The global galvanized steel pipe market is experiencing robust growth, driven by rising demand across construction, infrastructure, and industrial sectors. According to a report by Grand View Research, the global steel pipes market size was valued at USD 88.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030, with galvanized variants accounting for a significant share due to their corrosion resistance and durability. Similarly, Mordor Intelligence projects steady growth in the galvanized steel pipe market, attributing it to increased infrastructure development in emerging economies and stringent regulatory standards favoring long-life, low-maintenance piping solutions. As demand for 1 inch galvanized steel pipes—commonly used in plumbing, fencing, and structural applications—continues to rise, a select group of manufacturers have emerged as leaders in quality, scale, and innovation. Here are the top 9 manufacturers shaping the industry landscape in 2024.

Top 9 1 Inch Galvanized Steel Pipe Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Structural Steel Tubes & Steel Pipes Manufacturer in India

Domain Est. 2010

Website: aplapollo.com

Key Highlights: APL Apollo Tubes Limited is the largest producer of Structural Steel Tubes in India. We have an extended distribution network of warehouses and branch offices ……

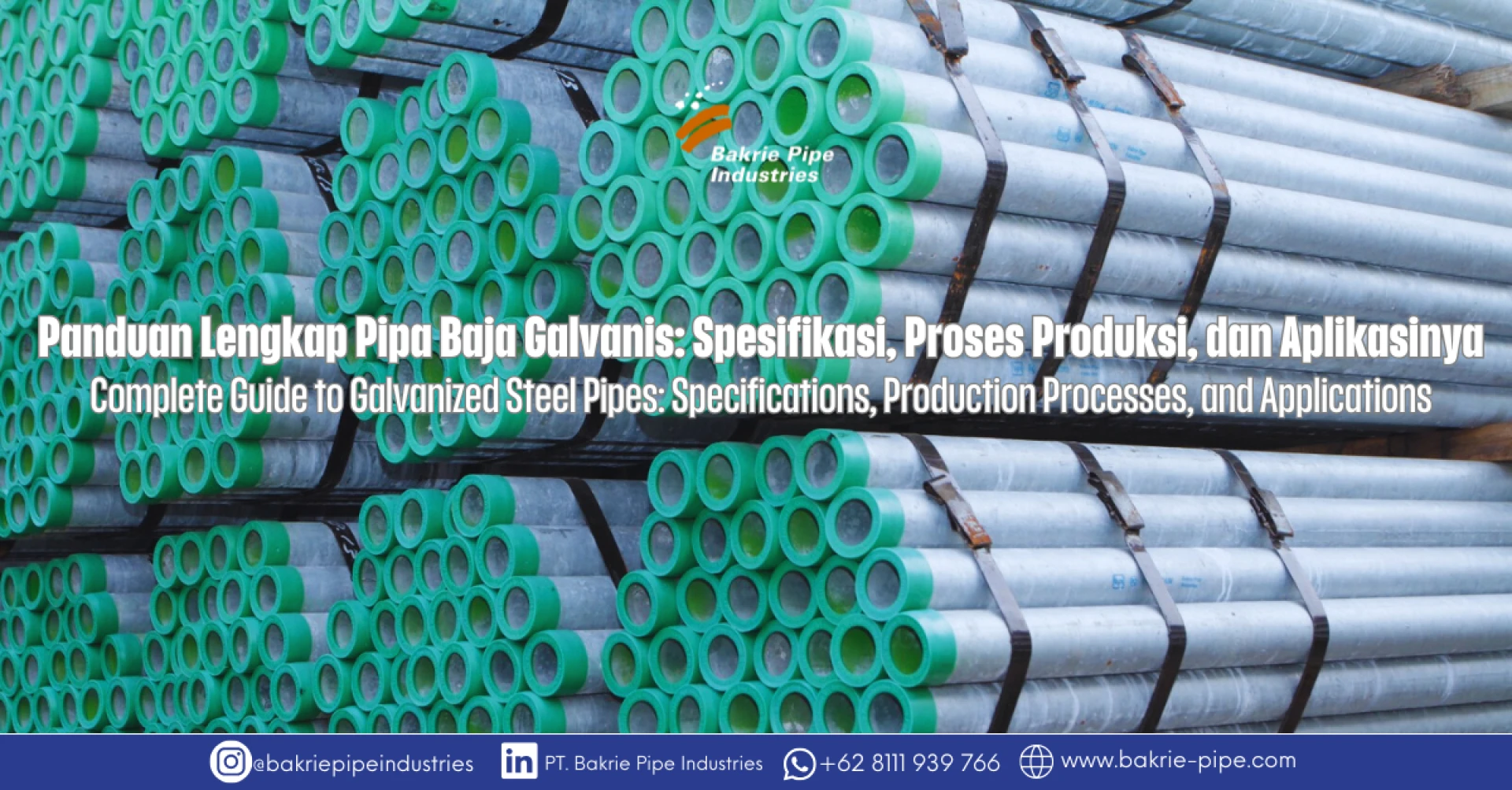

#2 Bakrie Pipe industries

Domain Est. 2007

Website: bakrie-pipe.com

Key Highlights: Bakrie Pipe Industries (BPI) is a leading pioneer manufacturer of Galvanized Pipes & Steel Pipes in Indonesia, producing high-quality steel pipe products ……

