directive requires producers to register and provide take-back options for end-of-life chainsaws. Include WEEE labeling on products and packaging where applicable. Ensure recycling instructions are provided in user manuals. Some countries also require participation in national recycling schemes or payment of eco-fees upon import.

Risk Mitigation & Best Practices

Conduct regular compliance audits and stay updated on regulatory changes. Partner with certified testing laboratories for pre-shipment verification. Train logistics teams on hazardous material handling and customs procedures. Use Incoterms® 2020 (e.g., FOB, CIF) clearly in contracts to define responsibilities. Consider product liability insurance tailored for heavy machinery to mitigate legal risks associated with non-compliance or safety incidents.

Conclusion: Sourcing a 100cc Chainsaw

Sourcing a 100cc chainsaw requires careful consideration of several key factors including intended use, engine type, quality, reliability, and supplier reputation. Due to their high power output, 100cc chainsaws are typically designed for professional or heavy-duty applications such as forestry, large-scale land clearing, or logging, rather than residential use. As such, sourcing should focus on industrial-grade models from reputable manufacturers known for durability and service support.

When evaluating suppliers, prioritize those offering authentic products with warranties, technical support, and access to spare parts. Sourcing from authorized distributors or directly from established brands (such as Stihl, Husqvarna, or Echo) helps ensure product authenticity and after-sales service. Additionally, compliance with safety standards and emissions regulations—especially in regions like the EU or North America—should be verified.

While cost is an important factor, the lowest price should not override concerns about performance, safety, and long-term maintenance. Bulk sourcing may provide cost advantages but should be balanced with storage, demand, and logistical considerations.

In conclusion, successfully sourcing a 100cc chainsaw involves a strategic balance of performance requirements, supplier credibility, and total cost of ownership. A well-informed procurement approach ensures reliable, efficient, and safe operation in demanding environments.