#3 Wheatland Tube

Domain Est. 1995

Website: wheatland.com

Key Highlights: American-made steel pipe and tube for electrical, process, fire suppression, fence framework, mechanical and energy systems….

#4 Chicago Tube & Iron

Domain Est. 1997

Website: chicagotube.com

Key Highlights: Chicago Tube and Iron offers pipe coupons for welder practice and testing. CTI Stocks standard sizes for performance and procedural weld qualifications. Explore ……

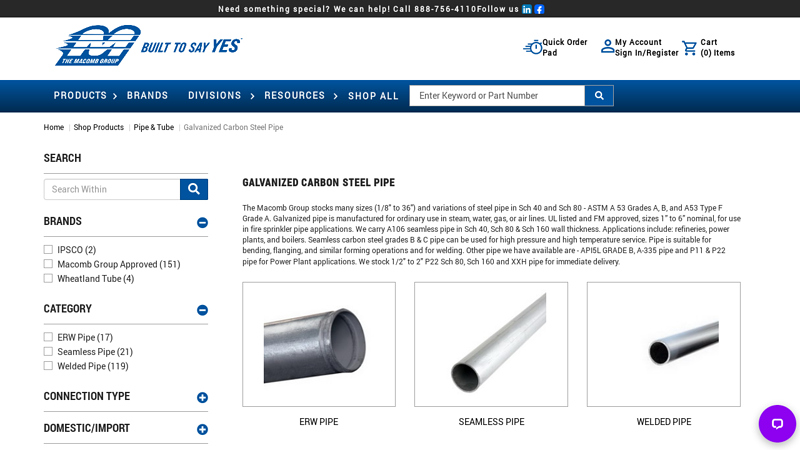

#5 Galvanized Carbon Steel Pipe

Domain Est. 1999

Website: macombgroup.com

Key Highlights: Galvanized pipe is manufactured for ordinary use in steam, water, gas, or air lines. UL listed and FM approved, sizes 1” to 6” nominal, for use in fire ……

#6 Galvanized Steel Pipe Supplier

Domain Est. 2000

Website: tottentubes.com

Key Highlights: As an industry-leading steel tubing distributor, Totten Tubes carries galvanized structural pipes in stock and ready to ship for your next project….

#7 ZENITH STEEL PIPES & INDUSTRIES LIMITED

Domain Est. 2001

Website: zenithsteelpipes.com

Key Highlights: We are one of the largest suppliers of ERW Black & Galvanized pipes to the USA market from India. We are certified for ISO 9001:2008, 14001:2001, OHSAS 18001: ……

#8 Galvanized Pipe sold online, custom cutting…

Domain Est. 2005

#9 Galvanized Steel Pipe

Domain Est. 2018

Website: coremarkmetals.com

Key Highlights: 7–12 day delivery 30-day returnsGalvanized pipes are A36 hot rolled steel, or mild steel, pipes that have been dipped into a molten zinc coating process (ASTM A123)….

Expert Sourcing Insights for 1 Inch Galvanized Steel Pipe

H2: 2026 Market Trends for 1 Inch Galvanized Steel Pipe

The global market for 1 inch galvanized steel pipe is expected to experience steady growth and notable shifts by 2026, driven by infrastructure development, industrial expansion, and evolving regulatory standards. Below is an analysis of key market trends shaping the demand, supply, and applications of 1 inch galvanized steel pipe in the forecast year.

1. Rising Infrastructure and Construction Demand

Urbanization and government-led infrastructure projects—especially in emerging economies across Asia-Pacific, Africa, and Latin America—are expected to drive significant demand for galvanized steel pipes. The 1 inch size is particularly popular in plumbing, fire protection systems, and structural frameworks due to its versatility and strength. With increased investments in water supply networks, commercial buildings, and smart cities, demand for corrosion-resistant piping solutions like galvanized steel will remain strong.

2. Growth in Water and Wastewater Management

Water scarcity and aging municipal systems are prompting modernization efforts worldwide. Galvanized steel pipes, especially 1 inch variants, are widely used in water distribution and sewage systems due to their durability and resistance to internal corrosion. The push for sustainable water infrastructure in regions like India, Southeast Asia, and the Middle East is likely to boost market penetration.

3. Competition from Alternative Materials

Despite their advantages, galvanized steel pipes face increasing competition from alternatives such as PEX (cross-linked polyethylene), PVC, and HDPE pipes. These materials offer easier installation, lighter weight, and resistance to scale build-up. However, galvanized steel remains preferred in high-pressure, high-temperature, and structural applications, preserving its niche in industrial and commercial sectors.

4. Impact of Raw Material and Energy Costs

Fluctuations in steel prices and zinc supply—key components in galvanization—will influence production costs and pricing strategies. Rising energy costs and environmental regulations on steel manufacturing may increase prices slightly by 2026. Producers are expected to adopt more efficient galvanizing techniques and recycling practices to mitigate cost pressures.

5. Environmental and Health Regulations

Concerns over lead leaching from older galvanized pipes have led to stricter regulations, particularly in potable water applications. While modern galvanized pipes are lead-free, regulatory scrutiny may limit their use in residential drinking water systems. This could redirect demand toward lined or alternative materials in certain geographies, especially in North America and Western Europe.

6. Technological Advancements in Coating and Manufacturing

Innovations in hot-dip galvanizing processes, such as improved zinc alloy coatings and automation in pipe production, are enhancing product longevity and consistency. These advancements help galvanized pipes compete with newer materials by extending service life and reducing maintenance costs.

7. Regional Market Dynamics

– Asia-Pacific: Expected to dominate the market due to rapid industrialization and construction in China, India, and Southeast Asia.

– North America: Steady demand from retrofitting and oil & gas sectors, though residential use may decline.

– Europe: Moderate growth, with emphasis on sustainable and recyclable materials.

– Middle East & Africa: High demand in oil, gas, and desalination projects.

8. Supply Chain Resilience and Localization

Post-pandemic supply chain challenges have prompted companies to localize production and diversify sourcing. By 2026, regional manufacturing hubs are expected to reduce dependency on imports, improving delivery times and reducing costs for 1 inch galvanized steel pipe.

In conclusion, while the 1 inch galvanized steel pipe market faces challenges from material substitution and regulation, its proven performance in critical applications ensures continued relevance. Strategic investments in quality, sustainability, and regional distribution will be key to capturing growth opportunities in 2026.

Common Pitfalls When Sourcing 1 Inch Galvanized Steel Pipe (Quality & IP)

Sourcing 1 inch galvanized steel pipe involves several potential pitfalls related to quality and intellectual property (IP) concerns. Being aware of these issues can help buyers avoid costly mistakes, project delays, and compliance risks.

Poor Coating Quality and Inadequate Galvanization

One of the most frequent quality issues is inconsistent or substandard galvanization. Pipes may exhibit thin or uneven zinc coatings, leading to premature corrosion, especially in humid or outdoor environments. Buyers should verify compliance with standards such as ASTM A53 or ASTM A123, which specify minimum zinc coating weights. Insufficient galvanization not only reduces lifespan but may also void warranties and fail inspection in regulated applications.

Misrepresentation of Material Specifications

Suppliers may falsely claim that pipes meet certain industry standards (e.g., Schedule 40, ASTM A53 Type E) without proper certification. This misrepresentation can result in pipes that are undersized, have incorrect wall thickness, or use inferior base steel. Always request mill test reports (MTRs) and conduct third-party inspections when sourcing from unfamiliar suppliers, especially from regions with less stringent quality controls.

Counterfeit or Non-Branded Products Infringing IP

Some manufacturers produce pipes that mimic the branding, packaging, or labeling of reputable brands without authorization. This constitutes intellectual property infringement and may involve counterfeit certification marks. Using such products can expose buyers to legal liability and reputational damage. Ensure suppliers provide documentation of brand authorization and verify trademarks with original equipment manufacturers (OEMs) when necessary.

Use of Substandard or Recycled Raw Materials

To cut costs, some producers use recycled or off-spec steel that doesn’t meet required mechanical properties. This can compromise pipe strength, weldability, and pressure ratings. Low-quality base materials may also lead to surface defects like pitting or warping after galvanizing. Confirm the source of raw materials and insist on compliance with chemical composition standards.

Inconsistent Dimensions and Tolerances

Pipes that fall outside dimensional tolerances—such as outer diameter, wall thickness, or length—can cause installation problems, leaks, or failure to fit with fittings and valves. Poor manufacturing control, especially in low-cost suppliers, often results in batch-to-batch variability. Require dimensional inspection reports and consider sampling inspections upon delivery.

Lack of Traceability and Documentation

Reputable suppliers provide full traceability, including heat numbers, batch records, and compliance certificates. A lack of documentation not only raises quality concerns but also creates IP and regulatory risks, particularly in projects requiring audit trails (e.g., oil & gas, construction). Ensure all pipes are supplied with verifiable documentation to support authenticity and compliance.

Ignoring Regional and Environmental Compliance

Different regions have specific regulations regarding materials, coatings, and import standards (e.g., REACH in the EU, NSF/ANSI 61 for potable water). Using pipes that don’t meet local requirements can lead to project rejection or regulatory fines. Additionally, zinc runoff from galvanized pipes in sensitive environments may be restricted—verify environmental compliance based on application and location.

By addressing these pitfalls proactively—through supplier vetting, third-party testing, and documentation review—buyers can ensure they receive high-quality, compliant, and legally sound 1 inch galvanized steel pipe.

1 Inch Galvanized Steel Pipe: Logistics & Compliance Guide

Overview and Product Specifications

1 inch galvanized steel pipe is a widely used material in construction, plumbing, HVAC, and industrial applications due to its corrosion resistance and strength. The pipe is typically manufactured to ASTM A53 or ASTM A120 standards and features a protective zinc coating applied via hot-dip or electro-galvanization. Nominal outer diameter (OD) is approximately 1.315 inches, with standard wall thicknesses classified as Schedule 40 (standard weight) or Schedule 80 (extra-strong). Understanding the specifications is essential for proper handling, transport, and compliance.

International Shipping and Packaging Requirements

For international shipment, 1 inch galvanized steel pipe must be securely packaged to prevent damage during transit. Pipes are commonly bundled using steel strapping or wooden crates, with protective end caps to prevent thread damage and zinc coating abrasion. Each bundle should be clearly labeled with product details, ASTM specifications, batch numbers, and handling instructions. For sea freight, pipes should be stowed in dry, ventilated containers to prevent moisture accumulation, which could compromise the galvanized coating. Use of desiccants and moisture barriers is recommended for long-haul shipments.

Regulatory Compliance and Standards

Compliance with regional and international regulations is critical. In the United States, galvanized steel pipe must meet ASTM A53 (for general structural and pressure applications) or ASTM A120 (for mechanical tubing). The Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) regulate handling and workplace exposure, particularly regarding zinc fumes during cutting or welding. Internationally, adherence to ISO 14692 (for industrial piping) and local building codes (such as the International Plumbing Code) is required. Always verify destination country standards—e.g., EN 10255 in Europe or AS 1163 in Australia.

Customs Documentation and Tariff Classification

Proper customs documentation ensures smooth border clearance. Required documents typically include a commercial invoice, packing list, bill of lading or air waybill, and a certificate of origin. The Harmonized System (HS) code for galvanized steel pipe is generally 7306.30 (for welded pipes of circular cross-section, of stainless steel or iron/steel, lined or coated with zinc). Accurate classification prevents delays and ensures correct duty assessment. Some countries may require additional certifications, such as SABER (Saudi Arabia) or SONCAP (Nigeria), so advance verification is advised.

Environmental, Health, and Safety (EHS) Considerations

During handling and installation, personnel should wear appropriate personal protective equipment (PPE), including gloves, safety glasses, and respiratory protection when cutting or welding, due to potential zinc oxide fume exposure (which can cause metal fume fever). Storage areas should be dry and well-ventilated to prevent degradation of the galvanized layer. Disposal of scrap galvanized steel should follow local environmental regulations—recycling is encouraged, as zinc-coated steel is fully recyclable. Spill containment is generally not applicable unless cutting fluids or lubricants are used.

Import/Export Restrictions and Trade Compliance

Check for trade restrictions between the origin and destination countries. For example, certain nations may impose anti-dumping duties on steel products from specific exporters. The U.S. International Trade Administration (ITA) and the European Commission monitor steel imports closely. Sanctions, embargoes, or licensing requirements may apply depending on the parties involved. Ensure compliance with the U.S. Export Administration Regulations (EAR) or the EU Dual-Use Regulation if the pipe is used in sensitive applications. Due diligence on end-use and end-user is recommended to prevent violations.

In conclusion, sourcing 1-inch galvanized steel pipe requires careful consideration of factors such as material quality, supplier reliability, pricing, and compliance with industry standards (e.g., ASTM A53 or A120). Galvanized pipes offer excellent corrosion resistance and durability, making them ideal for plumbing, structural, and industrial applications. To ensure optimal value and performance, it is advisable to compare multiple suppliers, verify certifications, assess lead times and shipping costs, and consider long-term maintenance benefits. By selecting a reputable supplier that meets technical specifications and delivery requirements, businesses can secure a reliable, cost-effective solution that supports project efficiency and longevity.